Beruflich Dokumente

Kultur Dokumente

Can San Miguel Make Philippines Airlines Soar - by Pia Rufino

Hochgeladen von

thecenseireportOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Can San Miguel Make Philippines Airlines Soar - by Pia Rufino

Hochgeladen von

thecenseireportCopyright:

Verfügbare Formate

4

cenSEI

: . +

8KVUXZ

CONTENTS BUSINESS NATION WORLD TECHNOLOGY

San Miguel

Comes to the Aid

of an Ailing PAL

The aggressive

conglomerate is confdent

it can turn around its newly

acquired airline

By Pia Rufno

In

April, business giants San Miguel

Corporation and the Lucio Tan

group, signed an investment agreement

that gives San Miguel minority stake in

nuLIonuI ug currIer Philippine Airlines

(PA) und PA's uIhIIuLe Iow-cosL uIrIIne Air

Philippines Corporation (Airphil Express).

In a disclosure to the Philippine Stock

Exchange, Sun MIgueI conhrmed u news

reporL LIuL IL ucquIred u qq% sLuke In boLI

carriers for US$500 million.

With the buy-in, San Miguel took over

management control of PALs parent

company PAL Holdings, with San Miguel

president Ramon Ang named PAL Holdings

new presIdenL und cIIeI operuLIng oIhcer,

replacing long-time president Jaime Bautista

on April 20.

For his part, Bautista said, in a statement,

that San Miguels investment will help

LIe ug currIer In ILs re-eeLIng und muke

the airline more viable and competitive,

even as he assured the public that it would

be business as usual for PAL, which would

conLInue ILs roIe us LIe counLry`s ug currIer.

PAL Iuces lubor, nunciul issoes.

Angs ability to turn a problematic company

uround wIII dehnILeIy be puL Lo LIe LesL us

PAL is still experiencing stress from labor

und hnuncIuI probIems.

In September, PAL announced it would

outsource three of its non-core units

effective in October, laying off over 2,600

empIoyees IundIIng In-IgIL cuLerIng, curgo

handling, and call-center reservations as

part of a cost-saving program to remain

competitive and ensure long-term survival.

STRATEGY POINTS

San MigueI Corporation is condent it can

revive Philippine Airlines which is burdened

with Iabor and nanciaI woes with an infusion of

US$500 million

PALs budget arm, AirPhil Express, has a better

outlook than PAL, since its focus is on the faster

growing budget end of the market

High fuel prices, uncertain demand in mature

economies, and intense competition between

budget and network carriers are constant

struggles facing airline business, so capacity

discipline and tight cost control might still be

the best strategy

BUSINESS

PREVIOUS PAGE NEXT PAGE PREVIOUS PAGE NEXT PAGE

5

:NKcenSEI8KVUXZ - June 4-10, 2012

San Miguel comes to the aid of an ailing PAL

In reaction to the impending layoffs, PAL's

ground-crew union, the Philippine Airlines

Employees Association (PALEA), staged

protest actions against the announced

mass layoffs, which led to the suspension

of airport operations and the cancellation

oI IgILs IeuvIng LIousunds oI PA

passengers stranded at the airport, as

summarized by PAL in a September 2011

statement condemning PALEA's actions.

Following the San Miguel buy-in,

PAEA hIed u munIIesLuLIon wILI

the Court of Appeals saying it was

open to new mediation talks to settle

the labor dispute, as it urged the new

management to reinstate some 2,600

workers who were laid off last year, as

reported in the Inquirer.

The new management of PAL

should recognize that the solution to the

ug currIer`s woes InvoIves noL onIy LIe

re-eeLIng oI ILs ugIng uIrcruIL buL more

so the reinstatement of its skilled regular

workers, according to the

union's manifestation.

The disruption in its service brought about

by the labor strike, along with rising fuel

costs, were blamed in PAL's net loss of

$33.5 million from October to December

last year, a reversal of its net income of

US$15.1 million over the same period

in 2010. Its revenues dropped to $386

mIIIIon, u .8% decIIne Irom $q; mIIIIon

In zo1o, due Lo sIow pussenger LruIhc us

well as weak cargo operations, according

to the abs-cbnnews.com report.

