Beruflich Dokumente

Kultur Dokumente

International Capital Budgeting

Hochgeladen von

shuaib20Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

International Capital Budgeting

Hochgeladen von

shuaib20Copyright:

Verfügbare Formate

INTERNATIONAL CAPITAL BUDGETING

In the changed global scenario, foreign direct investments are made by all countries in all countries. Reasons for global investment:1.To avail themselves of the comparative advantage-cheap labour, lower cost of raw materials, transportation etc., 2.To diversify risks-to avoid the dependence on the outcome of a unique investment 3.To take advantage of the availability of resources in the host country 4.To penetrate into the market-to compete more effectively 5.To reduce the cost of distribution and transportation-to make the firm more competitive

6.To forestall the entry of others in a particular market 7.To do business in a country for overcoming the constraint of political considerations 8.To avoid high tariffs or non-tariff barriers-the only way in such cases is to establish business in the country itself. 9.To overcome the operational constraints-for eg., certain raw materials may be available only in certain countries and such countries will insist of opening business there only. Very often, developing countries offer many incentives to attract FDI. Some countries have been identified as TAX HEAVENS. Some countries have developed network of banking, communication and other facilities.

Market characteristics of direct investment

M/c of the host country may also induce a company to make FDI. These include:1.A high return on investments 2.Increasing competition and the need to prevent loss of markets 3.Product life cycle approach-production beyond the domestic needs-FDI may be taken as a defensive approach 4.An attempt to exploit firms monopolistic advantage in terms of technology, capital market access, sourcing leads, mgt,etc.,

Other factors:1.Technological superiority and the desire of the firm to spread the cost of heavy investment in R&D 2.Intensity of competition in the domestic market 3.Desire to recapture the market 4.Capitalizing the firms intensive promotion and consumers with the differentiated product lines 4.FDI as a strategy

Phases of penetrating Foreign markets-some phases

1.Expansion into foreign operation is typically a gradual phase by phase process commencing with the export activities 2.Firm may establish an operating affioliate in one country and continue to meet the requirements of the markets in other countries by exports. The process of moving from one phase to the next in a particular market may be accelerated or even made inevitable by unforeseen developments, adverse or favourable in that market.

Problems in multinational capital budgeting

Though similar to that of domestic investment decisions, they differ in various ways. The cash flows from foreign projects must be converted into the currency of the parent company. Such flows may be subjected to various restrictions imposed by the host country. There are problems of taxation in both host and home countries. There are advantages also-easy finance-diversification benefits to shareholders-

Problems in multinational capital budgeting-contd.,

Difficulties in the determination of cash flows:1.Joint projects:-Maruthi-Suzuki for eg.,-if the proposed investment in the other country affects the operations of other units in the group, then the net revenues are to be calculated. 2.Economies of scale:3.Tied-in-sales:- If the subsidiary is required to purchase from the parent company, this may also lead to additional cash flow. This may be necessary for the purpose of quality control or to ensure lower costs 4.Inflationary trends:-may affect estimation of cash flows. 5.Equipment contributed:-Existing equipments may be sent to the projects in other countries.

Problems in multinational capital budgeting-contd.,

6.Opportunity cost:-The cost of land purchased earlier has to be adjusted now. 7.Transfer pricing:-At what rate the products are to be priced? 8.Overhead expenses:- The cost involved in R&D, general mgt, power, lighting, legal expenses should be charged if the additional expenses can be attributed to the project. 9.Repatriation of funds:-

Project appraisal methods

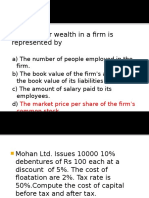

Traditional methods:- PBP-ARR-IRR-NPV In general, cost of capital indicates the minimum return needed to determine the viability of the project.-capital structure is an important determinant in the cost of capital. K=r+b+f r=rate of return at zero risk level b-premium for business risk: f=premium for financial risk Business risk inherent in the project Financial risk-risk derived from how the project is financedBusiness and financial risks are to be evaluated in any project investment. Exchange rate fluctuations affect only foreign projects. The financial risk can be taken care of by having long term debt with redemption from time to time.

