Beruflich Dokumente

Kultur Dokumente

Unit-3 Capital Budgeting Decisions

Hochgeladen von

Krishna Chandran Pallippuram0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

32 Ansichten30 Seitencapital

Originaltitel

finance

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldencapital

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

32 Ansichten30 SeitenUnit-3 Capital Budgeting Decisions

Hochgeladen von

Krishna Chandran Pallippuramcapital

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 30

Unit- 3

Capital Budgeting Decisions

The investment decisions of a firm are generally known

as the capital budgeting, or capital expenditure

decisions.

The firms investment decisions would generally include

expansion, acquisition, modernisation and replacement

of the long-term assets.

Decisions like the change in the methods of sales

distribution, or an advertisement campaign or a

research and development programme have long-term

implications for the firms expenditures and benefits, and

therefore, they should also be evaluated as investment

decisions.

They influence the firms growth in the long

run

They affect the risk of the firm.

They involve commitment of large amount of

funds.

They are irreversible, or reversible at substantial

loss.

They are among the most common decisions to

make.

One classification is as follows:

Expansion of existing business

Expansion of new business

Replacement and modernisation

Yet another useful way to classify

investments is as follows:

Mutually exclusive investments

Independent investments

Contingent investments

Expansion of existing business: a company may add

capacity to its existing product lines to expand existing

operations.

E.g.: Gujarat State Fertiliser Company (GSFC) may

increases its plant capacity to manufacture more urea.

Expansion of new business: expansion of a new

business requires investment in new products and a

new kind of production activity with in the firm.

E.g.: if a packing manufacturing company invests

in a new plant and machinery to produce ball bearings,

which the firm has not manufactured before.

Replacement and modernisation: the main objective of

modernisation and replacement is to improve operating

efficiency and reduce costs.

E.g.: if a cement company changes from semi-

automatic drying equipment to fully automatic drying

equipment.

Replacement decisions help to introduce more efficient

and economical assets and therefore, are also called cost

reduction investments.

Mutually exclusive investments: are those which

compete with each other.

If one investment is accepted others will have to be

excluded.

E.g: A company may, either use a more- labour

intensive, semi-automatic machine, or employ a more

capital- intensive , highly automatic machine for

production.

Choosing the semi- automatic machine will

precludes the acceptance of the highly automatic

machines.

Independent investments: independent investments

serve different purposes and do not compete with each

other.

e.g.: A heavy engineering company may be

considering expansion of its plant capacity to

manufacture additional excavators and addition of new

production facilities to manufacture a new product-

light commercial vehicles.

Depending on their profitability and availability of

funds, the company can undertake both investments.

Three steps are involved in the evaluation of

an investment:

Estimation of cash flows

Estimation of the required rate of return (the

opportunity cost of capital)

Application of a decision rule for making the

choice

It should maximise the shareholders wealth.

It should consider all cash flows to determine the true

profitability of the project.

It should help ranking of projects according to their true

profitability.

It should recognise the fact that bigger cash flows are

preferable to smaller ones and early cash flows are

preferable to later ones.

It should help to choose among mutually exclusive

projects that project which maximises the shareholders

wealth.

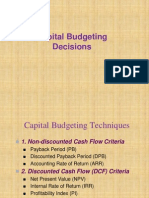

1. Discounted Cash Flow (DCF) Criteria

Net Present Value (NPV)

Internal Rate of Return (IRR)

Profitability Index (PI)

2. Non-discounted Cash Flow Criteria

Payback Period (PB)

Discounted Payback Period (DPB)

Accounting Rate of Return (ARR)

Cash flows of the investment project should be forecasted

based on realistic assumptions.

Appropriate discount rate should be identified to

discount the forecasted cash flows. The appropriate

discount rate is the projects opportunity cost of capital.

Present value of cash flows should be calculated using the

opportunity cost of capital as the discount rate.

The project should be accepted if NPV is positive (i.e.,

NPV > 0).

