Beruflich Dokumente

Kultur Dokumente

Specialized Fields and Branches of Accounting

Hochgeladen von

Ella SimoneCopyright

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Specialized Fields and Branches of Accounting

Hochgeladen von

Ella SimoneCopyright:

SPECIALIZED FIELDS and BRANCHES of Accounting

In the Philippine setting, accounting is segregated into four specialized fields and they are incorporated in the CMO No.3 Series of 2007, specifically: Public Accounting Private Accounting Government Accounting Accounting Education

PUBLIC ACCOUNTING

Accountants are said to be in public accounting when they offer their professional services for a fee the way other professionals do. Accountants in the public accounting practice are not employees of their clients. The following are the branches of Public Accounting field: EXTERNAL AUDITING External Auditing is concerned with rendering and expressing an opinion regarding the fairness of the contents of the Financial Statements of the client organization. External Auditors should be licensed CPAs as a requirement. Independent CPAs who renders external auditing services must be accredited by Board of Accountancy (BOA). In auditing, the audit work does not cover 100% of financial records but examines them selectively or do sampling tests on the accounting records. While the finish product of Financial Accounting is Financial Statements, the end product of External Auditing is the Independent Auditors Report. TAX SERVICES Whatever form of business organization the organization belongs, the entity is required to file and pay taxes. For tax compliance, accountants in public practice prepare various tax returns for income taxes, business taxes and transfer taxes. He may represent the client in tax assessment and examinations conducted by the BIR personnel. From time to time, BIR and local authorities sets out new regulations and advisories. Hence, Accountants rendering these services must always be updated and be constantly familiar with the tax laws, BIR regulations, local tax laws so they can readily give advises to their clients. Note that, a tax accountant or tax consultant need not be a CPA. MANAGEMENT ADVISORY SERVICES Accountants providing Managerial or Management Advisory Services, as the terms implies, renders assistance to management by giving advises to clients concerning finance, accounting, budgeting, accounting systems, organization policies and procedures, product costing, pricing and distribution, and other business undertakings. Likewise, a management accountant or management consultant need not also be a CPA.

PRIVATE ACCOUNTING

When accountants are employed in private businesses and non-profit organizations they are said to be in private accounting. Meaning, they are employees of the company performing accounting tasks.

Researched by WBBBB Accounting & Management Services. Click & visit our internet site: http://wbbbb-ams.blogspot.com/ Email us: wbbbb.ams@gmail.com Call/Text CP: 0917 767 78 56 / 0908 741 97 42 Call DL: 378 54 04 Services Offered: Business Registration Management Advisory Services Accounting/Bookkeeping Tax Advisory/Services Loans/Projects Proposals External Auditing Tax Returns Payroll Computation Services Financial Statements Financial Reports Assistance to SEC, BIR, SSS, Pag-ibig, Phil-health, etc Tutorials, Training or Consulting Services

Some companies, especially large ones grouped accounting tasks accordingly and divide their accounting departments into sections of similar jobs. The branches of Private Accounting field are as follows: FINANCIAL ACCOUNTING deals with the bookkeeping of transactions and events of the organization, and preparation of the basic Financial Statements of the company in accordance with GAAP. COST ACCOUNTING is concerned with inventory costing or product costing of the processed or manufactured goods. Cost accounting data are used for pricing of products offered by the company; planning and forecasting; and controlling of expenditures. TAX ACCOUNTING is involved with tax compliance and tax planning. Tax accountants or specialist deals with preparation of various tax returns for tax compliance and do tax planning to minimize the impact of taxes on the business. PLANNING and BUDGETING, and COMPTROLLERSHIP deal with business and financial planning, strategic planning, budgeting, analysis, monitoring and controlling businesses. This branch looks into the strategies and future directions of the business. INTERNAL AUDITING is concerned with safeguarding and protection of organizations assets, reliability of accounting records, and adherence to established policies and procedures of the company. Internal Auditors maybe internally hired or outsourced by an organization. They do not report to any financial or accounting officer so as not to ruin their independence which is critical to their work. Instead, they are hired to directly report to the audit committee of the organization. INTERNATIONAL ACCOUNTING covers accounting for international transactions, comparisons of accounting practices and principles in different countries, and synchronization of varied accounting standards worldwide and the tax requirements in the countries in which the company does business. SOCIO-ECONOMIC ACCOUNTING concerns with the measurement of the impact on the public sector about the decisions made by business or government agencies. The accountant engaged in social accounting supplements his accounting study with social science. NOT-FOR-PROFIT ACCOUNTING involves with special accounting for philanthropic or charitable institutions or foundations, religious organizations, governmental agencies, cooperatives, and non-profit educational institutions. Not-for-profit entities may earn profits but they are used for the organizations benefit and those they serve.

