Beruflich Dokumente

Kultur Dokumente

Jegi 1h-2012 M&a Overview

Hochgeladen von

Anonymous Feglbx5Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Jegi 1h-2012 M&a Overview

Hochgeladen von

Anonymous Feglbx5Copyright:

Verfügbare Formate

JEGIPressRelease

JEGI1H2012M&AOverview ActiveM&AMarketContinues,LedbyMarketing&InteractiveServices

NewYork,NYJune28,2012Mergersandacquisitionsinthemedia,information,marketingservicesand technologysectorscontinuedatafastclipinthefirsthalfof2012,asthenumberofdealsrose52%over 2011 levels, according to The Jordan, Edmiston Group, Inc. (JEGI) (www.jegi.com), the leading independentinvestmentbankingfirmspecializinginM&Aacrossthesemarkets.Announcedtransaction valueincreased49%tonearly$32billion,primarilyduetoafewmultibilliondollartransactions,withthe balanceofmarketactivitycenteredaroundmidsizetransactions. Overall, acquirers have been focusing on smaller, complementary acquisitions, with nearly 95% of transactionsin1H2012atvaluesoflessthan$100million.Onlyfivedealsexceeded$1billioninvalue, including Alibaba Groups pending acquisition of 20% of its shares from Yahoo for $7.1 billion, and the $3.3billionbuyoutofTransUnionbyAdventInternationalandGoldmanSachs. Themajorityofthedealactivityinthe first half of 2012 took place across the interactive, marketing services and technology markets. B2B and B2C Online Media & Technology, Marketing & Interactive Services, and MobileMedia&Technologyaccounted for 79% of total deals and 75% of deal valuefortheperiod. Marketing&InteractiveServices There are clashing forces in the marketplace.Ontheonehand,thereis theuncertaintycreatedbysuchfactors as historically high unemployment rates and low consumer confidence, the Eurozone challenges in Greece, Spain and elsewhere, as well as poorly performing bellwether stocks and postIPO hangover (e.g., Zynga, Facebook, etc.). At the same time,unprecedentedwavesofchangeandinnovationarecreatingnewopportunitiesinthemarket.The explosive growth of social media the Socialization of Everything is transforming whole industries, suchasentertainment,news,ecommerce,andgaming.Largebrandsarequicklytryingtoadaptandare shiftingdollarstointeractivemediaandbelowthelinemarketing(i.e.,customercentriccommunications, typicallywithmeasurableresults).Asaresult,InternetadvertisingspendingforQ12012setanewrecord at$8.4billion,accordingtotheInteractiveAdvertisingBureau(IAB).Moreonlineconsumersthanever aretakingtotheInternettoinformandnavigatetheirdailylivesbydesktop,tabletorsmartphone,said RandallRothenberg,PresidentandCEO,IAB.Marketersandagenciesareclearlyandwiselyinvesting dollarstoreachdigitallyconnectedconsumers.