Net present value should be found out by

subtracting present value of cash outflows from

present value of cash inflows. The formula for

the net present value can be written as follows:

3 1 2

0

2 3

0

1

NPV

(1 ) (1 ) (1 ) (1 )

NPV

(1 )

n

n

n

t

t

t

C C C C

C

k k k k

C

C

k

=

(

= + + + +

(

+ + + +

=

+

Assume that Project X costs Rs 2,500 now and is expected

to generate year-end cash inflows of Rs 900, Rs 800, Rs

700, Rs 600 and Rs 500 in years 1 through 5. The

opportunity cost of the capital may be assumed to be 10

per cent.

2 3 4 5

1, 0.10 2, 0.10 3, 0.10

4, 0.10 5, 0.

Rs 900 Rs 800 Rs 700 Rs 600 Rs 500

NPV Rs 2,500

(1+0.10) (1+0.10) (1+0.10) (1+0.10) (1+0.10)

NPV [Rs 900(PVF ) + Rs 800(PVF ) + Rs 700(PVF )

+ Rs 600(PVF ) + Rs 500(PVF

(

= + + + +

(

=

10

)] Rs 2,500

NPV [Rs 900 0.909 + Rs 800 0.826 + Rs 700 0.751 + Rs 600 0.683

+ Rs 500 0.620] Rs 2,500

NPV Rs 2,725 Rs 2,500 = + Rs 225

=

=

Accept the project when NPV is positive

NPV > 0

Reject the project when NPV is negative

NPV < 0

May accept the project when NPV is zero

NPV = 0

The NPV method can be used to select between

mutually exclusive projects; the one with the

higher NPV should be selected.

Internal Rate of Return

Method

The internal rate of return (IRR) is the rate that

equates the investment outlay with the present

value of cash inflow received after one period. This

also implies that the rate of return is the discount

rate which makes NPV = 0.

3 1 2

0

2 3

0

1

0

1

(1 ) (1 ) (1 ) (1 )

(1 )

0

(1 )

n

n

n

t

t

t

n

t

t

t

C C C C

C

r r r r

C

C

r

C

C

r

=

=

= + + + +

+ + + +

=

+

=

+

Uneven Cash Flows: Calculating IRR by Trial and

Error

The approach is to select any discount rate to

compute the present value of cash inflows. If the

calculated present value of the expected cash

inflow is lower than the present value of cash

outflows, a lower rate should be tried. On the

other hand, a higher value should be tried if the

present value of inflows is higher than the present

value of outflows. This process will be repeated

unless the net present value becomes zero.

Level Cash Flows

Let us assume that an investment would

cost Rs 20,000 and provide annual cash

inflow of Rs 5,430 for 6 years.

The IRR of the investment can be found

out as follows:

6,

6,

6,

NPV Rs 20,000 + Rs 5,430(PVAF ) = 0

Rs 20,000 Rs 5,430(PVAF )

Rs 20,000

PVAF 3.683

Rs 5,430

r

r

r

=

=

= =

Accept the project when r > k.

Reject the project when r < k.

May accept the project when r = k.

In case of independent projects, IRR and NPV

rules will give the same results if the firm has

no shortage of funds.

Profitability index is the ratio of the present

value of cash inflows, at the required rate of

return, to the initial cash outflow of the

investment.

PI = PV of cash inflows

Initial cash outlay

The initial cash outlay of a project is Rs 100,000

and it can generate cash inflow of Rs 40,000, Rs

30,000, Rs 50,000 and Rs 20,000 in year 1 through 4.

Assume a 10 per cent rate of discount. The PV of

cash inflows at 10 per cent discount rate is:

. 1235 . 1

1,00,000 Rs

1,12,350 Rs

PI

12,350 Rs = 100,000 Rs 112,350 Rs NPV

0.68 20,000 Rs + 0.751 50,000 Rs + 0.826 30,000 Rs + 0.909 40,000 Rs =

) 20,000(PVF Rs + ) 50,000(PVF Rs + ) 30,000(PVF Rs + ) 40,000(PVF Rs PV

0.10 4, 0.10 3, 0.10 2, 0.10 1,

= =

=

=

The following are the P

I

acceptance rules:

Accept the project when PI is greater than one.

PI > 1

Reject the project when PI is less than one.

PI < 1

May accept the project when PI is equal to one.

