Beruflich Dokumente

Kultur Dokumente

Supreme Court Rules Equipment Not Subject to Real Estate Tax

Hochgeladen von

Jett PascuaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Supreme Court Rules Equipment Not Subject to Real Estate Tax

Hochgeladen von

Jett PascuaCopyright:

Verfügbare Formate

Republic of the Philippines SUPREME COURT Manila EN BANC G.R. No.

L-17870 September 29, 1962

MINDANAO BUS COMPANY, petitioner, vs. THE CITY ASSESSOR & TREASURER and the BOARD OF TAX APPEALS of Cagayan de Oro City, respondents. Binamira, Barria and Irabagon for petitioner. Vicente E. Sabellina for respondents.

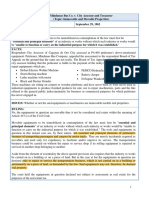

LABRADOR, J.: This is a petition for the review of the decision of the Court of Tax Appeals in C.T.A. Case No. 710 holding that the petitioner Mindanao Bus Company is liable to the payment of the realty tax on its maintenance and repair equipment hereunder referred to. Respondent City Assessor of Cagayan de Oro City assessed at P4,400 petitioner's above-mentioned equipment. Petitioner appealed the assessment to the respondent Board of Tax Appeals on the ground that the same are not realty. The Board of Tax Appeals of the City sustained the city assessor, so petitioner herein filed with the Court of Tax Appeals a petition for the review of the assessment. In the Court of Tax Appeals the parties submitted the following stipulation of facts: Petitioner and respondents, thru their respective counsels agreed to the following stipulation of facts: 1. That petitioner is a public utility solely engaged in transporting passengers and cargoes by motor trucks, over its authorized lines in the Island of Mindanao, collecting rates approved by the Public Service Commission; 2. That petitioner has its main office and shop at Cagayan de Oro City. It maintains Branch Offices and/or stations at Iligan City, Lanao; Pagadian, Zamboanga del Sur; Davao City and Kibawe, Bukidnon Province; 3. That the machineries sought to be assessed by the respondent as real properties are the following: (a) Hobart Electric Welder Machine, appearing in the attached photograph, marked Annex "A"; (b) Storm Boring Machine, appearing in the attached photograph, marked Annex "B"; (c) Lathe machine with motor, appearing in the attached photograph, marked Annex "C"; (d) Black and Decker Grinder, appearing in the attached photograph, marked Annex "D"; (e) PEMCO Hydraulic Press, appearing in the attached photograph, marked Annex "E"; (f) Battery charger (Tungar charge machine) appearing in the attached photograph, marked Annex "F"; and (g) D-Engine Waukesha-M-Fuel, appearing in the attached photograph, marked Annex "G". 4. That these machineries are sitting on cement or wooden platforms as may be seen in the attached photographs which form part of this agreed stipulation of facts; 5. That petitioner is the owner of the land where it maintains and operates a garage for its TPU motor trucks; a repair shop; blacksmith and carpentry shops, and with these machineries which are placed therein, its TPU trucks are made; body constructed; and same are repaired in a condition to be serviceable in the TPU land transportation business it operates; 6. That these machineries have never been or were never used as industrial equipments to produce finished products for sale, nor to repair machineries, parts and the like offered to the general public indiscriminately for business or commercial purposes for which petitioner has never engaged in, to date.1awphl.nt The Court of Tax Appeals having sustained the respondent city assessor's ruling, and having denied a motion for reconsideration, petitioner brought the case to this Court assigning the following errors: 1. The Honorable Court of Tax Appeals erred in upholding respondents' contention that the questioned assessments are valid; and that said tools, equipments or machineries are immovable taxable real properties.

2. The Tax Court erred in its interpretation of paragraph 5 of Article 415 of the New Civil Code, and holding that pursuant thereto the movable equipments are taxable realties, by reason of their being intended or destined for use in an industry. 3. The Court of Tax Appeals erred in denying petitioner's contention that the respondent City Assessor's power to assess and levy real estate taxes on machineries is further restricted by section 31, paragraph (c) of Republic Act No. 521; and 4. The Tax Court erred in denying petitioner's motion for reconsideration. Respondents contend that said equipments, tho movable, are immobilized by destination, in accordance with paragraph 5 of Article 415 of the New Civil Code which provides: Art. 415. The following are immovable properties: xxx xxx xxx

(5) Machinery, receptacles, instruments or implements intended by the owner of the tenement for an industry or works which may be carried on in a building or on a piece of land, and which tend directly to meet the needs of the said industry or works. (Emphasis ours.) Note that the stipulation expressly states that the equipment are placed on wooden or cement platforms. They can be moved around and about in petitioner's repair shop. In the case of B. H. Berkenkotter vs. Cu Unjieng, 61 Phil. 663, the Supreme Court said: Article 344 (Now Art. 415), paragraph (5) of the Civil Code, gives the character of real property to "machinery, liquid containers, instruments or implements intended by the owner of any building or land for use in connection with any industry or trade being carried on therein and which are expressly adapted to meet the requirements of such trade or industry." If the installation of the machinery and equipment in question in the central of the Mabalacat Sugar Co., Inc., in lieu of the other of less capacity existing therein, for its sugar and industry, converted them into real property by reason of their purpose, it cannot be said that their incorporation therewith was not permanent in character because, as essential and principle elements of a sugar central, without them the sugar central would be unable to function or carry on the industrial purpose for which it was established. Inasmuch as the central is permanent in character, the necessary machinery and equipment installed for carrying on the sugar industry for which it has been established must necessarily be permanent. (Emphasis ours.) So that movable equipments to be immobilized in contemplation of the law must first be "essential and principal elements" of an industry or works without which such industry or works would be "unable to function or carry on the industrial purpose for which it was established." We may here distinguish, therefore, those movable which become immobilized by destination because they are essential and principal elements in the industry for those which may not be so considered immobilized because they are merely incidental, not essential and principal. Thus, cash registers, typewriters, etc., usually found and used in hotels, restaurants, theaters, etc. are merely incidentals and are not and should not be considered immobilized by destination, for these businesses can continue or carry on their functions without these equity comments. Airline companies use forklifts, jeep-wagons, pressure pumps, IBM machines, etc. which are incidentals, not essentials, and thus retain their movable nature. On the other hand, machineries of breweries used in the manufacture of liquor and soft drinks, though movable in nature, are immobilized because they are essential to said industries; but the delivery trucks and adding machines which they usually own and use and are found within their industrial compounds are merely incidental and retain their movable nature. Similarly, the tools and equipments in question in this instant case are, by their nature, not essential and principle municipal elements of petitioner's business of transporting passengers and cargoes by motor trucks. They are merely incidentals acquired as movables and used only for expediency to facilitate and/or improve its service. Even without such tools and equipments, its business may be carried on, as petitioner has carried on, without such equipments, before the war. The transportation business could be carried on without the repair or service shop if its rolling equipment is repaired or serviced in another shop belonging to another. The law that governs the determination of the question at issue is as follows: Art. 415. The following are immovable property: xxx xxx xxx

(5) Machinery, receptacles, instruments or implements intended by the owner of the tenement for an industry or works which may be carried on in a building or on a piece of land, and which tend directly to meet the needs of the said industry or works; (Civil Code of the Phil.) Aside from the element of essentiality the above-quoted provision also requires that the industry or works be carried on in a building or on a piece of land. Thus in the case of Berkenkotter vs. Cu Unjieng, supra, the "machinery, liquid containers, and instruments or implements" are found in a building constructed on the land. A sawmill would also be installed in a building on land more or less permanently, and the sawing is conducted in the land or building. But in the case at bar the equipments in question are destined only to repair or service the transportation business, which is not carried on in a building or permanently on a piece of land, as demanded by the law. Said equipments may not, therefore, be deemed real property. Resuming what we have set forth above, we hold that the equipments in question are not absolutely essential to the petitioner's transportation business, and petitioner's business is not carried on in a building, tenement or on a specified land, so said equipment may not be considered real estate within the meaning of Article 415 (c) of the Civil Code. WHEREFORE, the decision subject of the petition for review is hereby set aside and the equipment in question declared not subject to assessment as real estate for the purposes of the real estate tax. Without costs. So ordered.

