Beruflich Dokumente

Kultur Dokumente

33.tax Planning Under Indirect Taxations

Hochgeladen von

mercatuzOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

33.tax Planning Under Indirect Taxations

Hochgeladen von

mercatuzCopyright:

Verfügbare Formate

Tax Planning under Indirect Taxation

. The main objectives of tax planning under Central Excise are enumerated below:A. Conservation of resources of the organisation. B. Adhering to the law of the land and avoid litigation to extent possible. C. Availing full advantage of the law even if it means litigation. D. In India the possibility of retrospective amendments also should be considered as the risk is real. A few illustrations of Tax planning possible under Central Excise, Customs, Service Tax and KVAT are set out hereinafter. The points have been provided in no particular order/ sequence. 1. Strategically before setting up the business look at what are the customers needs, which product segment are you meeting, can the buyer avail the set offs or not. 2. The cross sectional credit between service tax and central excise would provide some possible value adds. 3.GST is on the horizon ( maybe in 2012 or so) Be ready for the same by locating as required by business needs rather than tax breaks based decision. 4. In case of final products or sale to dealers/ traders. The decision to set up the unit at a particular location where excise Reliefs exist The North East ( 32 & 33/99 , Kutch, Chatitisgarh, Uttaranchal, Himachal Pradesh has some exemptions as on date. A large number of the larger FMCG companies have already opened shop there.: Scheme Started in 1997. For new industrial undertaking and those how have done substantial expansion in installed capacity increase of 25%., J&K employment also criterion, 10 years from date of commercial production, double the investment, specified areas some products and all areas some products. 5. The decision to set up the unit outside the country due to factors like customs rate- The rate of basic custom duty may be so low that the imports maybe cheaper. China, Taiwan, Bangladesh, Sri Lanka maybe considered for local as well as outstation. 6. Centralised working for growing businesses can be a blessing as the costs keep multiplying. The concessional rate have now been removed. 7. The excess capacity available in the country where work on principal to principal job work basis could be undertaken- Route preferred by MNC for consumer goods or low tech products. However for high tech product / non standardized product this may not be useful. Velvet shampoo, domestic cooking appliances, 8. The decision to take up the entire process in house- The cascading effect of multi point levy of sales tax may prompt this. Now with VAT this is not an issue for long. Imported/ CST purchases dominant

9. Maximisation of the cenvat credit by looking at alternative procurement possibilities. Where small suppliers then the decision to change the vendors from being suppliers to job

workers- This can happen when the process cost is minimal and material cost substantial. Cost saving of between 7-12.5% on total purchases not under Central Excise. 10. Independent unit for new collaborations, tie ups , new products to take advantage of exemptions- The benefits of SSI exemption per year for final consumer products works out to about Rs. 5-12 lakhs per annum. Other than this it gives a little breathing time for compliance. However capital goods credit should not be missed out due to this. - Register and claim the benefits. 11. The requirement of having trading, servicing and manufacturing together. This would depend on the product, and the customer. A broad view of the supplier, client and his customer needs to be taken. (a) customer under Central Excise,- excise dealer, taxable service provider and importantly manufacturer under Central Excise Manufacturer under Central Excise better off (b) customer a trader who does not pass on credit, exempted manufacturer, non taxable service provider - Status of trader/ manufacturer under exemption being better off 12. Sales channels: Through distributors/ depots/ associated companies/ marketing companies. although not used much by the unorganized sector 13. Complying with the frequent changes in the law to avoid demands ( penalties, interest) and losses due to customer not agreeing in future to re-reimburse additional amounts. 14. Utilising the exemption available- Electronic and medical industry in past few years, rural exemption. 15. Method of set up and method of export is export oriented- Advance Licence, FTZ, Advance Intermediate License, manufacture in bond, duty drawback, DEPB etc. 16. Method of import when exports exist- Advance licence, rebate on exports, rebate on inputs used in exports, high sea sales, warehousing procedures, drawback , EPCG etc. 17. VAT may become all pervasive compliance mode preferable- Long term planning of policy for the company. The supply chain may have to be relooked. 18. The SSI exemption option- Avoiding splitting unless legally clear. Rural area option to be examined. 19. Be ready for the audits by statutory authorities and not get coerced into reversal/ payments not required by law. 20. In all the suggestions given above, the current position of the law as well as judicial trends are important.

21. Under VAT the proper calculation of rebates/ special rebates are to be done to avoid demands with interest and penalties.

