Beruflich Dokumente

Kultur Dokumente

The Indian Institute of Planning and Management Advanced Accounting Re-Examination Assignment

Hochgeladen von

ravirrkOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Indian Institute of Planning and Management Advanced Accounting Re-Examination Assignment

Hochgeladen von

ravirrkCopyright:

Verfügbare Formate

1

IIPM

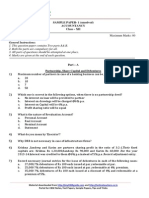

THE INDIAN INSTITUTE OF PLANNING AND MANAGEMENT Advanced Accounting Re-Examination Assignment

Paper Code: IIPM/FIN03/AA004 Max. Marks: 100 General Instructions: The Student should submit this assignment in his/her own handwritten (not in the typed format). The Student should submit this assignment within 2 days from the issue of the assignment. The student should attach this assignment paper with the answered papers. Write legibly and keep the length of the answer as per the weightage (in terms of marks) assigned to each question. DO NOT be unduly short or long in providing the relevant details. The student should only use the Rule sheet papers for answering the questions. Failure to comply with the above instructions would lead to rejection of assignment. Specific Instructions: There are Four Questions in this assignment. The student should answer all the questions along with their subparts. Marks are being assigned to each section of the question as well. Each Question carries equal marks (25 marks) unless specified explicitly.

Question-1(A) The Balance sheet of Bobby Ltd as at 31 March 2011 is as under: Marks] Liabilities 17500 Equity Shares of Rs 100 each fully paid 7000 10% Preference shares of Rs 100 each 15% Debentures Unsecured Loan Creditors Accrued interest on debentures Rs 17,50,000 7,00,000 7,00,000 3,50,000 5,25,000 1,05,000 41,30,000 Assets Patents Freehold Premises Machinery Stock Debtors Bank Profit & Loss A/c Rs 2,45,000 8,75,000 4,72,500 7,00,000 6,30,000 1,75,000 10,32,500 41,30,000

[ 20

The following scheme of reconstruction was passed and approved by the court:

2 (i)A new company Dreamy Ltd to be formed to takeover the entire business of Bobby Ltd. (ii)Dreamy Ltd to issue one equity share of Rs 100, Rs 60 paid up in exchange of every 2 shares in Bobby Ltd. to the shareholders who agree with the scheme. Shareholders who do no agree with the scheme, to be paid @ Rs 20 per share in cash. Such shareholders hold 1400 equity shares. (iii)Preference shareholders to get 15 11% Preference shares of Rs 10 each in exchange of 2 preference shares of Bobby Ltd. (iv)Liability in respect of 15% debenture and interest accrued thereon to be taken over and discharged directly by Dreamy Ltd by issue of equity shares of Rs 100 each fully paid up. (v)The creditors of Bobby Ltd will get from Dreamy Ltd 50% of their dues in cash and 25% in equity shares of Rs 100 each and the balance to be foregone by them. (vi)The freehold premises to be revalued at 20% more. The value of machinery to be reduced by 33-1/3% and that of debtors by 10%. The value of stock to be reduced to Rs 5,60,000. Patents have no value. (vii)The preliminary expenses amounted to Rs 17500. Open Realisation A/c in the books of Bobby Ltd and pass J.Es in the books of Dreamy Ltd. Question-1(B)[5Marks] A company issued 800,000 shares out of which 600,000 were underwritten by A,B,C And D in the ratio of 2:3:1:4. If applications were received for 550,000 shares, find out the liability of each underwriter in the following cases: (a)All applications were unmarked. (b)All applications were marked. (c)Applications for 60% shares were marked. Question.2[25Marks] The following is the Balance Sheet of Thomson Ltd. as on 31 March, 2011 Liabilities 72000 Equity shares of Rs 10 each General Reserve P&L a/c 12% Debentures Creditors Rs 7,20,000 96,000 41,600 3,20,000 2,54,880 Assets Building Plant & Machinery Furniture Patents Investments Debtors Stock Bank Rs

3,40,000 1,80,000 60,000 28,000 92,000 2,40,000 4,48,000 44,480 14,32,480 14,32,480 Thomson Ltd was absorbed by Johnson Ltd on the following terms and conditions: (i)Assume all liabilities and to acquire all assets except investments which were sold by Thomson Ltd at 90% of book value. (ii)Discharge the debentures of Thomson Ltd at a discount of 10% by the issue of 14% Debentures of Rs 100 each in Johnson Ltd. (iii)Patents were of no worth.

