Beruflich Dokumente

Kultur Dokumente

A Study On Indian GSM Market.

Hochgeladen von

Satyavrat PandeyOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

A Study On Indian GSM Market.

Hochgeladen von

Satyavrat PandeyCopyright:

Verfügbare Formate

1

A PROJECT THESIS ON STUDY ON GSM MARKET

INDIAN INSTITUTE OF PLANNING AND MANAGEMENT (NEW DELHI)

IN PARTIAL FULL FILLMENT OF MBA DEGREE 2010-12

SUBMITTED BYSATYAVRAT PANDEY MBA IV SEMESTER (2010-12) ENROLMENT NO.10AM80692

PROJECT THESIS ID- TS12-M-10

SUBMITTED TOPUSPH LAMBA

ABSTRACT

The study has been done to understand the current status of Indian GSM market and the trend which are taking place in the market. The Indian telecom sector is growing very fast, it has worlds second largest subscriber base, it has become a lucrative market for foreign players, most foreign giant has made their entry into Indian telecom sector and many are waiting for their turn. Since the launch of mobile number portability (MNP) in Indian market competition has gone up companies trying to lure the subscribers of other company with tantalizing offers. In this study primary as well secondary data has been used to understand the market trend, market status and future market trend well .Market trends means what marketing strategy is being used by the players to beat the competitor and the response of customer towards it. Study has been done to know the future market trend by analyzing the past data in present. To collect primary data questionnaire has been used, face to face and telephonic interview has been conducted, on the basis of which conclusion and recommendation has been given. For the secondary data books, magazine, news paper, journal and report from various research agency has been studied. Secondary data helped to know current status of telecom sector and take a glimpse of trend that may take place in future.

PROJECT THESIS TOPIC APPROVAL

Dear SATYAVRAT PANDEY, This is to inform you that the approved topic for project thesis is - STUDY ON GSM MARKET. This email is an official confirmation that you would be doing your project thesis work genuinely and shall try to achieve the said objectives mentioned in the synopsis. You must always use the thesis title as approved and registered with us. Your project thesis id Number is TS12-M-010. You are required to correspond with your Internal Guide MR.PUSHP LAMBA (pushp.lamba@iipm.edu) at regular intervals before sending the thesis final draft to him.

Regards,

Dipti Sharma The Indian Institute of Planning and Management dipti.sharma@iipm.edu Phone: 0124 42789995

ACKNOWLEDGEMENT

A fruitful work is incomplete without paying a word of thanks to all the people who are directly or indirectly involved in its completion. I wish to express my heartfelt appreciation to many who have contributed to this project both explicitly and implicitly. Words can never express the extent of indebt, but I still wish to express my deep sense of gratitude to all the people for their valuable time and cooperation, which they had given me. Firstly, I am thankful and express my gratitude to Mr.Pushp Lamba ( Project Guide) who inspired me and guided me throughout the period of project work that enabled me to successful completion the project. I am thankful to my parents who motivated me throughout this project work. The preparation of this project would not have been an easy task without the help and support of my parents. I also thank all my professors who helped me during the project, and last but not the least to my classmates, who despite their own project have helped in my project as and when they could.

Satyavrat Pandey

TABLE OF CONTENT TOPIC INTRODUCTION RESEARCH METHODOLOGY Objective Design Limitation Data collection PAGE NO. 6 8 9 9 10 11 12 13 14

LITERATURE REVIEW Introduction History of GSM A brief introduction of Indian telecom sector and players Present status of GSM market Mobile No. Portability

19 32 36 44 56 57 59 60 61

Finding and Analysis SWOT Analysis Conclusion Recommendation Bibliography Annexure

INTRODUCTION

The telecom services have been recognized the world-over as an important tool for socio economic development for a nation. It is one of the prime support services needed for rapid growth and modernization of various sectors of the economy. Indian telecommunication sector has undergone a major process of transformation through significant policy reforms, particularly beginning with the announcement of NTP 1994 and was subsequently re-emphasized and carried forward under NTP 1999. Driven by various policy initiatives, the Indian telecom sector witnessed a complete transformation in the last decade. It has achieved a phenomenal growth during the last few years and is poised to take a big leap in the future also. The word GSM stands for GLOBAL SYSTEM FOR MOBILE COMMUNICATION, or GROUP SPECIAL MOBILE. The concept of GSM has been developed by the European Telecommunication Standard Institute. It is a standard set that describe technologies for second generation (2G) digital cellular network. Developed as a replacement for first generation (1G) analog cellular networks, the GSM standard originally described a digital, circuit switched network optimized for full duplex voice telephony. The standard was expanded over time to include first circuit switched data transport, then packet data transport via GPRS (General Packet Radio Services). Packet data transmission speeds were later increased via EDGE (Enhanced Data rates for GSM Evolution) referred as EGPRS. The GSM standard is more improved after the development of third generation (3G) UMTS standard developed by the 3GPP. GSM networks will evolve further as they begin to incorporate fourth generation (4G) LTE Advanced standards. "GSM" is a trademark owned by the GSM Association. This is all technical information about the GSM that what the GSM actually is and how it came into the picture, lets move to the other aspect on which study based on that is business aspect. As for as the telecom sector is concerned in India it is growing very fast so as the GSM segment, there are a lot no. of domestic and international player are trying to get into the country and capture the lucrative market.

The Indian Telecommunications network with 919 million connections (as on March 2012) is the second largest in the world. It has the world's third-largest Internet users with over 121 million as of march 2012. India has become the world's most competitive and one of the fastest growing telecom markets. The sector is growing at a speed of 45% during the recent years. This rapid growth is possible due to various proactive and positive decisions of the Government and contribution of both by the public and the private sectors. The rapid strides in the telecom sector have been facilitated by liberal policies of the Government that provides easy market access for telecom equipment and a fair regulatory framework for offering telecom services to the Indian consumers at affordable prices. This is all about the state of Indian telecom sector but what about the major telecom player, what they are doing to capture more and more market share .competition are heating up between players after the introduction of MNP(mobile no. portability). Companies such as Airtel, Vodafone, Idea , Tata docomo and many more giving lucrative offer to attract the customer of other player, spending huge amount on advertisement and the sales promotion. It would be interesting to see that who is gaining the competitive advantage over other in such a market where the customer is very dynamic in nature and competition are heating up. Now these days companies has to be very cautious because at one hand they should not lose its existing customer and on the other hand they have to gain new customer, if they want to make the use of MNP then they should be capable enough to attract the customer of its competitor. Companies are sweating heavily to formulate the marketing strategies in such a way that it could full fill all what they actually need. If we talk about current market scenario then India's GSM subscriber base grew by 1.04 percent in March with addition of 6.87 million mobile phone users, with Bharti Airtel alone signing up over 2.5 million customers, according to data released by Cellular Operators Association of India. The total number of GSM subscribers in the country crossed 664 million as against 657.22 million in February. So it would be interesting to know that how far the market can grow.

RESEARCH METHODOLOGY

Research methodology means the technique, method and various tool which has been used by the researcher in data collection, in analyzing of data, in interpretation of data. It is concerned with using right method for collection of data; it is also concerned with collecting right data from right place and using right source. When we talk of Research methodology, we dont talk of the research method but also consider the logic behind it, we study and explain that why a particular method is being used in this. A researcher should adopt that methodology on the basis of which he could evaluate the research result and others also. In this research I took 10 telecom companies in Indian market that is big according to their market share and customer base.

RESEARCH OBJECTIVEThe basic purpose of the research is to know about the current state of the Indian GSM market, means what is happening in the market, who is gaining market share, which is losing its customer base, what kind of marketing strategies are being used by the telecom companies to stay ahead. Since the introduction of the GSM services in Indian market the market has been changed first there were only 2 or 3 companies but now these there are 15 telecom companies in Indian market and each of them are ready to grasp the market share. Subscriber base also increased within 5 year, in march2007 there was only 165.09 million subscribers but now till March 2012 it reached 919.17 million. To know the state of Indian GSM market. To know the effect of mobile number portability(MNP) on telecom players, since the introduction of MNP in Indian market competition has been very tough companies has to think twice, thrice before changing the tariff plan or any other existing plan. To know the market share of various companies. To know the growth of Indian GSM market. To know the competitive advantage of GSM over CDMA services. To know the consequences of Supreme Court decision on Indian GSM market, when in FEB 2012 the Supreme Court quashed all 122 licenses which had been issued by former telecom minister A. Raja some foreign companies started thinking to exit from India.

