Beruflich Dokumente

Kultur Dokumente

Riba and Its Presense in Today's Finanacial Institution

Hochgeladen von

Al FredoOriginalbeschreibung:

Copyright

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Riba and Its Presense in Today's Finanacial Institution

Hochgeladen von

Al FredoCopyright:

International Islamic University Malaysia

Department of General Studies

RIBA RIBA RIBA RIBA

And Its Presence in Todays Financial Institutions

Ahmad Faridi Bn Abdul Matin

O715433

Section: 19

BACHIR SOUALHI (DR.)

SEMESTER 2

2007/2008

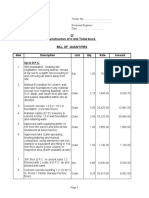

Table of Contents

Introduction i

Chapter 1: Riba: An Overview ii

1.1 Introduction to Riba 1

1.2 The Term and Its Definition 1

1.3 The Types of Riba 1

1.3.1 Riba Al-fadl & Riba Al- Nasiah: Definitions & Examples 2

1.4 The Hukm 3

1.5 Quranic and Sunnah verses 3

1.6 The Hikmah behind prohibiting Riba 4

1.7 Muslimss Reaction. 5

1.8 Chapter Conclusion. 5

Chapter 2: Riba in Todays Financial Institutions iii

2.1 Loans 6

2.1.1 How do banks give loans? 6

2.1.2 The Types. 8

2.1.3 The Hukm. 8

2.2 Savings 9

2.2.1 The Forms. 9

2.2.2 The Hukm. 9

2.3 Banking Cards 9

2.3.1 The Types 10

2.3.2 The Hukm 10

2.4 Monetary Exchange 10

2.4.1 Exchange using current and future rates. 11

2.5 Insurance. 11

2.5.1 The Types: 12

2.5.2 The Hukm: 12

2.6 Chapter Conclusion 13

Chapter 3: Islamic Banking: A Solution to Riba iv

3.1 Introduction and History 14

3.2 The Reasons Behind preference of Islamic banks in the modern world. 14

3.3 The characteristics and goals of Islamic banks 14

3.4 Types of banks falling under Islaimc banking category. 15

3.5 Services Islamic banks provide. 15

3.6 Islamic Banking Oporations and Interactions. 15

Conclusion v

Conclusion 17

Bibliography vi

Introduction

P

a

g

e

i

Introduction

AssalamuAlaikum wr. wb.

Praise be to Allah SWT, for his mercy and blessing has poured upon us without boundaries and the

blessing and prayers of Allah be upon our prophet SAW.

The issue of riba in the modern world has been a controversy issue between different intellects and

scholars, as it will be seen later on. This is because riba has evolved tremendously from a simple

interaction to a business that involves multibillion-dollar companies and individuals alike. The choosing

of this topic was based on some reasons I would like to present herewith.

1. The lack or limited resources of other topics pertaining modern fiqhi issue in our respective

university, and even it was hard to acquire these resources that I have used regarding this

particular topic.

2. To gain self satisfaction of understanding another scope of knowledge that is not related to my

course of study, which was the main reason I chose the scope of Contemporary fiqhi issue.

Although many people will argue, like some of my friends, that riba is not a contemporary issue

since it is well known in the early ages, and early scholars have plainly give their opinion regarding

its un-permissibility. I would like to stress that this argument is true in some sense but looking to the

topic in different angle, it would be obvious that it is a contemporary issue because the forms of riba

used today has somewhat evolved and changed from what is used to be.

Before going further, I would like to thank those who helped me in completing this work, by

correcting my grammatical and spelling mistakes and also by giving me ideas throughout, and letting

me use their resources.

Asking Allah SWT to bless this work and grant it acceptance.

WASSALAM

Chapter 1:

Riba (Usury): An

Overview

Introduction to usury in Islamic prospective

Ahmad Faridi

0715433

Riba: An Overview

Chapter 1

Riba and Its Presence in Todays Financial Institutions

P

a

g

e

1

1.1 Introduction to Riba.

The existence of financial exchange between people emerged since the beginning of

time such practices include trade and loans, and as time passed by, people began to make up

new practices or develop and alter the existing ones. Such additions include, among others,

investments, banking, usury, insurance, interests and the use of paper money etc. These

practices have a very good indication that humans have developed throughout time, but

alarmingly it also indicates how low peoples ethics have become. This is evident with the

emergence of non-ethical practices among people such as the appearance of Riba (en. Usury).

Riba has been practiced for centuries and thus we could find some traces of rejection from the

ancient intellects such as the Greek philosopher Aristotle

1

, who describe usury as a Fake

profit. And even religions such as Judaism and all Christian sects have prohibited it.

2

So it is not a mere coincidence that Islam, which is a religion sent to complete the ethics

Akhlaq has stated some guidelines for people to observe in order to restrain from such low

and unethical practices. And thus the rulings of Usury had been established.

1.2 Riba : The Term and Its Definition.

Riba " " literally means in Arabic accumulation and growth whether in something

physical or emotional

3

. Lisan Al-Arab dictionary provides: The root of it is the increase

4

.

Riba is usually translated to English as usury. Oxford Advanced Learners Dictionary

defines usury as: The practice of lending money to people at unfairly high rates of interest

5

and The American Heritage Dictionary have defined it as the lending of money at an exorbitant

rate of interest.

Although the Islamic term and the English term slightly differs in the meaning, both term are

used interchangeably.

Islamically, Riba can be defined according to its types. These types are presented below.

1.3 Riba: The Types.

According to S.H. Hamoud in his book, Banking: The Adaptation of Banking Practice to

Conform with Islamic law, that there are at least three trends

6

in the classification of Riba.

These trends are:

1

100 Soal Jawab Bank Islam, Ahmad Al-Nagar, Mohd. Ibrahim, Mohd. Al-Ansari, pg 13.

2

Ibid, pg 13.

3

, Abdul Fattah Mahmood Idris, pg. 5.

4

Islamic Banking: The adaptation of banking practice to conform with Islamic law, S.H. Hamoud, pg47.

5

Oxford Advanced Learners Dictionary, pg 1628.

6

Op.cit. pg, pg 53.

Riba: An Overview

Chapter 1

Riba and Its Presence in Todays Financial Institutions

P

a

g

e

2

1. Riba of increase Ar. Riba Al-Fadl

7

and Riba of Delayed paymentsAr. Riba Al-

Nassiah

8

. As-syafie adds a third type Riba of hand. This classification views Riba

with the scope of sales and its effects.

9

2. The second classification has two parts: (viewing it with a comprehensive scope)

A. Riba of the pre-Islamic

10

: Meaning to return the lent money with some extra

amount for each delay in paying back defined at the time of the agreement.

B. Riba explained by the prophet which is in two types:

I. Usury of increase. Such that one dinar sold with two and so on.

II. Usury of delayed payment.

3. Ibn Al-Qyyem classification:

a. Covert Usury; The increase usury.

b. Overt Usury; The delayed payment.

It seems that his classification does not differ from the first one. Yet his

argument is based upon How extreme the ban Haram is. He argues that

Covert usury has been banned Intentionally, but the overt one has been banned

to prevent leading to the former. Thus the later has a much milder degree in the

Haram standerd.

11

As seen, though there are three classification system most of the components are similar.

Classification system number 1 will be the basis that will be used throughout the paper.

1.2.2 Riba Alfadl & Riba Al-Nasiah : definitions, and examples.

1. Riba Al-fadl (Usury of increase):

Taking a superior thing of the same kind of goods by giving more of the same kind of

inferior goods

12

.

