Beruflich Dokumente

Kultur Dokumente

Beverage: Digest

Hochgeladen von

nazzishsOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Beverage: Digest

Hochgeladen von

nazzishsCopyright:

Verfügbare Formate

THE NEWSLETTER THE FACT BOOK COKE/PEPSI SYSTEM BOOKS BOTTLER TERRITORY MAPS CONFERENCES

T H E B E V E R AG E I N D U ST R Y S L E A D I N G I N F O R M AT I O N R E S O U R C E F O R B R E A K I N G N E W S , A N A LY S I S & DATA

BEVERAGE DIGEST

Special Issue: U.S. Beverage Results for 2011.

Top-10 CSD Companies 2011 CSD Share Share +/-0.1 -0.8 flat +0.4 flat +0.2 +0.2 +0.1 +0.1 -0.1 n/a

MARCH 20, 2012 VOLUME 61 / NO. 6 FOUNDED 1982 BEVERAGE-DIGEST.COM TWITTER UPDATES

CSDs Declined for 7th Straight Year. LRBs Were Up +0.8%. Among Big Soft Drink Companies: Dr Pepper Snapple Does Best in CSDs. Coke in LRBs. Fanta Top Performing CSD Brand. Dasani Fastest Growing LRB Megabrand.

Each March, BD publishes summary all-channel U.S. beverage results for the previous year in a Special Issue. In previous Special Issues, BD has focused on carbonated soft drink (CSD) results, as that category is the biggest and most important. However, as bottled water and non-carbs have grown, they have become a bigger part of the total LRB (liquid refreshment beverage) universe. LRBs include: CSDs; bottled water; and non-carbs (sports drinks, readyto-drink teas, juice drinks, etc). This year, BD is publishing four data sets, showing for each: market share by volume; market share change; and volume performance. The four data sets are: 1) top-10 CSD companies. 2) top-5 LRB companies. 3) top-10 CSD brands. 4) top-10 LRB Megabrands (definition below).

Top-5 LRB Companies 2011 Vol +/-1.0% -3.9% -0.7% +5.7% +0.1% +14.9% +17.0% +28.0% +5.4% n/a -1.0% Coca-Cola Co * PepsiCo Dr Pepper Snapple Nestle Waters Cott All other Total LRB Business

LRB Share Share +/34.0 26.9 11.1 9.9 3.7 14.3 100.0 -0.2 -0.6 -0.2 -0.2 +0.1 +1.1

Vol +/+0.2% -1.3% -0.6% -1.4% +4.4% n/a +0.8%

Coca-Cola Co. PepsiCo Dr Pepper Snapple Cott Corp. National Beverage Monster Beverage Co Red Bull Rockstar Big Red Private label/other Total CSD Category

41.9 28.5 16.7 5.2 2.8 1.2 1.0 0.6 0.6 1.5 100.0

n/a

* Includes declining volume from Spring brand bottled water which has been discontinued; without Spring, Coke up +1% (see text).

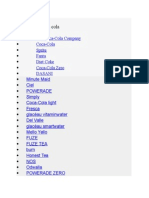

Top-10 CSD Brands 2011 CSD Share

Coke Diet Coke Pepsi-Cola Mt. Dew Dr Pepper Sprite Diet Pepsi Diet Mt. Dew Fanta Diet Dr Pepper 17.0 9.6 9.2 6.7 6.4 5.7 4.9 2.0 1.9 1.8

Top-10 LRB Megabrands 2011 Vol +/-1.0% -4.0% -4.8% -1.5% +0.5% +0.1% -8.2% +0.4% +3.0% -2.5% Coke Pepsi Mt. Dew Dr Pepper Gatorade Sprite Nestle Pure Life Dasani Aquafina Arizona

Share +/flat -0.3 -0.3 -0.1 +0.1 +0.1 -0.4 flat +0.1 -0.1

LRB Share Share +/18.8 10.0 6.0 5.3 4.2 3.8 3.5 2.1 2.0 2.0 -0.4 -0.7 -0.1 flat +0.3 flat

Vol +/-1.5% -5.5% -1.0% +0.4% +8.0% -0.5%

-0.1 -1.7% +0.2 +11.0% flat +2.1% +0.2 +9.3%

W A R N I N G: Unauthorized electronic, print or fax reproduction in whole or in part is a violation of Federal Law. Violators are liable for actual damages or statutory damages up to $100,000.

