Beruflich Dokumente

Kultur Dokumente

Roadmap To A 21st-Century Disability Policy

Hochgeladen von

workabilityOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Roadmap To A 21st-Century Disability Policy

Hochgeladen von

workabilityCopyright:

Verfügbare Formate

JANUARY 2012 NUMBER 12-01

A Roadmap to a 21st-Century Disability Policy

David Mann and David Stapleton

nearly 70 percent receive benefits from public programs (Houtenville and Brucker 2011). Despite increases over many decades in program participation and spending$357 billion in fiscal year 2008, representing some 12 percent of all federal outlays (Livermore et al. 2011)the disability support infrastructure in the United States is failing many of those it was designed to help, and the economic independence of people with disabilities has eroded. Although immediate fiscal pressures would be alleviated by tightening eligibility or reducing benefits for the largest support programs, including Social Security Disability Insurance (SSDI), Supplemental Security Income (SSI), Medicare, and Medicaid, failure to address the underlying structural issues will perpetuate program inefficiencies and poor outcomes. This issue brief outlines an alternative approach to slowing expenditure growth while improving the economic status of Americans with disabilities. The proposed plan addresses the work disincentives and fragmentation that drive up program costs. Reform will be difficult and will require a gradual transition, starting with a demonstration period to gather the information needed for effective reform.

Whats Wrong with Current Policy?

Americas disability policies are failing both taxpayers and the working-age population with disabilities. Even as program expenditures have risen, the economic status of this population has fallen even farther behind that of its nondisabled peers. Declining employment and household incomes among people with disabilities in recent decades have been accompanied by a sharp rise in applications for support, with the SSDI caseload almost tripling from 2.8 million in 1980 to 8.0 million in 2010.1 The Congressional Budget Office projects that, without legislative action, the SSDI Trust Fund will be exhausted in 2016.

1

Of the approximately 17.5 million working-age people in the United States who live with disabilities,

Two fundamental structural flaws in current disability policy are primarily responsible for these failings. First, to receive any assistance through SSDI and SSIthe primary gateways to benefitsapplicants must demonstrate an almost complete inability to work. This requirement fails to recognize that many people whose impairments limit their work capacity can still make significant contributions to their own financial support. By making complete inability to work a criterion for support, these programs create work disincentives among applicants and beneficiaries, erode work capacity, foster long-term dependence, and increase poverty among the very people they are intended to help.

Second, as the Government Accountability Office (2005) documents, the patchwork of state and federal disability support programs creates pervasive inefficiencies, including overlaps and gaps in services, misaligned incentives, and conflicting objectives. For example, states make initial disability determinations for SSI and SSDI, which are funded almost entirely by the federal government, with little or no regard for program expenditures and no reason to consider how program funds might be better used for the benefit of applicants. Support fragmentation also hinders substantive reform because the best opportunities to innovate cut across agency lines and levels of government. Conflicting priorities, jurisdictions, and objectives create dis-

The failings of current policy and the need for major structural reforms have been documented and discussed extensively elsewhere. See, for instance, Livermore et al. (2011), Stapleton and Wittenburg (2011), Burkhauser and Daly (2011), Social Security Administration (2011), Autor and Duggan (2010), Government Accountability Office (2005), Congressional Budget Office (2010), Social Security Advisory Board (2006), and Stapleton et al. (2006).

Mathematicas Center for Studying Disability Policy provides rigorous, objective disability policy research, collects data from the people disability policy aims to serve, and supplies the nations policymakers with the information they need to navigate the transition to 21st-century disability policy. For more information, visit our website at www.DisabilityPolicyResearch.org.

incentives for agencies to work together, resulting in little overall progress.