Examples of this type:

10 kg of first class dates with 15kg of an inferior type of dates.

1 gm of gold with 2gm of gold. And so on.

2. Riba Al-Nasiah (Usury of Delayed Payments ) .

This type has two subtypes:

7

, Abdul Fattah Mahmood Idris, pg. 7.

8

Ibid, pg 8.

9

Banking: The adaptation of banking practice to conform with Islamic law, S.H. Hamoud, pg 53,54.

10

Ibid, pg 56.

11

Ibid, pg 58,59.

12

The Noble Quran: English translation of the meanings and commentary, King Fahd Complex For Printing of the holy quraan.

Pg 62.

Riba: An Overview

Chapter 1

Riba and Its Presence in Todays Financial Institutions

P

a

g

e

3

First, to sell an items i.e Riba compatible item, with another one. With a delay in both

or either items collection

13

. Or what is well known in fiqhi terms Al-Qabd qabla Al-

Tafarruq or collect as you pay. Note here that Riba compatible items are, among

others, gold, silver, wheat, dates and salt

14

.

The second type is the Pre Islamic Riba. Meaning to return a lent money with some

extra amount for each delay in paying back defined at the time of the agreement.

An example of this is as follows.

Person a borrows RM100 from person b. person b then states that for any one day delay

on repaying, person a should pay extra %1 of the original amount.

1.4 Riba: The hukm.

Riba with all its forms are generally prohibited Haram, this is proven in The Holy Book

Al-Quraan , Prophets traditions and the Ijma of the Ummah , and it is considered as one of the

capital prohibition Kbair Alzzunub . Note that kabair is a term used to describe prohibited

actions which are not forgiven by Allah SWT except by sincere repentances (Tawba).

Though some scholars (as discussed earlier) classified the intensity of the prohibition to

extreme and mild like Ibn Al-Qayyem , and also some of the companions of the prophet, such as

Ibn Abbas, Ibn Arqam, Usamah bin Zaid and others, did not consider Riba of increase as

prohibited

15

as they have their own justification for it.

1.5 Verses from the Quraan and Sunnah regarding Riba.

The Quran has dealt with the issue of usury in four different chapters sura, this is to

stress the importance of the issue and also to remind people about the great punishment

awaiting those who rejects His orders.

Allah SWT warned those who do not restrain from committing Riba, A grave punishment

in the hereafter. Allah SWT said in His Glorious Quraan:

)) %!# =2' #/h9# ) ) $. ) %!# 6F 9# b9# ((

Those who eat Riba (usury) will not stand (on the Day of Resurrection) except like the standing of a

person beaten by shaitan

16

.

(2:275)

He then said in the next verse:

)) ,s !# #/h9# / M%9# 3 !# =s . A$ . ?O& ((

13

, Ahmad Al-dweesh,part 13, pg 330.

14

Ibid, 330.

15

, Abdul Fattah Mahmood Idris, pg. 7,8.

16

The Noble Quran: English translation of the meanings and commentary, King Fahd Complex For Printing of the holy Quran,

(2:275) pg 62.

Riba: An Overview

Chapter 1

Riba and Its Presence in Todays Financial Institutions

P

a

g

e

4

Allah will destroy riba (usury) and will give increase for Sadaqat (deeds of alms and charity)

And Allah likes not the disbelievers, sinners

17

.(2:276)

And in another verse he promised a spiritual war against those who commit Riba. He said:

)) $' %!# ## #)?# !# # $ +/ #/h9# ) F.

* 9 #=? #' 5>s/ i !# &! ((

O you who believe! Be afraid of Allah and give up what remains (due to you) from Riba (usury) (from

now onward), if you are (really) believers (278) And if you do not do it, then take a notice of war from

Allah and His Messenger

18

(2:278,279).

The above verses are all from the second chapter of the Quran surah el-Baqarah, the other

verses that dealt with Riba can be found in chapters 3 Aal Imran, 4 Al Nisa and 30 Al

Room of the glorious Quraan.

As for evidence from the Sunnh, the prophet has been reported saying several Hadiths

pertaining Riba. These Hadiths can be found in books of treditions of the prophet such as

SahihBukhari and Sahih Muslim.

Ibn masud (RA) has been reported saying:

(( ))

((Allahs Massenger SAW cursed the one who accepts ArRiba (the usury) and the one who pays it

19

)).

Being cursed here means that he will be away from Allahs SWT mercy

20

.

1.6 Riba: The Hikmah behind prohibiting it.

The prohibition of Riba in Islam has a lot of meaning behind it, one of the reasons are that Riba

comprises of using people

21

who are in need to satisfy ones greed and selfishness. This act is

without doubt can be considered as unjust Zhulm and thus it is Islamically unethical, as a

religion of equality and justice, will not pass without dealing with it. Also Riba to some extent is

a burden on the borrower since he has to pay extra of the original amount, and sometimes he

might be obliged to pay double the amount or even more. This is clearly a form of torture to the

borrower, and it might lead to bad consequences on him and his family.

Another reason that might be considered is that Riba is a way to earn money without work

22

,

which is contradicting Islam's teachings, which encourage Muslims to seek lawful rizk using

appropriate means.

17

Ibid, (2:276) pg 63.

18

Ibid, (2:278,279) pg 63.

19

Riyad-us-Saliheen, Al-Nawawi, part 2. pg1218.

20

" : " , Dr. Wahbah Al-zuhaili, 377..

21

Ibid, pg 377.

22

Ibid, pg 377.

Riba: An Overview

Chapter 1

Riba and Its Presence in Todays Financial Institutions

P

a

g

e

5

1.7 Riba: Muslims reaction towards it:

As discussed earlier Islam prohibited the use of Riba in the day to day transaction. Not only

that, it has warned a grave punishment for those who dare to defy Allahs command. Thus, it is

obvious that a self-conscious (Taqi) Muslim would be aware of it and also try to stay away from

involving him/her self in suspicious agreements and contracts with non-Islamic financial

institutions. Being aware means, to know and understand the process of these financial

transactions and how to perceive it and know what is Islams opinion regarding that or this

particular transaction.

As for those who already have engaged in such transaction should repent to Allah SWT and try

to find ways to abandon these practices.

1.8 Introduction to Riba in modern financial institution:

Riba throughout the centuries have evolved greatly in its forms and today as people intellectual

capability grown, these forms have been much wider. And its widespread have been alarming.

It might be also the direct consequence of the increase of peoples needs and wants. Another

consequence is that Riba in modern times have become an important part in peoples life, in a

way that in some places usury is part of day to day interactions. It has become part of life that

cannot be separated but rather people have to adapt to it. In the next chapter the issue of

modern financial institutions and how do they use Riba in their interactions will be discussed.

However, before going deeper into the discussion, a list of some of these interactions is

presented herewith. But it is important to understand that these topics are only a small part of

a wider spectrum.

1. Bank loans.

2. Savings.

3. Insurance.

23

4. Credit Cards.

5. And Monetary Exchange.

____________________________________________________________________

23

, Ahmad Al-dweesh, part 15, pg.

Chapter 2:

Riba in Todays

Financial Institutions

Examples of Riba interactions in banks and how to avoid it

Ahmad Faridi

0715433

Riba in Modern Financial Institutions

Chapter 2

Riba and Its Presence in Todays Financial Institutions

P

a

g

e

6

In the modern worlds people day to day dealings, financial establishments play a great

role in fulfilling their needs. Banks have become the treasure chest for a lot of people; they

depend on them in every interaction, this has lead to the sharp increase in the number of banks

and other financial institutions. Although in economic terms, this process is an indication of

healthy economy. However, looking at the issue in an Islamic point of view, this extension

possesses a bad indication that Riba has become wide spreading among suppliers and

consumers alike.

