Beruflich Dokumente

Kultur Dokumente

Global Leaders - 2012

Hochgeladen von

ragavendraprasathOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Global Leaders - 2012

Hochgeladen von

ragavendraprasathCopyright:

Verfügbare Formate

6

Corporate Dossier

{ India Incs Most Powerful CEOs 2012 }

SKD DA

Ambition makes all the difference .

May 25, 2012

THE ECONOMIC TIMES

Work the double shift? Or work a paradigm shift?

KDDA

1

LN Mittal

ArcelorMittal

2

Indra Nooyi

PepsiCo

3

Nikesh Arora

Google

4 5

Vikram Pandit

Citigroup

6 7 8 9 10

Anshu Jain

Deutsche Bank

1

Amartya Sen

Harvard University

2

Ram Charan

3

Vijay Govindarajan

Tuck Business Schiool

4 5

Pankaj Ghemawat

IESE Business School Harvard Business School

6 7 8 9

Goizueta Business School London Business School Harvard Business School

10

Jagdish Bhagwati

Columbia University

Harish Manwani

Unilever

Ajit Jain

Berkshire Hathaway Reinsurance Group

Shantanu Narayen

Adobe Systems

Vinod Khosla

Khosla Ventures

Rakesh Kapoor

Reckitt Benckiser

Tarun Khanna Jagdish Sheth Nirmalya Kumar Nitin Nohria

Bala Balachandran

Kellogg School of Management

Global Indian Business Leaders

Top Women CEOs

Chanda Kochhar

ICICI Bank

2 Kiran M Shaw

Biocon

Shobhana Bhartia

HT Media

4 Shikha Sharma

Axis Bank

Naina Lal Kidwai

HSBC India

6 Kalpana Morparia

JP Morgan India

Neelam Dhawan

Hewlett-Packard India

8 Mallika Srinivasan

TAFE

Preetha Reddy

Apollo Hospitals

10

Roopa Kudva

CRISIL

POWER PLAY

7 8

John Flannery

GE India

Global Indian Thought Leaders

Most Powerful MNC CEOs

1

Nitin Paranjpe

Hindustan Unilever

2

D Shivakumar

Nokia-India, Middle East & Africa

3

Rajan Anandan

Google India

4

Bhaskar Pramanik

Microsoft India

5

Naina Lal Kidwai

HSBC India

6

Kalpana Morparia

JP Morgan India

9

Neelam Dhawan

Hewlett-Packard India

10

Sanjeev Chadha

PepsiCo Middle East & Africa IBM India

Shanker Annaswamy

Introducing the new SKODA Superb Ambition. Come test drive pure indulgence today 1

KDDA

he Economic Times, in partnership with IMRB International, has been conducting comprehensive surveys to ascertain the 'Most Powerful CEOs' of India, for the past few years. The survey has endeavored to identify the business leaders who are well-recognised by people for their efforts in shaping Corporate India.

METHODOLOGY

cial Contribution/ Sustainability', and 'Governance'. The respondents were from large companies selected by referring to databases like the ET-500. The respondents were requested to participate through an invite from The Economic Times. The corporate respondents were divided into sector-wise panels, and each panel was invited to share their feedback on CEOs from their sector. In order to control respondent bias, we discounted the respondent's opinions on his/ her own company's CEO. The respondents were asked for their inputs using a small survey-instrument, which could be self-administered or administered face-to-face by seasoned interviewers. The survey-instrument captured inputs on the respondent's CEO-associations across each parameter. The respondents were also invited to add one CEO (to the list) that he/she considers as most powerful. This ensured that the opinion of the respondent was not restricted to the given list of CEO's. PROCESS: The respondents were first asked to allocate points to the six parameters, which would add up to a total of 100. The points were allocated on the basis of importance of each attribute as per their opinion. This helped us to arrive at the sector-wise and overall parameters-weights which were used in the final analysis. For deriving the weights we considered only those scores which were obtained from management respondents belonging to the senior corporate profiles, like the Vice President, Asst. Vice President, General Manager and the like. After determining the parameter-scores, we checked for the respondent's familiarity with each of the CEOs given in their specific survey-instrument. For CEOs the respondent was adequately familiar with, opinion on each parameter was captured using the 'free association method' followed by a rating on a 3-point association-scale. In this, respondents were given a parameter and were then requested to mention which of the CEOs in the list they associate that parameter with. The respondents had the freedom to associate as many CEOs that they felt could be associated. Once they have associated the CEOs for that particular parameter, they are then asked to rate each CEO on a scale of 1 to 3, wherein 1 signifies a weak association, 2 signifies a moderate association and 3 signifies a strong association. Then for each CEO a composite score was calculated at a respondent level. Across respondents, the sum of these composite scores gave us the power score for the respective CEO. The higher the power score, the higher the rank assigned to the CEO. Finally, we obtained a cross-sector ranking of the CEOs. For this, we indexed the scores for the CEOs across sectors and thereby obtained the master list of top 100 CEOs.

