Beruflich Dokumente

Kultur Dokumente

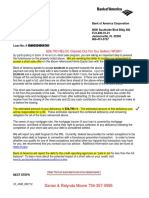

Bank of America Cooperative Short Sale Approval

Hochgeladen von

kwillsonOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bank of America Cooperative Short Sale Approval

Hochgeladen von

kwillsonCopyright:

Verfügbare Formate

.

Jimmy A Mclees 14 Kings Reserve Circle Simpsonville, SC 29681 Property Address: 14 Kings Reserve Circle Simpsonville, SC 29681 Dear Jimmy A MCLEES:

Your cooperative short sale offer has been approved. Please read below for important next steps.

DATE 06/18/2012 Loan Number: xxx-xx-7951

As your home loan servicer, we are dedicated to helping you find a solution to avoid foreclosure. We are pleased to inform you that the short sale offer submitted has been approved for the Bank of America Cooperative Short Sale Program. What This Means to You as the Seller Bank of America, N.A. and/or its investors and insurers (if applicable) have agreed to accept a short payoff (Short Sale) for the above-referenced property and first lien mortgage loan. This cooperative short sale approval is exclusive to the offer from the buyer referenced in this letter. Please accept as the formal payoff demand statement to be used by the closing agent to complete the transaction. You will need to forward a copy of this letter to your closing agent, because no additional statement will be issued. Under this Bank of America Cooperative Short Sale agreement, and/or its investors and/or insurers will accept less than the payoff balance due on the above referenced property and release you from any further financial responsibility for the outstanding first lien mortgage loan. Please note that if the cooperative short sale does not close within the 120 day marketing period, then we will resume normal servicing activities allowed under the Agreement, which may include foreclosure. Detailed below are the conditions of this approval, along with next steps that will need to be completed by the dates and/or timeframes noted. Please read through all the information carefully and call our Cooperative Short Sale Team at (805) 520-5423 if you have any questions. Conditions of the Cooperative Short Sale Approval The conditions of the cooperative short sale approval are as follows: 1. The sale and closing must comply with all terms and conditions of the Cooperative Short Sale Agreement between Bank of America, N.A. and you (the Borrower/Seller) as well as all terms and representations provided herein by the Borrower. 2. Any change to the terms and representations contained in the submitted Request for Approval of Short Sale or the submitted sales contract between you and the Buyer must be approved by Bank of America, N.A. in writing. Bank of America, N.A. is under no obligation to approve such changes. 3. A preliminary HUD-1 Settlement Statement must be provided to Bank of America, N.A. no later than one business day before the Closing Date of 07/20/2012. The final HUD-1 Settlement Statement will be signed by you and the Buyer at closing. 4. If you are currently in bankruptcy or you file bankruptcy prior to closing, you must obtain any required consent or approval of the Bankruptcy Court. 5. Closing must take place no later than 07/20/2012 or this approval is void. If an extension is requested and/or approved, interest on the loan will be charged per day through closing.

