Beruflich Dokumente

Kultur Dokumente

Executive Summary of 'Privately Held, Non-Resident Deposits in Secrecy Jurisdictions'

Hochgeladen von

Global Financial IntegrityOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Executive Summary of 'Privately Held, Non-Resident Deposits in Secrecy Jurisdictions'

Hochgeladen von

Global Financial IntegrityCopyright:

Verfügbare Formate

Executive Summary:

PRIVATELY HELD, NON-RESIDENT DEPOSITS IN SECRECY JURISDICTIONS

Private, non-resident deposits are highly correlated with tax evading offshore deposits. As part of our work measuring illicit financial flowsof which tax evading monies comprise a significant componentGlobal Financial Integrity has developed a method to measure these private deposits into offshore financial centers by year and on a center-by-center basis. 1. Findings: Current total deposits by non-residents in offshore and secrecy jurisdictions are just under US$10 trillion; The United States, the United Kingdom, and the Cayman Islands top the list of jurisdictions, with the United States out in front with a total of US $2 trillion; Contrary to expectations of perceived favorability for deposits, Asia only accounts for approximately 6 percent of worldwide offshore deposits, although Hong Kong is the tenth largest secrecy jurisdiction by deposits in this report; Case studies of selected jurisdictions show measurable fluctuations in financial deposits correlated to events in which financial secrecy or overall market solvency were threatened. This study looks specifically at Iceland and Switzerland which both experienced significant events in the range of years examined for this study; The rate of growth of offshore deposit holdings in secrecy jurisdictions has expanded at an average of 9 percent per annum; outpacing the rise of world wealth in the last decade. This is likely a result of the increases in illicit financial flows from developing countries and tax evasion by residents of developed countries.

Table 5. Private, Non-Resident Deposits in Top Ten Secrecy Jurisdictions in millions U.S. dollars Rank Secrecy Jurisdiction Mar.2008 Jun.2008 Sep.2008 1 2 3 4 5 6 7 8 9 10 United States Cayman Islands United Kingdom Luxembourg Germany Jersey Netherlands Ireland Switzerland Hong Kong 2,898,534.87 1,736,494.86 2,231,576.78 588,157.56 578,016.37 512,129.27 436,626.68 295,018.56 311,338.38 329,275.49 2,549,092.88 1,515,102.93 1,795,558.25 587,777.99 494,497.32 544,082.58 413,026.92 273,390.41 289,407.31 325,140.86

2,404,989.86 1,483,148.13 1,836,245.10 567,321.25 472,165.19 474,577.60 373,464.71 263,708.06 328,829.94 405,018.48

2,114,545.84 1,684,780.21 1,433,925.61 456,132.60 427,781.91 367,103.26 347,574.79 286,066.87 235,166.23 315,974.16

Dec.2008

2,164,805.09 1,457,701.97 1,459,580.28 379,289.72 409,710.67 367,715.64 349,324.10 285,165.40 255,419.23 310,859.98

Mar.2009

2,182,790.93 1,549,753.87 1,533,574.20 435,425.86 425,643.57 393,221.52 315,947.91 276,409.52 273,973.39 267,993.97

Jun.2009

w w w. g f i p . o r g

| 1

2. Methodology: Using multiple data sources, including the Bank for International Settlements (BIS) and the International Monetary Fund (IMF), which provide statistics on bank deposits worldwide, this report designs and em ploys a proxy method to estimate country-specific private, non-resident deposits, by both year and quarterly. This paper then analyzes the data on worldwide, regional, and individual levels. 3. Terminology: Tax Haven: The most widely recognized definition of a tax haven was developed by the Organization for Economic Cooperation and Development (OECD) in 1998 which considers a jurisdiction to be a tax haven if it satisfies the following conditions: 1) no or nominal tax on income; 2) lack of effective exchange of tax and income information; 3) lack of financial transparency; and 4) no substantial business activities. Offshore Financial Center (OFC): The terms offshore financial center and tax haven are significantly related, as all tax havens (with the exception of Liberia) are also offshore financial centers, although not all offshore financial centers are tax havens. According to the official definition maintained by the IMF, OFCs include jurisdictions that 1) have relatively large numbers of financial institutions in business with non-residents; 2) have financial systems with external assets and liabilities out of proportion to domestic economies 3) have low or zero taxation, moderate or light financial regulation, and banking secrecy and anonymity. Secrecy Jurisdiction: This report uses the term secrecy jurisdiction, as defined by the Tax Justice Network (TJN): Places that intentionally create regulation for the primary benefit and use of those not resident in their geographical domain. That regulation is designed to undermine the legislation or regulation of another jurisdiction. To facilitate its use, secrecy jurisdictions also create a deliberate, legally backed veil of secrecy that ensures that those from outside the jurisdiction making use of its regulation cannot be identified to be doing so. Private, Non-Resident Deposits: Deposits belonging to either private individuals who reside, or corporations which are organized, outside the jurisdiction. 4. Recommendations: It is the recommendation of this report that greater transparency be introduced into the offshore financial market to curtail tax evasion and illicit financial flows. As the Bank for International Settlements already collects detailed data on offshore deposits from member countries we recommend that the BIS provide breakdowns of private non-resident deposits by country of origin. Secondly, we recommend that the BIS provide a disaggregation of these deposits into privately and publicly held funds.

