Beruflich Dokumente

Kultur Dokumente

CH 08

Hochgeladen von

palak32Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CH 08

Hochgeladen von

palak32Copyright:

Verfügbare Formate

Chapter 8

Pricing and Output Decisions: Perfect Competition and Monopoly

Chapter Eight

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall.

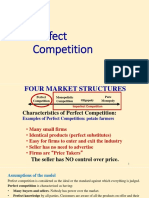

Four market types

Perfect competition (no market power)

large number of relatively small buyers and sellers standardized product very easy market entry and exit nonprice competition not possible

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall. 2

Chapter Eight

Four market types

Monopoly (absolute market power, subject to government regulation)

one firm, firm is the industry unique product or no close substitutes market entry and exit difficult or legally impossible nonprice competition not necessary

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall. 3

Chapter Eight

Four market types

Monopolistic competition (market power based on product differentiation)

large number of small firms acting independently differentiated product

market entry and exit relatively easy

nonprice competition very important

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall. 4

Chapter Eight

Four market types

Oligopoly (product differentiation and/or the firms dominance of the market)

small number of large mutually interdependent firms differentiated or standardized product

market entry and exit difficult

nonprice competition important

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall. 5

Chapter Eight

Four market types

Chapter Eight

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall.

Four market types

Examples: perfect competition

agricultural products financial instruments precious metals

petroleum

Chapter Eight

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall.

Four market types

Examples: monopoly

pharmaceuticals Microsoft gas station on edge of desert

Chapter Eight

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall.

Four market types

Examples: monopolistic competition

boutiques restaurants repair shops

Chapter Eight

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall.

Four market types

Examples: oligopoly

oil refining processed foods airlines

internet access

Chapter Eight

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall.

10

Pricing and output decisions in perfect competition

Basic business decision: entering a market using the following questions: how much should we produce? if we produce such an amount, how much profit will we earn? if a loss rather than a profit is incurred, will it be worthwhile to continue in this market in the long run (in hopes that we will eventually earn a profit) or should we exit?

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall. 11

Chapter Eight

Pricing and output decisions in perfect competition

Key assumptions of the perfectly competitive market: the firm is a price taker the firm makes the distinction between the short run and the long run the firms objective is to maximize its profit (or minimize loss) in the short run the firm includes its opportunity cost of operating in a particular market as part of its total cost of production

Chapter Eight

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall.

12

Pricing and output decisions in perfect competition

Perfectly elastic demand curve: consumers are willing to buy as much as the firm is willing to sell at the going market price firm receives the same marginal revenue from the sale of each additional unit of product; equal to the price of the product no limit to the total revenue that the firm can gain in a perfectly competitive market

Chapter Eight Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall. 13

Pricing and output decisions in perfect competition

Total revenue/Total cost approach:

compare the total revenue and total cost schedules and find the level of output that either maximizes the firms profits or minimizes its loss

Chapter Eight

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall.

14

Pricing and output decisions in perfect competition

Marginal revenue/Marginal cost approach produce a level of output at which the additional revenue received from the last unit is equal to the additional cost of producing that unit (ie. MR=MC) Note: for the perfectly competitive firm, the MR=MC rule may be restated as P=MC because P=MR in perfectly competitive market

Chapter Eight

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall.

15

Pricing and output decisions in perfect competition

Case A: economic profit The point where P=MR=MC is the optimal output (Q*) profit = TR TC =(P - AC) Q*

Chapter Eight Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall. 16

Pricing and output decisions in perfect competition

Case B: economic loss The firm incurs a loss. At optimum output, price is below AC however, since P > AVC, the firm is better off producing in the short run, because it will still incur fixed costs greater than the loss

Chapter Eight

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall.

