Beruflich Dokumente

Kultur Dokumente

12 Usc 411 001

Hochgeladen von

Cecilia A. WilksOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

12 Usc 411 001

Hochgeladen von

Cecilia A. WilksCopyright:

Verfügbare Formate

,..

,

i

1.

.

,.

!i

'

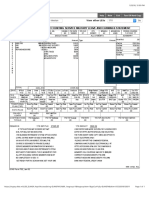

ROBERT C.

11

BOB

11

BALINK El Paso CO

I

!

02/95/2007 1B:50:49 AM

I ill 1111!11

Ooc. .--$0.00 Page

Rec $6.00 1 of 1

207015932

11395 TITLE 12-BANKS AND BANKING Page 148

ABoLlTION OP HO:Mil OWlfERs' LoAN CoRPORATION

For dissolution and abolishment of Home Owners'

Loan Corporation. referred to In this section. bY act

June 30, 1953, ch. l'lO, 21. 6'1 see note set

out under section 1463 of this title.

II 395. Federal resHTe banks aa depositaries, custo-

dians and fiscal agents for Commodity Credit

Corporation

The Federal Reserve banks are authorized to

act as depositaries, custodians, and fiscal agents

for the Commodity Credit Corporation.

<July 16, 1943, ch. 241, 3, 57 Stat. 566.)

TRANsFER or FtmcnoNS

Administration of program of Commodity Credit

Corporation transferred to Secretary of Agriculture by

Reorg. Plan No. 3 of 1948, 501, eU. July 16, 1946, 11

F.R. 7877, 60 Stat. 1100. See Appendix to Title 5. Gov-

ernment Organization and Employees.

Exc:r:ntOJIS FaOU: TRANSFER OP F'uNCriOMS

Punctlons of Corporations of Department of Agri-

culture, boards of directors and officers of such corpo-

rations, Advisory Board of Commodity Credit Corpo-

ration. and Farm Credit Administration or any agency,

officer or entity of, under, or subject to supervision of

Administration were excepted from funeUons of off!

cers, agencies, and employees transferred to Secretary

of Agriculture by Reorg. Plan No. 2 of 1953, 1, eft.

June 4, 1953, 18 P.R. 3219, 67 Stat. 633, set out In the

Appendix to Title 5, Government Organization and

Employees.

SUBCHAPTER XII-FEDERAL RESERVE

NOTES

411. IBIIuanee tD reserve banks; nature of obligation;.

redemption

Federal reserve notes, to be issued at the dis-

cretion of the Board of Governors ot the Feder-

al Reserve System for the purpose of making

advances to Federal reserve banks through the

Federal reserve agents as hereinafter set forth

and for no other purpose, are authorized. The

said notes shall be obligations of the United

States and shall be receivable by all national

and member banks and Federal reserve banks

and for all taxes, customs, and other public

dues. They shall be redeemed in lawful money

on demand at the Treasury Department of the

United States, in the city of Washington, Dis-

trict of Columbia, or at any Federal Reserve

bank..

(Dec. 23, 1913, ch. 6, 16 (par.>; 38 Stat. 265;

Jan. 30, 1934, ch. 6, 2(b)<l), 48 Stat. 337; Aug.

23, 1935, ch. 614, title n. 203(a), 49 Stat. 704.)

REI"ERJlMCES IN TExT

Phrase "hereinafter set forth" Is from section 16 of

the Federal Reserve Act. act Dec. 23, 1913. Reference

probably means as set .forth in sections 17 et seq. of

the Federal Reserve Act. For classification of these

sections to the Code, see Tables.

CODU'ICATION

Section Is comprised of fltst par. or section 16 of act

Dec. 23, 1913. Pars. 2 to 4, 5, and 6. 7, 8 to 11, 13 and 14

of section 18, and pars. 15 to 18 of section 16 as added

June 21, 1917, ch. 32, 8, 40 Stat. 238, are classified to

sections 412 to 414. 415, 416, 418 to 421. 360. 248-1, and

467, respectively, of this title .

Par. of secUon 16, lormerly classified to section

of ttus title, was repealed by act June 26, 1934, ch.

756, 1, 48 Stat. 1225;

AMENJIMEIITS

1934--Act Jan. 30, 1934. struck out from last sen-

tence provision permitting redemption In gold.

CH.\NGI: OP N.ua

Section 203<a> of act Aug. 23, 1935, changed name of

Federal Reserve Board to Board of Governors of the

Federal Reserve System.