Results: CSD Category. In 2011, CSDs declined -1%, a bit worse than the category's performance in 2010, when it was down -0.5%. Total CSD volume -- 9.274 bil 192-oz cases -- is down to about the level it was back in 1996. BD includes fast-growing energy drinks as part of CSDs; without energy drinks, the category would have been down closer to -1.5%. BD estimates that all-channel CSD pricing was up about +3%. That means CSD total retail dollars grew +2% to about $75.7 bil. Throughout most of the 1990s, the CSD category grew in the +3% range annually, but then its performance began to slow in 1999. It has been in decline since 2005. Per Capita Consumption. Per capita CSD consumption in the U.S. fell to 714 eight-ounce servings in 2011, down from 728 in 2010. That is the lowest it has been since 1987. CSDs, while still the biggest category, are playing a declining role in Americans' beverage consumption. Fact Book. BD will provide detailed information on the three LRB categories (CSDs, bottled water and non-carbs), the companies and brands in its soon-to-be published 2012 Fact Book. There is an order form on our website at: www.beverage-digest.com Results: CSD Companies. The big-three companies -- Coke, PepsiCo and Dr Pepper Snapple (DPS) -- each lost volume in 2011. DPS's market share was flat. Coke lost -0.1 share points. PepsiCo was down -0.8. The energy drink companies -- Monster, Red Bull and Rockstar -- each posted double-digit volume growth and gained share. Results: CSD Brands. Among the top-10 CSD brands, Coke has the #1 and #2 brands with Coke and Diet Coke. PepsiCo has the #3 and #4 brands with Pepsi and Mt. Dew. Among the top-10 brands, Coke has four, PepsiCo has four and DPS has two. In 2011, Fanta moved ahead of Diet Dr Pepper in the rankings. Fanta's +3% volume growth made it the strongest performing top-10 CSD brand. Diet Pepsi's -8.2% volume decline was the steepest. Six of the top-10 brands lost volume; four grew. Results: LRB Category and Companies. BD estimates that in 2011, total LRB volume totaled about 15.2 bil cases, up +0.8% vs 2010. In 2010, LRB volume was up +1.7%. In addition to being the biggest CSD company, Coke is also the biggest LRB company with a 34 share to PepsiCo's 26.9 share. Among the top-three companies, only Coke grew LRB volume. BD's all-channel LRB data does not completely correlate with the published financial results from Coke, PepsiCo and some other public companies. They follow certain accounting rules, and BD publishes actual volume data. Plus, BD's all-channel data does not include refrigerated juices such as Tropicana, Minute Maid and Simply. So, for example re Coke, it said in early 2010 it had "exited" the warehouse delivery bottled water business, mainly the Spring brand; it has excluded that business from its reported results for 2009, 2010 and 2011, treating it as a discontinued business. In BD's all-channel data, Coke's LRB volume in 2011 was up +0.2%, but it would have been up +1% if Spring and its volume decline were excluded. Results: LRB Megabrands. BD defines a "Megabrand" as a brand or trademark with total volume of more than 100 million 192-oz cases. So Megabrand Coke includes Coke Classic, Diet Coke, Coke Zero, Cherry Coke and all other iterations of the Coke trademark. Megabrand Gatorade includes Gatorade and G2. Megabrand Mt. Dew includes regular, diet, Code Red, etc. In 2011, the biggest Megabrand by far was Coke, with an 18.8 share of LRB volume. Its volume was down -1.5%. Megabrand Pepsi was down -5.5%. The three strongest performing Megabrands were Dasani, up +11%; Arizona up +9.3%; and Gatorade up +8%. Within the Gatorade Megabrand, brand Gatorade was up +7.3% and G2 was up +10.3%. Among the top-10 Megabrands, Coke had three with an aggregate share of 24.7. PepsiCo had four with an aggregate share of 22.1. Dr Pepper Snapple, Nestl and Arizona each had one brand in the list of top-10 Megabrands. In 2011, Arizona moved up in the Megabrand ranking from #11 to #10, as Poland Spring, which had been #8 in 2010, slipped out of the top-10. Methodology. BD tracks CSD and LRB volume in all channels including retail, vending and fountain. BD's all-channel data is based on BD estimates, which, in some cases, may differ from companies' data and is, in the end, based on BD's evaluation, analysis and opinion.