A More Promising Approach

In a recent paper (Mann and Stapleton 2011), we describe programmatic and financial reforms to address the structural problems of current disability policy. Although many details remain to be specified and more information is needed to implement them, these reforms promise to increase the economic success of people with disabilities while reducing growth in public spending for their support.

contact. The federal government would oversee the DSAs by establishing national eligibility criteria, adjudicating appeals, monitoring and reporting key outcomes, and encouraging continual program innovation. The success of the reformed system would depend, in part, on receiving timely feedback from the beneficiary population. To facilitate communication and oversight, we propose the creation of consumer boards. A national board would ensure that the federal government vigorously exercises its oversight responsibilities, while DSA boards would share consumer feedback and monitor programmatic efforts. The national eligibility criteria applied by DSAs would focus on potential work capacity rather than on the chronic inability to work. Each applicants potential work capacity would be measured as part of eligibility determination. Those truly unable to work would receive an income benefit as well as other supports, while those with unrealized work capacity would be eligible for work supports and training. With inability to work no longer a criterion for eligibility, workers would be able to apply for benefits while remaining in the labor force. We envision DSAs assigning each successful applicant to one of three categories: retiree with impairments, person with low work capacity, or worker with disabilities. Table 1 shows the eligibility criteria for and benefits available to people in each category. Retirees with impairments would comprise older workers (at least age 50) who meet the current nonmedical SSDI eligibility criteria and are determined to have minimal

or no work capacity. They would become eligible for SSDI and, eventually, Medicare, as under current law. Thus, the reforms would be consistent with the intent of the SSDI program when it was introduced in 1956, preserving current benefits for workers who experience the onset of work-ending impairments at an older age (Berkowitz 1987). People categorized as having low work capacity would qualify for income and in-kind benefits at least as generous as those currently available. Although not expected to, they could earn a generous amount without risking benefit loss and would have the option of obtaining some work-support services. Efficiency gained by support integration could help improve quality of life and reduce spending growth for this group. Most dramatically affected by the reforms would be those considered workers with disabilities. Determined to have significant potential work capacity, these beneficiaries would, with appropriate supports and assistance, be expected to contribute to their own financial support through work. Unemployed workers with disabilities would need to demonstrate good-faith employment efforts to continue receiving benefits. Workers with disabilities would each receive a customized package of supports through his or her DSA, covering a continuum of supports and including one, some, or all of the following: a disability allowance; self-sufficiency counseling services; an earned income tax credit; subsidies for disability services, equipment, and accommodations; and employment services. If awarded, the disability allowance would be designed to partially

Programmatic Reforms

The proposed programmatic reforms and structural changes are intended to consolidate the administration of support at the state or local level, provide important but limited federal oversight, expect and empower people with sufficient work capacity to support themselves at least partly through work, and protect and strengthen supports for those with insufficient work capacity. Under the reforms, responsibility for all eligibility determinations and support delivery would be consolidated under new entities called disability support administrators (DSAs), which would operate at the state or substate level but receive both federal and state funding. Every DSA would have the same responsibilities but potentially different organizational structures. A DSA could be run by the state or local government, a private organization, or a coalition of multiple entities. To ensure timely, coordinated support delivery, a single case manager would be responsible for each beneficiarys case and serve as his or her primary point of

Table 1:

POTENTIAL ELIGIBILITY GROUPS, CRITERIA, AND BENEFITS

Group

Workers with disabilities

Eligibility Criteria*

Substantial work capacity Need assistance to achieve economic success Long work history Over age 50 Very low work capacity Age 18 or older Need assistance to achieve economic success

Benefits Available**

Employment and other services Disability allowance Earned income tax credit SSDI Medicare after 24 months Disability allowance Disability services, equipment, and accommodations

Retirees with impairments

People with low work capacity

*Each beneficiary must have a significant, long-lasting medical condition or impairment. **Benefits for workers with disabilities and people with low work capacity would be customized to their individual needs, while those for retirees with impairments would not change relative to current law.

defray disability-related costs, such as special transportation accommodations. The duration of all supports would be determined by the beneficiarys medical condition, potential work capacity, and employment effort. The provision of supports to workers with disabilities would likely increase the total number of support recipients. Government savings generated from more efficient delivery of supports by the restructured programs would need to exceed the costs of supports provided to those who receive no assistance under current law. The reforms would create such savingssuggested by historical data to be on the order of tens of billions of dollars annually2by increasing the lifetime earnings of and tax payments by those with work capacity, reducing their reliance on government support, and integrating programs. It will be important to proceed with caution, however, because striking a balance between improving supports and reducing expenditure growth will be challenging. Under the reformed system, most beneficiaries would receive basic health care coverage from the same sources as other Americans. The Affordable Care Act would require those eligible for employerbased health insurance to enroll; all others would buy coverage through their states health insurance exchange or, if their household income is below 133 percent of the federal poverty level, would receive it from Medicaid. Retirees with impairments would qualify for Medicare under current SSDI program rules.

