Beruflich Dokumente

Kultur Dokumente

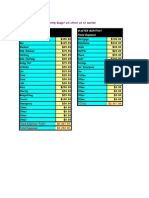

Solidbank vs. Permanent

Hochgeladen von

Marianne AndresOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Solidbank vs. Permanent

Hochgeladen von

Marianne AndresCopyright:

Verfügbare Formate

G.R. No.

171925 : July 23, 2010 SOLIDBANK CORPORATION, (now Metroplolitan Bank and Trust Company), Petitioner, vs. PERMANENT HOMES, INCORPORATED, Respondent. FACTS: The records disclose that PERMANENT HOMES is a real estate development company, and to finance its housing project known as the Buena Vida Townhome located within Merville Subdivision, Paraaque City, it applied and was subsequently granted by SOLIDBANK with an Omnibus Line credit facility in the total amount of SIXTY MILLION PESOS. Of the entire loan, FIFTY NINE MILLION as time loan for a term of up to three hundred sixty (360) days, with interest thereon at prevailing market rates, and subject to monthly repricing. The remaining ONE MILLION was available for domestic bills purchase. To secure the aforesaid loan, PERMANENT HOMES initially mortgaged three(3) townhouse units within the Buena Vida project in Paraaque. At the time, however, the instant complaint was filed against SOLIDBANK, a total of thirty six (36) townhouse units were mortgaged with said bank. Of the 60 million available to PERMANENT HOMES, it availed of a total of 41.5 million pesos covered by three(3) promissory notes. There was a standing agreement by the parties that any increase or decrease in interest rates shall be subject to the mutual agreement of the parties. For the three loan availments that PERMANENT HOMES obtained, the herein respondent argued that SOLIDBANK unilaterally and arbitrarily accelerated the interest rates without any declared basis of such increases, of which PERMANENT HOMES had not agreed to, or at the very least, been informed of. On July 5, 2002, the trial court promulgated its Decision in favor of Solidbank. Permanent then filed an appeal before the appellate court which was granted, in which reversed and set aside the assailed decision dated July 5, 2002. Hence, the present petition. ISSUES: (1) WON the Honorable Court of Appeals was correct in ruling that the increases in the interest rates on Permanents loans are void for having been unilaterally imposed without basis. (2) WON the Honorable Court of Appeals was correct in ordering the parties to enter into an express agreement regarding the applicable interest rates on Permanents loan availments subsequent to the initial thirty-day (30) period. RULING: (1) Yes. Although interest rates are no longer subject to a ceiling, the lender still does not have an unbridled license to impose increased interest rates. The lender and the borrower should agree on the imposed rate, and such imposed rate should be in writing of which was not provided by petitioner. (2) Yes. In order that obligations arising from contracts may have the force of law between the parties, there must be mutuality between the parties based on their essential quality. A contract containing a condition which makes its fulfillment dependent exclusively upon the uncontrolled will of one of the contracting parties is void. There was no showing that either Solidbank or Permanent coerced each other to enter into the loan agreements. The terms of the Omnibus Line Agreement and the promissory notes were mutually and freely agreed upon by the parties.

Das könnte Ihnen auch gefallen

- Case Digest, Agro - Conglomerates, Inc Vs Court of Appeals, 2000Dokument2 SeitenCase Digest, Agro - Conglomerates, Inc Vs Court of Appeals, 2000Jesa Formaran100% (1)

- De La Paz v. L&J Development Corp (Digest)Dokument2 SeitenDe La Paz v. L&J Development Corp (Digest)Tini GuanioNoch keine Bewertungen

- Catholic Vicar v. CA DigestDokument2 SeitenCatholic Vicar v. CA DigestPaul PhoenixNoch keine Bewertungen

- Saura Import and Expert Co. Inc., Vs DBPDokument2 SeitenSaura Import and Expert Co. Inc., Vs DBPtheresaNoch keine Bewertungen

- JN Dev't Corp vs. PhilGuaranteeDokument2 SeitenJN Dev't Corp vs. PhilGuaranteeJane SudarioNoch keine Bewertungen

- Agro Conglomerates and Soriano v. CADokument3 SeitenAgro Conglomerates and Soriano v. CAAntonio RebosaNoch keine Bewertungen

- Chan v. Maceda (Credit Trans. Digest)Dokument2 SeitenChan v. Maceda (Credit Trans. Digest)Francisco Ashley Acedillo100% (2)