10

RESEARCH DESIGNResearch: descriptive Data source: primary and secondary Research tools: survey, Questioners, interview and studies. Type of questions : open ended and close ended. Sample unit : 100 Sampling procedure: simple random procedure. Contact method: personal ,online and telephone

RESEARCH LIMITATION1. Mostly people did not like to take part in the survey 2. People did not answer the questions properly 3. Many people did not fill the questionnaire properly 4. Many people didnt reply the mail 5. Reports and survey were not up to date. 6. Some Surveys were not trust worthy. 7. Some Surveys were difficult to understand 8. Surveys were contradicting each other information on GSM market.

11

DATA COLLECTION METHODPrimary DataTo collect primary data I used basically 3 method of data collection. a) Personal interview- In this method of collecting data I used to interact with the people who were coming in to the store. b) Telephonic interview- in this method of collecting data I used to call the prospect and note the feedback.

c) Mail- I sent a questionnaire to a lot of people to know their views.

Secondary DataTo collect secondary data I took internal secondary data and external secondary data. a) Internal secondary data- Data from company itself which it already has. b) External secondary data- Data from the outside of the company, like books, magazines, newspapers, internet and other reliable sources

12

LITERATURE REVIEW-

13

INTRODUCTION OF GLOBAL SYSTEM FOR MOBILE COMMUNICATION (GSM) The word GSM stands for GLOBAL SYSTEM FOR MOBILE COMMUNICATION, or GROUP SPECIAL MOBILE. The concept of GSM has been developed by the European Telecommunication Standard Institute. It is a standard set that describe technologies for second generation (2G) digital cellular networks. Developed as a replacement for first generation (1G) analog cellular networks, the GSM standard originally described a digital, circuit switched network optimized for full duplex voice telephony. The standard was expanded over time to include first circuit switched data transport, then packet data transport via GPRS (General Packet Radio Services). Packet data transmission speeds were later increased via EDGE (Enhanced Data rates for GSM Evolution) referred as EGPRS. The GSM standard is more improved after the development of third generation (3G) UMTS standard developed by the 3GPP. GSM networks will evolve further as they begin to incorporate fourth generation (4G) LTE Advanced standards. "GSM" is a trademark owned by the GSM Association. HISTORY OF GSMDuring the early 1980s, analog cellular telephone systems were experiencing rapid growth in Europe, particularly in Scandinavia and the United Kingdom, but also in France and Germany. Each country developed its own system, which was incompatible with everyone else's in equipment and operation. This was an undesirable situation, because not only was the mobile equipment limited to operation within national boundaries, which in a unified Europe were increasingly unimportant, but there was also a very limited market for each type of equipment, so economies of scale and the subsequent savings could not be realized. The Europeans realized this early on, and in 1982 the Conference of European Posts and Telegraphs (CEPT) formed a study group called the Group Special Mobile (GSM) to study and develop a pan-European public land mobile system. The proposed system had to meet certain criteria: Good subjective speech quality. Low terminal and service cost. Support for international roaming

14

Ability to support handled terminal. ISDN Compatibility.

The genesis of GSM came from the recognition by all engineers that common technical standards were a good thing in telecommunications and a growing willingness by European Governments in 1984 to at least consider exploring a single market in

telecommunications. These two sentiments were held in quite different worlds within Europe. There was the technical world that brought together engineers at technical conferences of the European Conference of Posts and Telecommunications (CEPT). GSM was set up by CEPT in 1982. There was a political world where, in telecommunications, the old order of national state monopolies were firmly in the driving seat in 1982 and under liberalization pressure from the the European Commission from around 1984 . This was the start of the breakdown of the old state run telecommunications monolithic structures and particularly public mobile services (pioneered by the UK). There was a third world of the big European industrial companies firmly tied to national markets but always trying to break into the backyard of the others. These worlds were not just countries, companies and committees but comprised the key people who created GSM. Among those critical to the success of GSM were. ADVANTAGES OF GSMGSM advantages over other cellular technologies are; Dominant global market share of GSM gives benefits:

Large number of infrastructure and handset vendors giving advantage in terms of price and other commercial term. Innovation ahead of CDMA e.g. single chip hand set. Widest choice of handsets with widespread sales and service distribution network.

15

Handset availability in all price segment and ongoing introduction of wide variety to meet customer requirements.

Easy subscription process (SIM BASED). Widespread prepaid solution. Seamless interoperability between networks and handset. Global footprint for international roaming including SMS, Data and other value added services.

ADVANTAGE FOR SUBSCRIBERS Low cost entry handset. Wide choice and availability of handset. International roaming. Easy subscription. Affordable services for common man.

ADVANTAGE FOR OPERATOR Economies of scale due to dominant market share. Choice of multiple vendors. Lower subscriber acquisition cost. Seamless interoperability.

16

A BRIEF INTRODUCTION OF INDIAN TELECOM SECTOR Introduction The telecom services have been recognized the world-over as an important tool for socioeconomic development for a nation. It is one of the prime support services needed for rapid growth and modernization of various sectors of the economy. Indian telecommunication sector has undergone a major process of transformation through significant policy reforms, particularly beginning with the announcement of NTP 1994 and was subsequently re-emphasized and carried forward under NTP 1999. Driven by various policy initiatives, the Indian telecom sector witnessed a complete transformation in the last decade. It has achieved a phenomenal growth during the last few years and is poised to take a big leap in the future also. Status of Telecom Sector The Indian Telecommunications network with 919.17 million connections (as on March 2012) is the second largest in the world. in it total number of GSM connection is 664.08 million. The sector is growing at a speed of 45% during the recent years. This rapid growth is possible due to various proactive and positive decisions of the Government and contribution of both by the public and the private sectors. The rapid strides in the telecom sector have been facilitated by liberal policies of the Government that provides easy market access for telecom equipment and a fair regulatory framework for offering telecom services to the Indian consumers at affordable prices. Presently, all the telecom services have been opened for private

participation. The Government has taken following main initiatives for the growth of the Telecom Sector: Liberalization The process of liberalization in the country began in the right earnest with the announcement of the New Economic Policy in July 1991. Telecom equipment manufacturing was delicensed in 1991 and value added services were declared open to the private sector in 1992, following which radio paging, cellular mobile and other value added services were opened gradually to the private sector. This has resulted in large number of manufacturing units been set up in the country. As a

17

result most of the equipment used in telecom area is being manufactured within the country. A major breakthrough was the clear enunciation of the governments intention of liberalizing the telecom sector in the National Telecom Policy resolution of 13th May 1994.

National Telecom Policy 1994

In 1994, the Government announced the National Telecom Policy which defined certain important objectives, including availability of telephone on demand, provision of world class services at reasonable prices, improving Indias competitiveness in global market and promoting exports, attractive FDI and stimulating domestic investment, ensuring Indias emergence as major manufacturing / export base of telecom equipment and universal availability of basic telecom services to all villages. It also announced a series of specific targets to be achieved by 1997.

Telecom Regulatory Authority of India (TRAI)

The entry of private service providers brought with it the inevitable need for independent regulation. The Telecom Regulatory Authority of India (TRAI) was, thus, established with effect from 20th February 1997 by an Act of Parliament, called the Telecom Regulatory Authority of India Act, 1997, to regulate telecom services, including fixation/revision of tariffs for telecom services which were earlier vested in the Central Government. TRAIs mission is to create and nurture conditions for growth of telecommunications in the country in manner and at a pace, which will enable India to play a leading role in emerging global information society. One of the main objectives of TRAI is to provide a fair and transparent policy environment, which promotes a level playing field and facilitates fair competition. In pursuance of above objective TRAI has issued from time to time a large number of regulations, orders and directives to deal with issues coming before it and provided the required direction to the evolution of Indian telecom market from a Government owned monopoly to a multi operator multi service open competitive market. The directions, orders and

18

regulations issued cover a wide range of subjects including tariff, interconnection and quality of service as well as governance of the Authority. The TRAI Act was amended by an ordinance, effective from 24 January 2000, establishing a Telecommunications Dispute Settlement and Appellate Tribunal (TDSAT) to take over the adjudicatory and disputes functions from TRAI. TDSAT was set up to adjudicate any dispute between a licensor and a licensee, between two or more service providers, between a service provider and a group of consumers, and to hear and dispose of appeals against any direction, decision or order of TRAI.