StillOnTop

Continued from pg 5 As the 2012 list shows, much of the leadership of these firms has been trained in the world's best business schools. Ratan Tata has a degree from Cornell, Azim Premji trained at Stanford, Anand Mahindra has an MBA from the Harvard, Kumar Mangalam Birla has a London Business School degree. These are not new groups, although their business aggressiveness and their ability to think in global terms is a new phenomenon, which has been sharpened by the more pro-business atmosphere of the post 1980s. Not surprisingly many of the larger groups have incorporated managerial capitalism with family capitalism since at least the 1970s and have thus been able to rise to the challenges of liberalisation. Further, daughters are increasingly becoming part of succession planning, inheriting assets and entering boardrooms. Prime examples would be Manjushree Khaitan of the BK Birla Group and Priya and Priti Paul of the Apeejay Surendra Group. What is clear is that business as an actor has been able to negotiate several different regimes - the Nehruvian period was an especially difficult one when business, which was hoping to be a player in the newly independent nation state, was sidelined by the general anti-business rhetoric, the licenses and permits. There was brief relief in the 1960s but it proved to be too short lived. A worsening atmosphere came thereafter epitomized by Indira Gandhi's disdainful comments such as 'our private enterprise is more private than enterprising.' It is only with liberalisation that the private sector is beginning to be seen as a legitimate partner by the state. This new scenario has been enthusiastically received and channelised into measures, which have made private enterprise globally competitive. These measures include corporate restructuring, focusing on core competencies, implementing management changes and enhancing competitiveness as they aspire to global status. Larger groups have shown concerns that 'reputation' and 'high brand equity' should not be compromised in the face of rapid expansion and major acquisitions. Not surprisingly, the Tatas were among the earliest groups to implement a new code of ethics and 'brand equity Business Promotion agreement' and a 'Tata Business Excellence Model.' A confident private sector has gone on a global acquisitions spree with fierce aggressiveness. The acquisitions are impressive especially. Amongst the most symbolic is the takeover from Ford of Jaguar and Land Rover which heralds the acquisition of a 'symbol of British style', the makers of 'James Bond's new wheels' and 'Inspector Morse's classic.' Godrej is aspiring to global status through acquisitions of local brands in the personal care line and the AV Birla group in aluminum and carbon black. However, this could only be maintained if the pro-business atmosphere which was inaugurated with the economic reforms of the late 1980s and especially post 1991 is sustained. Unfortunately, this seems to be evaporating in the UPA II dispensation. Family business has thrived under liberalisation and has been able to forge meaningful links with MNCs in a confident way . The next challenge that lies before family business relates to what may happen to the retail sector, particularly in the context of the issue of entry of FDI. Walmart and 'Mom and Pop' run retail shops need not necessarily be adversaries. There may exist develop complementarities through the forging of relationships to mutual advantage. In any case the investment in logistics and supply chain would ultimately benefit the lower and medium segments of the retail sector energizing the vibrant bazaar component of the Indian economy.