6. The approved buyer(s) is/are Jack and Nancy M Murrin and the sales price for the property is $376,439.00. 7. Another buyer cannot be substituted without the prior written approval of Bank of America, N.A.. Furthermore, the buyer may not alter the capacity in which title is to be taken. For example, a buyer may not enter into a contract to purchase a property and then amend the contract to purchase the property as trustee for a trust or any other legal entity. 8. Closing costs have been negotiated and agreed upon with the authorized agent as of 06/18/2012. a. Total closing costs not to exceed $43,449.83 (this includes $9,613.49 relocation assistance fees) . b. Maximum commission paid $22,586.34. c. Maximum allowed to the subordinate lien holder(s) $6,000.00. d. Maximum allowed for HOA liens $0.00. e. Maximum allowed for termite inspection $0.00 Please be aware that any additional fees that were not approved on 06/18/2012 will not be covered by Bank of America, N.A., and will become the sole responsibility of the agent, the buyer or the Seller to pay at closing. The amount approved was $43,449.83. Net proceeds to Bank of America, N.A. must be no less than $332,989.17. The property is being sold in As Is condition. As a result, no repairs will be made or be paid out of the proceeds, unless specifically stated otherwise. There cannot be any subordinate liens or claims to the property other than those recognized and accounted for in the HUD-1 Settlement Statement used as the basis for providing this approval. Prior to releasing any funds to holders of subordinate liens/mortgages, the closing agent must obtain a written commitment from each subordinate lien holder that it will release Borrower from all claims and liability relating to the subordinate lien in exchange for receiving the agreed upon payoff amount. There are to be no transfers of property within 30 days of the closing of this transaction. If the closing agent is aware of any agreement whereby the buyer is to transfer title or possession of the property to any entity, including the Borrower or a third party, the closing agent must obtain the prior written approval of Bank of America, N.A.. Bank of America, N.A. does not charge the Borrower for statement, demand, recording, and reconveyance (release of lien) fees on short payoff transactions. These should not be included in the HUD-1 Settlement Statement. Bank of America, N.A. prepares and records its own release of lien. All funds must be wired. Please be advised that any other form of payment of funds will be returned. Payoff funds must be received within 48 business hours of the HUD-1 settlement date. If the closing is delayed and the Investor/Insurer agrees to an extension of the original closing date, the Borrower/Seller will be responsible for any daily fees through the new date(s) of closing, extension fees and foreclosure sale postponement fees. The Borrower/Seller will be responsible for any additional costs or fees over the stated approved amounts. The closing agent must upload a completed Assignment of Unearned Premium and Important Notice Regarding Income Tax Reporting (enclosed) along with a certified copy of the final estimated HUD-1 Settlement Statement into the short sale system 72 business hours before closing. Bank of America, N.A. reserves the right to revoke and/or modify the terms and conditions of this short sale approval in the event that 1) any information provided and used as the basis for our approval changes and/or 2) if we discover any evidence of fraud and/or misrepresentation by any parties involved in the transaction.

9. 10. 11.

12.

13.

14. 15.

16.

17.

If the Seller is entitled to receive any proceeds based on a claim for damage to the property under any policy of insurance, including homeowner's, lender-placed, casualty, fire, flood, etc., or if the Seller is entitled to receive other miscellaneous proceeds, as that term is defined in the deed of trust/mortgage (which could include Community Development Block Grant Program (CDBG) funds), the proceeds should have been disclosed before Bank of America, N.A. considered the request for short sale. If Bank of America, N.A. receives a check for insurance or miscellaneous proceeds that were not previously disclosed, we will have the right to keep the proceeds and apply them to Bank of America, N.A.s loss after the short sale. Similarly, we would have the right to claim the proceeds to offset any losses if they were not previously disclosed and were sent directly to the Borrower. What You Should Know

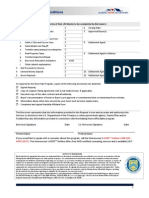

The owner of your mortgage note, the mortgage insurer, if your loan is covered by mortgage insurance, and Bank of America, N.A. waive their right to pursue collection of any deficiency following the completion of your short sale and your debt is considered settled. The deficiency is the difference between: (1) the remaining amount due under the mortgage note and mortgage or deed of trust; and (2) the current market value of the property plus any cash contribution you make or amount you agree to repay in the future. The amount of the deficiency will be reported to the Internal Revenue Service (IRS) on the appropriate 1099 Form or Forms. We suggest that you contact the IRS or your tax preparer to determine if you have any tax liability. Bank of America, N.A. will report the debt to the credit reporting agencies as a short sale. To learn more about the potential impact of a short sale on your credit, visit http://www.ftc.gov/bcp/edu/pubs/consumer/credit/cre24.shtm If the terms and conditions of the short sale approval are not met, we will cancel the approval of this offer and continue the foreclosure process as permitted by the mortgage documents. Important Instructions for the Seller and Agent 1. Please complete the enclosed Assignment of Unearned Premium and Important Notice Regarding Income Tax Reporting and provide this form to the closing agent by 07/17/2012. 2. The closing agent will need to upload the completed Assignment of Unearned Premium and Important Notice Regarding Income Tax Reporting and a certified copy of the final estimated HUD-1 Settlement Statement into the short sale system 72 business hours prior to closing. Please note that you cannot close without final approval of the closing costs. 3. Payoff funds must be wired (unless otherwise specified) and must be received within 48 business hours of the HUD-1 settlement date, per the instructions below. Reference loan# xxx-xx-7951 Jimmy A MCLEES Bank of America 275 Valencia Avenue Brea, CA 92823 MRC Account # 12357-47067 ABA 026-009-593 Please note: Wire transfers must include the loan number, Borrowers names and property address. If the funds cannot be properly identified, they will be returned. 4. A certified copy of the Final HUD-1 Settlement Statement must be uploaded into the short sale system at the time of closing.