Since the establishment of the early banks and Investment Companies, Muslim scholars tried to

explain to the public the unlawfulness of many of their services. Many people restrained or

limited their interaction with these institutions but as their services increase and the burden of

life increase, peoples need to use these services become more significant. What made it

difficult for a lot of people to restrain from using these dealings is some of the services they

provide cannot easily be traced as a Haram or Halal dealings.

In this chapter, such institutions and services will be discussed. The form of discussion will be

uniformed. The discussion will be in such way the definition, short history, relationship with

Riba, other negative sides and then the Islamic point of view will be covered.

____________________________________________________________________

2.1 Bank Loans .

Lending money or lending in general can be traced as far as human history. It is part of helping

others in need and religions throughout history encouraged such acts and Islam as religion of humanity

gave special stress on this, Although a lot of virtues can be traced for lending money, some people

developed the bad habit of using people in need to gain self interests. Adding extra expenses on the lent

money with the claim of giving a chance for every delay is simply considered islamically as Riba and it is

the same as how the Arabs of Jahiliah used to do. Thus, it is considered non-lawful interaction. This form

of Riba can now be seen around the world in the form of bank loans.

Although the term can be used to describe anything that is lent, it is most popular within

banking terms. The Cambridge Advanced Learners Dictionary defined loan as a sum of money which

is borrowed, often from a bank, and has to be paid back, usually together with an additional

amount of money that you have to pay as a charge for borrowing

1

.

It can be considered, along with savings, as one of the most common bank transactions and most

important one, since most of bank revenue comes from loan transactions

2

.

2.1.1 How do banks give loans?

Before going further it is worth a mention that interest that are taken from the client or

given to him is considered as usury no matter how high or low the percentage rate is. This view,

1

Cambridge Advanced Learners dictionary (software), version 1.0.

2

Banking: The adaptation of banking practice to conform With Islamic law, S.H. Hamoud, pg149.

Riba in Modern Financial Institutions

Chapter 2

Riba and Its Presence in Todays Financial Institutions

P

a

g

e

7

although it looks fundamentally correct, caused a controversial argument between scholars,

According to the vast majioraty of Muslim scholars, usury is usury no matter how high or low

the interest rate is, but some scholars including the current Mufti of Al-Azhar stated that since

the interest rate is so low, it is permissible for a bank client to take the interest for his savings.

There are several ways banks provide its loan services to the consumer, these forms can

vary from one bank to another, from time to time or even from a certain class of client to

another class.

Form number 1:

According to Ali Al-Salus, of Qatar University, in his book

one way Banks give loan is by calculating the interest rate and then

subtracting the amount from the loan itself, thus only lending the reaming amount

after subtracting. An example of this is as follows: a lady asks for a RM200 loan from

a bank so if the interest rate is 20%, thus the bank will only give 160 but she is

obliged to repay RM200 back, meaning she pays 25% extra

3

.

Form number two:

A more common way banks provide interest loans is by giving an amount of money

and then does not ask for any extra amount except if the borrower accedes certain

duration, and for every delay the so called fine increases. This type is a form of

multiple usury.

4

Form number three:

Another form is when a customer has a certain business with a third party. He gives

the bank the sole responsibility in paying his obligation to them on behalf of him.

Then, when the issue is resolved the bank asks a refund from the customer

exceeding the amount the bank has paid to the foreign company. If the exceeding

amount is for costs regarding the interaction i.e. commissions. it is not considered as

Riba but if the exceeding amount is portion or a percentage of the amount the bank

has paid, this is considered Riba since it is similar to loan of delayed payment

5

this

type of lending is called casual lending.

6

As mentioned before, the above forms are only few ways banks give loans, new ways and

techniques are constantly been developed to reach a wider scope of clients.

3

, Ali Al-Salus,pg 67.

4

Op.cit. pg 159.

5

Op.cit. pg 72,73.

6

The adaptation of banking practice to conform with Islamic law, S.H. Hamoud, pg163.

Riba in Modern Financial Institutions

Chapter 2

Riba and Its Presence in Todays Financial Institutions

P

a

g

e

8

2.1.2 The Types.

7

1. Loan for consumption :

This is the type of loan that is given to people who are in need of the money for survival

i.e. to fulfill day to day expenses such as food, rent, schooling, clothing and such.

2. Loan for production :

This type is the type where the bank gives the loan to corporation and businesses in

order to execute their plans and projects.

2.1.3 The Hukm.

As stated in chapter one, all forms of Riba are Haram. And it is a grave sin that cannot be

forgiven without sincere repentances. But the question arises here, whether the borrower (the

one who is paying the usury), gets any sin or not?. The answer to this question is easily quoted

by one of the prophet companions. He said:

(( ))

((Allahs Massenger SAW cursed the one who accepts ArRiba (the usury) and the one who pays it

8

)).

This is not to say that the borrower is always in sin, because in Fiqhi terms or needs

change the status of Haram to Halal

9

. This is only if the borrower could not find other sources of fund

and that he needs the funding urgently.

As for the types of loan, there are no different opinions regarding the Hukm of loan for consumption. It

is agreed that is Haram. The problem arises in the second type where some Ulamas argue that it is Halal

since there is no zulm and misuse of peoples condition. However the vast majority of Ulamas state the

unlawfulness of both types without differentiation.

10

As general, a fatwa that has been issued by the second conference of the Islamic research assembly

explains the Hukm of most of banking interaction.

The translation of the text is as follows:

Interest on any type of loan is all unlawful usury, whether the loan is for consumption or for

production. The Hukm, which is Haram, is the same whether the interest rate is low or high. Lending

money with interest is unlawful whether it is for a normal or urgent cause. Borrowing money with

interest is also unlawful except if the cause is urgent and it is a necessity

Accounts of delay payment, and other types of loan with interest are all Usury interactions. And it is

prohibited

11

.

7

, Abd. Alfattah idrees, pg67.

8

Riyad-us-Saliheen, Al-Nawawi, part 2. pg1218.

9

, Ali Al-Salus,pg 68

10

Op.cit pg 67, 68.

11

Op, cit 9, 10.

Riba in Modern Financial Institutions

Chapter 2

Riba and Its Presence in Todays Financial Institutions

P

a

g

e

9

2.2 Savings :

Savings are defined as the money kept in an account in a bank or similar financial

organization

12

. Saving money in a bank as a concept is lawful, but what is happening today in

such savings account is far from being Islamic as we will see, herewith.

Islamically and in law terms the word savings is not accurate to its true meaning. Savings

latterly means to save money or keep it with someone i.e. safekeeping. However, since the

bank is then using the money and it is obliged to return the money whether it got profit from

using it or it lost it, it is then considered as a loan from the client to the bank

13

. So whether the

contract between the client and the bank is to open a simple current account or an account

for investment it is still considered as a loan to the bank.

2.2.1 Savings: it forms:

1. Current Account:

It is to save some amount of money in the bank, and the client can refund his money at any

time whether as whole or part without any limits from the bank in the withdrawal or in

duration.

14

This type generally is lawful if it does not include any form of interest. Despite

the fact the interaction is lawful, it is somehow not encouraged since the bank, which is a

Riba-based bank is using it. It is unlawful in terms of helping for munkar.

