Beruflich Dokumente

Kultur Dokumente

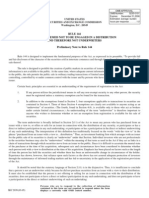

SEC Rule 144A - Private Placement For Investment Purposes

Hochgeladen von

Linda RougeuxOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

SEC Rule 144A - Private Placement For Investment Purposes

Hochgeladen von

Linda RougeuxCopyright:

Verfügbare Formate

ADVOCATES FOR JUSTICE

Linda J. Rougeux, President

MEMO

PRIVATE PLACEMENT FOR INVESTMENT PURPOSES

SEC RULE 144A

An administrative rule under the SEC allowing, under certain circumstances, for qualified institutional investors to trade certain securities with other institutional investors without registering the trade with the SEC. The rule requires that the private placement be for investment purposes and not for resale to the general public. These securities are traded on the NASDAQ Portal Market.

The rule was designed to develop a more liquid and efficient institutional resale market for unregistered securities. Specifically, the rule allows private companies, both domestic and international, to sell unregistered securities, also known as Rule 144 securities, to qualified institution buyers (QIBs) through a broker-dealer. The rule also permits QIBs to buy and sell these securities among themselves. To be a QIB, the institution must control a securities portfolio of $100 million or more.

Among the advantages of using Rule 144A programs are (1) no public disclosure of innovative structures or sensitive information; (2) limited FINRA filing requirements; and (3) reduced potential for liability under the Securities Act. Such securities to be resold in the United States or to United States persons without registrations, the requirements of Rule 144 must be met, including the one year/two year holding period.

The securities eligible for resale under Rule 144A are securities of U.S. and foreign issuers that are not listed on a U.S. securities exchange or quoted on a U.S. automated inter-dealer quotation system.

Rule 144A provides that reoffers and resales in compliance with the rule are not distributions and that the reseller is therefore not an underwriter within the meaning of Section 2(a)(11) of the Securities Act. A reseller that is not the issuer, an underwriter, or a dealer can rely on the exemption provided by Section 4(1) of the Securities Act. Resellers that are dealers can rely on the exemption provided by Section 4(3) of the Securities Act. Eligible purchasers under Rule 144A can be entities formed solely for the purpose of acquiring restricted securities, so long as they satisfy the qualifying QIB tests. Source: SEC Release No. 33-6862 (April 23, 1990).

COMPLIANCE QUESTIONS: Is the reseller an institution and not an individual? Does the involved QIB control a securities portfolio of $100 million or more? Was the unregistered security resold to the general public?

By Linda J. Rougeux, Advocates for Justice June 2012

Contact Advocates for Justice for Securitization, Compliance and Commercial Loan Audits, Chain of Title Assessments, Consumer Mortgage Litigation Support Consultant, Quiet Title and Expert Witness Services. New Service: Qualification Interview of Prospective Attorneys Bloomberg Securitization Trust Identity Look Ups and Auditing Services

Das könnte Ihnen auch gefallen

- 31 CFR 363-Definitions For TDA Acct - Minor Acct, Delinking Acct., GAIN CONTROLDokument7 Seiten31 CFR 363-Definitions For TDA Acct - Minor Acct, Delinking Acct., GAIN CONTROLSteveManning100% (5)

- Void Where Prohibited by Law: Private Issue Private IssueDokument1 SeiteVoid Where Prohibited by Law: Private Issue Private IssueMikeDouglas89% (18)

- Grant Deed: Recording Requested by and When Recorded, Mail ToDokument2 SeitenGrant Deed: Recording Requested by and When Recorded, Mail ToSim Cooke100% (1)

- The Gift of ADHDDokument233 SeitenThe Gift of ADHDGerman Rosales Vargas100% (3)

- Treasury Direct Information On Marketable SecuritiesDokument2 SeitenTreasury Direct Information On Marketable SecuritiesMARSHA MAINES50% (2)

- How To Secure A Bank Account From Levy - UpdatedDokument3 SeitenHow To Secure A Bank Account From Levy - Updatedrichard_rowland100% (4)

- Private Banking Full SyllabusDokument10 SeitenPrivate Banking Full SyllabusAnand VemugantiNoch keine Bewertungen

