Beruflich Dokumente

Kultur Dokumente

6ba02introduction To Financial Management

Hochgeladen von

Harshit GuptaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

6ba02introduction To Financial Management

Hochgeladen von

Harshit GuptaCopyright:

Verfügbare Formate

IIM B

Prepared by Prof. Hema Krishnamurthy,

OVERVIEW OF FINANCIAL MANAGEMENT 1. Introduction Financial accounting aims at preparing a balance sheet and profit and loss account at the end of an accounting period, say, a month, quarter or year. This is like a report card after the completion of the accounting period. These financial reports (Balance Sheet and Profit and Loss account) are primarily for use by people external to the organization investors, lenders and others. Hence they tend to be in a fixed format either as prescribed by law or by practice. Even though the management derives a lot of information for their decision making from these reports, they may need additional information in certain flexible formats. Management accounting aims at providing information for use by the management. Example: Division-wise profitability, details of a particular product or service cost, inventory valuation details etc. While accounting is recording of transactions, financial management involves taking decisions which will impact the financial results of the firm. In order to understand what financial management involves it is necessary to understand the goals of financial management. 2. Goals of Financial Management Maximising shareholders wealth would be a rationale guide for business decision-making as this would ensure an efficient allocation of resources. Business firms seek to achieve a high rate of growth, enjoy a substantial market share, attain product and technological leadership, promote employee welfare, further customer satisfaction, support education and research, improve community life and solve societal problems. Some of these goals may, of course, be in consonance with the goal of shareholder wealth maximisation. When these other goals seem to conflict with the goal of maximising wealth of equity shareholders, it is helpful to know the cost of pursuing these goals. The trade off has to be understood. It should be appreciated that maximisation of the wealth of equity shareholders constitutes the principal guarantee for efficient allocation of resources in the economy and hence is regarded as the essential goal from the financial point of view. 3. Key activities of Financial Management The three broad activities of financial management are : (i) Financial analysis, planning and control (ii) Management of the Firms asset structure (iii) Management of the Firms financial structure. * Financial analysis, planning and control are concerned with assessing the financial performance and condition of the firm forecasting and planning the financial future estimating the financing needs instituting appropriate systems and controls to ensure that the actions of managers are congruent to the goals.

- Page 1 of 6 -

IIM B

Prepared by Prof. Hema Krishnamurthy,

Management of the firms asset structure involves : determining the capital budget Working Capital Management which again involves establishing credit policy managing liquid assets like cash and securities controlling level of inventory. Management of Financial structure involves establishing the Debt-Equity ratio or financial leverage determining dividend policy choosing the specific instruments of financing negotiating and developing relationships with various suppliers of capital.

In brief, financial management involves managing assets, liabilities and profitability of the business and finally the disposal of the profits earned by the business. The subject of financial management is studied under the following heads: a) Capital budgeting: This involves deciding on the infrastructure or capacity or fixed assets additions. The decision is taken based on the returns expected from the investment and the cost of funds used for the investment. This involves deciding on investments in current assets inventories, receivables, cash and bank balances and advances. This involves deciding on how much to borrow at what cost and how much to raise by way of owner's funds (equity). This involves all the operating decisions relating to cost of production / sales, pricing, productivity and efficiencies. This involves deciding on how much of the profits has to be given away to the owners as dividend and how much has to be retained in the business for future growth.

b)

Working capital:

c)

Capital structure:

d)

Profitability:

e)

Dividend:

- Page 2 of 6 -

IIM B

Prepared by Prof. Hema Krishnamurthy,

Balance Sheet LIABILITIES: SHAREHOLDER'S FUNDS (Equity) LOAN FUNDS ASSETS: FIXED ASSETS CURRENT ASSETS 60 100 4. Risk-Return trade off Financial decisions often involve choosing between alternative sources of action. The alternative courses of action typically have different risk-return implications. The following shows schematically the relationship between the key financial decisions, return, risk and market value. 40 50

Capital Structure Decision

50 100

Capital Budgeting Decision Working Capital Management

Capital Budgeting Decisions Capital Structure Decisions Dividend Decisions Working Capital Decisions

Return Market Value of the Firm Risk

When a financial decision is made the following require to be answered : What is the expected return? What is the risk exposure? Given the risk-return characteristics of the decision, how would it influence value?

- Page 3 of 6 -

IIM B 5.

Prepared by Prof. Hema Krishnamurthy, Organisation of the finance function: There are many tasks of financial management and allied areas (like accounting) which are specialised in nature and which are attended to by specialists. Depending on the size and complexity, the organisation is structured. The functions of the two key roles in any organisation are as follows : Treasurer Obtaining finance Banking relationship Cash Management Credit administration Capital budgeting Controller Financial accounting Internal auditing Taxation Management accounting and control

* * * * * 6.

