Beruflich Dokumente

Kultur Dokumente

TMT Bars

Hochgeladen von

Nesa PriyaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

TMT Bars

Hochgeladen von

Nesa PriyaCopyright:

Verfügbare Formate

TMT BARS

Strength of the bars are carefully controlled by optimizing the water pressure for their pearlitic core and tough surface of tempered martensite, thereby providing an optimum strength, ductility and toughness. TMT bars are widely used in general purpose concrete reinforcement structures, bridges and flyovers, dams, thermal and hydel power plants, industrial structures, high-rise buildings, underground platforms in metro railway and rapid transport system. TMT Bars are thermo-mechanically-treated through leading world temp core based technology for high yield strength. The process involves rapid quenching of the hot bars through a series of water jets after they roll out of the last mill stand. The bars are cooled, allowing the core and surface temperatures to equalize. The bar core cools down slowly to turn into a ferrlite-pearlite aggregate. Kamdhenu Ispat Ltd., Bhiwadi unit has been authorized by CRM, Belgium to manufacture Tempcore TMT under licence agreement. Features of TMT Tempcore Bars Enhanced strength combined with high ductility Excellent weldability without loss of strength at welded joints Better ductility and malleability Earthquake resistant High thermal resistance Significant savings in cost of steel

Table of Contents 1. Overview of the Indian steel industry 2. Industry Structure/ Profile 3. Demand Supply Scenario 4. Consumption 5. Imports & Exports 6. Demand Supply Outlook 7. Price trends 8. Current Tariff structure 9. Industry Restructuring 10. Global Steel Industry 11. Company Details

AN OVERVIEW OF STEEL SECTOR Global Scenario | Domestic Scenario | Production | Demand - Availability Projection | Steel Prices | Imports of Iron & Steel | Exports of Iron & Steel | Levies on Iron & Steel | Opportunities for growth of Iron and Steel in Private Sector Global Scenario

In 2011 the world crude steel production reached 1527 million tonnes (mt) and showed a growth of 6.8% over 2010. (Source: World Steel Association or WSA; data provisional) China remained the worlds largest crude steel producer in 2011 (695.5 mt) followed by Japan (107.6 mt) and the USA (86.2 mt). India occupied the 4th position (72.2 mt) for the second consecutive year. (Source: WSA; data provisional) The WSA has projected that apparent steel use will increase by 6.5% to 1,398 mt in 2011, following growth of 15.1% in 2010. In 2012, it has projected that the same will grow further by 5.4%. Such growth will be largely driven by China and India with Chinas apparent steel use in 2011 and 2012 expected to increase by 7.5% and 6% respectively. For India, growth in apparent steel use is expected to be subdued at 4.3% in 2011 but expected to go up by 7.9% in 2012.

Per capita finished steel consumption is estimated at 206 kg for world, 427 kg for China.

Domestic Scenario

The Indian steel industry has entered into a new development stage from 2007-08, riding high on the resurgent economy and rising demand for steel. Rapid rise in production has resulted in India becoming the 4th largest producer of crude steel and the largest producer of sponge iron or DRI in the world. As per the report of the Working Group on Steel for the 12th Plan, there exist many factors which carry the potential of raising the per capita steel consumption in the country, currently estimated at 55 kg (provisional). These include among others, an estimated infrastructure investment of nearly a trillion dollars, a projected growth of manufacturing from current 8% to 11-12%, increase in urban population to 600 million by 2030 from the current level of 400 million, emergence of the rural market for steel currently consuming around 10 kg per annum buoyed by projects like Bharat Nirman, Pradhan Mantri Gram Sadak Yojana, Rajiv Gandhi Awaas Yojana among others.

At the time of its release, the National Steel Policy 2005 had envisaged steel production to reach 110 million tonnes by 2019-20. However, based on the assessment of the current ongoing projects, both in greenfield and brownfield, the Working Group on Steel for the 12th Plan has projected that the crude steel steel capacity in the county is likely to be 140 mt by 2016-17. Further, based on the status of MOUs signed by the private producers with the various State Governments, it is expected that Indias steel capacity would exceed 200 mt by 2020.