2. Savings Account:

This type also similar to the previous, it differs only that it has limits in withdrawal. It is also

lawful except if interest is included in the contract. In such accounts i.e. Riba saving

accounts, the client usually receive an amount of money at the end of every month

15

. This is

unlawful, because he is receiving an amount as usury of delay.

2.2.2 The Hukm:

It is haram if it containes interest, refer to section 2.1.3 for a full Fatwa text regarding loans.

2.3 Banking Cards :

In its strive to provide the best services to clients and also lessen the burden on its branches,

banks have developed the use of cards to ease the interaction between the user and the bank.

12

Cambridge Advanced Learners dictionary (software), version 1.0.

13

Op. cit.pg 9.

14

Ibid, pg 49.

15

Ibid, pg 51.

Riba in Modern Financial Institutions

Chapter 2

Riba and Its Presence in Todays Financial Institutions

P

a

g

e

1

0

Such cards have many benefits no doubt. From simple withdrawal from ones account, to

purchasing items using these cards.

2.3.1 The types.

1. Debit cards.

a plastic card that the holder can use to pay for purchases, the money being transferred

directly from the holder's bank account to the seller

16

This is the most common banking

card available, and currently most clients who have an account in a particular bank, will

be issued this type of card.

2. Credit cards.

a card issued by a bank or business that allows somebody to purchase goods and

services and pay for them later, often with interest

17

2.3.2. The Hukm.

According to scholars, debit cards are lawful since it is a mean to retrieve the loan from the

bank. As for credit cards, it is considered unlawful because the existence of interest which as

discussed earlier is Haram.

2.4 Monetary Exchange .

Exchanging money from one form to another has been common practice throughout the

centuries. Today , banks and monetary exchange shops still practice this important act. though,

ulamas has notice some errors in these interaction that transform the operation from Halal to

Haram.

To make it clear, monetary exchange as a principle is lawful because it is considered as a

buying-selling interaction . Allah SWT said in the holy Quran:

)) 3 ymr&u !$# yt79$# tymu (#4t/h9$# ((

Wheres Allah has permitted trade and forbidden Riba (usury)

18

(2:275)

To make exchange operation to be lawful Islamically some requirements must be fulfilled:

1. If the exchange is between the same currency:

16

Microsoft works dictionary. (software)

17

Ibid.

18

The Noble Quran: English translation of the meanings and commentary, King Fahd Complex For Printing of the holy Quran,

(2:275) pg 62

Riba in Modern Financial Institutions

Chapter 2

Riba and Its Presence in Todays Financial Institutions

P

a

g

e

1

1

a. The exchange should be between the same amounts e.g. 100 cents with RM1. Not

more or less in either party. A breach in this requirement is considered as Usury of

increase.

b. The exchange should be hand to hand i.e. on spot. Or the principle of Al-qabd qabl al

tafaruq. Possession before parting. A breach in this requirement is considered

Usury of delayed payments.

2. If the exchange is between different currencies:

Only the principle of possession before parting must be observed. Again, it is

considered as Usury of delayed payment if this condition is not observed.

19

2.4.1 Exchange using current and future rates.

Banks when dealing with exchange currencies, they either use one of these rates,

current currency rates or future rates.

According to the most majority of scholars exchange using the current rate is

permissible with the condition that before they part from each other, they must take

reciprocal possession. As what is meant by possession here, some scholars (such as Al-

Shafie and Al-Laith

20

) argue that it meant hand possession

21

. Others ,such as the

Hanafis, state that possession here is a designation and not necessary meant receiving

by hand.

22

As for the exchange using future expected rate is Haram

23

, the reason is that it that

there is suspicions of involving interest in the transaction.

24

2.5 Insurance .

Insurance is defined as An agreement between a client and a company in which the client pays

to the company regular amounts of money and the company agrees to pay the costs, for example,

if the client died, fell ill or if he/she lost or damaged something .

25

or as The American Heritage

dictionary defines it financial protection against loss or harm: an arrangement by which a

company gives customers financial protection against loss or harm such as theft or illness in

return for payment premium

26

.

In some countries insurance is compulsory to everyone. They have to have a one or more type

of insurance, mainly driving and car insurance.

19

, Abd. Alfattah idrees, pg87.

20

The adaptation of banking practice to conform with Islamic law, S.H. Hamoud, pg177

21

Op. cit, pg 91.

22

Op. cit. pg 176.

23

Op.cit. pg 93.

24

Op. cit. 182.

25

Oxford Advanced learners Dictionary. Pg 775. (with modification)

26

Microsoft works dictionary (software).

Riba in Modern Financial Institutions

Chapter 2

Riba and Its Presence in Todays Financial Institutions

P

a

g

e

1

2

2.6.1. The Types:

Today there many types of insurance to the extent that some companies cover almost all aspects of

peoples life. These types among others are:

1. Car and Driving insurance.

2. Life insurance.

3. Health insurance.

4. Travelling insurance, and

5. Property insurance.

2.6.2. The Hukm:

There are three opinions regarding the permissibility or the un-lawfulness of Insurance. These

different opinions are the result of the relatively modern issue insurance is.

Opinion one:

All types of conventional insurance are Haram. Because it contains types of Riba, gharar, and

gambling. Muhammad Salih Al-Munjid a mufti from the Saudi committee of supreme Ulamas

said: Insurance include both types of Riba. Riba of delay (because of the money lent) and Riba

of increase (because of replacing a superior good with the same good but inferior), It contains

acts of gambling, It containes the element of gharar (uncertainty of the item purchased)

which is Haram in Islam

27

. Other Saudi Ulamas such as the late Shekh Abdul-Aziz bin Baz (Allh

yarham), Abdul-Razaq Afifi, and Abdullah Bin Qaud signed a Fatwa regarding the

unpermissiblity of conventional insurance with the similar reasons above

28

.

Opinion two:

All types of conventional insurance are Haram because it contains the element of gharar, which

is considered as unlawful in Islam. Gharar is a term used to describe purchasing unknown items

or services. In this sense insurance is Haram because the service payment by the insurance

company is unknown at the time of the regular payments the client makes, and also it might be

that the reason for the company to repay will not happen. For example, an accident might not

happen to the client of a vehicle insurance company.

29

Opinion three.

30

This point of view stresses that the argument that insurance has gharar element is a weak

statement. It argues that there is no gharar in the contract since it has strategic and statistic

knowledge in it. Thus it gives the permissibility of insurance if the company fulfills two

requirements:

a. There is no Riba included in the contract.

b. That the insured items are Halal.

27

Fatwa menempuh kehidupan moden, Daud Baharum, pg 330.

28

, Ahmad Al-Dweesh, part 15, pg248,247 and 246.

29

Op. cit. 329,

30

Ibid, pg 320, 330.

Riba in Modern Financial Institutions

Chapter 2

Riba and Its Presence in Todays Financial Institutions

P

a

g

e

1

3

One of the scholars that supported this argument was the late Sheikh Mustafa Al-Zarqa.(Allah

yarham).

2.6 The Solution:

As seen above, the world has become so used to usury that it has become a normal

interaction. The wide spread of usury-friendly financial institutions made it crucial for Muslim

scholars and intellects to develop parallel institutions that are usury-free. Thus the idea of

Islamic Banking. In the next chapter we will discuss about it and its interaction with their

clients.

