Beruflich Dokumente

Kultur Dokumente

Your Finance Organization Time To Take Another Look913

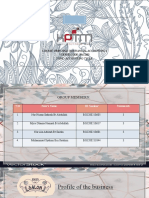

Hochgeladen von

Joe DemienOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Your Finance Organization Time To Take Another Look913

Hochgeladen von

Joe DemienCopyright:

Verfügbare Formate

CFO ADVISORY

Your Finance Organization: Time to Take Another Look?

KPMG LLP

The Opportunity to Revisit the Corporate Finance Organization Structure

Have you looked at your finance organization chart lately?

Unless you are a recently appointed CFO, preparing for an IPO, or reshuffling your organization after an acquisition, the answer is likely to be no While much . attention is given by analysts and vendors to topics of the day like outsourcing, shared services and business intelligence, addressing the finance organization structure is not commonly discussed as a strategic lever to improve performance. Recent research by KPMGs CFO Advisory Services suggests that this assumption is false. The research suggests there is a compelling case for finance leaders to assess how their functions are structured and aligned to their businesses. Based on the research conducted, we posit three principles of finance organization design. By addressing these principles along with a serious focus on how finance headcount is aligned to the business, significant benefits may be achieved in regard to the finance organizations ability to manage risk, reduce costs, and partner more effectively with the business. global company that has segmented its business into three business groups, each given its own P&L. As this matrix structure was created, the organizations finance structure was modified to include business group finance teams that are accountable for reporting on each business groups performance. While such business group finance teams may not be considered classic core finance functions, they are a logical example of how the finance structure often needs to change to meet changing business requirements. 3. As finance functions grow incrementally over time, the organizational structure often is not actively managed. As such, it is natural for less efficient legacy functions to survive past the point where they remain useful. For instance, an organization in its growth stage may decide to create a financial systems administration function that reports directly to finance, in order to provide support for queries and ad hoc reporting. However, as the organizations IT capabilities mature, a better alignment might be to dissolve that function to have financial systems managed by the IT organization. Without actively assessing the current finance function over time, the legacy financial systems administration function might remain in finance, creating redundancy and increasing technology costs. 4. Lastly, organizational politics has led certain finance functions to develop ineffective organizational structures. In many cases, new functions or reporting relationships were created to provide roles for certain individuals where such design does not make

Finance Function Evolution

Before reviewing the three principles, it is useful to understand how finance functions are often formed. Our analysis suggests that the typical finance organization structure is shaped over time by a combination of four factors: 1. Classic core functions, such as treasury, accounting, tax and FP&A are initially assembled to address common finance responsibilities. 2. Due to considerations such as international expansion or business model change, noncore finance functions and reporting relationships may be developed. For example, consider a

functional sense. For instance, we observed one global technology company that maintained no less than three field finance functions, where one global function would have clearly better served the business. Upon query, a determination was made that all three of the field finance leaders were well entrenched within the organization, and protected their unique functions using their political capital. By understanding how finance organizations are commonly formed, we can now utilize the three principles to begin the processes of developing a better organizational structure.

service levels and reduce costs. Principle #1 - The finance function structure should adapt based upon the organizations risk profile. For organizations that had recently had changes to their organizational risk profile, it was noted in our research that the finance structure often was changed to meet such circumstances. Identified events impacting the risk profile included: M&A activity, the transition to an outsourced finance environment, new regulatory requirements, or a shift in ownership (e.g., via a public stock offering). As risk increased, finance leadership realized that certain changes needed to be made to the organization structure. The following table highlights some of the common changes, along with their resultant risk benefits and potential disadvantages.

