Beruflich Dokumente

Kultur Dokumente

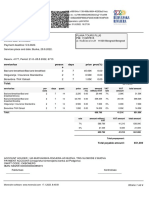

Trade Payments

Hochgeladen von

saikat55Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Trade Payments

Hochgeladen von

saikat55Copyright:

Verfügbare Formate

Presentation on International Trade Payment Practices

International Trade Documentation:

It is common in international trade transactions to require certain transport documents, administrative documents, financial documents, commercial documents, insurance documents, etc. There are a great variety of documents that may need to be produced to complete export/import transaction. However, in most export/import transactions, only a few documents are common in use (Invoice, Packing list, Certificate of Origin etc.). Trade documents can be classified based on their difference in consideration and use.

Classifications:

First Classification First of all, documents can be classified as follows: Documents obtained in the country of origin. Transport documents. Documents obtained in the country of destination.

Presentation on International Trade Payment Practices

Classifications:

Second Classification Documents can also be classified as: Essential Documents: invoice, certificate of origin, transport

etc.

documents,

Recommended documents: contract of sale, insurance policy, certificate

of quality, etc.

Documents on the goods: import/export licences, authorisations, safety

certificates, etc. Third Classification

Financial documents: Bill of exchange, promissory notes, etc. Commercial documents: Pro-forma invoice, invoice, packing list, Bill of

lading, Air way bill, insurance certificates, etc.

Presentation on International Trade Payment Practices

import license, customs declaration, etc. Other documents: Certificate of inspection, weight certificate, certificate of analysis, veterinary certificate, etc.

What function documents perform? Proof of contract: Documents such as transport documents (bill of lading), insurance documents, etc. evidence the existence of contracts of sale and conditions stipulated there. Title of the goods: Certain transport documents represent title of the goods, that is, they give the right to collect the goods from the carrier. Information: Certain documents provide information on the price for the goods (invoice), the contents of package units (packing list), etc. Customs: The customs of the country of destination require documents that evidence the origin of the goods, etc. in order to establish whether the goods are importable to the country and in order to charge appropriate taxes and duties. Proof of compliance: Certain documents serve as a proof that the conditions stipulated in the contract of sale are complied with, such as date of shipment (transport documents), the origin of the goods (certificate of origin), etc.

Administrative documents: Health certificate, Phytosanitary certificate,

Presentation on International Trade Payment Practices

International Commercial Terms or INCOTERMS 2000 INCOTERMS are a set of uniform rules codifying the interpretation of trade terms defining the rights and obligations of both Buyer and Seller in an international transaction. They define the responsibilities of both the buyer and seller, within international trade contracts, as regards where and when commercial, legal and insurance responsibilities pass from one party to the other. INCOTERMS 2000 is a revised version of INCOTERMS 1990 which clearly and accurately reflects trade practice. There are 13 INCOTERMS in use that are divided into 4 groups; to say, Group E, Group F, Group C and Group D. The brief characteristics of the 4 groups are listed below: Group E: Minimum obligation on seller (the buyer has to arrange export clearance, carriage, insurance etc.). Group F: Seller must hand over the goods to a nominated carrier free of risk and expense to the buyer. Group C: Seller must bear costs even after the critical point for the division of risk. Group D: Goods must arrive at a stated destination.

Presentation on International Trade Payment Practices

International Commercial Terms or INCOTERMS 2000 Group E Group F Departure EXW Ex Works (. . . Named place) Main Carriage Unpaid FCA Free Carrier (. . . Named place) FAS Free Alongside Ship (. . . Named port of shipment) FOB Free On Board (. . . Named port of shipment) Main Carriage Paid CFR Cost and Freight (. . . Named port of destination) CIF Cost, Insurance and Freight (. . . Named port of destination) CPT Carriage Paid To (. . . Name d place of destination) CIP Carriage and Insurance Paid To (. . Named place of destination) Arrival DAF DES DEQ DDU DDP Delivered At Frontier (. . . Named place) Delivered Ex Ship (. . . Named port of destination) Delivered Ex Quay (. . . Named port of destination) Delivered Duty Unpaid (. . . Named place of destination) Delivery Duty Paid (. . . Named place of destination)

Group C

Group D

Presentation on International Trade Payment Practices

International Commercial Terms or INCOTERMS 2000 Brief discussion on few terms that we confront frequently:

FOB or Free On Board (. . . Named port of shipment): Free On Board means that the seller delivers when the goods pass the ships rail in the port of shipment. This means that the buyer has to bear all costs and risks of loss or damage to the goods from that point. The FOB term requires the seller to clear the goods for export. This term can be used only for sea or inland waterway transport. If the parties do not intent to deliver the goods across the ships rail, the FCA term should be used. CFR or Cost and Freight (. . . Named port of destination): Cost and Freight means that the seller delivers when the goods pass the ships rail in the port of shipment. The seller must pay the costs and freight necessary to bring the goods to the named port of destination. BUT the risk of loss of or damage to the goods, as well as any additional costs due to events occurring after the time of delivery, are transferred from the seller to the buyer. The CFR term requires the seller to clear the goods for export. This term can be used only for sea and inland waterway transport. If the parties do not intent to deliver the goods across the ships rail, the CPT term should be used.