* * * *

Framework of Organisation The financial decisions of a firm are significantly influenced by the legal form of its organisation. The important forms of business organisations are : * * * * Sole proprietorship Partnership Private Limited Company Public Limited Company

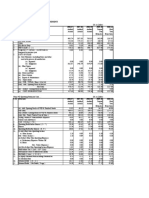

The choice of the form of organisation is very important as it has a bearing on (i) the ability of the entity to raise finances (ii) the manner in which risk is shared between owners and creditors (iii) the extent of control excercisable by the owners (iv) the nature of regulatory framework applicable to the entity and (v) the tax burden for the entity and the owners. The salient features of the different forms of organisations are as follows: Sole Proprietorship Partnership Private Ltd. Co. 1. Ownership Single person the proprietor 2. Status 3. Governing Law 4. Formation No formal requirement of incorporation No separate status Not a legal entity None Two or more Partners (upto 20) Partnership firm Not a legal entity Partnership Act, 1932 Partnership deed stating - Partners - Share of Profits - duties and responsibilities etc. Ends with death or retirement of a partner Unlimited Partners Companies Act, 1956 Memorandum & Articles of Association filed with Registrar of Companies, who issues a certificate of incorporation Shareholders Min.2 , Max 50

Public Ltd. Co. Shareholders Min.10 Max. unlimited

Separate legal entity

5. Life

At the will of the proprietor Unlimited Owner

Perpetual till wound up under the Act Limited to Shares subscribed Board of Directors appointed by Shareholders. Management

6. Liability of Owners 7. Management

- Page 4 of 6 -

IIM B

Prepared by Prof. Hema Krishnamurthy, divorced from owners.

7.

The Legal Framework: Many laws govern the conduct of business organisations ranging from Labour Laws, Environmental Laws, Company Law, Foreign Exchange Laws etc. The finance manager has to have a working knowledge of most of the laws even if he is not responsible for their compliance. This is required from the angle of audit and control and also because non-compliances often have financial implications. The laws in India which the finance manager has to have detailed knowledge are as follows: * Companies Act, 1956 * * * Foreign Exchange Management Act Direct and Indirect Tax laws SEBI guidelines

8.

Taxation Framework: The taxation framework is broadly as follows: A. Direct taxes : Where the impact and incidence of tax are on the same person. Eg. Income Tax Wealth Tax Where the impact and incidence of tax are on different people. Eg. Central Excise duties Sales Tax Customs duties Service Tax

B.

Indirect taxes

: -

- Page 5 of 6 -

IIM B

Prepared by Prof. Hema Krishnamurthy,

SUMMARY

Financial Accounting provides information for use by persons external to the organization investors, lenders and also by management. Whereas Management Accounting provides information tailor made for use by the management. Goals of Financial Management Maximising the wealth of the shareholder Key activities of Financial Management a) Capital budgeting: This involves deciding on the infrastructure or capacity or fixed assets additions. The decision is taken based on the returns expected from the investment and the cost of funds used for the investment. This involves deciding on investments in current assets inventories, receivables, cash and bank balances and advances. This involves deciding on how much to borrow at what cost and how much to raise by way of owner's funds (equity). This involves all the operating decisions relating to cost of production / sales, pricing, productivity and efficiencies. This involves deciding on how much of the profits has to be given away to the owners as dividend and how much has to be retained in the business for future growth.

b)

Working capital:

c)

Capital structure:

d)

Profitability:

e)

Dividend:

Risk-Return trade off All decisions involve a risk and therefore a return to the firm. Without risk there cannot be a return. Organisation of the finance function Treasury and Controller's function Framework of Organisation Sole Proprietorship, Partnership and Limited Companies. The Legal Framework Company Law, Foreign Exchange Management Act, Direct and Indirect Tax laws, SEBI guidelines Taxation Framework - Direct taxes Indirect taxesIncome Tax, Wealth Tax Central Excise duties, Sales Tax, Customs duties, Service Tax

- Page 6 of 6 -

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Valuation - DCFDokument38 SeitenValuation - DCFKumar Prashant100% (1)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Accounting Yellow BookDokument466 SeitenAccounting Yellow BookTshireletso100% (2)

- Compehensive Problem 8Dokument19 SeitenCompehensive Problem 8Trisha Gaile R. RañosaNoch keine Bewertungen

