Beruflich Dokumente

Kultur Dokumente

Untitled

Hochgeladen von

Mahesh PrasadOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Untitled

Hochgeladen von

Mahesh PrasadCopyright:

Verfügbare Formate

1 Executive Summary Global Economy: Back to fundamentals The global economy is in transitionary phase, as market conditions improved on a ccount

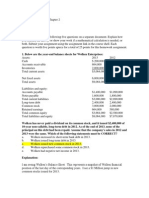

of ECB unleashing EUR 1 tn of liquidity through two rounds of LTRO s. However, it is too early to conclude that the worst of the European debt crisis is behind us. The rest of the world s contribution to the evolving growt h prospects is mixed as incoming data shows that growth has picked up in the US. EM economies are showin g signs of moderation on account of EZ related concerns. Meanwhile, the changing political landscape in t he world s most economically powerful and geopolitically significant economies further add to the uncertainty . The policymakers resolve to support the financial system unconditionally, will cap the downside risk to the financial markets State of the Indian economy: Indian economy likely to witness gradual recovery t his fiscal The Indian economy faced a difficult year in FY2012 with substantial growth mode ration and high inflation pressures. While the economy still remains vulnerable due to both domestic and e xternal factors, we believe some gradual recovery is slated to take place in FY2013 amidst policy support an d renewed strength in private consumption and investment demand. Currency: It is likely to be a bumpy ride Rupee ended FY2012 at 50.88, historically the weakest level for a fiscal year en d. The currency weakened by over 14% during the previous fiscal and could remain under some pressure in the first few months of FY2013. However, over the medium term improving global growth outlook coupled with pick up in domestic growth momentum should support investor sentiment and buoy the Rupee. However, elevated crude poses a significant risk to the currency. Rates: Supply concerns weigh on bond market The bond market has witnessed massive sell off since mid March, with the 10-year benchmark bond yields rising by around 51 bps to hit a new four month high of 8.78% on supply concerns. Going forward, despite our call of 75-100 bps repo rate cut, we expect the bond yields to remain under pressure due to supply concerns, with the yields trading in the 8.60 8.85% range. However, likely improvement in systemic li quidity in April along with a 25 bps rate cut in the policy meeting later this month, will limit the downside in bonds. Inflation: Inflation likely to ease, but elevated oil prices pose risk Inflation is likely to ease in FY2013 on the back of base effect, moderation in growth and consolidation in commodity prices. However, the downside is likely to be capped due to structural supply demand mismatches in the food economy, particularly protein rich items. We expect inflation to averag e around 6.5% in FY2013 as compared to FY2012 estimate of around 8.6%. The risk to our view emanates from s pike in global commodity prices, especially oil and uncertainty around monsoons. Feature: The implications of high oil prices for India Amidst persistent threats of escalating crude oil prices, we investigate how Ind ia would compare to other

Emerging Market economies, in its ability to withstand higher crude oil prices a nd have also quantified the effect of oil price movements on India s current account deficit, inflation and fiscal defi cit. Amongst the BRICS, India fares as the most vulnerable to swings in international oil price, on account of high oil intensity, reliance on oil imports and current account deficit. Further, our calculations show that an USD 1/bbl increase in the crude oil price leads to around USD 1 bn rise in the current account deficit. On the infla tion front, a 10% increase in the Rupee adjusted India s crude oil basket, along with a 10% hike in diesel prices lead s to 0.8% increase in headline WPI while a USD 10/bbl increase would result in 0.15 percentage point increase i n India s fiscal deficit in FY2013. Global Overview Samir Tripathi Th e g l o b a l econ om y is in the ph ase o f trans i ti on , as th e t u rm oil of th e l a st quart er of 201 1 h a s eas ed s i g n i f ican

tl y ECB tw o ro unds of LT RO s h a s dr ive n posi t iv e s p i llo ver effec t s for Ital ia n a nd S p a n is h sover e ig n b ond m a rket s It is to o ear ly t o co n c lu de th a t th e wo rst of

th e Euro p ea n de bt cr isis is be hin d us as fu nd am en ta l cha l l e n g e s conti n u e t o persis t Th e l a ck o f solv enc y im prov in g me asures sugg ests t h at E Z econ om ies are o u t of

t h e woo d s Th e US ec o n o my has show n t e nt ati v e s i g n s of rene we d m o m e nt um a nd the pot en ti al t o mov e on the pat h of susta i n a b i l i t y Global Economy: Back to fu

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Ross Hart Maiden SpeechDokument16 SeitenRoss Hart Maiden SpeechThe ExaminerNoch keine Bewertungen