Upon receipt of the above stated items, Bank of America, N.A. will issue a release of lien on the first lien mortgage loan. Thank you for your interest in a short sale. If you feel there is additional information you would like to provide, or if you need additional information, please contact your account specialist at 1.866.880.1232. Please continue to work closely with your real estate agent to finalize your short sale. Cooperative Short Sale Team Home Loan Team Bank of America, N.A.. Bank of America, N.A. is required by law to inform you that this communication is from a debt collector. However, the

purpose of this communication is to let you know about your potential eligibility for this program to help you avoid foreclosure.

Das könnte Ihnen auch gefallen

- 501 - Contract To Purchase Real Estate (C) 2012 - ID-WATERMARKDokument2 Seiten501 - Contract To Purchase Real Estate (C) 2012 - ID-WATERMARKRichard Vetstein29% (7)

- Sample-Loan Commitment LetterDokument3 SeitenSample-Loan Commitment LetterJustice Williams100% (1)

- Strategic Planning and Capital BudgetingDokument32 SeitenStrategic Planning and Capital BudgetingKeeiiiyyttt Joie100% (5)

- Primerica How Money Works PDFDokument17 SeitenPrimerica How Money Works PDFahmed75% (4)

- Wells Fargo FHA Pre-Foreclosure Short Sale Approval LetterDokument6 SeitenWells Fargo FHA Pre-Foreclosure Short Sale Approval Letterkev1970Noch keine Bewertungen

- Home Seller's RE Sales Contract Filled-In Example PDFDokument3 SeitenHome Seller's RE Sales Contract Filled-In Example PDFLarry Potter93% (15)

- Consulting Service AgreementDokument4 SeitenConsulting Service Agreementanandrai2Noch keine Bewertungen

- Loan Approval PDFDokument5 SeitenLoan Approval PDFabovetherest4110% (1)

- Real Time Resolutions Short Sale Approval (2nd Mortgage)Dokument3 SeitenReal Time Resolutions Short Sale Approval (2nd Mortgage)kwillsonNoch keine Bewertungen

- Bank of America HELOC Short Sale PackageDokument7 SeitenBank of America HELOC Short Sale PackagekwillsonNoch keine Bewertungen

- Regular Payments Form BarclaysDokument1 SeiteRegular Payments Form BarclaysarayNoch keine Bewertungen

- Lecture 1 and Lecture 2 Quiz Answer Section: Ramon Magsaysay Memorial CollegesDokument6 SeitenLecture 1 and Lecture 2 Quiz Answer Section: Ramon Magsaysay Memorial Collegesbelinda dagohoyNoch keine Bewertungen

- Bofa Approval LetterDokument3 SeitenBofa Approval LetterSteve Mun GroupNoch keine Bewertungen

- BofA Approval Letter 2Dokument3 SeitenBofA Approval Letter 2Steve Mun GroupNoch keine Bewertungen

- Bofa 5Dokument3 SeitenBofa 5Steve Mun Group100% (1)

- SunTrust Short Sale Approval (Fannie Mae)Dokument3 SeitenSunTrust Short Sale Approval (Fannie Mae)kwillson100% (1)

- WF Approval LetterDokument6 SeitenWF Approval LetterSteve Mun GroupNoch keine Bewertungen

- Ocwen HAFA MatrixDokument5 SeitenOcwen HAFA MatrixkwillsonNoch keine Bewertungen

- Sales Contract ResidentialDokument6 SeitenSales Contract Residentialapi-320542467Noch keine Bewertungen