17

Pricing and output decisions in perfect competition

Contribution margin: the amount by which total revenue exceeds total variable cost

CM = TR TVC

if CM > 0, the firm should continue to produce in the short run in order to defray some of the fixed cost

Chapter Eight Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall. 18

Pricing and output decisions in perfect competition

Shutdown point: the lowest price at which the firm would still produce At the shutdown point, the price is equal to the minimum point on the AVC If the price falls below the shutdown point, revenues fail to cover the fixed costs and the variable costs. The firm would be better off if it shut down and just paid its fixed costs

Chapter Eight

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall.

19

Pricing and output decisions in perfect competition

In the long run, the price in the competitive market will settle at the point where firms earn a normal profit

economic profit invites entry of new firms shifts the supply curve to the right puts downward pressure on price and reduces profits economic loss causes exit of firms shifts the supply curve to the left puts upward pressure on price and increases profits

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall. 20

Chapter Eight

Pricing and output decisions in perfect competition

Observations in perfectly competitive markets: the earlier the firm enters a market, the better its chances of earning above-normal profit

as new firms enter the market, firms must find ways to produce at the lowest possible cost, or at least at cost levels below those of their competitors

firms that find themselves unable to compete on the basis of cost might want to try competing on the basis of product differentiation instead

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall. 21

Chapter Eight

Pricing and output decisions in monopoly markets

A monopoly market consists of one firm (the firm is the market) firm has the power to set any price it wants however, the firms ability to set price is limited by the demand curve for its product, and in particular, the price elasticity of demand

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall. 22

Chapter Eight

Pricing and output decisions in monopoly markets

Assume demand is linear: it is downward sloping because the firm is a price setter

Assume MC is constant choose output where MR=MC, set price at P*

Chapter Eight

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall.

23

Pricing and output decisions in monopoly markets

Demand is the same as before, as is MR MC is upward sloping, which shows diminishing returns set output where MR=MC

Chapter Eight

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall.

24

Implications of perfect competition and monopoly for decision making

Perfectly competitive market

most important lesson is that it is extremely difficult to make money must be as cost efficient as possible it might pay for a firm to move into a market before others start to enter

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall. 25

Chapter Eight

Implications of perfect competition and monopoly for decision making

Monopoly market

most important lesson is not to be arrogant and assume their ability to earn economic profit can never be diminished changes in economics of a business eventually break down a dominating companys monopolistic power

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall. 26

Chapter Eight

Global application

Example: Bluefin tuna sushi restaurants operate in monopolistic competition bluefin tuna price determined by perfect competition low profit margin

Chapter Eight

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall.

27

Das könnte Ihnen auch gefallen

- Porter's Five Forces: Understand competitive forces and stay ahead of the competitionVon EverandPorter's Five Forces: Understand competitive forces and stay ahead of the competitionBewertung: 4 von 5 Sternen4/5 (10)

- Special Pricing Policies: Chapter Ten Publishing As Prentice Hall. 1Dokument34 SeitenSpecial Pricing Policies: Chapter Ten Publishing As Prentice Hall. 1palak32Noch keine Bewertungen

- Chapter 8 - Perfect Competition and MonopolyDokument31 SeitenChapter 8 - Perfect Competition and Monopolysalehsara556Noch keine Bewertungen

- Pricing and Output Decisions in Perfect CompetitionDokument8 SeitenPricing and Output Decisions in Perfect CompetitionTushar BallabhNoch keine Bewertungen

- Firms in Perfectly Competitive Markets: Chapter Summary and Learning ObjectivesDokument33 SeitenFirms in Perfectly Competitive Markets: Chapter Summary and Learning ObjectivesseriosulyawksomNoch keine Bewertungen

- Solution Manualch13Dokument33 SeitenSolution Manualch13StoneCold Alex Mochan80% (5)

- MarketDokument42 SeitenMarketSnn News TubeNoch keine Bewertungen

- BE - TUTORIAL 5 - STU 2Dokument16 SeitenBE - TUTORIAL 5 - STU 2Gia LinhNoch keine Bewertungen