Presentation on International Trade Payment Practices

International Commercial Terms or INCOTERMS 2000

CPT or Carriage Paid To (. . . Named place of destination): Carriage Paid To means that the seller

delivers the goods to the carrier nominated by him but the seller must in addition pay the cost of carriage to bring the goods to the named destination. This means that the buyer bears all risks and any other costs occurring after the goods have been so delivered. Carrier means any person who, in a contract of carriage, undertakes to perform or to procure the performance of transport, by rail, road, air, or by a combination of such modes. If subsequent carriers are used for the carriage to the agreed destination, the risk passes when the goods have been delivered to the first carrier. This CPT term requires the seller to clear the goods for export. This term may be used irrespective of the mode of transport including multimodal transport. DDU or Delivered Duty Unpaid (. . . Named place of destination): Delivered Duty Unpaid means that the seller delivers the goods to the buyer, not cleared for import, and not unloaded from any arriving means of transport at the named place of destination. The seller has to bear the costs and risks involved in bringing the goods thereto, other than, where applicable any duty (which term includes the responsibility for and the risks of the carrying out of customs formalities, and the payment of formalities, customs duties, taxes and other charges) for import in the country of destination. Such duty has to be borne by the buyer as well as any costs and risks caused by his failure to clear the goods for import in time. However, if the parties wish the seller to carry out customs formalities and bear the costs and risks resulting there from as well as some of the costs payable upon import of the goods, this should be made clear by adding explicit wording to this effect in the contract of sale.

This term may be used irrespective of the mode of transport but when delivery is to take place in the port of destination on board the vessel or on the quay wharf the DES or DEQ terms should be used.

Presentation on International Trade Payment Practices

Payment Methods in International Trade The payment methods practiced internationally can be summarised as follows: Open Account Clean and Documentary Collections;

Sight Term

Documentary Credits;

Sight Term

Standby Documentary Credits Payment In Advance

Presentation on International Trade Payment Practices

Payment Methods in International Trade

Open Account:

Open Account involves the most risk for the seller and the least risk for the buyer. Under open account the goods are dispatched by the seller with the agreement of the buyer that payment will be made after the arrival of the goods or after an agreed period of time in the future. The seller has no guarantee that the buyer will meet this terms and actually effect the payment. The buyer, on the other hand, receives the goods before payment is effected. Despite the high apparent level of risk it is worth remembering that Open Account is the most popular payment method in international trade. If the exporter knows the importer and if there is a good relationship and track record then Open Account may be the most appropriate way of trading. In addition, if there is an agency agreement, or some other legally binding agreement covering the ongoing trade transactions, then Open Account method may be made more secure. It would be unusual for an exporter to operate on Open Account with a new importer in a foreign market.

Presentation on International Trade Payment Practices

Payment Methods in International Trade Apart from having to make the payment transfers, bank involvement in Open Account trading is limited and the bank has no part to play in guaranteeing that payment will actually be made. Open Account trading should be avoided by exporters in dealing with new customers and new countries.

Documentary Collections:

Collections are a service whereby the exporter requests the bank to act as a collecting agent for payment in a foreign market. The exporters bank will use the services of one of its overseas correspondents or a bank specifically nominated by the exporting customer to collect payment from the importer on the exporters behalf.

Presentation on International Trade Payment Practices

Payment Methods in International Trade In the case of Documentary Collection, documents relating to the export/import transaction such as the invoice, transport documents and insurance documents are provided by the exporter to the bank with instructions to remit the documents to the importers bank in a foreign country. The instruction will indicate how the documents are to be released to the importer. Documents can be released against immediate payment (sight) , known as D/P (Documents against Payment), or against acceptance of the Bill of Exchange, known as D/A (Documents against Acceptance). It is important to understand that even though banks are involved in the collection process the exporter has not got any form of bank guaranteed payment before the goods are shipped and the documents are remitted through the banking system.

The Uniform Rules for Collections (URC 522) of the ICC Paris govern the operation of Documentary Collections.

Presentation on International Trade Payment Practices

Payment Methods in International Trade

Documentary Credit:

Documentary Credits or Letters of Credit (LC) are bank conditional undertakings to make payment against the presentation of certain stipulated documents. They are widely used internationally. Under a Documentary Credit an exporter is relying on the standing of a bank rather than the importer to obtain payment. This helps the traders to get over the problems of dealing with local law, political instability, trading conditions or whatever. Banks through their international connections and correspondent networks will assess the risk on the transaction and underwrite it by either issuing a Documentary Credit or underwriting the undertaking of an issuing bank by adding their confirmation to a Documentary Credit. Documentary Credit can allow for payment to be made immediately on presentation of documents (sight) or at a date some time after shipment (term). The Documentary Credit is one of the most secure method of payment. In addition to the security of being a bank undertaking to make payment, the Documentary Credit also reflects the seriousness of the buyers commitment to acquire the goods (i.e. payment terms underwritten by the bank). It should, however, be noted that

there is no obligation on the issuing bank to pay if documents are not in accordance with the Documentary Credit.

