Beruflich Dokumente

Kultur Dokumente

4 - The Theory of The Firm and The Cost of Production

Hochgeladen von

malingapereraOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

4 - The Theory of The Firm and The Cost of Production

Hochgeladen von

malingapereraCopyright:

Verfügbare Formate

The Theory of the Firm and the cost of production

Production Function

States the relationship between inputs and outputs or maximum output from various combinations of factors in puts. Inputs the factors of production classified as: Input Description Land All natural resources of the earth. Rent Labour all physical and mental human effort involved in production Wages Capital buildings, machinery and equipment not used for its own sake but for the contribution it makes to production Interest

Price paid to acquire

Mathematical representation of the relationship:

= (, , )

Q - Output K - Capital L - Land La - Labor

Full note set with Examples and Questions: http://www.executioncycle.lkblog.com/2012/06/mybusiness-economics-and-financial.html

Analysis of Production Function (Short Run and Long run): Short Run In the short run at least one factor fixed in supply but all other factors capable of being changed Reflects ways in which firms respond to changes in output (demand) Can increase or decrease output using more or less of some factors but some likely to be easier to change than others.

Long Run The long run is defined as the period taken to vary all factors of production By doing this, the firm is able to increase its total capacity not just short-term capacity and Associated with a change in the scale of production The period varies according to the firm and the industry In electricity supply, the time taken to build new capacity could be many years; for a market stallholder, the long run could be as little as a few weeks

Marginal Product The marginal product of any input in the production process is the increase in output that arises from an additional unit of that input = Diminishing Marginal Product Diminishing marginal product is the property whereby the marginal product of an input declines as the quantity of the input increases. Example: As more and more workers are hired at a firm, each additional worker contributes less and less to production because the firm has a limited amount of equipment. In the short run, a production process is characterized by a fixed amount of available land and capital. As more labour is hired, each unit of labour has less capital and land to work with.

Full note set with Examples and Questions: http://www.executioncycle.lkblog.com/2012/06/mybusiness-economics-and-financial.html

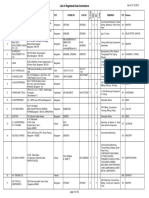

Units of L

Total Product (QL or TPL)

Marginal Product (MPL) 2 4 6 8 6 4 2 0 -2 -4

0 1 2 3 4 5 6 7 8 9 10

0 2 6 12 20 26 30 32 32 30 26

TP Total Product MP Marginal Product AP Average product

Full note set with Examples and Questions: http://www.executioncycle.lkblog.com/2012/06/mybusiness-economics-and-financial.html

Costs

In buying factor inputs, the firm will incur costs Costs are classified as: Fixed costs (FC) costs that are not related directly to production rent, rates, insurance costs, admin costs. They can change but not in relation to output Variable Costs (VC) costs directly related to variations in output. Raw materials primarily

Total Cost (TC) - the sum of all costs incurred in production = + Average Cost (AC) the cost per unit of output = / Marginal Cost (MC) the cost of one more or one fewer units of production = 1 =

Short run Diminishing marginal returns results from adding successive quantities of variable factors to a fixed factor Long run Increases in capacity can lead to increasing, decreasing or constant returns to scale

Full note set with Examples and Questions: http://www.executioncycle.lkblog.com/2012/06/mybusiness-economics-and-financial.html

Relationships between Costing and Production

Here I guess that first graph is obvious, in second the increasing increase is due to the increasing increase in the MC as shown in first set of graphs.

Revenue

Full note set with Examples and Questions: http://www.executioncycle.lkblog.com/2012/06/mybusiness-economics-and-financial.html

Total revenue the total amount received from selling a given output = Average Revenue the average amount received from selling each unit =

Marginal revenue the amount received from selling one extra unit of output = 1

Profit

=

Profits help in the process of directing resources to alternative uses in free markets Relating price to costs helps a firm to assess profitability in production

Normal Profit the minimum amount required to keep a firm in its current line of production Abnormal or Supernormal profit profit made over and above normal profit Abnormal profit may exist in situations where firms have market power Abnormal profits may indicate the existence of welfare losses Could be taxed away without altering resource allocation

Full note set with Examples and Questions: http://www.executioncycle.lkblog.com/2012/06/mybusiness-economics-and-financial.html

Sub-normal Profit profit below normal profit Firms may not exit the market even if sub-normal profits made if they are able to cover variable costs Cost of exit may be high Sub-normal profit may be temporary (or perceived as such!)