Adjustments for risky projects

1.Risk adjusted discount rate or method of varying discount rate:- With the discount rate, a certain % of risk premium rates also added to evaluate the projects.Eg.,10% is the discount rate+2% is the risk premium rate, then the cash inflows are discounted at 12% 2.Certainty Equivalent co-efficient:- is a method for evaluating risky projects. For eg., an inflow of Rs.10,000 may be discounted with the certainty equivalent co-efficient factor0.9 or 0.8 3.Sensitivity technique:-More than one forecast of cash flows are done. Optimistic, Likely, Pessimistic estimates are done and discounted with a discount factor.4.Probability technique:Inflows are discounted with the assigned probability. 5.Std.deviation method:- used to evaluate similar cost and return factor.

Complexities in International capital budgeting appraisal

1.Differing degrees of risk in cash flows:composition of capital structure-cost of capitaldepreciation- all affect the cash inflows. 2.Impact on the home country units:- The proposed overseas project might affect the profitability of the parent MNC or other subsidiaries in the region. 3.Host country may not permit repatriation of profit in full. 4.Estimation of future exchange rates

Complexities in International capital budgeting appraisal-contd.

5.Tax rates in both home and host country 6.Subsidies offered by local govt. 7.Discount rate :- The rate at which the projected cash inflows are to be discounted. 8.Transfer pricing:-This is the pricing of interaffiliate purchases and sales and it is used to move funds from affiliates in high tax countries to affiliates in low tax countries, so as to generate tax savings.

International working capital management

WCM-managing the wc required for the firms-objectivesminimizing the wc needs of affiliates and speeding up the collection from debtors-raising short term credit at minimum cost International cash mgt:-objectives-1.bringing the companys cash resources within control as quickly and efficiently as possible-(i) establishing accurate, timely forecasting and reporting systems (ii) improving cash collections and disbursements 2.achieving optimum conservation and utilization of these fundsby i. minimizing the required level of cash ii. making money available when and where it is needed and iii. Increasing the risk adjusted return on those funds that can be invested

The principles of domestic and international cash management are identical. The latter is a more complicated exercise as to follow the practices of the host country. For eg., in India, the time allowed for collecting the export dues is 180 days. Other complicating factors include multiple tax jurisdictions and absence of exchange facilities.

International cash mgt

Cash mgt. is an important aspect of WCM-It is one of the chief concerns of MNCs. The international money managers, as a first step try to attain on a worldwide basis the traditional objectives of cash mgt-1.How to manage and control the cash resources of the company as quickly and efficiently as possible2.Achieve the optimum utilization and conservation of funds

Objectives of International cash mgt.

1.Minimize the currency exposure risk 2.Minimize the country and political risk 3.Minimize the overall cash requirements of the company as a whole without disturbing the smooth operations of the subsidiary or its affiliate 4.minimize the transaction costs 5.Full benefits of economies of scale as well as the benefits of superior knowledge

Centralized cash system

A centralized cash mgt. group may be needed to monitor and manage the parent subsidiary and inter subsidiary cash flows. Centralization of information, reports, decisions making process as to cash mobilization should be done. A centralized cash system will benefit MNCs in the following ways:1.Maintaining minimum cash balance during the year.2.helping the centre to generate maximum possible returns by investing all cash resources optimally.

3.Judiciously manage the liquidity requirements of the centre. 4.Helping the centre to take complete adv. of multinational netting so as to minimize transaction costs and currency exposure. 5.Optimally utilize the various hedging strategies so as to minimize MNCs foreign exchange exposure. 6.Achieve max.utilisation of transfer pricing mechanism so as to enhance the profitability and growth by the firm.

Techniques to optimize cash inflow

1.Accelerating cash inflows 2.Managing blocked funds 3.Leading and lagging strategy 4.Using netting to reduce the overall transaction costs by eliminating a number of unnecessary conversions and transfer of currencies 5.Minimizing the tax on cash flow through international transfer pricing.

