Beruflich Dokumente

Kultur Dokumente

Time Series Econometrics - Assignment2

Hochgeladen von

Roman SchmidOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Time Series Econometrics - Assignment2

Hochgeladen von

Roman SchmidCopyright:

Verfügbare Formate

Time Series Econometrics

Assignment 2

by

Roman Schmid 05-603-295

A . Unit-root Simulations

The task is to simulate sequences of the pure random walk process (1) of size and to discard the first 50 observed values. Then, the following three scenarios have to be estimated by OLS for each sequence: (2) (3) (4)

Then the -ratio and its distribution has to be computed for every model in order to find the 5 th percentiles of the distribution. The -ratio ratio is calculated by the formula (5)

for

In lecture 6, it is shown that

(6)

With

being a Wiener process and

. It is stated that

is a random

variable which is non-normal and skewed. Furthermore it is shown that

1

(7)

where the denominator is a random variable. So the -ratio becomes

(8)

and the numerator is a product of two random variables while the denominator is a consistent estimator and converging to . The estimation result of scenario 1, 2 and 3 show a different distribution of the -ratio of the coefficient . Like mentioned in the lecture notes, the distribution of changes by adding of an intercept and/or by adding a deterministic time trend. Figure 1 below shows the distribution of the -ratio from each of the three model estimated with a kernel1 bandwith of 1. It can be seen that by adding an intercept to the pure random walk like in scenario 2 the distribution changes, e.g. becomes skewed to the left. If an intercept and a time trend is added like in scenario 3, then the distribution becomes even more left-skewed.

Figure 1:Distribution of the -ratio in each model

0.35 no intercept, no trend intercept, no trend intercept, trend

0.3

0.25

0.2

0.15

0.1

0.05

0 -10

-8

-6

-4

-2

Here I used a normal kernel smoother

For this simulation2, the 5th percentile of the distribution of the -ratio for scenario 1 is . As scenario 2 is more left-skewed, its 5th percentile of the distribution is . The distribution in scenario 3 has a 5th percentile of .

B. Decompositions

Part I:

a) The task in this part is to take US real GDP series and to log it so that . Then an AR(2) model with a constant has to be fitted to by OLS and the permanent and transitory components using the Beveridge-Nelson (BN) decomposition have to be found. The estimation for the AR(2) process gives the coefficients , and . Without going too far into detail, the BN-decomposition states that has two parts: a permanent part and a transitory part , so (9) BN assume that the permanent part is drift. Therefore , e.g. a random walk with

(10) The conditional mean is calculated by (11)

As of Lecture 6, (12) and (13)

As in an AR(p) model, no lags on are assumed, therefore integration back to the permanent part becomes

. By turning the

Percentiles change if the simulation of the pure random walk in (1) is repeated

(14)

The transitory part can simply be found by calculating (15) respectively, (16) Figure 2 below shows the permanent part (10) and the transitory part (15) using the BN decomposition. One can see that the transitory part is noisier than as of . Figure 3 below shows the permanent part (14) and the transitory part (16).

Figure 2: Permanent part and transitory part of

0.15 0.1

dy

using the BN decomposition

dy t dy P t,BN

0.05 0 -0.05

50

100

150 t

200

250

300

0.04 0.02

dy

dy T t,BN

0 -0.02 -0.04

50

100

150 t

200

250

300

Figure 3: Permanent part and transitory part of

10 y 9 yP t,BN

using the BN decomposition

y

8 7 0

50

100

150 t

200

250

300

0.02 0 -0.02 -0.04 -0.06 yT t,BN

50

100

150 t

200

250

300

b) Now the Hodrick-Prescott (HP) filter is applied to find the permanent and transitory component of both and . Without losing too much time on the theory, the HP filter applied for some time series chooses the permanent part for all such that

(17)

Where . The parameter is a smoothing parameter and generally set to 1600 for quarterly data like in . Figure 4 below shows the permanent part and the the transitory part of . One can see that the permanent part is smoother than the permanent part using the BN decomposition because of Figure 5 shows the permanent and transitory part for Like before, the permanent part using the HP filter is like a smooth line through

