Beruflich Dokumente

Kultur Dokumente

Vat 64

Hochgeladen von

Tarun AgarwalOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Vat 64

Hochgeladen von

Tarun AgarwalCopyright:

Verfügbare Formate

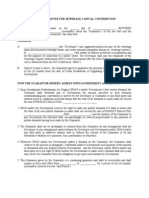

Form VAT - 64

(See Rule 26 (4)and 77))

Surety Bond

1.

KNOW ALL MEN by these presents that I/we......... .(name) S/o (in case of individual)........ aged .............(in case of individual (status) of M/s ...........(Address), am/are held and firmly bound unto the Governor of Rajasthan exercising the executive power of the Government of the State of Rajasthan (hereinafter referred to as the "Government"), which expression shall unless excluded by or repaginate to the context, include his successors in office and assigns including any officer appointed or holding office under the Rajasthan VAT Act, 2003 in the sum of rupees .............(amount in figures)............................................................................. (Amount in words) hereinafter referred to as " the said sum" to be paid to the Government or any of its officer on demand, for which payment well and truly to be made, I/we bind myself /ourselves made my/our heirs, executors administrators and legal representatives by these presents.

2.

(i) Whereas the above bounden has been required under the Act by the Assistant Commissioner/Commercial Taxes Officer/Assistant Commercial Taxes Officer to furnish security/additional security for the said sum for the purpose of securing timely payment of the amount of any tax or other sum payable under the act by him /them/ and / or for the save custody and proper use of declaration forms supplied under the Act and the Rules made their under to him/them and for indemnifying the Government against all losses, costs or expenses which the Government may, in any way, suffer, sustain or pay by reason of the omission, default or failure of the above bounden or any person acting under or for him/them to pay such tax or sum in the manner and by the time provided by or prescribed under/ the said act; or (ii) Whereas the above bounden on application under the Act to or the Commissioner/ Additional Commissioner, Commercial Taxes or Deputy Commissioner (Administration)/ (Appeals), Commercial Taxes, having jurisdiction, to stay the recovery of demand or to allow installments, has been called upon to execute a bond with two sureties in favour of the Government in the above mentioned sum of Rs.(in figures...........(in words) ............ for ensuring the due discharge by the said bounden of the liabilities under the provisions of the Act. and the rules made thereunder and in accordance with the orders passed and the directions given by the Competent Authority and for indemnifying the Government against all losses, costs or expenses which the Government may in any way suffer, sustain or pay, by reason of the default or failure in due discharge of liabilities under the Act or the rules , of the said bounden , or any person acting under him/them or for whom he may be responsible; or (iii) Whereas in pursuance of the order of ..............(designation) to release the seized goods / vehicle /accounts.................... (in case of goods, description of goods with weight and value /in case of vehicle decription of vehicle including registration number /in case of accounts, description of account) the above bounden has been called upon to execute a bond with two sureties in favour of the Government in the above mentioned sum of Rs. (in figures) ........ (in words) ............. for ensuring compliance by the said bounden of the directions given from time to time in this behalf and for indemnifying the Government against all losses, costs or expenses which the Government may in any way suffer, sustain or pay, by reason of the default or failure in compliance of the directions given of the said bounden or any person acting under him/them, or for whom he may be responsible; or (iv) .................................................................................................................................................................................. .......................................................................................................................................................................................

3.

Now the condition of the above written bond is such that if the said bounden, his/their heirs, executors or administrators or legal representatives or any person acting under or for him/them pays the full amount of tax, demand or other sum payable by him/them under the Act or the rules or discharges the liabilities undertaken by him/them or attributable to him/them, or carries out the orders and complies with the directions given to him/them/this obligation shall be void and of no effect, otherwise the same shall be and remain in force;

4.

And is hereby further agreed that in the event of death of the said bounden or on the final cessation of his liability this bond shall remain with the authority before whom it is executed for a period of twelve years from the date of the occurring of any of the events aforesaid for recovering any tax, demand or other sum payable by the above bounden for any loss, costs or expenses that may have been sustained, incurred or paid by the Government owing to the act, omission, default, failure or insolvency of the above bounden;

5.

