Beruflich Dokumente

Kultur Dokumente

Export Bill Discounting

Hochgeladen von

Kanaiya DarjiOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Export Bill Discounting

Hochgeladen von

Kanaiya DarjiCopyright:

Verfügbare Formate

Export Bill Discounting

Introduction Export bill discounting means that Bank of China buys from the exporter the undue time draft accepted by banks or the undue debt claim honored by banks under the export L/C, or the undue debt claim guaranteed by banks under the documentary collection. If the issuing bank fails to pay at maturity, Bank of China has the right of recourse. Functions The product aims to meet the short-term financing requirement of exporters under the usance L/C. Features 1. Acceleration of capital turnover. Get the fund immediately, so that capital turnover can be accelerated and financial pressure can be eased. 2. Simplification of financing procedures. Financing procedures are more convenient when compared with those for working capital loans. 3. Less financial expenses. The customer can choose the funding currency in accordance with the interest rates of different currencies in Bank of China, so as to minimize the financial expenses. Target Customers 1. Exporters have limited working capital, they have to develop business through rapid capital turnover; 2. Exporters encounter temporary difficulty in capital turnover between receipt of acceptance/confirmation/guarantee of payment from foreign banks and collection; 3. Exporters discover investment opportunities between receipt of acceptance/confirmation/guarantee of payment from foreign banks and collection, and the yield is higher than the discount rate. Application Qualifications

I. Basic qualifications 1. The business license of enterprises legally approved, registered and annually checked and other valid certifications sufficient to prove the legitimacy and scope of its operation; 2. Loan cards; 3. The account opening permit and a settlement account with Bank of China; 4. The qualification of import and export operation. II. The customer has the undue draft accepted by banks or the undue debt claim honored by banks, or undue debt claim guaranteed by banks under the documentary collection. III. Taking up the credit line of the issuing banks. Process

1. Exporters sign the financing agreement with Bank of China, and submit the export documents to Bank of China. 2. After approving the documents, Bank of China mails them to the foreign bank (the issuing bank or a designated bank) for reimbursement. 3. Upon receipt of the documents, the foreign bank will give the instruction of acceptance. 4. Upon receipt of acceptance order, the customers should submit business application to Bank of China, and Bank of China effects the payment to the exporter. 5. Foreign bank effects payment at maturity, which Bank of China will use it to cover the discount payment. Kind Reminder 1. Exporters should agree with the importer to take the usance L/C as the settlement instrument in the contract;

2. You should submit the application to Bank of China after the issuing bank accepted usance draft or issued acceptance notice; 3. After the usance draft accepted by issuing bank, you might as well choose export bill discounting while encountering the temporary difficulty of capital turnover and having demand for short-term capital financing. After the usance draft accepted by issuing bank, you might as well choose export bill discounting while discovering new investment opportunities and the expected yield is higher than the discount rate; 4. Bank of China generally will not provide bill discounting for investment purpose which has no real trade background.

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Quiz - 1Dokument3 SeitenQuiz - 1Faiz MokhtarNoch keine Bewertungen

- Licensing ProposalDokument6 SeitenLicensing ProposalKungfu SpartaNoch keine Bewertungen

- Stacey Burke Trading - YouTubeDokument1 SeiteStacey Burke Trading - YouTubeddhx9vhqhkNoch keine Bewertungen

- Metadesign Draft PresentationDokument12 SeitenMetadesign Draft Presentationapi-242436520100% (1)

- Required Documents For Properitory FirmDokument3 SeitenRequired Documents For Properitory FirmKanaiya DarjiNoch keine Bewertungen

- Book 1Dokument2 SeitenBook 1Kanaiya DarjiNoch keine Bewertungen

- Total Derivatives Indiceis and SecuritiesDokument6 SeitenTotal Derivatives Indiceis and SecuritiesKanaiya DarjiNoch keine Bewertungen

- Total Derivatives Indiceis and SecuritiesDokument6 SeitenTotal Derivatives Indiceis and SecuritiesKanaiya DarjiNoch keine Bewertungen

