Beruflich Dokumente

Kultur Dokumente

Presentation1.Ppt Ass

Hochgeladen von

kegnataCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Presentation1.Ppt Ass

Hochgeladen von

kegnataCopyright:

Verfügbare Formate

Calculating Future Bond Prices

Calculating Future Bond Prices

Realized Compound Yield

Yield Adjustments for Tax-Exempt Bonds

Calculating Future Bond Prices

Where:

P

f

= estimated future price of the bond

C

i

= annual coupon payment

n = number of years to maturity

hp = holding period of the bond in years

i = expected semiannual rate at the end of the holding

period

hp n

p

hp n

t

t

i

f

i

P

i

C

P

2 2

2 2

1

) 2 1 ( ) 2 1 (

2 /

=

+

+

+

=

Calculate the future price of the bond

Calculate the future price of the bond

rate 10%, t =25 bond with promised YTM = 12%, face value

$1000

Assume expected market YTM decline to 8% after 5 years

future price after 5 years to estimate the expected YTM

Pf = ?

20 years, and the market YTM of 8 %.

n-hp = 20 years or

2n-2hp (50-10) = 40 periods

future price of the bond = $1,197.94

Future price of the bond

Realized Compound Yield

Rate of return actually earned on a bond given

the reinvestment of the coupons at constant rate

The return that is actually earned over a given

time period.

0 . 1

bond of price Purchase

dollars future Total

RCY

2 / 1

=

n

Realized Compound Yield

Assume: F = 1000 C = $80 t=4 years

reinvestment of the annual 8% coupon (=$80 per annum).

Assuming we reinvest these coupons at 8%, we have the

following cash flows on the bond:

= .08

0 . 1

$1000

$1360.49

RCY

4 / 1

=

Realized Compound Yield

RCY = .08

If we reinvest the coupons at >8% we accumulate

>$1360.49(ending value)

and earn an annual return(RCY) > .08

and if < 8%

accumulate <$1360.49 and

earn an annual return(RCY) < .08.

Calculating Future Bond Prices

Yield Adjustments for Tax-Exempt Bonds

Municipal bonds, Treasury issues, and many agency

obligations possess one common characteristic: Their

interest income is partially or fully tax-exempt

For fully tax-exempt bonds

where: FTEY = fully taxable yield equivalent

i = the promised yield on the tax exempt bond

T = the amount and type of tax exemption

T - 1

i

FTEY =

Example

A taxable bond has a yield of 8% and a municipal bond

has a yield of 6%

If the investor is in a 40% tax bracket, which bond do the investor

prefer?

8%(1 - .4) = 4.8%

The after-tax return on the corporate bond is 4.8%, compared to a 6%

return on the municipal

T - 1

i

FTEY =

Das könnte Ihnen auch gefallen

- Presentation1.Ppt Ass - PPT 222Dokument8 SeitenPresentation1.Ppt Ass - PPT 222kegnataNoch keine Bewertungen

- Chapter 5 Ppt-DonusturulduDokument46 SeitenChapter 5 Ppt-DonusturulduOmer MehmedNoch keine Bewertungen

- Chapter 3: Interest Rates and Security ValuationDokument53 SeitenChapter 3: Interest Rates and Security ValuationhothaifaabusaleemNoch keine Bewertungen

- FIN4414 Security Valuation 001Dokument22 SeitenFIN4414 Security Valuation 001apugh1993Noch keine Bewertungen

- Soln CH 14 Bond PricesDokument12 SeitenSoln CH 14 Bond PricesSilviu TrebuianNoch keine Bewertungen

- Lec8.Cost of CapitalDokument52 SeitenLec8.Cost of Capitalvivek patelNoch keine Bewertungen

- Present Value of MoneyDokument29 SeitenPresent Value of MoneySuryamanyu SharmaNoch keine Bewertungen

- A. The Coupon Bonds Have A 6 Percent Coupon Which Matches The 6 Perent Required Return, So TheyDokument3 SeitenA. The Coupon Bonds Have A 6 Percent Coupon Which Matches The 6 Perent Required Return, So TheynithinNoch keine Bewertungen