Republic of the Philippines SUPREME COURT Manila EN BANC G.R. No. L-15334 January 31, 1964

BOARD OF ASSESSMENT APPEALS, CITY ASSESSOR and CITY TREASURER OF QUEZON CITY, petitioners, vs. MANILA ELECTRIC COMPANY, respondent. Assistant City Attorney Jaime R. Agloro for petitioners. Ross, Selph and Carrascoso for respondent. PAREDES, J.: From the stipulation of facts and evidence adduced during the hearing, the following appear: On October 20, 1902, the Philippine Commission enacted Act No. 484 which authorized the Municipal Board of Manila to grant a franchise to construct, maintain and operate an electric street railway and electric light, heat and power system in the City of Manila and its suburbs to the person or persons making the most favorable bid. Charles M. Swift was awarded the said franchise on March 1903, the terms and conditions of which were embodied in Ordinance No. 44 approved on March 24, 1903. Respondent Manila Electric Co. (Meralco for short), became the transferee and owner of the franchise. Meralco's electric power is generated by its hydro-electric plant located at Botocan Falls, Laguna and is transmitted to the City of Manila by means of electric transmission wires, running from the province of Laguna to the said City. These electric transmission wires which carry high voltage current, are fastened to insulators attached on steel towers constructed by respondent at intervals, from its hydro-electric plant in the province of Laguna to the City of Manila. The respondent Meralco has constructed 40 of these steel towers within Quezon City, on land belonging to it. A photograph of one of these steel towers is attached to the petition for review, marked Annex A. Three steel towers were inspected by the lower court and parties and the following were the descriptions given there of by said court: The first steel tower is located in South Tatalon, Espaa Extension, Quezon City. The findings were as follows: the ground around one of the four posts was excavated to a depth of about eight (8) feet, with an opening of about one (1) meter in diameter, decreased to about a quarter of a meter as it we deeper until it reached the bottom of the post; at the bottom of the post were two parallel steel bars attached to the leg means of bolts; the tower proper was attached to the leg three bolts; with two cross metals to prevent mobility; there was no concrete foundation but there was adobe stone underneath; as the bottom of the excavation was covered with water about three inches high, it could not be determined with certainty to whether said adobe stone was placed purposely or not, as the place abounds with this kind of stone; and the tower carried five high voltage wires without cover or any insulating materials. The second tower inspected was located in Kamuning Road, K-F, Quezon City, on land owned by the petitioner approximate more than one kilometer from the first tower. As in the first tower, the ground around one of the four legs was excavate from seven to eight (8) feet deep and one and a half (1-) meters wide. There being very little water at the bottom, it was seen that there was no concrete foundation, but there soft adobe beneath. The leg was likewise provided with two parallel steel bars bolted to a square metal frame also bolted to each corner. Like the first one, the second tower is made up of metal rods joined together by means of bolts, so that by unscrewing the bolts, the tower could be dismantled and reassembled. The third tower examined is located along Kamias Road, Quezon City. As in the first two towers given above, the ground around the two legs of the third tower was excavated to a depth about two or three inches beyond the outside level of the steel bar foundation. It was found that there was no concrete foundation. Like the two previous ones, the bottom arrangement of the legs thereof were found to be resting on soft adobe, which, probably due to high humidity, looks like mud or clay. It was also found that the square metal frame supporting the legs were not attached to any material or foundation. On November 15, 1955, petitioner City Assessor of Quezon City declared the aforesaid steel towers for real property tax under Tax declaration Nos. 31992 and 15549. After denying respondent's petition to cancel these declarations, an appeal was taken by respondent to the Board of Assessment Appeals of Quezon City, which required respondent to pay the amount of P11,651.86 as real property tax on the said steel towers for the years 1952 to 1956. Respondent paid the amount under protest, and filed a petition for review in the Court of Tax Appeals (CTA for short) which rendered a decision on December 29, 1958, ordering the cancellation of the said tax declarations and the petitioner City Treasurer of Quezon City to refund to the respondent the sum of P11,651.86. The motion for reconsideration having been denied, on April 22, 1959, the instant petition for review was filed. In upholding the cause of respondents, the CTA held that: (1) the steel towers come within the term "poles" which are declared exempt from taxes under part II paragraph 9 of respondent's franchise; (2) the steel towers are personal properties and are not subject to real property tax; and (3) the City Treasurer of Quezon City is held responsible for the refund of the amount paid. These are assigned as errors by the petitioner in the brief. The tax exemption privilege of the petitioner is quoted hereunder: PAR 9. The grantee shall be liable to pay the same taxes upon its real estate, buildings, plant (not including poles, wires, transformers, and insulators), machinery and personal property as other persons are or may be hereafter required by law to pay ... Said percentage shall be due and payable at the time stated in paragraph nineteen of Part One hereof, ... and shall be in lieu of all taxes and assessments of whatsoever nature and by whatsoever authority upon the privileges, earnings, income, franchise, and poles, wires, transformers, and insulators of the grantee from which taxes and assessments the grantee is hereby expressly exempted. (Par. 9, Part Two, Act No. 484 Respondent's Franchise; emphasis supplied.) The word "pole" means "a long, comparatively slender usually cylindrical piece of wood or timber, as typically the stem of a small tree stripped of its branches; also by extension, a similar typically cylindrical piece or object of metal or the like". The term also refers to "an upright standard to the top of which something is affixed or by which something is supported; as a dovecote set on a pole; telegraph poles; a tent pole; sometimes, specifically a vessel's master (Webster's New International Dictionary 2nd Ed., p. 1907.) Along the streets, in the City of Manila, may be seen cylindrical metal poles, cubical concrete poles, and poles of the PLDT Co. which are made of two steel bars joined together by an interlacing metal rod. They are called "poles" notwithstanding the fact that they are no made of wood. It must be noted from paragraph 9, above quoted, that the concept of the "poles" for which exemption is granted, is not determined by their place or location, nor by the character of the electric current it carries, nor the material or form of which it is made, but the use to which they are dedicated. In accordance with the definitions, pole is not restricted to a long cylindrical piece of wood or metal, but includes "upright standards to the top of which something is affixed or by which something is supported. As heretofore described, respondent's steel supports consists of a framework of four steel bars or strips which are bound by steel cross-arms atop of which are cross-arms supporting five high voltage transmission wires (See Annex A) and their sole function is to support or carry such wires.