CRoss REni!BKCES

Gold coinage discontinued. see section 51i2 of Title

31, Money and PJnance,

SECTION Rl:PElUt!:D TO IN Ol'B:ER SECTIONS

This seetlon Is referred to In sections 348. 420, 421,

407 of this title.

412. Application for notes; coHateml required

Any Federal Reserve bank may ma.ke applica-

tion tO the local Federal Reserve agent for such

amount of the Federal Reserve notes hereinbe-

fore provided for as it may requlre. Such appli-

cation shall be accompanied with a tender to

the local Federal Reserve a.gent of collateral in

amount equal to the sum of the Federal Re-

serve notes thus applied for and issued pursu-

ant to such application. The collateral security

thus offered shall be notes, drafts, of ex-

change, or acceptances acquired under the pro-

visions of sections 342 to 347, 347c. 347d, and

372 of this title, or bills of exchange endorsed

by a member bank of any Federal Reserve dis-

trict and purchased under the provisions of sec-

tions 348a and 353 to 359 of this title, or bank-

ers' acceptances purchased under the provisions

of said sections 348a a.nd 353 to 359 of this title,

or gold certificates, or Special Drawing Right

certificates, or any obligations which are direct

obligations of, or are fully guaranteed as to

principal- a.nd interest by, the United states or

any agency thereof, or assets that Federal Re-

serve banks may purchase or hold under sec-

tions 348a. and 353 to 359 of this title. In no

event shall such collateral security be less than

the amount of Federal Reserve notes applied

for. The Federal Reserve agent shall each day

notify the Board of Governors of the Federal

Reserve System of all issues and withdrawals of

Federal Reserve notes to and by the Federal

Reserve bank to which he is accredited. The

said Board of Governors of the Federal Reserve

System may at any time call upon a. Federal

Reserve bank for additional security to protect

the Federal Reserve notes issued to lt. Collater-

al shall not be required for Federal Reserve

notes which are held in the vaults of Federal

Reserve banks.

CDec. 23, 1913, ch. 6, 16 (par.), 38 Stat. 265;

Sept. 7, 1916, ch. 461, 39 Stat. 754; June 21,

1917, ch. 32, 7, 40 Stat. 236; Feb. 27, 1932, ch.

58, 3, 47 Stat. 57; Feb. 3, 1933, ch. 34, 47 Stat.

794; Jan. 30, 1934, ch. 6, 2<b><2>, 48 Stat. 338;

Mar. 6, 1934, ch. 47, 48 Stat. 398; Aug. 23, 1935,

ch. 614, title II, 203(a), 49 Stat. 704; Mar. l,

1937, ch. 20, 50 Stat. 23; June 30, 1939, ch. 256,

53 Stat. 991; June 30, 1941, ch. 264, 55 Stat. 395;

May 25, 1943, ch. 102, 57 Stat. 85; June 12, 1945,

I

'"

Das könnte Ihnen auch gefallen

- Constitution of the State of Minnesota — 1876 VersionVon EverandConstitution of the State of Minnesota — 1876 VersionNoch keine Bewertungen

- Nonprofit Law for Religious Organizations: Essential Questions & AnswersVon EverandNonprofit Law for Religious Organizations: Essential Questions & AnswersBewertung: 5 von 5 Sternen5/5 (1)

- Phoenix Rising: From Rock Bottom to Your Best LifeVon EverandPhoenix Rising: From Rock Bottom to Your Best LifeNoch keine Bewertungen

- The Constitutional Case for Religious Exemptions from Federal Vaccine MandatesVon EverandThe Constitutional Case for Religious Exemptions from Federal Vaccine MandatesNoch keine Bewertungen

- Naked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsVon EverandNaked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsNoch keine Bewertungen

- The Declaration of Independence: A Play for Many ReadersVon EverandThe Declaration of Independence: A Play for Many ReadersNoch keine Bewertungen

- Letter of Credit InstructionsDokument2 SeitenLetter of Credit InstructionsHenry Franks100% (2)

- National Banking Holiday RegulationsDokument2 SeitenNational Banking Holiday RegulationsA. J. BeyNoch keine Bewertungen

- Affidavit of Homeless Status For Fee Exempt Certified Copy of Birth CertificateDokument2 SeitenAffidavit of Homeless Status For Fee Exempt Certified Copy of Birth CertificateStephanie's World0% (1)

- Administrative Processing A Complete Guide - 2019 EditionVon EverandAdministrative Processing A Complete Guide - 2019 EditionNoch keine Bewertungen