| GLOBAL FINANCIAL INTEGRITY

Das könnte Ihnen auch gefallen

- Illicit Financial Flows From Developing Countries: 2004-2013Dokument72 SeitenIllicit Financial Flows From Developing Countries: 2004-2013Global Financial IntegrityNoch keine Bewertungen

- Illicit Financial Flows To and From Developing Countries: 2005-2014Dokument68 SeitenIllicit Financial Flows To and From Developing Countries: 2005-2014Global Financial IntegrityNoch keine Bewertungen

- Chancing It: How Secret Company Ownership Is A Risk To InvestorsDokument24 SeitenChancing It: How Secret Company Ownership Is A Risk To InvestorsGlobal Financial IntegrityNoch keine Bewertungen

- Financial Flows and Tax Havens: Combining To Limit The Lives of Billions of PeopleDokument136 SeitenFinancial Flows and Tax Havens: Combining To Limit The Lives of Billions of PeopleGlobal Financial Integrity100% (1)

- Chancing It: How Secret Company Ownership Is A Risk To InvestorsDokument24 SeitenChancing It: How Secret Company Ownership Is A Risk To InvestorsGlobal Financial IntegrityNoch keine Bewertungen

- Accelerating The IFF Agenda For African CountriesDokument20 SeitenAccelerating The IFF Agenda For African CountriesGlobal Financial IntegrityNoch keine Bewertungen

- Illicit Financial Flows From Developing Countries: 2003-2012Dokument68 SeitenIllicit Financial Flows From Developing Countries: 2003-2012Global Financial Integrity100% (1)

- Flight Capital and Illicit Financial Flows To and From Myanmar: 1960-2013Dokument64 SeitenFlight Capital and Illicit Financial Flows To and From Myanmar: 1960-2013Global Financial IntegrityNoch keine Bewertungen

- Illicit Financial Flows From Developing Countries: 2004-2013Dokument72 SeitenIllicit Financial Flows From Developing Countries: 2004-2013Global Financial Integrity100% (2)

- Illicit Financial Flows and Development Indices: 2008-2012Dokument56 SeitenIllicit Financial Flows and Development Indices: 2008-2012Global Financial IntegrityNoch keine Bewertungen

- RFP For Open Data ProjectDokument3 SeitenRFP For Open Data ProjectGlobal Financial IntegrityNoch keine Bewertungen

- Illicit Financial Flows From China and The Role of Trade MisinvoicingDokument26 SeitenIllicit Financial Flows From China and The Role of Trade MisinvoicingGlobal Financial IntegrityNoch keine Bewertungen

- Illicit Financial Flows: The Most Damaging Economic Condition Facing The Developing WorldDokument192 SeitenIllicit Financial Flows: The Most Damaging Economic Condition Facing The Developing WorldGlobal Financial Integrity100% (1)

- Illicit Financial Flows From Developing Countries: 2002-2011Dokument68 SeitenIllicit Financial Flows From Developing Countries: 2002-2011Global Financial IntegrityNoch keine Bewertungen

- Brazil: Capital Flight, Illicit Flows, and Macroeconomic Crises, 1960-2012Dokument60 SeitenBrazil: Capital Flight, Illicit Flows, and Macroeconomic Crises, 1960-2012Global Financial IntegrityNoch keine Bewertungen