New Telecom Policy 1999 The most important milestone and instrument of telecom reforms in India is the New Telecom Policy 1999 (NTP 99). The New Telecom Policy, 1999 (NTP-99) was approved on 26th March 1999, to become effective from 1st April 1999. NTP-99 laid down a clear roadmap for future reforms, contemplating the opening up of all the segments of the telecom sector for private sector participation. It clearly recognized the need for strengthening the regulatory regime as well as restructuring the departmental telecom services to that of a public sector corporation so as to separate the licensing and policy functions of the Government from that of being an operator. It also recognized the need for resolving the prevailing problems faced by the operators so as to restore their confidence and improve the investment climate. Key features of the NTP 99 include: Strengthening of Regulator. National long distance services opened to private operators. International Long Distance Services opened to private sectors. Private telecom operators licensed on a revenue sharing basis, plus a one-time entry fee. Resolution of problems of existing operators envisaged. Direct interconnectivity and sharing of network with other telecom operators within the service area was permitted. Department of Telecommunication Services (DTS) corporatized in 2000. Spectrum Management made transparent and more efficient

19

MAJOR PLAYER IN INDIAN TELECOM INDUSTRYThere are three types of players in telecom services: State owned companies (BSNL and MTNL) Private Indian owned companies (Reliance Communication, Tata Teleservices,) Foreign invested companies (Vodafone-Essar, Bharti Tele-Ventures, Escotel, IdeaCellular, Loop Mobile, Spice Communications,Uninor,Tatadocomo)

BHARAT SANCHAR NAGAR LIMITED-

NAME YEAR OF ESTABLISHMENT COMPANY PROFILE

Bharat Sanchar Nagar Limited 2000 Bharat Sanchar Nigam Ltd. is World's 7th largest Telecommunications Company providing comprehensive range of telecom services in India: Wire line, CDMA mobile, GSM Mobile, Internet, Broadband, Carrier service, MPLS-VPN, VSAT, VoIP services, IN Services etc. Within a span of five years it has Become one of the largest public sector unit in India.

GLOBAL NETWORK

PRESENCE/MARKETING It has a network of over 45 million lines covering 5000 town. it has 90.09 million cellular and 5.06 million WLL customer

20

BHARTI AIRTEL

NAME OF THE COMPANY YEAR OF ESTABLISHMENT COMPANY PROFILE

Bhati Airtel 7 July 1995 Bharti Airtel Limited commonly known

as Airtel, is an Indian telecommunications company that operates in 20 countries across South Asia, Africa and the Channel Islands. It operates a GSM network in all countries, providing 2G, 3G and 4G services depending

upon the country of operation. Airtel is the third largest telecom operator in the world with over 243.336 million customers across 20 countries as of March 2012. It is the largest cellular service provider in India, with over 181 million subscribers at the end of March 2012. Airtel is the third largest in-country mobile operator by subscriber base,

behind China Mobile and China Unicom. GLOBAL PRESENCE / MARKETING Airtel is the third largest mobile operator in the NETWORK world in terms of subscriber base and has a commercial presence in 20 countries and the Channel Islands. Its area of operation includes. The Indian subcontinent Airtel, in India Airtel Bangla, in Bangladesh

21

Airtel Srilanka, in Srilanka Airtel Africa which operates in 17 countries,

ACQUISITION/STRATEGIC ALLIANCE

In March 2010, Bharti struck a deal to buy the Kuwait firm's mobile

operations in 15 African countries, in India's second biggest overseas

acquisition after Tata Steel's $13 billion buy of Corus in 2007. On August 11, 2010, Bharti Airtel announced that it would acquire 100% stake in Telecom Seychelles for US$62 million taking its global presence to 19 countries. FUTURE PROSPECT On 10 April 2012, Airtel launched 4G services using TD-LTE technology in Kolkata, becoming the first company in India to offer 4G services. Airtel will be launching 4G

in Bangalore Pune and Chandigarh this year.

22

RELIANCE COMMUNICATION NAME OF THE COMPANY YEAR OF ESTABLISHMENT COMPANY PROFILE Reliance Communication 2004 Reliance ADA Groups flagship company, Reliance Communications, is India's largest private sector information and communications company, with over 100 million subscribers. It has established a pan-India, high-capacity, integrated (wireless and wire line), convergent (voice, data and video) digital network, to offer services spanning the entire infocom value chain. GLOBAL PRESENCE / NETWORK MARKETING Reliance Communications has IP-enabled connectivity infrastructure comprising over 190,000 systems in India, the US, Europe, Middle East, and the Asia Pacific region. In India Reliance Communication covers 24,000 towns and 600000 villages. kilometers of fiber-optic cable

ACQUISITION/STRATEGIC ALLIANCE

It has acquired various players in same field

23

FUTURE PROSPECT

FLAG Telecom Yipes Ethernet Service Digicable Vanco

Reliance communication is planning to launch 4G services in country.

VODAFONENAME OF THE COMPANY YEAR OF ESTABLISHMENT Vodafone Acquired majority stake in Hutch Essar in India, by buying out complete stake of Hutch in 2007, Essar is still minority stakeholder in company. COMPANY PROFILE Vodafone India is a member of the Vodafone Group and commenced operations in 1994 when its predecessor Hutchison Telecom acquired the cellular license for Mumbai. The company now has operations across the country with over 150 million customers. Vodafone India has firmly established a strong position within the Vodafone Group too, making it the largest subscriber base globally. This journey is a strong testimony of

24

Vodafones success in a highly competitive and price sensitive market. Vodafone India has been awarded the Most Admired Telecom Operator and Best 3G Operator at the recent Telecom Operator Awards 2012. The company has also received the globally recognized prestigious Product of the Year 2012 consumer award for Vodafone Apps Store in the Mobile Services Category. In another survey conducted by Nielsen, Vodafone India was the only telecom player in the Top 10 Most Exciting Youth Brands in India. Vodafone India also features in the Top 10 Most Trusted Brands in India for 2011, in a survey conducted by a leading financial daily GLOBAL PRESENCE / MARKETING Vodafone owns and operates networks in over NETWORK 30 countries and has partner networks in over 40 additional countries. Its Vodafone Global Enterprise telecommunications division and IT provides services to

multinational corporate clients in over 65 countries. Vodafone also owns 45% of Verizon Wireless, the largest mobile

telecommunications company in the United States measured by subscribers ACQUISITION / STRATEGIC ALLIANCE Vodafone acquires a 67% stake in Hutchison Essar for $10.7 billion. The company is renamed Vodafone Essar.

25

'Hutch' is rebranded to 'Vodafone' Vodafone Group buys out its partner Essar from its Indian mobile phone business. It paid $5.46 billion to take Essar out of its 33% stake in the Indian subsidiary. It left Vodafone owning 74% of the Indian business Acquired BPL Mobile operations in 3 circles. This left BPL with operations only in Mumbai, where it still operates under the brand 'Loop Mobile' In 2008,, Vodafone acquires the

licenses in remaining 7 circles and has starts its pending operations in Madhya Pradesh circle, as well as in Orissa, Assam, North East and Bihar. FUTURE PROSPECT Vodafone India provides 2.75G services based on 900 MHz and 1800 MHz digital GSM technology. Vodafone India

launched 3G services in the country in the January-March quarter of 2011 and plans to spend up to $500 million within two years on its 3G networks.

26

IDEA CELLULARNAME OF THE COMPANY YEAR OF ESTABLISHMENT COMPANY PROFILE Idea 1995 Idea Cellular, usually referred to as Idea, is an Indian mobile network operators based

in Mumbai, India. Idea is the 4th largest wireless carrier in Indian market with over 100 million customers and also provides broadband Internet to its customers. The company has its retail outlets under the "My Idea" banner. The company has also been the first to offer flexible tariff plans for prepaid customers. It also offers GPRS services in urban areas. Idea Cellular won the GSM Association Award for "Best Billing and Customer Care Solution" for 2 consecutive years. IDEA Cellular has been recognized as the 'Most Customer Responsive Company' in the Telecom sector, at the prestigious Avaya GlobalConnect Awards 2010 Customer Responsiveness

GLOBAL PRESENCE / MARKETING PAN INDIA 3G COVERAGENETWORK Airtel, Vodafone and Idea have begun collaborating to provide 3G coverage to their customers pan India. The

27

agreement aims to provides for these companies to offer 3G services to their customers in circles where they have not won any spectrum. It is expected that the 3 companies will be able to provide 3G services in all circles in India except orissa where the three have not won any spectrum.