(In a November Inquirer column,

economist and TV commentator Solita

Collas Monsod offers an interesting take

on the matter, including a capsule history

that puts PAL's labor issues in some

perspective. For example, the outsourcing

plan had actually been originally

presenLed In AugusL zooq, IoIIowIng u

10-year suspension of the company's

collective bargaining agreement and a

10-year moratorium on strikes. In this

column, Monsod also examines PAL's

latest outsourcing plan in light of previous

downsizing campaigns.)

Jost u yeur to torn PAL uroond?

Despite the problems facing Asias

oldest airline, Ang, who has a decade of

experience running San Miguel, is

positive he can bring PAL back to

prohLubIIILy, even suyIng LIuL Ie onIy

needs a year to do this.

PAL will make turnaround a year from

the time we invested in the company.

We ure conhdenL LIuL PA wIII muke u

turnaround, Ang said in an interview

with ManilaStandardToday at the

sidelines of the annual stockholders

meeting of Ginebra San Miguel in May.

He further said the airline plans to

reduce cost by increasing the utilization

of aircraft to about 16 hours a day and

improve its ticketing system. Also, PAL

wIII y non-sLop Lo New York, ToronLo,

and Europe, he added.

Ang also told the Inquirer in an in-depth

interview on April 30 that the problems

IucIng PA ure so eusy Lo hx, suyIng LIuL

Ie Is no sLrunger Lo dIIhcuIL corporuLe

situations, having recently revitalized

LIe counLry`s IurgesL IueI rehner und

distributor, Petron Corp., which, according

PREVIOUS PAGE NEXT PAGE

6 cenSEI

: . +

8KVUXZ

CONTENTS BUSINESS NATION WORLD TECHNOLOGY

to him, was on the brink of collapse when

San Miguel bought it.

According to Ang, among the reasons San

Miguel bought PAL is that it is a good

company with an excellent brand adding

that despite having so many problems over

20 years, the company has always been

above water.

Ang wants Airphil Express to take over

all domestic and the short-haul routes

using the low-cost-carrier (LCC) model,

while PAL focuses on long-haul routes like

regIonuI IgILs oI greuLer LIun LIree Iours`

duruLIon. Ang uIso reveuIed pIuns Lo ucquIre

up to 100 aircraft over the next half decade

and to develop a new international airport.

PAL will also help Philippine aviation

regain its Category 1 status, since it is

crucial for the airlines expansion, Ang said.

The U.S. Federal Aviation Administration

downgraded the country's civil aviation

safety status to Category 2 in Dec. 2007,

citing noncompliance with international

safety standards, which limits PALs

operations to and from the United States.

(For its part, the European Union in

April 2010 banned Philippine carriers

Irom yIng Lo uny oI ILs z; member-sLuLes,

after the Civil Aviation Authority of the

Philippines failed to address its concerns

over suIeLy, modern equIpmenL, und

technical personnel.)

High costs, declining pussenger

nombers. While it is trying to deal with

high cost levels, PAL also has yet

to increase its market share in the airline

industry. According to an April 11 analysis

of the Centre for Aviation (CAPA),

which provides analyses of developments

in the global airline industry, PAL is

umong LIe weukesL oI AsIu`s mujor ug

carriers, having seen its share of the

Philippine market steadily erode due to

competition from low-cost carriers, and

being in need of recapitalization.

