Beruflich Dokumente

Kultur Dokumente

Payers & Providers National Edition - Issue of June 2012

Hochgeladen von

PayersandProvidersOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Payers & Providers National Edition - Issue of June 2012

Hochgeladen von

PayersandProvidersCopyright:

Verfügbare Formate

June 2012

National Edition

In this Issue

1. News

Predictive Modeling

A Survey of Predictive Modeling Prioritizing Initiatives and Activities

Whether an organization is pursuing readmissions, accountable care, value based purchasing or numerous other key initiatives involving benchmarking and or identification of specific members of an applicable population at risk for a condition or behavior, optimal Data Mining becomes a critical initial part of the process for health plans and provider organizations to achieve success in their program. The Predictive Modeling Web Summit, Predictive Modeling News, and Payers & Providers jointly sponsored a survey of health plan and healthcare professionals conducted by MCOL on Prioritizing Predictive Modeling Activities. Survey participants typically have a more active interest in predictive modeling issues. This is the fifth annual survey in this regard, allowing the current results to be compared to 2011, 2010, 2009 and 2008 responses. Participants were asked to respond to two items: 1. Please categorize your organization. Purchaser (Health Plan, Employer, TPA, Agent, PBM) Provider (Hospital, Physician, Pharmaceutical, Other Providers) Vendor or Other 2. Suppose you had to prioritize how an organization could spend its funds on predictive modeling initiatives involving health benefits, and you were given a list of 10 items to prioritize. How would you rank them? (1= highest priority / 10 = lowest priority; rank them 1 through 10): The items to rank were as follows, with their abbreviated version, referred to subsequently, indicated in parentheses: Identification of High-Risk Patients for Care Management (Identify) Plan Design Development (Design) Fraud Prevention (Fraud) Treatment Guideline Development (Guideline) Provider Profiling for Network Development (Profiling) Provider Payment Rate and Restructuring (Payment)* Premium Rate Development (Premium) Medicare / Medicaid Population Financial Modeling (Medicare) Target Marketing Based on Customer / Prospect Risk Scores (Marketing) Formulary Development (Formulary)

3. Vitals

Emerging mHealth, Self-Employed Views on Healthcare Costs and Reforms, Medicare Beneficiary Payments: Rural vs. Urban Beneficiaries, Physician Payments Sunshine Act

4. California

Sutter Expands Research Reach, Prime Focuses On Texas Expansion Briefs - Consumer Watchdog Files Suit Against Blue Shield On Plan Closures, Kaiser Names Chief Diversity Officer

5. Midwest

In Ohio, A Medicaid Switcheroo Briefs - Coventrys Illinois Pact Is Renewed, Wisconsin Psychiatric Hospital Chain Names New CEO

6. WebinarsWhite Papers

Recent and Upcoming Events The Many Stories of One Litigious Physician Healthcare and Campaign Finance in California

7. Marketplace

Employment Advertising Opportunities Paid Subscriptions

8. Order Form

Payers & Providers Order Form

Volume 2, Issue 6 June, 2012

www.payersandproviders.com

Heres what we found: For the fifth year in a row a majority of respondents, 59.8%, ranked identification of high-risk patients for care management as the highest priority for how an organization could spend its funds on predictive modeling initiatives.

continued on page 2

2012, by Payers & Providers Publishing LLC and MCOL. All rights reserved

Payers & Providers

Payers & Providers

MARKETPLACE/EMPLOYMENT NEWS

Page 2

Page 7

Predictive Modeling continued

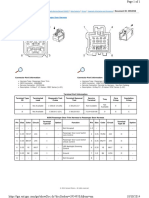

2012 Percent Listing an Item as their #1 Priority

The items with the lowest average rank (highest numerical value) were premium and marketing at 7.0 and 7.1 respectively. In comparing the average ranks of items with the percentage of respondents who ranked each item as the number one priority, there was a basic trend of a higher average rank (lower numerical value) being associated with a higher percentage of respondents who ranked the item as the number one priority for funding with a couple exceptions. Fraud, which had the second most amount of respondents choosing it as the number one priority, along with design and readmissions at 8%, had the third lowest average rank at 6.2. On the other end, guideline, which fell in the middle with its average rank of 5.6, had the lowest percent of respondents ranking it as their number one priority.

No other item had a significant number of respondents ranking it as the number one priority. Plan design development, fraud prevention and readmission prediction initiatives were all ranked as the number one priority by 8% of respondents. All other items were ranked as the number one priority by less than 4% of respondents. When broken down by respondent category, there were only slight changes in the priority rankings. In only two cases, the percentage of respondents ranking an item as the number one priority had a ten percentage point difference among respondent categories. While there was still a majority (53.3%) of payors who ranked identify as the number one priority, providers were twelve percentage points more likely to rank identify as the number one priority (65.4%). In the other case, no respondents categorizing themselves as providers ranked readmission prediction initiatives as the number one priority for funding, while 13.3% of payors did so. As expected from the percentage of respondents who ranked it as the top priority, when assessing the average rank of each item, identify had the highest rank (lowest numerical value) with an average of 2.3. The next average highest rank for an item was readmissions, which had an average rank of 4.3. Average Priority Ranking of Items for 2012

There were no significant differences in the percent of respondents ranking each item as the number one priority year over year. The only item to change over five percentage points from 2011 to 2012 was Medicare, which dropped from .9.9% to 3.4% of respondents. Average Priority Ranking of Items by Year

Item Identify Design Fraud Guideline Profiling Payment* Premium Medicare Marketing Readmission Formulary Other 2012 2.3 5.3 6.2 5.6 5.5 6.0 7.0 5.6 7.1 4.3 N/A N/A 2011 2.3 4.6 5.9 4.3 4.8 4.9 5.9 4.9 5.3 N/A 6.1 N/A 2010 2.9 4.4 N/A 5.3 4.8 5.9 5.9 4.9 5.8 N/A 6.5 8.8 2009 2.7 4.7 N/A 4.9 4.8 5.5 5.9 5.3 5.3 N/A 6.8 9.1 2008 2.5 4.3 N/A 4.8 5.2 5.4 5.6 5.7 5.8 N/A 6.4 9.5

Just as with the percent ranking each item as the top priority, the average ranks did not show significant change from 2011 to 2012. Only four items; payment, premium, guideline and marketing changed average rank by more than one. Marketing had the largest change moving up from 5.3 in 2011 to 7.1 in 2012.