GOVERNMENT ACCOUNTING

Government and local government units such as provinces, cities, municipalities, and barangays are typically uses funds coming from budget allotment. And, this is where government accounting comes in Government Accounting primarily centers its focus on the proper accounting and custody of government funds and their purposes. Government Accounting is a specialized field because it uses terminologies different from that of Financial Accounting.

ACCOUNTING EDUCATION

ACCOUNTING EDUCATION focuses in educating students and professionals alike about accounting, auditing, taxation, and advanced accounting and business subjects. It is the accounting educators who prepare the curriculum for accounting education. Take note, an accountant may engage himself in various specialized fields simultaneously. He/she may be employed privately or in government, and at the same time, publicly practice accounting profession independently, and, also be a part of the academe as a professor in an educational institution which offers Accountancy courses.

Researched by WBBBB Accounting & Management Services. Click & visit our internet site: http://wbbbb-ams.blogspot.com/ Email us: wbbbb.ams@gmail.com Call/Text CP: 0917 767 78 56 / 0908 741 97 42 Call DL: 378 54 04 Services Offered: Business Registration Management Advisory Services Accounting/Bookkeeping Tax Advisory/Services Loans/Projects Proposals External Auditing Tax Returns Payroll Computation Services Financial Statements Financial Reports Assistance to SEC, BIR, SSS, Pag-ibig, Phil-health, etc Tutorials, Training or Consulting Services

Das könnte Ihnen auch gefallen

- Item7 KPMG Audit Strategy Planning MemorandumDokument14 SeitenItem7 KPMG Audit Strategy Planning Memorandumshane natividad100% (3)

- 04 12 23 PCE Exam QuestionDokument18 Seiten04 12 23 PCE Exam QuestionYen Yik Wong82% (11)

- Journalize The Following Transactions in General Journal FormDokument1 SeiteJournalize The Following Transactions in General Journal FormShiela Mae Gabrielle AladoNoch keine Bewertungen

- What is the Pecking Order Theory? (39Dokument2 SeitenWhat is the Pecking Order Theory? (39Millat Afridi0% (1)

- Hotel Confirmation VougfhgcherDokument2 SeitenHotel Confirmation Vougfhgcherprakash1580Noch keine Bewertungen

- Analysis and Interpretation of FS-Part 1Dokument2 SeitenAnalysis and Interpretation of FS-Part 1Rhea RamirezNoch keine Bewertungen

- Nature and scope of accounting fundamentalsDokument2 SeitenNature and scope of accounting fundamentalsshashwat tripathiNoch keine Bewertungen

- Insurance Litigation FuelDokument60 SeitenInsurance Litigation FuelDylan WheelerNoch keine Bewertungen

- InventoryDokument8 SeitenInventoryJoana Marie Mara SorianoNoch keine Bewertungen

- Business Combination Types GuideDokument8 SeitenBusiness Combination Types GuideShanmuka NalliNoch keine Bewertungen

- AIOU Financial Accounting ChecklistDokument9 SeitenAIOU Financial Accounting ChecklistAhmad RazaNoch keine Bewertungen

- CaseDokument7 SeitenCasekhuloodNoch keine Bewertungen

- Basic Accounting EquationDokument17 SeitenBasic Accounting EquationArienaya100% (1)

- Week 6 To 7Dokument22 SeitenWeek 6 To 7JeanneNoch keine Bewertungen

- JFC Independtent Auditor Report 2017 PDFDokument114 SeitenJFC Independtent Auditor Report 2017 PDFAnonymous RFTbx1Noch keine Bewertungen

- 4 Exam Part 2Dokument4 Seiten4 Exam Part 2RJ DAVE DURUHANoch keine Bewertungen

- RRL FinalDokument5 SeitenRRL FinalMajane TognoNoch keine Bewertungen

- HW1Dokument4 SeitenHW1Annie JuliaNoch keine Bewertungen

- Chapter 4-Time Value of MoneyDokument23 SeitenChapter 4-Time Value of MoneyMoraya P. CacliniNoch keine Bewertungen

- Business Math Quarter 3 Week 2Dokument8 SeitenBusiness Math Quarter 3 Week 2Gladys Angela ValdemoroNoch keine Bewertungen