As and from July 1, 2007 Documentary Credits are issued subject to the Uniform Customs and Practice for Documentary Credits Publication no. 600 of the ICC, Paris.

Presentation on International Trade Payment Practices

Payment Methods in International Trade

Standby Letter of Credit:

The Standby Letter of credit is a similar instrument to a guarantee. However, the Standby credits operate as a Documentary Credit in that drawdown is made only against presentation of a document or documents as stipulated in the Standby itself. Standby credits are governed by two separate, independent rules either by UCPDC Pub-600 of ICC or International Standby Practices (ISP98). Under either stated rules payment is undertaken against documents being presented strictly complying with the terms and conditions of the Standby Letter of Credit. Standby Letters of Credit are being used increasingly worldwide. This is the most secure method of payment for the seller or exporter. The importer pays the exporter before dispatch and thereby takes full risk of delivery. Payment in advance tends to be used for products where the demand and need is great and supply is limited. The buyer takes all of the risk and the seller takes none. SWIFT is the Society for Worldwide Interbank Financial Telecommunications . This is a cooperative society of member banks (registered in Brussels) which has established a computerised international communications network to improve the administrative efficiency of the banks and to speed up international payment transfers between themselves.

Payment in Advance:

SWIFT:

Presentation on International Trade Payment Practices

Discussion on basic fundamentals of some international payment practices :

1. Documentary Collection:

Documentary collections are a service provided by the bank whereby the bank facilitates the settlement of payment between international buyers and sellers. Collections offer a greater degree of security to the exporter than open account transactions.

The parties involved in a Documentary Collection:

The Principal: often referred to as the Exporter, Seller or Drawer. The Remitting Bank: this is the exporters bank which remits the collection documents to the

collecting bank.

The collecting Bank: often referred to as the correspondent bank or agent of the remitting bank. The Presenting Bank: often the same bank as the collecting bank. The Importer: sometimes referred to as the Buyer or Drawee.

Presentation on International Trade Payment Practices

Discussion on basic fundamentals of some international payment practices :

The Documentary Collection Cycle:

i. The Principal will ship the goods and then send the documents (commercial/financial)

to the remitting bank.

ii. Remitting bank, usually located in the exporters country, forwards all the documents to

a bank in the importers country (Collecting Bank). the transaction.

iii. Collecting Bank acts as an agent of the Remitting Bank and carries out the major part of iv. The Importer is contacted by the Collecting Bank which requests the Importer to make

payment in the case of a Sight Collection or requests the Importer to accept a Bill of Exchange in case of a Term Collection for payment at a future date. payment is made by the Importer it is then passed through the Collecting/Presenting Bank to the Remitting Bank, and then forwarded to the Exporter.

v. The documents under collection are released to the Importer to collect the goods. vi. When

Presentation on International Trade Payment Practices

Discussion on basic fundamentals of some international payment practices :

Collection of payment and transfer of documents can occur in either of two ways:

1. Documents against Payment (D/P): Sight Bills 2. Documents against Acceptance (D/A): Term Bills

1. Documents against Payment (D/P): Sight Bills

With a Sight Bill, the collecting bank receives the Bill from the remitting bank and presents it on to the importer, if necessary using the service of another bank (the presenting bank). The payment instrument is accompanied by the commercial documents as specified in the collection order. On sight of this bill, the Drawee (importer) is requested to pay the amount due in exchange for release of the documents. When payment is effected the importer receives the documents to collect the goods. The proceeds are sent by the collecting bank to the remitting bank and then to the seller. This transaction is referred to as documents against payment (D/P), as the importer receives the documents as soon as the payment is made.

Presentation on International Trade Payment Practices

Discussion on basic fundamentals of some international payment practices :

Collection of payment and transfer of documents can occur in either of two ways:

1. Documents against Payment (D/P): Sight Bills 2. Documents against Acceptance (D/A): Term Bills

1. Documents against Acceptance (D/A): Term Bills

Term Bills are due for payment on a future date and thus provide the drawee or buyer with time to pay (period of credit). The buyer or drawee is expected to ACCEPT the term bill, which is an undertaking to pay the amount due at a specified future date (maturity date). If the bill is accepted then the documents are released to the drawee/importer to collect the goods. This payment procedure is referred to as documents against acceptance.

Presentation on International Trade Payment Practices

Discussion on basic fundamentals of some international payment practices :

2. Documentary Credits (Letter of Credit)

A documentary letter of credit is a written undertaking by a bank, on behalf of an importer (buyer), to pay a certain amount of money to an exporter (seller) within a specified period of time, provided that the exporter presents documents specified in the letter of credit, and which strictly conform to the stipulations of the letter of credit, to a nominated bank or the issuing bank by a certain date. A letter of credit can be payable at sight (on presentation of documents) or at a future date. Where payment is at a future date the payment instrument known as a term, acceptance, deferred payment or usance letter of credit.

Presentation on International Trade Payment Practices

Discussion on basic fundamentals of some international payment practices :

The Parties to a Documentary Credit: The parties involved in a letter of credit transaction are: Applicant/opener the importer or buyer. Opening/issuing bank the bank issuing the letter of credit on the instructions of the applicant.