22. Depending on the type of product and buyer decide the mode of delivery and sale which is optimal. Similarly plan for the purchases. 23. In every transaction look at the claiming of credit/ set off and to the maximum extent possible do not break the credit chain. Reference to case laws will indicate tax planning already in vogue. Ensure if doubt then proceed after intimation to department. The choice of option would also depend on the customer profile, environment in which the manufacturer exists and his accounting and organizational capabilities. The tax planning above is not to be applied blindly and only indicative at best. Questions 1.What are the tax planning measures available for SSI units? 2.What are the planning measures available under Central Excise? 3.Are there any benefits available to particular states?

Source:www.hiregange.com Complied by Fayaz Mohammed

Das könnte Ihnen auch gefallen

- GST & Msmes: Presentation Before The Hon'ble Members of Lok Sabha and Rajya SabhaDokument17 SeitenGST & Msmes: Presentation Before The Hon'ble Members of Lok Sabha and Rajya SabhaPragya Singh BaghelNoch keine Bewertungen

- Vat Audit by Chetan SarafDokument33 SeitenVat Audit by Chetan Sarafchetan saraf100% (1)

- Confirm Vat Audit ProjectDokument33 SeitenConfirm Vat Audit ProjectkennyajayNoch keine Bewertungen

- IndustryDokument14 SeitenIndustryMohd ShahidNoch keine Bewertungen

- Ifp 29 Tax PlanningDokument5 SeitenIfp 29 Tax Planningsachin_chawlaNoch keine Bewertungen

- ACC212 Student Notes 2019Dokument62 SeitenACC212 Student Notes 2019preciousgomorNoch keine Bewertungen

- Preface: What Is The Tax Planning ?Dokument29 SeitenPreface: What Is The Tax Planning ?SpUnky RohitNoch keine Bewertungen

- Corporate TaxDokument29 SeitenCorporate Taxsu_pathriaNoch keine Bewertungen

- Preface: What Is The Tax Planning ?Dokument29 SeitenPreface: What Is The Tax Planning ?su_pathriaNoch keine Bewertungen

- Research Paper On Service Tax in IndiaDokument6 SeitenResearch Paper On Service Tax in Indiaoqphebaod100% (1)

- Overview of Central Excise Law and ProceduresDokument38 SeitenOverview of Central Excise Law and ProceduresRavikumarrd RaviNoch keine Bewertungen

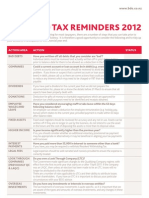

- Year-End Tax Reminders 2012: Action Area Action StatusDokument2 SeitenYear-End Tax Reminders 2012: Action Area Action Statusapi-129279783Noch keine Bewertungen

- Lesson 6 Tax Planning With Reference To Specific Magement DecisionDokument49 SeitenLesson 6 Tax Planning With Reference To Specific Magement DecisionkelvinNoch keine Bewertungen

- Procedure For Starting Small Scale Industries in IndiaDokument4 SeitenProcedure For Starting Small Scale Industries in IndiaViswan Thrissur100% (1)

- Entrepreneurship ManagementDokument33 SeitenEntrepreneurship ManagementhinalviraNoch keine Bewertungen

- Document 4Dokument2 SeitenDocument 4STAR PRINTINGNoch keine Bewertungen

- 20 Ways To Increase ProfitDokument2 Seiten20 Ways To Increase ProfitJohn HayesNoch keine Bewertungen

- English Final Assignment: Unit Six Tax Accounting DiscussionDokument5 SeitenEnglish Final Assignment: Unit Six Tax Accounting DiscussionHendraSaepulBaktiNoch keine Bewertungen

- Formalities For Setting Up A Small Business EnterpriseDokument8 SeitenFormalities For Setting Up A Small Business EnterpriseMisba Khan0% (1)

- Advantage and DisadvantageDokument4 SeitenAdvantage and Disadvantageishmeet kaurNoch keine Bewertungen

- Tax Commentary 2020Dokument85 SeitenTax Commentary 2020Javed MushtaqNoch keine Bewertungen

- Business - 4: Legal Requirements and Financial Considerations GewargisDokument18 SeitenBusiness - 4: Legal Requirements and Financial Considerations GewargislizNoch keine Bewertungen

- LTAB Final SemDokument22 SeitenLTAB Final Semyogesh280502Noch keine Bewertungen

- Main Points of VAT Implications On Supply ChainDokument2 SeitenMain Points of VAT Implications On Supply Chainapi-3743609Noch keine Bewertungen

- How GST Would Impact Startups & Small and Medium Size BusinessesDokument12 SeitenHow GST Would Impact Startups & Small and Medium Size BusinessesSouravNoch keine Bewertungen

- Impact of GST On Stock MarketDokument14 SeitenImpact of GST On Stock MarketSiddhartha0% (1)