3 (iv)Issue of one equity share of Rs 10 in Johnson Ltd, issued at R 12 and a cash payment of Rs 3 for every share in Thomson Ltd. (v)Pay the cost of absorption Rs 4640. (vi)Thomson Ltd sold in the open market half of the shares received from Johnson Ltd at Rs 15 per share. Show the necessary ledger accounts in the books of Thomson ltd and the opening Journal Entries in the books of Johnson Ltd. Question .3(A)[18Marks] Progressive Ltd. makes a public issue of 1,00,000 equity shares of Rs. 10 each at 10%premium.The Board of directors of the company decides that amount per share will be payable as follows by the share holders.

On Application On Allotment Rs. 4 On 1st call

Rs. 3 (including premium) Rs. 4

One of the shareholder Anil holding 1000 shares does not pay the call money and hence in the meeting of the board of directors of the company, it was decided to forfeit his shares. These forfeited shares were reissued by the company as fully paid up @ Rs. 5 per share. You are required to pass necessary journal entries to give effect to above transactions of the company.

Question-3(B)[7Marks] Pass necessary journal entries for the following transactions of Y Ltd. (i) (ii) 50,000 equity shares of Rs. 100 each sub-divided into shares of Rs. 10 each. 2,50,000 preference shares of Rs. 10 each are consolidated in to shares of Rs. 100 each.

Question- 4(A)[10Marks] The share capital of the company consisted of 3,00,000 shares of Rs 20 each fully paid up. For the purpose of reconstruction it was decided to sub-divided shares of Rs 20 each into Shares of Rs.5 each. After that, members decide to surrender 3 out of 4 shares held for reorganization of the company. Pass Journal entries if: (a)The company decides to cancel the shares surrendered by the members.

4 (b)The company reissues 2/3 of the surrendered shares for settlement of liabilities of the book value of Rs 35,00,000. Out of the remaining 1/3 of the surrendered shares, 20% are reissued to public for Rs 2,40,000 and 80% are cancelled at a later stage. Question-4(B)[15Marks] The following is the summarized Balance Sheet of Ananda Ltd: Liabilities Rs Asset Rs Paid-up Share Capital Bank 90,000 50,000 Equity Shares of Rs Other assets 8,10,000 10 each fully paid 5,00,000 1000 10% Redeemable Preference shares of Rs 100 each fully called up 100000 Less: calls in arrear @ Rs 20 each 1000 99,000 Reserves & Surplus: Securities Premium 20,000 Profit & Loss A/c 60,000 General reserve 70,000 Current Liabilities: Creditors 1,51,000 Total liabilities 9,00,000 Total assets 9,00,000 The redeemable preference shares were redeemed on the following basis: (i)Further 4,500 equity shares were issued at a premium of 10%; (ii)Expenses for fresh issue of shares Rs 5,000; (iii)Of the 50 preference shares, holders of 40 shares paid the call money before the date of redemption. The balance 10 shares were forfeited for non-payment of calls before redemption. The forfeited shares were re-issued as fully paid on receipt of Rs 500 before redemption; (ivPreference shares were redeemed at a premium of 10% and securities premium account was utilised in full for this purpose. Show journal entries including those relating to cash and the summarized balance sheet after redemption. ..ALL THE BEST