The issuing bank must ensure the importer is good for the money before agreeing to open the letter of credit and take collateral and get approval for credit line. Beneficiary the exporter or seller. Advising bank the bank, usually in the exporters country, which verifies the apparent authenticity of the letter of credit received from the issuing bank and which subsequently forwards it to the exporter. Nominated bank the bank authorised, within the letter of credit, to make settlement to the exporter and to whom documents are presented. The advising bank is often the nominated bank. Letters of credit are sometimes expressed to be available for negotiation with any bank. In this instance any bank prepared to do so may take responsibility for payment and then becomes the nominated bank . Confirming bank this bank usually located in the exporters country provides an additional independent undertaking to pay the exporter, provided that all the letter of credit terms and conditions have been met. Reimbursing bank a letter of credit may be issued which includes reference to a reimbursing bank which is the bank on which a payment claim can be made provided complying documents have been presented to the nominated bank.

Presentation on International Trade Payment Practices

Discussion on basic fundamentals of some international payment practices : The Documentary Credit Cycle

The sequence of events for a letter of credit transaction is as follows:

i. ii. iii. iv.

v. vi. vii. viii.

ix.

The seller quotes the buyer for the supply of the goods (or services). The buyer accepts the quotation. A sales contract is agreed requesting that payment is made by letter of credit. The buyer (applicant) instructs his bank to open a letter of credit in favour of the seller (beneficiary), stipulating the documents which need to be presented by the seller to obtain settlement. The instructions will include the date by which the goods must be shipped and the date by which all the documents must be presented to the nominated bank. The opening bank establishes the letter of credit and sends it to the advising or confirming bank in the sellers country by courier, tested telex or SWIFT. The advising bank/confirming bank sends the original letter of credit, under their own letter of advice or confirmation, to the seller (beneficiary). The seller ships the goods, obtains the relevant shipping documents, and collates all the documents required by the letter of credit. The seller presents the documents, together with the letter of credit itself, to the advising/confirming bank or any other nominated bank.

The advising/nominated/confirming bank checks the documents against the requirements of the letter of credit and, if the documents comply strictly with the terms therein, will pay, undertake to pay at an agreed future date or, if the credit is not confirmed, apply to the opening bank for reimbursement to pay the seller, which it will do on receipt of funds.

Presentation on International Trade Payment Practices

Discussion on basic fundamentals of some international payment practices : The Documentary Credit Cycle The sequence of events for a letter of credit transaction (contd):

x. xi. xii.

The advising/confirming bank sends the documents presented to the opening bank. The issuing bank reimburses the nominated/confirming bank in a pre-agreed manner. The issuing bank releases the documents to the buyer against payment of the invoice value (plus any bank charges). The opening banks debit to the buyers account is passed at the same value date as the date of payment to the advising/confirming bank.

xiii.

The buyer uses the documents to obtain customs clearance and release of the goods when they arrive.

Presentation on International Trade Payment Practices

Discussion on basic fundamentals of some international payment practices : Few characteristics to note of a Documentary Credit:

Irrevocable/Revocable:

The irrevocable letter of credit is the most widely used. Once issued, the opening bank gives an Irrevocable undertaking to honour payment as long as the letter of credit terms are complied with by the beneficiary (seller). The issuing bank can only cancel or amend the letter of credit with the agreement of all the parties involved. Under Uniform Customs & Practice for Documentary Credits (ICC Publication No. 600 which became effective on July 1, 2007) provides that all letters of credit are assumed to be irrevocable unless they expressly state otherwise by modification of the rules in the terms and conditions of the letter of credit itself. A revocable letter of credit may be cancelled or amended at any time after it has been issued without the prior consent or knowledge of the beneficiary (unless documents have been taken up by a nominated bank). For this reason it offers the beneficiary little protection and should not normally be accepted as a payment instrument or as a collateral if the bank is financing the customer.

Presentation on International Trade Payment Practices

Discussion on basic fundamentals of some international payment practices : Few characteristics to note of a Documentary Credit:

Confirmed/Unconfirmed:

A confirmed letter of credit is one in which the confirming bank, often the exporters own bank, on the instructions of the issuing bank, has added a commitment (confirmation) that settlement will be made. This commitment holds even should the issuing bank or the buyer fail, provided documents complying with the terms and conditions of the Credit are presented to the confirming bank. Exporters are advised to seek a confirmed letter of credit wherever they are concerned with the credit standing of the issuing bank or the political and economic situations in the issuing banks country. An unconfirmed letter of credit is forwarded by the advising bank to the exporter without adding its own independent undertaking to make the settlement or accept responsibility for payment at a future date, but verifying the authenticity of the letter of credit. However, the opening bank will usually instruct the nominating bank to pay the exporter on its behalf, although payment may be delayed by a few days whilst the advising bank awaits receipt of funds from overseas.

Presentation on International Trade Payment Practices

Discussion on basic fundamentals of some international payment practices : Few characteristics to note of a Documentary Credit:

Revolving Letter of Credit:

A Revolving letter of credit can be used where regular shipments of the same commodity are made to the same buyer. It can revolve in relation to time or to value:

(a) (b)

Time: Once utilised the letter of credit is re-instated for further regular shipments, e.g. monthly, until the credit is fully drawn. Value: Once utilised and paid, the value can be re-instated for further drawings.