Techniques to optimize cash inflow

1.A quicker recovery of inflows assures that they are available with the firm for use or for investment. 2.Host countries, sometimes, may block the money sent by the subsidiary co. to the parent company. It may insist to reinvest in the host country for some more time. The parent company may also instruct in the similar way to invest their surplus funds, raise loans locally, if necessary, and repay the loan with its earnings. 3.The technique of leading and lagging involve the movement of cash inflows and outflows, forward and backward in time so as to allow netting and achieving

the other goal. The scope for L&L is considerable when transactions are between divisions of the same multinational. Adv. Of L&L:-1.Helps in shifting liquidity among affiliates by changing credit terms. 2.It is designed to take advantage of expected revaluations and devaluations of currency movement. 3.No formal note on indebtedness is required and the credit terms can be changed by increasing or decreasing the terms on the a/cs.

4.Netting is a technique of optimizing cash flow movements with the joint efforts of subsidiaries. Netting has become important in the context of a highly coordinated international interchange of materials, parts and finished products among the various units of the MNC with many affiliates both buying and selling to each other. Adv. of netting:1.It reduces the no. of cross-border transactions thereby reducing the overall admn. cost of such transfers.2.Improves the reporting systems of subsidiaries.3.reduces the need and costs for f/e conversion4.It helps in improved cash flow forecasting since only the net cash transfers are made at the end of

each period. Netting is of two types-1.Bilateral netting system 2.Multinational netting system. Good banking relations are important to a companys international cash mgt. effort. The following are some of the common problems in bank relations .1.unisng too many bank relations-bank accounts.2.High banking costs 3.Inadequate reporting 4.Excessive clearing delays

A/Cs Receivables Mgt.

Firms grant credit both locally and internationally-to off set competition and to improve sales /profit.. The need to scrutinize the credit terms is particularly important in countries experiencing rapid rates of inflation. Customers will pay the money when the value is less and defer the payment. Credit stds. are more liberal in host countries than the home country. This will lead to risk of default, increased cost of funding the receivables and the risk of devaluation.

It should be remembered that when a unit of inventory is sold on credit, a real asset has been transformed into a monetary unit. To overcome the problem of receivables mgt., forfaiting has been recommended. In the domestic trade, it is factoring which takes the responsibility of collecting the debtors and in foreign trade, it is the forfaiting takes the responsibility of collecting international debts.

Inventory Mgt.

Inventories in the form of raw materials, WIP and FG are held (i) to facilitate the production process by both ensuring that supplies are at hand when needed and allowing a more even rate of production and (ii)to make certain that the goods are available for delivery at the time of sales. Some of the problems faced by MNCs are:-Difficulty in controlling their overseas inventory and realize inventory turnover objectives-some of the reasons are:-delay in ocean transportation- lengthy customs procedures-port strikes-import controls-higher tariffs-supply disruption and anticipated changes currency values-

Das könnte Ihnen auch gefallen

- Bond Portfolio ManagementDokument20 SeitenBond Portfolio ManagementJasiz Philipe OmbuguNoch keine Bewertungen

- MCQ On FMDokument28 SeitenMCQ On FMSachin Tikale100% (1)

- What is NIM and its functionsDokument39 SeitenWhat is NIM and its functionssachuvsudevnair100% (3)

- MCQ 501Dokument90 SeitenMCQ 501haqmalNoch keine Bewertungen

- ACC501 Mega File SolvedDokument1.045 SeitenACC501 Mega File SolvedOwais KhanNoch keine Bewertungen

- CFP - Module 1 - IIFP - StudentsDokument269 SeitenCFP - Module 1 - IIFP - StudentsmodisahebNoch keine Bewertungen

- Chap 005Dokument8 SeitenChap 005tai nguyenNoch keine Bewertungen

- FIN622 Online Quiz - PdfaDokument531 SeitenFIN622 Online Quiz - Pdfazahidwahla1100% (3)

- Thesis Report - Highrise Constrxn PDFDokument108 SeitenThesis Report - Highrise Constrxn PDFNancy TessNoch keine Bewertungen

- Sebi Act 1992Dokument13 SeitenSebi Act 1992Akash saxena86% (7)