The author is a business historian based at the National University of Singapore. She has written widely on Indian business and has recently edited The Oxford India Anthology of Business History (Oxford University Press, 2011)

The First Multinational

Continued from pg 5 By the end of the 1700s, the Company had undergone a curious change; it had begunto rule a part of India in the name of the Mughal Emperor. This was the beginning of the British Empire in South Asia. Why did a group of foreigners succeed so dramatically as traders in the Indian Ocean? And why did a group of traders decide to capture power in a distant land? In the 1600s the Company was an upstart in India, smaller in scale than almost any of the large Indian family firms operating from the Indian coastal trading towns like Surat, Masulipatnam, and Hooghly, and desperately trying to defend its operations against attacks by European rivals, the Dutch and the Portuguese. An empire was a prospect beyond dreams. Yet, collectively, the Europeans did possess three strengths that the greatest Indian firms did not have. First, the Europeans had knowledge of long-distance navigation. They understood charts, maps, ocean currents, instruments, routes, and the technique of making sturdier and larger ships carrying guns on board much better than did the Indian seafaring merchants. The Europeans, thus, had developed a truly global understanding of the oceans long before the other ocean-bound cultures. Indians were good navigators, but they did not venture beyond the Indian Ocean. Second, the Company could procure lots of Spanish silver. In turn, their capacity to do so had owed to the presence of well-developed financial markets in Europe of this time. In India, banking was less developed, money changed fewer hands, and interest rates were higher. The biggest advantage the Company possessed stemmed from its identity as a joint stock firm. In Asia, the biggest firms financed investments with their own money, family savings, or at the most, money borrowed from members of the same caste or community. The idea of the joint stock was unknown. That idea allowed the East India Company to pool in huge amounts of money, and make use of the economies of scale available in overseas trade. It could build an elaborate infrastructure consisting of forts, factories, harbours, and ships. Joint stock also made them better risk-takers. The Indian traders spread risks by dealing in a variety of goods in auction-type exchanges. They were what the Dutch historian Jacob van Leur had called 'peddlers' of the oceans. The Company, thanks to its capacity to absorb risks, dealt in a few goods, which it bought on large scale. Being specialised, it needed to contract with a specific set of suppliers year after year and to pay out vast sums of money as advances. Contractual sale of goods was not unknown in India before, but contractual sale on such a scale by a single firm had no precedent. The need to protect its ports and harbours from numerous enemies made the Company keen to own ports. The three leading examples, Madras, Bombay, and Calcutta, represented quite a different business culture in coastal India. Whereas Surat and Masulipatnam had belonged to states that lived mainly on land taxes, the Company towns were oceanbound, and had no ties with land. Bombay, Calcutta, and Madras were no ordinary ports. They were ports where seafaring merchants, rather than landlords and warlords, made laws. The Company towns, therefore, were attractive to Indian merchants as well. In the 1700s when the Mughal Empire started breaking up and warfare broke out in the interior, hundreds of wealthy Indian merchants and bankers fled to the Company towns. They were a huge source of support for the Company's political adventures. We need not overdraw these strengths. The Company's own business privileges, which were a monopoly granted by the British Crown, were constantly under attack fromprivate traders and even its own employees. The relation between Indian firms and the Indian rulers was based on informal understanding, but the Europeans did not enjoy such trust and goodwill. They had to take out license to trade, and pay massive bribes to the Indian kings and their henchmen. They also had to keep an army of paid agents to procure goods. These contracts had no Indian precedents, and therefore, they were not protected by any Indian law. Contracts were broken often, and the Company could do little when they were broken. In order to avoid such situations, the Company recruited its chief agents carefully. They were often individuals who held power over the textile artisans. At the same time, they were more knowledgeable about India than were the Company's own officers. The Company officers disliked this dependence and hated the agents. Lastly, unlike a modern firm, the Company did not have a unitary command-andcontrol structure. Its overseas enterprise was a peculiar combination of modern joint stock principle in raising money and pre-modern partnership in management. The two partners were the sedentary City merchants and peripatetic sailors and soldiers. These two classes were not friendly at home. But the sailors and soldiers joined the venture on the promise that they could trade a little on the side. Still, it was the latter that had to deal with hostile kings and untrustworthy agents in India, which made them more aggressive and opportunistic than the shareholders back home. The sailors and soldiers were the people who made the moves that led to the empire in India, often against the instructions of the shareholders. The Company's success, in conclusion, had much in common with the ingredientsthat many modern multinational make use of - capacity to absorb risks, capacity to think on a world scale, access to deep financial markets, and access to information. Its weaknesses too were surprisingly modern in character - miscalculation of political risks and unreliable local partners. But the Company was also quite unique. For one thing, it was a firm with a split personality, torn between merchants and soldiers. For another, it reached its peak during an unusual moment in Indian history that saw the collapse of a great medieval empire. That moment gave the sailors and soldiers the chance to take hold of the reins of the Company, giving birth to another empire.