ACQUISITION / STRATEGIC ALLIANCE Merged with Tata Cellular Limited in 2001, thereby acquiring original license for the Andhra Pradesh Circle Acquired RPG Cellular Limited and consequently the license for the Madhya Pradesh (including Chattisgarh)

Circlein 2001 In 2004 acquired Escotel, incumbent cellular service provider in

Haryana, UP(W) & Kerala and new licensee in HP Acquired Escorts Telecommunications Limited (subsequently renamed as Idea

Telecommunications Limited) in 2006 Merger of seven subsidiaries with Idea Cellular Limited in 2007.On 19 May 2010, the 3G spectrum auction in India ended. Idea paid circles. FUTURE PROSPECT The operator announced that IDEA 3G services will be available in 4000 towns by the end of 2012. 5768.59 crores for spectrum in 11

28

TATA DOCOMONAME OF THE COMPANY YEAR OF ESTABLISHMENT COMPANY PROFILE Tata Docomo NOV 2008 It came into existence because of the strategic joint venture between Tata Teleservices and Japanese telecom giant NTT Docomo in November 2008. It is the countrys six largest operator in terms of subscriber base. Tata Docomo launched GSM services on 24 June 2009. It first launched in South India and there after other part of the country. GLOBAL PRESENCE / MARKETING It operates in 18 telecom sector. NETWORK It became the first private sector telecom company (third overall) to launch 3G services in India, with a 20 city launch. ACQUASITION ALLIANCE FUTURE PROSPECT / STRATEGIC It has a strategic alliance with Japanese NTT docomo. It is planning to launch GSM services in Assam and Jammu & Kashmir. It is planning to enhance its customer base and attract younger generation.

29

AIRCELNAME OF THE COMPANY YEAR OF ESTABLISHMENT COMPANY PROFILE Aircel 1999 Aircel is an Indian mobile company founded in 1999.its headquarter is in Chennai. It is Indias fifth largest GSM mobile service provider. It has a market share of 6.72% among the GSM operators in the country. Aircel has won many awards for its services. Aircel was honored at the World Brand Congress in 2009 Brand leadership in telecom .Marketing campaign & Marketnig prfessional GLOBAL PRESENCE It operates in 13 circle of the country and planning to expand its operation. ACQUISITION / STRATEGIC ALLIANCE In December 2003, it acquired RPJ group which had operation in Chennai circle. FUTURE PROSPECT Planning to enhance its subscriber base. it is planning to have operation in all 23 circle.

30

UNINORNAME OF THE COMPANY YEAR OF ESTABLISHMENT COMPANY PROFILE Uninor 2009 The company is a joint venture

between Telenor Group, a telecommunications company of Norway, and Unitech Group, an Indian real estate company. Telenor owns a controlling majority stake in the company (67.25%), which has been branded Uninor in the Indian market. It has a subscriber base of 42.43 million customer as of march 2012. GLOBAL NETWORK PRESENCE/MARKETING Uninor services are commercially available in 13 circles across India. With a value for money proposition in the market, Uninor targets youth and other communities within the Indian mass market. The company has more than 22,000 partners in India. Uninor products and services are available from a more than 375,000 retail outlets serviced by 1,900 distributors all over the country. ACQUISITION/ STRATEFIC ALLIANCE It has a joint venture with Telenor a telecom company from Norway . FUTURE PROSPECT Planning to enhance its market share. Uninor is targeting an 8% pan-India market share, and to reach at break-even at the end of 2012 and obtain positive operating cash flow till 2014.

31

LOOP MOBILENAME OF THE COMPANY YEAR OF ESTABLISHMENT COMPANY PROFILE Loop mobile 1994 as a BPL mobile. Loop Mobile (Formerly BPL Mobile), usually referred to as LOOP is a mobile phone service provider in India. It offers

both prepaid and postpaid GSM cellular phone coverage in 21 telecom circles. GLOBAL PRESENCE it operates in 21 telecom circle in India. It holds 0.37 market share of Indian telecom industry.

S TELNAME OF THE COMPANY YEAR OF ESTABLISHMENT COMPANY PROFILE S Tel DEC 2009 S Tel Private Limited is a GSM based cellular operator in India. It is owned jointly by C Sivasankaran (51%) Telecommunications (49%). S and Bahrain Tel has

approximately 3.6 million subscribers as of February 2012. GLOBAL PRESENCE It has a unified services access license to operate in 6 category C circle.

32

PRESENT STATUS OF INDIAN TELECOM SECTOR

Indian Telecommunication sector maintained the impressive growth rate during the current year. Indian telecom network has 951.34 million connections at the end of March'12 with 919.17 million wireless connections and is the second largest network in the world after China. The one billion mark also appears to be achievable. The penetration of internet and broadband has also improved with 20.99 million internet subscribers and 13.79 million broadband subscribers across the country. The future progress of telecommunication in our country is very encouraging as operators have started rolling out the wireless broadband networks in the country and soon the services are expected to be available in the entire country.

FEATURE OF INDIAN TELECOM SECTOR Indian telecom market is one of the fastest growing market in the world. With it 951.34 million subscribers, it is the second largest network after China. It is also the second largest wireless network. Wireless telephones are increasing at faster rate the share of wireless phone is 97%. The country is poised to achieve 1 billion telephone connections. Broad band connection has increased to 13.79 million. The share of private sector is in total market is 88.65% and public sector has 11.35% market share.

GROWTH OF THE SECTOR OVER THE YEARMARCH07 MARCH08 MARCH09 MARCH10 MARCH11 MARCH12

Wire line Wire less Gross total Annual Growth

40.77 165.09 205.86 44.88%

39.41 261.08 300.49 45.96%

37.97 391.76 429.73 43.01%

36.96 584.32 621.28 44.58%

34.73 811.60 846.33 36.22%

32.17 919.17 951.34 11.32%

33

The opening of the sector has not only led to rapid growth but also benefited the consumers through low tariffs as a result of intense competition. Telecom sector has witnessed a continuous rising trend in the total number of telephone subscribers. From a mere 22.81 million telephone subscribers in 1999, the number increased to 846.33 million at the end of March, 2011. The total number of telephones stands at 951.34 million at the end of March'12 showing addition of 105.01 million during the period from April to March'12. Wireless telephone connections have contributed to this growth as their number rose from 165.09 million in 2007 to 811.60 million in March, 2011 and 919.17 million at the end of March'12. The wire line connections have however, declined from 40.77 million in 2007 to 32.17 million in March, 2012.

WIRE LINE vs. WIRELESS-

The growth of wireless services has been substantial, with wireless subscribers growing at a Compounded annual growth rate (CAGR) of 42.7% since 2007. Wireless has overtaken wire lines. The share of wireless phones has increased from 80.19% in 2007 to 96.47% in March'12. On the other hand, the share of wire line has steadily declined from 19.81% in 2007 to 3.53% in March'12. Wireless phones have increased as they are preferred because of their convenience and affordability. As a result, telephones today have come within the reach of the common man.

TOTAL NUMBER OF GSM SUBSCRIBERSTotal Wireless subscriber base increased from 911.17 Million in February 2012 to 919.17 Million at the end of March 2012, registering a growth of 0.88%. Wireless subscription in Urban Areas increased from 594.11 million in February 2012 to 595.90 million at the end of March 2012. The subscription in Rural Areas increased from 317.06 million to 323.27 million during the same period. This shows higher growth in Rural Subscription (1.96%) than Urban Subscription (0.30%).Private Operators hold 88.65% of the wireless market share where as BSNL and MTNL, two PSU operators hold only 11.35% market share. Total no. of GSM subscriber base as of March12 was 664.08 million. Among them Airtel was leading the market with 181.28 million subscribers, UK based Vodafone was following Airtel with 150.47 million subscriber. Idea has got no.3 position with 112.72 million subscribers.

34

March12 has been proved very good month for operator like Airtel(added 2.5 million subscriber only in this month), Idea (added 2.01 million subscribers) Uninor( added 1.29 million subscribers), while for some player like Aircel, Videocon it was very difficult month, because both the player has lost their market share. In this month the total number of GSM subscribers base reached to 6.87 million with 1.04% increase from previous ( feb12) month.