Principles for Finance Organization Design

By applying the three principles of finance organization design, finance leaders have a tremendous opportunity to objectively assess how their organization maps to the business, providing a clear case for change. Principle #1 The finance function structure should adapt based upon the organizations risk profile. Principle #2 Reporting relationships to the CFO should take into account key aspects of the business model. Principle #3 Sourcing alternatives should be assessed to improve finance

Table 1: Potential Options to Address an Increased Risk Profile Potential Organization Change Regional finance reports direct line to corporate finance, rather than to regional business leadership Risk Benefits Clear accountability for providing sound financial information to support the corporate financials Regional finance performance (and thus compensation) is dictated by corporate finance leadership Reduced potential for conflict of interest with regional business leadership The enterprise risk function is centralized, either within finance or in a separate function reporting to the CEO Clear accountability for the Strong communication is development of the enterprise required to help ensure risk strategy that business leadership is able to contribute to the Clear accountability for enterprise risk strategy managing enterprise risk Strong communication is If Compliance is centralized as required to help ensure a finance function, there is a that business leadership clear linkage between risk and understands its accountthe overall business model abilities for managing financial risk Promotes internal audits independence from the finance function, and is considered a leading practice for corporate governance None noted Potential Disadvantages Reduced responsiveness to regional business requirements Focus on financial reporting increases to the detriment of management reporting

Internal audit reports directly to the board of directors

Potential Organization Change The controller function is refocused on accounting and controls, where other administrative responsibilities are given to another function (such as a chief administrative officer or vice president of finance operations)

Risk Benefits Helps to ensure that the role of the controllership is focused upon maintaining financial records in accordance with key accounting policies

Potential Disadvantages Administrative functions such as corporate real estate or facilities, which have a direct impact upon OPEX, may not receive the proper cost focus or control monitoring

A prime example of where a risk event impacted the finance organization structure was the introduction of Sarbanes-Oxley in 2002, which significantly increased the risk profile due to increased compliance requirements for all U.S. organizations with publicly traded equity or debt. As a result of Sarbanes-Oxley, many organizations moved to separate their internal audit function from the finance domain, in order to promote objectivity. Additionally, many organizations chose to have regional and business group finance report directly to the corporate finance function, in order to reinforce the control environment. Over four years later, this trend is still evident within the companies we surveyed, where nearly 75% of the companies surveyed had internal audit placed outside of the finance function. Principle #2 - Reporting relationships to the CFO should take into account key aspects of the business model. The structure of the finance organization impacts the perception of key internal and external stakeholders. Internal stakeholders include the customers of finance,

including departments such as sales, marketing, and operations. External stakeholders include analysts, investors and potential job applicants, all of whom may draw conclusions from the organizational alignment. As such, finance leaders should evaluate the current organization structure to determine what messages are being sent to these important constituencies. In certain cases, it may be better for the overall organization to move certain functions out of the finance function. For instance, for a highly acquisitive company, corporate development may report directly to the chief executive officer and is a peer of the CFO function. This alignment signals both internally and to the investment community that this company considers M&A to be a critical component of its business model.

Furthermore, top-tier M&A talent that would otherwise not be interested in working within the finance domain might explore such companies due to the CEO reporting relationship. Based on our research, certain core functions nearly always reported directly to the CFO. These functions included: Controllership Reports to the CFO 97% of the time Tax Reports to the CFO 95% of the time FP&A Reports to the CFO 86% of the time Treasury Reports to the CFO 86% of the time Table 2 discusses other common finance functions where alignment varied within our research.

Table 2: Perception of Finance Based on Alignment

Most Common Functional Alignment Internal/External Perceptions Alternative Functional Alignment Corporate development reports to the CFO 36% of the time Corporate development is embedded within the FP&A function 22% of the time

Corporate M&A is deemed critical to the companys mission development (M&A) reports directly to Top internal and external the CEO 42% of talent is more attracted to the time the company Internally, may cause confusion as analytical skills may be split between FP&A and the corporate development teams Investor relations reports directly to the CFO 64% of the time Signals to investors a strong alignment between the business model and financial community Indicates that the CFO is empowered to speak to the business model , allowing the CEO to speak more strategically and longer term

Investor relations reports to the CEO 18% of the time Investor relations reports to treasury 18% of the time

