Beruflich Dokumente

Kultur Dokumente

Case Stdy - Internet Bankling

Hochgeladen von

Ketan_Dhanania_4941Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Case Stdy - Internet Bankling

Hochgeladen von

Ketan_Dhanania_4941Copyright:

Verfügbare Formate

Management of Financial Institutions Case Study: Caselet 5

If we compare the infrastructure costs of setting up Internet banking vis--vis the benefits that it offers, will it still be a profitable alternative for the Indian banks? The cost of setting up Internet banking and maintaining it & cost of setting up physical banks and maintaining them has a huge difference. Cost of setting up Internet banking is lot lesser than a physical bank. And a lower cost implies higher profitability. This framework gives a bank the opportunity to exist without paper, without geographical limitations, and without ever closing the doors to customers. Though India lacks far behind here are some Internet banking facts: The world's first Internet only bank is Security First Network Bank, now owned by Royal Bank of Canada, which currently has over 150,000 customers. The first profitable e-bank is NetBank that currently boasts $1.5 billion in assets with more than 110,000 accounts (Rombel, 2000). Telebank, which was started over 10 years ago as a virtual Savings and Loan institution and was acquired by E-Trade in 1999, began offering Internet transactions in 1998 and now has over 51,000 customers with over $1 billion in deposits. Though the Internet Penetration is close to 10 % but it gives us an existing market of .12 billion people as target market & already close 15% of this is using e-banking. There is slow movement but slowly it will gain momentum and be a good investment by the banks. Even ATMs encountered raised eyebrows but today its a success. And just not Internet banking but now the world is witnessing Mobile banking. Even though, India being a slow adopter has to keep pace with the world. And setting up Internet banking involves cost from 4 lakh 40 lakhs depending upon the sophistication it offers. And setting up a physical bank and maintaining it has a higher cost. In a scenario where the internet penetration in India is considerably low and also considering that the familiarity is also low. How should banks manage the transition? The population of USA is 030 billion. Population of India is 1.2 billion. Considering a 60% (which is on the higher side) Internet Penetration in the USA which is about 0.18 billion. And Internet penetration in India is 10% which gives us 0.12 billion. Now for a fact we know that Indian population is a young population and the Internet is spreading its web slowly and steadily. And we look at the relative figure of 10% then we may say the market is not yet ready but if the absolute figures are taken into account then it gives us a huge potential market to be captured and catered. Now, another question which arises is the vast rural population of India lacking knowledge, education & technical ability. But as far as this section of the population is considered, they have been the cause of losses and debts for banks & financial institutions rather than being a profit generating body. Initially this should not concern the banks and with time the training can be imparted in rural areas as well. Villages are slowly being bestowed with electricity, internet & not to forget the recently launched tablet Aakash, aimed at poor students. Though the government infrastructure is not in place to take the dive but certainly Internet & Mobile banking are the future. Google has already come up with Google Wallet application for mobile in the USA which will compete with the future of credit cards. India already lagging behind cannot for a readymade market. It has to create it which shall be fast, digitalized, modern and cost effective. The banks need to target the existing market & serve them, with slow penetration in villages and towns by giving training to the ignorant customers. The advantages of the new system have to be communicated to the user and special measures have to be taken for Internet Banking Security.

Which are the areas where security lapses play a crucial role in Internet Banking? Most of the attacks on online banking used today are based on deceiving the user to steal login data and valid TANs. Two well-known examples for those attacks are: Phishing - Phishing is a way of attempting to acquire information such as usernames, passwords, and credit card details by masquerading as a trustworthy entity in an electronic communication. Communications purporting to be from popular social web sites, auction sites, online payment processors or IT administrators are commonly used to lure the unsuspecting public. Phishing is typically carried out by e-mail spoofing or instant messaging and it often directs users to enter details at a fake website whose look and feel are almost identical to the legitimate one. Phishing is an example of social engineering techniques used to deceive users, and exploits the poor usability of current web security technologies. Attempts to deal with the growing number of reported phishing incidents include legislation, user training, public awareness, and technical security measures. Pharming Pharming is a hacker's attack aiming to redirect a website's traffic to another, bogus website. Pharming can be conducted either by changing the hosts file on a victims computer or by exploitation of a vulnerability in DNS server software. DNS servers are computers responsible for resolving Internet names into their real addresses they are the "signposts" of the Internet. Compromised DNS servers are sometimes referred to as "poisoned". Cross-site scripting and keylogger/Trojan horses can also be used to steal login information. The most recent kind of attack is the so-called Man in the Browser attack, where a Trojan horse permits a remote attacker to modify the destination account number and also the amount. In simpler terms most of the Internet Banking Security lapses because of the user itself. The Indian user is too casual about the virtual & digital world. Phishing scams are a result of Social Engineering by the hackers. The information passed and shared on the internet & awareness about it is relatively low in the country. A person must be aware, careful & alert while he/she is disseminating the information on the internet. The virtual world should not be considered as harmless because it has its own ways which are unpredictable. And therefore we should act behind our desktops as we would act in physicality or may be a little more cautious. Banks are doing their bit to updating security but unless the user develops understanding it is very difficult on part of the banks to minimise the risk. The Indian user at the moment is very vulnerable to Internet security lapses.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 110 - GSECL - 12 - 59 - 58 - Doc1 - GSECLPPEPC Tender For 131 MW Surendranagar Morbi290122Dokument233 Seiten110 - GSECL - 12 - 59 - 58 - Doc1 - GSECLPPEPC Tender For 131 MW Surendranagar Morbi290122Sivabalan SivasubramanianNoch keine Bewertungen