AdamGross,ChiefMarketingOfficer 2127540710;adamg@jegi.com www.jegi.com

JEGIPressRelease

At the same time, mobile is exploding. Smartphone sales have surpassed PC sales, and, according to StatCounter,mobiletrafficaccountedfor10%ofInternettrafficinMay2012vs.lessthan1%inDecember 2009.AccordingtoeMarketer,mobileadspendwillreach$10.8billionin2016,upfrom$2.6billionin2012 andrepresentingaCAGRof43%.Thereisasecularevolutionathand,andmarketingdollarscontinueto rapidly follow consumers. Media consumption continues to shift to the Internet, and now to mobile, movingawayfromtraditionalmedia.Onaverage,consumersarespending26%oftheirmediatimeonline and 10% of their media time with mobile, according to Kleiner Perkins partner Mary Meekers annual overviewofInternettrends.Digitaladspendinghasstartedtocatchupwithtimespentonline,with22% ofaddollarsflowingtotheweb.However,thegapisstillsignificantwithmobile,asitcapturesonly1%of addollars.AccordingtoMeeker,closingthegapbetweenshareoftimespentonline/onmobileandshare ofadvertisingdollarsspentonline/onmobilerepresentsa$20billionannualadvertisingopportunityinthe USandpointstothecontinuingmovementofaddollarstodigitalmediaintheyearsahead. Asaresult,companiesareinvestinginmarketingservicestobetterassisttheircustomersandcapturemore revenue.Advertisingagenciesandmarketingservicescompaniesareretoolingtheirbusinessmodelsby investinginintegratedandinteractivemarketingsolutions,suchasExperiansacquisitionofConversen,a pioneer in developing interaction management technologies, enabling crosschannel conversations (JEGI representedConverseninthisdeal).AccordingtoDougBacon,Director,CorporateDevelopment,Experian, We see Conversen as a bridge between our digital and traditional offerings. The concept of consistent messaging to the consumer, regardless of channel, is critical to marketing success. This acquisition becomes the glue that puts it all together and provides us with a platform to tie together our market leadingproductsintoasinglepointofentryforourclients. Large technology companies, such as IBM, Oracle, Adobe and others, are also aggressively investing in marketing technology solutions to help marketers create value from their data and provide customers with key business intelligence and analytics, to drive better customer experiences and enhance customer engagement. Oracles $300 million acquisition of Vitrue, which enables companies to manage their presence on social networks, clearly highlights this point. These trends have made Marketing & Interactive Services by far the most active sector for M&A,accountingfor40%ofalltransactionsand27% oftotalvaluein1H2012. AreasofFocusforMarketing&InteractiveServices M&A In the first half of 2012, the ad agency and digitalagencysubsectorswerethemostactivewithin Marketing & Interactive Services, accounting for a combined34%ofdealvolumeand26%ofdealvalue.

AdamGross,ChiefMarketingOfficer 2127540710;adamg@jegi.com www.jegi.com

JEGIPressRelease

Marketing technology and market research/consulting were the next most active subsectors, each accounting for 16% and15%, respectively, of deal volume for the half year. Other active subsectors for M&Aincludeddata&analytics(17deals),PRagency(12deals),adtechnology(13deals),andmonitoring &intelligence(11deals). DriversofM&AValueTheMarketing&InteractiveServicessectorsawonlyone$1+billiontransaction in the first half of 2012 Microsofts acquisition of Yammer, a provider of social networking portals for enterprises,for$1.2billion.However,thereweretwo$500+milliondealsandsevenmorewithvaluesof $200 million and higher. The marketing technology subsector accounted for 37% of Marketing & Interactive Services deal value, led by Salesforce.coms acquisition of Buddy Media, which helps companies manage content across social media platforms, for $745 million. Other marketing technology dealsmakingthetop10in1H2012includedtheIntuitacquisitionofDemandforce,aSaaSapplicationthat automatesInternetmarketingandcommunications,for$424millionandOraclesacquisitionofVitruefor $300million. Ad and digital agencies combined accounted for $2.2 billion of deal value in 1H 2012, led by WPPs acquisition of digital agency AKQA from General Atlantic for $540 million. Market research and consulting was next, accounting for 12% of deal value, including the acquisition by Genstar Capital of eResearch Technology, a provider of health outcomes research services, for $377 million. The following chartshowsthetop10Marketing&InteractiveServicesdealsbyvalueinthefirsthalfof2012:

AdamGross,ChiefMarketingOfficer 2127540710;adamg@jegi.com www.jegi.com

JEGIPressRelease

TheNew NormalAttheSIIAStrategic&FinancialInvestmentConferenceonJune21stinNYC,JEGI CoPresidents, Tolman Geffs and Scott Peters, provided the opening keynote presentation for more than 200M&Afocusedstrategicexecutivesandprivateequityinvestors.Thisinsightfulsessiondescribedthe confluence of global uncertainty with the forces of rapid technological change as the New Normal, leading to interesting business combinations via M&A activity. Examples include several deals highlightedabove,includingExperian/Conversen,Oracle/VitrueandSalesforce.com/BuddyMedia,aswell as the Amazon acquisition of Kiva Systems, which makes robots used in shipping centers to simplify operationsandreducecosts,andtheacquisitionbyFacebookofInstagram,whichprovidesFacebookusers withacompellingexperiencefor photosharing,for$1billion.Companies,possiblymorethanever,are focusingonservicingtheircustomers,andweexpecttoseemoreinterestingcombinationsviaM&Ainthe yearstocome.Toviewtheircompletepresentation,clickhere:http://tiny.cc/SIIA_Presentation. M&AHighlightsfor1H2012 The b2b online media and technology sector saw a 21% rise in the number of M&A transactions announcedin1H2012vs.1H2011anda160%increaseindealvalueto$7.9billion,ledbythepending AlibabaGroup/Yahoodeal.OthernotableQ2transactionsincludedtheIHSacquisitionofGlobalspec, b2bleadgenconnectingindustrialmarketerswiththeirtargetaudiencesinengineering,technicaland industrialmarkets;theacquisitionbyLinkedInofSlideShare,aprofessionalcontentsharingplatform, for$119million;andNorwestVenturePartnersacquisitionof49%ofManta,awebsiteforbusiness listingsservingthelocalmarket,for$44million.

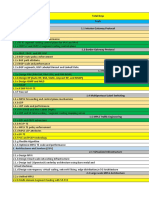

Media,Information,MarketingServices&TechnologyM&AActivity

2012 JanuaryJune IndustrySector B2BOnlineMedia&Technology B2COnlineMedia&Technology BusinesstoBusinessMedia ConsumerMagazines Database&InformationServices EducationInformation,Technology&Training Exhibitions&Conferences Marketing&InteractiveServices MobileMedia&Technology Total

Source:JEGITransactionDatabase

2011 JanuaryJune No.of Value Deals (millions) 39 130 8 16 21 32 11 129 44 430 $3,056 $4,554 $23 $2,020 $3,064 $1,272 $165 $5,740 $1,345 $21,236 %Change No.of Deals 21% 2% 75% 69% 71% (3%) 164% 103% 66% 52% Value 160% (7%) 266% (94%) 103% (9%) 165% 51% 109% 49%

No.of Value Deals (millions) 47 133 14 27 36 31 29 262 73 652 $7,932 $4,242 $82 $122 $6,205 $1,153 $437 $8,677 $2,808 $31,658