This type of instrument must state that it is a Revolving Letter of Credit and it may revolve either automatically or subject to certain provision as stated in the credit . The key advantages are that it saves the administration and cost of repeated identical letters of cerdit and also it ensures documentary requirements are identical for all shipments covered therein.

Presentation on International Trade Payment Practices

Discussion on basic fundamentals of some international payment practices : Few characteristics to note of a Documentary Credit:

Transferable Letter of Credit:

A Transferable letter of credit is one in which the beneficiary has the right to instruct the paying, or negotiating, bank to make either part, or all, of the credit value available to one or more third parties who are known as second beneficiaries. This type of letter of credit is useful for buying agents and traders who purchases goods for their overseas clients from manufacturers or suppliers. They are able to finance their purchases by transferring the letter of credit to their suppliers but restricting the value transferred to their purchase cost.

Typical transferable letter of credit transaction

(a) (b) (c)

ABC Export Agency receives an order from their overseas customer, DEF Imports Ltd., for building materials. The agreed price is USD50,000.00 payable by transferable letter of credit. ABC receives the letter of credit and orders the building materials from XYZ Materials for an agreed purchase price of USD45,000.00. ABC transfers the letter of credit to XYZ upto the value of USD45,000.00. The goods are shipped and XYZ presents documents to the bank for which it receives their invoice value of USD45,000.00. ABC then arranges, with the paying bank, to substitute its own invoices for their sale value of USD50,000.00. ABC will then receive the balance due to it, USD5,000.00, representing its margin on the sale.

(d) (e)

(f) (g)

Presentation on International Trade Payment Practices

Discussion on basic fundamentals of some international payment practices : Few characteristics to note of a Documentary Credit:

Back-to-Back Letters of Credit:

A Back-to-Back letters of credit are used in similar scenarios to those in which transferable letters of credit are used, i.e. as a means of paying a third party supplier or manufacturer. Rather than transferring the original letter of credit to the supplier, once the letter of credit is received by the exporter from the opening bank, that letter of the end supplier (on identical terms and conditions apart from price). The first letter of credit is used to back the second letter of credit.

Presentation on International Trade Payment Practices

Discussion on basic fundamentals of some international payment practices : Few characteristics to note of a Documentary Credit: Standby Documentary Credits A standby letter of credit is used to stand by and act as a back-up security to cover a default situation. A standby may be used to back-up open account trading where the seller sends the goods and documents to the buyer and awaits open account payments. When acting as a default or Standby instrument, the bank makes an unconditional undertaking to pay the seller (the beneficiary) against documents which evidence that a party fails to fulfill his/her contractual obligations under the conditions stipulated in the letter of credit. The standby should only be drawn on in the event of non-performance. If payment is made according to the conditions stipulated in the commercial letter of credit, standby LC should never be drawn on. However, great care must be taken as payment is dependent only on documents complying with the Standby terms and conditions being presented. It can happen that default may not have occurred but a beneficiary could present documents evidencing default.

Presentation on International Trade Payment Practices

Discussion on basic fundamentals of some international payment practices : Few characteristics to note of a Documentary Credit:

Standby Documentary Credits (Contd) A Standby LC can facilitate transaction if the parties are not very well known to each other or when there is no established credit relationship. Standbys are used when the seller performs a transaction under a less secure method of payment, e.g. open account. Under a Standby LC the beneficiary will not need to present commercial and shipping documents as in the case under a Commercial LC. So the issuing bank can have the risk of having to pay against complying documents even when a party has not defaulted under a contract. The beneficiary under a commercial letter of credit must present certain documents issued by other parties before they can claim. On the other hand, under a Standby LC the beneficiary doesnt necessarily need to present all the docs under the commercial LC. However, the Standby LC may be satisfied by submitting the following docs, namely, (a) the Standby LC itself; (b) Sight draft(s) for the amount due; (c) Copies of relevant unpaid invoices; (d) A signed declaration from the beneficiary that payment covering the transaction has not been received under the agreed terms.

Presentation on International Trade Payment Practices

Discussion on basic fundamentals of some international payment practices : Few characteristics to note of a Documentary Credit: Standby Documentary Credits (Contd)

It is advisable where possible that the Standby LC should also call for some documents issued by an independent party other than the beneficiary to reduce the chance of miss-declaration by the beneficiary. As Standby LCs are used internationally and are becoming a popular payment instrument in the western part of the world, the ICC has developed certain rules for uniform handling of Standbys: The rules are i. Uniform Custom and Practice for Documentary Credits, Publication No. 600 (UCP 600 effective from July 1, 2007), which covers commercial and standby letters of credit; ii. International Standby Practices (ISP 98), which covers only standbys.