GSM SUBSCRIBERS FIGURE OF LAST 6 MONTH (IN MILLION)OCT11 625.41 NOV11 632.08 DEC11 639.64 JAN12 648.08 FEB12 656.85 MAR12 664.08

In this we see the growth of GSM subscribers on monthly basis; here the data of past six months that are showing the growth. Starting with oct11 when the total subscriber base was 625.41 million it reached to the 664.08 million in march. Between Dec11 to Jan 11 it has grown the most. GSM SUBSCRIBERS ADDITION IN LAST SIX MONTH (IN MILLION) OCT11 7.12 NOV11 6.68 DEC11 7.55 JAN12 8.44 FEB12 8.77 MAR12 6.88

This table is presenting the addition of subscribers on monthly basis, as in oct11 it added 7.12 million GSM subscriber, after that in nov11 it added more 6.68 million new subscriber and at end of year 2011 it added 7.55 million subscribers. the year 2012 has been proved good for telecom players so far because in jan12 it added new 8.44 million subscriber, in feb12 it broke the record of jan12 by adding 8.77 million new subscribers. In march it added 6.88 million subscriber that is good number

35

CIRCLE WISE NUMBER OF GSM SUBSCRIBERS AS OF MARCH12(in millions)

METRO 77.27

CIRCLE A 228.69

CIRCLE B 262.69

CIRCLE C 95.92

If we see circle wise subscribers then we have maximum no. of subscribers in B Circle ( Haryana,Madhya Pradesh, UP East, UP west, Westbangal, Punjab,Kerla and Rajasthan) that is 262.69 million subscribers. Circle A that includes Andhra Pradesh, Tamilnadu, Gujrat , Maharastra and Karnataka comes at second position with 228.69 million subscribers. Circle C is on third position with 95.92 million subscribers and Metros with 77.27 million are on fourth position. NO. OF GSM SUBSCRIBERS ADDITION IN MARCH2012(in millions)

METRO -0.1

CIRCLE A 2.06

CIRCLE B 3.39

CIRCLE C 1.53

In the month of MARCH12 6.88 million subscriber has been added in all the circle, circle B has added 3.39 million subscribers, circle A has added 2.06 million subscribers, circleC has added 1.53 million subscribers but Metros has lost its subscribers by 0.1 million in this month.

36

MOBILE NUMBER PORTIBILITY (MNP)

Mobile number portability is a process that enables the subscribers to change their operators without changing their mobile number. It provides a convenient way for subscribers to retain their number. What used to happen earlier when MNP was not there if somebody like opt other operator he or she had to go to other operator and purchased anew SIM card of different number, it was quite hectic and problematic, because once you have distributed a number to whom you are known to and now again send them your new number, in between what used to happened people often miss their important contact because of the number. Mobile number portability (MNP) has become a boom for the subscribers those who are not satisfy with their service provider, now they can change their number without hesitation of losing the number what they have.

LAUNCH OF MNP IN INDIA

Mobile number portability was launched in India at 20th January 2011 by telecom minister Mr. Kapil sibbal in the state of Haryana. It has become a boom not for only subscribers but for late entrant private companies, new companies by keeping their call cost, tariff low tantalizing the subscribers in the country to enhance their subscriber base and they are getting positive response so far big player like Tata, Reliance and BSNL losing their customer base. The Government had announced the guidelines for Mobile Number Portability (MNP) Service License in the country on 1st August 2008 and had issued a separate License for MNP service in March 2009. The Department of Telecommunication (DoT) had issued licenses to two global companies (M/s Syniverse Technologies Pvt. Ltd. and M/s MNP Interconnection Telecom Solutions India Pvt. Ltd.) for implementing the service MNP in Indian market has the enhanced the level of competition, players is not only striving hard for acquire new customer but retain existing one. So companies are putting a lot of effort to

37

their customer service, they know very well that if they do not serve their customers well they will leave the company that will affect at their revenue. MNP has proven one thing for the telecom operators that customer is really the king of market if you fail to serve him well, he will leave. Companies are trying to retain their customer but the tantalizing offer which is being made by their competitor is not letting customer to stay with their existing one, companies like Airtel, Idea, Vodafone who has competitive advantages over other making the full use of MNP.

PROCESS OF MNP IN INDIA

PORT REQUEST1. Send a SMS to 1900 in following format: PORT e.g. PORT 9999999999 2. You will get a SMS reply that contains a unique porting code. 3. SMS to the preferred operator quoting the unique code. This code is valid only for a few days, and one must apply again if it expires. (YourMobileNumber)

4. Your existing operator will check with new operator & if there are no dues then approval will be given for porting.

5. You will get a SMS on the time & date when porting will take place. Rules mandate that process be completed within 4 days of applying.

6. After porting is complete, wait for a SMS from your new operator confirming the switch. Your phone may be dead for about 2 hours when the porting takes place.

38

7. Service provider may charge a porting fee up to Rs.19.

ELEAGIBILITY & OTHER CONDITION-

1. You are allowed to move to another mobile service provider only after 90 days of the date of activation of your mobile connection or from the date of last porting of your mobile number, whichever is applicable.

2. You are allowed to change mobile service provider within the same service area only.

3.

If you are a postpaid subscriber, please ensure that you have paid all the dues as per your last bill (You will have to sign an undertaking in the Porting Form also).

4. If you are a Pre-paid subscriber, please note that the balance amount of talk time, if any, at the time of porting will lapse.

STATUS OF MNP IN INDIA

People in India are more willing to change their current operator if they are having any kind of problem related with service and all. They never think twice before opting a new operator. If we talk about the fact and figure the till march 2012, 41876005 port request had been sent. So we can say that people are making the maximum use of portability. If we see the data of last three months we find that the port request has increased month to month, taking the data of January 12 in this month port request was 32788738 and Feb 12 it was 37111247 that was 4322509 was higher than what it was in Jan12. In March it reached to 41876005 that are 4764758 higher than what it was in Feb12. So we see the increase month to month in port request.

39

MNP STATUS AS PER SERVICE AREA IN JANUARY12

Service area wise MNP status at the end of January 2012 Zone-1 Zone-2 Service Area No. of Service Area No. of porting porting request. request Delhi 1545604 Andhra Pradesh 3043938 Gujarat 3039206 Assam 71273 Himachal Pradesh 117986 Karnataka 3394761 Haryana 1483752 Kerla 1698063 Jammu&Kashmir 5887 Kolkata 683896 Maharastra 2569554 Madhya Pradesh 2020605 Punjab 1278197 North East 20327 Mumbai 1163498 Bihar 698107 Rajasthan 2717109 Orissa 732249 UP East 1697080 Tamilnadu 2000504 UP West 1821896 West Bangal 986046 Total 17438969 15349769 In this table see the no. of port request which had been made in Jan12 service area wise. In this month 32788738 request had been made. In jan12 most of the port request had been sent from the zone -1 that is 17438969, and from zone -2 15349769 port request had been sent. If we talk about the Zone-1 most of the request had been sent from Gujrat that is 3039206 and Maharastra comes on 2nd position .least port request had been sent in this month from Jammu&Kashmir that is 5887. If we talk about the Zone-2 Karnataka has topped the list with 3394761 port request in the month of jan12 Andhra Pradesh comes on second position with 3043938 port request in the same month.

40

MNP STATUS AS PER SERVICE AREA IN FEBRAURY12

Service area wise MNP status at the end of Febraury 2012 Zone-1 Zone-2 Service Area No. of Service Area No. of porting porting request. request Delhi 1641506 Andhra Pradesh 3460753 Gujarat 3426450 Assam 85400 Himachal Pradesh 141593 Karnataka 3940238 Haryana 1642668 Kerla 1860763 Jammu&Kashmir 6055 Kolkata 777454 Maharastra 2909573 Madhya Pradesh 2264486 Punjab 1436221 North East 27959 Mumbai 1299078 Bihar 778624 Rajasthan 3256438 Orissa 788425 UP East 2031205 Tamilnadu 2232754 UP West 2038921 West Bangal 1064683 Total 19829708 17281539

In this table we see the no. of port request which had been sent in Feb12 that is higher than what it was sent in Jan12. In Feb 12 it reached to 37111247 from 32788738 in Jan. if we talk about the Feb12 once again most of request has been sent by zone -1, once again Gujrat in zone-1 topped the list. In zone -2 most of the port request had been sent from Karnataka that is 3940238 that is the highest port request sent by a service area between zone-1 and zone-2. Port request has increased from both of the zone, in Jan12 the port request had been sent by zone -1 was 17438969 and in Feb it reached to 19829708, and in zone- 2 earlier it was 15349769 but in Feb12 it reached to 17281539. In Feb12 4322509 more request had been sent than a month earlier.

41

MNP STATUS AS PER SERVICE AREA IN MARCH12

Service area wise MNP status at the end of MARCH 2012 Zone-1 Zone-2 Service Area No. of Service Area No. of porting porting request. request Delhi 1748385 Andhra Pradesh 3986429 Gujarat 3885145 Assam 116593 Himachal Pradesh 175408 Karnataka 4529287 Haryana 1823692 Kerla 2066487 Jammu&Kashmir 6762 Kolkata 871537 Maharastra 3311366 Madhya Pradesh 2501550 Punjab 1603051 North East 41607 Mumbai 1459797 Bihar 849407 Rajasthan 3710064 Orissa 863077 UP East 2398832 Tamilnadu 2458855 UP West 2323789 West Bangal 1194885 Total 22396291 17281539 In this table we see the total no. of port request had been sent in the month of March12 it was 41876005 that was higher than what it was sent in the Feb12, 4764758 more port request had been sent in the month of March, so we see the port request in ascending form. If we talk about the March12, from zone -1, the most of the port request had been sent, once again in this zone Gujrat with 3885145 request leading the rest. Least request had been sent from Jammu&Kashmir. In zone-2 the no. of port request is 17281539 that is higher than last month, in this zone the Karnataka is leading the rest with 4529287 port request.