Most Common Functional Alignment Risk management (i.e., the chief risk officer) reports to the CEO 38% of the time (this relationship was even more prevalent within the financial services industry)

Internal/External Perceptions Indicates to all stakeholders that risk/ compliance is actively managed by the organization Internally, may lead to confusion regarding risk reporting (i.e., the S-4 process) unless strong communication protocols are in place with finance and the risk function

Alternative Functional Alignment Risk management reports to operations 38% of the time Risk management reports to the CFO or treasury function 24% of the time

When determining the optimal alignment of the function, finance leaders must also take into account their span of control. This consideration is extremely important, due to the inherent difficulties associated with effectively managing multiple direct reports and business functions. While arguments can be made for many functions to be taken under the finance umbrella (i.e., corporate development, IT, sales operations, etc.), our research indicated that on average, seven functions reported directly to the CFO. This average did not include nonfunctional reporting relationships, such as regional or business group finance leadership. Based on this average, it is suggested that finance leaders review their direct reports to determine if nonstrategic functions can be either pushed down a level, consolidated, or moved outside of the finance organization entirely. For example, one $4B financial services organization had nine direct reports to the CFO, including separate IT finance and shared services functions. After evaluating this situation, the decision was made to combine the two functions under a single functional leader. This leaders mandate was to drive finance excellence by utilizing technology and process improvement in tandem with shared services techniques. Such a model made more sense for the maturing company, which needed to improve its processes and systems in order to compete effectively. Principle #3 - Sourcing alternatives should be assessed to improve service levels and reduce costs Overwhelmingly, 97% (see side bar) of the finance organizations researched utilized sourcing alternatives such as shared services and/or business process outsourcing. Based on follow-up interviews with research clients, it was apparent that the use of sourcing was driven by the following qualitative factors: Better scalability as transactional volumes increase, allowing finance to keep pace with business growth Improved service levels to the business by enabling centers of expertise for key finance disciplines Consolidated controls, reducing the effort and cost associated with documenting and testing controls for audit and/or other regulatory purposes (such as Sarbanes-Oxley). While these strategic factors have led many organizations to evaluate sourcing alternatives, the quantitative business case for sourcing was the primary driver for implementation. As organizations grew past the $1B revenue mark, the opportunity This high percentage is attributed in large part to the size of the organizations surveyed, where the smallest organization had $1.2B in annual revenues, while the average company had revenues of $46B. The average annual revenues decreased to $26.5B after factoring out three large oil and gas organizations, each with annual revenues north of $200B.

to shift transactional headcount to lower cost locations drove the decision to implement shared services, outsourcing or hybrid models. As sourcing alternatives are deployed, finance leadership should continually reevaluate the structure of their organization to determine where the sourcing function best resides. Based on this clear mandate for sourcing, we suggest that finance leaders conduct a simple exercise, segmenting headcount based on scope (enterprise versus business unit) and service type (decision support versus transactional). Figure 1 depicts a possible model for beginning this analysis, using a shared services example. Based upon an organizations business model, specific finance functions/responsibilities can then be added to the model, allowing headcount to be allocated accordingly. Figure 2 provides an example of such an allocation.

Figure 1: Sample Shared Services Evaluation Model Management Decision Support Services Specialty Services Externally defined activity High Profile mistakes Difficult to measure performance High-impact/specialty skill set Cost-Efficient Transaction Based Services Shared Services High volume Efficiency focused Repetitive activity Easily measured performance Consistent customer requirements Transaction/service-oriented skill set Analytical Services Drive high-level decisions Content focused Business Unit Specific Competitive advantage Project/issue driven Analytical/diagnostic skill set Management judgment Business Unit Transaction Processing Provides input to decisions Business-specific activity Broad content required Accounting skill set