- Chapter 1 Partnership QuizDokument2 SeitenChapter 1 Partnership QuizstudentoneNoch keine Bewertungen

- FABM1 Lesson8-1 Five Major Accounts-LIABILITIESDokument13 SeitenFABM1 Lesson8-1 Five Major Accounts-LIABILITIESWalter MataNoch keine Bewertungen

- Ethics 3.1 1Dokument38 SeitenEthics 3.1 1Nicole Tonog AretañoNoch keine Bewertungen

- Negros Occidental (ACCOUNTING1)Dokument7 SeitenNegros Occidental (ACCOUNTING1)Maxine Ceballos Glodove100% (1)

- Statement of Comprehensive IncomeDokument11 SeitenStatement of Comprehensive IncomeKhiezna PakamNoch keine Bewertungen

- South Asialink Finance Corporation (Credit Union)Dokument1 SeiteSouth Asialink Finance Corporation (Credit Union)Charish Kaye Radana100% (1)

- 10-1 - Developing An Effective Business PlanDokument21 Seiten10-1 - Developing An Effective Business PlanZameer AbbasiNoch keine Bewertungen

- Common Account TitlesDokument4 SeitenCommon Account TitlesJaydie CruzNoch keine Bewertungen

- Problems Accounting Equation 1 5 UnsolvedDokument5 SeitenProblems Accounting Equation 1 5 UnsolvedRaja NarayananNoch keine Bewertungen

- ACCTG ED-22 Unit 3 (Activity 3) BALASTA, JOHN RUBE B.Dokument6 SeitenACCTG ED-22 Unit 3 (Activity 3) BALASTA, JOHN RUBE B.John Rube BalastaNoch keine Bewertungen

- Special JournalsDokument4 SeitenSpecial Journalssamm yuu100% (1)

- Time Value of MoneyDokument8 SeitenTime Value of MoneyLj SzeNoch keine Bewertungen

- Basic Acctg 4th SatDokument11 SeitenBasic Acctg 4th SatJerome Eziekel Posada PanaliganNoch keine Bewertungen

- Reaction Paper #7Dokument5 SeitenReaction Paper #7Louelie Jean AlfornonNoch keine Bewertungen

- Strategy and National DevelopmentDokument35 SeitenStrategy and National DevelopmentelmarcomonalNoch keine Bewertungen

- Chapter 3Dokument12 SeitenChapter 3geexellNoch keine Bewertungen

- Case Study 3T FAST FOOD CHAINDokument4 SeitenCase Study 3T FAST FOOD CHAINMichaela CruzNoch keine Bewertungen

- Financial Management Nature, Purpose and ScopeDokument12 SeitenFinancial Management Nature, Purpose and ScopeAmalia Tamayo YlananNoch keine Bewertungen

- Lecture in FUNAC 2Dokument84 SeitenLecture in FUNAC 2Shaira Bloom RagonjanNoch keine Bewertungen

- Accounting For PartnershipDokument3 SeitenAccounting For PartnershipafifahNoch keine Bewertungen

- Chapter 1 - Review of Accounting ProcessDokument13 SeitenChapter 1 - Review of Accounting ProcessJam100% (1)

- Substance Over FormDokument2 SeitenSubstance Over Formsimson singawahNoch keine Bewertungen

- Lesson 1 The Nature and Forms of Business OrganizationsDokument1 SeiteLesson 1 The Nature and Forms of Business OrganizationsYanko Yap BondocNoch keine Bewertungen

- Statement of Realization and LiquidationDokument5 SeitenStatement of Realization and LiquidationPj ConcioNoch keine Bewertungen

- Far Prelims Week 1Dokument3 SeitenFar Prelims Week 1hat dawgNoch keine Bewertungen

- Guide Questions - Short Term BudgetingDokument3 SeitenGuide Questions - Short Term BudgetingAphol Joyce MortelNoch keine Bewertungen

- Accounting For Training Merchandising BusinessDokument109 SeitenAccounting For Training Merchandising BusinessIsa NgNoch keine Bewertungen

- Fundamental of Accounting, Business, and Management 2 PDFDokument15 SeitenFundamental of Accounting, Business, and Management 2 PDFElijah AramburoNoch keine Bewertungen

- Human Behavior in OrganizationDokument22 SeitenHuman Behavior in Organizationmirmo tokiNoch keine Bewertungen

- Ethical Issues in Business Case StudyDokument11 SeitenEthical Issues in Business Case Studyclarisse villegas100% (2)

