Beruflich Dokumente

Kultur Dokumente

Accounting Text & Cases Ed 13th Case 6-3

Hochgeladen von

Ki UmbaraOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Accounting Text & Cases Ed 13th Case 6-3

Hochgeladen von

Ki UmbaraCopyright:

Verfügbare Formate

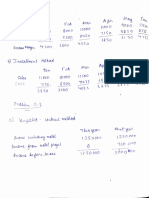

Group Accounting: Andre Trifanni, Dedi Sumardi, Erlin Octavia, Hendry Syaputra

Answer no

3

Case 6-3

Sales

Original Report

Morgan Manufacturing

Westwood

2009

2010

2009

2010

$

1,500 $

2,000 $

1,500 $

2,000

Morgan on FIFO

Method

2010

$

2,000

Cost Of Goods Sold

Gross Margin

Selling, General & Administrative Expenses

Income Before Taxes

Income Tax Expenses

Net Income

$

$

$

$

$

$

810

690

450

240

96

144

Cash

Accounts Receivable

$

$

100 $

250 $

Inventory

Plant, Property & Equipment (Net)

Total Assets

$

$

$

Current Liabilities

Long Term Liabilities

Common Stock

Retained Earnings

Total Liabilities and Owner's Equity

LIFO reserve

Income Statement for the year ended Dec 31 (in

US$ Mio)

$

$

$

$

$

$

1,110

890

600

290

116

174

$

$

$

$

$

$

800

700

450

250

100

150

1,040

$

$

$

$

$

$

1,100

900

600

300

120

180

$

$

$

$

$

960

600

360

116

244

140 $

350 $

100 $

250 $

140

350

$

$

140

350

120 $

1,385 $

1,855 $

100 $

1,580 $

2,170 $

140 $

1,385 $

1,875 $

170

1,580

2,240

$

$

1,580

2,240

$

$

$

$

$

250

500

400

705

1,855

$

$

$

$

$

325

675

400

770

2,170

250

500

400

725

1,875

330

675

400

835

2,240

$

$

$

$

$

325

675

400

770

2,170

10

70

70

Balance Sheet, as of Dec 31 (in US$ Mio)

Gross Margin

Answer no

Pretax Return on Sales

1

Pretax Return on Assets

46.0%

16.0%

12.9%

$

$

$

$

$

44.5%

14.5%

13.4%

46.7%

16.7%

13.3%

$

$

$

$

$

45.0%

15.0%

13.4%

Answer no 2: Account affected by different inventory method: Cost of Goods Sold & Inventory.

Answer no 4: Morgan Performance is better than Westwood with condition, if using similar inventory method with Westwood:

- Gross Margin Morgan higgher than Westwood (48% vs 45%)

- Pretax Return on Sales Morgan higgher than Westwood (18% vs 15%)

- Gross Margin Morgan higher than Westwood (48% vs 45%)

170

48.0%

18.0%

16.1%

Das könnte Ihnen auch gefallen

- Accounting Case 2Dokument3 SeitenAccounting Case 2ayushishahNoch keine Bewertungen

- Chapter 8-1 Group Report - NormanDokument6 SeitenChapter 8-1 Group Report - Normanvp_zarate100% (1)

- Case 4-4 Waltham Oil & Lube Center, Inc.: $40,000 Deposit With NationalDokument5 SeitenCase 4-4 Waltham Oil & Lube Center, Inc.: $40,000 Deposit With NationalCyd Marie VictorianoNoch keine Bewertungen

- Bonus ch15 PDFDokument45 SeitenBonus ch15 PDFFlorence Louise DollenoNoch keine Bewertungen

- Problem CH 11 Alfi Dan Yessy AKT 18-MDokument4 SeitenProblem CH 11 Alfi Dan Yessy AKT 18-MAna Kristiana100% (1)

- Waltham Oil Lube Centre Inc - FinalDokument10 SeitenWaltham Oil Lube Centre Inc - Finalerarun2267% (3)

- Case1 1,1 2,2 1,2 2,2 3,3 1,3 2,4 1,4 2,5 1 pb2 6,3 9Dokument20 SeitenCase1 1,1 2,2 1,2 2,2 3,3 1,3 2,4 1,4 2,5 1 pb2 6,3 9amyth_dude_9090100% (2)