- 17 - Equitable PCI Bank vs. NG Sheung NgorDokument3 Seiten17 - Equitable PCI Bank vs. NG Sheung NgorSeventeen 17Noch keine Bewertungen

- TOYOTA SHAW vs. CADokument2 SeitenTOYOTA SHAW vs. CAzenn18100% (1)

- Saura Import v. DBP DigestDokument1 SeiteSaura Import v. DBP Digestviva_33100% (2)

- Sps. Juico v. China BankDokument2 SeitenSps. Juico v. China BankRad IsnaniNoch keine Bewertungen

- Credit Case DigestDokument10 SeitenCredit Case DigestMhayBinuyaJuanzon100% (4)

- Naguiat Vs CA - Case DigestDokument2 SeitenNaguiat Vs CA - Case DigestmansikiaboNoch keine Bewertungen

- Doctrine on Commodatum and Simple LoanDokument2 SeitenDoctrine on Commodatum and Simple LoanKaye Miranda Laurente100% (1)

- JN Devt Corp. Vs Phil. Export - DigestDokument1 SeiteJN Devt Corp. Vs Phil. Export - DigestAhmad_deedatt03Noch keine Bewertungen

- Teofisto Guingona vs. City Fiscal of ManilaDokument2 SeitenTeofisto Guingona vs. City Fiscal of ManilaVienie Ramirez Badang100% (1)

- Bank liability for lost titles in safety deposit boxDokument2 SeitenBank liability for lost titles in safety deposit boxiwamawi100% (1)

- Premiere Development Bank Vs Central SuretyDokument1 SeitePremiere Development Bank Vs Central SuretyEcnerolAicnelav100% (1)

- Pajuyo Vs CADokument1 SeitePajuyo Vs CAwesleybooks100% (2)

- Deposit Cases Digests (BPI Vs IAC To Consolidated Terminals vs. Artex Development)Dokument11 SeitenDeposit Cases Digests (BPI Vs IAC To Consolidated Terminals vs. Artex Development)Ron QuintoNoch keine Bewertungen

- Digest - Javellana V Lim - GR 4015 (24 August 1908)Dokument1 SeiteDigest - Javellana V Lim - GR 4015 (24 August 1908)Rey BenitezNoch keine Bewertungen

- Case No. 9 Republic v. GrijaldoDokument2 SeitenCase No. 9 Republic v. GrijaldoAnjela Ching50% (2)

- Garcia v. Thio (G.R. No. 154878, March 16, 2007)Dokument3 SeitenGarcia v. Thio (G.R. No. 154878, March 16, 2007)Lorie Jean UdarbeNoch keine Bewertungen

- Dario Nacar Vs Gallery Frames DigestDokument2 SeitenDario Nacar Vs Gallery Frames DigestJay Jasper Lee100% (8)

- Tolentino V Gonzales Sy ChiamDokument7 SeitenTolentino V Gonzales Sy ChiamJason CabreraNoch keine Bewertungen

- Garcia V Thio DigestDokument2 SeitenGarcia V Thio DigestKathNoch keine Bewertungen

- Compañia Agricola de Ultramar Vs NepomucenoDokument2 SeitenCompañia Agricola de Ultramar Vs Nepomucenoerikha_araneta100% (1)

- Antichresis Contract ExplainedDokument11 SeitenAntichresis Contract Explainedus madamba100% (1)

- Catholic Bishop Wins Land Dispute CaseDokument4 SeitenCatholic Bishop Wins Land Dispute CaseMaricris GalingganaNoch keine Bewertungen

- BPI Vs CA Credit DigestDokument6 SeitenBPI Vs CA Credit Digestmaria luzNoch keine Bewertungen

- Durban Apartments Corporation Vs Pioneer Insurance CorporationDokument2 SeitenDurban Apartments Corporation Vs Pioneer Insurance CorporationJanWacnang100% (2)

- Saura Import and Export Co. Inc. v. DBP - G.R. No. L-24968Dokument1 SeiteSaura Import and Export Co. Inc. v. DBP - G.R. No. L-24968Jona Myka Dugayo100% (1)

- Investors Finance Corporation vs. Autoworld Sales CorporationDokument3 SeitenInvestors Finance Corporation vs. Autoworld Sales CorporationMike E DmNoch keine Bewertungen

- Medel VS CaDokument1 SeiteMedel VS Camcris101Noch keine Bewertungen

- Pajuyo Vs CA DigestDokument1 SeitePajuyo Vs CA DigestAngel Urbano100% (3)

- Republic V FNCBDokument6 SeitenRepublic V FNCBMp Cas100% (1)