- Deloitte Philippines Competitiveness ReportDokument15 SeitenDeloitte Philippines Competitiveness ReportArangkada PhilippinesNoch keine Bewertungen

- 306 FIn Financial System of India Markets & ServicesDokument6 Seiten306 FIn Financial System of India Markets & ServicesNikhil BhaleraoNoch keine Bewertungen

- Project Appraisal FinanceDokument20 SeitenProject Appraisal Financecpsandeepgowda6828Noch keine Bewertungen

- Types of StrategiesDokument6 SeitenTypes of StrategiesNishant JainNoch keine Bewertungen

- Book Building: Meaning, Process and ComparisonDokument8 SeitenBook Building: Meaning, Process and ComparisonAditi Basak ChakrabortyNoch keine Bewertungen

- ForexDokument38 SeitenForexDevendra BhagyawantNoch keine Bewertungen

- BCom 6th Sem - AuditingDokument46 SeitenBCom 6th Sem - AuditingJibin SamuelNoch keine Bewertungen

- Chapter 1 Basic ConceptsDokument342 SeitenChapter 1 Basic ConceptsKetan DesaiNoch keine Bewertungen

- Financial Management Overview and Key ConceptsDokument16 SeitenFinancial Management Overview and Key ConceptsKAUSHIKNoch keine Bewertungen

- Understanding the Security Market Line (SML) /TITLEDokument9 SeitenUnderstanding the Security Market Line (SML) /TITLEnasir abdulNoch keine Bewertungen

- Forex ProblemsDokument38 SeitenForex Problemsnehali Madhukar AherNoch keine Bewertungen

- A Framework For The Implementation of AI in The Financial Services Sector in ZimbabweDokument89 SeitenA Framework For The Implementation of AI in The Financial Services Sector in Zimbabweagreement.kaguraomnizwNoch keine Bewertungen

- Financial Management Question PaperDokument24 SeitenFinancial Management Question PaperDhatri Srivatsa100% (1)

- Capital Budgeting Quiz BankDokument235 SeitenCapital Budgeting Quiz Bankabooosy33% (3)

- Exercises On Exchange RatesDokument16 SeitenExercises On Exchange RatesRohit AggarwalNoch keine Bewertungen

- Managing Exchange Rate RiskDokument18 SeitenManaging Exchange Rate Riskramuk100% (1)

- SEBI Guidelines On IPODokument17 SeitenSEBI Guidelines On IPOpratheesh_tulsi75% (4)

- FinanceDokument5 SeitenFinancePiyushNoch keine Bewertungen

- International FinanceDokument14 SeitenInternational Financecpsandeepgowda6828100% (1)

- Strategic Management True/False ChapterDokument14 SeitenStrategic Management True/False Chapterfffatima100% (1)

- Dividend Policy and Firm Value ExplainedDokument9 SeitenDividend Policy and Firm Value ExplainedZabi MahammadNoch keine Bewertungen

- Foreign Exchange Market ParticipantsDokument3 SeitenForeign Exchange Market ParticipantsmanishaNoch keine Bewertungen

- Corporate Finance Exam QuestionsDokument30 SeitenCorporate Finance Exam QuestionsMohsin KhanNoch keine Bewertungen

- International Capital BudgetingDokument3 SeitenInternational Capital BudgetingSelva Kumar KrishnanNoch keine Bewertungen

- LeasingDokument6 SeitenLeasingSamar MalikNoch keine Bewertungen

- Study of Expenses in Different Branches of Hindustan Times at Western UP RegionDokument73 SeitenStudy of Expenses in Different Branches of Hindustan Times at Western UP RegionGuman Singh0% (1)

- Currency Derivatives in IndiaDokument27 SeitenCurrency Derivatives in IndiaNaveen AcharyNoch keine Bewertungen

- FIMDDA Debt Module1Dokument7 SeitenFIMDDA Debt Module1Kirti SahniNoch keine Bewertungen

- Exchange Rate DeterminationDokument22 SeitenExchange Rate DeterminationBilal Raja0% (1)