- Castle BOA - Bergman 7-28-14 PDFDokument6 SeitenCastle BOA - Bergman 7-28-14 PDFDarian MooreNoch keine Bewertungen

- About HAFA: Foreclosure Alternatives Program (HAFA) On November 30, 2009 and Released An UpdatedDokument4 SeitenAbout HAFA: Foreclosure Alternatives Program (HAFA) On November 30, 2009 and Released An Updatedapi-25884946Noch keine Bewertungen

- Hafa, Overview of Home Affordable Foreclosure Alternatives - Short Sale and Deed-In-Lieu of Foreclosure (In Effect As of April 5,2010)Dokument5 SeitenHafa, Overview of Home Affordable Foreclosure Alternatives - Short Sale and Deed-In-Lieu of Foreclosure (In Effect As of April 5,2010)Renata MoiseNoch keine Bewertungen

- Solitude - Lockett - BOA 2-13 PDFDokument3 SeitenSolitude - Lockett - BOA 2-13 PDFDarian MooreNoch keine Bewertungen

- HAFA Policies Bank of AmericaDokument5 SeitenHAFA Policies Bank of AmericaMelissa Rose Zavala100% (1)

- Accepted Offer Addendum-CounterDokument16 SeitenAccepted Offer Addendum-Counterrealestate6199Noch keine Bewertungen

- #154590294 HallDokument4 Seiten#154590294 Halltingoat59Noch keine Bewertungen

- HUD PEMCO Forfeiture and Extension Policy (Revised 031212)Dokument3 SeitenHUD PEMCO Forfeiture and Extension Policy (Revised 031212)ACGRealEstateNoch keine Bewertungen

- Citi Short Sale Approval Letter (Non-GSE)Dokument2 SeitenCiti Short Sale Approval Letter (Non-GSE)kwillsonNoch keine Bewertungen

- Loan Terms & ConditionsDokument10 SeitenLoan Terms & ConditionsTestingNoch keine Bewertungen

- Foreclosure Limited Guarantee 2009bDokument2 SeitenForeclosure Limited Guarantee 2009bDebra PrestonNoch keine Bewertungen

- Credit Agreement - Iinitial Advance Into The Bank Account Whose Details You Have Provided To Us at The Time You Made Your ApplicationDokument10 SeitenCredit Agreement - Iinitial Advance Into The Bank Account Whose Details You Have Provided To Us at The Time You Made Your ApplicationTestingNoch keine Bewertungen

- Shivesh Sanction LetterDokument11 SeitenShivesh Sanction LetterRR RajNoch keine Bewertungen

- Short Sale Disclosure InfoDokument2 SeitenShort Sale Disclosure InfoImani BalivajaNoch keine Bewertungen

- Program: Home Affordable Foreclosure AlternativesDokument5 SeitenProgram: Home Affordable Foreclosure AlternativesJim LouisNoch keine Bewertungen

- BOFA AddendumDokument6 SeitenBOFA AddendumkwillsonNoch keine Bewertungen

- Bank of America HELOC Short Sale ApprovalDokument2 SeitenBank of America HELOC Short Sale ApprovalkwillsonNoch keine Bewertungen

- Specialized Loan Servicing Charges $250 For A Refi, and $125 For A Loan ModDokument4 SeitenSpecialized Loan Servicing Charges $250 For A Refi, and $125 For A Loan ModTim BryantNoch keine Bewertungen

- JPMorgan Chase Mortgage Settlement DocumentsDokument291 SeitenJPMorgan Chase Mortgage Settlement DocumentsFindLaw100% (2)

- Mitigation Specialists Short Sale Presentation - Revised1Dokument28 SeitenMitigation Specialists Short Sale Presentation - Revised1Michele StredaNoch keine Bewertungen

- ResalesDokument11 SeitenResalesapi-212566936Noch keine Bewertungen

- North Carolina Residential Real Estate Purchase AgreementDokument9 SeitenNorth Carolina Residential Real Estate Purchase Agreementnida batoolNoch keine Bewertungen

- Loan Agreement Promissory NoteDokument3 SeitenLoan Agreement Promissory NoteWright AddilynNoch keine Bewertungen