- BIR Computations for Self-Employed ProfessionalsDokument10 SeitenBIR Computations for Self-Employed Professionalsbull jackNoch keine Bewertungen

- Economics PrelimsDokument2 SeitenEconomics PrelimsYannie Costibolo IsananNoch keine Bewertungen

- Different Strokes . Political and Economic Systems Around The GlobeDokument22 SeitenDifferent Strokes . Political and Economic Systems Around The GlobeMarjon DimafilisNoch keine Bewertungen

- Staffing As A Part of Human Resource ManagementDokument2 SeitenStaffing As A Part of Human Resource ManagementmanichawlaNoch keine Bewertungen

- Accounting Process of a Service BusinessDokument9 SeitenAccounting Process of a Service BusinessFiverr RallNoch keine Bewertungen

- SM Quiz1Dokument4 SeitenSM Quiz1Ah BiiNoch keine Bewertungen

- Financial Statement Analysis GuideDokument3 SeitenFinancial Statement Analysis GuideAmit KumarNoch keine Bewertungen

- Accounting Chap 1 DiscussionDokument7 SeitenAccounting Chap 1 DiscussionVicky Le100% (2)

- Characteristics of PartnershipDokument2 SeitenCharacteristics of Partnershipckarla800% (1)

- Financial Accounting and Reporting Chapter 4 Problem 3Dokument1 SeiteFinancial Accounting and Reporting Chapter 4 Problem 3Paula BautistaNoch keine Bewertungen

- Introduction to Accounting and BusinessDokument16 SeitenIntroduction to Accounting and BusinessHussen Abdulkadir100% (1)

- Obedelicious Prime's Foodflix Business Simulation Accomplishment ReportDokument37 SeitenObedelicious Prime's Foodflix Business Simulation Accomplishment ReportEricka DeguzmanNoch keine Bewertungen

- Answers 5Dokument101 SeitenAnswers 5api-308823932100% (1)

- JFC Strategic Human Resource ManagementDokument13 SeitenJFC Strategic Human Resource ManagementHarvey Bourdain LenonNoch keine Bewertungen

- PhilHealth Penalties For Non-Remitting and Non-Reporting EmployersDokument1 SeitePhilHealth Penalties For Non-Remitting and Non-Reporting EmployersElla SimoneNoch keine Bewertungen

- BIR Form No. 1901 Personal ExemptionsDokument1 SeiteBIR Form No. 1901 Personal ExemptionsBasil Maramag CastañoNoch keine Bewertungen

- DTI Business Name Application FormDokument2 SeitenDTI Business Name Application FormYourtv Inyourpc100% (6)

- BIR Form 1901Dokument1 SeiteBIR Form 1901Abdul Nassif Faisal80% (5)

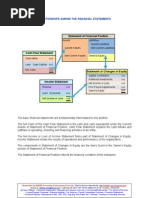

- Relationships Among The Financial StatementsDokument1 SeiteRelationships Among The Financial StatementsElla Simone100% (1)

- SSS Contribution TableDokument1 SeiteSSS Contribution TableElla SimoneNoch keine Bewertungen

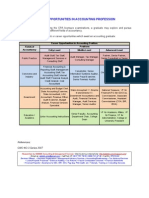

- Career Opportunities in Accounting ProfessionDokument1 SeiteCareer Opportunities in Accounting ProfessionElla SimoneNoch keine Bewertungen

- Relationships Among The Financial StatementsDokument1 SeiteRelationships Among The Financial StatementsElla Simone100% (1)

- Economic Entity AssumptionDokument1 SeiteEconomic Entity AssumptionElla SimoneNoch keine Bewertungen

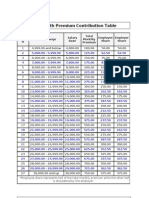

- Phil Health Contribution TableDokument1 SeitePhil Health Contribution TableElla SimoneNoch keine Bewertungen

- Diagram of Conceptual FrameworkDokument1 SeiteDiagram of Conceptual FrameworkElla Simone100% (4)

- Monetary Unit AssumptionDokument1 SeiteMonetary Unit AssumptionElla SimoneNoch keine Bewertungen

- Going Concern AssumptionDokument1 SeiteGoing Concern AssumptionElla SimoneNoch keine Bewertungen

- Objectives and Purpose of AccountingDokument1 SeiteObjectives and Purpose of AccountingElla Simone100% (1)