______________________________________________________________

Chapter 3:

Islamic Banking: A

Solution to Riba

Followed by the topics conclusion

Ahmad Faridi

0715433

Islamic Banking: A solution to Riba

Chapter 3

Riba and Its Presence in Todays Financial Institutions

P

a

g

e

1

4

Introduction and History:

The establishment of institutions that comply with Islamic rules and laws was always a dream that

seemed to some people a mere imposable task. This is because the wide spread of conventional

banks and what it brought with it. The establishment of the IDB (Islamic development bank) and the

International union of Islamic banks was a result of dedication and co-operation between a

numbers of Islamic countries. The establishment of both institutions opened the door to the

relatively rapid growth of Islamic banking and other Islamic financial institutions, today these

institutions has reached the level on which even some non-Muslim countries have opened (such as

Singapore) the door for such institutions to exist on their soils or on their way to implement it (such

as Japan). It is certainly great news that at last Muslims are contributing to the modern civilization

with something that will reshape the financial body of the world. But although the future looks

good for these institutions, many people do not understand how these institutions function and

whether they really comply with the true Islamic rules or it is just merely a change in the cover but

the essence is still un-Islamic. In this chapter Islamic banking interactions will be discussed and a

comparison between them and the conventional ones will be presented.

The Reasons Behind preference of Islamic banks in the modern world.

1

1. The unlawfulness of most of conventional banks interactions.

2. The dissatisfaction of people regarding conventional banks.

3. Peoples understanding that conventional banks are unlawful.

4. The willingness of Muslims to accept institutions that conform to the sharia.

5. The continuous success of Islamic banking in many countries.

6. The awakening of Muslims throughout the world ( ).

7. The support of some Islamic countries governments for these types of banking.

The characteristics and goals of Islamic banks:

The most apparent property and characteristic of Islamic banks is that they are usury free banks

2

,

meaning that they do not depend on interest in their dealings. Other characteristic is that unlike

conventional banks, which gain interest by lending to projects and businesses, it gain profit by

investing. This investment can be in two forms. Firstly, by direct investment in which the bank uses

its capital money to invest in projects and then gets it profit from there. Secondly, by taking over

partial or whole ownership of a business or projects.

Another characteristic of Islamic banks is that they strive to build strong and firm social and

economic ties.

1

The adaptation of banking practice to conform with Islamic law, S.H. Hamoud, pg 5.

2

100 Soal Jawab Bank Islam, Ahmad Al-Nagar, Mohd. Ibrahim, Mohd. Al-Ansari, pg 30,31,32 and 33.

Islamic Banking: A solution to Riba

Chapter 3

Riba and Its Presence in Todays Financial Institutions

P

a

g

e

1

5

As for its goals, These banks like other type of business set profit as a main goal, but other goals

that can be sought such as that these banks set observing the rules set by Allah Almighty ,proving

that Islam is a comprehensive way of life , mutual profit with the community, freeing it from usury-

based banks.

Types of banks falling under Islaimc banking category.

1. Islamic banks that are originally establish as such banks.

E.g. Bank Islam Malaysia sdn bhd and Bank Muamalat Mlaysia bhd in Malaysia. PT Bank

Muamalat in Indonesia. Bank Al Rajihi and Bank Al Bilad in Saudi Arabia.

2. Islamic banks that split from its mother bank.

E.g. PT Bank Syariah Mandiri in Indonesia which is a separate bank operating under the main

bank PT Bank Mandiri.

3. Conventional banks that provide Islamic banking corners.

4. And Islamic banks converted from conventional one.

Services Islamic banks provide.

Islamic banks provide similar services as other banks; the main difference is that Islamic banks

observe Islamic teachings in its interactions. These services among others:

1. Savings and current account.

3

2. Investments.

3. The good Loan .

4. Zakat or alms.

5. Exchange and others.

Islamic Banking Oporations and Interactions.

i) Loans in Islamic Banks

4

.

In a true Islamic interaction, banks are not supposed to take any interests meaning that

the bank should not add any extra amount to the value returned, however the bank is allowed to

charge a fixed service cost " commissions", and it is allowed to take guarantees () from the

client.

It might be argued that how will the bank profit from lending service if it does not take interest, the

answer arises that the profit comes from the fixed service cost and the prosperity of the

community. Since the good wellbeing of the community that the bank works in means the good

well being of the bank itself.

3

Ibid, pg 29.

4

Ibid, pg 34

Islamic Banking: A solution to Riba

Chapter 3

Riba and Its Presence in Todays Financial Institutions

P

a

g

e

1

6

ii) Savings.

5

Unlike conventional banks, Islamic banks do not give interest to the client. But it can give privileges

to the client. These privileges must be revised and set in a way that does not make it similar to

paying interest.

iii) Middle Man:

6

Islamic banks can be used as middle man, such that it receives payments on behalf of its client from

a third party. Also it can charge commissions from the client.

iv) Exchange:

Islamic banks must observe the Islamic rulings regarding exchanging money and also since

exchanging using future price has usury in it Islamic banks should restrain from that.

v) Interactions with other banks:

7

Islamic banks should minimize, since eliminating is almost impossible, its contact with usury-based

banks in order to purify its money as much as possible.

With the great competition between both Islamic and conventional banks, Islamic banks must prove

its compatibility to be used in todays hustle and bustling world. With this, discussion of the topic

has finished. A conclusion will be presented next.

____________________

5

Ibid, pg 36.

6

Ibid pg 37.

7

Ibid pg 71.

Conclusion

Riba and its Presence in Todays Financial Institutions

P

a

g

e

1

7

Riba existed in the past and present and most probably will exist in the future, the near future

at least. So it is plausible to say that this paper was worth the work and hopefully receive the

satisfaction it deserves. But before I wrap it up there are some points I have concluded that I

would like to stress regarding the topic of this mini-research.

1. Riba, usury, interest or whatever it is called or in which form it is, are strictly prohibited

in Islam and no point of time, whether present or future, nor will space change its

status.

2. Riba has evolved from a simple intercourse between simple lender and borrower to an

intercourse in which whole countries and organization are involved, thus it needs to be

studied and researched in order to understand its big picture.

3. Opening the door to usury is like opening the Pandora box, since it brings a lot of burden

and misery on an individual, organizations, families and countries as can be seen today.

4. When encountering issues with different opinions from the scholars it is always a good

practice to choose the vast majority opinion.

5. The Islamic ruling that says usury is unlawful and gives a harsh punishment in the

hereafter proves that Islam is a religion that is sent to purify intercourses between

people.

6. A huge task is must be put upon religious personnel and bodies in order to convey to the

public the dangers of interaction with riba- based banks, and also to help the authorities

to purify Islamic banks interactions as far as possible.

7. A Muslim must understand his interactions and he need to be aware of his dealings. This

knowledge is obligatory i.e. Fardu Ain. Since it is directly influencing his/her life.

8. A Muslim must be aware from which corner his rizq come from, Halal or Haram.

9. Muslims have a moral responsibility to convey Islams view about usury, and to convey

its alternative to the western or to the non-Muslim world in general.

10. Muslims should before engaging into a new dealing that is new to Islam, ask those who

are knowledgeable, since Alhamdulillah, we have been blessed with numerous of

Ulamas, Shekhs, and intellects who fear Allah SWT.

11. Educational institutes such as universities, schools and training centers should stress on

riba and its uses in todays world and provide sufficient resources in its libraries and

resource corners, as I have encountered some problems regarding acquiring the newest

resources from our respected university, this problem applies also resources regarding

other contemporary fiqhi issues.

Conclusion

Riba and its Presence in Todays Financial Institutions

P

a

g

e

1

8

12. Islamic banking as a concept is a positive indication that Muslims are capable in

developing and transforming non-Islamic interactions or dealings to a more Sharia

friendly intercourse.

13. Islamic banking has achieved an outstanding success in theoretical context but

practically it is something harder to achieve without co-operation between institutions,

government bodies, individuals and religious establishments and leaders.