Figure 4: Permanent part and transitory part of

0.04 0.02

dy

using the HP filter

dy t dy P t,HP

0 -0.02 -0.04

50

100

150 t

200

250

300

0.04 0.02

dy

dy T t,HP

0 -0.02 -0.04

50

100

150 t

200

250

300

Figure 5: Permanent part and transitory part of

10 y 9

y

using the HP filter

yP t,HP

50

100

150 t

200

250

300

0.1 0.05 0 -0.05 -0.1

y

yT t,HP

50

100

150 t

200

250

300

c) By comparing the transitory parts of with respect to the BN decomposition and the HP filter, one can obtain that in the BN- case the time series of the transitory part seems to evolve below zero over time. In both the BN- and the HP- case, there seems to be some pattern in the time series of the transitory part, e.g. some predictive structure. The reason for this argumentation is that if we consider the transitory parts of , one cannot really see whether the parts have some white noise structure or not. But the transitory parts of are in fact the cumulative sum of the transitory parts of and so, if was a random walk, then would not have that kind of a stationary structure as in Figure 6.

Figure 6: Transitory part of

0.1 0.05 0 -0.05 -0.1

y

and

with both the BN and HP decomposition

yT t,BN yT t,HP

50

100

150 t

200

250

300

0.04 0.02

dy

dy T t,BN dy T t,HP

0 -0.02 -0.04

50

100

150 t

200

250

300

Figure 7 below shows the permanent parts of as well as in both the BN- and the HP- case. One can obtain that in both and the permanent part found by the HP filter is smoother than the permanent part found by the BN decomposition. This is due to the fact that the HP filter is rather a smoother than a filter because of the smoothing parameter

Figure 7: Permanent part of

10

and

with both the BN and HP decomposition

9

y

yP t,BN yP t,HP

50

100

150 t

200

250

300

0.15 0.1

dy

dy P t,BN dy P t,HP

0.05 0 -0.05

50

100

150 t

200

250

300

Part II:

a) The permanent part of a pure random walk (RW) process of the form (18) is the RW itself, e.g. there is no transitory part in a time series which is a pure RW.

7

Proof: Let the BN decomposition be done by approximating the RW by an ARMA(p,q) model of the integrated variable : (19) As in fore , the lag operator and there are no lags in , so . There-

(20) Furthermore, there is no constant . Therefore the process is which means that there is no unconditional mean

(21)

b) The transitory component of a large simulation of a pure RW found by the HP filter looks like in Figure 8. So far it looks like is white noise. But according to the lecture notes, simulations show that the transitory component in a pure unit RW like here is a persistent AR(2) process. By estimating an AR(2) with respect to the time series of the transitory component (constant included) gives the coefficients , and (estimates vary by repeating the simulation of the RW). Therefore the transitory part is stationary and it seems that its long run average is (consequently, the long run average varies too by repeating the simulation of the RW). Figure 9 below shows the transitory part of a RW simulation of size 100 and a corresponding AR(2) fit to the time series. It looks like that the AR(2) model fits the transitory part of a RW found by the HP filter quite well.

of a pure RW of size 10000

Figure 8: Transitory component

5 4 3 2 1 0 -1 -2 -3 -4 -5

x

xT t,HP xT t,BN 0 1000 2000 3000 4000 5000 t 6000 7000 8000 9000 10000

Figure 9: Transitory component

3

of a pure RW of size 100 and AR(2) fit

-1 xT t,HP AR(2) fit xT t,BN -3 0 10 20 30 40 50 t 60 70 80 90 100

-2

C. VARs

Consider the following VAR(2) macroeconomic model, where is the output growth and is inflation, taking the form is the money growth,

(22)

(23) and (24)

where (25)

a) The system in its companion form looks as follows: (26)

9

with

(27)

where

(28)

The stability/stationarity of the system can be found by looking at the Eigenvalues of . The system is said to be stable/stationary if , . The vector . As can be seen, the system is stable/stationary.

b) The unconditional mean vector

of

is calculated as (29)

(30)

which gives from

. The variance of

is computed

10

(31)

whereas

(32)

Reshaping

yields

(33)

MATLAB gives the solution

(34)

so that the variance of

is (35)

and the covariance is

11

(36)

c) The cholesky decomposition of

into

gives for the lower triangular : (37)

The first 12 impulse responses of , and are computed as follows: first calculate the first twelve coefficients of the VMA( ) representation:

(38) (39) (40) (41) (42) (43) (44) (45) (46) (47) (48) (49) (50)

Then, calculate the impulse response matrices

by applying the lower triangular .