Enterprise Generic

Figure 2: Sample Shared Services Headcount Allocation Management Decision Support Services Specialty Services Internal Audit Strategic Planning Treasury Tax Planning and Compliance External Reporting Insurance and Risk Management Cost-Efficient Transaction Based Services Shared Services AP Invoice Processing T&E Vouchers Processing GL Entries and Reconciliation Fixed Assets Payroll and Payroll Tax Processing Cash Management and Lockbox Event Management 232 FTEs Analytical Services Financial Budgeting and Forecasting Business Unit Specific Financial Analysis and Ad Hoc Reporting 191 FTEs Business Unit Transaction Processing Month-End Close Processing Statutory Accounting Regional Accounting Billing and Collections 146 FTEs 40 FTEs

Enterprise Generic

Based upon 1) the location of finance resources within the model, 2) benchmark comparisons of headcount and transaction levels against similar organizations, and 3) evaluation of operating/transactional costs against industry peers, finance leaders can quickly develop a business case for pursuing sourcing alternatives. While cost reduction is only one aspect of a well-rounded business case, our research suggests that it is an important driver. As such, we suggest that finance leaders conduct a similar mapping exercise when evaluating the finance organization structure, to identify sourcing opportunities to reduce headcount costs. .

Summary

Finance leaders have an excellent opportunity to assess their current organization structure, leveraging the three principles. Key questions that you can ask now include: Based on our current situation, are we optimally managing risk? What does our finance organization structure signal to our stakeholders, both internally and externally? Does our current structure align to our business model, and allow us to recruit talent for key positions? How many direct reports do I have? Are all of these reports truly necessary, given our current business model?

How does finance headcount align to our business model? Are we taking best advantage of our sourcing options to improve service levels and maintain costs? Based on the answers to these questions, finance leaders can begin to actively refine their organizations to better manage enterprise risk, improve service levels to the business, and attract key talent, while actively managing the cost of finance. Have you looked at your finance org chart lately? Regarding the Research: In March 2007 KPMG conducted research with 34 organizations to understand: , Which finance functions reported to the corporate CFO What responsibilities were included within each function What factors led to current organizational structure Whether regional finance reported directly to the corporate finance function or the business, as well as the reasoning for utilizing the chosen relationship model Whether a matrix structure was utilized, and the reasoning for utilizing such a structure Whether shared services or other sourcing alternatives (BPO, etc.) were utilized, along with the reasoning for utilizing such alternatives The process for conducting this research included: Developing a finance organizational map template, which was sent to over 75 KPMG account teams. Thirty-four out of the 75 account teams responded. The template was completed by the account teams, indicating where each function reported to directly. In addition, the primary responsibilities handled by these functions were listed. Functions assessed included: Controllership Financial Reporting Investor Relations FP&A Treasury Tax Internal Audit Risk Management After results were tabulated, follow-up interviews with the account teams were conducted to validate the results Corporate Development Financial Systems Administration Accounting Operations Finance Center of Excellence Information Technology Human Resources Other

10

Key characteristics of the organizations surveyed include: All organizations surveyed could be classified as Global 2000 organizations, with revenues of $1.2B (USD) or greater Twenty-nine of the 34 organizations were U.S. multinationals, with the remaining organizations coming from Europe. Fourteen of the 34 organizations were from the financial services industry Five of the 34 organizations were from the consumer products/retail industry Three of the 34 organizations were from the oil and gas industry The remaining 12 organizations came from the industrial/manufacturing industry, including high technology and pharmaceuticals The findings of this research drove the three key principles that underpin this paper.

us.kpmg.com

About CFO Advisory KPMG's CFO Advisory practice is part of our Business Performance Services (BPS). BPS provides a broad array of services, practical experience, and deep functional and technical knowledge to help clients identify and implement improvement opportunities that best meet their business needs in today's changing environment. BPS services include: CFO Advisory Operations Management People and Change Management

For more information on KPMG's Business Performance Services, please contact one of the following professionals. Stephen Lis National Partner in Charge 267-256-1991 Midatlanic Cindy Bertrando Partner 267-256-1890 Midwest Linda Imonti Principal 312-665-2913 Northeast Joe Orlando Principal 617-988-6337 Southeast Jim Scalise Principal 919-664-7344 Southwest John Kunasek Partner 713-319-3513 West Arun Kumar Principal 650-404-4910 Federal Ronald Longo Managing Director 202-533-4014

Author Larry Melillo 55 Second St. San Francisco, CA 94105 415-254-3399 Contributors Arun Kumar 500 E. Middlefield Rd. Mountain View, CA 94043 650-404-4910 Anne Bothwell 500 E. Middlefield Rd. Mountain View, CA 94043 650-404-3084 Mike Scanlon 55 Second St. San Francisco, CA 94105 415-963-7137

The information provided is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation.

