Beruflich Dokumente

Kultur Dokumente

KKR To Partner With Management To Acquire SMCP Group

Hochgeladen von

Alex HoltOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

KKR To Partner With Management To Acquire SMCP Group

Hochgeladen von

Alex HoltCopyright:

Verfügbare Formate

KKR to Partner with Management to Acquire SMCP Group

KKR is a private equity group with $75 billion in assets, based out of New York City. It was co-founded by cousins Henry Kravis and George R Roberts.

KKR is investing in SMCP Group to drive further growth under strong leadership of current management team and to create a global leader in affordable luxury PARIS & LONDON--(BUSINESS WIRE)-- Kohlberg Kravis Roberts & Co. LP (together with its affiliates, "KKR") and SMCP Group (Sandro, Maje and Claudie Pierlot) ("SMCP" or "the Company"), a leading ready-to-wear affordable luxury apparel retailer, today announced that KKR signed a definitive agreement with SMCP's current shareholders to acquire a majority stake in the Company alongside its management team. KKR will own approximately 65% of the Company's share capital with management retaining approximately 35%. The agreement remains subject to regulatory approvals and customary closing conditions. "I have created this beautiful family history with my sister, Judith Milgrom, and I am pleased to embark on a new phase of our lives with KKR. Alongside Elie Kouby and Frdric Biousse, Judith and I are reaffirming our full commitment to the business and have great ambitions for the group: building a global leader in the affordable luxury segment", said Evelyne Chtrite, President of SMCP Group. "We are excited to partner with KKR", added Frdric Biousse, the CEO of SMCP Group. "We are proud of the Company's strong development over the recent years and would like to thank our shareholders L Capital and Florac for their support. We look forward to working with KKR as we accelerate the international expansion of our brands, particularly in the United States and Asia. KKR's global presence and extensive experience and track-record in the international retail sector will be important assets in helping us continue our growth trajectory".

Jacques Garaalde, Partner and Managing Director in charge of KKR's French operations, added, "SMCP is a remarkable business with an outstanding management team. The Company has developed strong French brands with international appeal, and high quality products at affordable prices that meet the needs of consumers around the world. We are pleased to support the team in their growth strategy". Over the past five years, the Company has experienced significant growth driven by a combination of like-for-like growth and new store openings across its four brands: Sandro, Sandro Men, Maje and Claudie Pierlot. Today, the Company has established a leading position in the French affordable luxury segment and a fast-growing international business with strong positions in Europe and a growing presence in the USA and more recently Asia. SMCP operates more than 570 points of sale, and generated a turnover of 350 million euros in 2012. Approximately 150 new store openings are planned for 2013, mainly outside France. "We are delighted to have accompanied SMCP Group during the last couple of years of rapid development and we wish the managers, founders and KKR much success", added Daniel Piette and Eduardo Velasco from L Capital and Lopold Meyer from Florac. KKR was advised by Rothschild & Cie and SMCP Group was advised by J.P. Morgan and Leonardo & Co.

About SMCP Group SMCP Group is a leading apparel retailing group, operating in the attractive affordable luxury apparel segment across four brands: Sandro, Sandro Men, Maje and Claudie Pierlot. Sandro and Maje were founded by Evelyne and Didier Chtrite and Judith Milgrom and Alain Moyal in the late 1980s and 1990s, respectively. In 2007, Evelyne and Judith were joined by Frdric Biousse and Elie Kouby to accelerate the development of their brands. Claudie Pierlot was acquired in early 2009 and SMCP Group was subsequently created in 2010 upon an investment made by L Capital and Florac. SMCP Group developed a unique and effective business model: combining luxury codes (marketing & communication, shopping experience) with creative design content and high-quality fabrics while leveraging best practices from the fast fashion industry (short collection cycles and reactivity to market trends supported by an efficient supply chain). Having already opened 69 retail outlets in North America over the last 18 months, Sandro, Maje, and Claudie Pierlot also have five stores in Hong Kong and will open their two first stores in Shanghai in July, followed by four additional stores by the end of the year. About KKR Founded in 1976 and led by Henry Kravis and George Roberts, KKR is a leading global investment firm with $75.5 billion in assets under management as of December 31st, 2012. With offices around the world, KKR manages assets through a variety of investment funds and accounts covering multiple asset classes.