PI = 1

The project with positive NPV will have PI greater

than one. PI less than means that the projects NPV is

negative.

Payback is the number of years required to recover the

original cash outlay invested in a project.

If the project generates constant annual cash inflows, the

payback period can be computed by dividing cash outlay

by the annual cash inflow. That is:

Assume that a project requires an outlay of Rs 50,000 and

yields annual cash inflow of Rs 12,500 for 7 years. The

payback period for the project is:

0

Initial Investment

Payback = =

Annual Cash Inflow

C

C

Rs 50,000

PB = = 4 years

Rs 12,000

Unequal cash flows In case of unequal cash inflows,

the payback period can be found out by adding up

the cash inflows until the total is equal to the initial

cash outlay.

Suppose that a project requires a cash outlay of Rs

20,000, and generates cash inflows of Rs 8,000; Rs

7,000; Rs 4,000; and Rs 3,000 during the next 4 years.

What is the projects payback?

3 years + 12 (1,000/3,000) months

3 years + 4 months

The project would be accepted if its payback

period is less than the maximum or standard

payback period set by management.

As a ranking method, it gives highest ranking to

the project, which has the shortest payback

period and lowest ranking to the project with

highest payback period.

The discounted payback period is the number of periods

taken in recovering the investment outlay on the present

value basis.

The discounted payback period still fails to consider the

cash flows occurring after the payback period.

3 DI SCOUNTED PAYBACK I LLUSTRATED

Cash Flows

(Rs)

C0 C1 C2 C3 C4

Simple

PB

Discounted

PB

NPV at

10%

P -4,000 3,000 1,000 1,000 1,000 2 yrs

PV of cash flows -4,000 2,727 826 751 683 2.6 yrs 987

Q -4,000 0 4,000 1,000 2,000 2 yrs

PV of cash flows -4,000 0 3,304 751 1,366 2.9 yrs 1,421

The accounting rate of return is the ratio of the

average after-tax profit divided by the average

investment. The average investment would be equal

to half of the original investment if it were

depreciated constantly.

A variation of the ARR method is to divide average

earnings after taxes by the original cost of the project

instead of the average cost.

Average income

ARR =

Average investment

This method will accept all those projects whose

ARR is higher than the minimum rate established

by the management and reject those projects

which have ARR less than the minimum rate.

This method would rank a project as number one

if it has highest ARR and lowest rank would be

assigned to the project with lowest ARR.

Das könnte Ihnen auch gefallen

- Capital BudgetingDokument52 SeitenCapital Budgetingrabitha07541Noch keine Bewertungen

- DR - Naushad Alam: Capital BudgetingDokument38 SeitenDR - Naushad Alam: Capital BudgetingUrvashi SinghNoch keine Bewertungen

- CH 08 Capital BudgetingDokument51 SeitenCH 08 Capital BudgetingLitika SachdevaNoch keine Bewertungen

- Capital BudgetingDokument42 SeitenCapital BudgetingPiyush ChitlangiaNoch keine Bewertungen

- Choosing Innovation ProjectDokument25 SeitenChoosing Innovation ProjectChrisha Jane LanutanNoch keine Bewertungen

- Capital BudgetingDokument37 SeitenCapital Budgetingyashd99Noch keine Bewertungen

- Chapte R: CAPITAL BUDGETING - Investment DecisionsDokument56 SeitenChapte R: CAPITAL BUDGETING - Investment DecisionsSurya SivakumarNoch keine Bewertungen

- L1. Conventional and DCF Methods PDFDokument30 SeitenL1. Conventional and DCF Methods PDFvidhiNoch keine Bewertungen

- Recall The Flows of Funds and Decisions Important To The Financial ManagerDokument27 SeitenRecall The Flows of Funds and Decisions Important To The Financial ManagerAyaz MahmoodNoch keine Bewertungen

- Capital BudgetingDokument26 SeitenCapital BudgetingSuresh KapoorNoch keine Bewertungen

- Complex Investment DecisionsDokument36 SeitenComplex Investment DecisionsAmir Siddiqui100% (1)