- Dwnload Full Contemporary Accounting A Strategic Approach For Users 9th Edition Hancock Solutions Manual PDFDokument35 SeitenDwnload Full Contemporary Accounting A Strategic Approach For Users 9th Edition Hancock Solutions Manual PDFfrederickboonemt21jc100% (13)

- Entreprenuerial Management Chapter3 Developing The Business PlanDokument23 SeitenEntreprenuerial Management Chapter3 Developing The Business PlancharrygabornoNoch keine Bewertungen

- MF0002 MF0011 Solved Assignment Set 1 2Dokument33 SeitenMF0002 MF0011 Solved Assignment Set 1 2atul221183Noch keine Bewertungen

- Supplies: The Capture of Credit Specific To Each and Only The Common CreditsDokument2 SeitenSupplies: The Capture of Credit Specific To Each and Only The Common CreditsCA Blog IndiaNoch keine Bewertungen

- FABM Q3 M2 (Output No. 2 - Principles of Accounting)Dokument4 SeitenFABM Q3 M2 (Output No. 2 - Principles of Accounting)Sophia MagdaraogNoch keine Bewertungen

- Taxation Dissertation TopicsDokument7 SeitenTaxation Dissertation TopicsInstantPaperWriterCanada100% (1)

- Department of Business Administration, DDU Gorakhpur University, Gorakhpur-273009Dokument7 SeitenDepartment of Business Administration, DDU Gorakhpur University, Gorakhpur-273009Amit SharmaNoch keine Bewertungen

- GST - Answer 2Dokument9 SeitenGST - Answer 2Tarun SolankiNoch keine Bewertungen

- Principles of Income and Business TaxationDokument3 SeitenPrinciples of Income and Business TaxationQueen ValleNoch keine Bewertungen

- Feasibility StudyDokument4 SeitenFeasibility StudyMayizNoch keine Bewertungen

- Taxation: Concept, Nature and Characteristics of Taxation and TaxesDokument11 SeitenTaxation: Concept, Nature and Characteristics of Taxation and TaxesMohammad FaizanNoch keine Bewertungen

- Vat PresentationDokument22 SeitenVat PresentationNicole AndersonNoch keine Bewertungen

- Impact of GST On Indian SCMDokument9 SeitenImpact of GST On Indian SCMVinodh Kumar Perumal100% (2)

- Solution Advance Taxation Planning and Fiscal Policy Nov 2007Dokument6 SeitenSolution Advance Taxation Planning and Fiscal Policy Nov 2007Samuel DwumfourNoch keine Bewertungen

- Entrep MGT Module 3Dokument31 SeitenEntrep MGT Module 3JasmeenNoch keine Bewertungen

- Advantages of Incentives and SubsidiesDokument38 SeitenAdvantages of Incentives and SubsidiesShashank Jain67% (3)

- Osi - Govt Policy Changes RequiredDokument5 SeitenOsi - Govt Policy Changes RequiredSneha ShahNoch keine Bewertungen

- ANewConsumerDuty FocusAreasDokument7 SeitenANewConsumerDuty FocusAreasprakhar agrawalNoch keine Bewertungen

- GST Implementation Issues: Input Tax CreditDokument5 SeitenGST Implementation Issues: Input Tax CreditSiva SankariNoch keine Bewertungen

- ED Unit 2 and 3Dokument28 SeitenED Unit 2 and 3Rohit NegiNoch keine Bewertungen

- Ial Accounting Unit 2 TheoryDokument13 SeitenIal Accounting Unit 2 TheorySterling ArcherNoch keine Bewertungen

- IBM Commissionaire OverviewDokument13 SeitenIBM Commissionaire OverviewSamik Biswas100% (1)

- Special Event (Rangkuman)Dokument4 SeitenSpecial Event (Rangkuman)FACIA ADINDA Mahasiswa PNJNoch keine Bewertungen

- Compulsory Registration: RequirementDokument4 SeitenCompulsory Registration: RequirementNur Iszyani PoadNoch keine Bewertungen

- Chapter 24 (Disclosure)Dokument3 SeitenChapter 24 (Disclosure)slymobiusNoch keine Bewertungen

- A Overview of Maharashtra Value Added Tax: IndexDokument10 SeitenA Overview of Maharashtra Value Added Tax: IndexAdnan ParkarNoch keine Bewertungen

- Sheet 1Dokument5 SeitenSheet 1Shruti MaheshwariNoch keine Bewertungen

- Cheema Boilers LTD.: Performance Analysis Report ForDokument6 SeitenCheema Boilers LTD.: Performance Analysis Report ForSaurabh SinghNoch keine Bewertungen

