Beruflich Dokumente

Kultur Dokumente

Untitled

Hochgeladen von

gunjan_jain_15Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Untitled

Hochgeladen von

gunjan_jain_15Copyright:

Verfügbare Formate

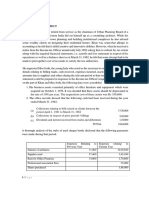

ICICI Bank of RajasthanMerger Submitted To: Submitted By:Prof. S. Bidwai Mohd.

. AbutalibIBS Mumbai 09BS0001290 Bank of Rajasthan, one of the oldest private sector banks in the country, on May 18 announcedthat it would merge with the largest private sector bank, ICICI Ban k. The board of ICICI Bank also agreed to give in-principle approval for merger of Bank of Rajasthan with it subject to duediligence and valuation by an independe nt valuer jointly appointed by both banks. Bank of Rajasthan is a listed bank wi th its corporate office in Mumbai and registered office at Udaipur inRajasthan. As on March 31, 2009, Bank of Rajasthan had 463 branches and 111 ATMs, totalasse ts of Rs.17,224 crore, deposits of Rs.15,187 crore and advances of Rs.7,781 cror e. It made anet profit of Rs.118 crore in the year ended March 31, 2009, and a n et loss of Rs.10 crore in thenine months ended December 31, 2009. ICICI Bank has a network of 2,009 branches and 5,219ATMs.In a day of high drama, BoR stock ros e 19.95% on the Bombay Stock Exchange to close atRs99.50, its year high, and aft er trading hours, the bank sent a release to the stock exchangessaying its board will meet in the evening to discuss a proposal of merging the bank with ICICIBa nk. ICICI Bank stock was down 1.45% to Rs889.35. The ICICI Bank ADR was trading at$38.61 down $0.86 or 2.18 per cent on the NYSE.ICICI Bank further stated that it has entered into an agreement with certain shareholders of Bank of Rajasthan agreeing to effect the amalgamation of Bank of Rajasthan with ICICI Bank with as hare exchange ratio of 25 shares of ICICI Bank for 118 shares of Bank of Rajasth an.ICICIBank said that its willing to pay more than BoRs present market valuation.Ac cording to banking circles, the Tayals, who acquired BoR a decade ago, have been under pressure to sell the old private bank which is grappling with directives from Sebi and RBI. InMarch, Sebi banned 100 entities allegedly holding BoR shar es on behalf of the promoters fromall stock market activities.A little earlier, RBI had slapped a penalty of Rs 25 lakh on the bank for a string of violations l ikedeletion of records in the banks IT system, irregular property deals and lapses in the accounts of a corporate group.In the past few months, the central bank h as virtually taken over BoR. The RBI appointed a newCEO for the bank, which curr ently has five RBI nominated directors. Significantly, well before the downturn, ICICI had considered the possibility of taking over BoR.But the deal fell through as ICICI was unwilling to fork out th e money Mr Tayal had asked for.On 24 th May,ICICI Bank (The Board of Directors of ICICI Bank Ltd ) approved theamalgamat ion of Bank of Rajasthan with it for a share exchange ratio of one share of ICIC I Bank for every 4.72 shares of Bank of Rajasthan.Unsatisfied with the internal valuation arrived at byICICI Bank, Bank of Rajasthan's promoter Tayals have aske d their suitor to sweeten the deal to alevel that would value the Udaipur-based bank at Rs 4,500 crore. After the two banks agreed tomerge, ICICI Bank released an internal valuation that put BoR's worth at nealry Rs 3,040 crore.During the w eek, shares of Bank of Rajasthan gained 74 per cent on the BSE to settle at Rs14 4.40 on 27 th May.On 13 th Aug the country's oldest private sector bank, Bank of Rajasthan Ltd, had become part of ICICI bank Ltd. Accordingly, all Bank of Rajasthan branches have started functioning as ICICIBank branches. This follows the Reserve Bank of India's (RB I) sanctioning the scheme of amalgamation of Bank of Rajasthan Ltd with ICICI Ba nk Ltd.The scheme has come into forcefrom the close of business on 12 August 201 0. Shares of ICICI Bank closed at Rs 963.95, down0.74 per cent, while that of Ba nk of Rajasthan slipped 0.03 per cent to Rs 190.15 on the BombayStock Exchange. K N Bhandari, Director Bank of Rajasthan assured that all BoR employees will be retained and there would be no job losses. The research reports by some foreign institutional investors have given a mixed

reaction to the proposed take-over bid of Bank of Rajasthan by ICICI Bank. JP Mo rgan says the valuations of the deal is very expensive. The swap ratio implies a price of Rs188/share for BoR, which is at a90% premium to the current market pr ice. It would typically take a year for ICICI Bank to set upa similar network to that of BoR and another two years to break-even. Key downside risk to thedeal i s potentially higher non performing loans (NPL