Provided always that without prejudice to any other right or remedies for recovering the tax, demand or other sum or loss costs or expenses as aforesaid, it shall be open to the Government or any of its officers to recover the amount payable under this bond as an arrear of land revenue.

6.

In witness whereof the said bounden has hereunto set his and this day of .20..

Signed by the above bounden In the presence of _ 1. 2. 7.

(Signature and status)

We, .andhereby declare ourselves sureties for the above said bounden ..and guarantee that he/they shall do and perform all that he/they has/have above undertaken to do and perform and in case of his/their making default therein, we herby bind ourselves jointly and severally to forfeit to the Governor of the State of Rajasthan (hereinafter referred to as the Government) the sum of Rs. (in figures) ..(in words) in which the above bounden has/have bound himself/themselves or such other lesser sum as shall be deemed to be sufficient by the Commissioner, Commercial Taxes, Rajasthan or the authority or officer before whom this security bond is furnished to recover any tax, demand or other sum payable by the above bounden and also to recover any loss, costs or expenses, which the Government may sustain, incur or pay by any omission, default or failure on the part of the said bounden or any other person acting under for him/them.

8.

And we agree that the authorities mentioned in the preceding para may, without prejudice to any other rights or remedies, recover the said sum from us, jointly and severally, as an arrear of land revenue. Names and addresses of the sureties 1. 2 Details of immovable properties of sureties 1. 2

9.

And we also agree that neither of us shall be at liberty to terminate this suretyship except upon giving to the authorities or officers concerned six calendar months notice in writing of our intention so to do, and our joint and several liability under this bond shall continue in respect of all acts, omissions, defaults, failures and insolvency on the part of the above bounden until the expiration of the said period of six months. In the presence of the witness. 1. .. 2. .. 1. 2. (Signature of the Sureties)

Note. 1. In para 2, the eventualities, which are not applicable should be struck and initialed by the executer.

Das könnte Ihnen auch gefallen

- Form Vat64Dokument2 SeitenForm Vat64BhupendraSinghChaudharyNoch keine Bewertungen

- VAT Bond FormDokument2 SeitenVAT Bond FormKiran KumarNoch keine Bewertungen

- Central Sales Tax Indemnity Bond FormDokument3 SeitenCentral Sales Tax Indemnity Bond FormVipayulNoch keine Bewertungen

- B 8 (Security)Dokument2 SeitenB 8 (Security)nlvmadhavNoch keine Bewertungen

- Bond For Export of Goods or Services Without Payment of Integrated TaxDokument1 SeiteBond For Export of Goods or Services Without Payment of Integrated TaxGiri SukumarNoch keine Bewertungen

- 1 (Form G Form of Indemnity Bond (See Rules 12 (2) and 12 (9) )Dokument3 Seiten1 (Form G Form of Indemnity Bond (See Rules 12 (2) and 12 (9) )maniNoch keine Bewertungen

- LOcal SUrety BondDokument3 SeitenLOcal SUrety BondSameer SharmaNoch keine Bewertungen

- OCS PenForm-20 PDFDokument2 SeitenOCS PenForm-20 PDFdkthedaredevil4496Noch keine Bewertungen

- 03 Letter of IndemnityDokument3 Seiten03 Letter of IndemnityVidhyasagar BsNoch keine Bewertungen

- Bank Guarantee Format As Per Store Purchase ManualDokument3 SeitenBank Guarantee Format As Per Store Purchase ManualadheesNoch keine Bewertungen

- Bank GuaranteeDokument2 SeitenBank GuaranteeAnkur Agarwal Vedic AstrologerNoch keine Bewertungen

- Computer Advance Form IVDokument2 SeitenComputer Advance Form IVAbhishek Kumar SinghNoch keine Bewertungen

- Loan AgreementDokument5 SeitenLoan AgreementkakoozahenryNoch keine Bewertungen

- Form of Bond Upper Division ClerkDokument3 SeitenForm of Bond Upper Division Clerkaman0% (1)