funding, encourage efficient decisions, contain growth in federal and state expenditures, make federal expenditures responsive to external factors such as the business cycle, and avoid precipitous declines in support. As under current law, federal funding sources would be a mixture of payroll taxes and general revenues. Funding would not be open-ended, however. Rather, federal expenditures would remain under a threshold determined by Congress to be consistent with national fiscal objectives. Each DSAs federal funding allocation would be based on its catchment areas current funding levels, projected needs, payroll tax revenues, and ability to pay. Federal funding would be adjusted as DSA catchment areas change demographically and beneficiaries migrate across areas. The sensitivity of the demand for services to the business cycle would also make it important for the funding mechanism to increase funding during economic downturns and decrease it during rapid expansions.3 Each DSAs share of federal funding would be allocated in two steps. The Social Security Administration (SSA) and the Centers for Medicare & Medicaid Services (CMS) would first directly pay all proposed income benefits and Medicare costs, respectively, for eligible beneficiaries in the DSAs catchment area. The remaining federal funds would then be granted to the DSA, which

3

would combine them with state funding to finance all other supports. This two-step federal funding system has two merits. First, with all income and Medicare payments excluded from grants, DSAs would have incentive to determine SSDI awards and other income supports responsibly. The more income support and SSDI allowances a DSA makes, the less money it would have to finance all other supports, and vice versa. Second, use of an existing national payment system would prevent costly duplication and support federal monitoring of cash payments. In fiscal year 2008, states contributed $71 billion to joint federal-state disability programs for working-age people. Under the reformed structure, even states that did not operate DSAs within their borders would be required to contribute commensurate funding for disability support. Initially, each state would divert funds currently used to pay Medicaid and other disability-related benefits to DSAs. Requirements for maintaining state funding levels would change gradually, as circumstances warranted. Each states minimum funding requirement would eventually be a percentage of federal grants to the DSAs in the state. Figure 1 shows the distribution of disability support funding under current law and illustrates how it might be allocated under the proposed reforms after a transition period. Federal matching grants and block grants to states, which comprise 22 percent and one percent of current funding, respectively, would be eliminated in favor of grants to DSAs. About

Financial Reforms

As the programmatic reforms deal with much of the structural fragmentation and inefficiency responsible for rapid expenditure growth, they will need to be supported by financial reforms that ensure adequate funding and the alignment of financial incentives with programmatic goals. The financial reforms described below are intended to ensure adequate

2

This feature is inspired by the most difficult lesson of welfare reform: that the welfare block grants do not adjust adequately to the business cycle. See Pavetti and Schott (2011).

Figure 1 The Financing Transition

Current Financing

Block Grants to States, 1% States, 17% Federal Programs, 60% Federal Grants to DSA, 45% Federal Programs, 39%

Hypothetical Post-Transition Financing

For instance, Stapleton and Wittenburg (2011) show that SSDI and Medicare expenditures would have been approximately $50 billion lower in 2010 had the rates of SSDI participation for covered workers within age-sex groups been the same as in 1980, when policymakers first became alarmed at the rapid growth in SSDI. vvv

Federal Match, 22%

Transition

State Grants to DSA, 16%

a third of federal disability program funding would also be rechanneled to DSAs. States would initially provide the same level of funding under the reformed policy as they do under current law. Financial reforms that create incentives for employers could generate additional funding and promote employment for program participants. For instance, the federal government could experience rate payroll taxes by levying surcharges on employers whose former employees frequently require disability supports, and vice versa (Burkhauser and Daly 2011). Tax incentives encouraging employers to retain employees with significant impairments could also be introduced.