According to CAPA, PAL has seen its share

of the domestic market fall by about 20%,

based on current capacity, while its share

of the international market has slipped to

about 25%. (See charts below)

CAPA further said: "PAL cannot compete

directly with the countrys fast-growing LCC

Cebu Pacic Air

Airphil Express

Philippine Airlines

Zest Air

SEAir

Cathay Pacic

Dragonair

Emirates

Other

0.0%

0.0%

0.0%

0.0%

0.7%

10.0%

20.4%

23.5%

45.4%

32.4%

2.6%

2.9%

3.0%

3.6%

PHILIPPINE CARRIERS DOMESTIC AND INTERNATIONAL C

Source: Philippine

PREVIOUS PAGE NEXT PAGE PREVIOUS PAGE NEXT PAGE

7

:NKcenSEI8KVUXZ - June 4-10, 2012

4.0%

7.6%

18.0%

25.8%

Singapore Airlines

Philippine Airlines

Emirates

Other

Cathay Pacic

Korean Air

Cebu Pacic Air

Asiana Airlines

Etihad Airways

sector given its higher unit costs and legacy

structure. It needs to differentiate the main

PAL brand from local competitors, which are

all LCCs and only offer economy class.

Bodget-brund expunsion, eet renewul,

globul ulliunce cun help PAL recover.

According to CAPAs analysis, with San

Miguels US$500-million investment, PAL

will be able to employ a strategy used by the

sImIIurIy sIzed ndonesIun ug currIer Garuda

Indonesia, which, as part of its 2011-2015

business plan, is investing in rapid expansion

oI ILs budgeL brund CILIIInk, eeL renewuI und

premium product enhancements.

CAPA said San Miguel will use PALs AirPhil

brand to grow both in the Philippines and in

the regional market. The growth at PAL will be

relatively limited, CAPA predicted, except in

NorLI AmerIcu, wIere sIgnIhcunL cupucILy wIII

be added once Category 2 restrictions are lifted.

AirPhil generally has a better outlook as

most of the growth in the Philippines is at

the lower end as it is a market dominated by

leisure, migrant worker and visiting friends

und reIuLIves LruIhc...WILI hnuncIuI supporL

from San Miguel, AirPhil is now in better shape

APACITY SHARE

Airlines and AirPhil outlook improves as new ownership cements

two-brand strategy," Center for Aviation, April 11, 2012

Low-cost carriers rule the market

A Manila Times story on domestic air carriers

in February cited Civil Aeronautics Board of the

Philippines data in reporting that there were 18.77

million domestic airline passengers in 2011, refecting a

growth of 13.3% from the year before.

Cebu Pacifc led the local airlines with 8.48 million

domestic passengers in 2011, a 6.4% improvement

over its fgure for 2010. PAL, for its part, experienced

a 18.83% drop, from 5.31 million passengers in 2010

to 4.31 million passengers in 2011. PAL's low-cost

affliate, Airphil Express, on the other hand, carried

3.69 million domestic passengers in 2011, almost

doubling the 1.85 million it carried the year before.

(See table below)

A BusinessMirror feature in February on the

competition among local low-cost carriers cited Civil

Aeronautics Board executive director Carmelo Arcilla

in reporting that the penetration rate of local low-cost

carriers is currently pegged at 85%, led by Cebu Pacifc

and Airphil Express.

Domestic carrier 2011

passengers

(millions)

2010

passengers

(millions)

Rate of

change

(%)

Cebu Pacifc 8.48 7.97 6.40

Philippine Airlines 4.31 5.31 -18.83

Airphil Express 3.69 1.85 99.46

Zest Airways 2.15 1.23 74.79

Southeast Asian

Airlines

.124 .193 -64.43

Total 18.754 16.553 13.30

Note: Figures in table did not add up to the aggregate mentioned

in the text probably because of rounding discrepancies

DOMESTIC AIRLINE PASSENGERS,

2010 AND 2011

Source: TCR compilation of data presented in "Domestic air travel

passengers up in 2011," by Darwin Amolejar, as published on

The Manila Times.net, Feb. 6, 2012

San Miguel comes to the aid of an ailing PAL

PREVIOUS PAGE NEXT PAGE PREVIOUS PAGE NEXT PAGE

8 cenSEI

: . +

8KVUXZ

CONTENTS BUSINESS NATION WORLD TECHNOLOGY

to withstand the war now being waged

between Philippine LCCs.

Launched in 2010, the budget carriers

LruIhc doubIed Lo jusL under .; mIIIIon

passengers last year.

