Beruflich Dokumente

Kultur Dokumente

Executive Summary Salsa

Hochgeladen von

anjumghaiOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Executive Summary Salsa

Hochgeladen von

anjumghaiCopyright:

Verfügbare Formate

Executive Summary

Salvador's is a manufacturer of authentic Hispanic foods including salsa and chips. Their products are positioned at the high end of the market in terms of both quality and price. Salvador's has been in business now for three years and has grown in popularity. What was once a business targeting solely the Hispanic community has grown into a business that has far broader appeal. Salvador's has several objectives that they will achieve within the next three years. The first is an increase in sales reaching two million dollars by Year 5. Salvador's also would like gross margins to be above 55%. Salvador's also hopes to have 40 different outlets that will distribute their product. Lastly, they aim to become known as the premier authentic Hispanic food producer in the area with an ever-expanding geographic distribution area. Currently, Salvador's has two main line of products. Their flagship product is their salsa, renowned for its freshness, uniqueness, and quality ingredients. Originally introduced in one temperature, hot, the market demand has asked for milder temperatures and Salvador's has responded with both a medium and mild version. To compliment their salsa, Salvador's offers fresh chips in both yellow and blue corn. Salvador's has targeted three main customer groups to sell their products to. The first group is grocery stores. The grocery stores will be then sell directly to the end consumer. This segment is growing at 75% and there currently are 53 potential customers. The second group is wholesale distributors. This segment has a 100% growth rate with 5 potential distributors. The last customer segment is restaurants which have a 45% growth rate. There are 18 potential restaurant customers. As mentioned before, Salvador's originally targeted the Hispanic community. The market has indicated that their products have broader appeal and Salvador's has recognized this and acted accordingly. The Hispanic community was initially targeted because of its exciting growth rate. The community has been growing at 22% a year, almost double the average of the overall US population. While there are many competitors at the mid price point, both regional and national, there are few direct competitors at Salvador's high price point. This is quite advantageous for Salvador's, providing them with additional breathing room to establish themselves as the premier brand of authentic Hispanic food. Salvador's strong management team of Ricardo and Pat Torres will ensure sustainable growth for Salvador's. Pat is the President and has 12 years of food industry experience. The previous five years was as manager of a four store Tex-Mex restaurant chain. This provided Pat with incredible insight and industry knowledge that reinforced the idea to start a business from scratch. Ricardo brings Salvador's over six years of financial control experience that was gained as a CPA with Arthur Andersen. Salvador's management team, due to its seasoned strength will help Salvador's achieve the dream of being the premier Hispanic food manufacturer. Salvador's has begun to reach profitability and forecasts a modest net profit in three years. The commensurate modest profit margin will be achieved from sales. The financials within the plan further reinforce the exciting nature of this business.

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

1.1 Objectives

1. 2. 3. 4. Increase sales significantly over the next three years. Improve gross margin % over the current product line and maintain that level. Add products and services to meet market demand, again at high gross margin. Improve inventory turnover, reduce the cost of goods sold while maintaining the high quality of the products. 5. To provide jobs to the Hispanic community that are rewarding and fulfilling.

1.2 Mission

Salvador's was built on offering the highest quality and value in its authentic hot salsa, filled with the history of the Hispanic community. Time honored family recipes have been passed down through the generations, rich with ethnic heritage. Knowledgeable consumers were looking for authentic products, filled with the best ingredients. The consumer was crying out for a change! They wanted real down home Hispanic salsa. Salvador's answered this call, first with its hot salsa, then adding mild and extra hot salsa, followed by yellow and blue corn chips. Constantly striving to supply what the consumer is asking for, we continually review what is available in the marketplace, and what isn't. Improving on what is available and providing new products and services to the areas of need will assure our success in a market driven by consumer demand.

1.3 Keys to Success

1. Delivering high quality products that set themselves apart from the others in taste and value. 2. Providing service, support, and a better than average margin to our dealers. 3. Increase gross margin %. 4. Bring new products into the mix to increase sales volume.

Read more: http://www.bplans.com/salsa_manufacturer_business_plan/executive_summary_fc.php#ixzz1 vNrPVYAP

Company Summary

Salvador's is in its third year of operation, increasing sales five-fold in its second year, and is on track to repeat this in its third year. It has a good reputation, excellent people, an increasing position in the local market, and opportunities to reach out into other states. Starting with a few outlets for our products, we now have over 40, with two large grocery chains in the approval process of carrying our full line of products, and a large distributor intending to sell over $100,000 worth of our products annually.

See enclosed copies of letters from Moctezuma Foods, Inc., Meijer, Inc., and others.

2.1 Company History

Salvador's has been hindered only by the lack of working capital it had in its initial stages of setup and operation. Sales are growing steadily, with the cost of goods sold consistently decreasing. But to make significant headway in this area, additional capital is needed to purchase ingredients and processing in larger volumes, thereby reducing the costs of goods sold by 32% overall.

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

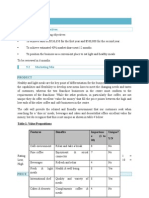

Past Performance 1993 Sales Gross Margin Gross Margin % Operating Expenses Collection Period (days) Inventory Turnover Balance Sheet Current Assets Cash Accounts Receivable Inventory Other Current Assets Total Current Assets Long-term Assets Long-term Assets Accumulated Depreciation Total Long-term Assets Total Assets Current Liabilities Accounts Payable Current Borrowing $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 0 $0 0.00 $126 $0 $3,492 $0 $3,618 $23,368 $9,792 $13,576 $17,194 $0 $16,207 $0 $16,207 $0 $16,207 $25,000 ($9,755) ($14,258) $987 $17,194 0 $0 0.00 $0 $0 0.00% $0 0 0.00 1993 1994 $4,224 $2,451 58.03% $12,028 0 6.00 1994 1995 $21,050 $14,160 67.27% $20,719 0 5.00 1995

Other Current Liabilities (interest free) $0 Total Current Liabilities $0 Long-term Liabilities $0 Total Liabilities Paid-in Capital Retained Earnings Earnings Total Capital Total Capital and Liabilities Other Inputs Payment Days Sales on Credit Receivables Turnover $0 $0 $0 $0 $0 $0 0 $0 0.00

Need real financials? We recommend using LivePlan as the easiest way to create automatic financials for your own business plan. Create your own business plan

2.2 Company Ownership

Salvador's is a privately-held C Corporation owned in total by its co-founders, Ricardo and Pat Torres.

2.3 Company Locations and Facilities

Currently we have one location in suburban Perrysburg. It includes the production area, offices, and warehouse area. We are currently looking into plans to increase the size of the warehouse by adding a location, and providing a store front to enhance the current business sales practices, while providing a high quality, ethnic outlet for Hispanic foods.

Read more: http://www.bplans.com/salsa_manufacturer_business_plan/company_summary_fc.php#ixzz1 vNrmVaIB

Products

Salvador's sells its authentic Hispanic salsa and chips to an ever-growing clientele. Originally geared toward the local Hispanic community, the market has expanded to include a much larger geographical area, in addition to a very broad consumer response. We are selling quality and product-uniqueness in a market segment filled with competition. Our approach is to take our product image up-market because or our rich heritage and uncompromising view of product quality. This focus has enabled us to view the voids in the market, and add product to our line that will fill it. We have researched and reviewed other ethnic food item organizations, tracking their successes and positioning ourselves similarly. Salvador's is building a reputation for high quality and strong value in a product filled with authentic Hispanic flavor. We service our dealers just as if they were a part of the family and that is our unique approach to marketing our products. You are not just a dealer; not just a consumer; you are special to us - you are family. We go to great lengths to provide our dealers with high quality products, and the ability to make a good margin on them. In addition, we make ourselves available for on-site demonstrations of the product at no charge to them. We hope to continue offering this service, but at a minimal cost to lower our expenses in the future.