- Cost of CapitalDokument39 SeitenCost of CapitalEkta JaiswalNoch keine Bewertungen

- Chapter 4 Valuation of Bonds and Cost of CspitalDokument24 SeitenChapter 4 Valuation of Bonds and Cost of Cspitalanteneh hailie100% (7)

- Calculating Present and Future ValuesDokument17 SeitenCalculating Present and Future Valuesየሞላ ልጅNoch keine Bewertungen

- HW 7Dokument3 SeitenHW 7Bandar Al-FaisalNoch keine Bewertungen

- FNCE101 wk02Dokument43 SeitenFNCE101 wk02Ian ChengNoch keine Bewertungen

- Bus Fin Module 4 Basic Long-Term Financial ConceptsDokument21 SeitenBus Fin Module 4 Basic Long-Term Financial ConceptsMariaShiela PascuaNoch keine Bewertungen

- Time Value of MoneyDokument63 SeitenTime Value of MoneyKEITH DESOUZANoch keine Bewertungen

- Chapter - Four: Bond and Stock Valuation and The Cost of CapitalDokument10 SeitenChapter - Four: Bond and Stock Valuation and The Cost of CapitalWiz Santa0% (1)

- Present Value Calculations for Retirement PlanningDokument38 SeitenPresent Value Calculations for Retirement Planningmarjannaseri77100% (1)

- BOND VALUATION With SolutionsDokument30 SeitenBOND VALUATION With Solutionschiaraferragni75% (8)

- Problems On Cost of CapitalDokument4 SeitenProblems On Cost of CapitalAshutosh Biswal100% (1)

- Engineering Economics 2Dokument65 SeitenEngineering Economics 2Muktar JemalNoch keine Bewertungen

- Chapter 5Dokument59 SeitenChapter 5Shrief MohiNoch keine Bewertungen

- Time Value of MoneyDokument35 SeitenTime Value of MoneyChimmy ParkNoch keine Bewertungen

- Chapter 1 - Updated-1 PDFDokument29 SeitenChapter 1 - Updated-1 PDFj000diNoch keine Bewertungen

- Financial Accounting 1 Unit 8Dokument27 SeitenFinancial Accounting 1 Unit 8Eyael ShimleasNoch keine Bewertungen

- Bond & Equity ValuationDokument16 SeitenBond & Equity ValuationNyasha GomoNoch keine Bewertungen

- Time Value of MoneyDokument10 SeitenTime Value of MoneyAnu LundiaNoch keine Bewertungen

- Financial MGMT, Ch3Dokument29 SeitenFinancial MGMT, Ch3heysemNoch keine Bewertungen

- Practice Worksheet Solutions - IBFDokument13 SeitenPractice Worksheet Solutions - IBFsusheel kumarNoch keine Bewertungen

- Valuation of Bonds and Shares WorkbookDokument3 SeitenValuation of Bonds and Shares Workbookkrips16100% (1)

- Time Value AnalysisDokument35 SeitenTime Value Analysisrizalito_t7644Noch keine Bewertungen

- Time Value MoneyDokument9 SeitenTime Value MoneySharmin ReulaNoch keine Bewertungen

- Determinants of Interest RatesDokument27 SeitenDeterminants of Interest RatesraviNoch keine Bewertungen

- Chapter 2Dokument29 SeitenChapter 2ebrahimnejad64Noch keine Bewertungen

- Module 4 - ValuationDokument29 SeitenModule 4 - ValuationKishore JohnNoch keine Bewertungen

- Corporate FinanceDokument87 SeitenCorporate FinanceXiao PoNoch keine Bewertungen

- RM Lecture 4Dokument57 SeitenRM Lecture 4觉慧Noch keine Bewertungen

- CHAPTER 5: Cost of CapitalDokument27 SeitenCHAPTER 5: Cost of Capitalgirma guddeNoch keine Bewertungen