2012, by Payers & Providers Publishing LLC and MCOL. All rights reserved

Payers & Providers

Payers & Providers

MARKETPLACE/EMPLOYMENT VITALS

LISTS from

Page 3

Page 7

Emerging mHealth

37% 32% 31% 30% 29% 22% 38% 21% 17% 16% 8%

of payers have begun to pay for/ provide telephone based consultations of payers have begun to pay for/ provide access to portions of member medical record of payers have begun to pay for/provide drug adherence/health related communication of payers have begun to pay for/provide text based consultations of payers have begun to pay for/provide for medical professionals receiving patient monitoring data of payers have begun to pay for/provide Video Consultations of doctors have begun to offer telephone based consultations of doctors have begun to receive data to monitor patients via mobile devices of doctors have begun to use mobile devices to explain/demonstrate to patients during office visits of doctors have begun to offer text based consultations of doctors have begun to offer video consultations

Medicare Beneficiary Payments: Rural vs. Urban Beneficiaries

1. Per-capita Inpatient Hospital Service payments

for rural beneficiaries are 2% less costly than payments for urban beneficiaries

2. Per-capita Physician Service payments for rural

beneficiaries are 18% less costly than payments for urban beneficiaries

3. Per-capita Outpatient Service payments for rural

beneficiaries are 14% more costly than payments for urban beneficiaries

Source: Rural Relevance Under Healthcare Reform, iVantage Health Analytics, http://www.ivantagehealth.com/rural-relevance-underhealthcare-reform/

Check out more healthsprocket lists at: www.healthsprocket.com

Source: Emerging mHealth: paths for growth, Economist Intelligence Unit (EIU), June 2012, http://www.pwc.com/gx/en/healthcare/mhealth/index.jhtml?WT.ac=vtmhealth#&panel1-1

Physician Payments Sunshine Act Self-Employed Views on Healthcare Costs and Reforms

More than 8 in 10 self-employed feel that, when it comes to health insurance access, their small businesses are at a disadvantage compared with larger businesses. Nearly 85% indicated that rising health coverage costs have been detrimental to themselves, their families, their businesses and their "bottom line" over the past three years. When asked if they would be more likely to provide and pay for a portion of health coverage for their employees, assuming the Affordable Care Act lowers coverage costs, over 65% are either unlikely to do so or unsure if they would be able to do so.

Source: National Association for the Self-Employed, http://www.nase.org/Media/PressReleases.aspx

MCOLBlog: PPSA: What will come of the Physician Payments Sunshine Act?, By Clive Riddle, June 8, 2012 Answers to the question Are you in favor of a public, searchable database of all physician-industry relationships to be available to the public? from a survey of 110 U.S.-based physicians and 223 executives from life sciences companies worldwide conducted for Deloitte by Forbes Insights in January-February 2012.

Yes, as long as patients understand how to interpret the data No, such a database is an invasion of doctors' privacy Yes, the more information patients can get, the better Other 54% 27% 14% 5%

Data source: Physician Payment Sunshine Act: Physicians and life sciences companies coming to terms with transparency?, Deloitte/Forbes Insights

2012, by Payers & Providers Publishing LLC and MCOL. All rights reserved

Payers & Providers

Payers & Providers

MARKETPLACE/EMPLOYMENT CALIFORNIA

Page 4

Page 7

In Brief

Consumer Watchdog Files Suit Against Blue Shield On Plan Closures

Santa Monica-based advocacy group Consumer Watchdog has filed a class action suit against Blue Shield of California, claiming the San Franciscobased insurer is systematically forcing its older and sicker enrollees into barebone highdeductible policies. The suit, filed in San Francisco Superior Court by Consumer Watchdog and the Watley Kallas law firm, claims Blue Shield shuts down older plans and compels its enrollees to take new policies with less coverage at a higher price. Consumer Watchdog refers to the practice as the death spiral. Consumer Watchdog also alleges that the suit violates a 1993 state law that requires insurers to pool members into another plan if they According to the suit, Blue Shield is accused of plans to close eight managed care policies and 23 preferred provider policies by July of this year without offering enrollees comparable coverage. In a statement, Blue Shield said the allegations were false and that it would fight the suit.

Sutter Health Expanding Research Reach

Investing $20 Million Patient-Related Initiatives

Sacramento-based hospital operator Sutter Health is investing $20 million over the next three years to boost its healthcare research and development programs, and has hired two wellknown researchers to carry out the initiative. Sutter, which operates 20 hospitals in Northern California, said it would focus on using the initiative to invent and launch new products, and develop transformative care solutions and innovation emphasizing highquality, patient-centric care, according to a statement released by the organization. No specific projects were discussed by Sutter officials. Sutter has appointed Martin Brotman, M.D., senior vice president of education, research and philanthropy to oversee the initiative. Hes the former chief executive officer of Sutters West Bay Region and head of California Pacific Medical Center in San Francisco. "We will translate knowledge into proven solutions and adopt improvements as rapidly as possible in real practice and community settings," Brotman said. "Sutter Health has a unique opportunity to build a world-class, enterprise-wide, healthcare delivery R&D capability that will create real value for patients." Sutter has previously focused on basic science and gaining approval for the use of medical devices. Most of that research has been performed by affiliated facilities in Palo Alto, San Francisco, Sacramento and Berkeley. Walter F. Stewart, founder and director of the Geisinger Center for Health Research in Pennsylvania, is serving as the initiatives chief research and development officer. Stewart is also an adjunct professor at Johns Hopkins Bloomberg School of Public Health. Joshua Liberman has been appointed as the executive director, research and development operations.

Kaiser Names Chief Diversity Officer

Ronald Copeland, M.D., has been named senior vice president and chief diversity officer for Oakland-based Kaiser Permanente. Copeland, who is currently president of Kaisers medical group in Ohio, assumes the new position on Jan. 1. He will lead Kaiser Permanente's diversity efforts to further create and sustain a cultural competencyexpand supplier diversity efforts, reduce health disparities within diverse and underserved populations, and achieve market growth across diverse population segments, read a prepared statement. Copeland, a graduate of the University of Cincinnati Medical College and a veteran of the U.S. Air Force Medical Corps, has been with Kaiser since 1988 and has been in his current position since 1998.