to move forward. During this time, federal and state agencies, municipalities, counties, and various private organizations would initiate numerous pilot projects. Interventions and policies discovered to be effective and viable would be incorporated into the new policy. The federal legislation needed to initiate such a demonstration period must authorize and encourage pilot projects, define demonstration objectives and requirements, guarantee the cooperation of pertinent agencies, and create a national disability demonstration commission. The commission would encourage government agencies and other organizations to plan and conduct demonstrations, ensure that risks to demonstration subjects are minimized, and foster a spirit of innovation and learning.

government spending for their support. A demonstration period could provide the time and evidence needed to specify and test the reforms fully. Without these changes, current programs may be forced to make cuts in ways that attempt to minimize harm but will likely lead to severe consequences. Policymakers should instead consider instituting an evidence-based structural reform process to improve performance and reduce costs in the long term, while affording more protection to current programs in the short term than would otherwise be possible.

References

For the full list of references, go to www.disabilitypolicyresearch.org/ brief12_01_ref.asp.

For more information, contact David Mann, dmann@mathematica-mpr.com. We would like to thank Craig Thornton and Jennifer de Vallance, who provided helpful comments on an earlier draft of this brief. This research was sponsored by the University of New Hampshires Rehabilitation, Research, and Training Center on Employment Policy and Measurement, funded by the U.S. Department of Education (ED), National Institute on Disability and Rehabilitation Research (cooperative agreement no. H133B100030). The contents of this brief do not necessarily represent the policies of ED or any other federal agency (Edgar, 75.620 [b]). The authors are solely responsible for all views expressed.

The Policy Transition

The reforms we describe require major structural changes to the nations disability support system. Although they can potentially benefit both people with disabilities and U.S. taxpayers, a policy transition that is too quick and not based on solid evidence could do more harm than good. The first step in a successful transition to a new disability policy must be a substantial demonstration periodperhaps 10 years or longerduring which to build the evidence base and policy consensus needed

Table 2:

Looking Ahead

The nations long-term fiscal problems are creating an urgent need for structural reform to programs that support working-age people with disabilities. Expenditures for these programs account for a large share of the federal budget and will almost inevitably have to be reduced. As summarized in Table 2, we have outlined a set of structural changes that can both improve economic outcomes for those with disabilities and reduce growth in

COMPARISON OF CURRENT AND FUTURE DISABILITY POLICY FEATURES

Policy Feature

Work

Current Law

Disability defined as inability to work because of medical conditions Program rules and culture discourage work Fragmented among federal, state, and local agencies Multiple points of contact SSDI: all beneficiaries receive income benefit. Size of benefit based on work history SSI: size of benefit based on a maximum net of countable income from other sources Some states supplement income benefit Secondary benefit for most Loosely coordinated with income supports Spread throughout a variety of programs Major programs funded as entitlements Encourages cost shifting Fragmented authority stifles innovation

New Policy

Focus on remaining work capacity, given physical or mental conditions Program rules and culture encourage work Fully integrated/coordinated by DSAs Single point of contact for access to all publicly funded supports SSDI still available to some older workers (retirees with impairments) For others, income benefits size and duration based on various beneficiary characteristics, including work capacity and impairment severity Some receive other supports, but no income benefit Primary benefit for many Targeted at those with substantial work capacity All supports are coordinated Allocation of all funds to individuals is the responsibility of the DSA Expenditures not open-ended Expenditures adjust for demography, economy DSAs always have authority and incentives to improve

Eligibility determinations and support delivery Income benefits

Work supports

Federal and state funding

Innovation and reform

Princeton, NJ Ann Arbor, MI Cambridge, MA Chicago, IL Oakland, CA Washington, DC

Visit our website at www.mathematica-mpr.com

Mathematica is a registered trademark of Mathematica Policy Research, Inc.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- All India Hospital ListDokument379 SeitenAll India Hospital ListVed prakash Singh0% (1)

- Top Five Regrets of The DyingDokument2 SeitenTop Five Regrets of The DyingVlad Ungureanu67% (6)

- Pqa Executive Fellow Q ADokument3 SeitenPqa Executive Fellow Q Aapi-407904109Noch keine Bewertungen