14. The success in solving the dilemma of riba will give hope in solving problems modern life

has arose.

With this I pray to Allah SWT, and thank Him for giving me the strength to complete this

paper and ask his forgiveness for any mishap or short coming.

Wallahu Alam

Wasallalahu Ala Syyidina Muhammad Wa AlaAlihi Wa Sahbihi Wa Sallam.

_______________________________________________________________________________

TAMAT

Riba and Its Presence in Todays financial Institutions

References

P

a

g

e

1

8

Bibliography/ References:

Arabic References:

1. Abdul Fattah Mahmoud Idrees, , 1

st

edition,1420H-2000.

2. Al-Zuhaili, Wahbah. : , 1

st

edition, 1423H-2002. .

3. Shekh Ahmad bin Abdul Razzaq Al-Duwaish, " ; 1424H,

.

4. Al-Salus, Dr. Ali Ahmad; ,1

st

edition, 1403H-1983,

.

5. , ministry of Education, Saudi Arabia.

6. Balabaki, Munir & Balabaki, Roohi; ;11

th

edition,2007, .

English Reference:

1. The Noble Quran: English Translation of the meanings and Commentary,1417H. King Fahd

Complex For The Printing of The Holy Quran.

2. Hamoud,S.H, Islamic Banking The Adaptation of banking Practice to Conform With Islamic

Law, 1985, Arabian information, London.

3. Hornby, A S, Oxford Advanced Learners Dictionary, 7

th

edition,2006, Oxford University Press.

4. Abu Zakariya yahya bin Sharaf An-Nawawi Al-Dimashqi, Riyad-us-Saliheen, 1

st

edition, 1418H,

Darussalam Publishers.

Bahasa Melayu References:

1. El-Nager, Ahmad Abdel Aziz; Ibrahim, Mohamed Samir; Al-Ansari, Mahmud Moman, 100 Soal

Jawab Bank Islam ,1

st

edition, 1984, Persatuan Ulama Malaysia.

2. Baharum, Daud ; Fatwa menempuh kehidupan moden;1

st

edition, 2006, Daud Baharum &

Islam Online.net.

Websites:

1. www.wikipedia.com

Other References:

1. Microsoft Works Dictionary. Microsoft Inc.

2. Cambridge Advanced Learners dictionary, version 1.0, Cambridge University Press.

Das könnte Ihnen auch gefallen

- Kuper ManualDokument335 SeitenKuper Manualdonkey slap100% (1)

- Technical Engineering PEEDokument3 SeitenTechnical Engineering PEEMariano Acosta Landicho Jr.Noch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Interest Free Banking in Islam by Ayatullah Baqir Al Sadar in EnglishDokument257 SeitenInterest Free Banking in Islam by Ayatullah Baqir Al Sadar in EnglishSyed Nalain AbbasNoch keine Bewertungen

- Drilling ProcessDokument15 SeitenDrilling ProcessAl Fredo95% (21)

- SyllabusDokument9 SeitenSyllabusrr_rroyal550Noch keine Bewertungen

- Session OneDokument90 SeitenSession OneMustafe MohamedNoch keine Bewertungen

- Interest in Islam and Modern Islamic BankingDokument23 SeitenInterest in Islam and Modern Islamic Bankingnaveed009Noch keine Bewertungen

- Article PDFHQMD 1Dokument8 SeitenArticle PDFHQMD 1Abdullafaroog IbrahimNoch keine Bewertungen

- Fin AllDokument11 SeitenFin AllCool AdiNoch keine Bewertungen

- Riba and Islamic BankingDokument33 SeitenRiba and Islamic BankingIbnrafique100% (3)

- Consider A Simple Loan ExampleDokument2 SeitenConsider A Simple Loan Examplegeena1980Noch keine Bewertungen

- Islamic Banking Law - Luthfan Abel AlghifaryDokument5 SeitenIslamic Banking Law - Luthfan Abel AlghifaryAlghifxryNoch keine Bewertungen

- Qur'an, Hadith and Riba Connotation: December 2012Dokument41 SeitenQur'an, Hadith and Riba Connotation: December 2012Muhammad BasitNoch keine Bewertungen

- Retail BankingDokument46 SeitenRetail BankingNeelanjan MitraNoch keine Bewertungen

- This Content Downloaded From 111.68.96.41 On Mon, 11 Oct 2021 06:33:03 UTCDokument11 SeitenThis Content Downloaded From 111.68.96.41 On Mon, 11 Oct 2021 06:33:03 UTCMuhammad HassanNoch keine Bewertungen

- Riba and A General Theory of InterestDokument13 SeitenRiba and A General Theory of InterestShamsi_adnanNoch keine Bewertungen

- Islamic Banking Refers To A System Of: Citation NeededDokument49 SeitenIslamic Banking Refers To A System Of: Citation Neededzeeshan_akberNoch keine Bewertungen

- Qard HasanDokument35 SeitenQard HasanShafiq12340% (1)

- Trust Islamic Banking Theory & PracticeDokument35 SeitenTrust Islamic Banking Theory & PracticeSonnet BhowmikNoch keine Bewertungen

- ABBAS Abdullahi J Islamic BankingDokument18 SeitenABBAS Abdullahi J Islamic Bankingabbasabdullahi1002Noch keine Bewertungen

- Riba and Islamic BankingDokument34 SeitenRiba and Islamic BankingMr Charles GreenNoch keine Bewertungen

- The Nature of Riba in IslamDokument17 SeitenThe Nature of Riba in IslamsatriasanNoch keine Bewertungen

- Problems and Challenges Facing The Islamic Banking System in The West: The Case of The UKDokument23 SeitenProblems and Challenges Facing The Islamic Banking System in The West: The Case of The UKZunaira AzharNoch keine Bewertungen

- Riba Complexity: Riba Revisited, #3Von EverandRiba Complexity: Riba Revisited, #3Bewertung: 5 von 5 Sternen5/5 (1)

- Islamic Banking WikiDokument15 SeitenIslamic Banking WikiNaffay HussainNoch keine Bewertungen

- LJMS Vol1 2007 29-404Dokument12 SeitenLJMS Vol1 2007 29-404akmalNoch keine Bewertungen

- Meezan Bank - Report 1Dokument166 SeitenMeezan Bank - Report 1Saadat Ullah KhanNoch keine Bewertungen

- G Bse Global Proceeding 2015Dokument569 SeitenG Bse Global Proceeding 2015gznkgp4bnfNoch keine Bewertungen

- Assignment On Introduction To Banking: Course: Theory and Practices of Banking (1203)Dokument24 SeitenAssignment On Introduction To Banking: Course: Theory and Practices of Banking (1203)Mrinal Kanti DasNoch keine Bewertungen

- Qard Hasan, Wadiah-Amanah and Bank DepositsDokument24 SeitenQard Hasan, Wadiah-Amanah and Bank Deposits_*_+~~>Noch keine Bewertungen

- New Mithaq Eng Tcm10-8830Dokument10 SeitenNew Mithaq Eng Tcm10-8830waniasimNoch keine Bewertungen

- 04article CurrencyTradingInModern PDFDokument35 Seiten04article CurrencyTradingInModern PDFA. A HabibNoch keine Bewertungen

- Jurnal Ekonomi Dan Perbankan Syariah Vol. 5. No.1, April, 2017: 5-18, ISSN (Cet) : 2355-1755 - ISSN (Online) : 2579-6437Dokument16 SeitenJurnal Ekonomi Dan Perbankan Syariah Vol. 5. No.1, April, 2017: 5-18, ISSN (Cet) : 2355-1755 - ISSN (Online) : 2579-6437Bayu DANoch keine Bewertungen