AdamGross,ChiefMarketingOfficer 2127540710;adamg@jegi.com www.jegi.com

JEGIPressRelease

Theb2conlinemediaandtechnologysectorwasthesecondmostactiveinthefirsthalfof2012,with 133transactionsatatotalvalueof$4.2billionverysimilarresultstothefirsthalfof2011.Thelargest deal of the half was the acquisition by Cerberus Capital Management of 53% of AT&Ts Advertising Solutions business, which comprises a combination of print and online yellow page listings, for $950 million in April. Other notable Q2 deals included Axel Springers acquisition of Totaljobs, online recruitingplatform,fromReedElsevierfor$176million;YbrantDigitalsacquisitionofonlineshopping comparisonsitesPriceGrabber,ClassesUSAandLowerMyBillsfromExperianfor$175million;andthe acquisitionbyCoxTargetMediaofSavings.com,anonlinesourceforsavings,personalizeddealsand moneysavingsexperts,for$100million. M&Aactivityforthebusinesstobusinessmediasectorcontinuestoberelativelyquiet,withonly14 deals in the first half of 2012, for a total value of $82 million. In Q2, Questex Media sold its b2b industrial and specialty publications to North Coast Media; and Bobit Business Media acquired b2b mediaassetsforthetruckingindustryfromNewportBusinessMedia. The consumer magazine sector has been uneventful in the first half of 2012, with 27 deals at a total valueof$122million,asharpcontrasttothefirsthalfof2011,whichsawseveralmultihundredmillion dollar deals, including the acquisition by Hearst Corporation of Lagardres magazine portfolio for $651million. Thedatabaseandinformationservicessectorpickedupconsiderablyinthefirsthalfof2012,ledby the PE buyout of TransUnion in Q1; and two transactions in Q2 Veritas Capitals acquisition of Thomson Reuters Healthcare business, a provider of healthcare data and analytics, for $1.25 billion; andPiramalHealthcaresacquisitionofDecisionResources,aproviderofhealthcaredata,researchand consulting,fromProvidenceEquityPartnersfor$635million.OthernotableQ2dealsincludedtheR.R. DonnelleyacquisitionofEdgarOnline,adistributoroffinancialdataandpublicfilings,for$67million; andMarkitsacquisitionofDataExplorers,aproviderofglobalsecuritieslendingdata. Theeducationinformation,technologyandtrainingsectorsawasimilarnumberofdealsandvaluein thefirsthalfof2012,comparedtothefirsthalfof2011.ThemostnotabledealofQ2wastheacquisition byPLATOLearningofArchipelagoLearning,aSaaSproviderofsupplementaleducationproducts,for $301million.Pearsoncontinuedtobeveryacquisitiveintheeducationsector,withtwoacquisitionsin MayGlobalEnglish,whichoffersondemandenterprisesolutionsforadvancingEnterpriseFluency, for $90 million; and Certiport, provider of performancebased certification exams and practice test solutions.OthernotabledealsinQ2includedtheJohnWileyacquisitionoftextbookpublisherHarlan Davidson;andtheacquisitionbyBoathouseCapitalandRenovusCapitalPartnersofAtomicLearning, which provides educators with professional development and training resources for introducing technologyintheclassroom. Theexhibitionsandconferencessectorsawasharpincreaseinnumberofdealsandvalueinthefirst halfof2012,comparedtothefirsthalfof2011.The29transactionsannouncedatatotaldealvalueof $437millionrepresented164%and165%respectiveincreasesover1H2011levels.Twoeventservices dealsledtheparade,withMaritzacquiringExperient,aproviderofmeetingandeventservices,from Riverside Partners and Veronis Suhler Stevenson in April (JEGI represented Experient in this deal); and AdamGross,ChiefMarketingOfficer 2127540710;adamg@jegi.com www.jegi.com

JEGIPressRelease

Gen Cap America acquiring Nth Degree, a provider of event management and marketing services, fromFrontenacCompanyinMarch.InQ2,globaleventcompaniescontinuedmakingacquisitionsof exhibitionsinemergingmarkets,suchastheTarsusacquisitionofLifeMedia,anorganizerofIstanbul basedtradefairsandITEsacquisitionofBeautexCo,anorganizerofbeautyeventsintheUkraine. Mobile media and technology was the third most active sector for M&A in 1H 2012, with 73 announced transactions at a total value of $2.8 billion, representing 66% and 109% increases, respectively,over1H2011.SeveralnotablemobilerelatedtransactionstookplaceinQ2,includingthe Facebook acquisition of Instagram. Facebook completed five additional mobile deals in the quarter, withtheacquisitionsofFace.com,mobilefacialrecognitionsoftwareandtechnology,for$60million; Karma Science, a mobile giftgiving application, for $80 million; as well as Tagtile, Lightbox and Glancee.OtherdealsinthequarterincludedGreeInternationalsacquisitionofFunzio,amobilegame developer,for$210million;theIntuitacquisitionofAisleBuyer,amobilepaymentservicethatallows customerstopurchaseanitemforhomedeliverybyscanningabarcodefrominsidethestore,for$90 million; and Conde Nasts acquisition of ZipList, which enables users to find recipes online and assembleshoppingliststosynctoiPhoneandAndroidphones,for$14million. AboutJEGI The Jordan, Edmiston Group, Inc. (JEGI) of New York, NY is the leading provider of independent investment banking services for the media, information, marketing services and technology sectors. Celebratingits25thanniversaryin2012,JEGIhascompletedmorethan500highprofileM&Atransactions forglobalcorporations;middlemarketandemergingcompanies;entrepreneurialandfamilyowners;and privateequityandventurecapitalfirms.Formoreinformation,visitwww.jegi.com. ###