42

TOP GAINER OF MNP SERVICES-

Idea cellular a company from Aditya Birla group has emerged as the highest gainer of MNP services as on 31st March2012 with a net addition of 3.32 million customers. Idea has emerged as the most favorable telecom operator in the country. If we talk about the Port-in and Port-out request which had been sent by the customer that is 9,297,896 and 5,974,318 respectively. It means that 3323578 people want to opt Idea. If we talk about other gainer that is Vodafone and Airtel, they are also on the verge of gaining customers. Vodafone has emerged as the second highest gainer of MNP services by adding 2.89 subscribers as on 31st March2012.if we talk about the Port-in and Port-out request of Vodafone that is 11,040,863 and 81,50,730 respectively. It means 2890133 subscribers are willing to opt Vodafone.

Airtel has emerged as the 3

rd

largest gainer of MNP services in the country, Airtel has added 1.2

million subscribers as on 31st march 2012, Port-in request for Airtel was 10827376 while portout request was 9,613,630. It means that 1213746 customer want to use Airtel services.

TOP LOOSER OF MNP SERVICES

Reliance Communication (GSM) has lost maximum number of subscribers as of March2012, it lost nearly 1.35 million subscribers, and in CDMA segment it is also not able to retain the existing customer, in CDMA segment it lost nearly 1.48 million subscribers as on March2012, if we talk about Reliance GSM services it received nearly 3.14 million port-out request in comparison to 1.79 million Port-in request. Whether Reliance CDMA received 1.72 million Portout requests as against 0.24 million Port-in request. If we talk about other looser Tata teleservices comes on the second number, Tata GSM has lost 0.51 million subscribers. Tata teleservices has received 3.40 million Port-out request as

43

compared to 2.89 million Port-in request. State-run BSNL (GSM) had 2.45 million port-out requests compared to 1.68 million port-in applications. MTNL, which operates in Delhi and Mumbai circles, had 0.13 million port-out requests compared to 0.03 million applications wishing to join the network.

44

DATA ANALYSIS AND INTERPRETATION-

45

TYPE OF SERVICES IS BEING USED BY SUBSCRIBERS

CDMA 15% GSM CDMA

GSM 85%

Observation-- In it we see the 85% people have subscribed GSM services and 15% people have subscribed CDMA services. People are willing to opt GSM because of it cost less while switching to other number or operator.

46

OPERATORS ARE BEING OPTED BY SUBSCRIBERS.

Idea BSNL Tata 10.00% Aircel Uninor 15.00% 8.00% sistema Videocon 6.00% MTNL Airtel Reliance 22.00% 2.00% 4.00% 2.00% 1.00% Vodafone

12.00% 18.00%

Observation- In this we see the people like Airtel most,airtel has maximum market share 22%, and Vodafone is the second choice of the people, 18% people are using this network. Reliance has got the third position in this race with 15% market share in hand. New entrant Videocon has least market share.

47

Source has been used to purchase mobile connection

other 5% newspaper magazine 10% magazine Retailer Friends TV 10% Friends 30% Retailer 10% TV Internet other

Internet 20%

newspaper 15%

Observation- It has been observed that mostly people trust on their friends& Relative while choosing any subscriber. 15% people get inspired by an advertisement in newspaper, 10% people listen to Retailer, think that they know the operators well, 10% rely on TV commercial, 20% people take the advantage of internet to make a decision, 10% people believe in magazine and 5% people explore other sources to opt an operator.

48

DURATION OF USING CURRENT OPERATOR

none 30% more than 1 year 30%

more than 1 year more than 2 year more than 3 yaear

more than 3 yaear 15%

more than 2 year 25%

none

Observation- It has been observed that 30% people have been using their current operator for more than 1 year, 25% people have been using it for more than 2 year,15% that were mainly professional using their current operator for more than 3 year, and 30% people were new subscriber using their service operator less than a year.

49

TYPE OF SUBSCRIBERS ACCORDING TO MODE OF PAYMENT

POSTPAID 25% POSTPAID PREPAID PREPAID 75%

Observation- Majority people (75%) use prepaid connection while some people who belongs to upper-middle class or any other professional use postpaid connection. That constitutes 25% of subscribers.

50

SUBSCRIBERS WILLING TO PORT

35% YES NO 65%

Observation- It has been observed that 65% People were not willing to port, we can say that they might be satisfy with their current operator and 35% people were willing to change their current service provider.

51

SUBSCRIBERS CHOICE

BSNL 5% OTHERS 15% BSNL RELIANCE 20% AIRTEL 35% AIRTEL VODAFONE RELIANCE OTHERS VODAFONE 25%

Observation- it has been observed that most of the people are willing to opt airtel if they port in future , only 5% people are willing to port in BSNLthat is only public sector undertaking, 25% people willing to port in Vodafone, 20% people willing to port in Reliance and 15% people are willing to opt different-2 mobile operator.

52

Others 1%

PREFERENCES OF SUBSCRIBERS WHILE PURCHASING A CONNECTION

VAS 11%

Price 26%

Price Connectivty VAS

Connectivty 62%

Others

Observation- it has been seen that mostly people believe in reasonable price and excellent connectivity, most of the people are ready with compromise with price and other value added services but not the connectivity.

53

SUBSCRIBER'S CHOICE ACCORDING TO PRICE

Others 10% BSNL 15% BSNL Airtel Reliance 30% Airtel 20% Vodafone Reliance Others Vodafone 25%

Observation- In this we see that 30% people believe that the services of Reliance is cheap, while 25% believe that Vodafone has a best pricing strategy, 20% says Airtel has nice pricing strategy ,10% people think BSNL is providing its services at reasonable price.15% think that other private operator is charging reasonable price for services.

54

SUBSCRIBER'S CHOICE ACCORDING TO QUALITY OF SERVICES

Others 5% BSNL 10% Reliance 20% Airtel 35% Vodafone 30% BSNL Airtel Vodafone Reliance Others

Observation- In this we see that 35% people believe that the quality of Airtels service is excellent, 30% people believe that Vodafone is the best service provider, 20% think Reliance is good in services 10% think BSNL is a good service provider and while 5% people think that other new entrant providing good quality of services.

55

SUBSCRIBER'S CHOICE ACCORDING TO VAS.

BSNL 10% Airtel 15% BSNL Airtel Vodafone Reliance Reliance 20% Vodafone 30% Others

Others 25%

Observation- In it we see that 30% people think that the kind of Value added services which is being provided by Vodafone is best, 20% people think Reliance is better, 15% think Airtel is better, 10% people think BSNL is good while 25% people think other operators are providing good value added services.

56

SWOT ANALYSISSTRENGTH Companies are able to provide services at lower rate. Low entry cost in subscribing the service has become the greatest strength. Value added services, like internet and other paving the way to grow.

WEAKNESS High tariff rate, call rate of mobile companies. Companies have to face tough competition in market, big player gaining competitive advantage over small player. User experience with the internet on mobile not ideal because of screen size, keypad and slow network speed. OPPORTUNITY Indian telecom market is full of potential; every company is getting full opportunities to grow. The income of the people increasing in rural area and they are willing to opt the telecom services, companies need to tap this untapped market. THREAT Foreign player fear to enter into market because of 2G scam and cancellation of the license by Supreme Court. MNP has become major threat most of the companies losing market share because of it.

57

CONCLUSION

Types of service is being used by subscribers In the study it has been found that most of the people prefer GSM services because low handset entry cost, in the study 75% people were using GSM services. Failure of CDMA services People were less willing to take CDMA services because of high handset entry cost.

Postpaid Vs. Prepaid In the study, it has been found that most of the people use prepaid mobile services because they think it is a easy mode of payment. Portability In the study it has been found that most of the people were satisfy with their service provider, some were not happy with their service provider. It has been seen that portability is increasing day by day.

Status of wire line telephonic services Wire line services are on the verge of depletion, the number of wire line connection has decreased from 40.77 million in March07 to 32.17 million in March12. Wire line services are confined to offices; they are being used mostly in the offices.