- HUD 9548 Sales ContractDokument3 SeitenHUD 9548 Sales ContractJoe LongNoch keine Bewertungen

- Offer To Purchase Real Estate 32Dokument6 SeitenOffer To Purchase Real Estate 32Umma BanchanNoch keine Bewertungen

- Basic Requirements For A Short Sale PackageDokument12 SeitenBasic Requirements For A Short Sale PackageBiggz703Noch keine Bewertungen

- CMLTI 2006-NC2 Citi Commitment LetterDokument18 SeitenCMLTI 2006-NC2 Citi Commitment Letterthe_akinitiNoch keine Bewertungen

- Mortgage Commitment Lu MF LiDokument5 SeitenMortgage Commitment Lu MF Lidonnytan6688Noch keine Bewertungen

- Loan Agreement: Parties PartyDokument5 SeitenLoan Agreement: Parties PartyMicoNoch keine Bewertungen

- Forensic Mortgage Fraud Audit Report (MFI Miami) Echeverria, Et Al Vs Bank of America, Et Al.Dokument7 SeitenForensic Mortgage Fraud Audit Report (MFI Miami) Echeverria, Et Al Vs Bank of America, Et Al.Isabel Santamaria100% (7)

- Loan Agreement Part B General Terms and Conditions: Info@homecredit - PHDokument3 SeitenLoan Agreement Part B General Terms and Conditions: Info@homecredit - PHBarbara Gracia RomeroNoch keine Bewertungen

- Origination AgreementsDokument3 SeitenOrigination Agreementsnolandpark100% (1)

- Loan Agreement (3743902)Dokument5 SeitenLoan Agreement (3743902)Nichole Joy XielSera TanNoch keine Bewertungen

- Residential Purchase and Sale AgreementDokument7 SeitenResidential Purchase and Sale AgreementWright AddilynNoch keine Bewertungen

- PART B General Terms and Conditions 2023 52de0762ebDokument6 SeitenPART B General Terms and Conditions 2023 52de0762ebRexel May SuicoNoch keine Bewertungen

- Contract For DeedDokument9 SeitenContract For DeedRocketLawyer100% (2)

- Missouri Loan Agreement Promissory Note - 2023 - 01 - 21 PDFDokument3 SeitenMissouri Loan Agreement Promissory Note - 2023 - 01 - 21 PDFSOSA RIVERANoch keine Bewertungen

- 6314534c617b3d29ef80ad92 - Purchase and Sale Contract (Between U &Dokument4 Seiten6314534c617b3d29ef80ad92 - Purchase and Sale Contract (Between U &anas imranNoch keine Bewertungen

- Hard Copy Loan Document (4213)Dokument6 SeitenHard Copy Loan Document (4213)kevin.johnsonloanNoch keine Bewertungen

- Demand NoteDokument4 SeitenDemand NoteLuke CooperNoch keine Bewertungen

- Loan Agreement (2148839)Dokument5 SeitenLoan Agreement (2148839)Brio RicaNoch keine Bewertungen

- Personal Loan Approval For Mugwagwa Kudakwashe: Dn948317 Reference Number: FPL/20200824Dokument5 SeitenPersonal Loan Approval For Mugwagwa Kudakwashe: Dn948317 Reference Number: FPL/20200824Kudakwashe Mugwagwa100% (1)

- MORIGINADokument7 SeitenMORIGINAatishNoch keine Bewertungen

- Loan Assumption Addendum: To Contract Concerning The Property atDokument2 SeitenLoan Assumption Addendum: To Contract Concerning The Property atsureshNoch keine Bewertungen

- Getting to Closing!: Insider Information to Help You Get a Good Deal on Your MortgageVon EverandGetting to Closing!: Insider Information to Help You Get a Good Deal on Your MortgageNoch keine Bewertungen

- #BANKOFAMERICA FHA Pre-Foreclosure Sale Approval LetterDokument2 Seiten#BANKOFAMERICA FHA Pre-Foreclosure Sale Approval LetterkwillsonNoch keine Bewertungen

- B65.37.1 Borrower Contributions and Relocation Assistance (11:01:12)Dokument4 SeitenB65.37.1 Borrower Contributions and Relocation Assistance (11:01:12)kwillsonNoch keine Bewertungen