2007 KPMG LLP a U.S. limited liability partnership and a , member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A. 20185SVO KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss Cooperative.

Das könnte Ihnen auch gefallen

- Report 2 Talent Assessment StrategiesDokument29 SeitenReport 2 Talent Assessment StrategiestatagalgoNoch keine Bewertungen

- PSHC R&D: Ndividual Evelopment LANDokument3 SeitenPSHC R&D: Ndividual Evelopment LANBalu BalajiNoch keine Bewertungen

- Tentemplates Talent Management PDFDokument26 SeitenTentemplates Talent Management PDFmanagementgraduateNoch keine Bewertungen

- SWOT Analysis Template DownloadDokument3 SeitenSWOT Analysis Template DownloadRyuk ShinigamiNoch keine Bewertungen

- CBHRM AjayDokument12 SeitenCBHRM AjayAjay PhalkeNoch keine Bewertungen

- Job Rotation AssignmentDokument7 SeitenJob Rotation AssignmentRohit MathurNoch keine Bewertungen

- Employee Performance AppraisalsDokument8 SeitenEmployee Performance AppraisalsPooja ChaudharyNoch keine Bewertungen

- Saratoga Survey Highlight ReportDokument20 SeitenSaratoga Survey Highlight ReportRohan MenonNoch keine Bewertungen

- Job Description Questionnaire InsightsDokument8 SeitenJob Description Questionnaire InsightsPràßhánTh Aɭoŋɘ ɭovɘʀNoch keine Bewertungen

- ING SustainabilityReport2011Dokument112 SeitenING SustainabilityReport2011Daniel PaloNoch keine Bewertungen

- Employment at WillDokument1 SeiteEmployment at WillGrace Ganta100% (1)

- Sample Performance AppraisalDokument6 SeitenSample Performance AppraisalReeces EwartNoch keine Bewertungen

- Budgeting and Budgetary ControlDokument38 SeitenBudgeting and Budgetary Controlessien akpanukoNoch keine Bewertungen

- Job Analysis Guide: Collecting Data & Designing RolesDokument49 SeitenJob Analysis Guide: Collecting Data & Designing RolesBhasker JorwalNoch keine Bewertungen

- Key Result AreasDokument2 SeitenKey Result Areasbright_hrNoch keine Bewertungen

- Building The Balanced ScorecardDokument26 SeitenBuilding The Balanced ScorecardpravinkavithaNoch keine Bewertungen

- Write Up On Job EvaluationDokument22 SeitenWrite Up On Job Evaluationtaniya pandeyNoch keine Bewertungen

- Overtime Audit Report-EDokument0 SeitenOvertime Audit Report-EGarto Emmanuel SalimNoch keine Bewertungen

- Dupont Analysis of Pharma CompaniesDokument8 SeitenDupont Analysis of Pharma CompaniesKalyan VsNoch keine Bewertungen

- Performance Appraisal PresentationDokument19 SeitenPerformance Appraisal PresentationPravej AlamNoch keine Bewertungen

- 4 - Training Needs AnalysisDokument2 Seiten4 - Training Needs AnalysisBial InamNoch keine Bewertungen

- What Is A BudgetDokument6 SeitenWhat Is A BudgetFentahun AmareNoch keine Bewertungen

- Group 4 Presentation - Collective IntelligenceDokument25 SeitenGroup 4 Presentation - Collective IntelligenceHassaan Bin KhalidNoch keine Bewertungen