- Pricing and Output Decisions: Monopolistic Competition and OligopolyDokument25 SeitenPricing and Output Decisions: Monopolistic Competition and OligopolyKiran MishraNoch keine Bewertungen

- Perfect Competition in 8 ChaptersDokument16 SeitenPerfect Competition in 8 ChaptersAbdulrahman Alotaibi100% (1)

- Perfect Competition MC Practice With AnswersDokument8 SeitenPerfect Competition MC Practice With AnswersMaría José AmezquitaNoch keine Bewertungen

- Monopolistic CompetitionDokument17 SeitenMonopolistic CompetitionAlok ShuklaNoch keine Bewertungen

- Chapter 8 Profit Maximization &cmptitive SupplyDokument92 SeitenChapter 8 Profit Maximization &cmptitive Supplysridhar7892Noch keine Bewertungen

- 5perfect CompetitionDokument19 Seiten5perfect CompetitionSHERIF GABERNoch keine Bewertungen

- Pure Competition in Short Run - NotesDokument6 SeitenPure Competition in Short Run - Notessouhad.abouzakiNoch keine Bewertungen

- What Is Economics?Dokument10 SeitenWhat Is Economics?Abdulrahman AlyousifNoch keine Bewertungen

- ME. MonopolisticDokument141 SeitenME. MonopolisticAndrewson BautistaNoch keine Bewertungen

- Module 5 - Chapter 7 Q&ADokument6 SeitenModule 5 - Chapter 7 Q&ABusn DNoch keine Bewertungen

- Maximizing Profits in Perfectly Competitive MarketsDokument4 SeitenMaximizing Profits in Perfectly Competitive MarketsRodney Meg Fitz Balagtas100% (1)

- Perfect Competition, Cost & Output DeterminationDokument70 SeitenPerfect Competition, Cost & Output DeterminationVũ TrangNoch keine Bewertungen

- Lec 15,16,17perfect CompetitionDokument19 SeitenLec 15,16,17perfect CompetitionSabira RahmanNoch keine Bewertungen

- An Overview of Monopolistic CompetitionDokument9 SeitenAn Overview of Monopolistic CompetitionsaifNoch keine Bewertungen

- Chapter 5 - Market StructureDokument19 SeitenChapter 5 - Market Structurejosephyoseph97Noch keine Bewertungen

- 2.1. Perfect CompetitionDokument73 Seiten2.1. Perfect Competitionapi-3696178100% (5)

- Chapter 8 F2013 Lecture SlidesDokument10 SeitenChapter 8 F2013 Lecture Slideslpinedo12Noch keine Bewertungen

- Chapter 9Dokument16 SeitenChapter 9BenjaNoch keine Bewertungen

- Chapter 8Dokument14 SeitenChapter 8Patricia AyalaNoch keine Bewertungen

- Chapter FiveDokument30 SeitenChapter FiveetNoch keine Bewertungen

- Parkin 13ge Econ IMDokument12 SeitenParkin 13ge Econ IMDina SamirNoch keine Bewertungen

- Pure CompetitionDokument9 SeitenPure Competitioncindycanlas_07Noch keine Bewertungen

- Monopolistic CompetitionDokument21 SeitenMonopolistic CompetitionBrigitta Devita ArdityasariNoch keine Bewertungen

- Microeconomics PartDokument30 SeitenMicroeconomics PartEmma QuennNoch keine Bewertungen

- Perfect Competition ADokument67 SeitenPerfect Competition APeter MastersNoch keine Bewertungen

- Perfect CompetitionDokument71 SeitenPerfect CompetitionSumedha SunayaNoch keine Bewertungen

- Monopolistic Competition and OligopolyDokument94 SeitenMonopolistic Competition and OligopolyVardaanNoch keine Bewertungen

- ECON Microeconomics 4 4th Edition McEachern Solutions Manual 1Dokument14 SeitenECON Microeconomics 4 4th Edition McEachern Solutions Manual 1debra100% (37)