- Impacts in The Tourism and HospitalityDokument26 SeitenImpacts in The Tourism and HospitalityAryan Clarish CalloNoch keine Bewertungen

- Sez ActDokument5 SeitenSez ActTapasya KabraNoch keine Bewertungen

- Department of Posts, India: Application For Purchase of National Savings Certificates (Viii Issue)Dokument3 SeitenDepartment of Posts, India: Application For Purchase of National Savings Certificates (Viii Issue)api-19984680Noch keine Bewertungen

- M&a FrameworkDokument12 SeitenM&a FrameworkfrancescoabcNoch keine Bewertungen

- SNAP GK Question Bank 2012Dokument8 SeitenSNAP GK Question Bank 2012Yogesh MundadaNoch keine Bewertungen

- Toyota Risk ManagementDokument15 SeitenToyota Risk ManagementAttiq RehmanNoch keine Bewertungen

- Perkins v. Haines - Initial BriefDokument84 SeitenPerkins v. Haines - Initial BriefFloridaLegalBlogNoch keine Bewertungen

- Chapter 23 Perfect CompetitionDokument1 SeiteChapter 23 Perfect CompetitionKathleen CornistaNoch keine Bewertungen

- VSA Bar Definitions V 2Dokument1 SeiteVSA Bar Definitions V 2No Name89% (9)

- FIN 534 Homework Chap.2Dokument3 SeitenFIN 534 Homework Chap.2Jenna KiragisNoch keine Bewertungen

- Problem Session-2 - 15.03.2012Dokument44 SeitenProblem Session-2 - 15.03.2012markydee_20Noch keine Bewertungen

- Macroeconomic Variables and FDI in Pakistan: Iqbal MahmoodDokument6 SeitenMacroeconomic Variables and FDI in Pakistan: Iqbal Mahmoodnadeem_skNoch keine Bewertungen

- Unit 4: Learning Aim A - Understand The Requirements of Preproduction of A Digital Media ProductDokument7 SeitenUnit 4: Learning Aim A - Understand The Requirements of Preproduction of A Digital Media ProductBestNutria GamingNoch keine Bewertungen

- 2018 National Budget Quick Glance 1172018Dokument2 Seiten2018 National Budget Quick Glance 1172018Jhave AñonuevoNoch keine Bewertungen

- Technical Analysis in A NutshellDokument46 SeitenTechnical Analysis in A Nutshelltechnicalcall100% (1)

- Cashflow Waterfall TutorialDokument2 SeitenCashflow Waterfall TutorialRichard Neo67% (3)

- Prospectus of Jamuna Bank Final-CorrectionDokument56 SeitenProspectus of Jamuna Bank Final-CorrectionShuvashish Dey100% (1)

- CH 13Dokument18 SeitenCH 13xxxxxxxxxNoch keine Bewertungen

- Internship ReportDokument76 SeitenInternship ReportAmbreen UmarNoch keine Bewertungen

- International Accounting Standards: IAS 4 FrameworkDokument37 SeitenInternational Accounting Standards: IAS 4 FrameworkchaieihnNoch keine Bewertungen

- Starbuck NewDokument72 SeitenStarbuck NewTania UlricaNoch keine Bewertungen

- Entrepreneurship and Small Business ManagementDokument7 SeitenEntrepreneurship and Small Business ManagementDon Grema OthmanNoch keine Bewertungen

- Instruction To Fill Form St3Dokument9 SeitenInstruction To Fill Form St3Dhanush GokulNoch keine Bewertungen

- Accounting For Managers - Practical ProblemsDokument33 SeitenAccounting For Managers - Practical ProblemsdeepeshmahajanNoch keine Bewertungen

- Aznar vs. Court of Tax Appeals GR No. 20569, 23 August 1974Dokument6 SeitenAznar vs. Court of Tax Appeals GR No. 20569, 23 August 1974Mai ReamicoNoch keine Bewertungen

- Balance of Payment and International Economic LinkagesDokument35 SeitenBalance of Payment and International Economic LinkagesAnil PatelNoch keine Bewertungen

- Bebchuk Cohen and Ferrell (2009) RFSDokument45 SeitenBebchuk Cohen and Ferrell (2009) RFSktsakasNoch keine Bewertungen

- Project Report ON Insurance Ombudsman Bachelor of Banking & Insurance (B.B.I.) Semester ViDokument76 SeitenProject Report ON Insurance Ombudsman Bachelor of Banking & Insurance (B.B.I.) Semester Vipravin8983kharate100% (3)

- Tfs 2015 Product Disclosure StatementDokument116 SeitenTfs 2015 Product Disclosure StatementRahul RahuNoch keine Bewertungen