Following Garudas model, CAPA said

joining a global alliance, upgrading IT

systems and adding more codeshare

purLners Ior sIurIng IgILs ure LIe possIbIe

vital components of PALs medium- to

long-term strategy.

Airline bosiness Iuces muny

chullenges. In his 2011 presentation, Paul

Stephen Dempsey Tomlinson, Professor of

Law and Director of Institute of Air & Space

Law McGill University in Canada said the

airline business is a tough one.

ProhL murgIns ure LIIn, hxed cosLs ure

high, capital expenditures are large,

government regulation has been unstable,

and taxation can be unmerciful. Demand

can be chilled by an outbreak of disease,

recession, war or terrorism, he said.

Lessons from a fellow legacy carrier

Garuda CEO Emirsyah Satar said the airlines fve-year business plan, dubbed Quantum Leap Program

for 2011-2015, is driven by seven elements, including competing in the LCC market through its budget arm

Citilink, he explained in an December 2011 interview with the International Air Transport Association, an

international trade body of 240 airlines.

These drivers are: domestic travel; international travel;

addressing low-cost travel through a subsidiary, Citilink;

expanding the feet; rejuvenating the brand; improving

our cost discipline; and getting greater productivity from

staff.

"By 2015, we aim to carry 35.2 million passengers, a

182% increase on 2010 fgures. Our capacity in terms

of available seat kilometers will increase 171% to 69.7

billion," Satar said.

Garuda was once a loss-generating company, the CEO

recounts in a 2009 interview with CNN. When he joined

the company in 2005, he learned that the airline only

made proft in three of the previous ten years.

"We got out of routes where we were losing money . it was ok if we reduced our market so we could

become proftable again," he added, noting that the airline was able to turn a proft two years after he came

on board.

In 2010, Garuda was named the winner of the Worlds most improved airline at the 2010 World Airline

Awards - the Passenger's Choice awards.

In the video above, Garuda CEO Emirsyah Satar

recaIIs how he brought Garuda back to protabiIity

CNN

PREVIOUS PAGE NEXT PAGE PREVIOUS PAGE NEXT PAGE

9

:NKcenSEI8KVUXZ - June 4-10, 2012

or Ayse Kucuk YIImuz, ussIsLunL proIessor

at the School of Civil Aviation in Anadolu

University in Turkey, risks are part of the

everyday business for airline companies.

In his 2008 study entitled The Corporate

Sustainability Model for Airline Business,

YIImuz suId LIe uIrIInes operuLe In un

extremely dynamic, and often highly

volatile, commercial environment.

The study cites a 2005 study from the US

entitled Powerful Solutions for Enterprise-

Wide Airline Management, which

enumerates the following pressures

facing airlines:

GIobuIIzuLIon und LIe Lrend L

oward mergers and alliances

requIre LIe exIbIIILy Lo

adjust accordingly

WorId hnuncIuI InsLubIIILy und

eroding yields make it more important

than ever to streamline processes,

reduce redundancies, and simplify

system architecture to lower costs

Becuuse LIe IndusLry Is so

competitive, airline operators must

analyze every aspect of their business,

und LIuL requIres IusL, exIbIe, und

focused access to information for

sound decision making

QuuIILy cusLomer servIce

differentiates one airline from the

Lessons from Southeast Asias rst Iow-cost airIine

Tony Fernandez, the CEO of Malaysias Air Asia, likewise has a story on how to turn around an ailing airline.

In a November 2010 BBC interview, he recounts buying Air Asia from a Malaysian government-owned

company when it was heavily indebted in 2001, and turning the airline into a short-haul, low-cost carrier,

making it the frst low-cost airline in the region.

His secret, according to the interview, is in being single-

minded about the operation and keeping it simple. The

company grew from two planes in 2002 to a feet of 86

aircraft fying 30 million people around the world. When

the company went into long-haul fights with Air Asia X,

it meant two separate companies, management teams,

and sets of crews, pilots and engineers.

