Beruflich Dokumente

Kultur Dokumente

Costs

Hochgeladen von

Mazlina Bt Mohd MadlanOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Costs

Hochgeladen von

Mazlina Bt Mohd MadlanCopyright:

Verfügbare Formate

COSTS (ORDER 59 OF RHC) O. 59 r. 1 - Cost includes fees, charge, disbursement, expenses and remuneration.

In general, costs are: The charge which a solicitor is entitled to make and recover remuneration for his solicitor services. An expense which is the winning party is entitled to recover from the other side including the court fees, stamp and solicitor fees (ascertained by taxation process). O. 59 r 2(2) awarding the cost is the discretionary of the court to order: o To whom the costs is to be paid (GR: cost follow the event-usually the winning party entitle for the costs, and the person who is wrongfully made as the party should get his costs). o How much the costs need to be paid. O. 59 r 3(2) for the incidental costs to the trial. (such as costs born due to the amendment pleading, or etc) - GR: usually, court will order the cost to follow the event . thats mean the party who apply to amend or etc need to bear the costs unless the court order otherwise. (subject to discretion of the court). O. 59 r 4(1) when the costs need to be paid? the costs may be dealt at any stage of proceeding, or end of the trial, and the court order it to be paid forthwith (immediately), even the trial still not be concluded if court think fit. Case: KOKOMA PONY HORSE CENTRE V RASA SAYANG BEACH HOTEL - power of court to deal with the Q of costs is as being stated under O59 r 49(1) where it stated that the costs may be dealt with by the court at any stage of proceeding/at the conclusion of trial. If the court thinks fit, it may order for the costs to be paid forthwith even before the conclusion of the proceeding.

TYPES OF COSTS 1. Reserved costs - this order made during the interlocutory proceeding. (the court still not decided on the issue of cost and deferred it until the end of the trial). 2. Costs of the day made on the hearing day of the application or on the hearing day proper where a party who makes a successful application of the postponement of the hearing is ordered to pay the costs of the day incurred by the other side. 3. Costs in the cause cost of those interlocutory proceeding are to be awarded according to the final award of costs in action (main suit). The successful party for the suit will be awarded with all cost of interlocutory proceeding (regardless he success for all or just partly in that interlocutory application). Pf costs in the cause if the pf win the action - he will be awarded for all costs for interlocutory proceeding and if he loss he need not to pay for the other sides costs. **the situation will go otherwise for df costs in the cause. 4. Costs in any event (or known as pf costs in any event) no matter who is win or loss, when the case is decided/settled, pf is to have the costs of those interlocutory proceeding without waiting for the decision. 5. Costs thrown away this order is made upon the application of the df to set aside the judgment, but in this situation, the df himself had failed to enter for appearance or deliver his defence. Thus, the court will order the df to pay for all costs which reasonably incurred by the pf during enforcing the judgment. 6. Bullock Order derived from the case of Bullock v General London Omnibus & Co. In this case, Pf sued 2 df. Then, the court found that only the first df liable. Thus, the court order the following term: i. Judgment for the pf against df with costs. (the pf win and awarded with costs). ii. Pfs claimed against the second df dismissed and pf need to pay for the second dfs costs.

iii. First df need to pay the pfs costs include the costs paid by the pf to the second df. (elaboration for Bullock order pf pay first to 2nd df, the 1st df need to pay back for the costs incurred by pf). 7. Sanderson Order derived from the case of Sanderson v Blyth Theatre. In this case, the pf had sued df for the price of building work done upon the instruction of the dfs architect who was his agent. Pf joined the architect as the co-df. At the trial, the df was found as solely liable. Court ordered the df to pay for the costs to the co-df directly. The order was like below: i. Judgment for pf (pf win the case) ii. Df need to pay for pfs costs. iii. Df need to pay for the co-dfs costs directly for defending the sue successfully. TAXATION FOR COSTS What is meant by taxation for costs? o Procedure the court will determine on how much the party will get as costs. (after the award made by court, the party who is awarded with costs needs to go to the registrar office, to apply for the costs to be taxed, only then the party will be entitled for the nett amount of costs). Who has the power to tax the costs? i. The Registrar (the court will not interfere) (O59 r 12 & r13).

Party who is taxing the party who is awarded with costs (applicant). Party who is to be taxed the opposite party who receive the notice of taxation (party who needs to pay for the costs). Procedures for taxation (O59 r20 r25). i. O59 r20 the party who is entitled for costs need to file in the courts registry the bill of costs and a copy of the bill together with all necessary papers and vouchers + apply for the notice of taxation to be issued. ii. O59 r21 - registrar shall notify the parties involved regarding the time appointed for the taxation hearing, notice of the day and give the not less than 7 days. (Subject to (2) where this para is not applicable for those who

not enter appearance/not taking part in the taxation proceeding and for any solicitors bill of costs under LPA 1976.) iii. O59 r22 any party, who receive the notice under r21, must serve a copy of his bill of cost to the other party involved under the hearing, within 2 days after receiving it. Review of taxation o By the Registrar (O59 r34) dissatisfied party may apply for the registrar to review his decision on taxation of costs. It must be made 14 days from the date of decision of taxation proceeding. The objection must be made in writing and delivered to registrar by stating concisely on the nature and ground of the objection. A copy of that objection must be send to all parties involved in the taxation proceeding. Then, the said parties must, within 14 days after receiving the objection, deliver an answer to opposed the objection in writing to the registrar and serve the answer to all other parties. Finally, the registrar will issue the certificate after review his decision.