- Chase Incentive Letter ($35,000)Dokument1 SeiteChase Incentive Letter ($35,000)kwillsonNoch keine Bewertungen

- Mortgage Servicer Settlement Stakeholder FAQsDokument10 SeitenMortgage Servicer Settlement Stakeholder FAQskwillsonNoch keine Bewertungen

- 2012 at 1801 Wells FargoDokument9 Seiten2012 at 1801 Wells FargoDinSFLANoch keine Bewertungen

- Bank of America FHA PFS Incentive LetterDokument1 SeiteBank of America FHA PFS Incentive LetterkwillsonNoch keine Bewertungen

- Citi Short Sale Approval Letter (Non-GSE)Dokument2 SeitenCiti Short Sale Approval Letter (Non-GSE)kwillsonNoch keine Bewertungen

- Greenville County, SC Subdivision Restrictions Prior To 1990Dokument50 SeitenGreenville County, SC Subdivision Restrictions Prior To 1990kwillsonNoch keine Bewertungen

- Ocwen Short Sale Approval (2nd Mortgage)Dokument6 SeitenOcwen Short Sale Approval (2nd Mortgage)kwillsonNoch keine Bewertungen

- Bank of America Short Sale Approval (FHA PFS)Dokument4 SeitenBank of America Short Sale Approval (FHA PFS)kwillsonNoch keine Bewertungen

- Ocwen Loan Servicing LLC - Servicing Transfer InformationDokument1 SeiteOcwen Loan Servicing LLC - Servicing Transfer InformationkwillsonNoch keine Bewertungen

- Bank of America HAFA Short Sale Approval (Non-GSE)Dokument5 SeitenBank of America HAFA Short Sale Approval (Non-GSE)kwillsonNoch keine Bewertungen

- Compromise Sale AgreementsDokument4 SeitenCompromise Sale AgreementskwillsonNoch keine Bewertungen

- 5 RVT Nry-: - L TT RM L AelDokument1 Seite5 RVT Nry-: - L TT RM L AelkwillsonNoch keine Bewertungen

- Federal Register /vol. 70, No. 33 / Friday, February 18, 2005 / Proposed RulesDokument23 SeitenFederal Register /vol. 70, No. 33 / Friday, February 18, 2005 / Proposed RuleskwillsonNoch keine Bewertungen

- Webinar III HUD Loss Mitigation Disposition Options ParticipantDokument45 SeitenWebinar III HUD Loss Mitigation Disposition Options Participantkwillson100% (1)

- Module # 7 - Pre Foreclosure Sale OptionDokument24 SeitenModule # 7 - Pre Foreclosure Sale OptionkwillsonNoch keine Bewertungen

- Bank of America HELOC Short Sale ApprovalDokument2 SeitenBank of America HELOC Short Sale ApprovalkwillsonNoch keine Bewertungen

- Suntrust Short Sale PackageDokument12 SeitenSuntrust Short Sale PackagekwillsonNoch keine Bewertungen

- Citi/Freddie Mac Short Sale Apporval LetterDokument4 SeitenCiti/Freddie Mac Short Sale Apporval LetterkwillsonNoch keine Bewertungen

- Bank of America HAFA Short Sale Approval (Non-GSE)Dokument4 SeitenBank of America HAFA Short Sale Approval (Non-GSE)kwillsonNoch keine Bewertungen

- Webinar I HUD Early Delinquency Activities and Loss Mitigation Program Overview - ParticipantDokument37 SeitenWebinar I HUD Early Delinquency Activities and Loss Mitigation Program Overview - ParticipantkwillsonNoch keine Bewertungen

- Bank of America - REQUEST FOR APPRAISAL OR REVIEW RECONSIDERATIONDokument2 SeitenBank of America - REQUEST FOR APPRAISAL OR REVIEW RECONSIDERATIONkwillsonNoch keine Bewertungen

- ALT RASS WorksheetDokument1 SeiteALT RASS WorksheetkwillsonNoch keine Bewertungen