- 2006 IBC Short ChecklistDokument1 Seite2006 IBC Short ChecklistBrandon VieceliNoch keine Bewertungen

- TAX (2 of 2) Preweek B94 - Questionnaire - Solutions PDFDokument25 SeitenTAX (2 of 2) Preweek B94 - Questionnaire - Solutions PDFSilver LilyNoch keine Bewertungen

- Powerpoint For Chapter Four of Our Sacraments CourseDokument23 SeitenPowerpoint For Chapter Four of Our Sacraments Courseapi-344737350Noch keine Bewertungen

- Strategies For Becoming A Franchisor: Know The Opportunities and ChallengesDokument26 SeitenStrategies For Becoming A Franchisor: Know The Opportunities and ChallengesShahmeer ShahidNoch keine Bewertungen

- A Mehtab Arshad Final Reserach30 06 2021Dokument31 SeitenA Mehtab Arshad Final Reserach30 06 2021RohailNoch keine Bewertungen

- (ORDER LIST: 592 U.S.) Monday, February 22, 2021Dokument39 Seiten(ORDER LIST: 592 U.S.) Monday, February 22, 2021RHTNoch keine Bewertungen

- How To Instantly Connect With AnyoneDokument337 SeitenHow To Instantly Connect With AnyoneF C100% (2)

- 08 Albay Electric Cooperative Inc Vs MartinezDokument6 Seiten08 Albay Electric Cooperative Inc Vs MartinezEYNoch keine Bewertungen

- Legal Research BOOKDokument48 SeitenLegal Research BOOKJpag100% (1)

- SnapLogic - Market Leader 3 Industry Reports Jan 2019Dokument5 SeitenSnapLogic - Market Leader 3 Industry Reports Jan 2019dharmsmart19Noch keine Bewertungen

- Dubai 5 Nights 6 DaysDokument2 SeitenDubai 5 Nights 6 DaysAniruddh ParikhNoch keine Bewertungen

- In The Industrial Court of Swaziland: Held at Mbabane CASE NO. 280/2001Dokument10 SeitenIn The Industrial Court of Swaziland: Held at Mbabane CASE NO. 280/2001Xolani MpilaNoch keine Bewertungen

- IPC Chapter 09A: Chapter IXA - of Offences Relating To ElectionsDokument18 SeitenIPC Chapter 09A: Chapter IXA - of Offences Relating To ElectionsAdnan MoquaddamNoch keine Bewertungen

- Development of Equation of Motion For Nonlinear Vibrating SystemsDokument45 SeitenDevelopment of Equation of Motion For Nonlinear Vibrating SystemsSteve KrodaNoch keine Bewertungen

- PVL2602 Assignment 1Dokument3 SeitenPVL2602 Assignment 1milandaNoch keine Bewertungen

- California Code of Civil Procedure Section 170.4 Striking 170.3Dokument1 SeiteCalifornia Code of Civil Procedure Section 170.4 Striking 170.3JudgebustersNoch keine Bewertungen

- Metrobank V Chuy Lu TanDokument1 SeiteMetrobank V Chuy Lu TanRobert RosalesNoch keine Bewertungen

- Al HallajDokument8 SeitenAl HallajMuhammad Al-FaruqueNoch keine Bewertungen

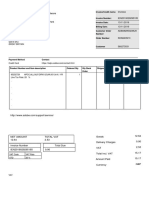

- Invoice: VAT No: IE6364992HDokument2 SeitenInvoice: VAT No: IE6364992HRajNoch keine Bewertungen

- Agency MBS Outlook 2014Dokument27 SeitenAgency MBS Outlook 2014analyst28Noch keine Bewertungen

- Tulipr Pitch Deck - DemoDay 6922 PDFDokument16 SeitenTulipr Pitch Deck - DemoDay 6922 PDFAlexandru ConstantinNoch keine Bewertungen

- COMMERCE MCQs WITH ANSWERS by Usman GhaniDokument7 SeitenCOMMERCE MCQs WITH ANSWERS by Usman GhaniMuhammad Irfan haiderNoch keine Bewertungen

- Accounting For Insurance Contracts Deferred Tax and Earnings Per ShareDokument2 SeitenAccounting For Insurance Contracts Deferred Tax and Earnings Per ShareJanine CamachoNoch keine Bewertungen

- GainesboroDokument21 SeitenGainesboroBayu Aji PrasetyoNoch keine Bewertungen

- List of Tallest Buildings in Delhi - Wikipedia, The Free EncyclopediaDokument13 SeitenList of Tallest Buildings in Delhi - Wikipedia, The Free EncyclopediaSandeep MishraNoch keine Bewertungen

- 00 Introduction ATR 72 600Dokument12 Seiten00 Introduction ATR 72 600destefani150% (2)

- (U) Daily Activity Report: Marshall DistrictDokument6 Seiten(U) Daily Activity Report: Marshall DistrictFauquier NowNoch keine Bewertungen

- CBF 10 Motion For Provisional Dismissal For Failure To Present WitnessDokument3 SeitenCBF 10 Motion For Provisional Dismissal For Failure To Present WitnessAndro DayaoNoch keine Bewertungen

- Audi A6 (4B) Headlight Aim Control (Dynamic Light)Dokument2 SeitenAudi A6 (4B) Headlight Aim Control (Dynamic Light)Krasimir PetkovNoch keine Bewertungen