The conclusion of the CTA that the steel supports in question are embraced in the term "poles" is not a novelty. Several courts of last resort in the United States have called these steel supports "steel towers", and they denominated these supports or towers, as electric poles. In their decisions the words "towers" and "poles" were used interchangeably, and it is well understood in that jurisdiction that a transmission tower or pole means the same thing. In a proceeding to condemn land for the use of electric power wires, in which the law provided that wires shall be constructed upon suitable poles, this term was construed to mean either wood or metal poles and in view of the land being subject to overflow, and the necessary carrying of numerous wires and the distance between poles, the statute was interpreted to include towers or poles. (Stemmons and Dallas Light Co. (Tex) 212 S.W. 222, 224; 32-A Words and Phrases, p. 365.) The term "poles" was also used to denominate the steel supports or towers used by an association used to convey its electric power furnished to subscribers and members, constructed for the purpose of fastening high voltage and dangerous electric wires alongside public highways. The steel supports or towers were made of iron or other metals consisting of two pieces running from the ground up some thirty feet high, being wider at the bottom than at the top, the said two metal pieces being connected with criss-cross iron running from the bottom to the top, constructed like ladders and loaded with high voltage electricity. In form and structure, they are like the steel towers in question. (Salt River Valley Users' Ass'n v. Compton, 8 P. 2nd, 249-250.) The term "poles" was used to denote the steel towers of an electric company engaged in the generation of hydro-electric power generated from its plant to the Tower of Oxford and City of Waterbury. These steel towers are about 15 feet square at the base and extended to a height of about 35 feet to a point, and are embedded in the cement foundations sunk in the earth, the top of which extends above the surface of the soil in the tower of Oxford, and to the towers are attached insulators, arms, and other equipment capable of carrying wires for the transmission of electric power (Connecticut Light and Power Co. v. Oxford, 101 Conn. 383, 126 Atl. p. 1). In a case, the defendant admitted that the structure on which a certain person met his death was built for the purpose of supporting a transmission wire used for carrying high-tension electric power, but claimed that the steel towers on which it is carried were so large that their wire took their structure out of the definition of a pole line. It was held that in defining the word pole, one should not be governed by the wire or material of the support used, but was considering the danger from any elevated wire carrying electric current, and that regardless of the size or material wire of its individual members, any continuous series of structures intended and used solely or primarily for the purpose of supporting wires carrying electric currents is a pole line (Inspiration Consolidation Cooper Co. v. Bryan 252 P. 1016). It is evident, therefore, that the word "poles", as used in Act No. 484 and incorporated in the petitioner's franchise, should not be given a restrictive and narrow interpretation, as to defeat the very object for which the franchise was granted. The poles as contemplated thereon, should be understood and taken as a part of the electric power system of the respondent Meralco, for the conveyance of electric current from the source thereof to its consumers. If the respondent would be required to employ "wooden poles", or "rounded poles" as it used to do fifty years back, then one should admit that the Philippines is one century behind the age of space. It should also be conceded by now that steel towers, like the ones in question, for obvious reasons, can better effectuate the purpose for which the respondent's franchise was granted. Granting for the purpose of argument that the steel supports or towers in question are not embraced within the term poles, the logical question posited is whether they constitute real properties, so that they can be subject to a real property tax. The tax law does not provide for a definition of real property; but Article 415 of the Civil Code does, by stating the following are immovable property: (1) Land, buildings, roads, and constructions of all kinds adhered to the soil; xxx xxx xxx

(3) Everything attached to an immovable in a fixed manner, in such a way that it cannot be separated therefrom without breaking the material or deterioration of the object; xxx xxx xxx

(5) Machinery, receptacles, instruments or implements intended by the owner of the tenement for an industry or works which may be carried in a building or on a piece of land, and which tends directly to meet the needs of the said industry or works; xxx xxx xxx

The steel towers or supports in question, do not come within the objects mentioned in paragraph 1, because they do not constitute buildings or constructions adhered to the soil. They are not construction analogous to buildings nor adhering to the soil. As per description, given by the lower court, they are removable and merely attached to a square metal frame by means of bolts, which when unscrewed could easily be dismantled and moved from place to place. They can not be included under paragraph 3, as they are not attached to an immovable in a fixed manner, and they can be separated without breaking the material or causing deterioration upon the object to which they are attached. Each of these steel towers or supports consists of steel bars or metal strips, joined together by means of bolts, which can be disassembled by unscrewing the bolts and reassembled by screwing the same. These steel towers or supports do not also fall under paragraph 5, for they are not machineries, receptacles, instruments or implements, and even if they were, they are not intended for industry or works on the land. Petitioner is not engaged in an industry or works in the land in which the steel supports or towers are constructed. It is finally contended that the CTA erred in ordering the City Treasurer of Quezon City to refund the sum of P11,651.86, despite the fact that Quezon City is not a party to the case. It is argued that as the City Treasurer is not the real party in interest, but Quezon City, which was not a party to the suit, notwithstanding its capacity to sue and be sued, he should not be ordered to effect the refund. This question has not been raised in the court below, and, therefore, it cannot be properly raised for the first time on appeal. The herein petitioner is indulging in legal technicalities and niceties which do not help him any; for factually, it was he (City Treasurer) whom had insisted that respondent herein pay the real estate taxes, which respondent paid under protest. Having acted in his official capacity as City Treasurer of Quezon City, he would surely know what to do, under the circumstances. IN VIEW HEREOF, the decision appealed from is hereby affirmed, with costs against the petitioners.

Republic of the Philippines SUPREME COURT Manila EN BANC G.R. Nos. L-10837-38 May 30, 1958