- Bank GuaranteeDokument2 SeitenBank GuaranteeTender CellNoch keine Bewertungen

- BG For IwkDokument2 SeitenBG For IwkSky SawNoch keine Bewertungen

- Preliminary LSGDDokument1 SeitePreliminary LSGDroneymannanalNoch keine Bewertungen

- Master Gilt Edged Stock Lending Agreement SummaryDokument30 SeitenMaster Gilt Edged Stock Lending Agreement SummaryMark Xavier OyalesNoch keine Bewertungen

- Form No. 3825 Life Insurance Corporation of India (Established by The Life Insurance Corporation Act, 1956)Dokument3 SeitenForm No. 3825 Life Insurance Corporation of India (Established by The Life Insurance Corporation Act, 1956)RubyNoch keine Bewertungen

- Maturity Claim (Form No.3825)Dokument3 SeitenMaturity Claim (Form No.3825)Sarvepalli Uday KiranNoch keine Bewertungen

- Maturity Claim (Form No.3825)Dokument3 SeitenMaturity Claim (Form No.3825)PrasanthNoch keine Bewertungen

- Form No. 3825 DischargeDokument3 SeitenForm No. 3825 DischargePrasanthNoch keine Bewertungen

- Maturity Form No 3825Dokument3 SeitenMaturity Form No 3825roshansm1978Noch keine Bewertungen

- Maturity Claim (Form No.3825)Dokument3 SeitenMaturity Claim (Form No.3825)PrasanthNoch keine Bewertungen

- LIC Claim Form 3825 Discharge Voucher For Pollicy Maturity PDFDokument3 SeitenLIC Claim Form 3825 Discharge Voucher For Pollicy Maturity PDFVasudeva AcharyaNoch keine Bewertungen

- Maturity Claim (Form No.3825) PDFDokument3 SeitenMaturity Claim (Form No.3825) PDFRajeev Ranjan100% (1)

- Central Excise Bond ExportDokument1 SeiteCentral Excise Bond ExportashishvsNoch keine Bewertungen

- Surety BondDokument4 SeitenSurety BondVinay KushwahaNoch keine Bewertungen

- Know All Men: Indemnity BondDokument2 SeitenKnow All Men: Indemnity BondjotisNoch keine Bewertungen

- Form 4A: Deed of Indemnity & SubrogationDokument3 SeitenForm 4A: Deed of Indemnity & SubrogationHemant Singh SisodiyaNoch keine Bewertungen

- POA (POWER OF ATTORNEY) LAX Amd4-BinexDokument1 SeitePOA (POWER OF ATTORNEY) LAX Amd4-BinexzamoNoch keine Bewertungen

- Appendix 25 A Bank Guarantee FormatDokument2 SeitenAppendix 25 A Bank Guarantee FormatdaljitkaurNoch keine Bewertungen

- Stakeholder AgreementDokument3 SeitenStakeholder AgreementBernard Tee Shyong JiunnNoch keine Bewertungen

- Bank Guarantee FormatDokument2 SeitenBank Guarantee FormatAbishek Kumar67% (3)

- BG12Dokument7 SeitenBG12Tapash SunjunuNoch keine Bewertungen

- Mpkby FormsDokument8 SeitenMpkby FormsmrinankadharlillyNoch keine Bewertungen

- Preliminary A GTDokument2 SeitenPreliminary A GTTijo ThomasNoch keine Bewertungen

- Documents Required for NEDFi Loan DisbursalDokument6 SeitenDocuments Required for NEDFi Loan DisbursalVarunNoch keine Bewertungen

- General Excise BondDokument2 SeitenGeneral Excise BondkhajuriaonlineNoch keine Bewertungen

- Bank Guarantee TemplateDokument2 SeitenBank Guarantee Templaterafikul123Noch keine Bewertungen

- Acknowledgement of DebtDokument3 SeitenAcknowledgement of DebtmyaNoch keine Bewertungen