- Open Letter To G20 Leaders On Beneficial Ownership and Country-by-Country ReportingDokument2 SeitenOpen Letter To G20 Leaders On Beneficial Ownership and Country-by-Country ReportingGlobal Financial IntegrityNoch keine Bewertungen

- Open Letter To The UN's Open Working Group On Proposed Goal 16Dokument1 SeiteOpen Letter To The UN's Open Working Group On Proposed Goal 16Global Financial IntegrityNoch keine Bewertungen

- GFI Comments On FinCEN Notice of Proposed Rulemaking On Customer Due Diligence Requirements For Financial InstitutionsDokument9 SeitenGFI Comments On FinCEN Notice of Proposed Rulemaking On Customer Due Diligence Requirements For Financial InstitutionsGlobal Financial IntegrityNoch keine Bewertungen

- Written Testimony of Tom Cardamone Before The Senate Foreign Relations CommitteeDokument9 SeitenWritten Testimony of Tom Cardamone Before The Senate Foreign Relations CommitteeGlobal Financial IntegrityNoch keine Bewertungen

- Illicit Financial Flows To and From The Philippines: A Study in Dynamic Simulation, 1960-2011Dokument56 SeitenIllicit Financial Flows To and From The Philippines: A Study in Dynamic Simulation, 1960-2011Global Financial IntegrityNoch keine Bewertungen

- Offshore Shell Games 2014Dokument56 SeitenOffshore Shell Games 2014Global Financial IntegrityNoch keine Bewertungen

- Global Shell Games Book Launch PresentationDokument42 SeitenGlobal Shell Games Book Launch PresentationGlobal Financial Integrity100% (2)

- Hiding in Plain Sight Trade Misinvoicing and The Impact of Revenue Loss in Ghana, Kenya, Mozambique, Tanzania, and Uganda: 2002-2011Dokument72 SeitenHiding in Plain Sight Trade Misinvoicing and The Impact of Revenue Loss in Ghana, Kenya, Mozambique, Tanzania, and Uganda: 2002-2011Repoa TanzaniaNoch keine Bewertungen

- Executive Summary of 'The Implied Tax Revenue Loss From Trade Mispricing'Dokument3 SeitenExecutive Summary of 'The Implied Tax Revenue Loss From Trade Mispricing'Global Financial IntegrityNoch keine Bewertungen

- Abstract and Introduction of 'Illicit Financial Flows From Africa: Hidden Resource For Development'Dokument3 SeitenAbstract and Introduction of 'Illicit Financial Flows From Africa: Hidden Resource For Development'Global Financial IntegrityNoch keine Bewertungen

- Executive Summary of 'The Absorption of Illicit Financial Flows From Developing Countries: 2002-2006'Dokument3 SeitenExecutive Summary of 'The Absorption of Illicit Financial Flows From Developing Countries: 2002-2006'Global Financial IntegrityNoch keine Bewertungen

- Executive Summary of 'Illicit Financial Flows From Developing Countries Over The Decade Ending 2009'Dokument2 SeitenExecutive Summary of 'Illicit Financial Flows From Developing Countries Over The Decade Ending 2009'Global Financial IntegrityNoch keine Bewertungen

- Executive Summary of 'Illicit Financial Flows From The Least Developed Countries 1990-2008'Dokument2 SeitenExecutive Summary of 'Illicit Financial Flows From The Least Developed Countries 1990-2008'Global Financial IntegrityNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Residency StatusDokument13 SeitenResidency StatusPhương NguyễnNoch keine Bewertungen

- Taxation of GPP Estates TrustsDokument7 SeitenTaxation of GPP Estates TrustsSharn Linzi Buan MontañoNoch keine Bewertungen

- GR 182722Dokument2 SeitenGR 182722Jenny Diaz100% (1)

- Jarl Moe - Think About Inheritance TaxDokument3 SeitenJarl Moe - Think About Inheritance TaxJarl MoeNoch keine Bewertungen

- Invoice TableauDokument1 SeiteInvoice Tableauameen9956Noch keine Bewertungen

- DEUTSCHE BANK AG MANILA BRANCH Vs CIRDokument5 SeitenDEUTSCHE BANK AG MANILA BRANCH Vs CIRBruno GalwatNoch keine Bewertungen

- 2 Feb 2018 20 Feb 2010 - 31 Jan 2018 1.15661852: Your BillDokument3 Seiten2 Feb 2018 20 Feb 2010 - 31 Jan 2018 1.15661852: Your BillumlzoneNoch keine Bewertungen