ASSOCIATED INSURANCE and SURETY COMPANY, INC., plaintiff, vs. ISABEL IYA, ADRIANO VALINO and LUCIA VALINO, defendants. ISABEL IYA, plaintiff, vs. ADRIANO VALINO, LUCIA VALINO and ASSOCIATED INSURANCE and SURETY COMPANY. INC., defendants. Jovita L. de Dios for defendant Isabel Iya. M. Perez Cardenas and Apolonio Abola for defendant Associated Insurance and Surety Co., Inc. FELIX, J.: Adriano Valino and Lucia A. Valino, husband and wife, were the owners and possessors of a house of strong materials constructed on Lot No. 3, Block No. 80 of the Grace Park Subdivision in Caloocan, Rizal, which they purchased on installment basis from the Philippine Realty Corporation. On November 6, 1951, to enable her to purchase on credit rice from the NARIC, Lucia A. Valino filed a bond in the sum of P11,000.00 (AISCO Bond No. G-971) subscribed by the Associated Insurance and Surety Co., Inc., and as counter-guaranty therefor, the spouses Valino executed an alleged chattel mortgage on the aforementioned house in favor of the surety company, which encumbrance was duly registered with the Chattel Mortgage Register of Rizal on December 6, 1951. It is admitted that at the time said undertaking took place, the parcel of land on which the house is erected was still registered in the name of the Philippine Realty Corporation. Having completed payment on the purchase price of the lot, the Valinos were able to secure on October 18, 1958, a certificate of title in their name (T.C.T. No. 27884). Subsequently, however, or on October 24, 1952, the Valinos, to secure payment of an indebtedness in the amount of P12,000.00, executed a real estate mortgage over the lot and the house in favor of Isabel Iya, which was duly registered and annotated at the back of the certificate of title. On the other hand, as Lucia A. Valino, failed to satisfy her obligation to the NARIC, the surety company was compelled to pay the same pursuant to the undertaking of the bond. In turn, the surety company demanded reimbursement from the spouses Valino, and as the latter likewise failed to do so, the company foreclosed the chattel mortgage over the house. As a result thereof, a public sale was conducted by the Provincial Sheriff of Rizal on December 26, 1952, wherein the property was awarded to the surety company for P8,000.00, the highest bid received therefor. The surety company then caused the said house to be declared in its name for tax purposes (Tax Declaration No. 25128). Sometime in July, 1953, the surety company learned of the existence of the real estate mortgage over the lot covered by T.C.T. No. 26884 together with the improvements thereon; thus, said surety company instituted Civil Case No. 2162 of the Court of First Instance of Manila naming Adriano and Lucia Valino and Isabel Iya, the mortgagee, as defendants. The complaint prayed for the exclusion of the residential house from the real estate mortgage in favor of defendant Iya and the declaration and recognition of plaintiff's right to ownership over the same in virtue of the award given by the Provincial Sheriff of Rizal during the public auction held on December 26, 1952. Plaintiff likewise asked the Court to sentence the spouses Valino to pay said surety moral and exemplary damages, attorney's fees and costs. Defendant Isabel Iya filed her answer to the complaint alleging among other things, that in virtue of the real estate mortgage executed by her co-defendants, she acquired a real right over the lot and the house constructed thereon; that the auction sale allegedly conducted by the Provincial Sheriff of Rizal as a result of the foreclosure of the chattel mortgage on the house was null and void for non-compliance with the form required by law. She, therefore, prayed for the dismissal of the complaint and anullment of the sale made by the Provincial Sheriff. She also demanded the amount of P5,000.00 from plaintiff as counterclaim, the sum of P5,000.00 from her co-defendants as crossclaim, for attorney's fees and costs. Defendants spouses in their answer admitted some of the averments of the complaint and denied the others. They, however, prayed for the dismissal of the action for lack of cause of action, it being alleged that plaintiff was already the owner of the house in question, and as said defendants admitted this fact, the claim of the former was already satisfied. On October 29, 1953, Isabel Iya filed another civil action against the Valinos and the surety company (Civil Case No. 2504 of the Court of First Instance of Manila) stating that pursuant to the contract of mortgage executed by the spouses Valino on October 24, 1952, the latter undertook to pay a loan of P12,000.00 with interest at 12% per annum or P120.00 a month, which indebtedness was payable in 4 years, extendible for only one year; that to secure payment thereof, said defendants mortgaged the house and lot covered by T.C.T. No. 27884 located at No. 67 Baltazar St., Grace Park Subdivision, Caloocan, Rizal; that the Associated Insurance and Surety Co., Inc., was included as a party defendant because it claimed to have an interest on the residential house also covered by said mortgage; that it was stipulated in the aforesaid real estate mortgage that default in the payment of the interest agreed upon would entitle the mortgagee to foreclose the same even before the lapse of the 4-year period; and as defendant spouses had allegedly failed to pay the interest for more than 6 months, plaintiff prayed the Court to order said defendants to pay the sum of P12,000.00 with interest thereon at 12% per annum from March 25, 1953, until fully paid; for an additional sum equivalent to 20% of the total obligation as damages, and for costs. As an alternative in case such demand may not be met and satisfied plaintiff prayed for a decree of foreclosure of the land, building and other improvements thereon to be sold at public auction and the proceeds thereof applied to satisfy the demands of plaintiff; that the Valinos, the surety company and any other person claiming interest on the mortgaged properties be barred and foreclosed of all rights, claims or equity of redemption in said properties; and for deficiency judgment in case the proceeds of the sale of the mortgaged property would be insufficient to satisfy the claim of plaintiff. Defendant surety company, in answer to this complaint insisted on its right over the building, arguing that as the lot on which the house was constructed did not belong to the spouses at the time the chattel mortgage was executed, the house might be considered only as a personal property and that the encumbrance thereof and the subsequent foreclosure proceedings made pursuant to the provisions of the Chattel Mortgage Law were proper and legal. Defendant therefore prayed that said building be excluded from the real estate mortgage and its right over the same be declared superior to that of plaintiff, for damages, attorney's fees and costs. Taking side with the surety company, defendant spouses admitted the due execution of the mortgage upon the land but assailed the allegation that the building was included thereon, it being contended that it was already encumbered in favor of the surety company before the real estate mortgage was executed, a fact made known to plaintiff during the preparation of said contract and to which the latter offered no objection. As a special defense, it was asserted that the action was premature because the contract was for a period of 4 years, which had not yet elapsed. The two cases were jointly heard upon agreement of the parties, who submitted the same on a stipulation of facts, after which the Court rendered judgment dated March 8, 1956, holding that the chattel mortgage in favor of the Associated Insurance and Surety Co., Inc., was preferred and superior over the real estate mortgage subsequently executed in favor of Isabel Iya. It was ruled that as the Valinos were not yet the registered owner of the land on which the building in question was constructed at the time the first encumbrance was made, the building then was still a personality and a chattel mortgage over the same was proper. However, as the mortgagors were already the owner of the land at the time the contract with Isabel Iya was entered into, the building was transformed into a real property and the real estate mortgage created thereon was likewise adjudged as proper. It is to be noted in this connection that there is no evidence on record to sustain the allegation of the spouses Valino that at the time they mortgaged their house and lot to Isabel Iya, the latter was told or knew that part of the mortgaged property, i.e., the house, had previously been mortgaged to the surety company. The residential building was, therefore, ordered excluded from the foreclosure prayed for by Isabel Iya, although the latter could exercise the right of a junior encumbrance. So the spouses Valino were ordered to pay the amount demanded by said mortgagee or in their default to have the parcel of land subject of the mortgage sold at public auction for the satisfaction of Iya's claim.