- Econ Microeconomics 4 4Th Edition Mceachern Solutions Manual Full Chapter PDFDokument35 SeitenEcon Microeconomics 4 4Th Edition Mceachern Solutions Manual Full Chapter PDFeric.herrara805100% (11)

- Monopolistic Competition and Imperfect MarketsDokument23 SeitenMonopolistic Competition and Imperfect MarketsNIKNISHNoch keine Bewertungen

- CH 13 Ans 4 eDokument33 SeitenCH 13 Ans 4 ecoffeedanceNoch keine Bewertungen

- Study Questions (Final Exam)Dokument7 SeitenStudy Questions (Final Exam)Ashley Ann StocktonNoch keine Bewertungen

- Requirmen For Perfect CompititionDokument4 SeitenRequirmen For Perfect CompititionVijayNoch keine Bewertungen

- Perfect CompetitionDokument21 SeitenPerfect Competitionkingsleymay08Noch keine Bewertungen

- Economic Analysis Ch.7.2023Dokument24 SeitenEconomic Analysis Ch.7.2023Amgad ElshamyNoch keine Bewertungen

- Market Structures HandoutDokument10 SeitenMarket Structures HandoutSuzanne HolmesNoch keine Bewertungen

- Monopolistic CompetitionDokument3 SeitenMonopolistic Competitionjoshcastv27Noch keine Bewertungen

- CIS Microeconomics Exam ThreeDokument4 SeitenCIS Microeconomics Exam ThreeVictoriaNoch keine Bewertungen

- Mock Exam 2Dokument6 SeitenMock Exam 2Anne Raquel MadambaNoch keine Bewertungen

- Chapter Two: Demand and SupplyDokument71 SeitenChapter Two: Demand and Supplykasech mogesNoch keine Bewertungen

- Managerial Decisions For Firms With Market Power: Essential ConceptsDokument8 SeitenManagerial Decisions For Firms With Market Power: Essential ConceptsRohit SinhaNoch keine Bewertungen

- Chapter 8 Profit Maximisation and Competitive SupplyDokument26 SeitenChapter 8 Profit Maximisation and Competitive SupplyRitesh RajNoch keine Bewertungen

- Micro Economic Assighment Send MainDokument9 SeitenMicro Economic Assighment Send MainMohd Arhaan KhanNoch keine Bewertungen

- Monopoly Oligopoly Monopolistic Competition Perfect CompetitionDokument8 SeitenMonopoly Oligopoly Monopolistic Competition Perfect CompetitionDerry Mipa SalamNoch keine Bewertungen

- Managerial Economics & Business StrategyDokument31 SeitenManagerial Economics & Business StrategyYokie RadnanNoch keine Bewertungen

- a) Spectrum of competitionDokument9 Seitena) Spectrum of competitionZacharias EliaNoch keine Bewertungen

- Econ Chapter 5Dokument30 SeitenEcon Chapter 5nunutsehaynuNoch keine Bewertungen

- Managerial Economics - Short Answer CHDokument4 SeitenManagerial Economics - Short Answer CHAnkita T. MooreNoch keine Bewertungen

- Chap 8 - Managing in Competitive, Monopolistic, and Monopolistically Competitive MarketsDokument48 SeitenChap 8 - Managing in Competitive, Monopolistic, and Monopolistically Competitive MarketsjeankerlensNoch keine Bewertungen

- Forms of MarketDokument21 SeitenForms of MarketRrisingg MishraaNoch keine Bewertungen

- Econ This IsDokument11 SeitenEcon This Isbeasteast80Noch keine Bewertungen

- MONOPOLIES, MONOPSONIES, AND DOMINANT FIRMSDokument18 SeitenMONOPOLIES, MONOPSONIES, AND DOMINANT FIRMSMagfirah Ayu MeilaniNoch keine Bewertungen

- Drsanchana: Kaplan Step 2 CK Lecture Notes 2011-12Dokument10 SeitenDrsanchana: Kaplan Step 2 CK Lecture Notes 2011-12palak320% (1)