The National Steel Policy 2005 is currently being reviewed keeping in mind the rapid developments in the domestic steel industry (both on the supply and demand sides) as well as the stable growth of the Indian economy since the release of the Policy in 2005. Production

Steel industry was delicensed and decontrolled in 1991 & 1992 respectively. Today, India is the 4 th largest crude steel producer of steel in the world. In 2010-11 (prov), production for sale of total finished steel (alloy + non alloy) was 66.01 mt. Production of Pig Iron in 2010-11 (prov), was 5.54 mt.

India is the largest producer of sponge iron in the world with the coal based route accounting for 78% of total sponge iron production in the country (27 mt in 2010-11; prov.): Last five year's production for sale of pig iron, sponge iron and total finished steel (alloy + nonalloy) are given below:

Indian steel industry : Production for Sale (in million tonnes) Category Pig Iron Sponge Iron Total Finished Steel (alloy + non alloy) 2006-07 2007-08 2008-09 2009-10 4.93 18.34 52.53 5.284 20.37 56.07 6.21 21.09 57.16 5.88 24.33 60.62 2010-11* 5.54 26.71 66.01

Source: Joint Plant Committee; *provisional

Demand - Availability Projection

Demand Availability of iron and steel in the country is projected by Ministry of Steel in its Five Yearly Plan documents. Gaps in availability are met mostly through imports. Interface with consumers by way of a Steel Consumers Council exists, the meetings of which are conducted on regular basis. Interface helps in redressing availability problems, complaints related to quality.

Steel Prices

Price regulation of iron & steel was abolished on 16.1.1992. Since then steel prices are determined by the interplay of market forces. Domestic steel prices are influenced by trends in raw material prices, demand supply conditions in the market, international price trends among others. An Inter-Ministerial Group (IMG) is functioning in the Ministry of Steel, under the Chairmanship of Secretary (Steel) to monitor and coordinate major steel investments in the country. The Government also took various fiscal and other measures for stabilizing steel prices like significant reduction in import duties on steel, major raw materials, including mineral products and ores and concentrates in last few years. Also, excise duty for steel is currently at 10%. To ensure sufficient domestic availability and curb the rising price of hot-rolled coils in the domestic market, its imports have been freed by the government. The government has also imposed export duty of 30% on iron ore fines and lumps in order to discourage its export and conserve the mineral for long term requirement of the domestic steel industry.

For ensuring quality of steel, several items have been brought under a quality control order issued by the Government. The matter to bring more steel items under this order is under examination. Imports of Iron & Steel

Iron & Steel are freely importable as per the extant policy. Last five years import of Finished (Carbon) Steel is given below:-

Indian steel industry : Imports (in million tonnes) Category Total Finished Steel (alloy + non alloy) 2006-07 2007-08 2008-09 2009-10 4.93 7.03 5.84 7.38 2010-11* 6.79

Source: Joint Plant Committee; *provisional

Exports of Iron & Steel

Iron & Steel are freely exportable. Exports of finished carbon steel and pig iron during the last five years and the current year is

as :

Indian steel industry : Exports (in million tonnes) Category Total Finished Steel (alloy + non alloy) 2006-07 5.24 2007-08 5.08 2008-09 4.44 2009-10 3.25 2010-11* 3.46

Source: Joint Plant Committee; *provisional

Levies on Iron & Steel SDF levy- This was a levy started for funding modernisation, expansion and development of steel sector. The Fund, inter-alia, supports : 1. 2. 3. 4. Capital expenditure for modernisation, rehabilitation, diversification, renewal & replacement of Integrated Steel Plants. Research & Development Rebates to SSI Corporations Expenditure on ERU of JPC o SDF levy was abolished on 21.4.94

o o o

Cabinet decided that corpus could be recycled for loans to Main producers Interest on loans to Main Producers be set aside for promotion of R&D on steel etc. An Empowered Committee has been set up to guide the R&D effort in this sector.

EGEAF Was a levy started for reimbursing the price differential cost of inputs used for engineering exporters. Fund was discontinued on 19.2.96.