There is no question as to appellant's right over the land covered by the real estate mortgage; however, as the building constructed thereon has been the subject of 2 mortgages; controversy arise as to which of these encumbrances should receive preference over the other. The decisive factor in resolving the issue presented by this appeal is the determination of the nature of the structure litigated upon, for where it be considered a personality, the foreclosure of the chattel mortgage and the subsequent sale thereof at public auction, made in accordance with the Chattel Mortgage Law would be valid and the right acquired by the surety company therefrom would certainly deserve prior recognition; otherwise, appellant's claim for preference must be granted. The lower Court, deciding in favor of the surety company, based its ruling on the premise that as the mortgagors were not the owners of the land on which the building is erected at the time the first encumbrance was made, said structure partook of the nature of a personal property and could properly be the subject of a chattel mortgage. We find reason to hold otherwise, for as this Court, defining the nature or character of a building, has said: . . . while it is true that generally, real estate connotes the land and the building constructed thereon, it is obvious that the inclusion of the building, separate and distinct from the land, in the enumeration of what may constitute real properties (Art. 415, new Civil Code) could only mean one thing that a building is by itself an immovable property . . . Moreover, and in view of the absence of any specific provision to the contrary, a building is an immovable property irrespective of whether or not said structure and the land on which it is adhered to belong to the same owner. (Lopez vs. Orosa, G.R. Nos. supra, p. 98). A building certainly cannot be divested of its character of a realty by the fact that the land on which it is constructed belongs to another. To hold it the other way, the possibility is not remote that it would result in confusion, for to cloak the building with an uncertain status made dependent on the ownership of the land, would create a situation where a permanent fixture changes its nature or character as the ownership of the land changes hands. In the case at bar, as personal properties could only be the subject of a chattel mortgage (Section 1, Act 3952) and as obviously the structure in question is not one, the execution of the chattel mortgage covering said building is clearly invalid and a nullity. While it is true that said document was correspondingly registered in the Chattel Mortgage Register of Rizal, this act produced no effect whatsoever for where the interest conveyed is in the nature of a real property, the registration of the document in the registry of chattels is merely a futile act. Thus, the registration of the chattel mortgage of a building of strong materials produce no effect as far as the building is concerned (Leung Yee vs. Strong Machinery Co., 37 Phil., 644). Nor can we give any consideration to the contention of the surety that it has acquired ownership over the property in question by reason of the sale conducted by the Provincial Sheriff of Rizal, for as this Court has aptly pronounced: A mortgage creditor who purchases real properties at an extrajudicial foreclosure sale thereof by virtue of a chattel mortgage constituted in his favor, which mortgage has been declared null and void with respect to said real properties, acquires no right thereto by virtue of said sale (De la Riva vs. Ah Keo, 60 Phil., 899). Wherefore the portion of the decision of the lower Court in these two cases appealed from holding the rights of the surety company, over the building superior to that of Isabel Iya and excluding the building from the foreclosure prayed for by the latter is reversed and appellant Isabel Iya's right to foreclose not only the land but also the building erected thereon is hereby recognized, and the proceeds of the sale thereof at public auction (if the land has not yet been sold), shall be applied to the unsatisfied judgment in favor of Isabel Iya. This decision however is without prejudice to any right that the Associated Insurance and Surety Co., Inc., may have against the spouses Adriano and Lucia Valino on account of the mortgage of said building they executed in favor of said surety company. Without pronouncement as to costs. It is so ordered.

Republic of the Philippines SUPREME COURT Manila EN BANC G.R. No. L-40411 August 7, 1935

DAVAO SAW MILL CO., INC., plaintiff-appellant, vs. APRONIANO G. CASTILLO and DAVAO LIGHT & POWER CO., INC., defendants-appellees. Arsenio Suazo and Jose L. Palma Gil and Pablo Lorenzo and Delfin Joven for appellant. J.W. Ferrier for appellees. MALCOLM, J.: The issue in this case, as announced in the opening sentence of the decision in the trial court and as set forth by counsel for the parties on appeal, involves the determination of the nature of the properties described in the complaint. The trial judge found that those properties were personal in nature, and as a consequence absolved the defendants from the complaint, with costs against the plaintiff. The Davao Saw Mill Co., Inc., is the holder of a lumber concession from the Government of the Philippine Islands. It has operated a sawmill in the sitio of Maa, barrio of Tigatu, municipality of Davao, Province of Davao. However, the land upon which the business was conducted belonged to another person. On the land the sawmill company erected a building which housed the machinery used by it. Some of the implements thus used were clearly personal property, the conflict concerning machines which were placed and mounted on foundations of cement. In the contract of lease between the sawmill company and the owner of the land there appeared the following provision: That on the expiration of the period agreed upon, all the improvements and buildings introduced and erected by the party of the second part shall pass to the exclusive ownership of the party of the first part without any obligation on its part to pay any amount for said improvements and buildings; also, in the event the party of the second part should leave or abandon the land leased before the time herein stipulated, the improvements and buildings shall likewise pass to the ownership of the party of the first part as though the time agreed upon had expired: Provided, however, That the machineries and accessories are not included in the improvements which will pass to the party of the first part on the expiration or abandonment of the land leased. In another action, wherein the Davao Light & Power Co., Inc., was the plaintiff and the Davao, Saw, Mill Co., Inc., was the defendant, a judgment was rendered in favor of the plaintiff in that action against the defendant in that action; a writ of execution issued thereon, and the properties now in question were levied upon as personalty by the sheriff. No third party claim was filed for such properties at the time of the sales thereof as is borne out by the record made by the plaintiff herein. Indeed the bidder, which was the plaintiff in that action, and the defendant herein having consummated the sale, proceeded to take possession of the machinery and other properties described in the corresponding certificates of sale executed in its favor by the sheriff of Davao. As connecting up with the facts, it should further be explained that the Davao Saw Mill Co., Inc., has on a number of occasions treated the machinery as personal property by executing chattel mortgages in favor of third persons. One of such persons is the appellee by assignment from the original mortgages. Article 334, paragraphs 1 and 5, of the Civil Code, is in point. According to the Code, real property consists of

1. Land, buildings, roads and constructions of all kinds adhering to the soil; xxx xxx xxx

5. Machinery, liquid containers, instruments or implements intended by the owner of any building or land for use in connection with any industry or trade being carried on therein and which are expressly adapted to meet the requirements of such trade of industry. Appellant emphasizes the first paragraph, and appellees the last mentioned paragraph. We entertain no doubt that the trial judge and appellees are right in their appreciation of the legal doctrines flowing from the facts. In the first place, it must again be pointed out that the appellant should have registered its protest before or at the time of the sale of this property. It must further be pointed out that while not conclusive, the characterization of the property as chattels by the appellant is indicative of intention and impresses upon the property the character determined by the parties. In this connection the decision of this court in the case of Standard Oil Co. of New York vs. Jaramillo ( [1923], 44 Phil., 630), whether obiter dicta or not, furnishes the key to such a situation. It is, however not necessary to spend overly must time in the resolution of this appeal on side issues. It is machinery which is involved; moreover, machinery not intended by the owner of any building or land for use in connection therewith, but intended by a lessee for use in a building erected on the land by the latter to be returned to the lessee on the expiration or abandonment of the lease. A similar question arose in Puerto Rico, and on appeal being taken to the United States Supreme Court, it was held that machinery which is movable in its nature only becomes immobilized when placed in a plant by the owner of the property or plant, but not when so placed by a tenant, a usufructuary, or any person having only a temporary right, unless such person acted as the agent of the owner. In the opinion written by Chief Justice White, whose knowledge of the Civil Law is well known, it was in part said: To determine this question involves fixing the nature and character of the property from the point of view of the rights of Valdes and its nature and character from the point of view of Nevers & Callaghan as a judgment creditor of the Altagracia Company and the rights derived by them from the execution levied on the machinery placed by the corporation in the plant. Following the Code Napoleon, the Porto Rican Code treats as immovable (real) property, not only land and buildings, but also attributes immovability in some cases to property of a movable nature, that is, personal property, because of the destination to which it is applied. "Things," says section 334 of the Porto Rican Code, "may be immovable either by their own nature or by their destination or the object to which they are applicable." Numerous illustrations are given in the fifth subdivision of section 335, which is as follows: "Machinery, vessels, instruments or implements intended by the owner of the tenements for the industrial or works that they may carry on in any building or upon any land and which tend directly to meet the needs of the said industry or works." (See also Code Nap., articles 516, 518 et seq. to and inclusive of article 534, recapitulating the things which, though in themselves movable, may be immobilized.) So far as the subject-matter with which we are dealing machinery placed in the plant it is plain, both under the provisions of the Porto Rican Law and of the Code Napoleon, that machinery which is movable in its nature only becomes immobilized when placed in a plant by the owner of the property or plant. Such result would not be accomplished, therefore, by the placing of machinery in a plant by a tenant or a usufructuary or any person having only a temporary right. (Demolombe, Tit. 9, No. 203; Aubry et Rau, Tit. 2, p. 12, Section 164; Laurent, Tit. 5, No. 447; and decisions quoted in Fuzier-Herman ed. Code Napoleon under articles 522 et seq.) The distinction rests, as pointed out by Demolombe, upon the fact that one only having a temporary right to the possession or enjoyment of property is not presumed by the law to have applied movable property belonging to him so as to deprive him of it by causing it by an act of immobilization to become the property of another. It follows that abstractly speaking the machinery put by the Altagracia Company in the plant belonging to Sanchez did not lose its character of movable property and become immovable by destination. But in the concrete immobilization took place because of the express provisions of the lease under which the Altagracia held, since the lease in substance required the putting in of improved machinery, deprived the tenant of any right to charge against the lessor the cost such machinery, and it was expressly stipulated that the machinery so put in should become a part of the plant belonging to the owner without compensation to the lessee. Under such conditions the tenant in putting in the machinery was acting but as the agent of the owner in compliance with the obligations resting upon him, and the immobilization of the machinery which resulted arose in legal effect from the act of the owner in giving by contract a permanent destination to the machinery. xxx xxx xxx