Das könnte Ihnen auch gefallen

- Incoterms: Eneral NformationDokument4 SeitenIncoterms: Eneral NformationrooswahyoeNoch keine Bewertungen

- Kennedy School of Government Case Program C14-99-1534.0Dokument26 SeitenKennedy School of Government Case Program C14-99-1534.0Andres SalinasNoch keine Bewertungen

- Logistics and Multi-Modal Transport: ICS Professional DiplomaDokument4 SeitenLogistics and Multi-Modal Transport: ICS Professional DiplomaOliver DsouzaNoch keine Bewertungen

- Intellectual Property RightsDokument21 SeitenIntellectual Property RightsSakshi BansalNoch keine Bewertungen

- Advancement in Technology in Water TransportDokument8 SeitenAdvancement in Technology in Water TransportAnkur BansalNoch keine Bewertungen

- RD of International Trade LawDokument6 SeitenRD of International Trade LawShikher GoelNoch keine Bewertungen

- Custom Clearance of Imported GoodsDokument6 SeitenCustom Clearance of Imported GoodsSabhaya ChiragNoch keine Bewertungen

- Patent Registration in IndiaDokument25 SeitenPatent Registration in IndiaRushikesh NikamNoch keine Bewertungen

- Lons West Africa - EnglishDokument48 SeitenLons West Africa - EnglishAllAfricaNoch keine Bewertungen

- Features of Water (Prevention and Control) Act 1974Dokument5 SeitenFeatures of Water (Prevention and Control) Act 1974JITENDER PAL SINGH100% (1)

- Information Technology Act 2000Dokument41 SeitenInformation Technology Act 2000siddharth devnaniNoch keine Bewertungen

- Alternative Dispute ResolutionDokument24 SeitenAlternative Dispute ResolutionpunithajobsNoch keine Bewertungen

- Public UtilityDokument3 SeitenPublic Utilitynurul sakdahNoch keine Bewertungen

- ParkingDokument3 SeitenParkinggandhi_akshay75420% (1)

- Republic Act No. 7916 "The Special Economic Zone Act of 1995"Dokument42 SeitenRepublic Act No. 7916 "The Special Economic Zone Act of 1995"hyosungloverNoch keine Bewertungen

- Geographical IndicationsDokument31 SeitenGeographical IndicationsChandrika Tewatia Raj100% (1)

- Procedure For Import and ExportDokument10 SeitenProcedure For Import and Exportswapneel234Noch keine Bewertungen

- Bretton Woods Complete InformationDokument1 SeiteBretton Woods Complete InformationNikhil Joshi100% (1)

- Introduction Foreign TradeDokument14 SeitenIntroduction Foreign Trade9702731617100% (4)

- Rules of OriginDokument11 SeitenRules of Originalvindadacay100% (1)

- International Trade and FinanceDokument28 SeitenInternational Trade and FinanceEHTMAM KHANNoch keine Bewertungen

- Scope of Cyber LawsDokument4 SeitenScope of Cyber Lawsrajat kanoiNoch keine Bewertungen

- Blood Donation:-A Social ResponsibilityDokument4 SeitenBlood Donation:-A Social ResponsibilityPavithraNoch keine Bewertungen

- PatentDokument10 SeitenPatentdivyangkvyasNoch keine Bewertungen

- The Arbitration and Conciliation Act 1996Dokument18 SeitenThe Arbitration and Conciliation Act 1996Rakesh MishraNoch keine Bewertungen

- New Microsoft Office PowerPoint PresentationDokument13 SeitenNew Microsoft Office PowerPoint PresentationNeelaksh SrivastavaNoch keine Bewertungen

- IT Act 2000Dokument22 SeitenIT Act 2000Nirav KothariNoch keine Bewertungen

- Role Function Powers of The Industrial CourtDokument17 SeitenRole Function Powers of The Industrial CourtEarl FinleyNoch keine Bewertungen

- Module 1 International Trade and WTODokument26 SeitenModule 1 International Trade and WTOMEHAK ZAIDINoch keine Bewertungen

- The Patent Act: Saurav Ghoshal Gulam Rafey Satyajeet Singh M.Pharm. I Yr. Pharmaceutics PSIT, KanpurDokument47 SeitenThe Patent Act: Saurav Ghoshal Gulam Rafey Satyajeet Singh M.Pharm. I Yr. Pharmaceutics PSIT, Kanpurkeenu23Noch keine Bewertungen

- Counter TradeDokument38 SeitenCounter TradethomasNoch keine Bewertungen

- Customs Cases Asylum and LotusDokument3 SeitenCustoms Cases Asylum and LotusLucas DelanoNoch keine Bewertungen

- Technical Barriers To TradeDokument11 SeitenTechnical Barriers To TradeBikash Jha100% (1)

- Patent: Presented by Saad FarooqDokument14 SeitenPatent: Presented by Saad FarooqHamza Masood100% (1)

- Business Diploma-May - June 2019Dokument29 SeitenBusiness Diploma-May - June 2019wonueNoch keine Bewertungen

- Hire Purchase FULL N FINALDokument12 SeitenHire Purchase FULL N FINALAmyt KadamNoch keine Bewertungen

- It ActDokument34 SeitenIt ActSanyam GoelNoch keine Bewertungen

- Transport FundamentalsDokument32 SeitenTransport FundamentalsmohsinaliNoch keine Bewertungen

- International Trade and Its Importance Adam Smith and The Theory of AA Narrative ReporttolosaDokument4 SeitenInternational Trade and Its Importance Adam Smith and The Theory of AA Narrative ReporttolosaNicki Lyn Dela Cruz100% (1)