(51)

(52)

12

(53)

(54)

(55)

(56)

(57)

(58)

(59)

(60)

(61)

(62)

(63)

Figure 10 12 below report the responses of each variable to different shocks. For example a shock in inflation will have a positive impact on output growth and also a positive impact on money growth in future lags. Figure 10 shows nicely that a shock in inflation will have a relatively high impact on money growth in future lags. Note that Figure 10 12 show impulse responses to one-standard deviation shocks in If the variables are logged then the impulse responses can be interpreted as elasticities.

13

Figure 11: Responses of inflation

to shocks in

Figure 10: Responses of money growth

to shocks in

0.5 0.45 0.4 0.35 0.3 u1 u2 u3

0.9 0.8 0.7 0.6 0.5 u1 u2 u3

0.25

0.4

0.2

0.3

0.15 0.1 0.05 0

0.2 0.1 0

5 t

10

5 t

10

Figure 12: Responses of output growth

0.35

to shocks in

0.3

u1 u2 u3

0.25

0.2

0.15

0.1

0.05

5 t

10

14

Das könnte Ihnen auch gefallen

- Frequency Domain Controller DesignDokument45 SeitenFrequency Domain Controller Designmarcum01Noch keine Bewertungen

- Analysis and Design of Multicell DC/DC Converters Using Vectorized ModelsVon EverandAnalysis and Design of Multicell DC/DC Converters Using Vectorized ModelsNoch keine Bewertungen

- Type 3 Compensator DesignDokument6 SeitenType 3 Compensator DesignĐơn Giản ThôiNoch keine Bewertungen

- Andreiadis Breakthrough CurvesDokument14 SeitenAndreiadis Breakthrough CurvesandersonbihainNoch keine Bewertungen

- Electric Machines and Drives 259Dokument3 SeitenElectric Machines and Drives 259Abhably AblablyNoch keine Bewertungen

- NA Module-5Dokument25 SeitenNA Module-5ss0097877Noch keine Bewertungen

- Analysis of Torque Ripple Due To Phase Commutation in Brushless DC MachinesDokument7 SeitenAnalysis of Torque Ripple Due To Phase Commutation in Brushless DC MachinesBattula Santhosh KumarNoch keine Bewertungen

- Homework Extruder TorqueDokument12 SeitenHomework Extruder TorqueIbrahimFikry100% (2)

- Xiicleee RBP 1754revDokument6 SeitenXiicleee RBP 1754revrbargallo0Noch keine Bewertungen

- Phase-Locked Loop: Hrpota June 6, 2005Dokument9 SeitenPhase-Locked Loop: Hrpota June 6, 2005Parameswararao BillaNoch keine Bewertungen

- Strucutural VibrationsDokument14 SeitenStrucutural Vibrationsamitu2bmineNoch keine Bewertungen

- ConvolutionDokument3 SeitenConvolutionSiddharth KumarNoch keine Bewertungen

- Part A (10X2 20 Marks) : Dept, of Ece, Ceg Campus, Annauniversity End Semester Examinations Apr-May 2011Dokument4 SeitenPart A (10X2 20 Marks) : Dept, of Ece, Ceg Campus, Annauniversity End Semester Examinations Apr-May 2011Seenivasan MaNoch keine Bewertungen

- Symbol Timing Recovery Fo A Class of Constant Envelope SignalsDokument4 SeitenSymbol Timing Recovery Fo A Class of Constant Envelope Signalsjoe2001coolNoch keine Bewertungen