John Sicher, Editor & Publisher

sicher@beverage-digest.com

| 914-244-0700

2012 Beverage Digest is published by Beverage Digest Company L.L.C. All rights reserved. No part of this publication may be reproduced or transmitted in any print or electronic format without written permission of the publisher. John Sicher, Editor & Publisher; Thomas Fine, Managing Editor; Anna Huerta, Circulation Director; John C. Maxwell, Contributing Editor. Correspondence: P.O. Box 621, Bedford Hills NY 10507. Deliveries: 2 Depot Plaza, Suite 101A, Bedford Hills NY 10507. Phone: (914) 244-0700. Fax: (914) 244-0774. Website: www.beverage-digest.com. E-mail: sicher@beverage-digest.com. One-year subscription $805 in U.S./Canada, $905 elsewhere. Fax subscription $985 to all locations. American Express, Mastercard and Visa accepted. Sample copies available. Subscriptions non-cancelable except pursuant to specific limited promotional offers. Printed on recycled paper. Published 22 times per year (plus additional Special Issues). Single copies or maps $75, prepaid orders only. ISSN 0738-8853. Printed in U.S.A.

BEVERAGE-DIGEST

MARCH 20, 2012

Page 2

Das könnte Ihnen auch gefallen

- Syllabus Class 2 - 6Dokument5 SeitenSyllabus Class 2 - 6nazzishsNoch keine Bewertungen

- Qualification Exams Class 1 MathsDokument7 SeitenQualification Exams Class 1 MathsnazzishsNoch keine Bewertungen

- Gmail - Red Chilli Whole (Dried)Dokument1 SeiteGmail - Red Chilli Whole (Dried)nazzishsNoch keine Bewertungen

- IMP - Theconvergenceofinsuranceandcapitalmarkets Johndaley 040313Dokument28 SeitenIMP - Theconvergenceofinsuranceandcapitalmarkets Johndaley 040313nazzishsNoch keine Bewertungen

- Showcase Malaysia ExhibitorsDokument13 SeitenShowcase Malaysia ExhibitorsnazzishsNoch keine Bewertungen

- Gmail - Red Chilli Whole (Dried)Dokument1 SeiteGmail - Red Chilli Whole (Dried)nazzishsNoch keine Bewertungen

- Aayat BayyinatDokument360 SeitenAayat BayyinatTariq Mehmood TariqNoch keine Bewertungen

- A.M. Best Webinar: Analysts See Resilient Reinsurance MarketDokument7 SeitenA.M. Best Webinar: Analysts See Resilient Reinsurance MarketnazzishsNoch keine Bewertungen

- Defence StrategyDokument1 SeiteDefence StrategynazzishsNoch keine Bewertungen

- 1.municipal Guarantee Fund-Contingent CapitalDokument12 Seiten1.municipal Guarantee Fund-Contingent CapitalnazzishsNoch keine Bewertungen

- Mirza Shahnawaz Agha Profile Brief Biography Pakistani Entrepreneur ConsultantDokument1 SeiteMirza Shahnawaz Agha Profile Brief Biography Pakistani Entrepreneur Consultantnazzishs100% (1)

- THINK! - The Decisive EdgeDokument32 SeitenTHINK! - The Decisive EdgenazzishsNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Embonor 1Dokument18 SeitenEmbonor 1Usuario clNoch keine Bewertungen

- EKMA5309 Manajemen Strategi Diskusi 1Dokument4 SeitenEKMA5309 Manajemen Strategi Diskusi 1Azizah AliahNoch keine Bewertungen

- SWOT Analysis of Coca ColaDokument7 SeitenSWOT Analysis of Coca ColaDhiren RudaniNoch keine Bewertungen