- Case Digest Tolentino vs. GonzalesDokument2 SeitenCase Digest Tolentino vs. GonzalesDiane Dee Yanee75% (4)

- Roman Catholic Bishop of Jaro vs. de La PeñaDokument2 SeitenRoman Catholic Bishop of Jaro vs. de La PeñaSJ San Juan100% (2)

- LBP Cannot Unilaterally Increase Interest Rate on Housing LoanDokument2 SeitenLBP Cannot Unilaterally Increase Interest Rate on Housing LoanblessaraynesNoch keine Bewertungen

- Credit Transactions PDFDokument311 SeitenCredit Transactions PDFVsgg Nnia100% (8)

- Producers Bank Vs CA - DigestDokument2 SeitenProducers Bank Vs CA - DigestRengie Galo100% (2)

- Case Digest - Sps. Toring Vs Sps. OlanDokument2 SeitenCase Digest - Sps. Toring Vs Sps. Olandaryll100% (1)

- Siga-An v. VillanuevaDokument2 SeitenSiga-An v. VillanuevaAbbyElbambo100% (1)

- June 7: Paradigm Development Vs Bpi G.R. No. 191174, 2007Dokument2 SeitenJune 7: Paradigm Development Vs Bpi G.R. No. 191174, 2007Donna Faith ReyesNoch keine Bewertungen

- 134.diego vs. Fernando GR No. L 15128 August 25 1960 AntichresisDokument1 Seite134.diego vs. Fernando GR No. L 15128 August 25 1960 AntichresisAnonymous 53bboBNoch keine Bewertungen

- YHT Realty Corp V CADokument2 SeitenYHT Realty Corp V CAJm Santos100% (5)

- G.R. No. 195166Dokument2 SeitenG.R. No. 195166KM Surtida100% (1)

- PNB liability for employee's actsDokument2 SeitenPNB liability for employee's actsCari Mangalindan Macaalay100% (1)

- Credit Transactions ReviewerDokument122 SeitenCredit Transactions ReviewerJingJing Romero96% (68)

- Solidbank Corporation V Permanent HomesDokument14 SeitenSolidbank Corporation V Permanent HomesAnonymous WDEHEGxDhNoch keine Bewertungen

- Solidbank V Permanent HomesDokument5 SeitenSolidbank V Permanent HomesJade AdangNoch keine Bewertungen

- Credit Transactions (Digested Cases)Dokument23 SeitenCredit Transactions (Digested Cases)Marie Antoinette Espadilla75% (4)

- Oblicon Cases 29Dokument32 SeitenOblicon Cases 29JoseReneRomanoCruelNoch keine Bewertungen

- Compiled DigestDokument7 SeitenCompiled DigestAbi GailNoch keine Bewertungen

- Supreme Court Rules on Interest Rate Increases in Loan AgreementsDokument18 SeitenSupreme Court Rules on Interest Rate Increases in Loan AgreementsDanielicah CruzNoch keine Bewertungen

- Sps. Silos V PNBDokument20 SeitenSps. Silos V PNBKingNoch keine Bewertungen

- Loan Contract Perfection Case DigestsDokument15 SeitenLoan Contract Perfection Case DigestsClutz MacNoch keine Bewertungen

- Digests Art 1250-1279Dokument5 SeitenDigests Art 1250-1279Gino LascanoNoch keine Bewertungen

- Civil Procedure Digest 3Dokument10 SeitenCivil Procedure Digest 3Neidine Angela FloresNoch keine Bewertungen

- HSBC Loan Dispute Headed to Supreme CourtDokument18 SeitenHSBC Loan Dispute Headed to Supreme Courtlou017Noch keine Bewertungen

- Yasco Vs - CA G.R. No. 104175Dokument1 SeiteYasco Vs - CA G.R. No. 104175Marianne AndresNoch keine Bewertungen

- Viajar vs. Ladrido G.R. No. L-45321Dokument1 SeiteViajar vs. Ladrido G.R. No. L-45321Marianne AndresNoch keine Bewertungen

- Tijam vs. Sibonghanoy G.R. No. L-21450Dokument1 SeiteTijam vs. Sibonghanoy G.R. No. L-21450Marianne Andres100% (1)

- SIOL vs. Asuncion G.R. Nos. 79937-38Dokument2 SeitenSIOL vs. Asuncion G.R. Nos. 79937-38Marianne Andres100% (1)

- Unimasters vs. CA G.R. No. 119657Dokument2 SeitenUnimasters vs. CA G.R. No. 119657Marianne AndresNoch keine Bewertungen