- HW 01 SolutionDokument12 SeitenHW 01 SolutionJuan Sebastian Suarez Ospina63% (8)

- Novel Scheme For Reduced S T C N G Loss Inverter: Control inDokument3 SeitenNovel Scheme For Reduced S T C N G Loss Inverter: Control inNguyen Dinh TuyenNoch keine Bewertungen

- Chapter 5 Computer GraphicsDokument14 SeitenChapter 5 Computer Graphicsibrahin mahamedNoch keine Bewertungen

- Computing Laplace Transforms For Numerical Inversion Via Continued FractionsDokument29 SeitenComputing Laplace Transforms For Numerical Inversion Via Continued Fractionstina mujahidahNoch keine Bewertungen

- Modeling & Simulation of Hysteresis Current Controlled Inverters Using MATLABDokument26 SeitenModeling & Simulation of Hysteresis Current Controlled Inverters Using MATLABRajesh NayakNoch keine Bewertungen

- ConsolidationDokument14 SeitenConsolidationMelissa SammyNoch keine Bewertungen

- Flutter Speed Determination Using PDokument14 SeitenFlutter Speed Determination Using PVijay KishoreNoch keine Bewertungen

- Understanding Transients: Conceptual Interpretation: Ieee On Vol. No. 2, 521Dokument6 SeitenUnderstanding Transients: Conceptual Interpretation: Ieee On Vol. No. 2, 521xernoxianNoch keine Bewertungen

- DC-DC ConverterDokument24 SeitenDC-DC ConverterkandularanjithNoch keine Bewertungen

- 2ND Rfic Assignment Question PDFDokument5 Seiten2ND Rfic Assignment Question PDFsvijiNoch keine Bewertungen

- InvertersDokument7 SeitenInverterslohitashriyaNoch keine Bewertungen

- Dynamic QuizDokument7 SeitenDynamic QuizAlan ATNoch keine Bewertungen

- Ghosh, D. P., 1971, Inverse Filter Coefficients For The Computation of Apparent Resistivity Standard Curves For A Horizontally Stratified EarthDokument7 SeitenGhosh, D. P., 1971, Inverse Filter Coefficients For The Computation of Apparent Resistivity Standard Curves For A Horizontally Stratified EarthCinthia MtzNoch keine Bewertungen

- Machine Simulation ModelsDokument22 SeitenMachine Simulation ModelsAshwani RanaNoch keine Bewertungen

- Measurement of Structural Damping and Equivalent Mass of A Vibrating BeamDokument5 SeitenMeasurement of Structural Damping and Equivalent Mass of A Vibrating BeamTRUNG QUOC LENoch keine Bewertungen

- Removal of DC Offset in Current Waveforms Using Digital Mimic FilteringDokument10 SeitenRemoval of DC Offset in Current Waveforms Using Digital Mimic FilteringOscar Cabrera ChirreNoch keine Bewertungen

- Study of Pneumatic Speed Control System With Friction Force CompensationDokument8 SeitenStudy of Pneumatic Speed Control System With Friction Force CompensationInternational Journal of Research in Engineering and ScienceNoch keine Bewertungen

- New Metrics For Evaluating Monte Carlo Tolerance Analysis of AssembliesDokument9 SeitenNew Metrics For Evaluating Monte Carlo Tolerance Analysis of Assembliesmhk665Noch keine Bewertungen

- Psoc® 1, Psoc 3, and Psoc 5 - Single-Pole Infinite Impulse Response (Iir) FiltersDokument11 SeitenPsoc® 1, Psoc 3, and Psoc 5 - Single-Pole Infinite Impulse Response (Iir) FiltersrednejetNoch keine Bewertungen

- Wavelet Transforms That Map Integers To IntegersDokument38 SeitenWavelet Transforms That Map Integers To IntegersPrasanna GaneshNoch keine Bewertungen

- Bode Plots OverviewDokument71 SeitenBode Plots OverviewibinhabeebNoch keine Bewertungen