3.1 Product Description

We currently offer two basic product lines:

Our original product, Salsa, was available only in a hot flavor. Because of consumer demand, we have added extra hot and mild flavors. Chips, both yellow corn and blue corn.

3.2 Competitive Comparison

To differentiate ourselves from all of the others, we stress quality and authenticity of the ingredients, and the heritage of the family recipe. We sell more than a jar with salsa in it. We sell high quality ingredients, carefully put together in a masterful blend that can't be matched in taste or true Hispanic authenticity. These are simple products that must be presented in a way that encourages the consumer to just give us a chance. Once they try our product, we will have a long-term relationship with them. As in similar food items, we can charge a premium for what we supply. The market has shown it will buy our product over more readily known names because of the richness and authentic taste of our salsa.

3.3 Sales Literature

We are currently working on a new line of brochures and sales materials to assist our marketing, and that of our dealers. Our newly designed labels show the direction we are taking in this area, and we have enclosed a copy as an appendix/attachment.

3.4 Sourcing

Our costs are a part of the margin squeeze. As our orders go up, we need to increase our production in a way that also increases our margin. We have found a local supplier that can reduce our costs by handling much larger batches of salsa than we are currently able, yet maintain our high quality. This will reduce our costs over 32% per jar in the production of our salsa. We need to continue to find additional opportunities that will afford us lower costs of production while maintaining the quality that has put us on the map. Our outsourcing for the corn chips has shown we can contract for a high quality product that we will be able to put our name on, and meet our goals for gross-profit margin.

3.5 Future Products

We are currently researching the addition of an authentic Hispanic Sauce, as well as other Hispanic food items to offer our current clients, and to build increased interest in Salvador's, Inc. We are now looking into additional products, sauce, and other Hispanic food items, as well as other ways of marketing the overall line. We are also looking into creation of a small store front, and eventually a lunch counter or small restaurant setting.

Read more: http://www.bplans.com/salsa_manufacturer_business_plan/products_fc.php#ixzz1vNrwvH3e

Market Analysis Summary

We have been selling at the rate of $2,500 per month to local restaurants, small grocery stores and distributors of Hispanic foodstuffs. Salvador's is currently awaiting approval for a large grocery chain to carry our products, and has received a commitment from a large distributor to sell from $100,000 to $150,000 of product per year. There are several other large grocery chains that have been approached and are in various stages of interest in carrying the Salvador's line of product.

4.1 Market Segmentation

The Hispanic food industry is in a boom period. While there are many items from various vendors available, Salvador's has approached the market as a Specialty Retailer: a provider of authentic high quality Hispanic salsa and chips. We have made significant inroads with several area restaurants and a small grocer's, each providing us with a market presence. We are now looking at developing our own store front as an adjunct to our current marketing. There is is a need for a specialty retailer catering specifically to the Hispanic client and to the individuals that appreciate authentic Hispanic cuisine. In addition to the above, we are also looking at packaging our products for other groups to use for fundraising events, gift baskets for corporate promotions, and the possibility of a house restaurant to further advertise and promote the products.

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

Market Analysis 1996 Potential Customers Grocery Stores Distributors Restaurants Other Total Growth 75% 100% 45% 53 5 18 93 10 26 11 140 163 20 38 12 233 285 40 55 13 393 499 80 80 15 674 1997 1998 1999 2000 CAGR 75.17% 100.00% 45.20% 10.67% 67.32%

12% 10 67.32% 86

Need real financials? We recommend using LivePlan as the easiest way to create automatic financials for your own business plan. Create your own business plan

4.2 Target Market Segment Strategy

We are initially focusing on the Hispanic community. They will be able to appreciate more readily the authenticity of the product. The market will observe the products they choose, and they will indirectly become promoters of our products.

4.2.1 Market Growth

The market analysis shows us a broad range of prospective clients, covering more than one ethnic group or body. The largest of these groups of customers is that of the mainstream American, which is projected to grow at 12% per year. The fasting growing segment is Hispanic, which is projected to grow at 22% per year.

4.3 Industry Analysis

The Hispanic food industry is relatively new, and its popularity is ever on the increase. The authentic taste is not common in this industry, which gives Salvador's a leg up on the competition. In an industry currently in a steady upward growth curve, Salvador's is poised to capitalize on the consumer's desire for authentic, high quality, Hispanic cuisine. While a troubling economy can affect many areas, food items are generally not as affected, with specialty items seeming to always find favor in the market place.

4.3.1 Competition and Buying Patterns

There are many suppliers of salsa and similar products currently available on the shelves at your local grocer. However, there is still a lot of room for new products and new companies. By positioning ourselves at the higher end of the market, we expose ourselves to consumers trying to get out of the rut, who continue to use a product that they have long forgotten why

they buy. By not trying to compete head on, we are selling our product consistently and increasingly. With entrance into some of the larger grocery chains we will broaden our audience considerably.

4.3.2 Main Competitors

Although Salvador's is staking out the high end of this market, we can not fail to be compared with some of the current leaders in this arena. Chi - Chi's, El Paso, and Hunt's are just a few of the participants in this segment. Most have been on the shelf for so long they are taken for granted by the consumer. Our fresh approach to authentic taste and texture makes us different.

4.3.3 Industry Participants

While there are currently several vendors in this market selling competitive products, the commonality of those products provides an opening in the marketplace for the vibrant packaging and positioning of Salvador's salsa and chips. We stand out on the shelf, we stand out in the restaurant, and we will stand out in the mind of the consumer.

4.3.4 Distribution Patterns

While current brand names carry more weight in the marketplace, because of our unique marketing approach using local restaurants, and displaying and demonstrating our wares in local grocery stores, we are able to build consumer awareness at a margin of the cost of television and radio advertising. In going to food fairs, neighborhood festivals and the like, we build consumer awareness and generate demand at the same time. While at these events we are also able to directly research the market and hear first-hand what the consumer is seeking.

Read more: http://www.bplans.com/salsa_manufacturer_business_plan/market_analysis_summary_fc.php #ixzz1vNs39AZz

Strategy and Implementation Summary

Our strategy is based on serving niche markets well. The world is full of consumers who can't get what they perceive to be high quality or authentic. We are capitalizing on the family heritage in our product line. We are building a marketing infrastructure that will provide what appears to be a seamless approach to our products, covering multiple avenues of utilizing grocery stores and major distributors. Each location will accent the other, providing for continuous exposure of Salvador's name.

5.1 Marketing Strategy

We are focusing on the consumer first through grocery exposure, and then impacting them through restaurants and other food places.

5.1.1 Promotion Strategy

The long-range goal is to gain enough visibility to leverage the product into other distribution sites within our region, then to move on to other geographical regions as inquiries and distribution requests come in. Although our current contacts in the grocery chains are for local consumption, they all move out of this region in their normal distribution. It is our goal to move with them.

5.1.2 Distribution Strategy

To this means we have been continually reworking our packaging for better corporate identity, providing a more attractive package, a very important ingredient in the food industry. An example is the recent addition of bar-coding and nutritional information to our label.