- Bond Value and ReturnDokument82 SeitenBond Value and Returnbhaskar5377Noch keine Bewertungen

- Interest Rates and Security ValuationDokument19 SeitenInterest Rates and Security ValuationHAZELMAE JEMINEZNoch keine Bewertungen

- TVM Principles and CalculationsDokument27 SeitenTVM Principles and Calculationshassan baradaNoch keine Bewertungen

- Chapter 5: How To Value Bonds and StocksDokument16 SeitenChapter 5: How To Value Bonds and StocksmajorkonigNoch keine Bewertungen

- Revision MidtermDokument12 SeitenRevision MidtermKim NgânNoch keine Bewertungen

- Bond Math Casepgdl01teamDokument8 SeitenBond Math Casepgdl01teamFernando Carrillo AlejoNoch keine Bewertungen

- Stocks and BondsDokument15 SeitenStocks and BondsKobe Bullmastiff0% (1)

- Valuation of Bonds and SharesDokument36 SeitenValuation of Bonds and SharesnidhiNoch keine Bewertungen

- CfbondDokument1 SeiteCfbondAayush ChopraNoch keine Bewertungen

- Hand Out-5Dokument11 SeitenHand Out-5muhammadNoch keine Bewertungen

- Time Value of MoneyDokument52 SeitenTime Value of MoneyJasmine Lailani ChulipaNoch keine Bewertungen

- Bonds Valuation Practice ProblemsDokument6 SeitenBonds Valuation Practice ProblemsMaria Danielle Fajardo CuysonNoch keine Bewertungen

- 1) Important Terms: Earning MoneyDokument9 Seiten1) Important Terms: Earning MoneyMaria DeeTee NguyenNoch keine Bewertungen

- Bond Valuation: M Number of Discounting Periods Per YearDokument12 SeitenBond Valuation: M Number of Discounting Periods Per YearMadel BANoch keine Bewertungen

- Cost of Capital Lecture 2Dokument7 SeitenCost of Capital Lecture 2Rica RegorisNoch keine Bewertungen

- GF520 Unit2 Assignment CorrectionsDokument7 SeitenGF520 Unit2 Assignment CorrectionsPriscilla Morales86% (7)

- Fixed Income SecuritiesDokument19 SeitenFixed Income SecuritiesShailendraNoch keine Bewertungen

- Present Value (Chapter 2)Dokument29 SeitenPresent Value (Chapter 2)Victoria Damsleth-AalrudNoch keine Bewertungen

- Time Value of MoneyDokument15 SeitenTime Value of MoneyMary Ann MarianoNoch keine Bewertungen

- Bond Characteristic and ValuationDokument6 SeitenBond Characteristic and ValuationWednesday AddamsNoch keine Bewertungen

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Von EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Bewertung: 3.5 von 5 Sternen3.5/5 (17)

- CPA Review Notes 2019 - BEC (Business Environment Concepts)Von EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Bewertung: 4 von 5 Sternen4/5 (9)

- GMAT Handbook 2Dokument120 SeitenGMAT Handbook 2Gustavo Reges100% (1)

- Chapter 19 Equity Portfolio ManagementDokument32 SeitenChapter 19 Equity Portfolio ManagementkegnataNoch keine Bewertungen

- Factors For Successful Development of Farmer Cooperatives in Northwest ChinaDokument16 SeitenFactors For Successful Development of Farmer Cooperatives in Northwest ChinakegnataNoch keine Bewertungen

- GMAT Tough Quants ProblemsDokument58 SeitenGMAT Tough Quants ProblemsnikhitaddankiNoch keine Bewertungen

- Bond Portfolio Strategies Laddered Barbell ImmunizationDokument21 SeitenBond Portfolio Strategies Laddered Barbell ImmunizationkegnataNoch keine Bewertungen

- Project Financing: Structure, Risks & Real CasesDokument23 SeitenProject Financing: Structure, Risks & Real CasesTushar AtreyNoch keine Bewertungen