The machinery levied upon by Nevers & Callaghan, that is, that which was placed in the plant by the Altagracia Company, being, as regards Nevers & Callaghan, movable property, it follows that they had the right to levy on it under the execution upon the judgment in their favor, and the exercise of that right did not in a legal sense conflict with the claim of Valdes, since as to him the property was a part of the realty which, as the result of his obligations under the lease, he could not, for the purpose of collecting his debt, proceed separately against. (Valdes vs. Central Altagracia [192], 225 U.S., 58.) Finding no reversible error in the record, the judgment appealed from will be affirmed, the costs of this instance to be paid by the appellant.

Das könnte Ihnen auch gefallen

- Mortgage NotesDokument6 SeitenMortgage NotesJohn AguirreNoch keine Bewertungen

- The Stamp Act, 1899 - 0Dokument56 SeitenThe Stamp Act, 1899 - 0gohar iqbalNoch keine Bewertungen

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintVon EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintBewertung: 4 von 5 Sternen4/5 (1)

- Understanding Real Estate MortgagesDokument4 SeitenUnderstanding Real Estate MortgagesPark Min YeonNoch keine Bewertungen

- Mortgage IssuesDokument160 SeitenMortgage IssuesOxigyneNoch keine Bewertungen

- 2008 Civil ProcedureDokument142 Seiten2008 Civil ProcedureDi CanNoch keine Bewertungen

- Developing Case TheoryDokument9 SeitenDeveloping Case TheoryJames Andrew Buenaventura100% (1)

- Credit Transactions-Syllabus (Uribe)Dokument8 SeitenCredit Transactions-Syllabus (Uribe)viva_33100% (2)

- Mindanao Bus Co. v. City Assessor and Treasurer 1962Dokument6 SeitenMindanao Bus Co. v. City Assessor and Treasurer 1962Maricel Caranto FriasNoch keine Bewertungen

- Real Propert Y: TaxationDokument41 SeitenReal Propert Y: TaxationFreeza Masculino FabrigasNoch keine Bewertungen

- Mindanao Bus Company VS City AssessorDokument2 SeitenMindanao Bus Company VS City AssessorJoesil Dianne SempronNoch keine Bewertungen

- 3 Aguila, JR V CaDokument8 Seiten3 Aguila, JR V CaTeps RaccaNoch keine Bewertungen

- Caltex Vs CBAA DigestDokument3 SeitenCaltex Vs CBAA DigestSaab Abelita100% (1)

- Investment House LawDokument7 SeitenInvestment House LawJett PascuaNoch keine Bewertungen

- CASE DIGEST Mindanao Bus CompanyDokument1 SeiteCASE DIGEST Mindanao Bus CompanyErica Dela CruzNoch keine Bewertungen

- Mindanao Bus Co. v. City Assessor, 6 SCRA 197Dokument8 SeitenMindanao Bus Co. v. City Assessor, 6 SCRA 197Micho DiezNoch keine Bewertungen

- Case Title: G.R. No.: Date: PetitionersDokument2 SeitenCase Title: G.R. No.: Date: PetitionersJett Pascua100% (1)

- 2 Mindanao Bus Company vs. City Assessor and Treasurer G.R. No. L-17870Dokument2 Seiten2 Mindanao Bus Company vs. City Assessor and Treasurer G.R. No. L-17870crisanto m. perezNoch keine Bewertungen

- LAW 2A NOTES Obli of Vendee Until End of SalesDokument5 SeitenLAW 2A NOTES Obli of Vendee Until End of SalesnelsonNoch keine Bewertungen

- Final Case Digest Property Updated 1 67Dokument79 SeitenFinal Case Digest Property Updated 1 67kedrick bumanghatNoch keine Bewertungen

- 10 Mindanao Bus Co. V City Assessor of Cagayan de OroDokument1 Seite10 Mindanao Bus Co. V City Assessor of Cagayan de OroSherwin Anoba Cabutija100% (3)

- Mindanao Bus Co. vs. City AssessorDokument6 SeitenMindanao Bus Co. vs. City Assessorred gynNoch keine Bewertungen

- Law 1- Obligations and Contracts ReviewDokument9 SeitenLaw 1- Obligations and Contracts ReviewCharles D. FloresNoch keine Bewertungen

- Pup College of Law Insurance: 2011 Bar ReviewerDokument45 SeitenPup College of Law Insurance: 2011 Bar ReviewerHoney Crisril M. CalimotNoch keine Bewertungen

- Oblicon DigestDokument37 SeitenOblicon DigestAleezah Gertrude Regado100% (1)

- Mindanao Bus vs. City Assessor (1962)Dokument2 SeitenMindanao Bus vs. City Assessor (1962)Kobe BullmastiffNoch keine Bewertungen

- AGUILAR CORP. v NLRC case on project employmentDokument2 SeitenAGUILAR CORP. v NLRC case on project employmentJett PascuaNoch keine Bewertungen

- Mindanao Bus Co. v. City Assessor and TreasurerDokument1 SeiteMindanao Bus Co. v. City Assessor and TreasurerDomski Fatima CandolitaNoch keine Bewertungen

- Property Cases - Digests (30) DigestsDokument31 SeitenProperty Cases - Digests (30) DigestsSan Vicente Mps IlocossurppoNoch keine Bewertungen

- A.M. Oreta and Co., Inc. V NLRCDokument2 SeitenA.M. Oreta and Co., Inc. V NLRCJett PascuaNoch keine Bewertungen

- Bus Company Equipment Not Subject to Realty TaxDokument2 SeitenBus Company Equipment Not Subject to Realty TaxSalie Villaflores100% (3)

- 18corpo Cometa V CADokument2 Seiten18corpo Cometa V CAAmor Basatan ManuelNoch keine Bewertungen