Das könnte Ihnen auch gefallen

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Von EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- Shareholders' Equity - ExercisesDokument5 SeitenShareholders' Equity - Exercisesjooo0% (1)

- INCOME TAX Ready Reckoner - by CA HARSHIL SHETHDokument38 SeitenINCOME TAX Ready Reckoner - by CA HARSHIL SHETHCA Harshil ShethNoch keine Bewertungen

- ACCOUNTANCY AND BUSINESS STATISTICS First Paper: Corporate AccountingDokument12 SeitenACCOUNTANCY AND BUSINESS STATISTICS First Paper: Corporate AccountingGuruKPONoch keine Bewertungen

- Company AccountsDokument3 SeitenCompany AccountsYATTIN KHANNANoch keine Bewertungen

- Corporate Accounting QUESTIONSDokument4 SeitenCorporate Accounting QUESTIONSsubba1995333333100% (1)

- Corrporate ModelDokument10 SeitenCorrporate Modelnithinjoseph562005Noch keine Bewertungen

- Worksheet For Issue of Share and DebentureDokument2 SeitenWorksheet For Issue of Share and DebentureLaxmi Kant SahaniNoch keine Bewertungen

- Question Bank (Repaired)Dokument7 SeitenQuestion Bank (Repaired)jayeshNoch keine Bewertungen

- CM11 3C CacDokument2 SeitenCM11 3C CacHaRiPrIyA JaYaKuMaRNoch keine Bewertungen

- Accountancy Model QuestionsDokument19 SeitenAccountancy Model QuestionsSunil Kumar AgarwalaNoch keine Bewertungen

- What Is Forfeiture of ShareDokument3 SeitenWhat Is Forfeiture of ShareSathish SmartNoch keine Bewertungen

- XII AccountancyDokument4 SeitenXII AccountancyAahna AcharyaNoch keine Bewertungen

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Dokument7 SeitenCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsNoch keine Bewertungen

- Corporate AccountingDokument32 SeitenCorporate AccountingSaran Ranny100% (1)

- Corporate Accounting AssignmentDokument22 SeitenCorporate Accounting Assignmentscribd345670% (1)

- XII - Accy. QP - Revision-15.2.14Dokument6 SeitenXII - Accy. QP - Revision-15.2.14devipreethiNoch keine Bewertungen

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Dokument20 SeitenClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatNoch keine Bewertungen

- No - of Printed PagesDokument4 SeitenNo - of Printed PagesRiteshHPatelNoch keine Bewertungen

- Sardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksDokument3 SeitenSardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksRiteshHPatelNoch keine Bewertungen

- 21 March Live Most Imp Questions Shares To Debent 240321 230837Dokument3 Seiten21 March Live Most Imp Questions Shares To Debent 240321 230837seemaanil029Noch keine Bewertungen

- Isc Accounts 5 MB: (Three HoursDokument7 SeitenIsc Accounts 5 MB: (Three HoursShivam SinghNoch keine Bewertungen

- TH TH STDokument3 SeitenTH TH STsharathk916Noch keine Bewertungen

- Class XiithDokument11 SeitenClass XiithSantvana ChaturvediNoch keine Bewertungen

- CBSE Class 12 Accountancy Sample Paper-02 (For 2012)Dokument20 SeitenCBSE Class 12 Accountancy Sample Paper-02 (For 2012)cbsesamplepaperNoch keine Bewertungen

- SAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80Dokument6 SeitenSAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80AcHu TanNoch keine Bewertungen

- Konganapuram, Idappadi Cycle Test-2 Hours:2 Hours Subject: Corporate Accounting-I Marks: 50 Answer All The QuestionDokument3 SeitenKonganapuram, Idappadi Cycle Test-2 Hours:2 Hours Subject: Corporate Accounting-I Marks: 50 Answer All The Questionnandhakumark152Noch keine Bewertungen

- CBSE 12th Accountancy 2009 Unsolved Paper Delhi BoardDokument7 SeitenCBSE 12th Accountancy 2009 Unsolved Paper Delhi Boardbrainhub50Noch keine Bewertungen