- Constitution of the State of Minnesota — 1974 VersionVon EverandConstitution of the State of Minnesota — 1974 VersionNoch keine Bewertungen

- 1damages Unto You by The Bank1Dokument2 Seiten1damages Unto You by The Bank1bperkyNoch keine Bewertungen

- Cases On Tender of PaymentDokument2 SeitenCases On Tender of PaymentAngelo LopezNoch keine Bewertungen

- Ch.6 Bills of Exchange Principles of Accounting NotesDokument7 SeitenCh.6 Bills of Exchange Principles of Accounting NotesMUHAMMAD AMIRNoch keine Bewertungen

- Virginia Quit Claim Deed FormDokument2 SeitenVirginia Quit Claim Deed FormLj PerrierNoch keine Bewertungen

- Public Letter to Bank Requests Renting After ForeclosureDokument2 SeitenPublic Letter to Bank Requests Renting After Foreclosuremptacly9152Noch keine Bewertungen

- The Law Governing Negotiable Instruments E1Dokument6 SeitenThe Law Governing Negotiable Instruments E1Muzammal Sarwar100% (1)

- Lawfully Yours: The Realm of Business, Government and LawVon EverandLawfully Yours: The Realm of Business, Government and LawNoch keine Bewertungen

- Uscode-2015-Chapter 2a-Securities and Trust IndenturesDokument78 SeitenUscode-2015-Chapter 2a-Securities and Trust IndenturesS Pablo AugustNoch keine Bewertungen

- AFV AND CONSIDERATION TENDERED TO CONVERGENT OUTSOURCING, INC. (COX COMMUNICATIONS) For MARK MENO©™Dokument33 SeitenAFV AND CONSIDERATION TENDERED TO CONVERGENT OUTSOURCING, INC. (COX COMMUNICATIONS) For MARK MENO©™MARK MENO©™Noch keine Bewertungen

- Once A Mortgage Always A MortgageDokument4 SeitenOnce A Mortgage Always A MortgageRupeshPandyaNoch keine Bewertungen

- Lawful Money Defined: What It Is and How It Differs From Fiat CurrencyDokument4 SeitenLawful Money Defined: What It Is and How It Differs From Fiat CurrencyLedoNoch keine Bewertungen

- Notice of BillDokument4 SeitenNotice of BillSultana Latisah ElBeyNoch keine Bewertungen

- Report Promissory NoteDokument4 SeitenReport Promissory NoteSaiyidah syafiqahNoch keine Bewertungen

- Civil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithVon EverandCivil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithNoch keine Bewertungen

- An Elementary Explanation of MoneyDokument7 SeitenAn Elementary Explanation of MoneyrooseveltkyleNoch keine Bewertungen

- 7 Day Notice No CureDokument2 Seiten7 Day Notice No CureunapantherNoch keine Bewertungen

- Chapter 9 Bills of ExchangeDokument12 SeitenChapter 9 Bills of ExchangeShaira BugayongNoch keine Bewertungen

- CFPB Mortgage Request-Error-ResolutionDokument4 SeitenCFPB Mortgage Request-Error-Resolutionmptacly9152Noch keine Bewertungen

- SHULTZYS Bill Notice-Fourth Letter 27-02-2023Dokument3 SeitenSHULTZYS Bill Notice-Fourth Letter 27-02-2023Michael SchulzeNoch keine Bewertungen

- Debt Collector Dispute Letter 1Dokument1 SeiteDebt Collector Dispute Letter 1Elcana MathieuNoch keine Bewertungen

- Promissory Note Secured FormDokument3 SeitenPromissory Note Secured Formsteve100% (1)

- Means of RemittancesDokument39 SeitenMeans of RemittancesMADHULIKAANoch keine Bewertungen

- Banker As SuretyDokument10 SeitenBanker As SuretyManu AyilyathNoch keine Bewertungen

- Power of AttorneyDokument2 SeitenPower of AttorneyCFBISD100% (1)

- How to Make Your Credit Card Rights Work for You: Save MoneyVon EverandHow to Make Your Credit Card Rights Work for You: Save MoneyNoch keine Bewertungen

- 8832 PDFDokument1 Seite8832 PDFIlija RistevskiNoch keine Bewertungen

- CFR's 220Dokument845 SeitenCFR's 220EheyehAsherEheyehNoch keine Bewertungen

- An Analysis of Chambers Usa Rankings For Amlaw 200 FirmsDokument5 SeitenAn Analysis of Chambers Usa Rankings For Amlaw 200 FirmsDante Gabriel RecideNoch keine Bewertungen