- Project Appraisal and Selection: Time Preference For MoneyDokument16 SeitenProject Appraisal and Selection: Time Preference For MoneynathnaelNoch keine Bewertungen

- Capital Budgeting: Financial ManagementDokument22 SeitenCapital Budgeting: Financial ManagementKaRin MerRoNoch keine Bewertungen

- Faculty: Ahamed Riaz: Capital Budgeting DecisionsDokument51 SeitenFaculty: Ahamed Riaz: Capital Budgeting DecisionsShivani RajputNoch keine Bewertungen

- CH 08 RevisedDokument51 SeitenCH 08 RevisedBhakti MehtaNoch keine Bewertungen

- DCF N Non DCFDokument36 SeitenDCF N Non DCFNikita PorwalNoch keine Bewertungen

- 5CHAPTER 5 LTI (Capital Budgeting)Dokument10 Seiten5CHAPTER 5 LTI (Capital Budgeting)TIZITAW MASRESHANoch keine Bewertungen

- EEF - Capital Budgeting - 2020-21Dokument31 SeitenEEF - Capital Budgeting - 2020-21salkr30720Noch keine Bewertungen

- Capital BudgetingDokument30 SeitenCapital BudgetinganupsuchakNoch keine Bewertungen

- Capital Budgeting DecisionsDokument44 SeitenCapital Budgeting Decisionsarunadhana2004Noch keine Bewertungen

- Capital Budgeting DecisionsDokument120 SeitenCapital Budgeting Decisionsgizex2013Noch keine Bewertungen

- Nature of Investment Decisions: Capital Budgeting, or Capital Expenditure DecisionsDokument49 SeitenNature of Investment Decisions: Capital Budgeting, or Capital Expenditure DecisionsRam Krishna Krish100% (2)

- EBF 2054 Capital BudgetingDokument48 SeitenEBF 2054 Capital BudgetingizzatiNoch keine Bewertungen

- Chapter 5Dokument10 SeitenChapter 5Tofik SalmanNoch keine Bewertungen

- Capital Budgeting Decision RulesDokument29 SeitenCapital Budgeting Decision RulesJuna Rose MamarilNoch keine Bewertungen

- Capital BudgetingDokument36 SeitenCapital BudgetingDevansh DoshiNoch keine Bewertungen

- Investment Valuation Criteria: Lecture 9thDokument49 SeitenInvestment Valuation Criteria: Lecture 9thMihai StoicaNoch keine Bewertungen

- Capital Investment AppraisalDokument41 SeitenCapital Investment Appraisalbookabdi1Noch keine Bewertungen

- Financial Management: A Project On Capital BudgetingDokument20 SeitenFinancial Management: A Project On Capital BudgetingHimanshi SethNoch keine Bewertungen

- Lecture 3 - Investment AppraisalDokument50 SeitenLecture 3 - Investment AppraisalKenneth Wen Xuan TiongNoch keine Bewertungen

- Capital Bud ..Updated FinalDokument36 SeitenCapital Bud ..Updated FinalKeyur JoshiNoch keine Bewertungen

- Capital Budgeting Lesson NewDokument44 SeitenCapital Budgeting Lesson NewLea MachadoNoch keine Bewertungen

- Presentation Capital Budgeting 1464200210 160310Dokument37 SeitenPresentation Capital Budgeting 1464200210 160310Esha ThawalNoch keine Bewertungen

- 254 Chapter 10Dokument23 Seiten254 Chapter 10Zidan ZaifNoch keine Bewertungen

- Unit 2 Capital Budgeting Technique ProblemsDokument39 SeitenUnit 2 Capital Budgeting Technique ProblemsAshok KumarNoch keine Bewertungen

- 29th Aug 2023 Final Complex Investment DecisionsDokument15 Seiten29th Aug 2023 Final Complex Investment DecisionsKunal KadamNoch keine Bewertungen

- Appraisal Criteria - Capital BudgetingDokument50 SeitenAppraisal Criteria - Capital BudgetingNitesh NagdevNoch keine Bewertungen

- Efa-Unit 5Dokument45 SeitenEfa-Unit 5mandavillinagavenkatasriNoch keine Bewertungen