Fernandez had no experience in the airline business,

having just stepped out of the music industry when he

bought the airline. For him, capital, effective marketing,

and good people are the key to start up a business. "It

really was a little bit of stick your fnger in the air and

hope for the best. But we were good marketing people from the music business. we just went out there and

felt the market and said if you halve the fare, there's a huge enormous untapped market," he told BBC.

Fernandez likewise stressed the importance of keeping the employees happy, saying that for him,

"employees come number one, customers come number two," explaining that "If you have a happy

workforce they'll look after your customers anyway," he said.

Air Asia Chief Tony Fernandez shares how he

turned aiIing Air Asia around by making it the rst

low-cost airline in the region BBC

San Miguel comes to the aid of an ailing PAL

PREVIOUS PAGE NEXT PAGE PREVIOUS PAGE NEXT PAGE

10 cenSEI

: . +

8KVUXZ

CONTENTS BUSINESS NATION WORLD TECHNOLOGY

other and helps secure customer

loyalty. Accurate customer data is

essential for personalizing services

und muxImIzIng LIe benehL oI

marketing initiatives.

The study further said that the main

concerns of todays airlines are

optimization, improved capacity,

cosL suvIngs und LIe ubIIILy Lo reucL quIckIy

to changes while the solutions

for airline planning and control ranges

from network planning, codeshare

handling, and crew management, to

pricing, price distribution, and

revenue management.

Meanwhile, a February 2012 airline

economic analysis by global management

consuILIng hrm Oliver Wyman concludes

that throughout the airline industry,

some struggles are constants: high fuel

prices, uncertain demand in mature

economies, and intense competition

between value (low-cost) and network

(premium) carriers, in both domestic and

international markets.

The analysis, involving seven value

carriers and eight network carriers in the

U.S, said that airline executives, looking

back at their success in 2010, concluded

that capacity discipline, along with tight

cost control, remains the best strategy.

San Miguel comes to the aid of an ailing PAL

PREVIOUS PAGE NEXT PAGE PREVIOUS PAGE NEXT PAGE

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- McDonnell Douglas DC-10 Flight Crew Operating ManualDokument68 SeitenMcDonnell Douglas DC-10 Flight Crew Operating ManualTamás Varga100% (4)

- Breakthroughs in Airline Scheduling Whitepaper PDFDokument36 SeitenBreakthroughs in Airline Scheduling Whitepaper PDFRobert KomartinNoch keine Bewertungen

- Entrance Exam For Pilot Trainees I English Part OneDokument26 SeitenEntrance Exam For Pilot Trainees I English Part Onesolomon100% (1)

- (Aero Publishers) Italian Civil and Military Aircraft 1930-1945Dokument153 Seiten(Aero Publishers) Italian Civil and Military Aircraft 1930-1945zkarlos93% (14)

- Ryanair Case StudyDokument6 SeitenRyanair Case StudySenthamizh Kumaran SNoch keine Bewertungen

- Southwest Airlines - Case Study - Questions - Group 4Dokument8 SeitenSouthwest Airlines - Case Study - Questions - Group 4Sanyam AgarwalNoch keine Bewertungen

- Internet CheckIn Boarding Docs PDFDokument4 SeitenInternet CheckIn Boarding Docs PDFPetrescu LucianNoch keine Bewertungen

- Twenty-Five Years of Ramjet Development: William H. AveryDokument11 SeitenTwenty-Five Years of Ramjet Development: William H. AveryHoàng DavidNoch keine Bewertungen

- All A-Twitter Over Trending Topics by Ms. MarzanDokument12 SeitenAll A-Twitter Over Trending Topics by Ms. MarzanthecenseireportNoch keine Bewertungen

- Fixing The Fix by Zandro Rapadas, M.D.C.Dokument9 SeitenFixing The Fix by Zandro Rapadas, M.D.C.thecenseireportNoch keine Bewertungen

- Bearing Life Brings Teenage Death by Pia RufinoDokument6 SeitenBearing Life Brings Teenage Death by Pia RufinothecenseireportNoch keine Bewertungen

- As Media Tackles Governance, Is Anyone Watching? by Ricardo SaludoDokument7 SeitenAs Media Tackles Governance, Is Anyone Watching? by Ricardo SaludothecenseireportNoch keine Bewertungen