Prime Focuses On Texas Expansion

Amarillo-area Purchase Second In Recent Months

Ontario-based Prime Healthcare Services has continued its expansion into Texas, acquiring 115-bed Pampa Regional Medical Center near Amarillo for an undisclosed sum. The purchase of Pampa from Houston based Signature Health is the second such deal Prime has undertaken in the Lone Star state in the past several months. In December, it acquired 112bed Harlingen Medical Center from MedCath Corp. Prime officials told the Texas Tribune journalism website earlier this week that it was seeking to expand outside of California. The move follows numerous allegations and investigations pertaining to billing patterns at several of its 13 hospitals in California, specifically focusing on treating Medicare enrollees for septicemia and malnutrition. Our goal at Prime is to provide quality, cost-effective care to patients and partner with the communities we serve, said Prime Chief Executive Officer Prem Reddy, M.D.. "We are honored to bring this mission to the patients of Pampa and the Texas Panhandle. In February, Prime acquired 140-bed Roxborough Memorial Hospital in Philadelphia from Solis Healthcare.

The Payers & Providers California Edition is published every Thursday with six pages of hard-hitting healthcare business and policy news and insights

2012, by Payers & Providers Publishing LLC and MCOL. All rights reserved

Payers & Providers

Payers & Providers

MARKETPLACE/EMPLOYMENT MIDWEST

Page 5

Page 7

In Brief

Coventrys Illinois Pact Is Renewed

The state of Illinois has renewed a pact with Champaign-based Coventry Health Care to administer its health plans and offer benefits. Coventry will offer an open access plan to enrollees through 2016. It will offer an HMO product for enrollment between July 1 and September 28. Were grateful for another opportunity to assist state employees and their families with high quality, affordable healthcare, said Mike Wolff, Coventry Health Cares executive director in Illinois. Formerly known as PersonalCare Insurance, Coventry has offered benefits to state employees since 1984.

In Ohio, A Medicaid Switcheroo

Molina, Centene Recapture Contracts They Lost

It turned out to be a lose-win for Centene Corp. and Molina Healthcare in the Buckeye State. After initially having their large Medicaid contracts that serve virtually all of Ohio given to other health plans, Centene and Molina won them back last week after filing protests. The Ohio Department of Job and Family Services overruled its preliminary awards made in April, when it gave the contracts to Aetna, CareSource, Meridian Health Plan, Paramount Advantage and UnitedHealthcare. These plans were selected through a fair and open application process and an objective scoring methodology, the department said in a statement at the time. that was based on applicants past performance in coordinating care and providing high-quality health outcomes. As a result of the changes, newcomers Aetna and Meridian were given the boot. Paramount and United had had their previous contracts renewed. Two other plans that did not receive contracts and filed protests, Amerigroup Corp. and WellCare Health Plans, remained out of the running. ODJFS officials said that Molinas Medicaid operations in other states favored it in rescoring. Meridian lost points because it did not secure proper licensure from the Ohio Department of Insurance. Aetna had overstated its Medicaid risk-sharing arrangements in other states in its bid, and had actually served more as a third-party administrator instead. The changes are irrevocable, and CareSource and Meridian do not have a right to appeal. ODJFS officials stressed that the selection process had been fair and objective throughout. There are 1.5 million Medicaid enrollees in Ohio, along with 129,000 aged, blind and disabled recipients and 37,000 special needs children who also qualify for coverage. The state recently merged all three populations and shrunk eight service regions into three as part of measures hoped to save $1.5 billion over the next two years. Altogether, the Medicaid managed care pacts are worth about $18 billion a year. The St. Louis-based Centene operates in Ohio as the Buckeye Community Health Plan. Molina, based in Long Beach, Calif., has expanded its Medicaid business into the Midwest in recent years. The Ohio pact constitutes nearly 20% of Molinas overall revenue. Molina Healthcare is pleased to be able to continue its partnership with the state of Ohio to provide quality health care to Ohios Medicaid beneficiaries statewide, said Molina Chief Executive Officer J. Mario Molina, M.D., president and chief executive officer of Molina Healthcare, Inc. We commend ODJFS for its decision, and we look forward to continuing our strong partnerships with the state, our providers, and community-based organizations to provide high-quality health care services for some of Ohios most vulnerable citizens. Buckeye Community CEO Steven White expressed a similar sentiment. We have long been committed to carrying out our mission of delivering innovative healthcare solutions that result in healthy outcomes for Ohio's Medicaid recipients, and we are pleased to continue our partnership with the state of Ohio, he said. All of the plans must pass a readiness assessment administered by the ODJFS prior to the new contracts commencing on Jan. 1.

Wisconsin Psychiatric Hospital Chain Names New CEO

Wisconsin-based Rogers Behavioral Health has named Patrick Hammer as its new chief executive officer. He will replace David L. Mouthrop, who will retire on Aug. 31. Hammer is chief executive officer of Wellstone Regional Medical Center in Jeffersonville, Indiana. He will assume the new position in early July. Rogers screened 500 potential candidates for the position. We narrowed the search down to three of the most qualified, said Rogers Chairman W. Carl Templer. "We believe that Pat will be an asset to Rogers and will build upon the legacy that Dave began. No doubt he will add some of his own vision and talents to the organization. Rogers operates five psychiatric facilities in the Milwaukee and Milwaukee regions, including Rogers Memorial Hospital.