- DSPAA Jan 2019 QP SolutionDokument34 SeitenDSPAA Jan 2019 QP SolutionAbhishek SinghNoch keine Bewertungen

- Modeling and Analysis of Differential VcosDokument20 SeitenModeling and Analysis of Differential VcosLiu WenNoch keine Bewertungen

- IJECE - Enhanced AC-To-AC Frequency ChangerDokument14 SeitenIJECE - Enhanced AC-To-AC Frequency Changeriaset123Noch keine Bewertungen

- The PI Controller 5EADokument6 SeitenThe PI Controller 5EADiah AnggrainiNoch keine Bewertungen

- Interharmonics Generated by Induction Machines: Jan RusekDokument4 SeitenInterharmonics Generated by Induction Machines: Jan RusekxwikiNoch keine Bewertungen

- 3G4 Distillation CalculationsDokument22 Seiten3G4 Distillation CalculationsMahmoud Nasr0% (1)

- Electric Machines and Drives 261Dokument2 SeitenElectric Machines and Drives 261Abhably AblablyNoch keine Bewertungen

- Signal Generator Project StatementDokument16 SeitenSignal Generator Project StatementHussain Bin AliNoch keine Bewertungen

- Assignment C ReportDokument14 SeitenAssignment C ReportPranil KapadiaNoch keine Bewertungen

- Dymanic Modelling of Machine SynchromuousDokument23 SeitenDymanic Modelling of Machine SynchromuousRaturi DeepankarNoch keine Bewertungen

- Module 1: Transfer Functions and Frequency ResponsesDokument49 SeitenModule 1: Transfer Functions and Frequency ResponsesAdil AbouelhassanNoch keine Bewertungen

- Induction Motor Drive System Applications: B. M. B. R. E. R. Da Silva A. 119. N.Dokument6 SeitenInduction Motor Drive System Applications: B. M. B. R. E. R. Da Silva A. 119. N.Scott MendozaNoch keine Bewertungen

- Chapter 3 Coordinate TransformationsDokument14 SeitenChapter 3 Coordinate Transformationsnaod abrehamNoch keine Bewertungen

- A State Space Single-Phase Transformer Model Incorporating Nonlinear Phenomena Magnetic Saturation and Hysteresis For Transient and Periodic Steady-State AnalysisDokument5 SeitenA State Space Single-Phase Transformer Model Incorporating Nonlinear Phenomena Magnetic Saturation and Hysteresis For Transient and Periodic Steady-State Analysissreekantha2013Noch keine Bewertungen

- PMSM 3Dokument4 SeitenPMSM 3VegembogaNoch keine Bewertungen

- Scope:: About The Ballbal - Direct Spreadsheet ..Dokument19 SeitenScope:: About The Ballbal - Direct Spreadsheet ..M. Ali ParvezNoch keine Bewertungen

- A New Current-Mode Squarer Circuit For RMS-to-DC Converter: ISO 9001:2008 CertifiedDokument4 SeitenA New Current-Mode Squarer Circuit For RMS-to-DC Converter: ISO 9001:2008 Certifiedarsham1Noch keine Bewertungen

- Novel Schiffman Phase ShiftersDokument6 SeitenNovel Schiffman Phase ShiftersSonia BaciNoch keine Bewertungen

- Module 3: Sequence Components and Fault Analysis: Sequence ComponentsDokument11 SeitenModule 3: Sequence Components and Fault Analysis: Sequence Componentssunny1725Noch keine Bewertungen

- Switching Modulator: Working Operation and AnalysisDokument3 SeitenSwitching Modulator: Working Operation and AnalysisgajulasureshNoch keine Bewertungen

- Dimensionality Reduction Report-Yomna Eid RizkDokument6 SeitenDimensionality Reduction Report-Yomna Eid RizkYomna EidNoch keine Bewertungen

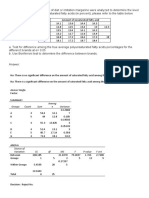

- Median Test and Fisher Sign TestDokument17 SeitenMedian Test and Fisher Sign TestAllyssa BernardoNoch keine Bewertungen