Opportunities for growth of Iron and Steel in Private Sector The New Industrial Policy Regime The New Industrial policy opened up the Indian iron and steel industry for private investment by (a) removing it from the list of industries reserved for public sector and (b) exempting it from compulsory licensing. Imports of foreign technology as well as foreign direct investment are now freely permitted up to certain limits under an automatic route. Ministry of Steel plays the role of a facilitator, providing broad directions and assistance to new and existing steel plants, in the liberalized scenario. The Growth Profile (i) Steel The liberalization of industrial policy and other initiatives taken by the Government have given a definite impetus for entry, participation and growth of the private sector in the steel industry. While the existing units are being modernized/expanded, a large number of new steel plants have also come up in different parts of the country based on modern, cost effective, state of-the-art technologies. In the last few years, the rapid and stable growth of the demand side has also prompted domestic entrepreneurs to set up fresh greenfield projects in different states of the country. At present, crude steel making capacity is 84 mt and India, the 4 th largest producer of crude steel in the world, has to its credit, the capability to produce a variety of grades and that too, of international quality standards. The country is expected to become the 2 nd largest producer of crude steel in the world by 2015-16, provided all requirements for creation of fresh capacity are adequately met. (ii) Pig Iron India is also an important producer of pig iron. Post-liberalisation, with setting up several units in the private sector, not only imports have drastically reduced but also India has turned out to be a net exporter of pig iron. The private sector accounted for 90% of total production for sale of pig iron in the country in 2010-11 (provisional). The production of pig iron has increased from 1.6 mt in 1991-92 to 5.54 mt in 2010-11 (provisional). (iii) Sponge Iron India is the worlds largest producer of sponge iron with a host of coal based units, located in the mineral-rich states of the country. Over the years, the coal based route has emerged as a key contributor and accounted for 78% of total sponge iron production in the country (27 mt; 2010-11; prov.). Capacity in sponge iron making too has increased over the years and stands at around 35 mt.

Das könnte Ihnen auch gefallen

- 74009Dokument225 Seiten74009Nesa PriyaNoch keine Bewertungen

- ICICI BankDokument24 SeitenICICI BankDevinder DhariwalNoch keine Bewertungen

- 2007-IPP Final ReportDokument140 Seiten2007-IPP Final ReportNesa PriyaNoch keine Bewertungen

- SAIL Secondary Products Marketing StrategyDokument91 SeitenSAIL Secondary Products Marketing StrategyMunmun Das100% (1)

- Status of Sponge Iron Plant in OrissaDokument36 SeitenStatus of Sponge Iron Plant in OrissachiranjibdcNoch keine Bewertungen

- Fact Sheet - Raw Materials2011Dokument2 SeitenFact Sheet - Raw Materials2011Nesa PriyaNoch keine Bewertungen

- Ch09 - National Income DeterminationDokument47 SeitenCh09 - National Income DeterminationHanson OwusuNoch keine Bewertungen

- Lecture Notes-Management (Edited)Dokument42 SeitenLecture Notes-Management (Edited)Alele VincentNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Perhitungan Produktivitas Alat Berat Jenis BulldozerDokument2 SeitenPerhitungan Produktivitas Alat Berat Jenis Bulldozerarno viraNoch keine Bewertungen

- Voicu GoldMetallogenyGuianaShieldDokument26 SeitenVoicu GoldMetallogenyGuianaShieldMarco AponteNoch keine Bewertungen

- SW (Adventure Edition) Deadlands - Lost Colony - WidowmakerDokument32 SeitenSW (Adventure Edition) Deadlands - Lost Colony - WidowmakerJacobo Cisneros100% (2)

- Fco Daw-CarpacoDokument1 SeiteFco Daw-CarpacoMuhammad SupiyanNoch keine Bewertungen

- JV AgreementDokument59 SeitenJV AgreementManisha SinghNoch keine Bewertungen

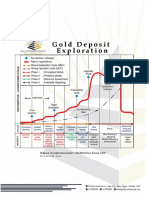

- Stages of An Exploration Project. (Modifted From Eimon 1988.)Dokument1 SeiteStages of An Exploration Project. (Modifted From Eimon 1988.)KareemAmenNoch keine Bewertungen