The Payers & Providers Midwest Edition is published every Tuesday with six pages of hard-hitting healthcare business and policy news and insights

2012, by Payers & Providers Publishing LLC and MCOL. All rights reserved

Payers & Providers

Payers & Providers

MARKETPLACE/EMPLOYMENT WEBINARS WHITE PAPERS

Page 6

Page 7

Recent and Upcoming Webinar Events

CD-ROMs with full audio recordings and presentation slides from all recent HealthcareWebSummit events cosponsored by Payers & Providers are available, and attendee registrations are accepted for all upcoming events. To order a CD-ROM or register to attend any of the following recent or upcoming events, call 209.577.4888 or go to www.healthwebsummit.com Hospital Value Based Purchasing: A Roadmap to be held June 27, 2012 at 1 PM Pacific with Robert A. Minkin, Senior Vice President, The Camden Group, Guy DAndrea, President, Discern, LLC, Jason Lee, Senior Manager, ECG Management Consultants Patient Finance: Issues and Pathways June 13, 2012 with Mitch Patridge, Chief Executive Officer, CSI Financial Services, Ron Shinkman, Publisher, Payers & Providers, Editor, Fierce Health Finance and Rick Tsupros, President, Match Point Solutions Hospital Districts: Mapping the Future May 24, 2012 with Michael A. Dowell, Partner, Hinshaw & Culbertson LLP, Walter Kopp, President, Medical Management Services, Inc. and Cleo E. Burtley, Manager, The Camden Group Claims Processing: A Collaborative Effort April 26, 2012 with Kenny Deng, Senior Director of Provider Services and Operations, Blue Shield of California, George H. Mack, Vice President, Payer/Provider Relations, and Vice President, Member Relations, Hospital Association of Southern California, and Dan Martinez, Director of Patient Financial Services, Mission Hospital Reducing Readmissions: Collateral Effects April 11, 2012 with Daniel C. Cusator, M.D., Vice President The Camden Group and Maria Lopes, M.D., Chief Medical Officer, AMC Health Managing an Increasing Trend of Elective Preterm Deliveries February 24, 2012 with Larry Boress, President & CEO at Midwest Business Group on Health, Harold Miller, Executive Director, Center for Healthcare, Quality and Payment Reform, and Peter Weeks, M.D., Chairman, Department of Obstetrics & Gynecology at Edward Hospital Charity Care & Community Benefits: The New Paradigm February 16, 2012 with Ronald Sorensen, Director of Community Partnerships at Providence Health and Services Hospital C-Suite Compensation: How Much is Too Much? January 20th, 2012 with Claudia Wyatt-Johnson, CoFounder, Partners in Performance, Ron Shinkman, Publisher, Payers & Providers Editor, Fierce HealthFinance and Mike Rosenbaum, Partner and Vice Chair of Employee Benefits and Executive Compensation Practice Group, Drinker Biddle & Reath LLP

On May 30, 2012 Payers & Providers released a special white paper, The Many Stories of One Litigious Physician. It is about a prominent surgeons decision to sue the patients she treated at hospital emergency rooms. Many had suffered serious injuries. She sued even if these patients and their families had insurance. She sued even after regulators ordered her to stop. This white paper raises significant questions regarding the payment levels specialist physicians receive to be on call, the role hospitals play in supervising their medical staffs, and the consumer protections available to patients. The Many Stories of One Litigious Physician is available in pdf format for $149. This white paper is the product of months of reporting. It might be the single most significant piece of journalism Payers & Providers has published. To order, call 209.577.4888 or go to www.healthexecstore.com

The Payers & Providers white paper, Follow The Money: Healthcare and Campaign Finance in California, discusses and analyzes the influence of the sectors money on politics and policy. It traces the biggest healthcare industry contributors to candidates and political action committees, how much theyre giving, and where that money is going. Follow the Money is available for $149. In addition to this concise and in-depth investigation, two databases in an easyto-read Excel spreadsheet format are also available for purchase for $129, or with the white paper for $199. They include: All healthcare-related organizations and the itemized contributions they made to candidates and PACs for the 2009-2010 campaign season. Details on more than 90 organizations and big individual contributors are included. A database of the largest donations made by individual employees of Californias hospitals, insurance plans and other healthcare organizations. Details on more than 200 entities are included. Both databases are available in an easy-to-read Excel spreadsheet format.

Given the ramifications of the landmark U.S. Supreme Court Citizens United case, you and your organization simply cannot lack a roadmap to where the political money flows from the healthcare industry in California. To order, call 209.577.4888 or go to www.healthexecstore.com

2012, by Payers & Providers Publishing LLC and MCOL. All rights reserved

Payers & Providers

Payers & Providers

MARKETPLACE/EMPLOYMENT MARKETPLACE

Page 7

Page 7

Employment

The following employment opportunities are listed in the Payers & Providers MCOL Employment Marketplace online at www.mcol.com/emp.htm EDI Software Engineer III - Ashland, OR AVP - Accountable Care Organization-Cincinnati, OH Finance Director, Mental Health MCO-Charlotte, NC VP of Medical Operations - New York

Advertising Opportunities

Payers & Providers, publishes the weekly California and Midwest Editions in electronic format and the monthly National Edition in print and electronic format, and serves as the superior source for healthcare business and policy news and insights. Available advertising solutions through these publications include: Dedicated e-blasts to applicable Payer&Providers distribution lists Sponsor messages in each cover email of any Edition Display Advertising inside each Edition Inquire about Sponsored white paper and webinar opportunities To request a 2012 Payers & Providers Media Kit or other detailed Advertising information, please call 209.577.4888.

The Payers & Providers MCOL Employment Marketplace provides three solutions for employers and recruitment firms to promote employment opportunities to the MCOL and Payers & Providers audience: 1. Payers & Providers Display Ads - that prominently feature your opportunity in the California, Midwest and or National Editions of Payers & Providers. 2. Payers & Providers Marketplace Ads - economically provide readers detailed information on your opportunity in any editions of Payers & Providers. 3. Online Advertising - with a package including web site listings of your opportunity in mcol.com and PayersandProviders.com, plus inclusion of your listing in the monthly edition of MCOL's @Career enewsletter, and eligibility to post the announcement in MCOL's member LinkedIn group. All Payers & Providers Display Advertising, plus qualifying Payers & Providers Marketplace ads receive the online advertising package at no additional cost. Call 209.577.4888 or go to www.mcol.com/aboutcls.htm to request an Employment Advertising Kit, post an employment opportunity or obtain additional information.