Assumption that firms aim to maximise profit May not always hold true there are other objectives Profit maximising output would be where MC = MR

Full note set with Examples and Questions: http://www.executioncycle.lkblog.com/2012/06/mybusiness-economics-and-financial.html

The Cost of Production

Profit = Total revenue - Total cost Total Cost includes all of the opportunity costs of production Explicit Costs and Implicit Costs Explicit costs are out-of-pocket expenses, such as labour, raw materials, and rent. Implicit costs are foregone expenses, such as the value of your own time, and the value of your own money (interest earned).

Economic Profit versus Accounting Profit Economic profit is smaller than accounting profit

Question: If a firms total revenue is $80,000, and its explicit and implicit costs are $70,000 and $25,000, respectively, what are its economic and accounting profits? Accounting: 35000, Economics: 10000

Full note set with Examples and Questions: http://www.executioncycle.lkblog.com/2012/06/mybusiness-economics-and-financial.html

Total and Per Unit Costs Total Variable Cost (TVC) Total Fixed Cost (TFC) Total Cost (TC) Average Variable Cost (AVC) Average Fixed Cost (AFC) Average Total Cost (ATC) Marginal Cost (MC)

Fixed and Variable Costs Fixed costs are those costs that do not vary with the quantity of output produced. Variable costs are those costs that do change as the firm alters the quantity of output produced. Average Costs Average costs can be determined by dividing the firms costs by the quantity of output produced. The average cost is the cost of each typical unit of product. Marginal Cost Marginal cost (MC) measures the amount total cost rises when the firm increases production by one unit. Question: Fill in the missing values Three Important Properties of Cost Curves 1. Marginal cost eventually rises with the quantity of output. [Law of Diminishing Marginal Returns] 2. The average-total-cost curve is U-shaped. 3. The marginal-cost curve crosses the average-total-cost curve at the minimum of average total cost.

Full note set with Examples and Questions: http://www.executioncycle.lkblog.com/2012/06/mybusiness-economics-and-financial.html

The Long-run Average Cost Curve In the long run, all inputs are variable. A firm has enough time to choose the size of its factory, farm, office building, or other capital goods. The firm can choose from many short-run cost curves. The bottom points of the short-run average cost curves make up the long-run average cost curve. Long-run average costs fall as production first rises. This is called economies of scale. When the firm gets too big, long-run average costs rise. This is called diseconomies of scale (DOS).

Full note set with Examples and Questions: http://www.executioncycle.lkblog.com/2012/06/mybusiness-economics-and-financial.html

Returns to Scale When inputs increase, and production more than proportionately increases, then we speak of increasing returns to scale (associated with economies of scale). Example - Inputs increase by 10%, and production increases by 20%. When inputs increase, and production less than proportionately increases, then we speak of decreasing returns to scale (associated with diseconomies of scale). Example - Inputs increase by 10%, and production increases by 5%. When inputs increase, and production increases by the same percentage, then we speak of constant returns to scale. Example - Inputs increase by 10%, and production increases by 10%.

Full note set with Examples and Questions: http://www.executioncycle.lkblog.com/2012/06/mybusiness-economics-and-financial.html

Das könnte Ihnen auch gefallen

- Question TOFDokument1 SeiteQuestion TOFmalingapereraNoch keine Bewertungen

- OligopolyDokument1 SeiteOligopolymalingapereraNoch keine Bewertungen

- Example - Income and SpendingDokument10 SeitenExample - Income and SpendingmalingapereraNoch keine Bewertungen

- Example: The Annual Overheads Are As FollowsDokument22 SeitenExample: The Annual Overheads Are As FollowsmalingapereraNoch keine Bewertungen