- Agricultural Economics and Marketing - Review Exam Set 1 Select The Best AnswerDokument20 SeitenAgricultural Economics and Marketing - Review Exam Set 1 Select The Best AnswerSean HooeksNoch keine Bewertungen

- Accounting 3 Done !Dokument24 SeitenAccounting 3 Done !Kiminosunoo LelNoch keine Bewertungen

- Holy Cross College: B. Cause and EffectDokument12 SeitenHoly Cross College: B. Cause and EffectSam VeraNoch keine Bewertungen

- Assessment of Working Capital Requirements Form # II: OperatingDokument10 SeitenAssessment of Working Capital Requirements Form # II: OperatingSuzanne Davis100% (2)

- Business Plan for Salma Enterprises Brick ManufacturingDokument15 SeitenBusiness Plan for Salma Enterprises Brick ManufacturingEmmanuelNoch keine Bewertungen

- Business LawDokument26 SeitenBusiness LawHarshit GuptaNoch keine Bewertungen

- Global Human Resource ManagementDokument20 SeitenGlobal Human Resource ManagementHarshit GuptaNoch keine Bewertungen

- Global Human Resource ManagementDokument20 SeitenGlobal Human Resource ManagementHarshit GuptaNoch keine Bewertungen

- Tata Management Training CentreDokument3 SeitenTata Management Training CentreNheha PallathNoch keine Bewertungen

- Bookassetmgtnew PDFDokument516 SeitenBookassetmgtnew PDFMayank Sahu100% (1)

- AoL Assessment Form - ACCT6033Dokument9 SeitenAoL Assessment Form - ACCT6033Dhitami KhairunnisaNoch keine Bewertungen

- Fabm Analysis and Interpretation of Financial Statements 1Dokument4 SeitenFabm Analysis and Interpretation of Financial Statements 1Mylen Noel Elgincolin Manlapaz67% (6)

- Business Valuations Business ValuationsDokument12 SeitenBusiness Valuations Business ValuationsAliNoch keine Bewertungen

- Business PlanDokument29 SeitenBusiness PlanHimanshuRajNoch keine Bewertungen

- Learning Aim CDokument6 SeitenLearning Aim CisheikhNoch keine Bewertungen

- Test Bank For Corporate Finance 10th Edition by Ross Westerfield Jaffe ISBN 0078034779 9780078034770Dokument36 SeitenTest Bank For Corporate Finance 10th Edition by Ross Westerfield Jaffe ISBN 0078034779 9780078034770tammythomasqowaytcgrz100% (18)

- Ratio Analysis and Interpretation 8Dokument24 SeitenRatio Analysis and Interpretation 8Shierwin Ebcas JavierNoch keine Bewertungen

- Module 4. Revenues and Other ReceiptsDokument10 SeitenModule 4. Revenues and Other ReceiptsAbegail CadacioNoch keine Bewertungen

- Pakistan State Oil Introduction of The OrganizationDokument32 SeitenPakistan State Oil Introduction of The OrganizationTAS_ALPHANoch keine Bewertungen

- Index of Front & Back of FileDokument8 SeitenIndex of Front & Back of FileAli RazaNoch keine Bewertungen

- BBC FNCLDokument12 SeitenBBC FNCLSaravanan RasayaNoch keine Bewertungen

- Kohinoor Chemical Company LTD.: Horizontal AnalysisDokument19 SeitenKohinoor Chemical Company LTD.: Horizontal AnalysisShehreen ArnaNoch keine Bewertungen

- Chp14 ConceptsDokument9 SeitenChp14 ConceptsMohd Hafiz AhmadNoch keine Bewertungen

- 6572beeb1353b - Tea Stall 2Dokument11 Seiten6572beeb1353b - Tea Stall 2Prashant Sunali C'naNoch keine Bewertungen

- Dell S Working Capital SolutionDokument12 SeitenDell S Working Capital SolutionSanjay SethiaNoch keine Bewertungen

- Ch15 EquityDokument7 SeitenCh15 EquitykonyatanNoch keine Bewertungen

- PPEDokument5 SeitenPPERodelia MalacastaNoch keine Bewertungen

- RATIO Analysis in Life Insurance CorporationDokument61 SeitenRATIO Analysis in Life Insurance Corporationsreeja kandula789Noch keine Bewertungen

- Answer Scheme Exam Paper PFM April 2020Dokument3 SeitenAnswer Scheme Exam Paper PFM April 2020Lishalini Gunasagaran100% (1)

- Polaroid 1996 CalculationDokument8 SeitenPolaroid 1996 CalculationDev AnandNoch keine Bewertungen

- Asset Purchase AgreementDokument5 SeitenAsset Purchase AgreementYna TianNoch keine Bewertungen