- Foreign Trusts - Form 3520 and From 3520-A-Filing Deadlines and Liability of A Decedent's EstateDokument5 SeitenForeign Trusts - Form 3520 and From 3520-A-Filing Deadlines and Liability of A Decedent's EstateSteveManning100% (4)

- Depository Trust CompanyDokument11 SeitenDepository Trust CompanyAntonio Luiz100% (6)

- Units of Beneficial Interest CertificateDokument1 SeiteUnits of Beneficial Interest CertificateRJ Landry90% (10)

- Profile Summary Role & ResponsibilitiesDokument2 SeitenProfile Summary Role & ResponsibilitiesGurleenNoch keine Bewertungen

- Collecting Judgement StepsDokument14 SeitenCollecting Judgement Steps1tonsils100% (2)

- TCUs TRUST CAPITAL UNITS CERTIFICATE GREEN BORDER EDITABLEDokument1 SeiteTCUs TRUST CAPITAL UNITS CERTIFICATE GREEN BORDER EDITABLE:Nikolaj: Færch.Noch keine Bewertungen

- Creating Perfect Security Interests A PremirDokument19 SeitenCreating Perfect Security Interests A Premirdratty100% (1)

- 144 ADokument9 Seiten144 AAmrin NazNoch keine Bewertungen

- Bankers Acceptance CondensedDokument5 SeitenBankers Acceptance CondensedLuka Ajvar100% (1)

- Foreign Situs TrustsDokument31 SeitenForeign Situs TrustsBálint Fodor100% (3)

- Living Trust Funding Worksheet - MarriedDokument14 SeitenLiving Trust Funding Worksheet - MarriedRocketLawyerNoch keine Bewertungen

- Form OC-10 Appl 4 FRNDokument51 SeitenForm OC-10 Appl 4 FRNBenne James100% (4)

- Account Relationships: Federal Reserve Banks Operating Circular 1Dokument18 SeitenAccount Relationships: Federal Reserve Banks Operating Circular 1Wesley Davis100% (3)

- TCUs TRUST CAPITAL UNITS BLUE BORDER EDITABLEDokument1 SeiteTCUs TRUST CAPITAL UNITS BLUE BORDER EDITABLEBIGBOY100% (1)

- 1973 UN Internationally Protected PersonsDokument8 Seiten1973 UN Internationally Protected PersonsSofia marisa fernandesNoch keine Bewertungen

- FR Coll GuidelinesDokument23 SeitenFR Coll GuidelinesJustaNoch keine Bewertungen

- The Setting SunDokument61 SeitenThe Setting Sunmarina1984100% (7)

- W8 Instructions PDFDokument15 SeitenW8 Instructions PDFKrisdenNoch keine Bewertungen

- Justice at Salem Reexamining The Witch Trials!!!!Dokument140 SeitenJustice at Salem Reexamining The Witch Trials!!!!miarym1980Noch keine Bewertungen

- Ford Motor Company-Issuer-Jp Morgan Trustee-Trust IndentureDokument49 SeitenFord Motor Company-Issuer-Jp Morgan Trustee-Trust IndentureAlex G Stoll100% (1)

- Ucc Security Interests OpinionsDokument72 SeitenUcc Security Interests OpinionstrustkonanNoch keine Bewertungen

- 26 CFR 1.671-5 - Reporting For Widely Held Fixed Investment TrustsDokument43 Seiten26 CFR 1.671-5 - Reporting For Widely Held Fixed Investment Trustspatricklaverty100% (1)

- The Exempt Offering Secondary MarketDokument8 SeitenThe Exempt Offering Secondary MarketDouglas SlainNoch keine Bewertungen

- Crochet World October 2011Dokument68 SeitenCrochet World October 2011Lydia Lakatos100% (15)

- Fidelity Certification of TrustDokument2 SeitenFidelity Certification of Trustvicki forchtNoch keine Bewertungen

- Foriegn Grantor Trusts - 2010 HIRE ActDokument9 SeitenForiegn Grantor Trusts - 2010 HIRE ActGary S. Wolfe100% (2)

- SecuritizationDokument31 SeitenSecuritizationSaravanan SnrNoch keine Bewertungen