AdamGross,ChiefMarketingOfficer 2127540710;adamg@jegi.com www.jegi.com

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Houston's Office Market Is Finally On The MendDokument9 SeitenHouston's Office Market Is Finally On The MendAnonymous Feglbx5Noch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Progress Ventures Newsletter 3Q2018Dokument18 SeitenProgress Ventures Newsletter 3Q2018Anonymous Feglbx5Noch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- CIO Bulletin - DiliVer LLC (Final)Dokument2 SeitenCIO Bulletin - DiliVer LLC (Final)Anonymous Feglbx5Noch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- ValeportDokument3 SeitenValeportAnonymous Feglbx5Noch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Woodlands Office Submarket SnapshotDokument4 SeitenThe Woodlands Office Submarket SnapshotAnonymous Feglbx5Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- 4Q18 Washington, D.C. Local Apartment ReportDokument4 Seiten4Q18 Washington, D.C. Local Apartment ReportAnonymous Feglbx5Noch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Houston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterDokument6 SeitenHouston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterAnonymous Feglbx5Noch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- 4Q18 Houston Local Apartment ReportDokument4 Seiten4Q18 Houston Local Apartment ReportAnonymous Feglbx5Noch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Mack-Cali Realty Corporation Reports Third Quarter 2018 ResultsDokument9 SeitenMack-Cali Realty Corporation Reports Third Quarter 2018 ResultsAnonymous Feglbx5Noch keine Bewertungen

- THRealEstate THINK-US Multifamily ResearchDokument10 SeitenTHRealEstate THINK-US Multifamily ResearchAnonymous Feglbx5Noch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- 4Q18 North Carolina Local Apartment ReportDokument8 Seiten4Q18 North Carolina Local Apartment ReportAnonymous Feglbx5Noch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- 4Q18 Philadelphia Local Apartment ReportDokument4 Seiten4Q18 Philadelphia Local Apartment ReportAnonymous Feglbx5Noch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- 4Q18 South Florida Local Apartment ReportDokument8 Seiten4Q18 South Florida Local Apartment ReportAnonymous Feglbx5Noch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- 4Q18 Atlanta Local Apartment ReportDokument4 Seiten4Q18 Atlanta Local Apartment ReportAnonymous Feglbx5Noch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- 4Q18 New York City Local Apartment ReportDokument8 Seiten4Q18 New York City Local Apartment ReportAnonymous Feglbx5Noch keine Bewertungen

- Asl Marine Holdings LTDDokument28 SeitenAsl Marine Holdings LTDAnonymous Feglbx5Noch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- 4Q18 Boston Local Apartment ReportDokument4 Seiten4Q18 Boston Local Apartment ReportAnonymous Feglbx5Noch keine Bewertungen

- 3Q18 Philadelphia Office MarketDokument7 Seiten3Q18 Philadelphia Office MarketAnonymous Feglbx5Noch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- 4Q18 Dallas Fort Worth Local Apartment ReportDokument4 Seiten4Q18 Dallas Fort Worth Local Apartment ReportAnonymous Feglbx5Noch keine Bewertungen

- Fredericksburg Americas Alliance MarketBeat Industrial Q32018Dokument1 SeiteFredericksburg Americas Alliance MarketBeat Industrial Q32018Anonymous Feglbx5Noch keine Bewertungen

- 2018 U.S. Retail Holiday Trends Guide - Final PDFDokument9 Seiten2018 U.S. Retail Holiday Trends Guide - Final PDFAnonymous Feglbx5Noch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Wilmington Office MarketDokument5 SeitenWilmington Office MarketWilliam HarrisNoch keine Bewertungen

- Under Armour: Q3 Gains Come at Q4 Expense: Maintain SELLDokument7 SeitenUnder Armour: Q3 Gains Come at Q4 Expense: Maintain SELLAnonymous Feglbx5Noch keine Bewertungen

- Roanoke Americas Alliance MarketBeat Office Q32018 FINALDokument1 SeiteRoanoke Americas Alliance MarketBeat Office Q32018 FINALAnonymous Feglbx5Noch keine Bewertungen

- Hampton Roads Americas Alliance MarketBeat Office Q32018Dokument2 SeitenHampton Roads Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5Noch keine Bewertungen