- Antibiotics Made EasyDokument6 SeitenAntibiotics Made Easypalak32Noch keine Bewertungen

- Introduction Operational ManagementDokument16 SeitenIntroduction Operational Managementpalak32Noch keine Bewertungen

- PSU AUA Fall 2010 Grading ExplanationDokument2 SeitenPSU AUA Fall 2010 Grading Explanationpalak32Noch keine Bewertungen

- HR in Healthcare at PSUDokument1 SeiteHR in Healthcare at PSUpalak32Noch keine Bewertungen

- Sci006-Lev 11Dokument380 SeitenSci006-Lev 11palak320% (1)

- Use of Oral Antibiotics: High Risk Low RiskDokument1 SeiteUse of Oral Antibiotics: High Risk Low Riskpalak32Noch keine Bewertungen

- How To Become MillioniareDokument3 SeitenHow To Become Millioniarepalak32Noch keine Bewertungen

- Performance - Measurements Operational ManagementDokument7 SeitenPerformance - Measurements Operational Managementpalak32Noch keine Bewertungen

- Fall 2010 QuizDokument1 SeiteFall 2010 Quizpalak32Noch keine Bewertungen

- Student CH 01Dokument56 SeitenStudent CH 01palak32Noch keine Bewertungen

- Assignment 3Dokument3 SeitenAssignment 3palak32Noch keine Bewertungen

- Syllabus Economic Analysis Fall 2011Dokument10 SeitenSyllabus Economic Analysis Fall 2011palak32Noch keine Bewertungen

- How To Solve A Problem in ExcelDokument4 SeitenHow To Solve A Problem in Excelpalak32Noch keine Bewertungen

- Chapter One Publishing As Prentice Hall. 1Dokument29 SeitenChapter One Publishing As Prentice Hall. 1palak32100% (1)

- Historical Perspective: History Is Relevant To Understanding The Past, Defining The Present, and Influencing The FutureDokument50 SeitenHistorical Perspective: History Is Relevant To Understanding The Past, Defining The Present, and Influencing The Futurepalak32Noch keine Bewertungen

- Assignment 3Dokument10 SeitenAssignment 3palak32Noch keine Bewertungen

- Ethics Ch01 IntroDokument48 SeitenEthics Ch01 Intropalak32Noch keine Bewertungen

- Student Guide to Fundamental Law and Ethics QuestionsDokument34 SeitenStudent Guide to Fundamental Law and Ethics Questionspalak32Noch keine Bewertungen

- BU 5700 AU2 Allen Marketing Techiques Spring II May 17Dokument6 SeitenBU 5700 AU2 Allen Marketing Techiques Spring II May 17palak32Noch keine Bewertungen

- Historical Perspective: History Is Relevant To Understanding The Past, Defining The Present, and Influencing The FutureDokument50 SeitenHistorical Perspective: History Is Relevant To Understanding The Past, Defining The Present, and Influencing The Futurepalak32Noch keine Bewertungen

- Chap 006Dokument61 SeitenChap 006palak32Noch keine Bewertungen

- Ethics Ch01 IntroDokument48 SeitenEthics Ch01 Intropalak32Noch keine Bewertungen

- Student CH 03Dokument66 SeitenStudent CH 03palak32Noch keine Bewertungen

- Chap 007Dokument65 SeitenChap 007palak3267% (6)

- Historical Perspective: History Is Relevant To Understanding The Past, Defining The Present, and Influencing The FutureDokument50 SeitenHistorical Perspective: History Is Relevant To Understanding The Past, Defining The Present, and Influencing The Futurepalak32Noch keine Bewertungen

- Student CH 04Dokument64 SeitenStudent CH 04palak32Noch keine Bewertungen

- Chap 010Dokument67 SeitenChap 010palak32100% (1)

- Chap 015Dokument40 SeitenChap 015palak32100% (2)