- Reform in Finance Riba vs. Interest in TDokument18 SeitenReform in Finance Riba vs. Interest in TMr. Mozahid SikderNoch keine Bewertungen

- Islamic SecuritizationDokument119 SeitenIslamic SecuritizationNorzalikha Zakaria100% (1)

- Riba-Interest Equation and IslamDokument42 SeitenRiba-Interest Equation and Islamabdul razak omarNoch keine Bewertungen

- AlMurshid Islamic Booklet 4theng Tcm10-8837Dokument12 SeitenAlMurshid Islamic Booklet 4theng Tcm10-8837Mrudula GummuluriNoch keine Bewertungen

- SSRN Id1790222Dokument48 SeitenSSRN Id1790222EASNNoch keine Bewertungen

- CH 03Dokument28 SeitenCH 03AbdullahNoch keine Bewertungen

- The Real Tawarruq Concept The Product of Islamic Bank For Liquidity Risk ManagementDokument13 SeitenThe Real Tawarruq Concept The Product of Islamic Bank For Liquidity Risk ManagementZulqarnain HaiderNoch keine Bewertungen

- (Angelo M. Venardos) Islamic Banking and FinanceDokument259 Seiten(Angelo M. Venardos) Islamic Banking and Financem_sekerNoch keine Bewertungen

- Anger Is The Feeling That Makes Your Mouth Work Faster Than Your MindDokument19 SeitenAnger Is The Feeling That Makes Your Mouth Work Faster Than Your MindFatima FarnazNoch keine Bewertungen

- Islamic Finance FoundationDokument22 SeitenIslamic Finance Foundationapi-3734464Noch keine Bewertungen

- Umer Ibrahim VaddiloDokument32 SeitenUmer Ibrahim VaddiloMuzzamil85100% (1)

- Islamic Banking in Pakistan: A Critical Review: 1. History of Modern BankingDokument16 SeitenIslamic Banking in Pakistan: A Critical Review: 1. History of Modern BankingshizaNoch keine Bewertungen

- 10 2307@27650555 PDFDokument12 Seiten10 2307@27650555 PDFSaveeza Kabsha AbbasiNoch keine Bewertungen

- Islamic Banking: NAUSHAD Sultan Talukdar Aslam ParvezDokument24 SeitenIslamic Banking: NAUSHAD Sultan Talukdar Aslam ParvezmudeyeducationNoch keine Bewertungen

- AlMurshid Islamic Booklet 4thengDokument12 SeitenAlMurshid Islamic Booklet 4thengJusticeman AminNoch keine Bewertungen

- MIFTAHUDIN - Resume BANK, RENTE DAN FEEDokument6 SeitenMIFTAHUDIN - Resume BANK, RENTE DAN FEEMIFTAH SMKN100% (1)

- Dispute Resolution in Islamic Banking and Finance: Current Trends and Future PerspectivesDokument25 SeitenDispute Resolution in Islamic Banking and Finance: Current Trends and Future PerspectivesSidra MeenaiNoch keine Bewertungen

- Hakikat Keharaman Riba Dalam Islam: AbstractDokument12 SeitenHakikat Keharaman Riba Dalam Islam: AbstractMT30623 Nurul Izzati Binti Mohd ZaibNoch keine Bewertungen

- RibaDokument10 SeitenRibaRamadhan FumoNoch keine Bewertungen

- Islamic Economics, Definition, Objectives, Goals, Principles of Isl. Eco., Reference From Quran, Characteristics of IslDokument25 SeitenIslamic Economics, Definition, Objectives, Goals, Principles of Isl. Eco., Reference From Quran, Characteristics of IslMD. ANWAR UL HAQUE0% (1)

- Riba (Interest) and Gharar (Excessive Uncertainty)Dokument21 SeitenRiba (Interest) and Gharar (Excessive Uncertainty)Abid Hassan100% (2)

- Introduction To: Islamic BankingDokument28 SeitenIntroduction To: Islamic BankingAbdul Karim JangdaNoch keine Bewertungen

- Reform in Finance: Riba vs. Interest in The Modern Economy by Abdur RabDokument18 SeitenReform in Finance: Riba vs. Interest in The Modern Economy by Abdur RabBost BostonNoch keine Bewertungen

- Riba and Islamic Banking and FinanceDokument23 SeitenRiba and Islamic Banking and FinanceKhalids MusaNoch keine Bewertungen

- D F W P S: Epartment of Inance Orking Aper EriesDokument49 SeitenD F W P S: Epartment of Inance Orking Aper Erieshafis82Noch keine Bewertungen

- Professor Umar Ibrahim VadilloDokument32 SeitenProfessor Umar Ibrahim VadilloAther Sajjad100% (1)

- Unit 9Dokument43 SeitenUnit 9ahmed sunoosyNoch keine Bewertungen

- Theory of Riba (Differences Between Conventional Personal Financing and Islamic Personal Financing)Dokument20 SeitenTheory of Riba (Differences Between Conventional Personal Financing and Islamic Personal Financing)millimilNoch keine Bewertungen

- Islamic Banking and Interest: A Study of Prohibition of Interest and Its Contemporary InterpretationDokument4 SeitenIslamic Banking and Interest: A Study of Prohibition of Interest and Its Contemporary InterpretationArshad BashirNoch keine Bewertungen

- Lecture 2 Sources of Shariah, Riba, BanksDokument28 SeitenLecture 2 Sources of Shariah, Riba, Banksarslan shahNoch keine Bewertungen

- ECON 1550, Introduction To Economics END-OF-SEMESTER EXAMINATION SEMESTER II, 2004/2005 SESSIONDokument12 SeitenECON 1550, Introduction To Economics END-OF-SEMESTER EXAMINATION SEMESTER II, 2004/2005 SESSIONAl FredoNoch keine Bewertungen

- KAUST Graduate ProgramsDokument18 SeitenKAUST Graduate ProgramsAl FredoNoch keine Bewertungen

- UNGS 2030, The Islamic Worldview, Standard ContentDokument48 SeitenUNGS 2030, The Islamic Worldview, Standard ContentAl Fredo100% (1)

- UNGS 2040, Islam, Knowledge and Civilization, Final Exam, SEMESTER III, 2005/2006Dokument2 SeitenUNGS 2040, Islam, Knowledge and Civilization, Final Exam, SEMESTER III, 2005/2006Al FredoNoch keine Bewertungen

- UNGS 2030, The Islamic Worldview Final Exam Semester 3, 2005Dokument3 SeitenUNGS 2030, The Islamic Worldview Final Exam Semester 3, 2005Al FredoNoch keine Bewertungen

- UNGS 2030, The Islamic Worldview, Final Exam 2006/2007 Semester 1Dokument3 SeitenUNGS 2030, The Islamic Worldview, Final Exam 2006/2007 Semester 1Al FredoNoch keine Bewertungen

- Lect01: History of Human Computer InteractionDokument26 SeitenLect01: History of Human Computer InteractionAl FredoNoch keine Bewertungen

- ECON 1550 Introduction To EconomicsEND-OF-SEMESTER EXAMINATION SEMESTER II, 2005/2006 SESSIONDokument17 SeitenECON 1550 Introduction To EconomicsEND-OF-SEMESTER EXAMINATION SEMESTER II, 2005/2006 SESSIONAl Fredo100% (1)