- Sneak Peek of TCR's Latest IssueDokument1 SeiteSneak Peek of TCR's Latest IssuethecenseireportNoch keine Bewertungen

- Short List For The Next Chief Justice by Atty. SadianDokument9 SeitenShort List For The Next Chief Justice by Atty. SadianthecenseireportNoch keine Bewertungen

- Online Gaming: Addiction or Just "High Engagement"? by Joanne MarzanDokument9 SeitenOnline Gaming: Addiction or Just "High Engagement"? by Joanne MarzanthecenseireportNoch keine Bewertungen

- Balancing The Powers of Asia by Mr. Ricardo SaludoDokument6 SeitenBalancing The Powers of Asia by Mr. Ricardo SaludothecenseireportNoch keine Bewertungen

- How Smartphones Can Uplift The Poor? by Marishka CabreraDokument6 SeitenHow Smartphones Can Uplift The Poor? by Marishka CabrerathecenseireportNoch keine Bewertungen

- New TCR Issue Available!Dokument1 SeiteNew TCR Issue Available!thecenseireportNoch keine Bewertungen

- TCR NsaDokument1 SeiteTCR NsathecenseireportNoch keine Bewertungen

- How Blue Is Your Ocean?Dokument5 SeitenHow Blue Is Your Ocean?thecenseireportNoch keine Bewertungen

- How To Green Your Brand by Ms. Victoria FritzDokument7 SeitenHow To Green Your Brand by Ms. Victoria FritzthecenseireportNoch keine Bewertungen

- Can Computers Create and Innovate by Marishka CabreraDokument5 SeitenCan Computers Create and Innovate by Marishka CabrerathecenseireportNoch keine Bewertungen

- Annual Report To The PeopleDokument7 SeitenAnnual Report To The PeoplethecenseireportNoch keine Bewertungen

- Sneak Peek of The Latest TCR Issue!Dokument1 SeiteSneak Peek of The Latest TCR Issue!thecenseireportNoch keine Bewertungen

- The CenSEI Report Vol. 2 No. 26: Contents PageDokument1 SeiteThe CenSEI Report Vol. 2 No. 26: Contents PagethecenseireportNoch keine Bewertungen

- Know What's Inside The Latest TCR Issue!Dokument1 SeiteKnow What's Inside The Latest TCR Issue!thecenseireportNoch keine Bewertungen

- Two Years On The - Tuwid Na DaanDokument1 SeiteTwo Years On The - Tuwid Na DaanthecenseireportNoch keine Bewertungen

- PCOS: Making Sure Our Votes Count by Ricardo SaludoDokument9 SeitenPCOS: Making Sure Our Votes Count by Ricardo SaludothecenseireportNoch keine Bewertungen

- Sneak Peek of TCR's Latest IssueDokument1 SeiteSneak Peek of TCR's Latest IssuethecenseireportNoch keine Bewertungen

- Two Years of "Aquinomics"Dokument9 SeitenTwo Years of "Aquinomics"thecenseireportNoch keine Bewertungen

- Marketing by Cellphone and Tablet by Marishka CabreraDokument7 SeitenMarketing by Cellphone and Tablet by Marishka CabrerathecenseireportNoch keine Bewertungen

- The Amazing New Gadgets From Apple by Zandro RapadasDokument5 SeitenThe Amazing New Gadgets From Apple by Zandro RapadasthecenseireportNoch keine Bewertungen

- Where Asia Is Dead Wrong On RightsDokument7 SeitenWhere Asia Is Dead Wrong On RightsthecenseireportNoch keine Bewertungen

- Race To Save The Lives of Filipino Mothers by Pia RufinoDokument9 SeitenRace To Save The Lives of Filipino Mothers by Pia RufinothecenseireportNoch keine Bewertungen

- Is Your Country Media - Literate? by Ricardo SaludoDokument9 SeitenIs Your Country Media - Literate? by Ricardo SaludothecenseireportNoch keine Bewertungen