- Els 10 29 2016 PDFDokument1 SeiteEls 10 29 2016 PDFRebeca LedezmaNoch keine Bewertungen

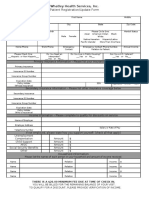

- Whatley Health Services, IncDokument2 SeitenWhatley Health Services, IncElla WardNoch keine Bewertungen

- Adam PharmaDokument18 SeitenAdam PharmawaelajlanyNoch keine Bewertungen

- Print CouponDokument1 SeitePrint CouponHEATHER BNoch keine Bewertungen

- Beta Health Full List of Hospitals and Medical CentresDokument70 SeitenBeta Health Full List of Hospitals and Medical CentresAdedimeji FredNoch keine Bewertungen

- Introduction To Health Insurance PPT 8 23 13 FinalDokument38 SeitenIntroduction To Health Insurance PPT 8 23 13 Finalapi-225367524100% (1)

- Resume of Wacostar101Dokument2 SeitenResume of Wacostar101api-24225898Noch keine Bewertungen

- Math Questions and SolutionsDokument2 SeitenMath Questions and Solutionsapi-238781118Noch keine Bewertungen

- Payslip: Employee Details Payment & Leave DetailsDokument2 SeitenPayslip: Employee Details Payment & Leave DetailsKushal Malhotra100% (3)

- 8-6 PayrollDokument7 Seiten8-6 Payrollapi-341598565Noch keine Bewertungen

- HR3 TitleI&II MemoDokument16 SeitenHR3 TitleI&II MemoPeter SullivanNoch keine Bewertungen

- Improving Communication With Older PatientsDokument6 SeitenImproving Communication With Older PatientsluisleNoch keine Bewertungen

- Chap 16Dokument44 SeitenChap 16Gabril AsadeNoch keine Bewertungen

- Keemberly Antunez Resume FinalDokument2 SeitenKeemberly Antunez Resume Finalapi-396783495Noch keine Bewertungen

- Bozeman Deaconess Proposal For Big Sky HospitalDokument48 SeitenBozeman Deaconess Proposal For Big Sky HospitalBozeman Daily ChronicleNoch keine Bewertungen

- Advocacy AssignmentDokument2 SeitenAdvocacy Assignmentapi-483044745Noch keine Bewertungen

- Mary P. Lodato, RN Acknowledged As An Honored Member by Strathmore's Who's Who Worldwide PublicationDokument2 SeitenMary P. Lodato, RN Acknowledged As An Honored Member by Strathmore's Who's Who Worldwide PublicationPR.comNoch keine Bewertungen

- The Name Partner by Carlos CisnerosDokument353 SeitenThe Name Partner by Carlos CisnerosArte Público PressNoch keine Bewertungen

- clp11 01Dokument78 Seitenclp11 01Charlton ButlerNoch keine Bewertungen

- Exam Form PDF Physical SchoolDokument2 SeitenExam Form PDF Physical SchoolJamesNoch keine Bewertungen

- PMHNP Portfolio Article 1Dokument14 SeitenPMHNP Portfolio Article 1api-281484882Noch keine Bewertungen

- ABC Healthcare Industry IMPDokument42 SeitenABC Healthcare Industry IMPanishokm2992Noch keine Bewertungen

- Ah Report Healthcare ServicesDokument9 SeitenAh Report Healthcare ServicesHosam GomaaNoch keine Bewertungen

- Proposed Rule: TRICARE: Outpatient Hospital Prospective Payment System (OPPS)Dokument19 SeitenProposed Rule: TRICARE: Outpatient Hospital Prospective Payment System (OPPS)Justia.com100% (1)

- NY Medicaid Audit Final ReportDokument40 SeitenNY Medicaid Audit Final ReportjodatoNoch keine Bewertungen

- Teamwork Workbook Part 1Dokument85 SeitenTeamwork Workbook Part 1I am a sexy potatoNoch keine Bewertungen

- United States Court of Appeals, Eighth CircuitDokument11 SeitenUnited States Court of Appeals, Eighth CircuitScribd Government DocsNoch keine Bewertungen