- Fredericksburg Americas Alliance MarketBeat Retail Q32018Dokument1 SeiteFredericksburg Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5Noch keine Bewertungen

- Fredericksburg Americas Alliance MarketBeat Office Q32018Dokument1 SeiteFredericksburg Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5Noch keine Bewertungen

- Roanoke Americas Alliance MarketBeat Office Q32018 FINALDokument1 SeiteRoanoke Americas Alliance MarketBeat Office Q32018 FINALAnonymous Feglbx5Noch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Roanoke Americas Alliance MarketBeat Retail Q32018 FINALDokument1 SeiteRoanoke Americas Alliance MarketBeat Retail Q32018 FINALAnonymous Feglbx5Noch keine Bewertungen

- Hampton Roads Americas Alliance MarketBeat Retail Q32018Dokument2 SeitenHampton Roads Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5Noch keine Bewertungen

- Cisco Super Lab TopologyDokument9 SeitenCisco Super Lab TopologyYuwana PatriawarmanNoch keine Bewertungen

- ProjectDokument123 SeitenProjectAnole WakoNoch keine Bewertungen

- OpenScape 4000 V7, VHG 3500 HFA For OpenScape 4000 SoftGate, Administrator Documentation, Issue 2 PDFDokument56 SeitenOpenScape 4000 V7, VHG 3500 HFA For OpenScape 4000 SoftGate, Administrator Documentation, Issue 2 PDFChris ThianNoch keine Bewertungen

- (Draft) The Physical Consequences of Mobile Gaming Addiction To The Students of Labogon National HighschoolDokument12 Seiten(Draft) The Physical Consequences of Mobile Gaming Addiction To The Students of Labogon National HighschoolStefanie PachicoNoch keine Bewertungen

- dm702v10 83 TCP Ip PDFDokument75 Seitendm702v10 83 TCP Ip PDFOscar L. Cavanzo RamirezNoch keine Bewertungen

- CSS 7 - 8 SSLMs 3 PDFDokument4 SeitenCSS 7 - 8 SSLMs 3 PDFLouise MaglantayNoch keine Bewertungen

- Sandbox 1270018080 Not AccessibleDokument2 SeitenSandbox 1270018080 Not AccessiblenewbiesNoch keine Bewertungen

- A Project ReportDokument53 SeitenA Project ReportTangirala AshwiniNoch keine Bewertungen

- CCIE Study Plan - ProgressDokument6 SeitenCCIE Study Plan - ProgressMuhammad Adel EsmailNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Fortigate SwitchDokument3 SeitenFortigate SwitchneelNoch keine Bewertungen

- Iot Based On Device Fault Detection Final Report 8TH SEMDokument40 SeitenIot Based On Device Fault Detection Final Report 8TH SEMChimanlal PatelNoch keine Bewertungen

- EForensics Magazine - Memory Forensics Step by StepDokument205 SeitenEForensics Magazine - Memory Forensics Step by StepDilip Thummar100% (3)

- Digital Certificate HTTP ConnectionDokument27 SeitenDigital Certificate HTTP ConnectionDennerAndradeNoch keine Bewertungen

- Clow Imc08 Im 11Dokument32 SeitenClow Imc08 Im 11Fatima AbboudNoch keine Bewertungen

- Web Page Design With HTMLDokument125 SeitenWeb Page Design With HTMLNanduni AnjanaNoch keine Bewertungen

- ID DCU Marine 3 0 0 Global Guide r2Dokument284 SeitenID DCU Marine 3 0 0 Global Guide r2Ricardo aguilarNoch keine Bewertungen

- International CFQDokument7 SeitenInternational CFQapi-311036617Noch keine Bewertungen

- The Information Technology SystemDokument1 SeiteThe Information Technology SystemRadha Raman ChaudharyNoch keine Bewertungen

- Concept PaperDokument3 SeitenConcept PaperJomarian MercadoNoch keine Bewertungen

- Writing A Dynamic Personal Profile: F S /P MDokument8 SeitenWriting A Dynamic Personal Profile: F S /P MAlejandraNoch keine Bewertungen