- Chapter 12 Test BankDokument49 SeitenChapter 12 Test BankMariA YAGHINoch keine Bewertungen

- ICFAI University MBA Paper 2Dokument18 SeitenICFAI University MBA Paper 2Rihaan ShakeelNoch keine Bewertungen

- Unit 2 Capital Budgeting Decisions: IllustrationsDokument4 SeitenUnit 2 Capital Budgeting Decisions: IllustrationsJaya SwethaNoch keine Bewertungen

- Paper III For NABARD Grade B: The Answers Along With Explanations Are Given at The End of The Question PaperDokument52 SeitenPaper III For NABARD Grade B: The Answers Along With Explanations Are Given at The End of The Question PaperDhaval patelNoch keine Bewertungen

- Internal Audit of DPDokument9 SeitenInternal Audit of DPAlpa ShahNoch keine Bewertungen

- Uniform CostingDokument19 SeitenUniform CostingASHISH NYAUPANENoch keine Bewertungen

- 9 MCQ On Third Party Products With Ans.Dokument4 Seiten9 MCQ On Third Party Products With Ans.Nitin MalikNoch keine Bewertungen

- Balance of Payments: International FinanceDokument42 SeitenBalance of Payments: International FinanceSoniya Rht0% (1)

- 1Dokument10 Seiten1Sai Krishna DhulipallaNoch keine Bewertungen

- Dividend Concepts & Theories: Year EPS (X LTD.) DPS (X LTD.) Eps (Y LTD.) Dps (Y LTD.) Mps (X LTD.)Dokument23 SeitenDividend Concepts & Theories: Year EPS (X LTD.) DPS (X LTD.) Eps (Y LTD.) Dps (Y LTD.) Mps (X LTD.)amiNoch keine Bewertungen

- MCQ FinanceDokument5 SeitenMCQ FinancevasundhraNoch keine Bewertungen

- WCMDokument10 SeitenWCMTEJASREE SANIKEYNoch keine Bewertungen

- SFM Theory BookDokument33 SeitenSFM Theory BookvishnuvermaNoch keine Bewertungen

- FRM 5 Market Risk Related RisksDokument38 SeitenFRM 5 Market Risk Related RisksLoraNoch keine Bewertungen

- International Capital Budgeting ExplainedDokument18 SeitenInternational Capital Budgeting ExplainedHitesh Kumar100% (1)

- MCQ On International Finance MergedDokument25 SeitenMCQ On International Finance MergedAjay AjayNoch keine Bewertungen

- Mcqs SolvedDokument15 SeitenMcqs SolvedWaqar Ahmed100% (1)

- MGT301 Marketing Management QuestionsDokument54 SeitenMGT301 Marketing Management QuestionsEric MartinezNoch keine Bewertungen

- Unit VDokument9 SeitenUnit VDr.P. Siva RamakrishnaNoch keine Bewertungen

- chapter 1 LECTURER ENG INTRODUCTION TO INTERNATIONAL FINANCE STUDENT (1)Dokument45 Seitenchapter 1 LECTURER ENG INTRODUCTION TO INTERNATIONAL FINANCE STUDENT (1)Kiều Trần Nguyễn DiễmNoch keine Bewertungen

- Acceptance Criteria for Foreign InvestmentsDokument20 SeitenAcceptance Criteria for Foreign InvestmentsHarsh Vardhan GuptaNoch keine Bewertungen

- IF Unit 02Dokument18 SeitenIF Unit 02gowrirao496Noch keine Bewertungen

- Capital Budgeting DecisionDokument94 SeitenCapital Budgeting DecisionRahul GuptaNoch keine Bewertungen

- KOTRA Catalog 2022Dokument28 SeitenKOTRA Catalog 2022sunjung kimNoch keine Bewertungen

- OECD Digital Economy Paper No. 11Dokument74 SeitenOECD Digital Economy Paper No. 11FredrickNoch keine Bewertungen

- Viswateja Spinning Mills Internship Production ReportDokument52 SeitenViswateja Spinning Mills Internship Production Reportaravind vjNoch keine Bewertungen