- Monopoly - Short Run EquilibriumDokument3 SeitenMonopoly - Short Run EquilibriummalingapereraNoch keine Bewertungen

- ExampleDokument3 SeitenExamplemalingapereraNoch keine Bewertungen

- ExampleDokument3 SeitenExamplemalingapereraNoch keine Bewertungen

- Prepaire A Statement of CostDokument2 SeitenPrepaire A Statement of CostmalingapereraNoch keine Bewertungen

- Financial Statement AnalysisDokument12 SeitenFinancial Statement AnalysismalingapereraNoch keine Bewertungen

- Example MonopolisticDokument2 SeitenExample Monopolisticmalingaperera0% (1)

- Example 2Dokument5 SeitenExample 2malingapereraNoch keine Bewertungen

- Example Cost-Volume-Profit (CVP) AnalysisDokument5 SeitenExample Cost-Volume-Profit (CVP) AnalysismalingapereraNoch keine Bewertungen

- 8 - Income and SpendingDokument6 Seiten8 - Income and SpendingmalingapereraNoch keine Bewertungen

- EOQ QuestionsDokument3 SeitenEOQ QuestionsmalingapereraNoch keine Bewertungen

- 6 - MacroeconomicsDokument5 Seiten6 - MacroeconomicsmalingapereraNoch keine Bewertungen

- 7 - Monopolistic Competition & OligopolyDokument3 Seiten7 - Monopolistic Competition & OligopolymalingapereraNoch keine Bewertungen

- 6 - Inventory ManagementDokument6 Seiten6 - Inventory ManagementmalingapereraNoch keine Bewertungen

- 7 - Standard CostingDokument4 Seiten7 - Standard CostingmalingapereraNoch keine Bewertungen

- 5 - Perfect Competition and MonopolyDokument4 Seiten5 - Perfect Competition and MonopolymalingapereraNoch keine Bewertungen

- 5 - Cost-Volume-Profit (CVP) AnalysisDokument4 Seiten5 - Cost-Volume-Profit (CVP) AnalysismalingapereraNoch keine Bewertungen

- 2 - Net Present Value ExDokument4 Seiten2 - Net Present Value ExmalingapereraNoch keine Bewertungen

- 4 - Accounting For Overheads and Marginal CostingDokument6 Seiten4 - Accounting For Overheads and Marginal CostingmalingapereraNoch keine Bewertungen

- 1 - Introduction To EconomicsDokument5 Seiten1 - Introduction To EconomicsmalingapereraNoch keine Bewertungen

- 3 - Demand, Supply and The MarketDokument12 Seiten3 - Demand, Supply and The MarketmalingapereraNoch keine Bewertungen

- 2 - Cash Flow and Financial Statement AnalysisDokument14 Seiten2 - Cash Flow and Financial Statement AnalysismalingapereraNoch keine Bewertungen

- Imagine Cup 2012 Software Design RulesDokument11 SeitenImagine Cup 2012 Software Design RulesmalingapereraNoch keine Bewertungen

- 3 - Cost Terms, Concepts, and ClassificationsDokument10 Seiten3 - Cost Terms, Concepts, and ClassificationsmalingapereraNoch keine Bewertungen

- Python 3000 and You: Guido Van Rossum Europython July 7, 2008Dokument21 SeitenPython 3000 and You: Guido Van Rossum Europython July 7, 2008malingapereraNoch keine Bewertungen

- Strength Enhancement in Concrete Confined by SpiralsDokument43 SeitenStrength Enhancement in Concrete Confined by SpiralsmalingapereraNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- HAL Approved Vendors PDFDokument142 SeitenHAL Approved Vendors PDFwinmanjuNoch keine Bewertungen

- Operations Management William J Stevenson 55844fe3a3cd3Dokument16 SeitenOperations Management William J Stevenson 55844fe3a3cd3melakuNoch keine Bewertungen

- Kampada Ispred Poprecne Veze U Profili-ModelDokument1 SeiteKampada Ispred Poprecne Veze U Profili-ModeljodjaNoch keine Bewertungen