- Module 5. T-Test One Sample TestDokument5 SeitenModule 5. T-Test One Sample TestBelle AmeNoch keine Bewertungen

- Cap 16 Construccion de ModelosDokument25 SeitenCap 16 Construccion de ModelosJorge EnriquezNoch keine Bewertungen

- Statistics Lecture 9 PDFDokument24 SeitenStatistics Lecture 9 PDFKajal KumariNoch keine Bewertungen

- Copula Marginal AlgorithmDokument17 SeitenCopula Marginal AlgorithmCoolidgeLowNoch keine Bewertungen

- Chapter TwoDokument28 SeitenChapter TwoDawit MekonnenNoch keine Bewertungen

- SPC FormatDokument2 SeitenSPC FormatRaajha MunibathiranNoch keine Bewertungen

- Hyfran Plus Guide Ev 13janv2015 FDokument71 SeitenHyfran Plus Guide Ev 13janv2015 FEdi Setiawan100% (1)

- Math11 SP Q3 M6 PDFDokument16 SeitenMath11 SP Q3 M6 PDFJessa Banawan EdulanNoch keine Bewertungen

- Practica 1Dokument23 SeitenPractica 1Mariana AlandiaNoch keine Bewertungen

- RS 12 Calculating Reliability of A MeasureDokument27 SeitenRS 12 Calculating Reliability of A MeasureFree IconNoch keine Bewertungen

- Probit Logit Ohio PDFDokument16 SeitenProbit Logit Ohio PDFKeith Salazar ArotomaNoch keine Bewertungen

- WK5 Assgn Yun DDokument4 SeitenWK5 Assgn Yun DdorothyNoch keine Bewertungen

- Quiz 2 - Attempt Review (Keandalan 100)Dokument3 SeitenQuiz 2 - Attempt Review (Keandalan 100)Yosua Petra HattuNoch keine Bewertungen

- Lecture7 KNNDokument40 SeitenLecture7 KNNraveritaNoch keine Bewertungen

- Tutorial: MSBA7003 Quantitative Analysis MethodsDokument34 SeitenTutorial: MSBA7003 Quantitative Analysis MethodsAmanda WangNoch keine Bewertungen

- TCC - Course OutlineDokument3 SeitenTCC - Course OutlineKim Serenuela PagalNoch keine Bewertungen

- Answer To AE 108 Handout No.7Dokument2 SeitenAnswer To AE 108 Handout No.7AndreaaAAaa TagleNoch keine Bewertungen

- P370 Sample Questions Midterm: TH TH TH STDokument5 SeitenP370 Sample Questions Midterm: TH TH TH STSehoon OhNoch keine Bewertungen

- Subjective QuestionsDokument8 SeitenSubjective QuestionsKeerthan kNoch keine Bewertungen

- Statistical InferenceDokument14 SeitenStatistical Inferenceamelia99Noch keine Bewertungen

- Three Segments: - Multiple Regression (MR) - Matrix Algebra - Estimation of CoefficientsDokument16 SeitenThree Segments: - Multiple Regression (MR) - Matrix Algebra - Estimation of CoefficientsJuanNoch keine Bewertungen

- Sample Size Calculator: Confidence LevelDokument3 SeitenSample Size Calculator: Confidence Levelcasanova mrNoch keine Bewertungen

- Notes On Cronbach's AlphaDokument10 SeitenNotes On Cronbach's AlphaSyed Umar Shirazi Hashmi100% (1)

- Spatial Econometric Modeling Using PROC SPATIALREG - Subconscious MusingsDokument3 SeitenSpatial Econometric Modeling Using PROC SPATIALREG - Subconscious MusingsRic KobaNoch keine Bewertungen

- Final S03Dokument7 SeitenFinal S03Bình CaoNoch keine Bewertungen

- Assignment 1Dokument3 SeitenAssignment 1Abbaas AlifNoch keine Bewertungen

- Chapter 3 - ResearchDokument79 SeitenChapter 3 - ResearchMonosodiumXOXONoch keine Bewertungen