- HTTPDokument1 SeiteHTTPkegnataNoch keine Bewertungen

- 9 M S of Management PDFDokument76 Seiten9 M S of Management PDFkegnata60% (5)

- 9 M S of Management PDFDokument76 Seiten9 M S of Management PDFkegnata60% (5)

- Freeman10e SM Ch02 PDFDokument26 SeitenFreeman10e SM Ch02 PDFkegnata100% (1)

- 10JSSP022013 PDFDokument9 Seiten10JSSP022013 PDFkegnataNoch keine Bewertungen

- Bti 01Dokument6 SeitenBti 01kegnataNoch keine Bewertungen

- HTTPDokument1 SeiteHTTPkegnataNoch keine Bewertungen

- Marakon Approach Alcar Approach Mckinsey Approach Stern Stewart Approach Boston Consulting Group ApproachDokument1 SeiteMarakon Approach Alcar Approach Mckinsey Approach Stern Stewart Approach Boston Consulting Group ApproachkegnataNoch keine Bewertungen

- GCE O Level Principles of Accounts GlossaryDokument6 SeitenGCE O Level Principles of Accounts Glossaryebookfish0% (1)

- Heteros Ce Dasti CityDokument17 SeitenHeteros Ce Dasti CityjazibscribNoch keine Bewertungen

- Public FinanceDokument1 SeitePublic FinancekegnataNoch keine Bewertungen

- Investing For Growth 1Dokument8 SeitenInvesting For Growth 1kegnataNoch keine Bewertungen

- Active Equity Management: Examining The Differences Between Fundamental and Quantitative StrategiesDokument6 SeitenActive Equity Management: Examining The Differences Between Fundamental and Quantitative StrategieskegnataNoch keine Bewertungen

- Growth Value 1Dokument15 SeitenGrowth Value 1kegnataNoch keine Bewertungen

- Active Equity Management: Examining The Differences Between Fundamental and Quantitative StrategiesDokument6 SeitenActive Equity Management: Examining The Differences Between Fundamental and Quantitative StrategieskegnataNoch keine Bewertungen

- Bti 01Dokument6 SeitenBti 01kegnataNoch keine Bewertungen

- Bti 01Dokument6 SeitenBti 01kegnataNoch keine Bewertungen

- Bti 01Dokument6 SeitenBti 01kegnataNoch keine Bewertungen

- The Capital Asset Pricing Model (Chapter 8)Dokument47 SeitenThe Capital Asset Pricing Model (Chapter 8)kegnataNoch keine Bewertungen

- Bti 01Dokument6 SeitenBti 01kegnataNoch keine Bewertungen

- Active Vs Passive Money MgrsDokument6 SeitenActive Vs Passive Money MgrskegnataNoch keine Bewertungen

- Bti 01Dokument6 SeitenBti 01kegnataNoch keine Bewertungen

- Active Vs Passive Money MgrsDokument6 SeitenActive Vs Passive Money MgrskegnataNoch keine Bewertungen

- Active Equity Management: Examining The Differences Between Fundamental and Quantitative StrategiesDokument6 SeitenActive Equity Management: Examining The Differences Between Fundamental and Quantitative StrategieskegnataNoch keine Bewertungen

- Balance Sheet of Ambuja CementDokument4 SeitenBalance Sheet of Ambuja CementMansharamani ChintanNoch keine Bewertungen

- Macroeconomics 13th Edition Parkin Test BankDokument76 SeitenMacroeconomics 13th Edition Parkin Test Bankodetteisoldedfe100% (28)

- The Rehn Meidner ModelDokument37 SeitenThe Rehn Meidner ModelJavier SolanoNoch keine Bewertungen

- Economic IssuesDokument5 SeitenEconomic Issuesedwin lisutsaNoch keine Bewertungen

- Deco502 Indian Economic Policy English PDFDokument386 SeitenDeco502 Indian Economic Policy English PDFAditya ShrivastavaNoch keine Bewertungen