5.1.3 Pricing Strategy

We are able to price our products competitively. Even though we are subject to some impulse buying, we can provide a product to be resold at a generous mark-up for our dealers, while still providing a satisfactory experience for the consumer. At a retail range of $2.79 to $3.05 per jar of salsa, we cover the mid-to-upper price range of the salsa market, while providing a 33% margin for the dealers.

5.2 Sales Strategy

The keys to our continuing success are in the areas we are adding to our current distribution channels. This will remain our main focus for the next five years. Sales calls on the following enterprises have resulted in Salvador's Salsa being stocked and sold by them. Barney's (Perrysburg) Bassets IGA (Oak Harbor) Brinkman's Country Corner (Findlay) Brownings (Whitehouse) Char's Best Market (Toledo) Churchill Supermarkets Connie Mac's (Toledo) D & D's Carryout (Pemberville) Dels (Woodville) E & L Meats (Detroit) El Aguila Bakery (Fremont) Elmore Super Value (Elmore) Falls Crestview Market (Toledo) Gerrards (Rossford) Gift Baskets (Perrysburg) Grumpy's (Toledo)

IGA (Delta) Kazmaiers Kirwen's (Gibsonburg) K.O.A. Campground (Stoney Ridge) La Bottelia (Detroit) LaColmena (Detroit) LaMexicana (Toledo) LaPeria (Toledo) Luna Bakery & Grocery (Detroit) Mad Anthony's (Waterville) Markada (Ann Arbor) Moser's Farm Market (Perrysburg) Ohlman's Farm Market (Toledo) Ottawa Market (Toledo) Partners in Wine II (Ann Arbor) Pauken Wine & Liquor (Maumee) Schorlings (Toledo) South Point Carryout (Toledo) Stephen's Restaurant (Perrysburg) Vernor Foods (Detroit) Wolfert's (Toledo)

5.2.1 Sales Programs

Dealer sales: Thorough and persistent effort to generate sales through major names including:

Meijer, Inc. Foodtown, Inc. Kroger's Moctezuma Foods, Inc. IGA (various) Churchill's Ohlman's

To this means, we are currently interviewing distributors to assist us with the marketing and distribution of our salsa. Again, the hiring of a distributor, and a modest performance increase on their efforts for Salvador's would make our sales projections conservative. Key to the sale and distribution of our products through this channel is the constant care and feeding of the buyers for each of the organizations. Sales calls on a regular basis, along with samples of new product, will keep the doors open to us.

5.2.2 Sales Forecast

We currently forecast our sales to grow at an astounding rate for the next 12 months because of written commitments we have received from distributors intending to take on our product line in larger volumes in the future. This growth will continue, but at a lower rate for the next year, and the following year. We anticipate the growth rate to flatten out within five years, but to remain steady. Should the market on Hispanic food items continue at its current pace, we will keep pace with it. Our

forecast does assume a downturn in the product within a three-year period, and the lower figures are a reflection of that forecast. We would be happy if it didn't falter.

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan.

Create your own business plan

Sales Forecast 1996 Sales All Products Other Total Sales Direct Cost of Sales All Products Other Subtotal Direct Cost of Sales $168,602 $217,320 $312,052 $0 $0 $0 $168,602 $217,320 $312,052 1996 1997 1998 $64,916 $0 $64,916 $86,928 $0 $86,928 $124,821 $0 $124,821 1997 1998

Need real financials? We recommend using LivePlan as the easiest way to create automatic financials for your own business plan. Create your own business plan

5.3 Strategic Alliances

We do have some opportunity for building strategic alliances with several local restaurants some of which are listed below. Approached properly, they will not only serve our products in their restaurants, but also sell for carry out.

La Perla Connie Mac's Zingerman's

5.4 Milestones

The following table lists important program milestones, with dates and budgets for each. The milestone schedule indicates our emphasis on planning and for having a sure method of implementation when the time comes for each action.

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

Milestones Milestone SBA Loan Hirzel Contract First Employee Store Front/Warehouse Second Employee New Product Development Marketing Development

Start Date 9/1/1996 4/15/1997 1/1/1997 1/1/1997 3/1/1997 1/1/1997 1/1/1997

End Date 11/1/1996 6/15/1997 1/10/1997 3/1/1997 5/1/1997 12/1/1997 3/1/1997 3/1/1998 6/1/1998 $1,500 $9,600 $9,600 $12,000 $25,000 $350 $500 $18,500 $24,500 $101,550

Budget

Manager Patricia Ricardo Patricia Ricardo Ricardo Pat/Ric Ricardo Patricia Ricardo

Department Finance Finance Admin/Mgmt Sales Production Marketing Marketing Admin Warehouse

Third Employee - Administration 1/15/1998 Fourth Employee 3/1/1998 Warehouse/Delivery Totals

Read more: http://www.bplans.com/salsa_manufacturer_business_plan/strategy_and_implementation_su mmary_fc.php#ixzz1vNsANhXE

Management Summary

Salvador's was founded by Ricardo & Patricia Torres and has operated without the burden of any payroll or salary expense to this point. Patricia Torres - President Patricia is currently responsible for the preparation of salsa and maintaining the various inventories of raw materials; purchasing of food ingredients; assistance with packaging and

shipping. In addition, she maintains the company records and is in direct communication with the accountant and other advisors. Ricardo Torres - Vice President Ricardo assists with the preparation and production of salsa; maintains the inventory of the finished products; is responsible for packing and shipping; assists with recordkeeping and cost containment. Ricardo also shares in the marketing and promotion of the product. Current plans are to bring Patricia on board in a paid capacity on or about August 1st, and we have forecast the proper expenses to do so. As orders are processed and goals met, Ricardo will take charge of the logistics and become a full time paid employee as well. We are currently forecasting this to transpire in the first quarter of 1997. We plan on hiring additional personnel as the need for them arises, and as we have the ability to pay them.

6.1 Organizational Structure

Salvador's planned organization calls for sales and marketing, product development, finance and administration. Actual production falls under the finance and administrative area. We are currently using outside consultants to assist in these areas.

6.2 Management Team

The management team is currently comprised of Ricardo and Patricia Torres, the founders of Salvador's, Inc. In addition, they have a board of advisors with over 78 years of administrative, financial, and sales management experience to assist them with management decisions on daily operations, and the long-range planning necessary for continued, consistent growth. The team is currently compose of the following professionals: [Personal and Confidential information removed]

6.3 Management Team Gaps

The gaps in the management team are currently being addressed through the use of outside consultants as mentioned above, and will continue to be until the cash flow allows for the hiring of employees to fill those capacities. The identifiable gaps are in administration, finance management, and marketing.

6.4 Personnel Plan

The current personnel plan calls for Patricia to become a paid employee on or about August 1st. Although she has been working for Salvador's since its inception two years ago, she has not drawn a salary or been reimbursed for expenses. We are then planning on Ricardo taking a paid position with Salvador's by early 1997, or the successful approval of a Link Deposit Loan; whichever comes first.

Personnel Plan

Patricia Torres Ricardo Torres Other Total People Total Payroll

1996 1997 1998 $9,600 $23,000 $38,000 $0 $20,500 $34,800 $0 2 $0 2 $0 2

$9,600 $43,500 $72,800

Read more: http://www.bplans.com/salsa_manufacturer_business_plan/management_summary_fc.php#ix zz1vNsGmasJ

Financial Plan

We have forecast a very rapid growth for Salvador's this year. Although this may seem ambitious based on historic sales, this rate of growth is due to the large orders we have received to date from several distributors, letters of commitment from Meijer's and Kroger's, and the increasing number of orders from current clients.