Volume 2, Issue 6

Payors & Providers Natinal Edition is published monthly by Payers & Providers Publishing, LLC. Inquiries may be directed to: Phone: (877) 248-2360 e-mail: info@payersandproviders.com Postal: 818 N. Hollywood Way, Suite B, Burbank CA 91505 Web: www.payersandproviders.com Facebook: http://www.facebook.com/Payers-Providers Twitter: www.twitter.com/payersproviders Editorial Board Members: California Edition: Steven T. Valentine, President, The Camden Group; Ross Goldberg, Immediate Past President, Los Robles Hospital and Medical Center; Mark Finucone, Managing Director, Alvarez & Marsol; Henry Loubet, Chief Strategy Officer, Keenan; Anthony Wright, Executive Director, Health Access California Midwest Edition: William M. Dwyer, Healthcare Strategist, Jay Warden, Senior Vice President, , The Camden Group, Ross A. Slotten, M.D., Klein Slotten & French, Michael L. Millenson, President, Health Quality Advisors LLC, Publisher /Editor: Ron Shinkman publisher@payersandproviders.com

Paid Subscriptions

Payers & Providers is the premier publication covering healthcare business and policy news in California, the Midwest and Nationally. Each issue of the weekly California and Midwest Editions includes feature articles, Editorials, News Briefs and more, all dedicated to payer and provider news of direct interest to stakeholders. Paid Subscriptions are available for $99 annually for individuals or $149 in bulk for up to ten subscribers. Payer and Provider California or Midwest Edition Paid Subscriptions receive the applicable weekly Edition via email notification listing issue highlights, with links to two viewing options for each issue (direct pdf download, and online viewing). Along with the following additional benefits: Exclusive access to an online archive of past applicable Editions A copy at no additional cost of upcomingl Payers & Providers Quarterly White Papers for that Edition (typically valued at $149 per edition)* Complimentary attendance to Payers & Providers sponsored Healthcare Web Summit event each December: Healthcare Trends (a $225 value) 50% discount on registrations with other Payers & Providers co-sponsored Healthcare Web Summit events Complimentary electronic subscription to Payers and Provider National Edition (a $99 value)

*Note: Paid subscriptions must be in effect for 30 days in order to be eligible to receive upcoming Quarterly White papers at no additional cost.

National Edition Paid Subscriptions receive exclusive access to an online archive of past national editions; Delivery of each national edition in pdf and print formats; electronic delivery of weekly regional editions (California and Midwest; an annual complimentary electronic copy of one Payers & Providers Quarterly White Papers; and a 50% discount on registrations with other Payers & Providers co-sponsored Healthcare Web Summit events

2012, by Payers & Providers Publishing LLC and MCOL. All rights reserved

Payers & Providers

Payers & Providers

MARKETPLACE/EMPLOYMENT ORDER FORM

Page 8

Page 7

Payers & Providers Order Form

This Payers & Providers Order Form is available for Paid Subscription and White Paper ordering, via postal or fax submissions. Detailed information, pricing, and online ordering is available at www.healthexecstore.com. For Payers & Providers recent or upcoming webinar orders, call 209.577.4888 or go to www.healthwebsummit.com/cdroms.htm. Subscriptions

Editions (check applicable) CA Midwest National Subscription Level Paid Paid Two Year Bulk Rate Bulk Two Year

Annual Cost@ $99.00 $175.00 $149.00 $275.00

Description (Annual Cost is per each edition) Paid Individual Subscription for one year Paid subscription for two years License for up to ten paid subscriptions indicate primary contact below Bulk Rate for two years

Quantity

White Paper Order Information

Item (list items and applicable prices)

Price@

Total

Delivery Requested (circle) Electronic Hard Copy Sub-Total CA Sales Tax (CA Residents Only) only required for Hard Copy Processing Fee Grand Total

Payment Information (paid subscriptions) Payment by Credit Card: (Circle One) American Express Card Number: Payment by check: (Circle One) Payment Enclosed MasterCard Visa Discover Expires Please Invoice Us

7.375%

$8.00

You may cancel subscriptions at any time. Annual payments will receive pro-rata refunds upon cancellation.

To Submit Your Order:

Fax: 209.577.3557 Phone: 209.577.4888 Web: www.PayersandProviders.com Mail: MCOL 1101 Standiford Avenue, Suite C-3 Modesto, CA 95350

2012, by Payers & Providers Publishing LLC and MCOL. All rights reserved

Das könnte Ihnen auch gefallen

- HBR's 10 Must Reads on Strategy for Healthcare (featuring articles by Michael E. Porter and Thomas H. Lee, MD)Von EverandHBR's 10 Must Reads on Strategy for Healthcare (featuring articles by Michael E. Porter and Thomas H. Lee, MD)Bewertung: 4 von 5 Sternen4/5 (3)

- Turning The Vision of Connected Health Into A RealityDokument14 SeitenTurning The Vision of Connected Health Into A RealityCognizant100% (2)

- Newton Gauss MethodDokument37 SeitenNewton Gauss MethodLucas WeaverNoch keine Bewertungen

- 70-30-00-918-802-A - Consumable Materials Index For The Engine (Pratt & Whitney)Dokument124 Seiten70-30-00-918-802-A - Consumable Materials Index For The Engine (Pratt & Whitney)victorNoch keine Bewertungen

- Digital Transformation of Healthcare Industry Liquid Hub WhitepaperDokument14 SeitenDigital Transformation of Healthcare Industry Liquid Hub WhitepaperNitin AmesurNoch keine Bewertungen

- 2015 Health Care Providers Outlook: United StatesDokument5 Seiten2015 Health Care Providers Outlook: United StatesEmma Hinchliffe100% (1)

- Digest of Ganila Vs CADokument1 SeiteDigest of Ganila Vs CAJohn Lester LantinNoch keine Bewertungen

- History of Phosphoric Acid Technology (Evolution and Future Perspectives)Dokument7 SeitenHistory of Phosphoric Acid Technology (Evolution and Future Perspectives)Fajar Zona67% (3)

- Cortana Analytics in Healthcare White PaperDokument16 SeitenCortana Analytics in Healthcare White PaperDeyverson Costa100% (1)

- IBM AnalyticsDokument16 SeitenIBM AnalyticsWisley VelascoNoch keine Bewertungen