- General Structure of ShippingDokument62 SeitenGeneral Structure of ShippingRamalingam ChandrasekharanNoch keine Bewertungen

- Rent Control Act 1Dokument16 SeitenRent Control Act 1krishna garg100% (1)

- Balance of Trade and Balance of PaymentDokument16 SeitenBalance of Trade and Balance of PaymentDr-Shefali Garg100% (1)

- Patent: Law Made Simple Intellectual Property Law Note 3 0f 7 NotesDokument44 SeitenPatent: Law Made Simple Intellectual Property Law Note 3 0f 7 Notesmusbri mohamed100% (1)

- Factoring A Better Altenative of Interna PDFDokument20 SeitenFactoring A Better Altenative of Interna PDFMuhammed HibbanNoch keine Bewertungen

- International TradeDokument2 SeitenInternational TradeDhanasekarNoch keine Bewertungen

- 6 - T-6 Transit & TransshipmentDokument3 Seiten6 - T-6 Transit & TransshipmentKesTerJeeeNoch keine Bewertungen

- Assignment of Ibdrm On ConciliationDokument5 SeitenAssignment of Ibdrm On Conciliationdeepti tiwariNoch keine Bewertungen

- Environmental Legislation in IndiaDokument13 SeitenEnvironmental Legislation in IndiaRuchi SinglaNoch keine Bewertungen

- Arbitration PDFDokument24 SeitenArbitration PDFmanivith reddy100% (1)

- Central Excise - Into & Basic ConceptsDokument21 SeitenCentral Excise - Into & Basic ConceptsMruduta JainNoch keine Bewertungen

- Section 4 Water Problems and Japan's EffortsDokument18 SeitenSection 4 Water Problems and Japan's EffortsBrighton Muguta100% (1)

- Covid e CourtsDokument1 SeiteCovid e CourtsKashish KocharNoch keine Bewertungen

- Public Nuisance MulheronDokument37 SeitenPublic Nuisance MulheronJoshua Victor AdamsNoch keine Bewertungen

- GSCM-18-Global Manufacturing and Materials ManagementDokument20 SeitenGSCM-18-Global Manufacturing and Materials Managementabdul rehmanNoch keine Bewertungen

- Chapter-1 Introduction To Unilever Bangladesh: Term Paper On Hris of Unilever BangaldeshDokument29 SeitenChapter-1 Introduction To Unilever Bangladesh: Term Paper On Hris of Unilever BangaldeshMuhammad Towfiqul IslamNoch keine Bewertungen

- Incoterms - International Shipping Incoterms Shipping IncotermDokument4 SeitenIncoterms - International Shipping Incoterms Shipping IncotermSrinivas SundaramNoch keine Bewertungen

- Chap 7Dokument12 SeitenChap 7Xuan Phuong HuynhNoch keine Bewertungen

- Terms Used in Shipping (INCO Terms) : Nitesh Shelly 09MBA095 Kanda Kumar 09MBA Abhijit 09MBADokument38 SeitenTerms Used in Shipping (INCO Terms) : Nitesh Shelly 09MBA095 Kanda Kumar 09MBA Abhijit 09MBAMukund BalasubramanianNoch keine Bewertungen

- Inco TermsDokument11 SeitenInco TermsMuhammad Ibrahim KhanNoch keine Bewertungen

- International Purchasing: Unit Code: BCP 400 Incoterms International Commercial Terms and Their DefinitionsDokument30 SeitenInternational Purchasing: Unit Code: BCP 400 Incoterms International Commercial Terms and Their DefinitionsLinto SophieNoch keine Bewertungen

- Statement On Unarmed Non-Police ResponseDokument4 SeitenStatement On Unarmed Non-Police ResponseWDIV/ClickOnDetroitNoch keine Bewertungen

- The Knowledge Society Book OkDokument17 SeitenThe Knowledge Society Book OkMan Iam StrongNoch keine Bewertungen

- KBP Program Announcers in Am - Radio Stations, Best Practices and ViolationsDokument65 SeitenKBP Program Announcers in Am - Radio Stations, Best Practices and ViolationsMICHELLE DIALOGONoch keine Bewertungen

- Transfer On Death - JointDokument1 SeiteTransfer On Death - JointJuan Carlos Chemello JimenezNoch keine Bewertungen

- FIDP TemplateDokument3 SeitenFIDP Templatemarlon anzanoNoch keine Bewertungen

- Mother Courage and Her ChildrenDokument11 SeitenMother Courage and Her ChildrenAnonymous s0LhehR7nNoch keine Bewertungen

- Invoice 2260, 2261, 2262Dokument4 SeitenInvoice 2260, 2261, 2262miroljubNoch keine Bewertungen

- Solution Manual For Design and Analysis of Experiments 10th Edition Douglas C MontgomeryDokument35 SeitenSolution Manual For Design and Analysis of Experiments 10th Edition Douglas C Montgomeryverminly.rhaetic96no100% (48)