7.1 Important Assumptions

The financial plan depends on important assumptions, most of which are shown in the following table. The key underlying assumptions are:

We assume a slow-growth economy, without major recession. We assume, of course, that there are no unforeseen changes in the consumer market to make products immediately obsolete or out of favor (or not increasing in popularity). We assume access to equity capital and financing sufficient to maintain our financial plan as shown in the tables, addendum, and additional documentation.

General Assumptions 1996 Plan Month Current Interest Rate 5.00% Long-term Interest Rate 5.00% Tax Rate Other 25.00% 0 1 5.00% 5.00% 25.00% 0 1997 2 5.00% 5.00% 25.00% 0 1998 3

Need real financials? We recommend using LivePlan as the easiest way to create automatic financials for your own business plan. Create your own business plan

7.2 Key Financial Indicators

The most important factor in our case is the ability to procure financing to go the the next level. The size of the orders currently being asked of us are well beyond our current production capacity, but well within the production capability of a local processor. *Note:

purchasing from this supplier will also reduce our per unit production costs in excess of 30%. An additional alternative would be to purchase the production equipment necessary, and not be subject to the local manufacturer's production scheduling. We must maintain reasonably high gross margins, and hold marketing costs to no more than 20% of sales to provide the income to reduce out debt, and equip us to sustain the growth we anticipate. We will meet and exceed all of theses conditions through buying at increased volumes. Then we'll pass the savings on to our customers through increases in the margins at which they retail the product.

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

7.3 Break-even Analysis

The break-even analysis shows that Salvador's has a good balance of fixed costs and sufficient sales to remain healthy. We have already passed our monthly break-even point; last year's overall loss reflects high costs in the first half of the year. We have just recently contracted with another jar supplier that will reduce our costs by 18% per jar of salsa with the next supply order. This will further reduce the break-even point, and add to our goal of increasing the margin on our salsa.

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

Break-even Analysis Monthly Revenue Break-even $4,747 Assumptions: Average Percent Variable Cost 39% Estimated Monthly Fixed Cost $2,919

7.4 Projected Profit and Loss

We expect to close out this year with good sales growth, and to increase our sales each year through the turn of the century, with comfortable net profit.

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

Pro Forma Profit and Loss 1996 Sales Direct Cost of Sales Other Costs of Sales Total Cost of Sales Gross Margin Gross Margin % Expenses Payroll Marketing/Promotion Depreciation Rent Utilities Leased Equipment Insurance Payroll Taxes Other Total Operating Expenses Profit Before Interest and Taxes EBITDA Interest Expense Taxes Incurred Net Profit Net Profit/Sales $168,602 $64,916 $0 $64,916 $103,686 61.50% $9,600 $6,763 $5,520 $3,500 $3,850 $465 $1,044 $0 $4,290 $35,032 $68,654 $74,174 $7,533 $15,280 $45,841 27.19% 1997 $217,320 $86,928 $0 $86,928 $130,392 60.00% $43,500 $0 $0 $0 $0 $0 $0 $0 $4,225 $47,725 $82,667 $82,667 $7,958 $18,677 $56,032 25.78% 1998 $312,052 $124,821 $0 $124,821 $187,231 60.00% $72,800 $0 $0 $0 $0 $0 $0 $0 $6,275 $79,075 $108,156 $108,156 $6,817 $25,335 $76,004 24.36%

7.5 Projected Cash Flow

We expect to manage cash flow over the next three years with the assistance of a Small Business Administration supported loan. This financing assistance is required to provide the working capital to meet the current needs while providing a solid foundation to build the growth of the organization. After a six-month period, we anticipate requesting an open line of credit to further the company's ability to meet and exceed sales projections, gross margin, and return on investment.

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

Pro Forma Cash Flow 1996 Cash Received Cash from Operations Cash Sales Subtotal Cash from Operations Additional Cash Received Sales Tax, VAT, HST/GST Received New Current Borrowing New Other Liabilities (interest-free) New Long-term Liabilities Sales of Other Current Assets Sales of Long-term Assets New Investment Received Subtotal Cash Received Expenditures Expenditures from Operations Cash Spending Bill Payments Subtotal Spent on Operations Additional Cash Spent Sales Tax, VAT, HST/GST Paid Out $143,312 $164,267 $0 $0 $0 $165,000 $0 $0 $0 $329,267 1996 $9,600 $101,045 $110,645 $0 $184,722 $216,067 $0 $0 $0 $0 $0 $0 $0 $216,067 1997 $43,500 $120,055 $163,555 $0 $5,555 $0 $17,042 $0 $0 $265,244 $309,616 $0 $0 $0 $0 $0 $0 $0 $309,616 1998 $72,800 $163,313 $236,113 $0 $6,000 $0 $17,042 $0 $0 1997 1998

Principal Repayment of Current Borrowing $3,650 Other Liabilities Principal Repayment $0 Long-term Liabilities Principal Repayment $7,100 Purchase Other Current Assets $0 Purchase Long-term Assets $0

Dividends Subtotal Cash Spent Net Cash Flow Cash Balance

$45,000 $166,395 $162,872 $162,998

$0 $186,152 $29,916 $192,913

$0 $259,155 $50,461 $243,375

7.6 Projected Balance Sheet

As shown by the balance sheet in the table, we expect a healthy growth in net worth through the end of the plan period.

Pro Forma Balance Sheet 1996 Assets Current Assets Cash Accounts Receivable Inventory Other Current Assets Total Current Assets Long-term Assets $162,998 $4,335 $6,745 $0 $174,078 $192,913 $5,587 $9,032 $0 $207,533 $23,368 $15,312 $8,056 $215,589 1997 $9,869 $7,002 $0 $16,871 $140,858 $157,729 $25,000 $243,375 $8,023 $12,970 $0 $264,367 $23,368 $15,312 $8,056 $272,423 1998 $13,741 $1,002 $0 $14,743 $123,816 $138,559 $25,000 1997 1998

Long-term Assets $23,368 Accumulated Depreciation $15,312 Total Long-term Assets Total Assets Liabilities and Capital Current Liabilities Accounts Payable Current Borrowing Other Current Liabilities $8,056 $182,134 1996 $9,849 $12,557 $0

Subtotal Current Liabilities $22,406 Long-term Liabilities $157,900 Total Liabilities Paid-in Capital Retained Earnings Earnings Total Capital $180,306 $25,000

($69,013) ($23,172) $32,860 $45,841 $56,032 $76,004 $1,828 $57,860 $133,864 $215,589 $57,860 $272,423 $133,864

Total Liabilities and Capital $182,134 Net Worth $1,828

Need real financials? We recommend using LivePlan as the easiest way to create automatic financials for your own business plan. Create your own business plan

7.7 Business Ratios

Standard business ratios are included in the table that follows. The ratios show a plan for well balanced, healthy growth. The industry comparisons are for the Perishable Prepared Food Manufacturing industry, NAICS classification code 311991.