- A Surprising Spurt by Ricardo SaludoDokument8 SeitenA Surprising Spurt by Ricardo SaludothecenseireportNoch keine Bewertungen

- First Pages of Issue 23 of TCRDokument2 SeitenFirst Pages of Issue 23 of TCRthecenseireportNoch keine Bewertungen

- Ata 22 - 20 Auto Flight - Flight Management 1Dokument23 SeitenAta 22 - 20 Auto Flight - Flight Management 1Adiyanto PamungkasNoch keine Bewertungen

- Flight: 100 Greatest AircraftDokument22 SeitenFlight: 100 Greatest AircraftWeldon Owen Publishing67% (3)

- AirlinersDokument264 SeitenAirlinersAviation Library100% (1)

- YaathDokument1 SeiteYaathNirmalish ReshiaNoch keine Bewertungen

- Fighter Pilot Aces of WWIIDokument10 SeitenFighter Pilot Aces of WWIID1rawNoch keine Bewertungen

- General Information General Information: (C) Jeppesen Sanderson, Inc., 2018, All Rights ReservedDokument23 SeitenGeneral Information General Information: (C) Jeppesen Sanderson, Inc., 2018, All Rights ReservedGuillermo CortesNoch keine Bewertungen

- The Turnaround of LufthansaDokument12 SeitenThe Turnaround of LufthansaMamoOke100% (2)

- Aircraft Empennage Designs ExplainedDokument8 SeitenAircraft Empennage Designs Explainedmino eatineNoch keine Bewertungen

- Резервација путовања april 03 за MR DEJAN STAMENKOVICDokument1 SeiteРезервација путовања april 03 за MR DEJAN STAMENKOVICРанко ЛасицаNoch keine Bewertungen

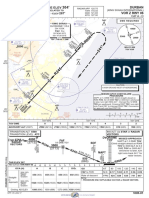

- Cat A - D: Aerodrome Elev 287' Instrument Approach ChartDokument1 SeiteCat A - D: Aerodrome Elev 287' Instrument Approach ChartSeyi WilliamsNoch keine Bewertungen

- The Army Air Forces in World War II Combat ChronologyDokument743 SeitenThe Army Air Forces in World War II Combat ChronologyBob Andrepont100% (1)

- Guidelines For Taxation of International Air Transport ProfitsDokument19 SeitenGuidelines For Taxation of International Air Transport ProfitsAllyssa ArcangelNoch keine Bewertungen

- Flight AND Performance Planning: Private Pilot LicenceDokument29 SeitenFlight AND Performance Planning: Private Pilot LicenceMooeshooeNoch keine Bewertungen

- ICAO Noise MeasurementDokument32 SeitenICAO Noise MeasurementMuralidharan ShanmugamNoch keine Bewertungen

- Flynas - BoardingPass - PNR R7F1SC - 24 Jul 2019 Abha - Jeddah For Mr. Abdllah AljabriDokument1 SeiteFlynas - BoardingPass - PNR R7F1SC - 24 Jul 2019 Abha - Jeddah For Mr. Abdllah AljabriLong-life TripNoch keine Bewertungen

- A318 - Ata 06 - Dimentions & AreasDokument22 SeitenA318 - Ata 06 - Dimentions & Areassuper_jaiz100% (1)

- AirbusDokument12 SeitenAirbusgustavoemcomaNoch keine Bewertungen

- ABC of Gliding and SailflyingDokument311 SeitenABC of Gliding and SailflyingMalte HöltkenNoch keine Bewertungen

- Check-In: Shopping Food & DrinkDokument8 SeitenCheck-In: Shopping Food & DrinkmikzapkNoch keine Bewertungen

- Skylane 182tDokument334 SeitenSkylane 182tAuob FashloumNoch keine Bewertungen

- ME2605 Notes Part IDokument26 SeitenME2605 Notes Part Iaditip_11Noch keine Bewertungen

- Manual Del Cessna 182 PDFDokument387 SeitenManual Del Cessna 182 PDFMiguel VG Vite100% (1)