- South Carolina Deficiency Judgments in Foreclosure ActionsDokument7 SeitenSouth Carolina Deficiency Judgments in Foreclosure ActionskwillsonNoch keine Bewertungen

- Wells Fargo - Dodd Frank ActDokument1 SeiteWells Fargo - Dodd Frank ActkwillsonNoch keine Bewertungen

- Fin 2 Prelim NotesDokument8 SeitenFin 2 Prelim NotesChaNoch keine Bewertungen

- Offshore BanksDokument22 SeitenOffshore BanksMillenine Lupa-asNoch keine Bewertungen

- Q3 2019 Standard Industries Financial StatementsDokument29 SeitenQ3 2019 Standard Industries Financial StatementsMiguel RamosNoch keine Bewertungen

- Dccco Loan FormDokument2 SeitenDccco Loan FormJane CA100% (3)

- Chapter 3 Income or Loss From EmploymentDokument12 SeitenChapter 3 Income or Loss From EmploymentDonna SoNoch keine Bewertungen

- The World's Most Valuable Asset in A Time of CrisisDokument8 SeitenThe World's Most Valuable Asset in A Time of CrisisRaphael CoderNoch keine Bewertungen

- Current OpeningDokument2 SeitenCurrent OpeningdassmbaNoch keine Bewertungen

- Teddy G. Pabugais vs. Dave P. SahijwaniDokument1 SeiteTeddy G. Pabugais vs. Dave P. SahijwaniLouie Marrero DadatNoch keine Bewertungen

- LectureDokument3 SeitenLectureJimmy RecedeNoch keine Bewertungen

- Annexure A B CDokument4 SeitenAnnexure A B CAmila SampathNoch keine Bewertungen

- Week 6 Case AnalysisDokument2 SeitenWeek 6 Case AnalysisVarun Abbineni0% (1)

- Sworn Declaration On Waiver or Right To Claim ExemptionDokument1 SeiteSworn Declaration On Waiver or Right To Claim ExemptionElvin Nobleza Palao0% (1)

- Computation of Total Income Income From Other Sources (Chapter IV F) 289381Dokument2 SeitenComputation of Total Income Income From Other Sources (Chapter IV F) 289381Ashish AgarwalNoch keine Bewertungen

- C Ons TR Uc Ted Res Ponse Questions - Section C: S E Cti On 3Dokument2 SeitenC Ons TR Uc Ted Res Ponse Questions - Section C: S E Cti On 3Mazni Hanisah100% (1)

- Banking WorksheetDokument2 SeitenBanking WorksheetvimalparkNoch keine Bewertungen

- Employer-Employee Proposal Form PDFDokument2 SeitenEmployer-Employee Proposal Form PDFGD SinghNoch keine Bewertungen

- Advanced Accounting Chapter 6Dokument17 SeitenAdvanced Accounting Chapter 6Ya Lun67% (6)

- Prudential Global LogisticsDokument6 SeitenPrudential Global LogisticsAmit GoelNoch keine Bewertungen

- Introduction To Record Keeping PDFDokument4 SeitenIntroduction To Record Keeping PDFÏťž ÄbïNoch keine Bewertungen

- AFM Sample Model - 2 (Horizontal)Dokument18 SeitenAFM Sample Model - 2 (Horizontal)munaftNoch keine Bewertungen

- Wealth Tax Flow ChartDokument3 SeitenWealth Tax Flow ChartParasuram IyerNoch keine Bewertungen

- Dusseldorf TableDokument5 SeitenDusseldorf TableMRANoch keine Bewertungen

- Narciso Filed A Complaint Against Norte University For The Payment of Retirement Benefits After Having Been A PartDokument1 SeiteNarciso Filed A Complaint Against Norte University For The Payment of Retirement Benefits After Having Been A PartJessiel DiamanteNoch keine Bewertungen

- Managerial EconomicsDokument49 SeitenManagerial EconomicsBhagyashri HolaniNoch keine Bewertungen

- JKR Design and Build ConditionDokument14 SeitenJKR Design and Build Conditionjerrycl67% (3)

- CSEC POA January 2008 P2 PDFDokument11 SeitenCSEC POA January 2008 P2 PDFDmitr33% (3)