- Sample Paper (Cbse) - 2009 Accountancy - XiiDokument5 SeitenSample Paper (Cbse) - 2009 Accountancy - XiiJanine AnzanoNoch keine Bewertungen

- Shares Class PPT Sunil PandaDokument60 SeitenShares Class PPT Sunil Pandadollpees01Noch keine Bewertungen

- Sy Bcom Oct2011Dokument83 SeitenSy Bcom Oct2011Anonymous l0j1IwcPDNoch keine Bewertungen

- AcctsDokument63 SeitenAcctskanchanthebest100% (1)

- Accountancy: Time Allowed: 3 Hours Maximum Marks: 80Dokument58 SeitenAccountancy: Time Allowed: 3 Hours Maximum Marks: 809chand3Noch keine Bewertungen

- 2015 12 SP Accountancy Unsolved 07Dokument6 Seiten2015 12 SP Accountancy Unsolved 07BhumitVashishtNoch keine Bewertungen

- AKHY Sample PaperDokument24 SeitenAKHY Sample PaperShreya PushkarnaNoch keine Bewertungen

- cCLASS TEST 2Dokument1 SeitecCLASS TEST 2vsy9926Noch keine Bewertungen

- MCQ - Issue of SharesDokument7 SeitenMCQ - Issue of SharesHarshal KaramchandaniNoch keine Bewertungen

- MCQ - Issue of SharesDokument7 SeitenMCQ - Issue of SharesHarshal KaramchandaniNoch keine Bewertungen

- Shares 2024 Final PDF SPCC - 98efd20d c80b 4cd4 A01b 6ce76136740cDokument106 SeitenShares 2024 Final PDF SPCC - 98efd20d c80b 4cd4 A01b 6ce76136740cDaksh YadavNoch keine Bewertungen

- Financial ReportingDokument7 SeitenFinancial ReportingDivyesh TrivediNoch keine Bewertungen

- Accounts AmalgamationDokument6 SeitenAccounts AmalgamationscarunamarNoch keine Bewertungen

- Question SheetDokument2 SeitenQuestion SheetHarsh DubeNoch keine Bewertungen

- Problems On Internal ReconstructionDokument24 SeitenProblems On Internal ReconstructionYashodhan Mithare100% (4)

- 12 Amalgamation NotesDokument12 Seiten12 Amalgamation NoteskautiNoch keine Bewertungen

- Class 12 Accountancy Solved Sample Paper 1 - 2012Dokument34 SeitenClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsNoch keine Bewertungen

- Accountancy Set 3 QPDokument6 SeitenAccountancy Set 3 QPKunal Gaurav100% (2)

- CBSE Class 12 Accountancy Sample Papers 2014 - 15Dokument7 SeitenCBSE Class 12 Accountancy Sample Papers 2014 - 15Karthick KarthickNoch keine Bewertungen

- Internal ReconstructionDokument5 SeitenInternal ReconstructionJoshua StarkNoch keine Bewertungen

- Test 1Dokument105 SeitenTest 1PrathibaVenkatNoch keine Bewertungen

- Marking Scheme PRE-BOARD (2009-10) : Part ADokument9 SeitenMarking Scheme PRE-BOARD (2009-10) : Part AIsha KembhaviNoch keine Bewertungen

- Issue of ShareDokument2 SeitenIssue of ShareavtaranNoch keine Bewertungen

- 858 Accounts Sem II SpecimenDokument7 Seiten858 Accounts Sem II SpecimenDia JacobNoch keine Bewertungen

- Dileep PreboardDokument10 SeitenDileep PreboardmktknpNoch keine Bewertungen

- Issue of DebenturesDokument15 SeitenIssue of DebenturesKrish BhargavaNoch keine Bewertungen