- Mindanao Bus Co. vs. City Assessor and TreasurerDokument5 SeitenMindanao Bus Co. vs. City Assessor and TreasurerMan HernandoNoch keine Bewertungen

- Property Law (Title 1 Cases)Dokument58 SeitenProperty Law (Title 1 Cases)Macky CaballesNoch keine Bewertungen

- 11 G.R. No. L-17870 September 29, 1962 Mindanao Bus Vs City AssDokument3 Seiten11 G.R. No. L-17870 September 29, 1962 Mindanao Bus Vs City AssrodolfoverdidajrNoch keine Bewertungen

- Supreme Court: Binamira, Barria and Irabagon For Petitioner. Vicente E. Sabellina For RespondentsDokument23 SeitenSupreme Court: Binamira, Barria and Irabagon For Petitioner. Vicente E. Sabellina For RespondentsN4STYNoch keine Bewertungen

- Supreme Court: Binamira, Barria and Irabagon For Petitioner. Vicente E. Sabellina For RespondentsDokument23 SeitenSupreme Court: Binamira, Barria and Irabagon For Petitioner. Vicente E. Sabellina For RespondentsJp Delos ReyesNoch keine Bewertungen

- Property Law Cases Art 414 - 418Dokument138 SeitenProperty Law Cases Art 414 - 418Albert Navaja SadiliNoch keine Bewertungen

- Supreme Court Rules Maintenance Equipment of Bus Company Not Subject to Realty TaxDokument86 SeitenSupreme Court Rules Maintenance Equipment of Bus Company Not Subject to Realty TaxLozande RominaNoch keine Bewertungen

- 7 Mindanao Bus Co. vs. City Assessor of CDO, GR No. L-17870Dokument3 Seiten7 Mindanao Bus Co. vs. City Assessor of CDO, GR No. L-17870faith.dungca02Noch keine Bewertungen

- Mindanao Bus Co. vs. Cagayan de Oro City Tax DisputeDokument3 SeitenMindanao Bus Co. vs. Cagayan de Oro City Tax DisputeShally Lao-unNoch keine Bewertungen

- Supreme Court Rules on Taxation of Repair EquipmentDokument73 SeitenSupreme Court Rules on Taxation of Repair EquipmentMargeNoch keine Bewertungen

- Mindanao Bus Co. vs. City Assessor and Treasurer, G.R. NO. L-17870Dokument54 SeitenMindanao Bus Co. vs. City Assessor and Treasurer, G.R. NO. L-17870Charmilli PotestasNoch keine Bewertungen

- Supreme Court: Binamira, Barria and Irabagon For Petitioner. Vicente E. Sabellina For RespondentsDokument100 SeitenSupreme Court: Binamira, Barria and Irabagon For Petitioner. Vicente E. Sabellina For RespondentsKevin Patrick Magalona DegayoNoch keine Bewertungen

- Mindanao Bus Co Vs City Assesor and TreasurerDokument6 SeitenMindanao Bus Co Vs City Assesor and TreasurerLau NunezNoch keine Bewertungen

- PROP Set 1 Cases Art. 414-418 PDFDokument63 SeitenPROP Set 1 Cases Art. 414-418 PDFIris MendiolaNoch keine Bewertungen

- Petitioner vs. vs. Respondents Binamira, Barria & Irabagon Vicente E SabellinaDokument4 SeitenPetitioner vs. vs. Respondents Binamira, Barria & Irabagon Vicente E Sabellinadylan everetteNoch keine Bewertungen

- 2 G.R. No. L-17870Dokument3 Seiten2 G.R. No. L-17870KingNoch keine Bewertungen

- 16-Mindanao Bus Co. vs. City Assessor and TreasurerDokument6 Seiten16-Mindanao Bus Co. vs. City Assessor and Treasurerresjudicata100% (1)

- Mindanao Bus Co. V City AssessorDokument4 SeitenMindanao Bus Co. V City AssessorRenceNoch keine Bewertungen

- Property Part 1 and 2 CasesDokument44 SeitenProperty Part 1 and 2 CasesAliceAliceNoch keine Bewertungen

- Tax Court Overturns Assessment of Repair Equipment as Real PropertyDokument48 SeitenTax Court Overturns Assessment of Repair Equipment as Real PropertyYves Tristan MartinezNoch keine Bewertungen

- Mindanao Bus Tools Not Subject to Real Estate TaxDokument2 SeitenMindanao Bus Tools Not Subject to Real Estate TaxFarrah MalaNoch keine Bewertungen

- PROPERTYCASESWEEK1Dokument101 SeitenPROPERTYCASESWEEK1Joey CelesparaNoch keine Bewertungen

- 9) 13 Phil 152 - GR 5013 - Harty v. Municipality of VictoriaDokument4 Seiten9) 13 Phil 152 - GR 5013 - Harty v. Municipality of VictoriaLeopoldo, Jr. Blanco100% (1)

- Mindanao Bus Co. vs. City Assessor, L-17870, Sept. 28, 1962Dokument3 SeitenMindanao Bus Co. vs. City Assessor, L-17870, Sept. 28, 1962KimmyNoch keine Bewertungen

- GR No. L-17870: Additional Note (For Recit Purposes)Dokument1 SeiteGR No. L-17870: Additional Note (For Recit Purposes)Gale Charm SeñerezNoch keine Bewertungen

- 6 Property - MindanaoBusCo - V - City-Assessor - DolinogDokument1 Seite6 Property - MindanaoBusCo - V - City-Assessor - DolinogHANNAH GRACE TEODOSIONoch keine Bewertungen

- Property CasesDokument62 SeitenProperty CasesJa VillaromanNoch keine Bewertungen

- Mindanao Pres Co. v. City Assessors G.R. No. L-17870Dokument2 SeitenMindanao Pres Co. v. City Assessors G.R. No. L-17870Liam LacayangaNoch keine Bewertungen

- Mindanao Bus Vs AssessorDokument3 SeitenMindanao Bus Vs AssessorAnonymous 6AOOPQBd6Noch keine Bewertungen

- Mindanao Bus Co. v. City Assessor ruling on movable equipment tax statusDokument4 SeitenMindanao Bus Co. v. City Assessor ruling on movable equipment tax statusDonna Jane G. SimeonNoch keine Bewertungen

- Mindanao Bus Comp v. City AssessorDokument3 SeitenMindanao Bus Comp v. City AssessorAsaiah WindsorNoch keine Bewertungen

- P Title1Dokument402 SeitenP Title1Norman jOyeNoch keine Bewertungen

- Case Digest MINDANAO BUS COMPANY v. CITY ASSESSORDokument2 SeitenCase Digest MINDANAO BUS COMPANY v. CITY ASSESSORAbeguel SebandalNoch keine Bewertungen

- Mortgage of real estate includes fixtures and improvementsDokument6 SeitenMortgage of real estate includes fixtures and improvementsJake Floyd G. FabianNoch keine Bewertungen

- Property - 01 - 03 (Cases 1-3)Dokument4 SeitenProperty - 01 - 03 (Cases 1-3)Lea Gabrielle FariolaNoch keine Bewertungen

- Supreme Court: Binamira, Barria and Irabagon For Petitioner. Vicente E. Sabellina For RespondentsDokument3 SeitenSupreme Court: Binamira, Barria and Irabagon For Petitioner. Vicente E. Sabellina For RespondentssollskiNoch keine Bewertungen