KKR seeks to create value by bringing operational expertise to its portfolio companies and through active oversight and monitoring of its investments. KKR & Co. L.P. is publicly traded on the New York Stock Exchange (NYSE: KKR), and "KKR," as used in this release, includes its subsidiaries, their managed investment funds and accounts, and/or their affiliated investment vehicles, as appropriate. Shareholders L Capital: Eduardo Velasco, Philippe Franchet and Manal Saleh Florac: Lopold Meyer, Olivier Golder and Gautier Preney Advisers Buyers: Rothschild & Cie (Laurent Baril), Bredin Prat (Sbastien Prat), Simpson Thacher & Bartlett, Landwell, McKinsey, Roland Berger, Anne Beall, Deloitte. Sellers: JP Morgan (Sverin Brizay), Leonardo & Co (Laurance Danon), The Financial Company of Edmond de Rothschild, SJ Berwin (Jrme Jouhanneaud), DLA Piper (Michel Frieh), Shearman & Sterling (Guillaume Isaultier), KPMG (Axel Rebaudires and Vincent Delmas), Taj (Sophie Blegent-Delaphille), Oloyrn (Frdric Jannin and Eric Lesieur).

KKR Image 7 Estelle Guillot-Tantay + 33 1 53 70 74 93 or RLM Finsbury Michael Turner / Nina Suter +44 207 251 3801 Source: KKR News Provided by Acquire Media

Das könnte Ihnen auch gefallen

- The Art of Investing and Portfolio ManagementVon EverandThe Art of Investing and Portfolio ManagementBewertung: 5 von 5 Sternen5/5 (1)

- KKR Annual Review 2006Dokument53 SeitenKKR Annual Review 2006AsiaBuyoutsNoch keine Bewertungen

- Value: The Four Cornerstones of Corporate FinanceVon EverandValue: The Four Cornerstones of Corporate FinanceBewertung: 4.5 von 5 Sternen4.5/5 (18)

- Chapter - 1 Motive of Summer Training: Mohd. Tabish 1Dokument82 SeitenChapter - 1 Motive of Summer Training: Mohd. Tabish 1Baba KhanNoch keine Bewertungen

- The Brandgym, third edition: A Practical Workout to Grow Your Brand in a Digital AgeVon EverandThe Brandgym, third edition: A Practical Workout to Grow Your Brand in a Digital AgeNoch keine Bewertungen

- Tapestry-Capri AcquisitionDokument2 SeitenTapestry-Capri Acquisitionmanick 08Noch keine Bewertungen

- About DubaiDokument17 SeitenAbout DubaiAnt SoNoch keine Bewertungen

- Info On DiageoDokument11 SeitenInfo On DiageoChevaughne MillerNoch keine Bewertungen

- Pre Release Super. DryDokument7 SeitenPre Release Super. DryDuane MendesNoch keine Bewertungen

- GCE Business Studies 6BS04 01 Pre-Release January 2013 EdexcelDokument7 SeitenGCE Business Studies 6BS04 01 Pre-Release January 2013 EdexcelEzioAudi77100% (2)

- MSE WRSX Group Profile v2 01Dokument32 SeitenMSE WRSX Group Profile v2 01MirnesNoch keine Bewertungen

- MSE WRSX Group Profile v2 01Dokument32 SeitenMSE WRSX Group Profile v2 01MirnesNoch keine Bewertungen

- CREDO PresentationDokument23 SeitenCREDO PresentationPampalini01Noch keine Bewertungen

- Opalesque Roundtable Series - Geneva 2012Dokument29 SeitenOpalesque Roundtable Series - Geneva 2012Opalesque PublicationsNoch keine Bewertungen

- Mont Saint-Victor Le Teil Viviers Argillaceous Cement: Hydraulic Lime French Construction Aggregates ConcreteDokument4 SeitenMont Saint-Victor Le Teil Viviers Argillaceous Cement: Hydraulic Lime French Construction Aggregates ConcreteArpit BishnoiNoch keine Bewertungen

- Hailey College of Commerce University of PunjabDokument12 SeitenHailey College of Commerce University of PunjabFaryal MunirNoch keine Bewertungen

- LVMH StrategyDokument8 SeitenLVMH Strategyaj_chowdary100% (2)

- Opalesque 2011 UK RoundtableDokument34 SeitenOpalesque 2011 UK RoundtableOpalesque PublicationsNoch keine Bewertungen

- Opalesque 2010 Roundtable GenevaDokument25 SeitenOpalesque 2010 Roundtable GenevaOpalesque PublicationsNoch keine Bewertungen

- Opalesque 2011 Cayman RoundtableDokument22 SeitenOpalesque 2011 Cayman RoundtableOpalesque PublicationsNoch keine Bewertungen

- IPO PortoDokument23 SeitenIPO PortoBayuRedgiantchildNoch keine Bewertungen

- S Kumar's Nationwide Limited: Business Model/StrategyDokument5 SeitenS Kumar's Nationwide Limited: Business Model/Strategyanubhav1109Noch keine Bewertungen