The author is Professor of Economic History, London School of Economics and author of The East India Company...The Worlds Most Powerful Corporation

The survey was conducted through a fivestep process: A. Collating the list of CEOs across sectors B. Setting evaluation parameters C. Calculating the parameter-scores D. Free association & rating of CEOs on each evaluation parameter E. Ranking of CEOs at an overall level The team at IMRB International was provided with a list of CEOs, collated mainly from this year's ET 500 rankings as well as previous years' rankings of 'Most Powerful CEOs' with relevant additions and removals in line with the current corporate scenario. The aim was to arrive at a final short-list of top 100 CEOs to be crowned as the 'Most Powerful CEOs' of corporate India for the current year. The CEOs were then evaluated by corporate people in senior/middle management roles on six important parameters - 'Leadership', 'Strategy & Innovation', 'Performance', 'Stature', 'So-

Eld, St,x MUMDAI . irIIWiM Mdad (W),TeL:28810222 I Wards. Road,TeL: 2353 46291 Lb,ldn Road, 4 Khar W) Td.:2648 6865 lath Roa4 O,ernbur(E Tei.: 25286070 1 Cb I , & Gor aon (E),TeL: 28495013/4 G,o a?nlOlMul, dKat Kan Tel.:67420820 1 MuauuMuH, Bhsysnder (W),Thi.: 28151 1 R atyMal. 514 Ghat1ooi,ar At,Tel.:25175552 1 konin,Md, Thsno ty4ToL: 25377035 1 LiWuWotid Maii. Nsa Murth i.Td. : 27748780 NEW DELHI . Panific MaE. 161:011-4568 3838 I Gr6a K iIanh i M Biadld. 011-4103 0025 I PUNE. Pho nix Murkatoity, Nugar R0a4 Td.: 020-3095 0394 I !m,ano. l s. .Cantot Maii, : o. To.: 020 - 6726 7951

ARRIVING

CHENNAJ - E peessAaosee ltto ii ,Tei.: 044- 28464057 I AURANGABAD- Pnoxong MaiI, Tei.: 0240-6660768 I AMPSISAR. Las.renes Road, TOL:0183 - 5059931 1 WDHIANA . D Neopdit Muii, Tei.: 0161- 4607450 I9 99 E rnproes C i ty Ma li , Nagp c r I Pho enix Market City, Beng a is r o I www .bo rn bayhig htas h ion n. co ro I t fsc ebook .c o rn/Bo rn b sy Hig h Psg e I tw itter. co n /# l/Bo es b ayH igh