- Payers & Providers National Edition - Issue of February 2012Dokument8 SeitenPayers & Providers National Edition - Issue of February 2012PayersandProvidersNoch keine Bewertungen

- DUP218 Health Care Consumer FINALDokument48 SeitenDUP218 Health Care Consumer FINALSteveEpsteinNoch keine Bewertungen

- Health Insurance Research PaperDokument7 SeitenHealth Insurance Research Paperxfeivdsif100% (1)

- Us Chs MondayMemo 2013healthcare 5Cs 021313Dokument1 SeiteUs Chs MondayMemo 2013healthcare 5Cs 021313Subhani ShaikNoch keine Bewertungen

- Payers & Providers National Edition October 2011Dokument8 SeitenPayers & Providers National Edition October 2011PayersandProvidersNoch keine Bewertungen

- Trends in Healthcare Payments Annual Report 2015 PDFDokument38 SeitenTrends in Healthcare Payments Annual Report 2015 PDFAnonymous Feglbx5Noch keine Bewertungen

- Frontline of Healthcare - It's Time To Elevate The Patient Experience in Healthcare - Bain & CompanyDokument5 SeitenFrontline of Healthcare - It's Time To Elevate The Patient Experience in Healthcare - Bain & Companyb00810902Noch keine Bewertungen

- Research Paper On Health Care CostsDokument6 SeitenResearch Paper On Health Care Costsgw1nm9nb100% (1)

- Outline For Medicaid Research PaperDokument6 SeitenOutline For Medicaid Research Paperafnhiheaebysya100% (1)

- Payers & Providers National Edition December 2011Dokument8 SeitenPayers & Providers National Edition December 2011PayersandProvidersNoch keine Bewertungen

- Collect Now or Pay Later White PaperDokument10 SeitenCollect Now or Pay Later White PaperShyam Sunder Rao ChepurNoch keine Bewertungen

- Hospital Administration Research PapersDokument6 SeitenHospital Administration Research Papersafmcbmoag100% (1)

- MetLife Employee Benefits Trends Study Release Two FINALDokument3 SeitenMetLife Employee Benefits Trends Study Release Two FINALAmerican Health LineNoch keine Bewertungen

- Midwest Edition: Wellpoint at Bottom of Hospitals' ListDokument5 SeitenMidwest Edition: Wellpoint at Bottom of Hospitals' ListPayersandProvidersNoch keine Bewertungen

- Article Text-363-2-10-20200316Dokument48 SeitenArticle Text-363-2-10-20200316Najib OtmaneNoch keine Bewertungen

- Combined Written DeliverableDokument25 SeitenCombined Written DeliverableJonesConsultingTCUNoch keine Bewertungen

- Dissertation On Health Care FinancingDokument6 SeitenDissertation On Health Care FinancingWriterPaperSingapore100% (1)

- MIT CV Booklet 11 4 2010Dokument67 SeitenMIT CV Booklet 11 4 2010XesemeNoch keine Bewertungen

- A Dissertation: Comparative Study of Icici Prudential and HDFC in Reference To Children Insurance PolicyDokument43 SeitenA Dissertation: Comparative Study of Icici Prudential and HDFC in Reference To Children Insurance Policywarezisgr867% (3)

- Thesis On Health InsuranceDokument8 SeitenThesis On Health Insurancekimberlyjonesnaperville100% (2)

- Understanding and Addressing "Hot Spots" Critical To Bending The Medicaid Cost CurveDokument8 SeitenUnderstanding and Addressing "Hot Spots" Critical To Bending The Medicaid Cost CurvePartnership to Fight Chronic DiseaseNoch keine Bewertungen

- EinavDokument66 SeitenEinavAdrian GuzmanNoch keine Bewertungen

- HealthCareConsumers Brazil 2011Dokument28 SeitenHealthCareConsumers Brazil 2011wp7sNoch keine Bewertungen

- Consumer-Driven Health Plans Show More Patient Involvement in Their Health CareDokument4 SeitenConsumer-Driven Health Plans Show More Patient Involvement in Their Health CareAutomotive Wholesalers Association of New EnglandNoch keine Bewertungen

- Paying For Quality CaseDokument14 SeitenPaying For Quality CaseWILFRED ZVAREVASHENoch keine Bewertungen

- Critical Literature AppraisalDokument12 SeitenCritical Literature AppraisalThe HoopersNoch keine Bewertungen

- Accenture Losing PatienceDokument4 SeitenAccenture Losing PatienceAnna NguyenNoch keine Bewertungen

- ACA Health Reform and Mental Health Care 2012Dokument3 SeitenACA Health Reform and Mental Health Care 2012Mike F MartelliNoch keine Bewertungen

- Health Care Term PapersDokument6 SeitenHealth Care Term Papersafmzkbuvlmmhqq100% (1)

- Financial Wellness The Next Frontier in Wellness Programs PDFDokument16 SeitenFinancial Wellness The Next Frontier in Wellness Programs PDFYanoNoch keine Bewertungen

- Week 2 Summary OldDokument5 SeitenWeek 2 Summary OldKharryunna McCloudNoch keine Bewertungen

- Dissertation Funding Public HealthDokument5 SeitenDissertation Funding Public HealthWriteMyPaperCanadaUK100% (1)

- Zero B Health Eco Health ReformDokument5 SeitenZero B Health Eco Health ReformAnusha VergheseNoch keine Bewertungen

- Health Care PlanningDokument2 SeitenHealth Care Planningapi-166459739Noch keine Bewertungen

- 8973308Dokument9 Seiten8973308Anonymous mWI4Hktm50% (2)

- Dissertation Topics For Masters in Public HealthDokument8 SeitenDissertation Topics For Masters in Public HealthPaperWritersForCollegeUK100% (1)

- Health SectorDokument84 SeitenHealth SectorRahul MandalNoch keine Bewertungen

- DTC Study 2012Dokument45 SeitenDTC Study 2012drewguariniNoch keine Bewertungen

- Midwest Edition: Vouchers Could Spike PremiumsDokument5 SeitenMidwest Edition: Vouchers Could Spike PremiumsPayersandProvidersNoch keine Bewertungen