- Case 9-2 Innovative Engineering CoDokument4 SeitenCase 9-2 Innovative Engineering CoFaizal PradhanaNoch keine Bewertungen

- AHM13e Chapter 05 Solution To Problems and Key To CasesDokument21 SeitenAHM13e Chapter 05 Solution To Problems and Key To CasesGaurav ManiyarNoch keine Bewertungen

- CASE SUMMARY Waltham Oil and LubesDokument2 SeitenCASE SUMMARY Waltham Oil and LubesAnurag ChatarkarNoch keine Bewertungen

- anthonyIM 06Dokument18 SeitenanthonyIM 06Jigar ShahNoch keine Bewertungen

- Stern Corporation Stafford PressDokument10 SeitenStern Corporation Stafford Presssushie22Noch keine Bewertungen

- Accounting Case 9-2Dokument2 SeitenAccounting Case 9-2cvrzakNoch keine Bewertungen

- Case Report - Grenell FarmDokument5 SeitenCase Report - Grenell Farmajsibal100% (1)

- Waltham Oil and Lube WorkingsDokument5 SeitenWaltham Oil and Lube WorkingsGaurav Sahu100% (1)

- Chap004 SolutionsDokument7 SeitenChap004 Solutionsdavegeek100% (1)

- Mile High Cycles CaseDokument6 SeitenMile High Cycles CaseShubh TanejaNoch keine Bewertungen

- Solution Manual For Accounting Text andDokument17 SeitenSolution Manual For Accounting Text andanon_995783707Noch keine Bewertungen

- Basic Accounting Concepts: The Income Statement: Changes From Eleventh EditionDokument19 SeitenBasic Accounting Concepts: The Income Statement: Changes From Eleventh EditionDhiwakar SbNoch keine Bewertungen

- AHM13e Chapter - 03 - Solution To Problems and Key To CasesDokument24 SeitenAHM13e Chapter - 03 - Solution To Problems and Key To CasesGaurav ManiyarNoch keine Bewertungen

- Accounting:Text and Cases 2-1 & 2-3Dokument3 SeitenAccounting:Text and Cases 2-1 & 2-3Mon Louie Ferrer100% (5)

- Accounting-Lone Pine Cafe CaseDokument28 SeitenAccounting-Lone Pine Cafe CaseMuadz Akbar100% (1)

- Innovative Eng. CompanyDokument6 SeitenInnovative Eng. CompanyNadia Farahiya Rachmadini100% (1)

- Quick Lunch Financial StatementsDokument3 SeitenQuick Lunch Financial StatementsDV Villan100% (1)

- Waltham Oil and Lube CentreDokument5 SeitenWaltham Oil and Lube CentreAnirudh Singh0% (2)

- anthonyIM 09Dokument17 SeitenanthonyIM 09Ki Umbara100% (1)

- Joan Holtz (A) Case Revenue Recognition QuestionsDokument5 SeitenJoan Holtz (A) Case Revenue Recognition QuestionsAashima GroverNoch keine Bewertungen

- Assignment 3.2 LOne Pine Cafe (B) Rajesh RanjanDokument2 SeitenAssignment 3.2 LOne Pine Cafe (B) Rajesh RanjanamitkrhpcicNoch keine Bewertungen

- Delaney Motors CaseDokument15 SeitenDelaney Motors CaseVan DyNoch keine Bewertungen

- Case 11-2 SolutionDokument2 SeitenCase 11-2 SolutionArjun PratapNoch keine Bewertungen

- Debt sources and accounting in Norman Corporation caseDokument19 SeitenDebt sources and accounting in Norman Corporation caseDhiwakar Sb100% (1)

- Chapter 5 ProblemsDokument7 SeitenChapter 5 Problemsanu balakrishnanNoch keine Bewertungen

- Stafford Press SolvedDokument2 SeitenStafford Press SolvedMurali DharanNoch keine Bewertungen

- Problem 13-1 - Chapter 13 - SolutionDokument6 SeitenProblem 13-1 - Chapter 13 - Solutionppdisme100% (1)

- AHM13e - Chapter - 06 Solution To Problems and Key To CasesDokument26 SeitenAHM13e - Chapter - 06 Solution To Problems and Key To CasesGaurav ManiyarNoch keine Bewertungen

- AHM13e Chapter - 02 - Solution To Problems and Key To CasesDokument23 SeitenAHM13e Chapter - 02 - Solution To Problems and Key To CasesGaurav ManiyarNoch keine Bewertungen