- Samaniego vs. Aguila G.R. No. 125567Dokument1 SeiteSamaniego vs. Aguila G.R. No. 125567Marianne AndresNoch keine Bewertungen

- Toribio vs. Bidin G.R. No. L-57821Dokument2 SeitenToribio vs. Bidin G.R. No. L-57821Marianne AndresNoch keine Bewertungen

- Ventura vs. Mitilante G.R. No. 63145Dokument2 SeitenVentura vs. Mitilante G.R. No. 63145Marianne AndresNoch keine Bewertungen

- Uy vs. Contreras G.R. No. 111416 September 26Dokument2 SeitenUy vs. Contreras G.R. No. 111416 September 26Marianne Andres100% (1)

- Tiu Po vs. Bautista G.R. No. L-55514Dokument1 SeiteTiu Po vs. Bautista G.R. No. L-55514Marianne AndresNoch keine Bewertungen

- Tacay vs. Tagum G.R. Nos. 88075-77Dokument2 SeitenTacay vs. Tagum G.R. Nos. 88075-77Marianne AndresNoch keine Bewertungen

- Tadeo vs. People G.R. No. 129774Dokument1 SeiteTadeo vs. People G.R. No. 129774Marianne AndresNoch keine Bewertungen

- Salacup vs. Maddela G.R. No. L-50471Dokument1 SeiteSalacup vs. Maddela G.R. No. L-50471Marianne AndresNoch keine Bewertungen

- Santos vs. Gabriel G.R. No. L-22996Dokument2 SeitenSantos vs. Gabriel G.R. No. L-22996Marianne AndresNoch keine Bewertungen

- Reburiano vs. CA G.R. No. 102965Dokument1 SeiteReburiano vs. CA G.R. No. 102965Marianne AndresNoch keine Bewertungen

- Republic vs. Hernandez G.R. No. 117209Dokument2 SeitenRepublic vs. Hernandez G.R. No. 117209Marianne AndresNoch keine Bewertungen

- Raymond vs. CA G.R. No. 80380Dokument1 SeiteRaymond vs. CA G.R. No. 80380Marianne AndresNoch keine Bewertungen

- Republic vs. Sandiganbayan G.R. No. 90478Dokument2 SeitenRepublic vs. Sandiganbayan G.R. No. 90478Marianne Andres89% (18)

- Quebral vs. CA G.R. No. 101941Dokument1 SeiteQuebral vs. CA G.R. No. 101941Marianne AndresNoch keine Bewertungen

- People vs. Webb G.R. No. 132577Dokument1 SeitePeople vs. Webb G.R. No. 132577Marianne Andres100% (1)

- NIC vs. CA G.R. No. 88709Dokument1 SeiteNIC vs. CA G.R. No. 88709Marianne AndresNoch keine Bewertungen

- People vs. Florendo G.R. No. L-627Dokument1 SeitePeople vs. Florendo G.R. No. L-627Marianne AndresNoch keine Bewertungen

- MBTC vs. DII G.R. No. L-33695Dokument1 SeiteMBTC vs. DII G.R. No. L-33695Marianne AndresNoch keine Bewertungen

- PBC Vs CA G.R. No. 126158Dokument1 SeitePBC Vs CA G.R. No. 126158Marianne AndresNoch keine Bewertungen

- Natcher vs. CA G.R. No. 133000Dokument2 SeitenNatcher vs. CA G.R. No. 133000Marianne AndresNoch keine Bewertungen

- Lichauco vs. Guash G.R. No. L-51Dokument1 SeiteLichauco vs. Guash G.R. No. L-51Marianne AndresNoch keine Bewertungen

- PATC vs. CA G.R. No. L-62781Dokument2 SeitenPATC vs. CA G.R. No. L-62781Marianne AndresNoch keine Bewertungen

- Meliton vs. CA G.R. No. 101883Dokument2 SeitenMeliton vs. CA G.R. No. 101883Marianne Andres100% (1)

- Manchester vs. CA G.R. 75919Dokument1 SeiteManchester vs. CA G.R. 75919Marianne Andres100% (2)

- Loyola vs. CA G.R. No. 117186Dokument2 SeitenLoyola vs. CA G.R. No. 117186Marianne AndresNoch keine Bewertungen

- GR12 Business Finance Module 3-4Dokument8 SeitenGR12 Business Finance Module 3-4Jean Diane JoveloNoch keine Bewertungen