- Screenshot 2023-11-27 at 1.48.32 PMDokument9 SeitenScreenshot 2023-11-27 at 1.48.32 PManupriyakapil85Noch keine Bewertungen

- 03 - Accounts - Prelims 2Dokument7 Seiten03 - Accounts - Prelims 2Pawan TalrejaNoch keine Bewertungen

- Internal ReconstructionDokument8 SeitenInternal Reconstructionsmit9993Noch keine Bewertungen

- COA Unit 2 Issue of Shares - ProblemsDokument3 SeitenCOA Unit 2 Issue of Shares - ProblemsGayatri Prasad BirabaraNoch keine Bewertungen

- 4 CO4CRT11 - Corporate Accounting II (T)Dokument5 Seiten4 CO4CRT11 - Corporate Accounting II (T)emildaraisonNoch keine Bewertungen

- Go 260911Dokument12 SeitenGo 260911ravirrkNoch keine Bewertungen

- Management Information System: Course Developed by K.K.NigamDokument271 SeitenManagement Information System: Course Developed by K.K.NigamravirrkNoch keine Bewertungen

- Article - Justify Toll On Unfinished NHs - SCDokument1 SeiteArticle - Justify Toll On Unfinished NHs - SCravirrkNoch keine Bewertungen

- Field OfficersDokument6 SeitenField OfficersravirrkNoch keine Bewertungen

- India TOLLDokument3 SeitenIndia TOLLravirrkNoch keine Bewertungen

- Federation of Automobile Dealers AssociationsDokument2 SeitenFederation of Automobile Dealers AssociationsravirrkNoch keine Bewertungen

- Dissertation - Online Advertising - Sep 12 '10Dokument65 SeitenDissertation - Online Advertising - Sep 12 '10ravirrkNoch keine Bewertungen

- Conflicts & GroupsDokument7 SeitenConflicts & GroupsravirrkNoch keine Bewertungen

- Rescued DocumentDokument13 SeitenRescued DocumentravirrkNoch keine Bewertungen

- Summer TRG Guidelines 2010 (For 2008 Batch) FinalDokument24 SeitenSummer TRG Guidelines 2010 (For 2008 Batch) FinalravirrkNoch keine Bewertungen

- Helper ScheduleDokument11 SeitenHelper ScheduleravirrkNoch keine Bewertungen

- 1Dokument90 Seiten1ravirrkNoch keine Bewertungen

- Land and Agrarian Reform in The PhilippinesDokument36 SeitenLand and Agrarian Reform in The PhilippinesPrix John EstaresNoch keine Bewertungen

- Slide 4 Code of Conducts Professional PracticeDokument23 SeitenSlide 4 Code of Conducts Professional PracticeAjim Senamo D'clubNoch keine Bewertungen

- Eng Vs LeeDokument2 SeitenEng Vs LeeRon AceNoch keine Bewertungen

- People V SabalonesDokument49 SeitenPeople V SabalonesKarlo KapunanNoch keine Bewertungen

- Project Cerberus Processor Cryptography SpecificationDokument16 SeitenProject Cerberus Processor Cryptography SpecificationabcdefghNoch keine Bewertungen

- Hazrat Abu Bakr and Hazrat UmarDokument22 SeitenHazrat Abu Bakr and Hazrat UmarUzair siddiquiNoch keine Bewertungen

- Edart - Is18037 - R0Dokument2 SeitenEdart - Is18037 - R0Edwin GallegosNoch keine Bewertungen

- Knapp St. Safety Petition 1Dokument5 SeitenKnapp St. Safety Petition 1WXMINoch keine Bewertungen

- SST Project Social IssuesDokument2 SeitenSST Project Social Issuesv75% (4)

- Install Erdas Imagine 2018 Off Campus - WindowsDokument11 SeitenInstall Erdas Imagine 2018 Off Campus - WindowsDan GheorghițăNoch keine Bewertungen