- Grennell FarmDokument1.270 SeitenGrennell FarmPradeep Elavarasan50% (4)

- Standard Costs, Variable Costing Systems, Quality Costs, and Joint CostsDokument18 SeitenStandard Costs, Variable Costing Systems, Quality Costs, and Joint CostsAlka NarayanNoch keine Bewertungen

- ARS Waltham Case TransactionsDokument2 SeitenARS Waltham Case TransactionsRajnikaanth SteamNoch keine Bewertungen

- Chapter 6 Cost of Sales and Inventories GuideDokument62 SeitenChapter 6 Cost of Sales and Inventories GuideRosedel Rosas100% (2)

- Chapter 7 (Case) : Joan HoltzDokument2 SeitenChapter 7 (Case) : Joan Holtzjenice joy100% (1)

- Dispensers of California, IncDokument9 SeitenDispensers of California, IncHimanshu PatelNoch keine Bewertungen

- Stafford Press CaseDokument4 SeitenStafford Press CaseAmit Kumar AroraNoch keine Bewertungen

- Hardin Tool CompanyDokument42 SeitenHardin Tool CompanyMayank KumarNoch keine Bewertungen

- Chapter 8 PDFDokument36 SeitenChapter 8 PDFRoan CalimdorNoch keine Bewertungen

- Financial Reporting and Analysis: Assignment - 1Dokument8 SeitenFinancial Reporting and Analysis: Assignment - 1Sai Chandan Duggirala100% (1)

- Lone Pine Cafe Case SolutionDokument5 SeitenLone Pine Cafe Case SolutionShammika Krishna75% (4)

- Mile High Cycles Flexible Budget AnalysisDokument4 SeitenMile High Cycles Flexible Budget Analysisnino7578Noch keine Bewertungen

- The Behavior of Costs: Changes From The Eleventh EditionDokument14 SeitenThe Behavior of Costs: Changes From The Eleventh EditionAlka NarayanNoch keine Bewertungen

- Final Exam Paper (C) 2020.11 OpenDokument3 SeitenFinal Exam Paper (C) 2020.11 OpenKshitiz NeupaneNoch keine Bewertungen

- Chapter 15&16 Problems and AnswersDokument22 SeitenChapter 15&16 Problems and AnswersMa-an Maroma100% (10)

- Report On Sinclair CompanyDokument5 SeitenReport On Sinclair CompanyVictor LimNoch keine Bewertungen

- Kellogg Company and SubsidiariesDokument7 SeitenKellogg Company and SubsidiariesAlejandra DiazNoch keine Bewertungen

- Consolidated financial statements of Pal CorporationDokument5 SeitenConsolidated financial statements of Pal CorporationfebbiniaNoch keine Bewertungen

- Ch03 P15 Build A ModelDokument2 SeitenCh03 P15 Build A ModelHeena Sudra77% (13)

- Preliminary computations and consolidation working papersDokument7 SeitenPreliminary computations and consolidation working papersLoretta SmithNoch keine Bewertungen

- Tablas Caso Examen HHCDokument12 SeitenTablas Caso Examen HHCCristian MuñozNoch keine Bewertungen

- Parent, Inc Actual Financial Statements For 2012 and OlsenDokument23 SeitenParent, Inc Actual Financial Statements For 2012 and OlsenManal ElkhoshkhanyNoch keine Bewertungen

- KuisDokument22 SeitenKuismc2hin9100% (1)

- B. Revising The Estimated Life of Equipment From 10 Years To 8 YearsDokument4 SeitenB. Revising The Estimated Life of Equipment From 10 Years To 8 YearssilviabelemNoch keine Bewertungen

- 2021.01 - Key-Findings - Green Bond Premium - ENDokument6 Seiten2021.01 - Key-Findings - Green Bond Premium - ENlypozNoch keine Bewertungen

- Consular Assistance For Indians Living Abroad Through "MADAD"Dokument12 SeitenConsular Assistance For Indians Living Abroad Through "MADAD"NewsBharatiNoch keine Bewertungen

- Examen 03 Aula - F PostgradoDokument5 SeitenExamen 03 Aula - F PostgradodiegoNoch keine Bewertungen