- A Project Work On "A Study On Cash Flow Statement Analysis - at Penna Cement Industries LTDDokument4 SeitenA Project Work On "A Study On Cash Flow Statement Analysis - at Penna Cement Industries LTDEditor IJTSRDNoch keine Bewertungen

- LTO Application To Deposit Plan - V18Dokument1 SeiteLTO Application To Deposit Plan - V18anjeeNoch keine Bewertungen

- Vlookup ExampleDokument3 SeitenVlookup ExampleAnand KumarNoch keine Bewertungen

- Bank Voor Handel en Scheepvaart N. v. V Slatford and Another (1953) - 1-Q.B.-248Dokument52 SeitenBank Voor Handel en Scheepvaart N. v. V Slatford and Another (1953) - 1-Q.B.-248Tan KSNoch keine Bewertungen

- Media ResearchDokument53 SeitenMedia Researchdeepak kumarNoch keine Bewertungen

- List of HDWOsDokument16 SeitenList of HDWOsrohanagarwalNoch keine Bewertungen

- Tarlac - San Antonio - Business Permit - NewDokument2 SeitenTarlac - San Antonio - Business Permit - Newarjhay llave100% (1)

- AFC Statutes 2018Dokument60 SeitenAFC Statutes 2018Axel ChowNoch keine Bewertungen

- 2014 CFA Level 3 Mock Exam Morning - AnsDokument51 Seiten2014 CFA Level 3 Mock Exam Morning - AnsElsiiieNoch keine Bewertungen

- 7) Shangri-La v. Developers Group Case DigestDokument2 Seiten7) Shangri-La v. Developers Group Case DigestIvan Dizon100% (1)

- Week 31: What Was The Mein Kampf?Dokument3 SeitenWeek 31: What Was The Mein Kampf?Andrés GiraldoNoch keine Bewertungen

- Information Sheet Motorcycle Helmets Visors and Goggles Aug 10Dokument4 SeitenInformation Sheet Motorcycle Helmets Visors and Goggles Aug 10HANIFNoch keine Bewertungen

- Guinea Tax 2Dokument6 SeitenGuinea Tax 2Onur KopanNoch keine Bewertungen

- Asef Bayat (Editor) - Post-Islamism - The Changing Faces of Political Islam-Oxford University Press (2013)Dokument368 SeitenAsef Bayat (Editor) - Post-Islamism - The Changing Faces of Political Islam-Oxford University Press (2013)Alfin SanggilalungNoch keine Bewertungen

- Yellaiah AndeDokument5 SeitenYellaiah AndePatel PatelNoch keine Bewertungen

- RahulVansh - SS101 FALL MIDTERM EXAMDokument2 SeitenRahulVansh - SS101 FALL MIDTERM EXAMRahul VanshNoch keine Bewertungen

- CHAPTER 14 of CPADokument8 SeitenCHAPTER 14 of CPAAluve MbiyozoNoch keine Bewertungen

- United States Court of Appeals For The Ninth CircuitDokument81 SeitenUnited States Court of Appeals For The Ninth CircuitMaureen Dowling100% (1)

- Gallagher Marine Hull Machinery Report 02 21Dokument11 SeitenGallagher Marine Hull Machinery Report 02 21Nguyen Thanh LongNoch keine Bewertungen

- Problem 1 (Wholly Owned Subsidiary) :: Holding Companies: Problems and SolutionsDokument9 SeitenProblem 1 (Wholly Owned Subsidiary) :: Holding Companies: Problems and SolutionsRafidul IslamNoch keine Bewertungen

- 1st National Virtual Negotiation Competition Brochure (With Registration Link) - LAW ADDICTSDokument7 Seiten1st National Virtual Negotiation Competition Brochure (With Registration Link) - LAW ADDICTSKRISHNA VIDHUSHANoch keine Bewertungen

- Annex A Application Form - P3Dokument37 SeitenAnnex A Application Form - P3Dorina TicuNoch keine Bewertungen

- Arizona, Utah & New Mexico: A Guide to the State & National ParksVon EverandArizona, Utah & New Mexico: A Guide to the State & National ParksBewertung: 4 von 5 Sternen4/5 (1)

- The Bahamas a Taste of the Islands ExcerptVon EverandThe Bahamas a Taste of the Islands ExcerptBewertung: 4 von 5 Sternen4/5 (1)

- Japanese Gardens Revealed and Explained: Things To Know About The Worlds Most Beautiful GardensVon EverandJapanese Gardens Revealed and Explained: Things To Know About The Worlds Most Beautiful GardensNoch keine Bewertungen

- New York & New Jersey: A Guide to the State & National ParksVon EverandNew York & New Jersey: A Guide to the State & National ParksNoch keine Bewertungen

- South Central Alaska a Guide to the Hiking & Canoeing Trails ExcerptVon EverandSouth Central Alaska a Guide to the Hiking & Canoeing Trails ExcerptBewertung: 5 von 5 Sternen5/5 (1)

- Naples, Sorrento & the Amalfi Coast Adventure Guide: Capri, Ischia, Pompeii & PositanoVon EverandNaples, Sorrento & the Amalfi Coast Adventure Guide: Capri, Ischia, Pompeii & PositanoBewertung: 5 von 5 Sternen5/5 (1)