Beruflich Dokumente

Kultur Dokumente

Promissory Note FR Euro Credit Europe Bank

Hochgeladen von

tylerdurdendutchOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Promissory Note FR Euro Credit Europe Bank

Hochgeladen von

tylerdurdendutchCopyright:

Verfügbare Formate

Promissory

Note (Floating Rate) EUR

Place & Date of Issue: Reference Number of Principal Amount :

1/2

Against this Promissory Note we ..........................................................................., a financial institution organized under the laws of the ............................................................ and with offices at .............................................(the Issuer) hereby irrevocably and unconditionally promise to pay to the order of Credit Europe Bank N.V. (the Bank) including any successor, assignee or endorsee thereof, (the Holder) the principal sum of effective ........................ on .......................................... (The Maturity Date) We also unconditionally promise to pay to the Bank or Holder interest on the following dates ....................................................................................................................................................................... (each an Interest Payment Date) at an interest rate which is the aggregate of the six months EURO LIBOR rate plus .............................. per annum margin. LIBOR shall refer to the London Inter Bank Offered Rate as quoted on Reuters page LIBOR01, as fixed at 11.00 a.m. London time, for each period, two business days prior to commencement of each six month interest period as set by the bank or the Holder. Interest shall be calculated on the principal sum on the number of actual days elapsed since the issue date or, as the case may be since the last Interest Payment Date, and on a 360 day basis. In the event that principal and/or interest are not paid on the Maturity date and/or Interest Payment date (each, a Due date), then default interest shall be paid from the Due Date to the date good funds are received by the Bank or Holder at the applicable LIBOR quoted on the Interest Payment Date/ Maturity Date, plus 3.0%per annum. Interest shall be computed on the basis of actual days elapsed over a year consisting of 360 days. If the Issuer fails to pay any amount of interest and/or principal due under this Promissory Note on the Due Date, then the Bank or the Holder of this Promissory Note may declare any outstanding balance immediately due and payable. If payment of principal and/or interest under this promissory Note falls due on a day which is not a business day in New York, London and/or Amsterdam, such Due Date shall be extended to the next following business day and interest shall accrue and be payable for the period of such extension. Pre-payment is not permitted under this note. Effective payment to be made in EUROS without set-off or counterclaim and shall be free and clear of and without deduction or withholding for any tax, impost, levies present or future of any nature. If the Issuer is required by law to deduct or withhold any tax, levy, duties or impost from or in respect of the sum payable hereunder, the sum payable shall be increased as necessary so that after making all required deductions and withholdings, the Bank or the Holder of this Promissory Note receives an amount equal to the sum it would have received had no such deductions or withholdings been made. We confirm that all necessary governmental consents and approvals have been obtained and have been and will be complied with and are and will be in full force and effect for the valid issuance of this Promissory Note to enable payments of principal and interest to be made to the Bank or the Holder on the due Dates.

Credit Europe Bank N.V. Karspeldreef 6A, 1101 CJ Amsterdam The Netherlands

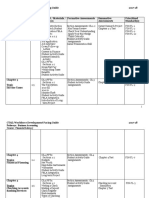

Credit Europe Bank Forfaiting Country List

2/2

The second page of Floating Interest Rate Promissory Note No: The Issuer waives diligence, presentment, demand, protest notice or non-payment notice, dishonor and any other notice whatsoever with respect to this Promissory Note. The failure of the bank or Holder to exercise any of its rights hereunder in any instance shall not constitute a waiver such rights in that or in any other instance. The Issuer agrees to pay on demand all reasonable and documented costs and expenses of the Bank or Holder that are incurred in connection with the enforcement of this Promissory note, including, without limitation, reasonable and documented attorney fees and expenses related thereto. This Promissory Note constitutes a direct, unconditional and unsecured obligation of the Issuer ranking at least pari passu with all other unsecured and unsubordinated obligations of the Issuer resulting from any borrowings or guarantees, except for obligations accorded preference by mandatory provisions of law in the State of New York. This Promissory Note is governed by and is to be construed in accordance with the laws of the ................................................... without regard to its doctrine of conflict of laws. The Issuer, by its execution hereof, (i) agrees that any legal suit, action or proceeding arising from or related to this Note may be instituted ............................................................................. (ii) waives any objection which it may now or hereafter have to the laying of venue of any such suit, action or proceeding; and (iii) irrevocably submits to the jurisdiction of any such court in any such suit, action or proceeding. FOR VALUE RECEIVED This promissory note and any interest are payable against: claims to be made at ................................................................................... For and on behalf of .........................................................................................................