- Brand Management of CokeDokument16 SeitenBrand Management of Cokeparvezkhaled100% (2)

- Evidencia 3 Report Discussing What Went WrongDokument4 SeitenEvidencia 3 Report Discussing What Went WrongMiguel CastroNoch keine Bewertungen

- Clipped Words QuizDokument1 SeiteClipped Words QuizAldren100% (2)

- Mountain DewDokument2 SeitenMountain DewFariha AnsariNoch keine Bewertungen

- PepsiCo Brands PortfolioDokument42 SeitenPepsiCo Brands Portfolioshiprag_21Noch keine Bewertungen

- Preturi Produse PDFDokument26 SeitenPreturi Produse PDFpandurualin100% (1)

- M.S.I.L Liquor Retail Outlet Udupi DistrictDokument3 SeitenM.S.I.L Liquor Retail Outlet Udupi DistrictAnish VeettiyankalNoch keine Bewertungen

- Thursday, June 24, 2021: Sipan Basis SAP "Envase" Articulo B C C P 1400 - PTER 1450 - PTERDokument22 SeitenThursday, June 24, 2021: Sipan Basis SAP "Envase" Articulo B C C P 1400 - PTER 1450 - PTERJRIISSNoch keine Bewertungen

- Dew Positioning ReportDokument6 SeitenDew Positioning ReportKandarp VyasNoch keine Bewertungen

- The Short History of Coca ColaDokument1 SeiteThe Short History of Coca ColathereviewerNoch keine Bewertungen

- The Cola WarDokument23 SeitenThe Cola WarEric HawkNoch keine Bewertungen

- COKE PresentationDokument61 SeitenCOKE PresentationMaryam IftikharNoch keine Bewertungen

- Brand Purchased Refrescos Frecuencia Absoluta Frecuencia Porcentual o RelativaDokument3 SeitenBrand Purchased Refrescos Frecuencia Absoluta Frecuencia Porcentual o RelativaMarco GómezNoch keine Bewertungen

- Felbugs General MerchandisingDokument1 SeiteFelbugs General MerchandisingkrshjnglxyNoch keine Bewertungen

- Punjab Liquor Price List 285Dokument7 SeitenPunjab Liquor Price List 285Parijat AggarwalNoch keine Bewertungen

- Irish The GreatDokument10 SeitenIrish The GreatroxyjomoloNoch keine Bewertungen

- CocaDokument2 SeitenCocaLeo CerenoNoch keine Bewertungen

- Densitati BauturiDokument4 SeitenDensitati BauturiCristi TomaNoch keine Bewertungen

- Store Survey on Soft Drink Brand PreferencesDokument7 SeitenStore Survey on Soft Drink Brand PreferencesHarishNoch keine Bewertungen

- Introdaction: Head Office Pepsico, Inc. Purchase, Ny10577 United StatesDokument16 SeitenIntrodaction: Head Office Pepsico, Inc. Purchase, Ny10577 United Statesdinesh_kumar_18977Noch keine Bewertungen

- The Launch of New CokeDokument14 SeitenThe Launch of New CokeVishal VaidNoch keine Bewertungen

- Soft Drink Preferences by Age GroupDokument9 SeitenSoft Drink Preferences by Age GroupDhruv BansalNoch keine Bewertungen

- Case Study: Cola Wars: Coca-Cola vs. PepsicoDokument33 SeitenCase Study: Cola Wars: Coca-Cola vs. PepsicoTak BunleangNoch keine Bewertungen

- Coffee Chain Store Deployment and Popularity in VietnamDokument18 SeitenCoffee Chain Store Deployment and Popularity in VietnamTHUY LE THI XUANNoch keine Bewertungen

- Formato Control InventarioDokument7 SeitenFormato Control Inventariocoromoto prietoNoch keine Bewertungen

- Coca Cola Plant Layout PDFDokument33 SeitenCoca Cola Plant Layout PDFAbbas InanlooNoch keine Bewertungen

- Coca-Cola Beverages PhilippinesDokument2 SeitenCoca-Cola Beverages PhilippinesFerryjay DuropanNoch keine Bewertungen