S U M M E R C O L L E C T I O N 2012

I,

REDTAPE

APPAREL FOOTWEAR ACCESSORIES

S H I R T S

T -S HIRTS

JEANS

SHOES

ACCESSORIES

REfl TAPE Exclusive Showrooms: BANGALORE - Marathalli Main Road: Ph.; 412843 62 Ring RoadJ unction , Maratlialli: Ph.: 41268298/4219 1465 White Field Road: Ph.; 28026551 PUNJAB -Amritsar: G.T Road. Ph.; 5012111 , Mall Road. Ph.; 2210524 Bliatinda: Post Office Bazaar. Ph.: 5004800, Miltal City Mall: Ph.: 5003451 Chandigarh .Sector liD, P11.: 2128922 Firozepur: Ph.: 50210 1 Jalandhar: Lajpat Nagar Market. Ph.: 4631258 , New Jawahar Nagar. Ph.: 4608380 Ludhiana .Model Town: Ph.: 4636111 Ghumar Mandi: Ph.: 5012200 Mall Road: Ph.: 4618380 Mohali: Ph.: 4562200 Patiala: Ph.: 5006465 Moga: Dull Road. Ph.: 500112 Muktsar: Ph.: 502699 Abohar: Ph.: 500194 JAMMU - Gandhi Nagar: Ph.: 2431610 Raghuna th Bazar: Ph.: 2548071 DELHI. South Ext . Part-2: Ph.: 41011334 Ansa l Plaza Mall: Ph.: 46612431 Lajpat Nagar II: Ph.: 46340025 Karol Bagh: Pb.: 45647821 Rajo uri Garden: Ph.: 43703169 Dwarka: Ph.: 42720449 Paschim Viliar: Ph.: 45661939 Roliini: Ph.: 47096465 Pitampura: Ph.: 273515 10 Kamla Nagar: Ph.: 23847487 Mukherj ee Nagar: Ph.: 27652627 Vikas Marg: Marg: Ph.: 22422075 Janak puri: Ph.: 41589722 Rani Bagh. Ph.: 47563383 GURGAON - Metropolitan Mall: Ph.: 4008321 Naya Bazaar: Ph.: 4104360 Sec-14. Ph.: 4086504 NOIDA . Great India Place: Ph.: 4352109 GHAZIABAD .Opulent Mall: Ph.: 4325379 , PacifIc Mall: Ph.: 4103845 HARYANA -Ambala: Ph.: 2611418 Hissar:P h.: 238411 , 270181 . Karnal: Ph.:22 12010 Rohtak:Ph.: 655156 Sirsa: Ph.:22 0123 Yamunanagar:Ph.: 2220406 Sonipat: Ph.: 2240024 Kurukshetra: Ph.: 290356 Panipat: Ph.: 4012851 Bahad urgarh:Ph.: 236444 , 212764 Jaipur : Ph.: 4022204 Sri Ganga Nagar: Ph.: 9414512444 Udaipur: Ph.: 9828144766 MUMBAI h P . AGRA: Ph.: 4042499 KANPUR - Rave-3: Ph.: 3024856 Swaroo p Nagar: Ph.: 3047881 LUCKNOW - Fan Republic Mall: Ph.: 4019375 BAREILY: Ph.: 2301408 RAJASTHAN . Lo khan dwa la: Ph.: 42952560 , Laxmi Plaza: Ph.: 42645302 HYDERABAD . Himayal Nagar: Ph.: 66630080 MP. Bhopal: Ph.: 4074761 FACTORY OUTLET: Naj afgarh: Ph.: 25322505 Santa Vihar: Ph.: 29944816 Noida , Sec.59: Ph.: 4281322 Mumbai, Parel (E): Ph.: 24150140 OPENING SHORTLY: Gurgaon: Metropolis Mall Mumbai: K Mall Patna Ranchi Also Available at JABONG Apparel Distributors: Delhi NCR - M/S Yaakshi Apparels: Ph.: 0981 0088344

Mumbai Region - MIS Ponchanan Retail Products Pvt. Ltd. Ph.: 09930461 221 I 022-23753 813

foliow.....

I: i

Now Buy Onlinewww.redtape.com

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Agile Fo DummiesDokument76 SeitenAgile Fo DummiesTon Gonçalves100% (3)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Drupal 8 User GuideDokument224 SeitenDrupal 8 User Guideibrail5Noch keine Bewertungen

- PLJ-8LED Manual Translation enDokument13 SeitenPLJ-8LED Manual Translation enandrey100% (2)

- p2 - Guerrero Ch13Dokument40 Seitenp2 - Guerrero Ch13JerichoPedragosa88% (17)

- 37 Operational Emergency and Abnormal ProceduresDokument40 Seiten37 Operational Emergency and Abnormal ProceduresLucian Florin ZamfirNoch keine Bewertungen

- Agile Topics Cards Jimmy Janlén Crisp 108 CardsDokument42 SeitenAgile Topics Cards Jimmy Janlén Crisp 108 CardsragavendraprasathNoch keine Bewertungen

- Agile LinksDokument2 SeitenAgile LinksragavendraprasathNoch keine Bewertungen

- Organic Growth Is The Underestimated Opportunity - HBRDokument1 SeiteOrganic Growth Is The Underestimated Opportunity - HBRragavendraprasathNoch keine Bewertungen

- Butterfly Group's 40-Year Journey as India's Stainless Steel Appliance PioneerDokument3 SeitenButterfly Group's 40-Year Journey as India's Stainless Steel Appliance PioneerragavendraprasathNoch keine Bewertungen