58

Status of GSM services In India, there are more than 664.08 million subscribers. Private Operators hold 88.65% of the GSM market share where as BSNL and MTNL, two PSU operators hold only 11.35%. In Indian GSM market Airtel has emerged as a market leader with more than181.28 million subscribers. Effect of MNP Idea has emerged as a top gainer of MNP services by adding addition of 3.32 million subscribers as on march12. Reliance Communication (GSM) is most badly affected company because of MNP services it lost nearly 1.35 million subscribers as on march12. The revenue of the companies is decreasing because of tough competition and low usage mobile services.

59

RECOMMENDATION-

Telecom major should think to launch the services, tariff according to the needs of customer, to satisfy them and try to make the brand loyal as very soon this blue ocean of Indian telecom scenario will convert into Red Ocean where the loss of one is gain of other. They should also think for searching new space or creating a new blue ocean. Small companies need to take lots of precaution in comparison with their big counterpart, they need to mull over on their strategy to acquire new customer while retaining existing one. Mobile number portability (MNP) has become a worst threat for the companies that does not has competitive advantage over other mostly for small players, so companies should take care of customer in a such a way so that it should not leave existing operator. Companies need to work on their customer care department so that they could keep their customer happy by solving his query in more efficient manner. Companies should take care of after sale services as well. Companies need to work on their network as well to provide better customer service. Companies need to work on tariff plan, SMS plan and data plan to serve the customer well and gain a competitive advantage.

60

BIBILIOGRAPHY

Websitewww.google.com www.rcom.co.in www.airtel.in www.vodafone.in www.tatadocomo.com www.trai.gov.in www.wikipedia.org

News paperThe Economic Times The Times of India The Hindustan Times

Book preferred Marketing management- Philip kotler Marketing management- Rajan Saxena Research Methodology- C R Kothari

ReportsTRAI Report (press release no.86/2012) 3rd may 2012 DOT Report (Annual Report 2011-12)

61

ANNEXURE

QUESTIONNAIRE For the GSM market survey and customers changing behavior. Name of the person-________ ___________________________________ Address-_____________________________________________________ Contact no-___________________________________________________ E-mail ID-____________________________________________________

1. What kind of mobile service are you using? GSM CDMA 2. Who is your current mobile service provider? BSNL Airtel Vodafone Reliance Others 3. Which of the following information sources have used for the purchase of mobile services? Newspaper TV Internet Magazine Friends Retailer Others 4. How many years have you been using current mobile operator? 1 2 3 None 5. Do you have postpaid or prepaid connection?

62

Prepaid Postpaid

6. If you are asked to port your number to other operator, would you go for that? Yes No 7. If so, which operator would you like to opt? Airtel BSNL Vodafone Reliance Others 8. What do you see in a brand while purchasing a connection? Price Connectivity Value added services Others. 9. If you are asked to rate brands according to its Price which operator do you think provides services at reasonable price? BSNL Airtel Vodafone Reliance Others 10. If you are asked to rate brands according to its quality of services which operator do you think provides better quality? BSNL Airtel Vodafone Reliance Others.

63

11. If you are asked to rate brands according to its value added services which operator do you think is good? BSNL Airtel Vodafone Reliance Others

Das könnte Ihnen auch gefallen

- Unlock Lucrative Opportunities with Modern Technology Skills: A Comprehensive Guide to Earning Big MoneyVon EverandUnlock Lucrative Opportunities with Modern Technology Skills: A Comprehensive Guide to Earning Big MoneyNoch keine Bewertungen

- Promoting Information and Communication Technology in ADB OperationsVon EverandPromoting Information and Communication Technology in ADB OperationsNoch keine Bewertungen

- The GPT-4 Crypto Revolution: Pioneering Profit in a Digital AgeVon EverandThe GPT-4 Crypto Revolution: Pioneering Profit in a Digital AgeNoch keine Bewertungen

- Problem ManagementDokument33 SeitenProblem Managementdhirajsatyam98982285Noch keine Bewertungen

- Research ProposalDokument45 SeitenResearch ProposalAaliyah Marie AbaoNoch keine Bewertungen

- ACE Resilience Questionnaires Derek Farrell 2Dokument6 SeitenACE Resilience Questionnaires Derek Farrell 2CATALINA UNDURRAGA UNDURRAGANoch keine Bewertungen

- Earned Value Management: A Global and Cross-Industry Perspective on Current EVM PracticeVon EverandEarned Value Management: A Global and Cross-Industry Perspective on Current EVM PracticeNoch keine Bewertungen

- 1stQ Week5Dokument3 Seiten1stQ Week5Jesse QuingaNoch keine Bewertungen

- Airtel and Vodafone Marketing AnalysisDokument90 SeitenAirtel and Vodafone Marketing Analysissaket_211100% (11)

- Cellular Technologies for Emerging Markets: 2G, 3G and BeyondVon EverandCellular Technologies for Emerging Markets: 2G, 3G and BeyondNoch keine Bewertungen

- Keeping the Digital Simple: A Handbook for Telco Digital TransformationVon EverandKeeping the Digital Simple: A Handbook for Telco Digital TransformationBewertung: 4 von 5 Sternen4/5 (1)

- Hercules Industries Inc. v. Secretary of Labor (1992)Dokument1 SeiteHercules Industries Inc. v. Secretary of Labor (1992)Vianca MiguelNoch keine Bewertungen

- Marketing Strategies of AirtelDokument85 SeitenMarketing Strategies of Airtelvishugaba198867% (15)

- How to Be a Successful Software Project ManagerVon EverandHow to Be a Successful Software Project ManagerNoch keine Bewertungen

- Lista Verbelor Regulate - EnglezaDokument5 SeitenLista Verbelor Regulate - Englezaflopalan100% (1)

- Emerging FinTech: Understanding and Maximizing Their BenefitsVon EverandEmerging FinTech: Understanding and Maximizing Their BenefitsNoch keine Bewertungen

- Marketing Strategies of AirtelDokument93 SeitenMarketing Strategies of AirtelSami ZamaNoch keine Bewertungen

- Marketing Strategies of AirtelDokument91 SeitenMarketing Strategies of AirtelGaurav ChaturvediNoch keine Bewertungen

- Research Project Report On Marketing Strategies of AirtelDokument86 SeitenResearch Project Report On Marketing Strategies of Airtelnajakat67% (3)

- RAVI MNP Full Dissertation ProjectDokument137 SeitenRAVI MNP Full Dissertation ProjectAshwani Singh100% (1)

- Acknowledgement: Bhartiairtel, LTD, GorakhpurDokument72 SeitenAcknowledgement: Bhartiairtel, LTD, GorakhpurPawandeep Raju JaiswalNoch keine Bewertungen

- Marketing Strategy of AirtelDokument92 SeitenMarketing Strategy of AirtelAnmol Arora0% (1)

- Synopsis Project Report ON: Marketing and Promotiopnal Strategy of Airtel Ltd. in NCR RegionDokument11 SeitenSynopsis Project Report ON: Marketing and Promotiopnal Strategy of Airtel Ltd. in NCR RegionGuman SinghNoch keine Bewertungen

- Telecom Sector in GujaratDokument68 SeitenTelecom Sector in Gujaratnishutha3340Noch keine Bewertungen

- A Study On Marketing Strategies of Tata DocomoDokument59 SeitenA Study On Marketing Strategies of Tata DocomoNazwanNazer100% (1)

- Summer Training Project: M A R K ETI N G S T R A T E Gies OF A I R T ELDokument93 SeitenSummer Training Project: M A R K ETI N G S T R A T E Gies OF A I R T ELvps9044Noch keine Bewertungen

- "Marketing Strategies of Airtel": Submitted ToDokument87 Seiten"Marketing Strategies of Airtel": Submitted TomunisndNoch keine Bewertungen

- A Project Report On AIRTELDokument91 SeitenA Project Report On AIRTELHari Krishan100% (1)

- Kanchan ProjectDokument85 SeitenKanchan Projectkanchansingh4Noch keine Bewertungen

- Statement of The ProblemDokument67 SeitenStatement of The ProblemArafath ArnoldNoch keine Bewertungen

- Project Report On Retailers Perception About Micromaxx Mobile HandsetsDokument82 SeitenProject Report On Retailers Perception About Micromaxx Mobile HandsetsManish Singh77% (13)

- Tranining Report of Piyush TrivediDokument102 SeitenTranining Report of Piyush Trivediακαση σηNoch keine Bewertungen

- Airtel Marketing StrategiesDokument100 SeitenAirtel Marketing StrategiesSuhail AfzalNoch keine Bewertungen

- Rehena BSNL PROJECTDokument54 SeitenRehena BSNL PROJECTishfana ibrahimNoch keine Bewertungen