- C01 Exam Practice KitDokument240 SeitenC01 Exam Practice Kitlesego100% (2)

- Internalization Theory For The Digital EconomyDokument8 SeitenInternalization Theory For The Digital Economyefe westNoch keine Bewertungen

- Commodity Trading: An OverviewDokument15 SeitenCommodity Trading: An OverviewvijayxkumarNoch keine Bewertungen

- ABM Fundamentals of ABM 1 Module 12 Accounting Cycle of A Merchandising BusinessDokument16 SeitenABM Fundamentals of ABM 1 Module 12 Accounting Cycle of A Merchandising BusinessMariel Santos67% (3)

- Indian Economy Classified by 3 Main Sectors: Primary, Secondary and TertiaryDokument5 SeitenIndian Economy Classified by 3 Main Sectors: Primary, Secondary and TertiaryRounak BasuNoch keine Bewertungen

- Business Plan of Electronic BicycleDokument9 SeitenBusiness Plan of Electronic BicycleSabdi AhmedNoch keine Bewertungen

- 2 4ms of ProductionDokument31 Seiten2 4ms of ProductionYancey LucasNoch keine Bewertungen

- CUSIP IdentifierDokument4 SeitenCUSIP IdentifierFreeman Lawyer97% (33)

- Literature Review On Poverty AlleviationDokument6 SeitenLiterature Review On Poverty Alleviationea46krj6100% (1)

- How Businesses Have Adapted Their Corporate Social Responsibility Amidst the PandemicDokument7 SeitenHow Businesses Have Adapted Their Corporate Social Responsibility Amidst the PandemicJapsay Francisco GranadaNoch keine Bewertungen

- Marketing Management Case AnalysisDokument6 SeitenMarketing Management Case AnalysisRajat BishtNoch keine Bewertungen

- Republic Act No 9679 PAG IBIGDokument17 SeitenRepublic Act No 9679 PAG IBIGJnot VictoriknoxNoch keine Bewertungen

- Varshaa D Offer Letter PDFDokument11 SeitenVarshaa D Offer Letter PDFKavitha RajaNoch keine Bewertungen

- Poster-Nike and BusinessDokument2 SeitenPoster-Nike and BusinessK. PaulNoch keine Bewertungen

- Tài Liệu Tham Khảo Chương 2 KTQTNC- UpdatedDokument43 SeitenTài Liệu Tham Khảo Chương 2 KTQTNC- UpdatedMai TuấnNoch keine Bewertungen

- Smu Project Synopsis Format & HelpDokument4 SeitenSmu Project Synopsis Format & HelpKautilyaTiwariNoch keine Bewertungen

- Accounting For Decision MakersDokument33 SeitenAccounting For Decision MakersDuminiNoch keine Bewertungen

- Jewar Airport PPT Mid SemDokument7 SeitenJewar Airport PPT Mid SemHimanshu DhingraNoch keine Bewertungen

- Production Planning and ControlDokument16 SeitenProduction Planning and Controlnitish kumar twariNoch keine Bewertungen

- Castle (Met BKC)Dokument38 SeitenCastle (Met BKC)aashishpoladiaNoch keine Bewertungen

- Revenue Reconigtion Principle - ExamplesDokument4 SeitenRevenue Reconigtion Principle - Examplesmazjoa100% (1)

- Peta 4TH QTR Business-Simulation-Final-042522Dokument4 SeitenPeta 4TH QTR Business-Simulation-Final-042522Kevin GuinsisanaNoch keine Bewertungen

- Egypte Food Drink SurveyDokument71 SeitenEgypte Food Drink SurveysaadabdallaNoch keine Bewertungen

- Retail Technology Management: Presented by Kumar Gaurav Harshit KumarDokument19 SeitenRetail Technology Management: Presented by Kumar Gaurav Harshit KumarKumar GauravNoch keine Bewertungen

- Modify Monthly Budget TemplateDokument32 SeitenModify Monthly Budget TemplateMohammed TetteyNoch keine Bewertungen

- Capital Structure of DR Reddy's LaboratoriesDokument11 SeitenCapital Structure of DR Reddy's LaboratoriesNikhil KumarNoch keine Bewertungen

- Capital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Dokument10 SeitenCapital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Aditya Anshuman DashNoch keine Bewertungen

- Investment ManagementDokument25 SeitenInvestment ManagementVyshNoch keine Bewertungen

- Accenture IT Strategy Transformation ServicesDokument6 SeitenAccenture IT Strategy Transformation Serviceserusfid100% (1)