- ECON 1550, Introduction To Economics END-OF-SEMESTER EXAMINATION SEMESTER II, 2004/2005 SESSIONDokument12 SeitenECON 1550, Introduction To Economics END-OF-SEMESTER EXAMINATION SEMESTER II, 2004/2005 SESSIONAl FredoNoch keine Bewertungen

- ECE 1311 Electric Circuits Assignment and SolutionDokument2 SeitenECE 1311 Electric Circuits Assignment and SolutionAl FredoNoch keine Bewertungen

- ECE 1311 Electric Circuits Quiz and SolutionDokument2 SeitenECE 1311 Electric Circuits Quiz and SolutionAl FredoNoch keine Bewertungen

- ECON 1550 Introduction To Economics END-OF-SEMESTER EXAMINATION SEMESTER III, 2004/2005 SESSIONDokument16 SeitenECON 1550 Introduction To Economics END-OF-SEMESTER EXAMINATION SEMESTER III, 2004/2005 SESSIONAl FredoNoch keine Bewertungen

- IT GuideDokument11 SeitenIT GuideApiz Atau AhcaiNoch keine Bewertungen

- MillingDokument10 SeitenMillingAl Fredo100% (8)

- MSC Malaysia Open Source Conference 2010 MOSC2010 Mini Programme BookDokument5 SeitenMSC Malaysia Open Source Conference 2010 MOSC2010 Mini Programme BookLinuxMalaysia MalaysiaNoch keine Bewertungen

- Accelerometer App NoteDokument6 SeitenAccelerometer App NoteAl FredoNoch keine Bewertungen

- Study Flow Bachelor of Computer Science, IiumDokument2 SeitenStudy Flow Bachelor of Computer Science, IiumAl FredoNoch keine Bewertungen

- Elements of An Array Converted To Absolute Values by Using RecursionDokument2 SeitenElements of An Array Converted To Absolute Values by Using RecursionAl FredoNoch keine Bewertungen

- Blackberry Java Development Environment Accelerometer Sample App OverviewDokument13 SeitenBlackberry Java Development Environment Accelerometer Sample App OverviewAl FredoNoch keine Bewertungen

- Metal FormingDokument7 SeitenMetal FormingAl Fredo100% (3)

- ECE 1113, Final Exam Sem 1 05/06Dokument8 SeitenECE 1113, Final Exam Sem 1 05/06Al Fredo100% (2)

- Iium Wireless Configuration (Win Vista & Win 7)Dokument15 SeitenIium Wireless Configuration (Win Vista & Win 7)Al FredoNoch keine Bewertungen

- A&R Undergraduate Handbook, IIUMDokument46 SeitenA&R Undergraduate Handbook, IIUMAl Fredo100% (2)

- UNGS 2050 Slides (Ethics and Fiqh of Everyday Life)Dokument371 SeitenUNGS 2050 Slides (Ethics and Fiqh of Everyday Life)Al Fredo100% (1)

- UNGS 2030, The Islamic Worldview Final Exam Semester 3, 2005Dokument3 SeitenUNGS 2030, The Islamic Worldview Final Exam Semester 3, 2005Al FredoNoch keine Bewertungen

- Aerospace and Biotechnology EngineeringDokument46 SeitenAerospace and Biotechnology EngineeringAl Fredo100% (3)

- Structure of (BIT) at IIUMDokument7 SeitenStructure of (BIT) at IIUMAl FredoNoch keine Bewertungen

- Change Language DynamicallyDokument3 SeitenChange Language DynamicallySinan YıldızNoch keine Bewertungen

- Invoice Acs # 18 TDH Dan Rof - Maret - 2021Dokument101 SeitenInvoice Acs # 18 TDH Dan Rof - Maret - 2021Rafi RaziqNoch keine Bewertungen

- 01 Eh307 Crimpro Case Digests Part 1Dokument214 Seiten01 Eh307 Crimpro Case Digests Part 1Kimberly PerezNoch keine Bewertungen

- Chap 06 Ans Part 2Dokument18 SeitenChap 06 Ans Part 2Janelle Joyce MuhiNoch keine Bewertungen

- COVID Immunization Record Correction RequestDokument2 SeitenCOVID Immunization Record Correction RequestNBC 10 WJARNoch keine Bewertungen

- Central Banking and Monetary PolicyDokument13 SeitenCentral Banking and Monetary PolicyLuisaNoch keine Bewertungen

- Payment Plan 3-C-3Dokument2 SeitenPayment Plan 3-C-3Zeeshan RasoolNoch keine Bewertungen

- Perhitungan Manual Metode Correlated Naïve Bayes Classifier: December 2020Dokument6 SeitenPerhitungan Manual Metode Correlated Naïve Bayes Classifier: December 2020andreas evanNoch keine Bewertungen

- Chapter 11 Walter Nicholson Microcenomic TheoryDokument15 SeitenChapter 11 Walter Nicholson Microcenomic TheoryUmair QaziNoch keine Bewertungen

- Mayor Breanna Lungo-Koehn StatementDokument2 SeitenMayor Breanna Lungo-Koehn StatementNell CoakleyNoch keine Bewertungen

- h6811 Datadomain DsDokument5 Seitenh6811 Datadomain DsChristian EstebanNoch keine Bewertungen

- Is 10719 (Iso 1302) - 1Dokument1 SeiteIs 10719 (Iso 1302) - 1Svapnesh ParikhNoch keine Bewertungen

- Auto Report LogDokument3 SeitenAuto Report LogDaniel LermaNoch keine Bewertungen

- Business Occupancy ChecklistDokument5 SeitenBusiness Occupancy ChecklistRozel Laigo ReyesNoch keine Bewertungen

- ODF-2 - Learning MaterialDokument24 SeitenODF-2 - Learning MateriallevychafsNoch keine Bewertungen

- Chapter 1.4Dokument11 SeitenChapter 1.4Gie AndalNoch keine Bewertungen

- Rules On Evidence PDFDokument35 SeitenRules On Evidence PDFEuodia HodeshNoch keine Bewertungen

- Toshiba Satellite L200 M200 M203 M206 KBTIDokument59 SeitenToshiba Satellite L200 M200 M203 M206 KBTIYakub LismaNoch keine Bewertungen

- National Senior Certificate: Grade 12Dokument13 SeitenNational Senior Certificate: Grade 12Marco Carminé SpidalieriNoch keine Bewertungen

- Sem 4 - Minor 2Dokument6 SeitenSem 4 - Minor 2Shashank Mani TripathiNoch keine Bewertungen

- EMI-EMC - SHORT Q and ADokument5 SeitenEMI-EMC - SHORT Q and AVENKAT PATILNoch keine Bewertungen

- AdvertisingDokument2 SeitenAdvertisingJelena ŽužaNoch keine Bewertungen

- Incoterms 2010 PresentationDokument47 SeitenIncoterms 2010 PresentationBiswajit DuttaNoch keine Bewertungen

- 1 Ton Per Hour Electrode Production LineDokument7 Seiten1 Ton Per Hour Electrode Production LineMohamed AdelNoch keine Bewertungen

- Type BOQ For Construction of 4 Units Toilet Drawing No.04Dokument6 SeitenType BOQ For Construction of 4 Units Toilet Drawing No.04Yashika Bhathiya JayasingheNoch keine Bewertungen

- Resources and Courses: Moocs (Massive Open Online Courses)Dokument8 SeitenResources and Courses: Moocs (Massive Open Online Courses)Jump SkillNoch keine Bewertungen

- Stainless Steel 1.4404 316lDokument3 SeitenStainless Steel 1.4404 316lDilipSinghNoch keine Bewertungen