- The CardiacDokument7 SeitenThe CardiacCake ManNoch keine Bewertungen

- Noor Hafifi Bin Jalal: Operating Code 1: Demand ForecastDokument47 SeitenNoor Hafifi Bin Jalal: Operating Code 1: Demand ForecastGopalakrishnan SekharanNoch keine Bewertungen

- J S S 1 Maths 1st Term E-Note 2017Dokument39 SeitenJ S S 1 Maths 1st Term E-Note 2017preciousNoch keine Bewertungen

- Porter 5 ForcesDokument44 SeitenPorter 5 ForcesSwapnil ChonkarNoch keine Bewertungen

- Activity7 Raptshia DataSetDokument16 SeitenActivity7 Raptshia DataSetoneinamillionnamedlunaNoch keine Bewertungen

- Hepatobiliary Surgery BlumgartDokument301 SeitenHepatobiliary Surgery Blumgartaejazahsan100% (7)

- Attaei PDFDokument83 SeitenAttaei PDFHandsomē KumarNoch keine Bewertungen

- Underpinning Methods, Procedure and ApplicationsDokument10 SeitenUnderpinning Methods, Procedure and ApplicationsShivaun Seecharan0% (1)

- Philips Solar+LED Marketing StrategyDokument15 SeitenPhilips Solar+LED Marketing StrategyrejinairNoch keine Bewertungen

- C15 DiagranmaDokument2 SeitenC15 Diagranmajose manuel100% (1)

- 28/08/2016 1 Advanced Research Methodology... RU, Bangalore-64Dokument38 Seiten28/08/2016 1 Advanced Research Methodology... RU, Bangalore-64Ananthesh RaoNoch keine Bewertungen

- Nothophytophthora Gen. Nov., A New Sister Genus of Phytophthora From Natural and Semi-Natural Ecosystems in Europe, Chile and VietnamDokument32 SeitenNothophytophthora Gen. Nov., A New Sister Genus of Phytophthora From Natural and Semi-Natural Ecosystems in Europe, Chile and VietnamChi Nguyen MinhNoch keine Bewertungen

- High Performance, Low Cost Microprocessor (US Patent 5530890)Dokument49 SeitenHigh Performance, Low Cost Microprocessor (US Patent 5530890)PriorSmartNoch keine Bewertungen

- User Interface Analysis and Design TrendsDokument38 SeitenUser Interface Analysis and Design TrendsArbaz AliNoch keine Bewertungen

- E-Leadership Literature ReviewDokument36 SeitenE-Leadership Literature ReviewYasser BahaaNoch keine Bewertungen

- The International Journal of Periodontics & Restorative DentistryDokument7 SeitenThe International Journal of Periodontics & Restorative DentistrytaniaNoch keine Bewertungen

- Watson Studio - IBM CloudDokument2 SeitenWatson Studio - IBM CloudPurvaNoch keine Bewertungen

- 1 Osteology (MCQ)Dokument12 Seiten1 Osteology (MCQ)Utkarsh MishraNoch keine Bewertungen

- Mémoire ENSMDokument97 SeitenMémoire ENSMAntoine Laurent100% (1)

- Fmi Code GuideDokument82 SeitenFmi Code GuideNguyễn Văn Hùng100% (4)

- DIRECTORS1Dokument28 SeitenDIRECTORS1Ekta ChaudharyNoch keine Bewertungen

- Railway noise source modeling and measurement methodsDokument78 SeitenRailway noise source modeling and measurement methodsftyoneyamaNoch keine Bewertungen

- Complaint FTC V SkechersDokument60 SeitenComplaint FTC V SkechersLara PearsonNoch keine Bewertungen

- Martek Navgard BnwasDokument4 SeitenMartek Navgard BnwasСергей БородинNoch keine Bewertungen

- Soft Matter Physics Seminar on Non-Equilibrium SystemsDokument98 SeitenSoft Matter Physics Seminar on Non-Equilibrium Systemsdafer_daniNoch keine Bewertungen

- Cambridge O Level: Agriculture 5038/12 October/November 2020Dokument30 SeitenCambridge O Level: Agriculture 5038/12 October/November 2020Sraboni ChowdhuryNoch keine Bewertungen

- Behavioural Theory of The Firm: Presented By: Shubham Gupta Sumit MalikDokument26 SeitenBehavioural Theory of The Firm: Presented By: Shubham Gupta Sumit MalikvarunymrNoch keine Bewertungen