- BuddhismDokument1 SeiteBuddhismragavendraprasathNoch keine Bewertungen

- Climate Change and AgricultureDokument3 SeitenClimate Change and AgricultureragavendraprasathNoch keine Bewertungen

- EasyLogic PM2000 Series - METSEPM2130Dokument4 SeitenEasyLogic PM2000 Series - METSEPM2130ٍJordan SportNoch keine Bewertungen

- Insert BondingDokument14 SeitenInsert BondingHelpful HandNoch keine Bewertungen

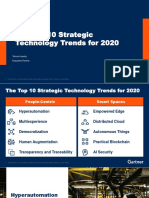

- The Top 10 Strategic Technology Trends For 2020: Tomas Huseby Executive PartnerDokument31 SeitenThe Top 10 Strategic Technology Trends For 2020: Tomas Huseby Executive PartnerCarlos Stuars Echeandia CastilloNoch keine Bewertungen

- VFD ManualDokument187 SeitenVFD ManualgpradiptaNoch keine Bewertungen

- Type of PoemDokument10 SeitenType of PoemYovita SpookieNoch keine Bewertungen

- Appendix B, Profitability AnalysisDokument97 SeitenAppendix B, Profitability AnalysisIlya Yasnorina IlyasNoch keine Bewertungen

- Team Dynamics and Behaviors for Global ExpansionDokument15 SeitenTeam Dynamics and Behaviors for Global ExpansionNguyênNoch keine Bewertungen

- Textile Finishing Different Types of Mechanical Finishes For TextilesDokument3 SeitenTextile Finishing Different Types of Mechanical Finishes For TextilesMohammed Atiqul Hoque ChowdhuryNoch keine Bewertungen

- Ejemplo FFT Con ArduinoDokument2 SeitenEjemplo FFT Con ArduinoAns Shel Cardenas YllanesNoch keine Bewertungen

- Wei Et Al 2016Dokument7 SeitenWei Et Al 2016Aline HunoNoch keine Bewertungen

- 2113T Feasibility Study TempateDokument27 Seiten2113T Feasibility Study TempateRA MagallanesNoch keine Bewertungen

- APLI - Annual Report - 2016Dokument122 SeitenAPLI - Annual Report - 2016tugas noviaindraNoch keine Bewertungen

- Lay Out New PL Press QltyDokument68 SeitenLay Out New PL Press QltyDadan Hendra KurniawanNoch keine Bewertungen

- John Williams - WikipediaDokument2 SeitenJohn Williams - Wikipedia三木和代Noch keine Bewertungen

- IS 2848 - Specition For PRT SensorDokument25 SeitenIS 2848 - Specition For PRT SensorDiptee PatingeNoch keine Bewertungen

- Priming An Airplane EngineDokument6 SeitenPriming An Airplane Enginejmoore4678Noch keine Bewertungen

- Plumbing Arithmetic RefresherDokument80 SeitenPlumbing Arithmetic RefresherGigi AguasNoch keine Bewertungen

- Modification Adjustment During Upgrade - Software Logistics - SCN WikiDokument4 SeitenModification Adjustment During Upgrade - Software Logistics - SCN Wikipal singhNoch keine Bewertungen

- The Quantum Gravity LagrangianDokument3 SeitenThe Quantum Gravity LagrangianNige Cook100% (2)

- Foundry Technology GuideDokument34 SeitenFoundry Technology GuidePranav Pandey100% (1)

- Liu030 Nepal Bans Solo Mountain ClimbersDokument2 SeitenLiu030 Nepal Bans Solo Mountain Climberssanti.miranda.parrillaNoch keine Bewertungen

- Fabm1 q3 Mod4 Typesofmajoraccounts FinalDokument25 SeitenFabm1 q3 Mod4 Typesofmajoraccounts FinalClifford FloresNoch keine Bewertungen

- Nysc Editorial ManifestoDokument2 SeitenNysc Editorial ManifestoSolomon Samuel AdetokunboNoch keine Bewertungen

- Fi 7160Dokument2 SeitenFi 7160maxis2022Noch keine Bewertungen

- Reaction CalorimetryDokument7 SeitenReaction CalorimetrySankar Adhikari100% (1)

- Costos estándar clase viernesDokument9 SeitenCostos estándar clase viernesSergio Yamil Cuevas CruzNoch keine Bewertungen