- Exercise 2-General LedgerDokument2 SeitenExercise 2-General LedgerTerefe DubeNoch keine Bewertungen

- Tax Invoice Seller Buyer: (AED) (AED) (AED)Dokument2 SeitenTax Invoice Seller Buyer: (AED) (AED) (AED)ZiZo AgnoNoch keine Bewertungen

- ITL Paper Feb 2023Dokument2 SeitenITL Paper Feb 2023Harnoor SinghNoch keine Bewertungen

- 0 0 0 10000 0 10000 SGST (0006)Dokument2 Seiten0 0 0 10000 0 10000 SGST (0006)Pruthiv RajNoch keine Bewertungen

- Final Tax Planning ProjectDokument14 SeitenFinal Tax Planning ProjectyashNoch keine Bewertungen

- ATO Phone ListDokument35 SeitenATO Phone Listrani.christine91Noch keine Bewertungen

- The Proceeds of Life Insurance Policies They Do The Heirs or Beneficiaries Upon Death of The Insured Shall Be Exempt From Income TaxDokument18 SeitenThe Proceeds of Life Insurance Policies They Do The Heirs or Beneficiaries Upon Death of The Insured Shall Be Exempt From Income TaxXhien YeeNoch keine Bewertungen

- Chapter 10-Compensation Income: True or FalseDokument15 SeitenChapter 10-Compensation Income: True or FalseJarren Basilan57% (7)

- TOLLAND 3 Minutes - Town Council - 2019 - 2019-03-13 Special Budget Meeting MinutesDokument2 SeitenTOLLAND 3 Minutes - Town Council - 2019 - 2019-03-13 Special Budget Meeting MinutesHelen BennettNoch keine Bewertungen

- C7021-22-2717923 30-03-2023 30-03-2023 Sold by (Pharmacy) Bill To / Ship To (Patient) Healthsaverz Medical LLP UshaDokument1 SeiteC7021-22-2717923 30-03-2023 30-03-2023 Sold by (Pharmacy) Bill To / Ship To (Patient) Healthsaverz Medical LLP UshaViraj DobriyalNoch keine Bewertungen

- Taxation Material 3Dokument11 SeitenTaxation Material 3Shaira BugayongNoch keine Bewertungen

- Declaration by Salaried Persons To Be Submitted To The Employer by The EmployeeDokument4 SeitenDeclaration by Salaried Persons To Be Submitted To The Employer by The EmployeeM. AamirNoch keine Bewertungen

- Government AccountingDokument2 SeitenGovernment AccountingLloyd SonicaNoch keine Bewertungen

- Computation of Total Income and Income Under H Ad: Chap. 5Dokument18 SeitenComputation of Total Income and Income Under H Ad: Chap. 5Rewant MehraNoch keine Bewertungen

- Chapter 1 Productivity and Yield Section 1.1 Functional Productivity Example 1.1 Nokia CellphoneDokument4 SeitenChapter 1 Productivity and Yield Section 1.1 Functional Productivity Example 1.1 Nokia CellphoneRoselie BarbinNoch keine Bewertungen

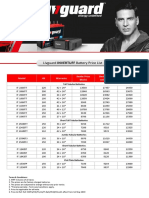

- Livguard IB Dealers Pricelist May 2019Dokument1 SeiteLivguard IB Dealers Pricelist May 2019chirag tandonNoch keine Bewertungen

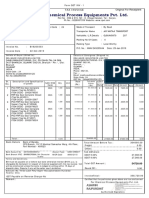

- Invoice1 PDFDokument4 SeitenInvoice1 PDFcpe plNoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)KeerthipaulNoch keine Bewertungen

- Spa Services: Revenue ParametersDokument2 SeitenSpa Services: Revenue ParametersJosel Millan UbaldoNoch keine Bewertungen

- Payroll PDFDokument7 SeitenPayroll PDFtylerNoch keine Bewertungen

- IOERJTraceable File 57 F 4 F 22858 F 72Dokument1 SeiteIOERJTraceable File 57 F 4 F 22858 F 72helio_bacNoch keine Bewertungen

- Request For ReinvestigationDokument9 SeitenRequest For Reinvestigationjoel raz94% (16)

- Course Outline For Public FinanceDokument6 SeitenCourse Outline For Public Financerami assefaNoch keine Bewertungen