- Private BankingDokument2 SeitenPrivate BankingAnwar Ludin50% (2)

- ) $1M Note Purchase AgreementDokument16 Seiten) $1M Note Purchase AgreementAndré MoschettiNoch keine Bewertungen

- SECURITIES Mode of Charging SecuritiesDokument32 SeitenSECURITIES Mode of Charging SecuritiesMohammad Shahnewaz HossainNoch keine Bewertungen

- Introduction To DTCCDokument11 SeitenIntroduction To DTCCefx8x75% (4)

- Bill of Sale: The John Smith Doe TrustDokument1 SeiteBill of Sale: The John Smith Doe TrustSim CookeNoch keine Bewertungen

- Va Grantor Trust Outline 010711Dokument48 SeitenVa Grantor Trust Outline 010711Bob MasonNoch keine Bewertungen

- Sav1455 PDFDokument6 SeitenSav1455 PDFTed100% (1)

- Tesla Trust IndentureDokument102 SeitenTesla Trust IndenturejjNoch keine Bewertungen

- Deed of TrustDokument15 SeitenDeed of TrustAllen-nelson of the Boisjoli family100% (1)

- Illustration 1) Shows A Basic: TrusteeDokument1 SeiteIllustration 1) Shows A Basic: TrusteeMazloom ShikariNoch keine Bewertungen

- Name of Trust: Units of Beneficial InterestDokument2 SeitenName of Trust: Units of Beneficial Interest:Nikolaj: Færch.100% (1)

- Unincorporated Business Organizations: SocietasDokument31 SeitenUnincorporated Business Organizations: Societasal mooreNoch keine Bewertungen

- Power of Attorney and Declaration of RepresentativeDokument2 SeitenPower of Attorney and Declaration of RepresentativeEri TakataNoch keine Bewertungen

- P.O.A. TrustDokument2 SeitenP.O.A. Trustjoe100% (1)

- Non Marketable Financial Assets & Money Market SecuritiesDokument3 SeitenNon Marketable Financial Assets & Money Market Securities020Elisya MufadilahNoch keine Bewertungen

- UBIs UNITS OF BENEFICIAL INTEREST CERTIFICATE BLUE BORDER EDITABLEDokument1 SeiteUBIs UNITS OF BENEFICIAL INTEREST CERTIFICATE BLUE BORDER EDITABLE:Nikolaj: Færch.100% (2)

- Articles of AssociationDokument2 SeitenArticles of AssociationMadan MathodNoch keine Bewertungen

- Leixner (1999) Securitization of Financial Assets - An IntroductionDokument8 SeitenLeixner (1999) Securitization of Financial Assets - An Introductionapi-3778585Noch keine Bewertungen

- Rule 144Dokument7 SeitenRule 144JoelMFunk100% (1)

- Private Placement Memorandum Blackcommerce, LLC: Page 1 of 111Dokument112 SeitenPrivate Placement Memorandum Blackcommerce, LLC: Page 1 of 111Viper 6058100% (1)

- Loan Agreement and Promissory NoteDokument4 SeitenLoan Agreement and Promissory NoteSJ GeronimoNoch keine Bewertungen

- Revocable TrustDokument5 SeitenRevocable TrustempoweredwendyNoch keine Bewertungen

- Rights and Duties of Beneficial OwnerDokument7 SeitenRights and Duties of Beneficial Ownerdeepa100% (2)

- Chapter 8 Supplier Quality ManagementDokument71 SeitenChapter 8 Supplier Quality ManagementAnh NguyenNoch keine Bewertungen

- PMP Chapter-12 P. Procurement ManagementDokument30 SeitenPMP Chapter-12 P. Procurement Managementashkar299Noch keine Bewertungen

- Formation of Charitable TrustDokument36 SeitenFormation of Charitable TrusteBook ManisNoch keine Bewertungen

- Depository AssignmentDokument11 SeitenDepository AssignmentDinesh GodhaniNoch keine Bewertungen

- Remittance Processing System (RPS)Dokument7 SeitenRemittance Processing System (RPS)Noman DxNoch keine Bewertungen