- The Nine-Box Grid or Talent MatrixDokument2 SeitenThe Nine-Box Grid or Talent MatrixAngel AraujoNoch keine Bewertungen

- Sop Human ResourceDokument3 SeitenSop Human ResourceANGELOU SAGARALNoch keine Bewertungen

- Unit 2 Conceptual Framework of Organizational DevelopmentDokument48 SeitenUnit 2 Conceptual Framework of Organizational DevelopmentShiwangi Alind Tiwary100% (1)

- Role of Customer Delight - IpsosDokument12 SeitenRole of Customer Delight - IpsosSugandha TanejaNoch keine Bewertungen

- Work-Life Balance AssessmentDokument2 SeitenWork-Life Balance AssessmentAxel WatkinsNoch keine Bewertungen

- Talent Assessment StrategiesDokument28 SeitenTalent Assessment StrategiesBrianEarlNoch keine Bewertungen

- 2BC3 W2020 Lecture 2 - Strategic HRDokument36 Seiten2BC3 W2020 Lecture 2 - Strategic HRasdfghjklNoch keine Bewertungen

- Unit 3 HRMDokument60 SeitenUnit 3 HRMlakshayNoch keine Bewertungen

- Ifp 23 Estimating Retirement Needs and How Much Do You Need On RetirementDokument9 SeitenIfp 23 Estimating Retirement Needs and How Much Do You Need On Retirementsachin_chawlaNoch keine Bewertungen

- Management Control Systems in Service OrganizationsDokument9 SeitenManagement Control Systems in Service OrganizationsnewyorkkkNoch keine Bewertungen

- JK Galbraith Public Policy Fellowship Application PackefDokument6 SeitenJK Galbraith Public Policy Fellowship Application PackefNikolai HamboneNoch keine Bewertungen

- Pestle AnalysisDokument4 SeitenPestle AnalysisSrivastava MukulNoch keine Bewertungen

- EMPLOYEE COMPENSATION Radhika SahityaDokument36 SeitenEMPLOYEE COMPENSATION Radhika SahityaShikhar MaheshwariNoch keine Bewertungen

- MG 370 Term PaperDokument12 SeitenMG 370 Term PaperDaltonNoch keine Bewertungen

- Design of Work Systems: Mcgraw-Hill/IrwinDokument32 SeitenDesign of Work Systems: Mcgraw-Hill/IrwinSagar Murty100% (1)

- Logic Model Grant Workplan GuidelinesDokument10 SeitenLogic Model Grant Workplan GuidelinesPrincess SonalNoch keine Bewertungen

- Complexity ManagementDokument19 SeitenComplexity Managementmtaimur1Noch keine Bewertungen

- Argenti A ScoreDokument1 SeiteArgenti A Scoremd1586100% (1)

- 360 Degree Performance AppraisalDokument4 Seiten360 Degree Performance AppraisalMohd.faisal NabiNoch keine Bewertungen

- Job Analysis Recruitment & Selection: Prof. Rama Shankar YadavDokument73 SeitenJob Analysis Recruitment & Selection: Prof. Rama Shankar YadavNikhil DarganNoch keine Bewertungen

- EY Performance Control EnvironmentDokument10 SeitenEY Performance Control EnvironmentIndra WantoNoch keine Bewertungen

- Models For Measuring HUMAN ASSETSDokument16 SeitenModels For Measuring HUMAN ASSETSashish_laddaNoch keine Bewertungen

- MFRS 108Dokument22 SeitenMFRS 108Yeo Chioujin0% (1)

- Historical Financial Analysis - CA Rajiv SinghDokument78 SeitenHistorical Financial Analysis - CA Rajiv Singhవిజయ్ పి100% (1)

- Corporate GovernanceDokument89 SeitenCorporate GovernanceGolpo MahmudNoch keine Bewertungen

- Job RotationDokument3 SeitenJob RotationNayan RathodNoch keine Bewertungen

- Srikanth Performance AppraisalDokument10 SeitenSrikanth Performance Appraisaliam_ur_sriNoch keine Bewertungen