- APGLI Indemnity BondDokument2 SeitenAPGLI Indemnity BondSEKHARNoch keine Bewertungen

- SBD FormsDokument10 SeitenSBD FormsmfundhisiNoch keine Bewertungen

- Composition DeedDokument3 SeitenComposition DeedAnkur SharmaNoch keine Bewertungen

- Indemnity BondDokument4 SeitenIndemnity BondSunny BhambhaniNoch keine Bewertungen

- Writing EIRL To SPA TransformationDokument10 SeitenWriting EIRL To SPA TransformationScribdTranslationsNoch keine Bewertungen

- Escrow Agreement (SRO)Dokument8 SeitenEscrow Agreement (SRO)Bryan CuaNoch keine Bewertungen

- Assignment of Business DebtsDokument2 SeitenAssignment of Business DebtsRitikaNoch keine Bewertungen

- No Claim Bond TitleDokument2 SeitenNo Claim Bond TitleDashanandNoch keine Bewertungen

- Agreement ContractDokument2 SeitenAgreement ContractCoburg EqptsNoch keine Bewertungen

- TNEB New Connection Indemnity BondDokument4 SeitenTNEB New Connection Indemnity BondSathish Julius60% (5)

- Master Agreement for Commercial Letters of CreditDokument13 SeitenMaster Agreement for Commercial Letters of CreditKagimu Clapton ENoch keine Bewertungen

- Guarantee Bond Format (To Be Used by Approved Schedule Banks)Dokument2 SeitenGuarantee Bond Format (To Be Used by Approved Schedule Banks)cmlr shopNoch keine Bewertungen

- Personal Bond of IndemnityDokument4 SeitenPersonal Bond of IndemnityAmit Kumar100% (1)

- Chat Mortgage DocDokument4 SeitenChat Mortgage DocJec Luceriaga BiraquitNoch keine Bewertungen

- ModelCommerciaContractTemplates (WordFormat)Dokument20 SeitenModelCommerciaContractTemplates (WordFormat)Chandan Kumar SinghNoch keine Bewertungen

- Indemnity Bond (To Be Executed by Agreement To Sell Holder) (To Be Executed On Non-Judicial Stamp Paper of Rs.100/-)Dokument1 SeiteIndemnity Bond (To Be Executed by Agreement To Sell Holder) (To Be Executed On Non-Judicial Stamp Paper of Rs.100/-)John SnowNoch keine Bewertungen

- ICAR Study Leave Bond - in - Editable FormatDokument3 SeitenICAR Study Leave Bond - in - Editable FormatAshokMahariyaNoch keine Bewertungen

- English Mortgage in Favour of A BankDokument10 SeitenEnglish Mortgage in Favour of A Bankshreya bhattacharjeeNoch keine Bewertungen

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Von EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Noch keine Bewertungen

- India's T-Bills Market GuideDokument23 SeitenIndia's T-Bills Market Guidepriyanka_pagedar73Noch keine Bewertungen

- Latihan B Ingg Un SMKDokument5 SeitenLatihan B Ingg Un SMKChandra GrowlingNoch keine Bewertungen

- Caietele de Doleante Ale NobilimiiDokument15 SeitenCaietele de Doleante Ale Nobilimiiiancu costiNoch keine Bewertungen

- Review of Monetary Economics: An Integrated Approach to Credit, Money, Income, Production, and WealthDokument5 SeitenReview of Monetary Economics: An Integrated Approach to Credit, Money, Income, Production, and Wealthmirando93100% (1)

- Buletin Mutiara Oct 2 - Tamil, Mandarin, EnglishDokument28 SeitenBuletin Mutiara Oct 2 - Tamil, Mandarin, EnglishChan LilianNoch keine Bewertungen

- Effect of Public Expenditure On Economic Growth in Nigeria, 1970 2009Dokument16 SeitenEffect of Public Expenditure On Economic Growth in Nigeria, 1970 2009Andy OkwuNoch keine Bewertungen