_____________________ (Authorised signatory) Name: Title:

_______________________ (Authorised signatory) Name: Title:

Credit Europe Bank N.V. Karspeldreef 6A, 1101 CJ Amsterdam The Netherlands

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Letter of CreditDokument4 SeitenLetter of CreditRahul Mehrotra67% (3)

- Commerce EM PDFDokument344 SeitenCommerce EM PDFkarthik_be_eeeNoch keine Bewertungen

- Nilson 1183 PDF Way2pay 99 07 15Dokument16 SeitenNilson 1183 PDF Way2pay 99 07 15Elena Elena100% (1)

- Ge Money Bank, Inc. v. Sps DizonDokument2 SeitenGe Money Bank, Inc. v. Sps DizonYetteMargNoch keine Bewertungen

- Hotel Details Check in Check Out Rooms: Guest Name: DateDokument1 SeiteHotel Details Check in Check Out Rooms: Guest Name: DateAARTI AHIRWARNoch keine Bewertungen

- Guthrie-Jensen - Corporate ProfileDokument8 SeitenGuthrie-Jensen - Corporate ProfileRalph GuzmanNoch keine Bewertungen

- Bank Statement 1 Fusionn 1 PDFDokument6 SeitenBank Statement 1 Fusionn 1 PDFBenny BerniceNoch keine Bewertungen

- Introduction To Vault CoreDokument25 SeitenIntroduction To Vault CoreUni QloNoch keine Bewertungen

- Pacing Guide-Financial LiteracyDokument6 SeitenPacing Guide-Financial Literacyapi-377548294Noch keine Bewertungen

- MBA SyllabusDokument4 SeitenMBA SyllabusMorerpNoch keine Bewertungen

- Inbt Finals ReviewerDokument11 SeitenInbt Finals ReviewerQuenie SagunNoch keine Bewertungen

- MCQDokument33 SeitenMCQAnkesh DevNoch keine Bewertungen

- Coprative BankDokument4 SeitenCoprative BankJasmandeep brarNoch keine Bewertungen

- Trust ReceiptsDokument23 SeitenTrust ReceiptskarenkierNoch keine Bewertungen

- National Bank of PakistanDokument27 SeitenNational Bank of Pakistansara243910% (1)

- Data Guide PDFDokument141 SeitenData Guide PDFRudi MSNoch keine Bewertungen

- GL Account Balance QueryDokument5 SeitenGL Account Balance QueryKhalil ShafeekNoch keine Bewertungen

- In McAllenDokument1 SeiteIn McAllenismeldareyna0622Noch keine Bewertungen

- Clarical New ClarificationDokument2 SeitenClarical New Clarificationmevrick_guyNoch keine Bewertungen

- GuggenheimDokument5 SeitenGuggenheimRochester Democrat and ChronicleNoch keine Bewertungen

- A Joint Development Between S R Jindal Group & Prestige GroupDokument2 SeitenA Joint Development Between S R Jindal Group & Prestige GroupSampath Kumar RNoch keine Bewertungen

- Public Provident Fund Scheme 1968: Salient FeaturesDokument16 SeitenPublic Provident Fund Scheme 1968: Salient FeaturesjyottsnaNoch keine Bewertungen

- Carana BankDokument26 SeitenCarana BankRakesh Kolasani NaiduNoch keine Bewertungen

- Business Studies Class11 Chapter 4Dokument8 SeitenBusiness Studies Class11 Chapter 4bhawnaNoch keine Bewertungen

- VFIPL Annual Report FY 2022 23Dokument134 SeitenVFIPL Annual Report FY 2022 23Shiva BhardwajNoch keine Bewertungen

- Customer Relationship ManagementDokument1 SeiteCustomer Relationship ManagementYamini Katakam0% (1)

- Application of Engineering or Mathematical Analysis and Synthesis To Decision Making in EconomicsDokument6 SeitenApplication of Engineering or Mathematical Analysis and Synthesis To Decision Making in EconomicsmizaelledNoch keine Bewertungen

- Engels SEM1 SECONDDokument2 SeitenEngels SEM1 SECONDJolien DeceuninckNoch keine Bewertungen

- One Pager Bajaj Finserv DBS Bank 999+ GST First Year FreeDokument2 SeitenOne Pager Bajaj Finserv DBS Bank 999+ GST First Year FreeAazad JiiNoch keine Bewertungen

- P136 - FIME EMV Tool First To Automate Complex Terminal Integration Testing ProcessesDokument3 SeitenP136 - FIME EMV Tool First To Automate Complex Terminal Integration Testing ProcessesAnonymous 9bkCCPWNoch keine Bewertungen