- AccountsDokument546 SeitenAccountsRhinosmike100% (1)

- ECO415 ASSIGNMENT ANALYSISDokument7 SeitenECO415 ASSIGNMENT ANALYSISSaleh HashimNoch keine Bewertungen

- Chapter 7 - Operations ManagementDokument9 SeitenChapter 7 - Operations ManagementAnagha PranjapeNoch keine Bewertungen

- Inventory Models: Multiple ChoiceDokument9 SeitenInventory Models: Multiple ChoiceMarwa HassanNoch keine Bewertungen

- PPAP PriruckaDokument10 SeitenPPAP PriruckaKin MattNoch keine Bewertungen

- What Is PQCDSM in TPM Concept - Yahoo AnswersDokument2 SeitenWhat Is PQCDSM in TPM Concept - Yahoo Answersgetashishvaid67% (3)

- ERP Implementation in Service Industry: Key Challenges and BenefitsDokument16 SeitenERP Implementation in Service Industry: Key Challenges and BenefitsasaNoch keine Bewertungen

- Chapter 11 Solutions SummaryDokument22 SeitenChapter 11 Solutions SummarySunny YeoNoch keine Bewertungen

- Production and Cost Estimation: Essential ConceptsDokument6 SeitenProduction and Cost Estimation: Essential ConceptsRohit SinhaNoch keine Bewertungen

- Software Quality AssuranceDokument27 SeitenSoftware Quality AssuranceVaishnavo Devi100% (1)

- Ch04 - Building Competitive Advantage Through Functional-Level StrategyDokument21 SeitenCh04 - Building Competitive Advantage Through Functional-Level StrategyMd. Sazzad Bin Azad 182-11-5934100% (1)

- Data SheetDokument12 SeitenData SheetAJAY1381Noch keine Bewertungen

- CNC HistoryDokument26 SeitenCNC HistoryBas RamuNoch keine Bewertungen

- 3D InCertA PresentationDokument27 Seiten3D InCertA PresentationKubilayNoch keine Bewertungen

- Sample Multiple Choice Test QuestionsDokument15 SeitenSample Multiple Choice Test QuestionsSoofeng LokNoch keine Bewertungen

- Advance Software Engineering: Course Code: MCSE503Dokument10 SeitenAdvance Software Engineering: Course Code: MCSE503Humaun KabirNoch keine Bewertungen

- Notes Unit 3 Project ManagementDokument20 SeitenNotes Unit 3 Project ManagementAvni SharmaNoch keine Bewertungen

- SWOT Analysis Campaign Bolts and Nuts ProductionDokument7 SeitenSWOT Analysis Campaign Bolts and Nuts Productionminimoy86Noch keine Bewertungen

- TPS ChristopherFritze Jan16Dokument13 SeitenTPS ChristopherFritze Jan16IrmaNoch keine Bewertungen

- Diagnose The Underlying Causes of The Difficulties That The JITD Program Was Created To Solve. What Are The Benefits and Drawbacks of This Program?Dokument2 SeitenDiagnose The Underlying Causes of The Difficulties That The JITD Program Was Created To Solve. What Are The Benefits and Drawbacks of This Program?Nitin RajotiaNoch keine Bewertungen

- Facility Optimum Bulgaria RFIDokument3 SeitenFacility Optimum Bulgaria RFIPlamen MichevNoch keine Bewertungen

- Chapter3 CHopraDokument47 SeitenChapter3 CHopraDivyesh ParmarNoch keine Bewertungen

- Who TRS 981 QRMDokument32 SeitenWho TRS 981 QRMrdasarath100% (1)

- Efficient Facility Layout DesignDokument78 SeitenEfficient Facility Layout DesignPrakhar RastogiNoch keine Bewertungen

- Acknowledgement and AbstractDokument6 SeitenAcknowledgement and AbstractSatz TradesNoch keine Bewertungen

- ProductionDokument33 SeitenProductionNaveen Krishna Sunkara0% (1)

- OM MCQ QuizletDokument67 SeitenOM MCQ QuizletRamya Teja VemulaNoch keine Bewertungen