- 1978-06 Successful Applications of NDT Techniques To Mining Equipment Maintenance - Sutcliffe, Cottier (#MNG)Dokument3 Seiten1978-06 Successful Applications of NDT Techniques To Mining Equipment Maintenance - Sutcliffe, Cottier (#MNG)rhinemine100% (1)

- Mine Closure Planning GuideDokument77 SeitenMine Closure Planning GuideЛуис Ангел Кинтеро ГазNoch keine Bewertungen

- Bloody Hands Full of Gold Henry Kissinger and The Freeport-McMoRan MineDokument12 SeitenBloody Hands Full of Gold Henry Kissinger and The Freeport-McMoRan Minefaizal rizkiNoch keine Bewertungen

- CTI PresentationDokument19 SeitenCTI PresentationSantosh BeheraNoch keine Bewertungen

- BOTSWANADokument32 SeitenBOTSWANAAvinash_Negi_7301Noch keine Bewertungen

- Flyrock Phenomena and Area SecurityDokument12 SeitenFlyrock Phenomena and Area SecuritydiiegoNoch keine Bewertungen

- Earth Science - Week 3Dokument15 SeitenEarth Science - Week 3JUAN DELA CRUZ100% (1)

- Big Oak Flat RoadDokument226 SeitenBig Oak Flat RoadAnonymous rdyFWm9Noch keine Bewertungen

- Crystal Activation - CitrineDokument5 SeitenCrystal Activation - CitrineKostas Onibushi50% (2)

- Updated Companies DatabaseDokument73 SeitenUpdated Companies DatabaseLiberiaEITI100% (8)

- Artificial Intelligence With Sas PDFDokument141 SeitenArtificial Intelligence With Sas PDFnaveen kumar Malineni100% (1)

- Barmac VSI Crusher Saves $0.32/Tonne Processing Hard Copper Reverberation SlagDokument2 SeitenBarmac VSI Crusher Saves $0.32/Tonne Processing Hard Copper Reverberation Slaghulupat100% (1)

- Memorandum of Agreement DraftDokument3 SeitenMemorandum of Agreement DraftJerry EnocNoch keine Bewertungen

- Marta PuraDokument3 SeitenMarta PuraMuhammad Al-banjaryNoch keine Bewertungen

- Brochure JacoviDokument5 SeitenBrochure JacovimenriquepcNoch keine Bewertungen

- DLB RoadDokument23 SeitenDLB RoadNehal AhmedNoch keine Bewertungen

- How Tall A Column in Block Caving 2014-May-2Dokument11 SeitenHow Tall A Column in Block Caving 2014-May-2carlo cerruttiNoch keine Bewertungen

- Bitcoin Com PK Bitcoin Mining Works Urdu Bitcoin Mining KeseDokument7 SeitenBitcoin Com PK Bitcoin Mining Works Urdu Bitcoin Mining KeseAmir MushtaqNoch keine Bewertungen

- Feistech Com Spreader-P00149p1 HTMLDokument4 SeitenFeistech Com Spreader-P00149p1 HTMLCRISTIAN LEVI ALBORNOZ REATEGUINoch keine Bewertungen

- Coal Trader: InternationalDokument5 SeitenCoal Trader: InternationalandreasNoch keine Bewertungen

- NI 43-101 Report On The Guanajuato Mine July 2013 - Final For Filing PDFDokument122 SeitenNI 43-101 Report On The Guanajuato Mine July 2013 - Final For Filing PDFpicochulo17Noch keine Bewertungen

- PWC Investment Appraisal of Mining-Capital-projects Jul12Dokument16 SeitenPWC Investment Appraisal of Mining-Capital-projects Jul12Nicholas AngNoch keine Bewertungen

- Stripping Ratio ConsiderationsDokument18 SeitenStripping Ratio ConsiderationsFranz Diaz100% (2)

- Brief History of Iron and Steel Industry in India: Chapter-2Dokument13 SeitenBrief History of Iron and Steel Industry in India: Chapter-2Suresh BabuNoch keine Bewertungen