- IRS Publication 962Dokument2 SeitenIRS Publication 962Francis Wolfgang UrbanNoch keine Bewertungen

- Wage and Tax StatementDokument6 SeitenWage and Tax StatementNick RubleNoch keine Bewertungen

- Sample Computaion of Estate TaxDokument6 SeitenSample Computaion of Estate TaxlheyniiNoch keine Bewertungen

- Measuring The Fdi Attractiveness in The Eap Countries From An Institutional PerspectiveDokument10 SeitenMeasuring The Fdi Attractiveness in The Eap Countries From An Institutional Perspectivefaq111Noch keine Bewertungen

- Corporation Application For Tentative Refund: Sign HereDokument1 SeiteCorporation Application For Tentative Refund: Sign HereIRSNoch keine Bewertungen

- Aashto T26Dokument2 SeitenAashto T26filipe33% (6)

- Long-Term Rating Grades Mapping TableDokument1 SeiteLong-Term Rating Grades Mapping TableSidrah ShaikhNoch keine Bewertungen

- MarketSmiths Growth250 (Total 300) 25-50Dokument1 SeiteMarketSmiths Growth250 (Total 300) 25-50LNoch keine Bewertungen

- Description: Tags: 0506Top100ConsolidatorspublicDokument3 SeitenDescription: Tags: 0506Top100Consolidatorspublicanon-101724Noch keine Bewertungen

- BYMA Tabla CEDEAR 20190923 PDFDokument8 SeitenBYMA Tabla CEDEAR 20190923 PDFMarcosConocenteNoch keine Bewertungen

- US Internal Revenue Service: I1040 - 1997Dokument84 SeitenUS Internal Revenue Service: I1040 - 1997IRSNoch keine Bewertungen

- Propertytax ReliefDokument2 SeitenPropertytax ReliefJohny HoNoch keine Bewertungen

- MyPay PDFDokument1 SeiteMyPay PDFPaul BeznerNoch keine Bewertungen

- SETTLING BANKS MONTH ENDDokument2 SeitenSETTLING BANKS MONTH ENDjacque zidane0% (1)

- BMI-Africa IRS EIN #Dokument3 SeitenBMI-Africa IRS EIN #Joseph VillarosaNoch keine Bewertungen

- Instructions For Student: CorrectedDokument1 SeiteInstructions For Student: CorrectedBipal GoyalNoch keine Bewertungen

- Birth Certificate Bond Order TemplateDokument2 SeitenBirth Certificate Bond Order TemplateKonan Snowden96% (49)

- Apply IRS Individual Taxpayer ID Number FormDokument1 SeiteApply IRS Individual Taxpayer ID Number Formdesikudi9000Noch keine Bewertungen

- TOP 100 Multinational CompaniesDokument7 SeitenTOP 100 Multinational CompaniesMy FakeNoch keine Bewertungen

- New Deal Powerpoint - LessonDokument16 SeitenNew Deal Powerpoint - Lessonapi-299135311100% (1)

- Request IRS Tax Transcript OnlineDokument3 SeitenRequest IRS Tax Transcript OnlineAsjsjsjsNoch keine Bewertungen

- Form 4506-T (Rev. 11-2021)Dokument1 SeiteForm 4506-T (Rev. 11-2021)keyNoch keine Bewertungen

- Top US government vendors by obligationsDokument152 SeitenTop US government vendors by obligationsFhreewayNoch keine Bewertungen

- Adp Pay Stub TemplateDokument1 SeiteAdp Pay Stub Templateluis gonzalezNoch keine Bewertungen

- 4 Types of Retirement Plans and Employer-Sponsored PlansDokument1 Seite4 Types of Retirement Plans and Employer-Sponsored PlansThanu SuthatharanNoch keine Bewertungen

- Bank Failures in 2010Dokument14 SeitenBank Failures in 2010Richarnellia-RichieRichBattiest-CollinsNoch keine Bewertungen

- Making Use of The Illinois Rules - Part 1: Reducing Illinois Estate Taxes Through Lifetime GiftsDokument36 SeitenMaking Use of The Illinois Rules - Part 1: Reducing Illinois Estate Taxes Through Lifetime Giftsrobertkolasa100% (1)

- Taxation 1 ExercisesDokument2 SeitenTaxation 1 ExercisesJohn Rey Bantay RodriguezNoch keine Bewertungen

- CBO Reid Letter HR3590Dokument28 SeitenCBO Reid Letter HR3590clyde2400Noch keine Bewertungen