Ratio Analysis 1996 Sales Growth Percent of Total Assets Accounts Receivable Inventory Other Current Assets Total Current Assets Long-term Assets Total Assets Current Liabilities Long-term Liabilities Total Liabilities Net Worth Percent of Sales 700.96% 2.38% 3.70% 0.00% 95.58% 4.42% 100.00% 12.30% 86.69% 99.00% 1.00% 1997 28.90% 2.59% 4.19% 0.00% 96.26% 3.74% 100.00% 7.83% 65.34% 73.16% 26.84% 100.00% 60.00% 34.22% 0.00% 38.04% 12.30 11.77 73.16% 129.12% 34.65% 1997 25.78% 96.84% 5.83 56 11.02 12.17 30 1.01 2.73 0.11 $190,662 10.39 0.99 8% 11.43 3.76 0.00 1998 43.59% 2.94% 4.76% 0.00% 97.04% 2.96% 100.00% 5.41% 45.45% 50.86% 49.14% 100.00% 60.00% 35.64% 0.00% 34.66% 17.93 17.05 50.86% 75.70% 37.20% 1998 24.36% 56.78% 5.83 53 11.35 12.17 26 1.15 1.04 0.11 $249,624 15.87 0.87 5% 16.51 2.33 0.00 Industry Profile 6.68% 15.95% 13.45% 21.34% 50.74% 49.26% 100.00% 25.96% 29.44% 55.40% 44.60% 100.00% 19.36% 11.01% 0.60% 1.06% 1.56 0.86 63.95% 1.88% 5.23% n.a n.a n.a n.a n.a n.a n.a n.a n.a n.a n.a n.a n.a n.a n.a n.a n.a

Sales 100.00% Gross Margin 61.50% Selling, General & Administrative Expenses 34.31% Advertising Expenses Profit Before Interest and Taxes Main Ratios Current Quick Total Debt to Total Assets Pre-tax Return on Net Worth Pre-tax Return on Assets Additional Ratios Net Profit Margin Return on Equity Activity Ratios Accounts Receivable Turnover Collection Days Inventory Turnover Accounts Payable Turnover Payment Days Total Asset Turnover Debt Ratios Debt to Net Worth Current Liab. to Liab. Liquidity Ratios Net Working Capital Interest Coverage Additional Ratios Assets to Sales Current Debt/Total Assets Acid Test Sales/Net Worth Dividend Payout 3.27% 40.72% 7.77 7.47 99.00% 3343.58% 33.56% 1996 27.19% 2507.69% 5.83 57 10.91 11.26 27 0.93 98.63 0.12 $151,672 9.11 1.08 12% 7.27 92.23 0.98

Appendix

Sales Forecast Jan Sales All Products Other Total Sales Direct Cost of Sales All Products Other Subtotal Direct Cost of Sales 0% 0% $13,351 $0 $13,351 Jan $3,981 $0 $3,981 $12,271 $0 $12,271 Feb $3,726 $0 $3,726 $12,421 $0 $12,421 Mar $6,924 $0 $6,924 $15,099 $0 $15,099 Apr $4,659 $0 $4,659 $14,370 $0 $14,370 May $5,093 $0 $5,093 $15,850 $0 $15,850 Jun $5,615 $0 $5,615 $14,350 $0 $14,350 Jul $5,925 $0 $5,925 $13,800 $0 $13,800 Aug $6,173 $0 $6,173 $14,112 $0 $14,112 Sep $5,313 $0 $5,313 $13,643 $0 $13,643 Oct $5,500 $0 $5,500 $13,100 $0 $13,100 Nov $5,875 $0 $5,875 $16,235 $0 $16,235 Dec $6,132 $0 $6,132 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Need real financials? We recommend using LivePlan as the easiest way to create automatic financials for your own business plan. Create your own business plan

Personnel Plan Jan Patricia Torres Ricardo Torres Other Total People Total Payroll

Pro Forma Profit and Loss Jan Sales Direct Cost of Sales Other Costs of Sales Total Cost of Sales Gross Margin Gross Margin % Expenses Payroll Marketing/Promotion Depreciation Rent Utilities Leased Equipment Insurance Payroll Taxes Other Total Operating Expenses Profit Before Interest and Taxes EBITDA Interest Expense Taxes Incurred Net Profit Net Profit/Sales 15% $0 $466 $460 $0 $315 $0 $87 $0 $167 $1,495 $7,875 $8,335 $67 $1,952 $5,856 43.86% $0 $722 $460 $0 $400 $0 $87 $0 $1,591 $3,260 $5,285 $5,745 $67 $1,305 $3,914 31.89% $0 $330 $460 $0 $315 $0 $87 $0 $118 $1,310 $4,187 $4,647 $754 $858 $2,575 20.73% $0 $845 $460 $0 $300 $0 $87 $0 $614 $2,306 $8,134 $8,594 $753 $1,845 $5,535 36.66% $0 $335 $460 $0 $315 $0 $87 $0 $225 $1,422 $7,855 $8,315 $753 $1,776 $5,327 37.07% $0 $435 $460 $500 $315 $65 $87 $0 $225 $2,087 $8,148 $8,608 $752 $1,849 $5,547 35.00% $0 $595 $460 $500 $315 $0 $87 $0 $225 $2,182 $6,243 $6,703 $751 $1,373 $4,119 28.70% $1,920 $470 $460 $500 $315 $0 $87 $0 $225 $3,977 $3,650 $4,110 $743 $727 $2,180 15.80% $1,920 $800 $460 $500 $315 $75 $87 $0 $225 $4,382 $4,417 $4,877 $735 $920 $2,761 19.57% $1,920 $470 $460 $500 $315 $0 $87 $0 $225 $3,977 $4,166 $4,626 $727 $860 $2,579 18.90% $1,920 $675 $460 $500 $315 $325 $87 $0 $225 $4,507 $2,718 $3,178 $719 $500 $1,499 11.44% $1,920 $620 $460 $500 $315 $0 $87 $0 $225 $4,127 $5,976 $6,436 $710 $1,316 $3,949 24.33% $13,351 $3,981 $0 $3,981 $9,370 70.18% Feb $12,271 $3,726 $0 $3,726 $8,545 69.64% Mar $12,421 $6,924 $0 $6,924 $5,497 44.26% Apr $15,099 $4,659 $0 $4,659 $10,440 69.14% May $14,370 $5,093 $0 $5,093 $9,277 64.56% Jun $15,850 $5,615 $0 $5,615 $10,235 64.57% Jul $14,350 $5,925 $0 $5,925 $8,425 58.71% Aug $13,800 $6,173 $0 $6,173 $7,627 55.27% Sep $14,112 $5,313 $0 $5,313 $8,799 62.35% Oct $13,643 $5,500 $0 $5,500 $8,143 59.69% Nov $13,100 $5,875 $0 $5,875 $7,225 55.15% Dec $16,235 $6,132 $0 $6,132 $10,103 62.23%

Feb $0 $0 $0 2 $0

Mar $0 $0 $0 2 $0

Apr $0 $0 $0 2 $0

May $0 $0 $0 2 $0

Jun $0 $0 $0 2 $0

Jul $0 $0 $0 2 $0

Aug

Sep

Oct

Nov

Dec

0% 0% 0%

$0 $0 $0 2 $0

$1,920 $1,920 $1,920 $1,920 $1,920 $0 $0 $0 $0 $0 $0 2 $0 2 $0 2 $0 2 $0 2

$1,920 $1,920 $1,920 $1,920 $1,920

Pro Forma Cash Flow Jan Cash Received Cash from Operations Cash Sales Subtotal Cash from Operations Additional Cash Received Sales Tax, VAT, HST/GST Received New Current Borrowing 0.00% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $11,348 $11,348 $10,430 $10,497 $10,558 $12,555 $12,834 $14,676 $12,215 $14,091 $13,473 $15,734 $12,198 $14,360 $11,730 $14,100 $11,995 $14,145 $11,597 $13,668 $11,135 $13,249 $13,800 $15,843 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