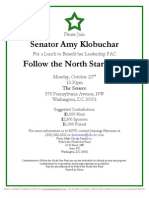

- Lunch With Sen. Amy Klobuchar For Follow The North Star FundDokument2 SeitenLunch With Sen. Amy Klobuchar For Follow The North Star FundSunlight FoundationNoch keine Bewertungen

- Department of Labor and Employment Wage Distortion Formula: Where Exponent Is Represented by NDokument10 SeitenDepartment of Labor and Employment Wage Distortion Formula: Where Exponent Is Represented by NJonnalyn ObaNoch keine Bewertungen

- Factors Affecting Business EnvironmentDokument17 SeitenFactors Affecting Business EnvironmentDrShailesh Singh Thakur100% (1)

- Monetary and Fiscal PolicyDokument22 SeitenMonetary and Fiscal PolicydhawalraginiNoch keine Bewertungen

- The Impact of Stock Market On Indian EconomyDokument6 SeitenThe Impact of Stock Market On Indian EconomyIJRASETPublicationsNoch keine Bewertungen

- DCF and Trading Multiple Valuation of Acquisition OpportunitiesDokument4 SeitenDCF and Trading Multiple Valuation of Acquisition Opportunitiesfranky1000Noch keine Bewertungen

- Is LM BP AnalysisDokument40 SeitenIs LM BP Analysisapi-3825580100% (1)

- CBRC Free LET Review For All: GEN. ED. (Social Science)Dokument8 SeitenCBRC Free LET Review For All: GEN. ED. (Social Science)Julieto VitorNoch keine Bewertungen

- W-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDokument1 SeiteW-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnjeminaNoch keine Bewertungen

- PEST AnalysisDokument2 SeitenPEST Analysism_tahir_saeed57270% (1)

- New Economic Policy (1991)Dokument17 SeitenNew Economic Policy (1991)supreti_tyagidelhi4322100% (4)

- Tata Consultancy Services LTD: Profit and Loss AccountDokument4 SeitenTata Consultancy Services LTD: Profit and Loss AccountHiren SutariyaNoch keine Bewertungen

- Economic Reforms Since 1991Dokument12 SeitenEconomic Reforms Since 1991Sampann KumarNoch keine Bewertungen

- Three Tab Foldable NDDokument1 SeiteThree Tab Foldable NDchelseaNoch keine Bewertungen

- 2022 - Fiscal PolicyDokument48 Seiten2022 - Fiscal PolicySwapnil JaiswalNoch keine Bewertungen

- Business Studies Notes For IGCSEDokument21 SeitenBusiness Studies Notes For IGCSEsonalNoch keine Bewertungen

- Unit 1 Elements of Banking 1Dokument51 SeitenUnit 1 Elements of Banking 1harshita bhatiaNoch keine Bewertungen

- The Colonial Economies: DVS 1203 Political Economy of Africa and DevelopmentDokument54 SeitenThe Colonial Economies: DVS 1203 Political Economy of Africa and DevelopmentSean JoshuaNoch keine Bewertungen

- New Economic Policy of IndiaDokument58 SeitenNew Economic Policy of Indiathulasie_600628881Noch keine Bewertungen

- 4 - Macroeconomics Board Exam Syllabus Part 1 Final PDFDokument53 Seiten4 - Macroeconomics Board Exam Syllabus Part 1 Final PDFastra_per_asperaNoch keine Bewertungen

- Chapter-1: Managerial EconomicsDokument24 SeitenChapter-1: Managerial EconomicsVivek SharmaNoch keine Bewertungen

- Vipin SharmaDokument2 SeitenVipin SharmaManmohan ParasharNoch keine Bewertungen

- Inflationary & Deflationary GapDokument52 SeitenInflationary & Deflationary GapAli Saima100% (2)

- Net Estate Gross Estate - Deductions DeductionsDokument3 SeitenNet Estate Gross Estate - Deductions DeductionsJm EjeNoch keine Bewertungen

- Swan Diagram NotesDokument3 SeitenSwan Diagram NotesGizri AlishaNoch keine Bewertungen