- How To Run A Packet Capture PDFDokument4 SeitenHow To Run A Packet Capture PDFAhps ServerNoch keine Bewertungen

- Educational Technology & Education Conferences #42, December 2019 To June 2020, Clayton R. WrightDokument139 SeitenEducational Technology & Education Conferences #42, December 2019 To June 2020, Clayton R. WrightcrwrNoch keine Bewertungen

- G Suite Data Protection Implementation GuideDokument31 SeitenG Suite Data Protection Implementation GuideAlex MelmanNoch keine Bewertungen

- T and C Baroda Insta Smart Trade 08-07-2020Dokument7 SeitenT and C Baroda Insta Smart Trade 08-07-2020naveenNoch keine Bewertungen

- LLDP-MED and Cisco Discovery ProtocolDokument13 SeitenLLDP-MED and Cisco Discovery ProtocolTestNoch keine Bewertungen

- DLP - Etech YholDokument60 SeitenDLP - Etech YholManuelo Vangie100% (1)

- Vision 2020 - User GuideDokument59 SeitenVision 2020 - User GuideMetering Section100% (1)

- Policy Paper - Inclusive Internet Governance - Official TemplateDokument6 SeitenPolicy Paper - Inclusive Internet Governance - Official TemplateGustavo SouzaNoch keine Bewertungen

- PhDthesisSexyadventures MarijkeNaezer-compressedDokument229 SeitenPhDthesisSexyadventures MarijkeNaezer-compressedVivek DevkotaNoch keine Bewertungen

- A-Level Presentation - 21 Network Protocols and LayersDokument36 SeitenA-Level Presentation - 21 Network Protocols and LayersDebasruti SahaNoch keine Bewertungen

- Summary: $100M Leads: How to Get Strangers to Want to Buy Your Stuff by Alex Hormozi: Key Takeaways, Summary & Analysis IncludedVon EverandSummary: $100M Leads: How to Get Strangers to Want to Buy Your Stuff by Alex Hormozi: Key Takeaways, Summary & Analysis IncludedBewertung: 3 von 5 Sternen3/5 (6)

- $100M Leads: How to Get Strangers to Want to Buy Your StuffVon Everand$100M Leads: How to Get Strangers to Want to Buy Your StuffBewertung: 5 von 5 Sternen5/5 (19)

- $100M Offers: How to Make Offers So Good People Feel Stupid Saying NoVon Everand$100M Offers: How to Make Offers So Good People Feel Stupid Saying NoBewertung: 5 von 5 Sternen5/5 (24)

- The Catalyst: How to Change Anyone's MindVon EverandThe Catalyst: How to Change Anyone's MindBewertung: 4.5 von 5 Sternen4.5/5 (274)

- Jab, Jab, Jab, Right Hook: How to Tell Your Story in a Noisy Social WorldVon EverandJab, Jab, Jab, Right Hook: How to Tell Your Story in a Noisy Social WorldBewertung: 4.5 von 5 Sternen4.5/5 (18)

- Fascinate: How to Make Your Brand Impossible to ResistVon EverandFascinate: How to Make Your Brand Impossible to ResistBewertung: 5 von 5 Sternen5/5 (1)

- Obviously Awesome: How to Nail Product Positioning so Customers Get It, Buy It, Love ItVon EverandObviously Awesome: How to Nail Product Positioning so Customers Get It, Buy It, Love ItBewertung: 4.5 von 5 Sternen4.5/5 (152)

- How to Read People: The Complete Psychology Guide to Analyzing People, Reading Body Language, and Persuading, Manipulating and Understanding How to Influence Human BehaviorVon EverandHow to Read People: The Complete Psychology Guide to Analyzing People, Reading Body Language, and Persuading, Manipulating and Understanding How to Influence Human BehaviorBewertung: 4.5 von 5 Sternen4.5/5 (33)

- The Power of Experiments: Decision-Making in a Data Driven WorldVon EverandThe Power of Experiments: Decision-Making in a Data Driven WorldNoch keine Bewertungen