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Latif Khan PDFDokument2 SeitenLatif Khan PDFGaurav AroraNoch keine Bewertungen

- Benefits Management - Key Principles (Ogc)Dokument4 SeitenBenefits Management - Key Principles (Ogc)Muhemmed AhmedNoch keine Bewertungen

- Strengths and Weakness of Airborne FedexDokument2 SeitenStrengths and Weakness of Airborne FedexSrilakshmi ShunmugarajNoch keine Bewertungen

- QH1133Dokument8 SeitenQH1133Whitney KellyNoch keine Bewertungen

- Not Profit Organisations - Additional Practice Que. Set - AnswersDokument13 SeitenNot Profit Organisations - Additional Practice Que. Set - AnswersRushikesh100% (1)

- Costingg Work BookDokument170 SeitenCostingg Work BookDharshini AravamudhanNoch keine Bewertungen

- Chapter 1-Ten Principles of Economics: Instructor: A Tabassum Class Notes ECON 1000Dokument2 SeitenChapter 1-Ten Principles of Economics: Instructor: A Tabassum Class Notes ECON 1000AmanNoch keine Bewertungen

- Allwyn Nissan Group 8Dokument58 SeitenAllwyn Nissan Group 8Jayesh VasavaNoch keine Bewertungen

- China Water Purifier Production: 4.2.2 by SegmentDokument3 SeitenChina Water Purifier Production: 4.2.2 by SegmentWendell MerrillNoch keine Bewertungen

- Preboard 1 Plumbing ArithmeticDokument8 SeitenPreboard 1 Plumbing ArithmeticMarvin Kalngan100% (1)

- ACCA F1 Night Before NotesDokument20 SeitenACCA F1 Night Before NotesMarlyn RichardsNoch keine Bewertungen

- Tenant App Form 2Dokument2 SeitenTenant App Form 2api-26508830Noch keine Bewertungen

- Draft Bangladesh Railwasy (Managing High Performance)Dokument24 SeitenDraft Bangladesh Railwasy (Managing High Performance)Asif W HaqNoch keine Bewertungen

- BCLTE Points To ReviewDokument4 SeitenBCLTE Points To Review•Kat Kat's Lifeu•Noch keine Bewertungen

- Productivity & Work Study BasicsDokument34 SeitenProductivity & Work Study BasicsSangam Kadole75% (4)

- Bank MaterialDokument30 SeitenBank Materialgaffar87mcaNoch keine Bewertungen

- 1 Handbook of Business PlanningDokument326 Seiten1 Handbook of Business PlanningjddarreNoch keine Bewertungen

- 7056 ESG ReportDokument44 Seiten7056 ESG Reportfrancis280Noch keine Bewertungen

- E Payment SystemDokument47 SeitenE Payment SystemNamrata KshirsagarNoch keine Bewertungen

- Quess CorpDokument22 SeitenQuess CorpdcoolsamNoch keine Bewertungen

- Recruitment of A StarDokument8 SeitenRecruitment of A StarAshok Kumar VishnoiNoch keine Bewertungen

- (For Individuals and Hufs Not Having Income From Profits and Gains of Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Dokument37 Seiten(For Individuals and Hufs Not Having Income From Profits and Gains of Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Devanshi GoyalNoch keine Bewertungen

- Primus - Abap FactoryDokument2 SeitenPrimus - Abap FactorySambhajiNoch keine Bewertungen

- What Is Talent ManagementDokument8 SeitenWhat Is Talent ManagementarturoceledonNoch keine Bewertungen

- INFOSYSDokument9 SeitenINFOSYSSai VasudevanNoch keine Bewertungen

- Sukhwinder Kaur - Office ManagerDokument4 SeitenSukhwinder Kaur - Office ManagerAbhishek aby5Noch keine Bewertungen

- Struktur Organisasi Personil OC-2 KOTAKU SumutDokument1 SeiteStruktur Organisasi Personil OC-2 KOTAKU SumuttomcivilianNoch keine Bewertungen

- Accounting TermsDokument5 SeitenAccounting TermsShanti GunaNoch keine Bewertungen

- Arijit Bose - KMBDokument3 SeitenArijit Bose - KMBArijit BoseNoch keine Bewertungen