- Forms of Business OrganizationDokument1 SeiteForms of Business OrganizationElla Simone100% (3)

- Periodicity AssumptionDokument1 SeitePeriodicity AssumptionElla SimoneNoch keine Bewertungen

- Nature of AccountingDokument2 SeitenNature of AccountingElla Simone100% (5)

- Philippine Regulatory AuthorityDokument1 SeitePhilippine Regulatory AuthorityElla SimoneNoch keine Bewertungen

- Accounting Processing CycleDokument1 SeiteAccounting Processing CycleElla SimoneNoch keine Bewertungen

- Definition of AccountingDokument1 SeiteDefinition of AccountingElla Simone100% (1)

- Accounting EquationDokument1 SeiteAccounting EquationElla SimoneNoch keine Bewertungen

- Delivery Note - JKTFX - Ship - 21967 - So86887Dokument2 SeitenDelivery Note - JKTFX - Ship - 21967 - So86887Trisna SanjayaNoch keine Bewertungen

- Edward Ferguson: Elements of Walmart's Marketing Mix ProductDokument2 SeitenEdward Ferguson: Elements of Walmart's Marketing Mix ProductAli RazaNoch keine Bewertungen

- DR L. Ravindran, CFP, Ph. D, Founder Managing Director & CEO, Wealthmax Enterprises Management P LTD, BangaloreDokument14 SeitenDR L. Ravindran, CFP, Ph. D, Founder Managing Director & CEO, Wealthmax Enterprises Management P LTD, Bangalorekeyur1975Noch keine Bewertungen

- Declaration Zakat CZ 50Dokument2 SeitenDeclaration Zakat CZ 50Sheraz SakhaniNoch keine Bewertungen

- Ap - CashDokument13 SeitenAp - CashDiane PascualNoch keine Bewertungen

- BonanzaDokument25 SeitenBonanzamuditsrivastav03Noch keine Bewertungen

- ANZ Internet BankingDokument7 SeitenANZ Internet Bankingheatercanyon03Noch keine Bewertungen

- Spa Ceylon Monthly Ev. August Vs SeptemberDokument1 SeiteSpa Ceylon Monthly Ev. August Vs SeptemberDinithi SathyapalaNoch keine Bewertungen

- Final Exam Autumn 2010-Final Solutions 020710Dokument20 SeitenFinal Exam Autumn 2010-Final Solutions 020710Yasir MuyidNoch keine Bewertungen

- Nov BIl PGRDokument2 SeitenNov BIl PGRBryanNoch keine Bewertungen

- Frederick's Account StatementDokument3 SeitenFrederick's Account StatementArdan DiazNoch keine Bewertungen

- Health Apps - A ToolkitDokument3 SeitenHealth Apps - A ToolkitAlexandra WykeNoch keine Bewertungen

- LIC-IRDA Exam-1Dokument10 SeitenLIC-IRDA Exam-1umesh50% (2)

- Audit of InventoriesDokument2 SeitenAudit of InventoriesJenny BernardinoNoch keine Bewertungen

- Fortinet ProductGuide NOV2021 R127Dokument248 SeitenFortinet ProductGuide NOV2021 R127CromNoch keine Bewertungen

- EnglishDokument20 SeitenEnglishTimothy SheltonNoch keine Bewertungen

- Accounting For DepreciationDokument6 SeitenAccounting For DepreciationKaran GNoch keine Bewertungen

- SAP Transaction Code ModulesDokument6 SeitenSAP Transaction Code ModulesVivek Shashikant SonawaneNoch keine Bewertungen

- Compleate FASTagDokument3 SeitenCompleate FASTagSourav GhoshNoch keine Bewertungen

- Topics in Preliminary for Highway and Railroad EngineeringDokument15 SeitenTopics in Preliminary for Highway and Railroad EngineeringRodin James GabrilloNoch keine Bewertungen

- How To Work With OTAsDokument35 SeitenHow To Work With OTAsSushil GhimireNoch keine Bewertungen

- Process of EB, QB Samples ShipmentDokument9 SeitenProcess of EB, QB Samples ShipmentBự BụngNoch keine Bewertungen

- Tugas Bahasa InggrisDokument12 SeitenTugas Bahasa InggrisAnonymous a2C6YgevfNoch keine Bewertungen

- Form 2 Computer NOTESDokument316 SeitenForm 2 Computer NOTESProff MuchNoch keine Bewertungen

- Page 287 Special JournalDokument30 SeitenPage 287 Special JournalAgent348Noch keine Bewertungen