- Chapter 3 Part 2 Financial AppraisalDokument34 SeitenChapter 3 Part 2 Financial Appraisalyohannesalemayehu019Noch keine Bewertungen

- 6 Capital Budgeting TechniquesDokument49 Seiten6 Capital Budgeting TechniquesAkwasi BoatengNoch keine Bewertungen

- Factoring Services: Factoring Is Selling The Debts That Your Customer Owe To You To Another PartyDokument27 SeitenFactoring Services: Factoring Is Selling The Debts That Your Customer Owe To You To Another PartyTrisha Abhishek PrasadNoch keine Bewertungen

- Capital Budgeting - Part 1Dokument6 SeitenCapital Budgeting - Part 1Aurelia RijiNoch keine Bewertungen

- Capital Budgeting: Financial Appraisal of Investment Projects Welcome To The Power Point PresentationDokument41 SeitenCapital Budgeting: Financial Appraisal of Investment Projects Welcome To The Power Point PresentationInSha RafIqNoch keine Bewertungen

- Unit-2 Capital Budgeting: Value, Size by Influencing Its Growth, Profitability and RiskDokument26 SeitenUnit-2 Capital Budgeting: Value, Size by Influencing Its Growth, Profitability and RiskAsfawosen DingamaNoch keine Bewertungen

- Capital BudgetingDokument8 SeitenCapital BudgetingVarsha KastureNoch keine Bewertungen

- Fnce 220: Business Finance: Lecture 6: Capital Investment DecisionsDokument39 SeitenFnce 220: Business Finance: Lecture 6: Capital Investment DecisionsVincent KamemiaNoch keine Bewertungen

- Economics Unit 2.1 NotesDokument9 SeitenEconomics Unit 2.1 Notes3004 Divya Dharshini. MNoch keine Bewertungen

- NPV, Irr, ArrDokument9 SeitenNPV, Irr, ArrAhsan MubeenNoch keine Bewertungen

- 5, 6 & 7 Capital BudgetingDokument42 Seiten5, 6 & 7 Capital BudgetingNaman AgarwalNoch keine Bewertungen

- Capital Budgeting Technique: Md. Nehal AhmedDokument25 SeitenCapital Budgeting Technique: Md. Nehal AhmedZ Anderson Rajin0% (1)

- 03 - 20th Aug Capital Budgeting, 2019Dokument37 Seiten03 - 20th Aug Capital Budgeting, 2019anujNoch keine Bewertungen

- Cost of Capital and Investment CriteriaDokument9 SeitenCost of Capital and Investment Criteriamuhyideen6abdulganiyNoch keine Bewertungen

- Business Finance Module 9Dokument13 SeitenBusiness Finance Module 9Kanton FernandezNoch keine Bewertungen

- IRR NPV and PBP PDFDokument13 SeitenIRR NPV and PBP PDFyared haftuNoch keine Bewertungen

- Capital BudgetingDokument36 SeitenCapital BudgetingTakreem AliNoch keine Bewertungen

- Financial Management-Lecture 6Dokument21 SeitenFinancial Management-Lecture 6TinoManhangaNoch keine Bewertungen

- Capital Budgeting (NPV PI)Dokument22 SeitenCapital Budgeting (NPV PI)Udit DhawanNoch keine Bewertungen

- Applied Corporate Finance. What is a Company worth?Von EverandApplied Corporate Finance. What is a Company worth?Bewertung: 3 von 5 Sternen3/5 (2)

- Decoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisVon EverandDecoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisNoch keine Bewertungen

- Investment Appraisal: A Simple IntroductionVon EverandInvestment Appraisal: A Simple IntroductionBewertung: 4 von 5 Sternen4/5 (6)

- Strategic Evaluation and ControlDokument21 SeitenStrategic Evaluation and ControlKrishna Chandran PallippuramNoch keine Bewertungen

- Product Life CycleDokument29 SeitenProduct Life CycleParamjit Sharma92% (12)

- Ed DevelopmentDokument13 SeitenEd DevelopmentKrishna Chandran PallippuramNoch keine Bewertungen