- Formulation & Development / Review of No-Non Sense Credit and Collection Policies and ProceduresDokument72 SeitenFormulation & Development / Review of No-Non Sense Credit and Collection Policies and ProceduresLede Ann Calipus YapNoch keine Bewertungen

- Custom Duty in IndiaDokument29 SeitenCustom Duty in IndiaKaranvir GuptaNoch keine Bewertungen

- Making Sense of A Complex WorldDokument16 SeitenMaking Sense of A Complex WorldciaranharronNoch keine Bewertungen

- 1040 Exam Prep Module X: Small Business Income and ExpensesVon Everand1040 Exam Prep Module X: Small Business Income and ExpensesNoch keine Bewertungen

- JK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineVon EverandJK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- J.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- 67.ifrs ConvergenceDokument2 Seiten67.ifrs ConvergencemercatuzNoch keine Bewertungen

- Certificate of Deposit: Add-On CdsDokument4 SeitenCertificate of Deposit: Add-On CdsmercatuzNoch keine Bewertungen

- 7.stpi & SezDokument3 Seiten7.stpi & SezmercatuzNoch keine Bewertungen

- 9.corporate GovernanceDokument3 Seiten9.corporate GovernancemercatuzNoch keine Bewertungen

- 17.role of Tax ConsultantsDokument4 Seiten17.role of Tax Consultantsmercatuz100% (1)

- 68 GaarDokument2 Seiten68 GaarmercatuzNoch keine Bewertungen

- 8.global WarmingDokument3 Seiten8.global WarmingmercatuzNoch keine Bewertungen

- 66.six SigmaDokument3 Seiten66.six SigmamercatuzNoch keine Bewertungen

- 63 KaizenDokument4 Seiten63 KaizenmercatuzNoch keine Bewertungen

- 61.forensic AccountingDokument3 Seiten61.forensic Accountingmercatuz0% (1)

- 65.role of A ConsultantDokument2 Seiten65.role of A ConsultantmercatuzNoch keine Bewertungen

- 62.insider TradingDokument5 Seiten62.insider TradingmercatuzNoch keine Bewertungen

- 64.role of Chartred Accountants in Financial InstitutionsDokument2 Seiten64.role of Chartred Accountants in Financial Institutionsmercatuz100% (1)

- 6.standards On Quality ControlDokument2 Seiten6.standards On Quality ControlmercatuzNoch keine Bewertungen

- 54.banking Regulation ActDokument5 Seiten54.banking Regulation ActmercatuzNoch keine Bewertungen

- 60.central Excise Compliance CertificateDokument3 Seiten60.central Excise Compliance CertificatemercatuzNoch keine Bewertungen

- 58.process CostingDokument3 Seiten58.process CostingmercatuzNoch keine Bewertungen

- 57.pricing DecisionsDokument3 Seiten57.pricing DecisionsmercatuzNoch keine Bewertungen

- 51.limited Liability PartnershipDokument8 Seiten51.limited Liability PartnershipmercatuzNoch keine Bewertungen

- System Audit: Foundations of Information System AuditingDokument4 SeitenSystem Audit: Foundations of Information System AuditingmercatuzNoch keine Bewertungen

- 56.IFRS Vs IASDokument3 Seiten56.IFRS Vs IASmercatuzNoch keine Bewertungen

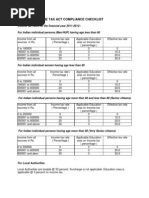

- 53.income Tax Compliance Check ListDokument5 Seiten53.income Tax Compliance Check ListmercatuzNoch keine Bewertungen

- 55.profesional EthicsDokument5 Seiten55.profesional EthicsmercatuzNoch keine Bewertungen

- 52.analysis For Decision MakingDokument4 Seiten52.analysis For Decision MakingmercatuzNoch keine Bewertungen

- 49.transfer PricingDokument4 Seiten49.transfer PricingmercatuzNoch keine Bewertungen

- Due Diligence Review: Purpose of Due-Diligence Review-The Purpose of Due Diligence Review Is To Assist TheDokument4 SeitenDue Diligence Review: Purpose of Due-Diligence Review-The Purpose of Due Diligence Review Is To Assist ThemercatuzNoch keine Bewertungen

- 5.money LaunderingDokument3 Seiten5.money LaunderingmercatuzNoch keine Bewertungen

- 50.cost Control & Cost ReductionDokument6 Seiten50.cost Control & Cost ReductionmercatuzNoch keine Bewertungen

- 46.repo ArrangementsDokument5 Seiten46.repo ArrangementsmercatuzNoch keine Bewertungen