- Doubt Query Solution: You Can Also Use The Historical Data in The Sheet Named "Fututres"Dokument91 SeitenDoubt Query Solution: You Can Also Use The Historical Data in The Sheet Named "Fututres"Kanaiya DarjiNoch keine Bewertungen

- Competitive Advantage in Mature Industries: OutlineDokument9 SeitenCompetitive Advantage in Mature Industries: OutlineRohanNoch keine Bewertungen

- Expertise in trade finance sales and distributionDokument4 SeitenExpertise in trade finance sales and distributionGabriella Njoto WidjajaNoch keine Bewertungen

- Financial Consultant Excel SkillsDokument1 SeiteFinancial Consultant Excel SkillsOlgaNoch keine Bewertungen

- MIS - Systems Planning - CompleteDokument89 SeitenMIS - Systems Planning - CompleteDr Rushen SinghNoch keine Bewertungen

- TVSM 2004 2005 1ST InterimDokument232 SeitenTVSM 2004 2005 1ST InterimMITCONNoch keine Bewertungen

- Finance TestDokument3 SeitenFinance TestMandeep SinghNoch keine Bewertungen

- Mem 720 - QBDokument10 SeitenMem 720 - QBJSW ENERGYNoch keine Bewertungen

- MphasisDokument2 SeitenMphasisMohamed IbrahimNoch keine Bewertungen

- Get Surrounded With Bright Minds: Entourage © 2011Dokument40 SeitenGet Surrounded With Bright Minds: Entourage © 2011Samantha HettiarachchiNoch keine Bewertungen

- Review of Financial Statements PDFDokument13 SeitenReview of Financial Statements PDFMartin EgozcueNoch keine Bewertungen

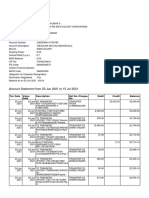

- Account Statement From 23 Jun 2021 To 15 Jul 2021Dokument8 SeitenAccount Statement From 23 Jun 2021 To 15 Jul 2021R S enterpriseNoch keine Bewertungen

- HESCO Quality Plan for TDC Flap Gate Valves and Stoplogs ProjectDokument50 SeitenHESCO Quality Plan for TDC Flap Gate Valves and Stoplogs ProjectAyman AlkwaifiNoch keine Bewertungen

- Contact Sushant Kumar Add Sushant Kumar To Your NetworkDokument2 SeitenContact Sushant Kumar Add Sushant Kumar To Your NetworkJaspreet Singh SahaniNoch keine Bewertungen

- Stars 1.06Dokument22 SeitenStars 1.06ratiitNoch keine Bewertungen

- Filipino Terminologies For Accountancy ADokument27 SeitenFilipino Terminologies For Accountancy ABy SommerholderNoch keine Bewertungen

- Special Offers to Colombo from London on SriLankan AirlinesDokument32 SeitenSpecial Offers to Colombo from London on SriLankan AirlinesSri Sakthi SumananNoch keine Bewertungen

- Session 5Dokument2 SeitenSession 5Angelia SimbolonNoch keine Bewertungen

- TD Bio-Flex F 1100 enDokument1 SeiteTD Bio-Flex F 1100 enKaren VeraNoch keine Bewertungen

- Money ClaimDokument1 SeiteMoney Claimalexander ongkiatcoNoch keine Bewertungen

- Appendix - Structural Vetting ProjectsDokument37 SeitenAppendix - Structural Vetting Projectsqsultan100% (1)

- Lecture 4Dokument27 SeitenLecture 4aqukinnouoNoch keine Bewertungen

- Group 2Dokument54 SeitenGroup 2Vikas Sharma100% (2)

- GodrejDokument4 SeitenGodrejdeepaksikriNoch keine Bewertungen

- HR ManagementDokument7 SeitenHR ManagementAravind 9901366442 - 9902787224Noch keine Bewertungen

- Customer Profitability in A Manufacturing Firm Bizzan ManufactuDokument2 SeitenCustomer Profitability in A Manufacturing Firm Bizzan Manufactutrilocksp SinghNoch keine Bewertungen

- Surbhi Lohia - Vikash Kandoi - : Page - 1Dokument23 SeitenSurbhi Lohia - Vikash Kandoi - : Page - 1Neetesh DohareNoch keine Bewertungen