New Other Liabilities (interest-free) New Long-term Liabilities Sales of Other Current Assets Sales of Long-term Assets New Investment Received Subtotal Cash Received Expenditures Expenditures from Operations Cash Spending Bill Payments Subtotal Spent on Operations Additional Cash Spent Sales Tax, VAT, HST/GST Paid Out Principal Repayment of Current Borrowing Other Liabilities Principal Repayment Long-term Liabilities Principal Repayment Purchase Other Current Assets Purchase Long-term Assets Dividends Subtotal Cash Spent Net Cash Flow Cash Balance

$0 $0 $0 $0 $0 $11,348 Jan $0 $264 $264

$0 $0 $0 $0 $0 $10,497 Feb $0 $7,912 $7,912

$0 $165,000 $0 $0 $0 $177,555 Mar $0 $7,793 $7,793

$0 $0 $0 $0 $0 $14,676 Apr $0 $12,694 $12,694

$0 $0 $0 $0 $0 $14,091 May $0 $6,694 $6,694

$0 $0 $0 $0 $0 $15,734 Jun $0 $9,106 $9,106

$0 $0 $0 $0 $0 $14,360 Jul $0 $10,407 $10,407

$0 $0 $0 $0 $0 $14,100 Aug $1,920 $10,092 $12,012

$0 $0 $0 $0 $0 $14,145 Sep $1,920 $9,463 $11,383

$0 $0 $0 $0 $0 $13,668 Oct $1,920 $8,054 $9,974

$0 $0 $0 $0 $0 $13,249 Nov $1,920 $8,914 $10,834

$0 $0 $0 $0 $0 $15,843 Dec $1,920 $9,652 $11,572

$0 $100 $0 $0 $0 $0 $0 $364 $10,984 $11,110

$0 $100 $0 $0 $0 $0 $0 $8,012 $2,485 $13,595

$0 $100 $0 $0 $0 $0 $0 $7,893 $169,662 $183,257

$0 $100 $0 $0 $0 $0 $5,000 $17,794 ($3,119) $180,139

$0 $100 $0 $0 $0 $0 $5,000 $11,794 $2,297 $182,436

$0 $200 $0 $0 $0 $0 $5,000 $14,306 $1,428 $183,864

$0 $200 $0 $0 $0 $0 $5,000 $15,607 ($1,247) $182,617

$0 $500 $0 $1,420 $0 $0 $5,000 $18,932 ($4,832) $177,785

$0 $500 $0 $1,420 $0 $0 $0 $13,303 $842 $178,627

$0 $500 $0 $1,420 $0 $0 $0 $11,894 $1,775 $180,401

$0 $500 $0 $1,420 $0 $0 $0 $12,754 $495 $180,896

$0 $750 $0 $1,420 $0 $0 $20,000 $33,742 ($17,898) $162,998

Pro Forma Balance Sheet Jan Assets Current Assets Cash Accounts Receivable Inventory Other Current Assets Total Current Assets Long-term Assets Long-term Assets Accumulated Depreciation Total Long-term Assets Total Assets Liabilities and Capital Current Liabilities Accounts Payable Current Borrowing Other Current Liabilities Subtotal Current Liabilities Long-term Liabilities Total Liabilities Paid-in Capital Retained Earnings Earnings Total Capital Total Liabilities and Capital Net Worth $0 $16,207 $0 $16,207 $0 $16,207 $25,000 ($9,755) ($14,258) $987 $17,194 $987 $7,658 $16,107 $0 $23,765 $0 $23,765 $25,000 ($24,013) $5,856 $6,843 $30,608 $6,843 $7,363 $16,007 $0 $23,370 $0 $23,370 $25,000 ($24,013) $9,770 $10,757 $34,127 $10,757 $12,474 $15,907 $0 $28,381 $165,000 $193,381 $25,000 ($24,013) $12,345 $13,332 $206,712 $13,332 $6,392 $15,807 $0 $22,199 $165,000 $187,199 $25,000 ($29,013) $17,880 $13,867 $201,066 $13,867 $8,759 $15,707 $0 $24,466 $165,000 $189,466 $25,000 ($34,013) $23,207 $14,194 $203,659 $14,194 $10,070 $15,507 $0 $25,577 $165,000 $190,577 $25,000 ($39,013) $28,753 $14,740 $205,318 $14,740 $9,775 $15,307 $0 $25,082 $165,000 $190,082 $25,000 ($44,013) $32,872 $13,859 $203,941 $13,859 $9,196 $14,807 $0 $24,003 $163,580 $187,583 $25,000 ($49,013) $35,052 $11,039 $198,622 $11,039 $7,757 $14,307 $0 $22,064 $162,160 $184,224 $25,000 ($49,013) $37,814 $13,801 $198,025 $13,801 $8,593 $13,807 $0 $22,400 $160,740 $183,140 $25,000 ($49,013) $40,393 $16,380 $199,520 $16,380 $9,312 $13,307 $0 $22,619 $159,320 $181,939 $25,000 ($49,013) $41,892 $17,879 $199,818 $17,879 $9,849 $12,557 $0 $22,406 $157,900 $180,306 $25,000 ($69,013) $45,841 $1,828 $182,134 $1,828 $23,368 $9,792 $13,576 $17,194 $23,368 $10,252 $13,116 $30,608 Jan $23,368 $10,712 $12,656 $34,127 Feb $23,368 $11,172 $12,196 $206,712 Mar $23,368 $11,632 $11,736 $201,066 Apr $23,368 $12,092 $11,276 $203,659 May $23,368 $12,552 $10,816 $205,318 Jun $23,368 $13,012 $10,356 $203,941 Jul $23,368 $13,472 $9,896 $198,622 Aug $23,368 $13,932 $9,436 $198,025 Sep $23,368 $14,392 $8,976 $199,520 Oct $23,368 $14,852 $8,516 $199,818 Nov $23,368 $15,312 $8,056 $182,134 Dec $126 $0 $3,492 $0 $3,618 $11,110 $2,003 $4,379 $0 $17,492 $13,595 $3,777 $4,099 $0 $21,471 $183,257 $3,642 $7,616 $0 $194,516 $180,139 $4,066 $5,125 $0 $189,330 $182,436 $4,345 $5,602 $0 $192,383 $183,864 $4,461 $6,177 $0 $194,502 $182,617 $4,451 $6,518 $0 $193,585 $177,785 $4,151 $6,790 $0 $188,726 $178,627 $4,118 $5,844 $0 $188,589 $180,401 $4,093 $6,050 $0 $190,544 $180,896 $3,943 $6,463 $0 $191,302 $162,998 $4,335 $6,745 $0 $174,078 Starting Balances Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Need real financials? We recommend using LivePlan as the easiest way to create automatic financials for your own business plan. Create your own business plan

General Assumptions Jan Plan Month Current Interest Rate Long-term Interest Rate Tax Rate Other 5.00% 5.00% 25.00% 0 1 5.00% 5.00% 25.00% 0 Feb 2 5.00% 5.00% 25.00% 0 Mar 3 5.00% 5.00% 25.00% 0 Apr 4 5.00% 5.00% 25.00% 0 May 5 5.00% 5.00% 25.00% 0 Jun 6 5.00% 5.00% 25.00% 0 Jul 7 5.00% 5.00% 25.00% 0 Aug 8 5.00% 5.00% 25.00% 0 Sep 9 5.00% 5.00% 25.00% 0 Oct 10 5.00% 5.00% 25.00% 0 Nov 11 Dec 12 5.00% 5.00% 25.00% 0