- Sav 0105Dokument1 SeiteSav 0105MichaelNoch keine Bewertungen

- Campos V BPI (Civil Procedure)Dokument2 SeitenCampos V BPI (Civil Procedure)AngeliNoch keine Bewertungen

- PFASDokument8 SeitenPFAS王子瑜Noch keine Bewertungen

- UNIT VI. Gunpowder and ExplosivesDokument6 SeitenUNIT VI. Gunpowder and ExplosivesMariz Althea Jem BrionesNoch keine Bewertungen

- COSMO NEWS September 1, 2019 EditionDokument4 SeitenCOSMO NEWS September 1, 2019 EditionUnited Church of Christ in the PhilippinesNoch keine Bewertungen

- STD 4 Maths Half Yearly Revision Ws - 3 Visualising 3D ShapesDokument8 SeitenSTD 4 Maths Half Yearly Revision Ws - 3 Visualising 3D ShapessagarNoch keine Bewertungen

- ACA 122-My Academic Plan (MAP) Assignment: InstructionsDokument5 SeitenACA 122-My Academic Plan (MAP) Assignment: Instructionsapi-557842510Noch keine Bewertungen

- 11 PJBUMI Digital Data Specialist DR NOOR AZLIZADokument7 Seiten11 PJBUMI Digital Data Specialist DR NOOR AZLIZAApexs GroupNoch keine Bewertungen

- TAX Report WireframeDokument13 SeitenTAX Report WireframeHare KrishnaNoch keine Bewertungen

- Test For Determining Agency - Analysis Using Case LawsDokument7 SeitenTest For Determining Agency - Analysis Using Case Lawsanitta joseNoch keine Bewertungen

- Provisional DismissalDokument1 SeiteProvisional DismissalMyra CoronadoNoch keine Bewertungen

- 2beloved Lizzo PDFDokument1 Seite2beloved Lizzo PDFAntwerpQueerChoir AQCNoch keine Bewertungen

- Algebra Lineal Septima Edicion Stanley I. Grossman S. Mcgraw-Hilliinteramericana Editores S.A. de C.V Mexico, DFDokument1 SeiteAlgebra Lineal Septima Edicion Stanley I. Grossman S. Mcgraw-Hilliinteramericana Editores S.A. de C.V Mexico, DFJOSE JULIAN RAMIREZ ROJASNoch keine Bewertungen

- Literature StudyDokument20 SeitenLiterature StudyAnn NambiaparambilNoch keine Bewertungen

- John Wick 4 HD Free r6hjDokument16 SeitenJohn Wick 4 HD Free r6hjafdal mahendraNoch keine Bewertungen

- StrategiesDokument7 SeitenStrategiesEdmar PaguiriganNoch keine Bewertungen

- DentinogenesisDokument32 SeitenDentinogenesisNajeeb UllahNoch keine Bewertungen

- Glyn Marston, Town Crier - Barry McQueen and Dept. Mayor - Tony LeeDokument1 SeiteGlyn Marston, Town Crier - Barry McQueen and Dept. Mayor - Tony LeeJake HoosonNoch keine Bewertungen

- Sap Successfactors Training Materials Guide: April 2020Dokument4 SeitenSap Successfactors Training Materials Guide: April 2020pablo picassoNoch keine Bewertungen

- Pedia Edited23 PDFDokument12 SeitenPedia Edited23 PDFAnnJelicaAbonNoch keine Bewertungen

- Diffusion Osmosis Enzymes Maths and Write Up Exam QuestionsDokument9 SeitenDiffusion Osmosis Enzymes Maths and Write Up Exam QuestionsArooj AbidNoch keine Bewertungen

- Goldilocks and The Three BearsDokument2 SeitenGoldilocks and The Three Bearsstepanus delpiNoch keine Bewertungen

- 215 Final Exam Formula SheetDokument2 Seiten215 Final Exam Formula SheetH.C. Z.Noch keine Bewertungen

- Unit 4: Alternatives To ImprisonmentDokument8 SeitenUnit 4: Alternatives To ImprisonmentSAI DEEP GADANoch keine Bewertungen

- Coaching Manual RTC 8Dokument1 SeiteCoaching Manual RTC 8You fitNoch keine Bewertungen