- Davao Saw Mill vs Castillo - Machinery Classified as Personal PropertyDokument71 SeitenDavao Saw Mill vs Castillo - Machinery Classified as Personal PropertyHeberdon LitaNoch keine Bewertungen

- Mindanao Bus Co. vs. City Assessor and Treasurer: 2019. 7. 27. 오전 10 (57 Supreme Court Reports Annotated Volume 006Dokument7 SeitenMindanao Bus Co. vs. City Assessor and Treasurer: 2019. 7. 27. 오전 10 (57 Supreme Court Reports Annotated Volume 006Jappy AlonNoch keine Bewertungen

- Property Cases2Dokument28 SeitenProperty Cases2Rizza MoradaNoch keine Bewertungen

- GOCC Exemption from Real Property TaxDokument9 SeitenGOCC Exemption from Real Property TaxKingNoch keine Bewertungen

- Caltex Gas Station Equipment Subject to Realty TaxDokument3 SeitenCaltex Gas Station Equipment Subject to Realty TaxrodolfoverdidajrNoch keine Bewertungen

- 9-11 Case Digest (Capitol Wireless - Meralco - Berkenkotter)Dokument4 Seiten9-11 Case Digest (Capitol Wireless - Meralco - Berkenkotter)Mik ZeidNoch keine Bewertungen

- Mindanao Bus CompanyDokument2 SeitenMindanao Bus CompanyJann Cedric S. MontorioNoch keine Bewertungen

- Case Digest On PropertyDokument6 SeitenCase Digest On PropertyKenneth HolascaNoch keine Bewertungen

- Supreme Court: Binamira, Barria and Irabagon For Petitioner. Vicente E. Sabellina For RespondentsDokument3 SeitenSupreme Court: Binamira, Barria and Irabagon For Petitioner. Vicente E. Sabellina For RespondentssollskiNoch keine Bewertungen

- Patent Laws of the Republic of Hawaii and Rules of Practice in the Patent OfficeVon EverandPatent Laws of the Republic of Hawaii and Rules of Practice in the Patent OfficeNoch keine Bewertungen

- Case Title: G.R. No.: Date: Petitioner: Respondents: Ponente: FactsDokument2 SeitenCase Title: G.R. No.: Date: Petitioner: Respondents: Ponente: FactsJett PascuaNoch keine Bewertungen

- Party AutonomyDokument52 SeitenParty AutonomyCamille ConcepcionNoch keine Bewertungen

- Philippine Institute of ArbitratorsDokument33 SeitenPhilippine Institute of ArbitratorsJett PascuaNoch keine Bewertungen

- Work Hard and Persevere For Greatness Is in Your HandsDokument51 SeitenWork Hard and Persevere For Greatness Is in Your HandsJett PascuaNoch keine Bewertungen

- Workhard and Persevere For Greatness Is in Your Hands: Negotiorum GestioDokument18 SeitenWorkhard and Persevere For Greatness Is in Your Hands: Negotiorum GestioJett PascuaNoch keine Bewertungen

- Labor OpsDokument127 SeitenLabor OpsJett PascuaNoch keine Bewertungen

- Consti2 CasesDokument33 SeitenConsti2 CasesJett PascuaNoch keine Bewertungen

- Labor Case Digest FORMATDokument1 SeiteLabor Case Digest FORMATJett PascuaNoch keine Bewertungen

- Consti2 CasesDokument33 SeitenConsti2 CasesJett PascuaNoch keine Bewertungen

- E 33 e 3 e 3 e 3 e 3 e 3Dokument1 SeiteE 33 e 3 e 3 e 3 e 3 e 3Jett PascuaNoch keine Bewertungen

- REVALIDADokument35 SeitenREVALIDAJett PascuaNoch keine Bewertungen

- FsddfdocasdDokument1 SeiteFsddfdocasdJett PascuaNoch keine Bewertungen

- SdasdasdDokument1 SeiteSdasdasdJett PascuaNoch keine Bewertungen

- Property Cases 4Dokument45 SeitenProperty Cases 4Jett PascuaNoch keine Bewertungen

- Si Bongbong GisingDokument2 SeitenSi Bongbong GisingJett PascuaNoch keine Bewertungen

- Si Bongbong GisingDokument2 SeitenSi Bongbong GisingJett PascuaNoch keine Bewertungen

- Si Bongbong GisingDokument2 SeitenSi Bongbong GisingJett PascuaNoch keine Bewertungen

- Property Cases 2Dokument23 SeitenProperty Cases 2Jett PascuaNoch keine Bewertungen

- Transpo Cases Under Atty de GranoDokument96 SeitenTranspo Cases Under Atty de GranoJett Pascua100% (1)

- Obligations and Contracts ReviewerDokument20 SeitenObligations and Contracts ReviewerJett PascuaNoch keine Bewertungen

- ALW - Prework EXERCISEDokument8 SeitenALW - Prework EXERCISE0506sheltonNoch keine Bewertungen

- Marine RelatedDokument58 SeitenMarine RelatedsupriyodebNoch keine Bewertungen

- Pointers On Land Titles Deeds by Prof. Manuel RigueraDokument309 SeitenPointers On Land Titles Deeds by Prof. Manuel RigueraAlexa Neri ValderamaNoch keine Bewertungen

- Platon Notes - Credit Transactions (Bolivar) PDFDokument56 SeitenPlaton Notes - Credit Transactions (Bolivar) PDFajapanganibanNoch keine Bewertungen

- Property - CasesDokument117 SeitenProperty - CasesWen JunhuiNoch keine Bewertungen

- Ownership Dispute Over 16,050-Square Meter Land in Cebu CityDokument19 SeitenOwnership Dispute Over 16,050-Square Meter Land in Cebu CityCharmaine MejiaNoch keine Bewertungen

- United Overseas Bank V RosDokument10 SeitenUnited Overseas Bank V RosarnyjulesmichNoch keine Bewertungen

- ACME Shoe v. CADokument1 SeiteACME Shoe v. CAd2015memberNoch keine Bewertungen

- Group III SecurityDokument41 SeitenGroup III SecurityAnna Lyssa BatasNoch keine Bewertungen

- Insurance Digest 2Dokument19 SeitenInsurance Digest 2AlamMoBa?Noch keine Bewertungen

- Cachola 5 7 DigestDokument5 SeitenCachola 5 7 Digestgenshin asiaNoch keine Bewertungen

- 2001 Bar ExaminationDokument12 Seiten2001 Bar ExaminationAnnHopeLoveNoch keine Bewertungen

- This Judgement Ranked 1 in The Hitlist.: VersusDokument13 SeitenThis Judgement Ranked 1 in The Hitlist.: VersusGURMUKH SINGHNoch keine Bewertungen

- Roman V ABC Digest - Warehouse ReceiptsDokument1 SeiteRoman V ABC Digest - Warehouse ReceiptsLook ArtNoch keine Bewertungen

- 1SANTOS VS MANARANG, 27 PHIL 209 (1914) : Institution of HeirsDokument16 Seiten1SANTOS VS MANARANG, 27 PHIL 209 (1914) : Institution of HeirsALEXANDRIA RABANESNoch keine Bewertungen

- Cruz v. JacintoDokument6 SeitenCruz v. JacintoPaul Joshua Torda SubaNoch keine Bewertungen