Das könnte Ihnen auch gefallen

- How to Open a Financially Successful Specialty Retail & Gourmet Foods ShopVon EverandHow to Open a Financially Successful Specialty Retail & Gourmet Foods ShopNoch keine Bewertungen

- Chili Proposal-JemDokument5 SeitenChili Proposal-JemJosephine Turaray100% (1)

- A Complete Sandwich Shop Business Plan: A Key Part Of How To Start A Deli & RestaurantVon EverandA Complete Sandwich Shop Business Plan: A Key Part Of How To Start A Deli & RestaurantNoch keine Bewertungen

- KetchupDokument12 SeitenKetchupFaisal EmonNoch keine Bewertungen

- How To Start A Sandwich Shop: A Complete Deli Restaurant Business PlanVon EverandHow To Start A Sandwich Shop: A Complete Deli Restaurant Business PlanBewertung: 3.5 von 5 Sternen3.5/5 (3)

- Product ProposalDokument9 SeitenProduct ProposalHeidi OpadaNoch keine Bewertungen

- Entrega 3 Logistica y Mercadeo 3Dokument22 SeitenEntrega 3 Logistica y Mercadeo 3William FonsecaNoch keine Bewertungen

- The Food Service Professional Guide to Restaurant Site Location Finding, Negotiationg & Securing the Best Food Service Site for Maximum ProfitVon EverandThe Food Service Professional Guide to Restaurant Site Location Finding, Negotiationg & Securing the Best Food Service Site for Maximum ProfitBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Wait A Few SecondsDokument4 SeitenWait A Few SecondsAna QuirinoNoch keine Bewertungen

- Do Less Better: The Power of Strategic Sacrifice in a Complex WorldVon EverandDo Less Better: The Power of Strategic Sacrifice in a Complex WorldNoch keine Bewertungen

- Business Plan Entrep IntegrationDokument5 SeitenBusiness Plan Entrep IntegrationPatrick FillarcaNoch keine Bewertungen

- Pinulito ChikenDokument5 SeitenPinulito Chikenpatoj310Noch keine Bewertungen

- Whole FoodsDokument76 SeitenWhole Foodsnino7578Noch keine Bewertungen

- TestDokument27 SeitenTestjmarye20Noch keine Bewertungen

- Business Plan For Small Food BusinessesDokument5 SeitenBusiness Plan For Small Food BusinessesKharen DomilNoch keine Bewertungen

- Marketing Plan Dried FruitDokument17 SeitenMarketing Plan Dried Fruitchaqle18100% (1)

- Executive Summary: 1.1 ObjectivesDokument17 SeitenExecutive Summary: 1.1 ObjectivesjhanakshahNoch keine Bewertungen

- Food BusinessDokument15 SeitenFood BusinessKharen DomilNoch keine Bewertungen

- Situation Analysis 2.1 Market SummaryDokument14 SeitenSituation Analysis 2.1 Market SummaryRon MalibiranNoch keine Bewertungen

- Feasibility Study: Pan de UlamDokument101 SeitenFeasibility Study: Pan de UlamCamille Grace Gonzales Datay100% (5)

- Marketing PlanDokument8 SeitenMarketing PlanmwaimoffatNoch keine Bewertungen

- Specialty Clothing Retail Business PlanDokument26 SeitenSpecialty Clothing Retail Business Planloso1990Noch keine Bewertungen

- Ur Business: Key Challenges and Strategies For Driving GrowthDokument8 SeitenUr Business: Key Challenges and Strategies For Driving Growthkhullg01Noch keine Bewertungen

- MARKET ANALYSIs Dulce CasaDokument4 SeitenMARKET ANALYSIs Dulce CasaMaria MiguelNoch keine Bewertungen

- Business PlannnnnnnnnDokument6 SeitenBusiness PlannnnnnnnnMichael James BuyaNoch keine Bewertungen

- Coffeehouse Business Plan: Dark Roast JavaDokument4 SeitenCoffeehouse Business Plan: Dark Roast JavaAyeesha AnnaNoch keine Bewertungen

- PDF 2Dokument11 SeitenPDF 2api-354854386Noch keine Bewertungen

- Reynaldo Boton Business PlanDokument38 SeitenReynaldo Boton Business PlanReynalie Boton100% (2)

- Shake Crazy MarketingDokument5 SeitenShake Crazy MarketingCurvex GroundNoch keine Bewertungen

- Ar08 LetterDokument4 SeitenAr08 LetterNuntaruk PengsiriNoch keine Bewertungen

- Annual 2003Dokument47 SeitenAnnual 2003Justine ChengNoch keine Bewertungen

- Restro Wheels Food Truck Business Plan: Laurence SmithDokument19 SeitenRestro Wheels Food Truck Business Plan: Laurence SmithAshita PunjabiNoch keine Bewertungen

- 1.0 Executive Summary: ServicesDokument8 Seiten1.0 Executive Summary: ServicesIrin SoniaNoch keine Bewertungen

- Selling ReportDokument4 SeitenSelling ReportTehreem MujiebNoch keine Bewertungen

- Virtual Restaurant Business Plan LiteDokument23 SeitenVirtual Restaurant Business Plan LiteBent El ArabiNoch keine Bewertungen

- FINAL EXPORT Business ColombiDokument35 SeitenFINAL EXPORT Business ColombiSheyla SharpNoch keine Bewertungen

- Tim HortonsDokument194 SeitenTim HortonsShashank Vatsavai100% (2)

- T1 GLOBAL MARKET PERSPECTIVES AJEGROUP y ALICORP.Dokument6 SeitenT1 GLOBAL MARKET PERSPECTIVES AJEGROUP y ALICORP.Fred Flores100% (1)

- Mi Caribe Exec Summary Creative BriefDokument5 SeitenMi Caribe Exec Summary Creative Briefapi-340824351Noch keine Bewertungen

- Del Cano Inc Business PlanDokument12 SeitenDel Cano Inc Business PlanGregory100% (1)

- Business Plan CompilationDokument17 SeitenBusiness Plan CompilationRomiet Carmelo Mendoza Capuz100% (1)

- Sugarcane Juice Shop Business Plan MTM 252020Dokument15 SeitenSugarcane Juice Shop Business Plan MTM 252020momolutmassaquoi100% (1)

- A Business Proposal ExampleDokument8 SeitenA Business Proposal ExampletrishamaeNoch keine Bewertungen

- Business PlanDokument5 SeitenBusiness PlanLucas JerryNoch keine Bewertungen

- Antipolo's Best: Marketing PlanDokument33 SeitenAntipolo's Best: Marketing PlanRandom KidNoch keine Bewertungen

- A Business ProposalDokument7 SeitenA Business Proposalclient mellecNoch keine Bewertungen

- DR Pepper AnalysisDokument10 SeitenDR Pepper Analysisdvorak6Noch keine Bewertungen

- 2014-WFM - Annual ReportDokument74 Seiten2014-WFM - Annual ReportReel LeeNoch keine Bewertungen

- Free Juice and Smoothie Bar Business PlanDokument19 SeitenFree Juice and Smoothie Bar Business PlanNo Brakes MartinNoch keine Bewertungen

- Business Plan InformationDokument15 SeitenBusiness Plan InformationMetchell ManlimosNoch keine Bewertungen