- COVID-19 Outbreak: Impact On Sri Lanka and RecommendationsDokument19 SeitenCOVID-19 Outbreak: Impact On Sri Lanka and RecommendationsMohamed FayazNoch keine Bewertungen

- Plan of Action For Job Creation: Sustainable Jobs For AllDokument27 SeitenPlan of Action For Job Creation: Sustainable Jobs For AllGetachew HussenNoch keine Bewertungen

- Principles ProblemSet11Dokument5 SeitenPrinciples ProblemSet11Bernardo BarrezuetaNoch keine Bewertungen

- ASSIGNMENT of Business EnvironmentDokument12 SeitenASSIGNMENT of Business EnvironmenttanyabediNoch keine Bewertungen

- 4.3.1 What Are The Causes and Effects of GlobalisationDokument4 Seiten4.3.1 What Are The Causes and Effects of GlobalisationUnderTheWaterNoch keine Bewertungen

- Chapter 19Dokument34 SeitenChapter 19chinyNoch keine Bewertungen

- Global Location TrendsDokument26 SeitenGlobal Location TrendsigorNoch keine Bewertungen

- DIFC PWC Book Final UpdatedDokument59 SeitenDIFC PWC Book Final Updatedmoameen78Noch keine Bewertungen

- VN Tax Vietnam Doing Business 2022 2023Dokument56 SeitenVN Tax Vietnam Doing Business 2022 2023alicejinny JInnyNoch keine Bewertungen

- Prepared by Faculty: S. S. PaudelDokument43 SeitenPrepared by Faculty: S. S. PaudelRojan JoshiNoch keine Bewertungen

- Multinational CorporationsDokument9 SeitenMultinational CorporationsRamapriyaiyengarNoch keine Bewertungen

- India Vs China.... Comparison of InfrastructureDokument6 SeitenIndia Vs China.... Comparison of InfrastructureDaras Bir Singh100% (12)

- 15th Global PWC Ceo SurveyDokument40 Seiten15th Global PWC Ceo SurveyDapo TaiwoNoch keine Bewertungen

- STE Research 2 W2 LASDokument20 SeitenSTE Research 2 W2 LASKhallex ObraNoch keine Bewertungen

- Research Proposal-Mitika NangiaDokument14 SeitenResearch Proposal-Mitika NangiaNeelam YadavNoch keine Bewertungen

- Competition and Strategy - DLF Group A StudyDokument15 SeitenCompetition and Strategy - DLF Group A StudysoumyaharNoch keine Bewertungen

- How To Do Business in Pakistan?: Trade & Investment GuideDokument79 SeitenHow To Do Business in Pakistan?: Trade & Investment GuideTabinda IslamNoch keine Bewertungen

- India's 1991 Economic Reforms - Adopting the LPG ModelDokument21 SeitenIndia's 1991 Economic Reforms - Adopting the LPG ModelDivanshu SachdevaNoch keine Bewertungen

- International Business - Meaning, Importance, Nature and ScopeDokument5 SeitenInternational Business - Meaning, Importance, Nature and ScopeAdi ShahNoch keine Bewertungen

- The Stakeholder Analysis For SEA of Chinese Foreign Direct Investment The Case of One Belt One Road Initiative in PakistanDokument15 SeitenThe Stakeholder Analysis For SEA of Chinese Foreign Direct Investment The Case of One Belt One Road Initiative in PakistanlalisangNoch keine Bewertungen

- Marketing Strategy of RanbaxyDokument9 SeitenMarketing Strategy of Ranbaxytasneem890% (1)

- Chapter 3-Asssignment 2Dokument21 SeitenChapter 3-Asssignment 2shaily DasNoch keine Bewertungen

- Legal Framework Related To Franchising: Under The Guidance ofDokument8 SeitenLegal Framework Related To Franchising: Under The Guidance ofrohanNoch keine Bewertungen

- The Ukraine Competitiveness Report 2008Dokument272 SeitenThe Ukraine Competitiveness Report 2008World Economic Forum100% (52)

- Research Paper Food IndustryDokument6 SeitenResearch Paper Food Industrygvym06g6100% (1)