- Human Resources (HR) Planning ProcessDokument38 SeitenHuman Resources (HR) Planning ProcessMoeed KhanNoch keine Bewertungen

- Performance Appraisal - Wikipedia, The Free EncyclopediaDokument11 SeitenPerformance Appraisal - Wikipedia, The Free Encyclopediaductran268100% (1)

- HR Audit Set 1Dokument11 SeitenHR Audit Set 1Zayed PatelNoch keine Bewertungen

- Performance Appraisal Interview QuestionsDokument6 SeitenPerformance Appraisal Interview QuestionsMatin Nick100% (2)

- Performance Based Bonus InfographicDokument1 SeitePerformance Based Bonus InfographicDBM CALABARZONNoch keine Bewertungen

- Evp SG ReviewDokument3 SeitenEvp SG ReviewyvesdubaiNoch keine Bewertungen

- People Capability Maturity Model A Complete Guide - 2021 EditionVon EverandPeople Capability Maturity Model A Complete Guide - 2021 EditionNoch keine Bewertungen

- Business Development Management A Complete Guide - 2021 EditionVon EverandBusiness Development Management A Complete Guide - 2021 EditionNoch keine Bewertungen

- IN-BASKET EXAMINATION: Passbooks Study GuideVon EverandIN-BASKET EXAMINATION: Passbooks Study GuideNoch keine Bewertungen

- Nigeria'sDokument3 SeitenNigeria'sJoe DemienNoch keine Bewertungen

- Nigeria'sDokument3 SeitenNigeria'sJoe DemienNoch keine Bewertungen

- Erp Case StudyDokument101 SeitenErp Case StudyNalinee KumariNoch keine Bewertungen

- Global Financial Crisis - Lessons For Nigeria's Monetary PolicyxDokument12 SeitenGlobal Financial Crisis - Lessons For Nigeria's Monetary PolicyxJoe DemienNoch keine Bewertungen

- Global Financial Crisis - Lessons For Nigeria's Monetary PolicyxDokument12 SeitenGlobal Financial Crisis - Lessons For Nigeria's Monetary PolicyxJoe DemienNoch keine Bewertungen

- Nigeria - The Road AheadDokument26 SeitenNigeria - The Road AheadJoe DemienNoch keine Bewertungen

- Nigerian Economic Outlook 2010Dokument28 SeitenNigerian Economic Outlook 2010Joe DemienNoch keine Bewertungen

- Nigeria - The Road AheadDokument26 SeitenNigeria - The Road AheadJoe DemienNoch keine Bewertungen

- Hot ChocolateDokument19 SeitenHot Chocolatechlsc100% (1)

- Unit Test: The Accounting Cycle Part A: Completing The Accounting CycleDokument7 SeitenUnit Test: The Accounting Cycle Part A: Completing The Accounting CycleKevin PanesarNoch keine Bewertungen

- IAS 23 Borrowing Costs CapitalizationDokument10 SeitenIAS 23 Borrowing Costs CapitalizationMaria100% (1)

- Wire and Wire ProductsDokument29 SeitenWire and Wire ProductsThomas MNoch keine Bewertungen

- Assignment AccountDokument9 SeitenAssignment AccountAin SaidinNoch keine Bewertungen

- Negotiable Instruments Law SyllabusDokument13 SeitenNegotiable Instruments Law Syllabusk santosNoch keine Bewertungen

- Microsoft Word - Supplier Registration Form REV 4Dokument3 SeitenMicrosoft Word - Supplier Registration Form REV 4PT Arinda Ananda ArsindoNoch keine Bewertungen

- Main ProjectDokument85 SeitenMain ProjectMani Prasanth0% (1)

- Ienergizer Limited 31 March 2019 Execution VersionDokument85 SeitenIenergizer Limited 31 March 2019 Execution VersionzvetibaNoch keine Bewertungen

- Project Report On TDS PDFDokument35 SeitenProject Report On TDS PDFPriti gupta50% (2)