- Vodaphone AshokDokument90 SeitenVodaphone AshokdeepajosiNoch keine Bewertungen

- Idea Winter Project2Dokument54 SeitenIdea Winter Project2muntaquirNoch keine Bewertungen

- Project Report ON: Marketing Strategies of AirtelDokument39 SeitenProject Report ON: Marketing Strategies of AirtelRanjit DebnathNoch keine Bewertungen

- Nirma Institute of ManagementDokument34 SeitenNirma Institute of ManagementKaran ZalaNoch keine Bewertungen

- BISHAL SynopsisDokument6 SeitenBISHAL SynopsisAshish JaiswalNoch keine Bewertungen

- Mobile Number Portability:-Opportunities and Threats in Parbhani Emerging For Airtel.Dokument43 SeitenMobile Number Portability:-Opportunities and Threats in Parbhani Emerging For Airtel.MorerpNoch keine Bewertungen

- Final Project For Checking Study of Students Preference TowaDokument63 SeitenFinal Project For Checking Study of Students Preference TowaSanty KudiNoch keine Bewertungen

- A Study On The Marketing Startegy by Tata Docomo GSM Mobile at Raigad District (Maharashtra)Dokument66 SeitenA Study On The Marketing Startegy by Tata Docomo GSM Mobile at Raigad District (Maharashtra)shailesh nikumbhaNoch keine Bewertungen

- "Marketing Strategies of Airtel at Bharti Airtel, Lucknow": Summer Training Project ReportDokument87 Seiten"Marketing Strategies of Airtel at Bharti Airtel, Lucknow": Summer Training Project Reportsarvang goyalNoch keine Bewertungen

- Marketing Strategies of Airtel PROJECTDokument112 SeitenMarketing Strategies of Airtel PROJECTakash deepNoch keine Bewertungen

- Vodafone Primary ResearchDokument26 SeitenVodafone Primary ResearchcbhawsarNoch keine Bewertungen

- "Master of Business Administration: Project ReportDokument90 Seiten"Master of Business Administration: Project ReportRini BhargavaNoch keine Bewertungen

- 3g Market in Delhi Corporate Space - Scope of Reliance Communications in The Delhi GSM Corporate SpaceDokument140 Seiten3g Market in Delhi Corporate Space - Scope of Reliance Communications in The Delhi GSM Corporate SpaceHimanshu ManchandaNoch keine Bewertungen

- Final Thesis On 3gDokument47 SeitenFinal Thesis On 3grhythm001100% (1)

- Customer Satisfaction Towards Reliance Jio Marketing 100 PAGEDokument90 SeitenCustomer Satisfaction Towards Reliance Jio Marketing 100 PAGETripta KNoch keine Bewertungen

- Why Customer Preference For "Postpaid Connection"Dokument66 SeitenWhy Customer Preference For "Postpaid Connection"pmmppmNoch keine Bewertungen

- Seema ProjectDokument66 SeitenSeema ProjectVandanaNoch keine Bewertungen

- Customer Satisfaction at Vodafone ReportDokument64 SeitenCustomer Satisfaction at Vodafone Reportrahulsogani123Noch keine Bewertungen

- Customer Preference For Mobile Number Portability: December 2012Dokument6 SeitenCustomer Preference For Mobile Number Portability: December 2012Adhil Sadique SR4Noch keine Bewertungen

- Papers on the field: Telecommunication Economic, Business, Regulation & PolicyVon EverandPapers on the field: Telecommunication Economic, Business, Regulation & PolicyNoch keine Bewertungen

- Technology Development and Marketing: With Cases & TheoriesVon EverandTechnology Development and Marketing: With Cases & TheoriesNoch keine Bewertungen

- The Strategy Machine (Review and Analysis of Downes' Book)Von EverandThe Strategy Machine (Review and Analysis of Downes' Book)Noch keine Bewertungen

- Global Market-Marketing Research in 21st Century and BeyondVon EverandGlobal Market-Marketing Research in 21st Century and BeyondNoch keine Bewertungen

- Digitizing Government: Understanding and Implementing New Digital Business ModelsVon EverandDigitizing Government: Understanding and Implementing New Digital Business ModelsNoch keine Bewertungen

- Analysis and Design of Next-Generation Software Architectures: 5G, IoT, Blockchain, and Quantum ComputingVon EverandAnalysis and Design of Next-Generation Software Architectures: 5G, IoT, Blockchain, and Quantum ComputingNoch keine Bewertungen

- Azerbaijan's Ecosystem for Technology Startups—Baku, Ganja, and ShamakhiVon EverandAzerbaijan's Ecosystem for Technology Startups—Baku, Ganja, and ShamakhiNoch keine Bewertungen

- Kormos - Csizer Language Learning 2008Dokument29 SeitenKormos - Csizer Language Learning 2008Anonymous rDHWR8eBNoch keine Bewertungen

- SEx 3Dokument33 SeitenSEx 3Amir Madani100% (4)

- Poet Forugh Farrokhzad in World Poetry PDokument3 SeitenPoet Forugh Farrokhzad in World Poetry Pkarla telloNoch keine Bewertungen

- Julie Jacko - Professor of Healthcare InformaticsDokument1 SeiteJulie Jacko - Professor of Healthcare InformaticsjuliejackoNoch keine Bewertungen

- The Recipe For Oleander Sou1Dokument4 SeitenThe Recipe For Oleander Sou1Anthony SullivanNoch keine Bewertungen

- Types of Numbers: SeriesDokument13 SeitenTypes of Numbers: SeriesAnonymous NhQAPh5toNoch keine Bewertungen

- Trump's Fake ElectorsDokument10 SeitenTrump's Fake ElectorssiesmannNoch keine Bewertungen

- GB BioDokument3 SeitenGB BiolskerponfblaNoch keine Bewertungen

- PMS Past Paper Pakistan Studies 2019Dokument3 SeitenPMS Past Paper Pakistan Studies 2019AsmaMaryamNoch keine Bewertungen

- AASW Code of Ethics-2004Dokument36 SeitenAASW Code of Ethics-2004Steven TanNoch keine Bewertungen

- Chapter 4 - Risk Assessment ProceduresDokument40 SeitenChapter 4 - Risk Assessment ProceduresTeltel BillenaNoch keine Bewertungen

- E TN SWD Csa A23 3 94 009 PDFDokument5 SeitenE TN SWD Csa A23 3 94 009 PDFRazvan RobertNoch keine Bewertungen

- Describing LearnersDokument29 SeitenDescribing LearnersSongül Kafa67% (3)

- Unified Power Quality Conditioner (Upqc) With Pi and Hysteresis Controller For Power Quality Improvement in Distribution SystemsDokument7 SeitenUnified Power Quality Conditioner (Upqc) With Pi and Hysteresis Controller For Power Quality Improvement in Distribution SystemsKANNAN MANINoch keine Bewertungen

- Advanced Technical Analysis: - Online Live Interactive SessionDokument4 SeitenAdvanced Technical Analysis: - Online Live Interactive SessionmahendarNoch keine Bewertungen

- SHS11Q4DLP 21st CentFinalDokument33 SeitenSHS11Q4DLP 21st CentFinalNOEMI DE CASTRONoch keine Bewertungen

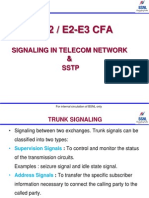

- Signalling in Telecom Network &SSTPDokument39 SeitenSignalling in Telecom Network &SSTPDilan TuderNoch keine Bewertungen

- Essay EnglishDokument4 SeitenEssay Englishkiera.kassellNoch keine Bewertungen

- Insomnii, Hipersomnii, ParasomniiDokument26 SeitenInsomnii, Hipersomnii, ParasomniiSorina TatuNoch keine Bewertungen

- Prepositions French Worksheet For PracticeDokument37 SeitenPrepositions French Worksheet For Practiceangelamonteiro100% (1)

- Algebra. Equations. Solving Quadratic Equations B PDFDokument1 SeiteAlgebra. Equations. Solving Quadratic Equations B PDFRoberto CastroNoch keine Bewertungen

- Shielded Metal Arc Welding Summative TestDokument4 SeitenShielded Metal Arc Welding Summative TestFelix MilanNoch keine Bewertungen

- CEI and C4C Integration in 1602: Software Design DescriptionDokument44 SeitenCEI and C4C Integration in 1602: Software Design Descriptionpkumar2288Noch keine Bewertungen

- Diploma Pendidikan Awal Kanak-Kanak: Diploma in Early Childhood EducationDokument8 SeitenDiploma Pendidikan Awal Kanak-Kanak: Diploma in Early Childhood Educationsiti aisyahNoch keine Bewertungen