- US CHS 2010SurveyofHealthCareConsumers LS 043010Dokument12 SeitenUS CHS 2010SurveyofHealthCareConsumers LS 043010shekar20Noch keine Bewertungen

- Segmentation in The Healthcare Insurance Industry: WhitepaperDokument8 SeitenSegmentation in The Healthcare Insurance Industry: WhitepaperMerhan FoudaNoch keine Bewertungen

- 9 The Move To Consumer ChoiceDokument11 Seiten9 The Move To Consumer ChoiceVinayaka KumarNoch keine Bewertungen

- Beyond BordersDokument91 SeitenBeyond Bordersfl_in1Noch keine Bewertungen

- Big Data Technologies in Health and BiomedicalDokument7 SeitenBig Data Technologies in Health and BiomedicalAJER JOURNALNoch keine Bewertungen

- Research Paper in Health EconomicsDokument6 SeitenResearch Paper in Health Economicscaqllprhf100% (1)

- Microeconomic AnalysisDokument12 SeitenMicroeconomic AnalysisNat AliNoch keine Bewertungen

- The Single Strategy To Use For A Health Care Professional Is Caring For A Patient Who Is About To Begin Using BetaxololDokument3 SeitenThe Single Strategy To Use For A Health Care Professional Is Caring For A Patient Who Is About To Begin Using Betaxololkeenan4o7aNoch keine Bewertungen

- Referral Rates Direct Indirect Costs 121713Dokument14 SeitenReferral Rates Direct Indirect Costs 121713QMx2014Noch keine Bewertungen

- 2009 AAA StudyDokument18 Seiten2009 AAA Studycaryr100% (2)

- Health Economics Research Paper TopicsDokument5 SeitenHealth Economics Research Paper Topicsefj02jba100% (1)

- Cost Control in Health Care......................................Dokument11 SeitenCost Control in Health Care......................................Rifat ParveenNoch keine Bewertungen

- Thesis On Health Care Management PDFDokument5 SeitenThesis On Health Care Management PDFlaurajohnsonphoenix100% (2)

- Final Final HSM PaperDokument20 SeitenFinal Final HSM PaperJamie JacksonNoch keine Bewertungen

- Supervisor Janet Nguyen's Presentation On Orange County Grand Jury Report.Dokument20 SeitenSupervisor Janet Nguyen's Presentation On Orange County Grand Jury Report.PayersandProvidersNoch keine Bewertungen

- Payers & Providers California Edition - Issue of November 1, 2012Dokument5 SeitenPayers & Providers California Edition - Issue of November 1, 2012PayersandProvidersNoch keine Bewertungen

- Payers & Providers Midwest Edition - Issue of November 6, 2012Dokument5 SeitenPayers & Providers Midwest Edition - Issue of November 6, 2012PayersandProvidersNoch keine Bewertungen

- Midwest Edition: Ford Merger Likely To DisappointDokument5 SeitenMidwest Edition: Ford Merger Likely To DisappointPayersandProvidersNoch keine Bewertungen

- California Edition: Health Net, DHCS Settle Rate LawsuitDokument5 SeitenCalifornia Edition: Health Net, DHCS Settle Rate LawsuitPayersandProviders100% (1)

- Midwest Edition: Sequester May Hit Health ResearchDokument5 SeitenMidwest Edition: Sequester May Hit Health ResearchPayersandProvidersNoch keine Bewertungen

- Payers & Providers National Edition - Issue of October 2012Dokument8 SeitenPayers & Providers National Edition - Issue of October 2012PayersandProvidersNoch keine Bewertungen

- California Edition: Dignity Health Facing ChallengesDokument5 SeitenCalifornia Edition: Dignity Health Facing ChallengesPayersandProvidersNoch keine Bewertungen

- Midwest Edition: Michigan Has A $1 Billion QuestionDokument5 SeitenMidwest Edition: Michigan Has A $1 Billion QuestionPayersandProvidersNoch keine Bewertungen

- Payers & Providers California Edition - Issue of October 25, 2012Dokument5 SeitenPayers & Providers California Edition - Issue of October 25, 2012PayersandProvidersNoch keine Bewertungen

- Midwest Edition: Vouchers Could Spike PremiumsDokument5 SeitenMidwest Edition: Vouchers Could Spike PremiumsPayersandProvidersNoch keine Bewertungen

- California Edition: Dignity Health Facing ChallengesDokument5 SeitenCalifornia Edition: Dignity Health Facing ChallengesPayersandProvidersNoch keine Bewertungen

- Payers & Providers California Edition - Issue of October 18, 2012Dokument5 SeitenPayers & Providers California Edition - Issue of October 18, 2012PayersandProvidersNoch keine Bewertungen

- California Edition: Dignity Health Facing ChallengesDokument5 SeitenCalifornia Edition: Dignity Health Facing ChallengesPayersandProvidersNoch keine Bewertungen

- Payers & Providers Midwest Edition - Issue of October 9, 2012Dokument5 SeitenPayers & Providers Midwest Edition - Issue of October 9, 2012PayersandProvidersNoch keine Bewertungen

- Midwest Edition: UM Docs Slash Dual-Eligible CostsDokument5 SeitenMidwest Edition: UM Docs Slash Dual-Eligible CostsPayersandProvidersNoch keine Bewertungen

- Payers & Providers Midwest Edition - Issue of October 2, 2012Dokument5 SeitenPayers & Providers Midwest Edition - Issue of October 2, 2012PayersandProvidersNoch keine Bewertungen

- Payers & Providers National Edition - Issue of September 2012Dokument8 SeitenPayers & Providers National Edition - Issue of September 2012PayersandProvidersNoch keine Bewertungen

- Payers & Providers California Edition - Issue of October 4, 2012Dokument5 SeitenPayers & Providers California Edition - Issue of October 4, 2012PayersandProvidersNoch keine Bewertungen

- Payers & Providers Midwest Edition - Issue of September 25. 2012Dokument5 SeitenPayers & Providers Midwest Edition - Issue of September 25. 2012PayersandProvidersNoch keine Bewertungen

- California Edition: IHA Cites Medical Groups For QualityDokument6 SeitenCalifornia Edition: IHA Cites Medical Groups For QualityPayersandProvidersNoch keine Bewertungen