- 2156.environment AnalysisDokument36 Seiten2156.environment AnalysisMano DhillonNoch keine Bewertungen

- Cosiderations For Evalutation Business OppurtunitiesDokument12 SeitenCosiderations For Evalutation Business OppurtunitiesKrishna Chandran PallippuramNoch keine Bewertungen

- Marketing For New VenturesDokument31 SeitenMarketing For New VenturesKrishna Chandran PallippuramNoch keine Bewertungen

- A PPT On Money MarketDokument25 SeitenA PPT On Money MarketBrinder SinghNoch keine Bewertungen

- Credit RatingDokument15 SeitenCredit RatingKrishna Chandran PallippuramNoch keine Bewertungen

- Stages of EntrepreneurshipDokument40 SeitenStages of EntrepreneurshipKrishna Chandran PallippuramNoch keine Bewertungen

- Commercial PaperDokument15 SeitenCommercial PaperKrishna Chandran Pallippuram100% (1)

- AtmDokument19 SeitenAtmKrishna Chandran PallippuramNoch keine Bewertungen

- Governmental Institution For Environmental ManagementDokument7 SeitenGovernmental Institution For Environmental ManagementKrishna Chandran PallippuramNoch keine Bewertungen

- Legal Procedures For: Mergers & AmalgamationDokument8 SeitenLegal Procedures For: Mergers & AmalgamationKrishna Chandran PallippuramNoch keine Bewertungen

- Commercial PaperDokument15 SeitenCommercial PaperKrishna Chandran Pallippuram100% (1)

- Demand Forecasting MEDokument26 SeitenDemand Forecasting MEmanslikeNoch keine Bewertungen

- Credit Rating AgenciesDokument20 SeitenCredit Rating AgenciesKrishna Chandran PallippuramNoch keine Bewertungen

- Credit RatingDokument18 SeitenCredit Ratingrameshmba100% (10)

- Differentiationand Product PositioningDokument21 SeitenDifferentiationand Product PositioningKrishna Chandran PallippuramNoch keine Bewertungen

- DD ForecastingDokument20 SeitenDD ForecastingKrishna Chandran PallippuramNoch keine Bewertungen

- Portfolio ManagementDokument20 SeitenPortfolio ManagementKrishna Chandran Pallippuram100% (1)

- PPTDokument11 SeitenPPTKrishna Chandran PallippuramNoch keine Bewertungen

- Sales BudgetDokument27 SeitenSales BudgetKrishna Chandran PallippuramNoch keine Bewertungen

- Presentation 1Dokument30 SeitenPresentation 1Krishna Chandran PallippuramNoch keine Bewertungen

- Financial Services: A Seminar OnDokument34 SeitenFinancial Services: A Seminar OnKrishna Chandran PallippuramNoch keine Bewertungen

- PMDokument23 SeitenPMKrishna Chandran PallippuramNoch keine Bewertungen

- Em Regulation and Legal FrameworkDokument3 SeitenEm Regulation and Legal FrameworkKrishna Chandran PallippuramNoch keine Bewertungen

- Green TaxDokument4 SeitenGreen TaxKrishna Chandran PallippuramNoch keine Bewertungen

- Environmental Taxation: Don Fullerton (Texas) Andrew Leicester (IFS) Stephen Smith (UCL)Dokument23 SeitenEnvironmental Taxation: Don Fullerton (Texas) Andrew Leicester (IFS) Stephen Smith (UCL)Krishna Chandran PallippuramNoch keine Bewertungen

- Haz Wate MHTDokument19 SeitenHaz Wate MHTKrishna Chandran PallippuramNoch keine Bewertungen

- Green TaxDokument4 SeitenGreen TaxKrishna Chandran PallippuramNoch keine Bewertungen

- Principles of Sustainable Finance - (Part III Financing Sustainability) - 2Dokument41 SeitenPrinciples of Sustainable Finance - (Part III Financing Sustainability) - 2SebastianCasanovaCastañedaNoch keine Bewertungen

- Valuation HandbookDokument97 SeitenValuation Handbookdeddy as100% (1)