- Nutr 404 BusinessPlanProjectDokument16 SeitenNutr 404 BusinessPlanProjectAna P.Noch keine Bewertungen

- Final Group Project MKT 231-2Dokument23 SeitenFinal Group Project MKT 231-2api-301901537Noch keine Bewertungen

- Business Plan TemplateDokument16 SeitenBusiness Plan TemplateKathleen Marie Chuang100% (4)

- Marketing Plan Final ReportDokument11 SeitenMarketing Plan Final Reportareeba arifNoch keine Bewertungen

- Business PlanDokument24 SeitenBusiness PlanHarshi Aggarwal80% (5)

- Executive SummaryDokument12 SeitenExecutive SummaryicelryNoch keine Bewertungen

- ZAGUDokument3 SeitenZAGUAlexandra Bucher50% (2)

- Feasibility RestaurantDokument38 SeitenFeasibility Restaurantlendiibanez56% (9)

- CIFFA NewsletterDecDokument20 SeitenCIFFA NewsletterDecLe Dinh CuongNoch keine Bewertungen

- Marketing Plan XXXDokument3 SeitenMarketing Plan XXXHuong HoangNoch keine Bewertungen

- Salesmanship CHAPTER 2Dokument45 SeitenSalesmanship CHAPTER 2Israel Ad FernandoNoch keine Bewertungen

- Tanishq - Capturing Indian Women's HeartDokument10 SeitenTanishq - Capturing Indian Women's HeartRahul RajendranNoch keine Bewertungen

- M&A Due Diligence: The 360-Degree ViewDokument4 SeitenM&A Due Diligence: The 360-Degree Viewrohit_wade1579Noch keine Bewertungen

- Wilkerson, C Bracket, Accessories-IndexDokument25 SeitenWilkerson, C Bracket, Accessories-IndexFabrizio DandreamatteoNoch keine Bewertungen

- Cashless Canteen ProgramDokument2 SeitenCashless Canteen Programblue stackNoch keine Bewertungen

- Jordan Belfort EssayFINALDokument7 SeitenJordan Belfort EssayFINALKennyNoch keine Bewertungen

- Cost Management Test Questions and Suggested SolutionsDokument63 SeitenCost Management Test Questions and Suggested SolutionsPiyanat JinanusinlapasatNoch keine Bewertungen

- Arranging Fine Perfume Compositions - Floral Aldehydic PDFDokument919 SeitenArranging Fine Perfume Compositions - Floral Aldehydic PDFGisele Ferreira100% (5)

- Champion Waterproofers BrochureDokument6 SeitenChampion Waterproofers BrochureSai Santosh50% (2)

- HOW TO-Get Paid Flipping Houses You Never Even Own PDFDokument158 SeitenHOW TO-Get Paid Flipping Houses You Never Even Own PDFDimitrije Mijatovic100% (2)

- 'Data Interpretation Replica Questions That Have Appeared in Cat in The Last 4 Years PDFDokument63 Seiten'Data Interpretation Replica Questions That Have Appeared in Cat in The Last 4 Years PDFAaditya BaidNoch keine Bewertungen

- Unit Test in Eim Grade 9Dokument3 SeitenUnit Test in Eim Grade 9louren brutasNoch keine Bewertungen

- Matching Dell - Case AnalysisDokument6 SeitenMatching Dell - Case AnalysisAvash Shrestha50% (2)

- Ch. 15Dokument8 SeitenCh. 15Delonita PricillyaNoch keine Bewertungen

- Kapatiran NG Mga Naglilingkod Sa Pamahalaan vs. TanDokument3 SeitenKapatiran NG Mga Naglilingkod Sa Pamahalaan vs. TanAngelei Tecson TiguloNoch keine Bewertungen

- Gorenje in ItalyDokument5 SeitenGorenje in Italy2readNoch keine Bewertungen

- Purchase Agreement TTDokument1 SeitePurchase Agreement TTLarita WootenNoch keine Bewertungen

- Joe Deklic - Final2Dokument1 SeiteJoe Deklic - Final2api-374894269Noch keine Bewertungen

- A Project Report ON: Bachelor of Commerce'Dokument52 SeitenA Project Report ON: Bachelor of Commerce'Aryan Jain100% (6)

- Chapter 5 - Building Profit PlanDokument28 SeitenChapter 5 - Building Profit Plansiyeni100% (2)

- Central Excise ActDokument19 SeitenCentral Excise ActPoonam MehtaNoch keine Bewertungen

- Marketing Strategic Management Competitors: Competitor Analysis inDokument5 SeitenMarketing Strategic Management Competitors: Competitor Analysis inmoh4uNoch keine Bewertungen

- Cold Calling: Direct Marketing When A Sales Rep-Whose Primary Job Is To SellDokument4 SeitenCold Calling: Direct Marketing When A Sales Rep-Whose Primary Job Is To SellShrikant BaviskarNoch keine Bewertungen

- To Study Distribution Channel of PidiliteDokument72 SeitenTo Study Distribution Channel of Pidilitevikrant munde100% (1)

- CE Principles of Accounts 1995 PaperDokument6 SeitenCE Principles of Accounts 1995 Paperapi-3747191Noch keine Bewertungen

- NIKEDokument8 SeitenNIKEMarryam Majeed75% (4)

- Manky QuestinairDokument7 SeitenManky QuestinairThe Himalayas 360100% (1)

- Customers Satisfaction in Tata MotorsDokument74 SeitenCustomers Satisfaction in Tata MotorsGaurav SharmaNoch keine Bewertungen

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Von EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- Finance Basics (HBR 20-Minute Manager Series)Von EverandFinance Basics (HBR 20-Minute Manager Series)Bewertung: 4.5 von 5 Sternen4.5/5 (32)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindVon EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindBewertung: 5 von 5 Sternen5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Von EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (13)

- Getting to Yes: How to Negotiate Agreement Without Giving InVon EverandGetting to Yes: How to Negotiate Agreement Without Giving InBewertung: 4 von 5 Sternen4/5 (652)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantVon EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantBewertung: 4.5 von 5 Sternen4.5/5 (146)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceVon EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNoch keine Bewertungen

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsVon EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsBewertung: 5 von 5 Sternen5/5 (1)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyVon EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyBewertung: 4.5 von 5 Sternen4.5/5 (37)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditVon EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditBewertung: 5 von 5 Sternen5/5 (1)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?Von EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Bewertung: 5 von 5 Sternen5/5 (1)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyVon EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyBewertung: 5 von 5 Sternen5/5 (1)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Von EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Bewertung: 4 von 5 Sternen4/5 (33)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Von EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Bewertung: 4.5 von 5 Sternen4.5/5 (14)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeVon EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeBewertung: 4 von 5 Sternen4/5 (21)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageVon EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageBewertung: 4.5 von 5 Sternen4.5/5 (109)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Von EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Bewertung: 4.5 von 5 Sternen4.5/5 (24)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Von EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- Financial Accounting For Dummies: 2nd EditionVon EverandFinancial Accounting For Dummies: 2nd EditionBewertung: 5 von 5 Sternen5/5 (10)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetVon EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNoch keine Bewertungen

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelVon Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNoch keine Bewertungen

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineVon EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNoch keine Bewertungen

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesVon EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNoch keine Bewertungen

- Contract Negotiation Handbook: Getting the Most Out of Commercial DealsVon EverandContract Negotiation Handbook: Getting the Most Out of Commercial DealsBewertung: 4.5 von 5 Sternen4.5/5 (2)