- Financing To Msme Units - Andhra BankDokument111 SeitenFinancing To Msme Units - Andhra BankRavi Kumar100% (1)

- NTPC For Kudanali-Luburi Coal ProjectDokument58 SeitenNTPC For Kudanali-Luburi Coal ProjectMonilGuptaNoch keine Bewertungen

- Black Book PDFDokument57 SeitenBlack Book PDFprabhas MakwanaNoch keine Bewertungen

- Selling ATM Card Cashout ICQ 747095810 Dumps Pin Emv Chip ATM Skimmers Track2 PinDokument3 SeitenSelling ATM Card Cashout ICQ 747095810 Dumps Pin Emv Chip ATM Skimmers Track2 Pinnguyen cuongNoch keine Bewertungen

- aFM12 Test Bank PrefaceDokument10 SeitenaFM12 Test Bank PrefaceLe Trung25% (4)

- CH 5 LS Practice HW QUIZDokument25 SeitenCH 5 LS Practice HW QUIZDenise Jane RoqueNoch keine Bewertungen

- PMS - Data TTM Return Till May16bDokument15 SeitenPMS - Data TTM Return Till May16bMoneylife FoundationNoch keine Bewertungen

- Auto Loan IndustryDokument38 SeitenAuto Loan IndustryVinay SinghNoch keine Bewertungen

- Taking A Look at PPP Loan Forgiveness: Duo Receive ScholarshipDokument1 SeiteTaking A Look at PPP Loan Forgiveness: Duo Receive ScholarshipPrice LangNoch keine Bewertungen

- Auto Loan AgreementDokument3 SeitenAuto Loan AgreementJ CNoch keine Bewertungen

- Conceptual Framework Purpose Assist Standards Developed IFRSDokument6 SeitenConceptual Framework Purpose Assist Standards Developed IFRSKyleZapantaNoch keine Bewertungen

- Improving AIM's Performance Through Algorithm ChangesDokument8 SeitenImproving AIM's Performance Through Algorithm Changesd1234dNoch keine Bewertungen

- Plaintiff-Appellant vs. vs. Defendants-Appellees Marcial Esposo Solicitor General Arturo A. Alafriz, Assistant Solicitor General Antonio G. Ibarra Attorney Concepcion Torrijos-AgapinanDokument4 SeitenPlaintiff-Appellant vs. vs. Defendants-Appellees Marcial Esposo Solicitor General Arturo A. Alafriz, Assistant Solicitor General Antonio G. Ibarra Attorney Concepcion Torrijos-AgapinanRoselle Grace MendovaNoch keine Bewertungen

- Bharat Rasayan - Issues and ConcernsDokument5 SeitenBharat Rasayan - Issues and ConcernsJayaprakash Gopala KamathNoch keine Bewertungen

- Circular Economy Finance GuidelinesDokument4 SeitenCircular Economy Finance GuidelinesAbu NawasNoch keine Bewertungen

- Chapter Eleven: Liquidity and Reserves Management: Strategies and PoliciesDokument34 SeitenChapter Eleven: Liquidity and Reserves Management: Strategies and PoliciestusedoNoch keine Bewertungen

- I2BE-Morning Evening PDFDokument10 SeitenI2BE-Morning Evening PDFusama sajawalNoch keine Bewertungen

- FBI Interview of Veldora ArthurDokument9 SeitenFBI Interview of Veldora ArthurThe Straw BuyerNoch keine Bewertungen

- SAP S - 4HANA Cash and Liquidity Management - Important AspectsDokument19 SeitenSAP S - 4HANA Cash and Liquidity Management - Important AspectsshaiNoch keine Bewertungen

- Question Bank of Financial and Management Accounting - 1markDokument38 SeitenQuestion Bank of Financial and Management Accounting - 1marklakkuMS100% (1)

- FIN441 Assignment 2Dokument4 SeitenFIN441 Assignment 2MahiraNoch keine Bewertungen