- 5 Challenges in SG's Social Compact (Tham YC and Goh YH)Dokument5 Seiten5 Challenges in SG's Social Compact (Tham YC and Goh YH)Ping LiNoch keine Bewertungen

- Deoband Anti Sufi 1 1Dokument18 SeitenDeoband Anti Sufi 1 1Herb NazheNoch keine Bewertungen

- Tremblay v. OpenAIDokument17 SeitenTremblay v. OpenAITHRNoch keine Bewertungen

- Letter - For - Students - 1ST - Year - Programmes (Gu)Dokument2 SeitenLetter - For - Students - 1ST - Year - Programmes (Gu)Ayush SinghNoch keine Bewertungen

- COA 10 March 2020Dokument2 SeitenCOA 10 March 2020Gabriel TalosNoch keine Bewertungen

- Rsi - ProfileDokument91 SeitenRsi - ProfileNhung TruongNoch keine Bewertungen

- Extraordinary: Government of GoaDokument4 SeitenExtraordinary: Government of GoatrajrajNoch keine Bewertungen

- उच्चत्तर शिक्षा शिभाग शिक्षा मंत्रालय भारत सरकार के तहत एक स्वायत्त संगठन ( (An Autonomous Organization under the Department of Higher Education, Ministry of Education, Government of India)Dokument1 Seiteउच्चत्तर शिक्षा शिभाग शिक्षा मंत्रालय भारत सरकार के तहत एक स्वायत्त संगठन ( (An Autonomous Organization under the Department of Higher Education, Ministry of Education, Government of India)DivyanshNoch keine Bewertungen

- 001 History Chapter 8 Class 6Dokument2 Seiten001 History Chapter 8 Class 6Basveshwara RisawadeNoch keine Bewertungen

- Basis of Institutional Capacity Building of Rural-Local Government in Bangladesh: A Brief DiscussionDokument9 SeitenBasis of Institutional Capacity Building of Rural-Local Government in Bangladesh: A Brief DiscussionA R ShuvoNoch keine Bewertungen

- B. Counsel de Parte - A Lawyer Chosen by A Party To RepresentDokument20 SeitenB. Counsel de Parte - A Lawyer Chosen by A Party To RepresentPons Mac PacienteNoch keine Bewertungen

- River Plate and Brazil Conferences v. Pressed Steel Car Company, Inc., Federal Maritime Board, Intervening, 227 F.2d 60, 2d Cir. (1955)Dokument6 SeitenRiver Plate and Brazil Conferences v. Pressed Steel Car Company, Inc., Federal Maritime Board, Intervening, 227 F.2d 60, 2d Cir. (1955)Scribd Government DocsNoch keine Bewertungen

- J2534 VCI Driver Installation GuideDokument3 SeitenJ2534 VCI Driver Installation GuideHartini SusiawanNoch keine Bewertungen

- G. R. No. 108998 Republic Vs Court of Appeals Mario Lapina and Flor de VegaDokument5 SeitenG. R. No. 108998 Republic Vs Court of Appeals Mario Lapina and Flor de VegaNikko Franchello SantosNoch keine Bewertungen

- Socrates Vs Sandiganbayan - 116259-60 - February 20, 1996 - J RegaladoDokument14 SeitenSocrates Vs Sandiganbayan - 116259-60 - February 20, 1996 - J Regaladowesternwound82Noch keine Bewertungen

- Chapter 14 Firms in Competitive Markets PDFDokument38 SeitenChapter 14 Firms in Competitive Markets PDFWasiq BhuiyanNoch keine Bewertungen

- Appendix Master C1D VisaDokument6 SeitenAppendix Master C1D VisaJared YehezkielNoch keine Bewertungen

- The Competition (Amendment) Act, 2023Dokument21 SeitenThe Competition (Amendment) Act, 2023Rahul JindalNoch keine Bewertungen

- Ee-1151-Circuit TheoryDokument20 SeitenEe-1151-Circuit Theoryapi-19951707Noch keine Bewertungen