o By the judge(O59 r34) the dissatisfied party need to apply for the judge to review on the registrars decision, within 14 days after the date of the decision had been made. In this level, no further evidence or new ground may be adduced unless directed by the judge. Finally, the judge may amend the registrars certificate or order the item listed to be remitted to the registrar for taxation.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

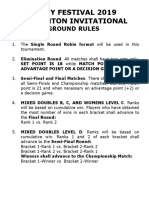

- Ground Rules 2019Dokument3 SeitenGround Rules 2019Jeremiah Miko LepasanaNoch keine Bewertungen

- ImpetigoDokument16 SeitenImpetigokikimasyhurNoch keine Bewertungen

- Linear Space-State Control Systems Solutions ManualDokument141 SeitenLinear Space-State Control Systems Solutions ManualOrlando Aguilar100% (4)

- Ad1 MCQDokument11 SeitenAd1 MCQYashwanth Srinivasa100% (1)

- Discussion #3: The Concept of Culture Learning ObjectivesDokument4 SeitenDiscussion #3: The Concept of Culture Learning ObjectivesJohn Lery SurellNoch keine Bewertungen

- Birds (Aves) Are A Group Of: WingsDokument1 SeiteBirds (Aves) Are A Group Of: WingsGabriel Angelo AbrauNoch keine Bewertungen

- Gits Systems Anaphy DisordersDokument23 SeitenGits Systems Anaphy DisordersIlawNoch keine Bewertungen

- Action List 50Dokument4 SeitenAction List 50hdfcblgoaNoch keine Bewertungen

- The Handmaid's Tale - Chapter 2.2Dokument1 SeiteThe Handmaid's Tale - Chapter 2.2amber_straussNoch keine Bewertungen

- HG G5 Q1 Mod1 RTP PDFDokument11 SeitenHG G5 Q1 Mod1 RTP PDFKimberly Abilon-Carlos100% (1)

- Memoire On Edgar Allan PoeDokument16 SeitenMemoire On Edgar Allan PoeFarhaa AbdiNoch keine Bewertungen

- MPCDokument193 SeitenMPCpbaculimaNoch keine Bewertungen

- Mathematics Trial SPM 2015 P2 Bahagian BDokument2 SeitenMathematics Trial SPM 2015 P2 Bahagian BPauling ChiaNoch keine Bewertungen

- Management Strategy CH 2Dokument37 SeitenManagement Strategy CH 2Meishera Panglipurjati SaragihNoch keine Bewertungen

- (Abhijit Champanerkar, Oliver Dasbach, Efstratia K (B-Ok - Xyz)Dokument273 Seiten(Abhijit Champanerkar, Oliver Dasbach, Efstratia K (B-Ok - Xyz)gogNoch keine Bewertungen

- Form No. 10-I: Certificate of Prescribed Authority For The Purposes of Section 80DDBDokument1 SeiteForm No. 10-I: Certificate of Prescribed Authority For The Purposes of Section 80DDBIam KarthikeyanNoch keine Bewertungen

- Capacitor Banks in Power System Part FourDokument4 SeitenCapacitor Banks in Power System Part FourTigrillo100% (1)

- Jordana Wagner Leadership Inventory Outcome 2Dokument22 SeitenJordana Wagner Leadership Inventory Outcome 2api-664984112Noch keine Bewertungen

- Sumit Kataruka Class: Bcom 3 Yr Room No. 24 Roll No. 611 Guide: Prof. Vijay Anand SahDokument20 SeitenSumit Kataruka Class: Bcom 3 Yr Room No. 24 Roll No. 611 Guide: Prof. Vijay Anand SahCricket KheloNoch keine Bewertungen

- Social Awareness CompetencyDokument30 SeitenSocial Awareness CompetencyudaykumarNoch keine Bewertungen

- Bersin PredictionsDokument55 SeitenBersin PredictionsRahila Ismail Narejo100% (2)

- Roofing Shingles in KeralaDokument13 SeitenRoofing Shingles in KeralaCertainteed Roofing tilesNoch keine Bewertungen

- PETE 689 Underbalanced Drilling (UBD) : Well Engineering Read: UDM Chapter 5 Pages 5.1-5.41Dokument74 SeitenPETE 689 Underbalanced Drilling (UBD) : Well Engineering Read: UDM Chapter 5 Pages 5.1-5.41Heris SitompulNoch keine Bewertungen

- 5HP500-590 4139 - 751 - 627dDokument273 Seiten5HP500-590 4139 - 751 - 627ddejanflojd100% (24)

- THE LAW OF - John Searl Solution PDFDokument50 SeitenTHE LAW OF - John Searl Solution PDFerehov1100% (1)

- Global Marketing & R&D CH 15Dokument16 SeitenGlobal Marketing & R&D CH 15Quazi Aritra ReyanNoch keine Bewertungen

- University of Dar Es Salaam MT 261 Tutorial 1Dokument4 SeitenUniversity of Dar Es Salaam MT 261 Tutorial 1Gilbert FuriaNoch keine Bewertungen

- Mwa 2 - The Legal MemorandumDokument3 SeitenMwa 2 - The Legal Memorandumapi-239236545Noch keine Bewertungen

- CopacabanaDokument2 SeitenCopacabanaNereus Sanaani CAñeda Jr.Noch keine Bewertungen

- Papadakos PHD 2013Dokument203 SeitenPapadakos PHD 2013Panagiotis PapadakosNoch keine Bewertungen