- INUKA Business Info Brochure January 2022Dokument2 SeitenINUKA Business Info Brochure January 2022DanubioMadiquirNoch keine Bewertungen

- C2 - Premium LiabilityDokument14 SeitenC2 - Premium LiabilityMarjorie Tuinkle G. Rivera50% (2)

- Sapinsider VistexDokument27 SeitenSapinsider VistexAjersh Paturu0% (1)

- A Project Report On Sales and Advertising: K. MAMATHA, Assistant Professor Dr. T. SRINIVASA RAO, Professor &HODDokument5 SeitenA Project Report On Sales and Advertising: K. MAMATHA, Assistant Professor Dr. T. SRINIVASA RAO, Professor &HODChaitanya JamdarNoch keine Bewertungen

- Comparative Study OF Sales Promotions On Bajaj V/S Hero HondaDokument47 SeitenComparative Study OF Sales Promotions On Bajaj V/S Hero Hondamss_sikarwar3812Noch keine Bewertungen

- Intermediate Accounting: Revenue RecognitionDokument153 SeitenIntermediate Accounting: Revenue Recognition12C1 LớpNoch keine Bewertungen

- Taurus USA Rebate Form - FINAL - 20150831Dokument1 SeiteTaurus USA Rebate Form - FINAL - 20150831Kristin LerdahlNoch keine Bewertungen

- Butterfly Gandhimathi Appliances Limited:: Client CompanyDokument4 SeitenButterfly Gandhimathi Appliances Limited:: Client CompanyvamsiNoch keine Bewertungen

- SAP QuestionsDokument15 SeitenSAP Questionsramesh BNoch keine Bewertungen

- TPMDokument16 SeitenTPMArnab MahatoNoch keine Bewertungen

- Sales Agent Contract AgreementDokument11 SeitenSales Agent Contract AgreementmaenterpriseNoch keine Bewertungen

- 1EQ - Profit and Loss - RevisionDokument11 Seiten1EQ - Profit and Loss - RevisionSubham SahNoch keine Bewertungen

- Mobil 1 Rebate FormDokument1 SeiteMobil 1 Rebate Formsnowboa50% (2)

- Sap SD Process FlowsDokument20 SeitenSap SD Process Flows曹龙Noch keine Bewertungen

- Shell Brand C I GuideDokument40 SeitenShell Brand C I GuideRolando Daclan100% (1)

- 02.03.05.06.01 - Manage Sales Rebate AgreementDokument11 Seiten02.03.05.06.01 - Manage Sales Rebate AgreementVinoth100% (1)

- View BillDokument1 SeiteView BillaaaaaaaaNoch keine Bewertungen

- Karthik Project On Reliance TrendsDokument50 SeitenKarthik Project On Reliance TrendsMunna Munna86% (14)

- Walmart Black Magic Buy One, Get One FREEDokument1 SeiteWalmart Black Magic Buy One, Get One FREESunita NairNoch keine Bewertungen

- Promotions: Mcgraw-Hill/IrwinDokument12 SeitenPromotions: Mcgraw-Hill/IrwinShikha AgarwalNoch keine Bewertungen

- Purchasing Rebate Processing (2R7 - SA) : Test Script SAP S/4HANA - 02-09-19Dokument52 SeitenPurchasing Rebate Processing (2R7 - SA) : Test Script SAP S/4HANA - 02-09-19noor ahmedNoch keine Bewertungen

- Second Summative Test in PMDokument3 SeitenSecond Summative Test in PMRobelyn Fababier VeranoNoch keine Bewertungen

- Pricing 2Dokument26 SeitenPricing 2İlker ToktasNoch keine Bewertungen

- Verizon USA 1Dokument2 SeitenVerizon USA 1Yonca AhmetNoch keine Bewertungen

- Note Book SDDokument110 SeitenNote Book SDMurali MNoch keine Bewertungen

- LAWS20060 Taxation Law of AustraliaDokument6 SeitenLAWS20060 Taxation Law of AustraliaPrashansa AryalNoch keine Bewertungen

- Billing Type ControlsDokument18 SeitenBilling Type ControlsRam KLNoch keine Bewertungen

- Partnering With Dell Technologies Services SPDokument32 SeitenPartnering With Dell Technologies Services SPThanh Minh100% (1)

- SAP GRC SOD Conflicts High RiskDokument12 SeitenSAP GRC SOD Conflicts High Riskpreeti singhNoch keine Bewertungen

- Settlements Management in S - 4 HANA - SAP BlogsDokument20 SeitenSettlements Management in S - 4 HANA - SAP BlogsBijay Agarwal100% (4)