Beruflich Dokumente

Kultur Dokumente

Jerusalem Institute For Market Studies: Bank Customers Finance High Bank Salaries

Hochgeladen von

krnharelOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Jerusalem Institute For Market Studies: Bank Customers Finance High Bank Salaries

Hochgeladen von

krnharelCopyright:

Verfügbare Formate

Jerusalem Institute for Market Studies: Bank Customers Finance High Bank Salaries NIS 27 Billion in Operating Expenses

Passed to Consumers JIMS: Internet Banking in Israel = Account Holders Save NIS 411 M/year Bank Leumi earned NIS 3.7 billion in banking fees in 2011, with approximately 1.5 million customers. At the same time, internet bank ING Direct, with ten times as many customers (16.7 million) spread over many countries, turned a good profit while demanding only one-quarter of that amount in bank fees. JIMS compared the Israeli banking system with different internet banks around the world and in a position paper issued June 4, 2012, concluded that Israeli consumers would be well served if local regulators would allow internet banking in Israel. Currently, Israeli regulators have put up obstacles to internet banking that include a requirement that all accounts be opened in person by the customer in a bank branch; a prohibition on credit scoring agencies to report on consumers credit history; a refusal to recognize the postal bank as a bank for the purposes of transferring funds from an existing bank account to some new accounts; and limiting the amounts of certain banking transfers on the internet to NIS 6,000 or NIS 50,000 per month. The five major banks of Israel had total operating expenses of NIS 27.1 billion in 2011, three times as much as ING Direct spent despite its operations in many countries. ING had expenses equaling NIS 9.6 billion, while Bank Leumi alone incurred expenses almost that high: NIS 8.3 billion. Lital Faragi, author of the JIMS paper, explained that the high expenses of Israeli banks stem mostly from salaries and building upkeep and as they eat into potential profits, they are passed onto consumers who pay higher fees. In a world in which so many operations are executed with a click via the Internet, or at the most with a call to a banks telephone center, while visiting a branch involves long lines and limited hours, we ask why Israeli consumers have been left behind those of other countries.

Ninety percent of Israeli banks income from banking fees on personal accounts is based on fees for the use of ATM machines such as cashing checks, depositing checks, depositing cash, withdrawals, transfers, payments, monthly credit card charges, and data retrieval; other charges for operations involving bank clerks; having a credit line and using it. For the sake of comparison, ING does not charge its customers holding accounts for the above operations. JIMS suggests that the regulatory authorities in Israel allow banks to confirm the identify of new customers by means of existing accounts in other institutions, instead of requiring their physical presence in a bank branch, and drop the current regulatory opposition to transfers from accounts held in the postal bank and the limits placed on amounts allowed to be transferred by internet. These changes, along with others, would speed the development of the internet banking system in Israel and do much to increase competition and reduce costs in this sector. For more information: www.jims-israel.org

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 286 - Public Money vs. Private CreditDokument2 Seiten286 - Public Money vs. Private CreditDavid E Robinson75% (4)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- BPR American BankDokument18 SeitenBPR American BankGargy ShekharNoch keine Bewertungen

- Infinity ArchitectureDokument57 SeitenInfinity Architecturebeimnet100% (2)

- SARFAESI Act, 2002: How It Works?Dokument4 SeitenSARFAESI Act, 2002: How It Works?Anurag KumarNoch keine Bewertungen

- Memorandum To RBI On Mis-SellingDokument4 SeitenMemorandum To RBI On Mis-SellingMoneylife FoundationNoch keine Bewertungen

- MCQ (New Topics-Special Laws) - PartDokument2 SeitenMCQ (New Topics-Special Laws) - PartJEP WalwalNoch keine Bewertungen

- Global Payplus BrochureDokument16 SeitenGlobal Payplus BrochureGirishNoch keine Bewertungen

- Mindanao Savings and Loans Inc Vs WillkomDokument2 SeitenMindanao Savings and Loans Inc Vs Willkomis_still_artNoch keine Bewertungen

- Agreement On Delivery of Cash Funds For Investments: Via Swift Mt103 FTP Mode Manual DownloadDokument17 SeitenAgreement On Delivery of Cash Funds For Investments: Via Swift Mt103 FTP Mode Manual DownloadDarren Quah100% (2)

- AES CS Virtual Internship ProjectDokument22 SeitenAES CS Virtual Internship ProjectAjay0% (1)

- AJO (ROSCA) Contribution AgreementDokument3 SeitenAJO (ROSCA) Contribution Agreementejogheneta72% (18)

- Mps (Jul Dec2023)Dokument43 SeitenMps (Jul Dec2023)JasimNoch keine Bewertungen

- 20150827161213912.12.prof. Bharati R. HiremathDokument23 Seiten20150827161213912.12.prof. Bharati R. HiremathMuhammed Rafee100% (1)

- CPC AssignmentDokument39 SeitenCPC AssignmentBhaskar Gupta BhayaNoch keine Bewertungen

- Electronic Waste Management in Sri Lanka Performance and Environmental Aiudit Report 1 EDokument41 SeitenElectronic Waste Management in Sri Lanka Performance and Environmental Aiudit Report 1 ESupun KahawaththaNoch keine Bewertungen

- Nature of Commercial BanksDokument3 SeitenNature of Commercial BanksVenkatesh VenkyNoch keine Bewertungen

- FM3 Midterm Exam ReviewerDokument5 SeitenFM3 Midterm Exam ReviewerXa ShionNoch keine Bewertungen

- Letter of Transmittal: Jagannath UniversityDokument5 SeitenLetter of Transmittal: Jagannath Universitysalauddin Kader0% (1)

- Arun Excello Infrastructure Private LimitedDokument15 SeitenArun Excello Infrastructure Private LimitedRamanujam RaghavanNoch keine Bewertungen

- Determinants of Profitability Performance: An Analysis of Class I Railroads in The United StatesDokument18 SeitenDeterminants of Profitability Performance: An Analysis of Class I Railroads in The United StatesJayaniNoch keine Bewertungen

- Tax-RegulationsDokument12 SeitenTax-RegulationsMichelle Jude TinioNoch keine Bewertungen

- A Study On Awareness of Retirement Planning in IndiaDokument13 SeitenA Study On Awareness of Retirement Planning in IndiakizieNoch keine Bewertungen

- Literature ReviewDokument6 SeitenLiterature ReviewKakili ChishiNoch keine Bewertungen

- (T) Audit of State Co-Operative BanksDokument342 Seiten(T) Audit of State Co-Operative BanksArvind Kumar100% (2)

- What Is Commercial Banks - Definition, Structure, Functions, Asset Structure, Role, ProblemsDokument15 SeitenWhat Is Commercial Banks - Definition, Structure, Functions, Asset Structure, Role, ProblemsdhaiwatNoch keine Bewertungen

- 1 Chapter-IndianFinancial SystemDokument21 Seiten1 Chapter-IndianFinancial Systemwasi28Noch keine Bewertungen

- Repot On SBIDokument76 SeitenRepot On SBIPrasad SawantNoch keine Bewertungen

- Short Term FinancingDokument39 SeitenShort Term Financingmomindkhan100% (1)

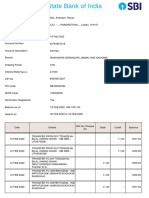

- Account StatementDokument2 SeitenAccount StatementBilal AhmadNoch keine Bewertungen

- Micro FinanceDokument5 SeitenMicro FinancePayal SharmaNoch keine Bewertungen