- Management and Cost Accounting 10th Edition Drury Solutions Manual Full Chapter PDFDokument38 SeitenManagement and Cost Accounting 10th Edition Drury Solutions Manual Full Chapter PDFirisdavid3n8lg100% (10)

- MGT201 Finalterm GoldenFileDokument230 SeitenMGT201 Finalterm GoldenFilemaryamNoch keine Bewertungen

- Net Present Value MethodDokument9 SeitenNet Present Value MethodRain Roslan100% (2)

- DCF in Depth Calculate The Revenue Growth Rate: Forecasting Free Cash FlowsDokument5 SeitenDCF in Depth Calculate The Revenue Growth Rate: Forecasting Free Cash FlowsJustBNoch keine Bewertungen

- Stock Valuation - Practice QuestionsDokument2 SeitenStock Valuation - Practice QuestionsMuhammad Mansoor0% (1)

- Advanced MGT Accounting Paper 3.2 by PPLDokument354 SeitenAdvanced MGT Accounting Paper 3.2 by PPLVainess S Zulu100% (1)

- Capital Budgeting 1Dokument39 SeitenCapital Budgeting 1Carla CarreonNoch keine Bewertungen

- Solution Manual For Managerial Economics 12th Edition by HirscheyDokument37 SeitenSolution Manual For Managerial Economics 12th Edition by Hirscheytubuloseabeyant4v9n100% (13)

- Chapter 10Dokument37 SeitenChapter 10carlo knowsNoch keine Bewertungen

- Top 50 Report-Malaysian BrandsDokument28 SeitenTop 50 Report-Malaysian Brandsfrancistsy100% (1)

- US CMA - Part 2 TerminologyDokument67 SeitenUS CMA - Part 2 TerminologyAhad chyNoch keine Bewertungen

- Discounted Dividend Valuation: Presenter Venue DateDokument46 SeitenDiscounted Dividend Valuation: Presenter Venue DateAinie IntwinesNoch keine Bewertungen

- CB Analysis of Shipping Container Emergency SheltersDokument8 SeitenCB Analysis of Shipping Container Emergency SheltersVioleta MihajlovicNoch keine Bewertungen

- ACC602-Topic 6 (CED) PDFDokument23 SeitenACC602-Topic 6 (CED) PDFNishika KaranNoch keine Bewertungen

- DCF - Reverse DCFDokument4 SeitenDCF - Reverse DCFDeep BorsadiyaNoch keine Bewertungen

- CF NotesDokument73 SeitenCF NotesSonu DCNoch keine Bewertungen

- Dividen 1Dokument3 SeitenDividen 1Lucyana Maria MagdalenaNoch keine Bewertungen

- Neptune Model CompleteDokument23 SeitenNeptune Model CompleteChar_TonyNoch keine Bewertungen

- On Company ValuationDokument43 SeitenOn Company Valuationneelam mishraNoch keine Bewertungen

- Lease and HPDokument27 SeitenLease and HPpreetimaurya100% (1)

- Warren E BuffetDokument13 SeitenWarren E BuffetAyu Eka Putri67% (3)

- Bauer Industries Is An Automobile Manufacturer Management Is CuDokument1 SeiteBauer Industries Is An Automobile Manufacturer Management Is CuAmit PandeyNoch keine Bewertungen

- Memo 2 Final Michael LamaitaDokument16 SeitenMemo 2 Final Michael Lamaitaapi-247303303100% (2)

- Valuation: The Valuation Principle: The Foundation of Financial Decision Making ValuationDokument15 SeitenValuation: The Valuation Principle: The Foundation of Financial Decision Making ValuationWensky RagpalaNoch keine Bewertungen

- Investment Banking Interview QuestionsDokument3 SeitenInvestment Banking Interview QuestionsdaweiliNoch keine Bewertungen

- Bài tập chap 17 18Dokument3 SeitenBài tập chap 17 18huanbilly2003Noch keine Bewertungen

- Hind. UnileverDokument37 SeitenHind. UnileveradasdasNoch keine Bewertungen

- Chapter 13 ValuationDokument23 SeitenChapter 13 ValuationIndah Dwi RetnoNoch keine Bewertungen