- Treasury Letter To Congress 100115Dokument2 SeitenTreasury Letter To Congress 100115Brett LoGiuratoNoch keine Bewertungen

- How and Why Wonder Book of Coins and CurrencyDokument52 SeitenHow and Why Wonder Book of Coins and Currencykett8233100% (6)

- Indemnity BondDokument4 SeitenIndemnity BondSunny BhambhaniNoch keine Bewertungen

- BG For IwkDokument2 SeitenBG For IwkSky SawNoch keine Bewertungen

- Deficit FinancingDokument18 SeitenDeficit Financingshreyamenon95Noch keine Bewertungen

- STD 12 Accountancy1Dokument264 SeitenSTD 12 Accountancy1Chetan KhonaNoch keine Bewertungen

- In Re Petition For Assistance V BIR DigestDokument2 SeitenIn Re Petition For Assistance V BIR DigestLiana AcubaNoch keine Bewertungen

- India's Central Bank Reserve Bank of India Regional Office, Delhi, Foreign Remittance Department. New Delhi: 110 001, India, 6, Sansad MargDokument2 SeitenIndia's Central Bank Reserve Bank of India Regional Office, Delhi, Foreign Remittance Department. New Delhi: 110 001, India, 6, Sansad MargvnkatNoch keine Bewertungen

- Political and Economic Aspects of Spanish ColonizationDokument25 SeitenPolitical and Economic Aspects of Spanish Colonizationdan hermogila0% (1)

- Affidavit of Notary PresentmentDokument7 SeitenAffidavit of Notary Presentmentpreston_402003100% (7)

- Tax Verification Script 9.22Dokument2 SeitenTax Verification Script 9.22Kyle SanfordNoch keine Bewertungen

- Sands, Lynsay - Familia Argeneau 04 - Alto, Moreno y HambrientoDokument249 SeitenSands, Lynsay - Familia Argeneau 04 - Alto, Moreno y HambrientoAnny Muñoz100% (2)

- Budget & EconomyDokument13 SeitenBudget & Economysonu_dpsNoch keine Bewertungen

- New System of Property Tax AssessmentDokument12 SeitenNew System of Property Tax Assessmentpoornima_npNoch keine Bewertungen

- Prepare The Cash BookDokument4 SeitenPrepare The Cash BookShaloom TV100% (1)

- 2 Regime To Rate FlowDokument26 Seiten2 Regime To Rate Flowramaswamy_sridharNoch keine Bewertungen

- Public Financial Management in Latin America - The Key To Efficiency and Transparency, Gestion Financiera Publica en America Latina - La Clave de La Eficiencia y La TransparenciaDokument403 SeitenPublic Financial Management in Latin America - The Key To Efficiency and Transparency, Gestion Financiera Publica en America Latina - La Clave de La Eficiencia y La Transparenciaradoniaina100% (1)

- Outstanding SBN 2010 UploadDokument42 SeitenOutstanding SBN 2010 UploadriadhusNoch keine Bewertungen

- Treasury Bills: Working Capital Management Assignment - 1Dokument4 SeitenTreasury Bills: Working Capital Management Assignment - 1Divya Gopakumar100% (1)

- System Dynamics of Interest Rate Effects On Aggregate Demand PDFDokument24 SeitenSystem Dynamics of Interest Rate Effects On Aggregate Demand PDFUmkc Economists100% (2)

- NPP Response To Budget - 7 Year NDC Record - Alternative Vision Speech by DR BawumiaDokument63 SeitenNPP Response To Budget - 7 Year NDC Record - Alternative Vision Speech by DR BawumiaMahamudu BawumiaNoch keine Bewertungen

- Marriott Case Questions Final DraftDokument5 SeitenMarriott Case Questions Final DraftRahul PandeyNoch keine Bewertungen

- Governmental and Nonprofit Accounting Theory and PracticeDokument68 SeitenGovernmental and Nonprofit Accounting Theory and Practicegilli1tr100% (2)

- Blank Form SALN - 2017Dokument2 SeitenBlank Form SALN - 2017Nic OleNoch keine Bewertungen