- California Edition: State's Hospitals Make Quality GainsDokument6 SeitenCalifornia Edition: State's Hospitals Make Quality GainsPayersandProvidersNoch keine Bewertungen

- Payers & Providers California Edition - Issue of August 30, 2012Dokument6 SeitenPayers & Providers California Edition - Issue of August 30, 2012PayersandProvidersNoch keine Bewertungen

- Payers & Providers California Edition - Issue of September 13, 2012Dokument6 SeitenPayers & Providers California Edition - Issue of September 13, 2012PayersandProvidersNoch keine Bewertungen

- Midwest Edition: Healthpartners, Park Nicollet MergeDokument5 SeitenMidwest Edition: Healthpartners, Park Nicollet MergePayersandProvidersNoch keine Bewertungen

- Payers & Providers California Edition - Issue of September 6, 2012Dokument6 SeitenPayers & Providers California Edition - Issue of September 6, 2012PayersandProvidersNoch keine Bewertungen

- California Edition: The Long, Mysterious Appeals RoadDokument6 SeitenCalifornia Edition: The Long, Mysterious Appeals RoadPayersandProvidersNoch keine Bewertungen

- Payers & Providers National Edition - Issue of August 2012Dokument8 SeitenPayers & Providers National Edition - Issue of August 2012PayersandProvidersNoch keine Bewertungen

- Payers & Providers Midwest Edition - Issue of August 28, 2012Dokument5 SeitenPayers & Providers Midwest Edition - Issue of August 28, 2012PayersandProvidersNoch keine Bewertungen

- Midwest Edition: Wellpoint at Bottom of Hospitals' ListDokument5 SeitenMidwest Edition: Wellpoint at Bottom of Hospitals' ListPayersandProvidersNoch keine Bewertungen

- Psychological Attitude Towards SafetyDokument17 SeitenPsychological Attitude Towards SafetyAMOL RASTOGI 19BCM0012Noch keine Bewertungen

- Corporate Restructuring Companies Amendment Act 2021Dokument9 SeitenCorporate Restructuring Companies Amendment Act 2021Najeebullah KardaarNoch keine Bewertungen

- Suggested Answers Spring 2015 Examinations 1 of 8: Strategic Management Accounting - Semester-6Dokument8 SeitenSuggested Answers Spring 2015 Examinations 1 of 8: Strategic Management Accounting - Semester-6Abdul BasitNoch keine Bewertungen

- Curriculum Vitae H R VijayDokument8 SeitenCurriculum Vitae H R VijayvijaygowdabdvtNoch keine Bewertungen

- Order 49Dokument14 SeitenOrder 49NURADRIANA OMAR BAHSIRNoch keine Bewertungen

- Helsingborg EngDokument8 SeitenHelsingborg EngMassaCoNoch keine Bewertungen

- X606 PDFDokument1 SeiteX606 PDFDany OrioliNoch keine Bewertungen

- Chapter 9 Audit SamplingDokument47 SeitenChapter 9 Audit SamplingYenelyn Apistar CambarijanNoch keine Bewertungen

- Guide To Networking Essentials Fifth Edition: Making Networks WorkDokument33 SeitenGuide To Networking Essentials Fifth Edition: Making Networks WorkKhamis SeifNoch keine Bewertungen

- Burberry Annual Report 2019-20 PDFDokument277 SeitenBurberry Annual Report 2019-20 PDFSatya PhaneendraNoch keine Bewertungen

- Visa Requirements Austrian EmbassyDokument2 SeitenVisa Requirements Austrian Embassyadalcayde2514Noch keine Bewertungen

- 3UF70121AU000 Datasheet enDokument7 Seiten3UF70121AU000 Datasheet enJuan Perez PerezNoch keine Bewertungen

- "Laughter Is Part of The Human Survival Kit. : David NathanDokument4 Seiten"Laughter Is Part of The Human Survival Kit. : David NathanTrang NhungNoch keine Bewertungen

- Supply DemandProblems With Solutions, Part 1Dokument16 SeitenSupply DemandProblems With Solutions, Part 1deviNoch keine Bewertungen

- WTO & MFA AnalysisDokument17 SeitenWTO & MFA Analysisarun1974Noch keine Bewertungen

- Traffic Speed StudyDokument55 SeitenTraffic Speed StudyAnika Tabassum SarkarNoch keine Bewertungen

- Azure Subscription and Service Limits, Quotas, and ConstraintsDokument54 SeitenAzure Subscription and Service Limits, Quotas, and ConstraintsSorinNoch keine Bewertungen

- T53 L 13 Turboshaft EngineDokument2 SeitenT53 L 13 Turboshaft EngineEagle1968Noch keine Bewertungen

- Formula Retail and Large Controls Planning Department ReportDokument235 SeitenFormula Retail and Large Controls Planning Department ReportMissionLocalNoch keine Bewertungen

- Evaluating The Policy Outcomes For Urban Resiliency in Informal Settlements Since Independence in Dhaka, Bangladesh: A ReviewDokument14 SeitenEvaluating The Policy Outcomes For Urban Resiliency in Informal Settlements Since Independence in Dhaka, Bangladesh: A ReviewJaber AbdullahNoch keine Bewertungen

- Energia Eolica Nordex N90 2500 enDokument20 SeitenEnergia Eolica Nordex N90 2500 enNardo Antonio Llanos MatusNoch keine Bewertungen

- Scout Activities On The Indian Railways - Original Order: MC No. SubjectDokument4 SeitenScout Activities On The Indian Railways - Original Order: MC No. SubjectVikasvijay SinghNoch keine Bewertungen

- Berger Paints - Ar-19-20 PDFDokument302 SeitenBerger Paints - Ar-19-20 PDFSahil Garg100% (1)

- Siemens C321 Smart LockDokument2 SeitenSiemens C321 Smart LockBapharosNoch keine Bewertungen

- EE FlowchartDokument1 SeiteEE Flowchartgoogley71Noch keine Bewertungen

- 14 DETEMINANTS & MATRICES PART 3 of 6 PDFDokument10 Seiten14 DETEMINANTS & MATRICES PART 3 of 6 PDFsabhari_ramNoch keine Bewertungen