- Company: Client-Driven Investment SolutionsDokument2 SeitenCompany: Client-Driven Investment SolutionsKo NgeNoch keine Bewertungen

- Business Plan For SpeedX in Canada-3Dokument16 SeitenBusiness Plan For SpeedX in Canada-3YASH JOHRI-DM 21DM222Noch keine Bewertungen

- AIG ChartisDokument29 SeitenAIG ChartisVariantPerceptionsNoch keine Bewertungen

- EuroHedge Summit Brochure - April 2011Dokument12 SeitenEuroHedge Summit Brochure - April 2011Absolute ReturnNoch keine Bewertungen

- Kreos Capital Press Release 23 April 2007Dokument3 SeitenKreos Capital Press Release 23 April 2007Marius RusNoch keine Bewertungen

- Inventory & Working Capital Management & ValuationDokument56 SeitenInventory & Working Capital Management & ValuationAmit WankarNoch keine Bewertungen

- Sebi Anti Money LaunderingDokument10 SeitenSebi Anti Money LaunderingSushil KewlaniNoch keine Bewertungen

- Elle Saab Case Write Up Group 2Dokument6 SeitenElle Saab Case Write Up Group 2Nischal KanthNoch keine Bewertungen

- Opalesque Roundtable Series - Brazil 2012Dokument24 SeitenOpalesque Roundtable Series - Brazil 2012Opalesque PublicationsNoch keine Bewertungen

- EuroHedge Summit Brochure - March 2012Dokument12 SeitenEuroHedge Summit Brochure - March 2012Absolute ReturnNoch keine Bewertungen

- Company Analysis PaperDokument10 SeitenCompany Analysis Papersameen shafaatNoch keine Bewertungen

- LOREAL Rapport Activite 2012 GBDokument96 SeitenLOREAL Rapport Activite 2012 GBDolce VitaNoch keine Bewertungen

- History: Religare Enterprises Limited (REL) Is A Diversified Financial Services Group Headquartered in NewDokument4 SeitenHistory: Religare Enterprises Limited (REL) Is A Diversified Financial Services Group Headquartered in NewJayati BhasinNoch keine Bewertungen

- KKR Annual Review 2008Dokument77 SeitenKKR Annual Review 2008AsiaBuyoutsNoch keine Bewertungen

- Killer Annual ReportDokument168 SeitenKiller Annual ReportShaswat SinghNoch keine Bewertungen

- Case Study 5 BUS 421 OL 009 JPattersonDokument6 SeitenCase Study 5 BUS 421 OL 009 JPattersonblankteknoNoch keine Bewertungen

- Loreal Paris AssignmentDokument11 SeitenLoreal Paris AssignmentZarmin GullNoch keine Bewertungen

- Private Equity Advent International 2008 Global HighlightsDokument27 SeitenPrivate Equity Advent International 2008 Global HighlightsAsiaBuyouts100% (2)

- Gul Ahmed Final ReportDokument26 SeitenGul Ahmed Final ReportHira Qidwai67% (3)

- Pernod RicardDokument18 SeitenPernod RicardSarsal6067Noch keine Bewertungen

- Seasif World Profile March 25 2021Dokument29 SeitenSeasif World Profile March 25 2021Fundiciones EENoch keine Bewertungen

- Stratma-1-Case-Paper-Dimaano, Rian JayDokument6 SeitenStratma-1-Case-Paper-Dimaano, Rian JayRJ DimaanoNoch keine Bewertungen

- Charles & Keith 1Dokument39 SeitenCharles & Keith 1Shruti Jhunjhunwala75% (4)

- International Management Assignment 2 - Leithycia DeschezeauxDokument20 SeitenInternational Management Assignment 2 - Leithycia DeschezeauxLeithycia DeschézeauxNoch keine Bewertungen

- Millennium Management: BY: Group 5Dokument16 SeitenMillennium Management: BY: Group 5anjishilpa anjishilpaNoch keine Bewertungen

- LandmarkDokument5 SeitenLandmarkapi-3716851Noch keine Bewertungen

- Manitou Group's Annual Report 2012Dokument200 SeitenManitou Group's Annual Report 2012Manitou GroupNoch keine Bewertungen

- Company Overview:: Corporate Finance ProjectDokument17 SeitenCompany Overview:: Corporate Finance ProjectmaryamNoch keine Bewertungen

- About Kotak Life InsuranceDokument6 SeitenAbout Kotak Life InsuranceSundeepKumarReddyNoch keine Bewertungen

- Corp. Governance Framework (HSBC)Dokument13 SeitenCorp. Governance Framework (HSBC)edoolawNoch keine Bewertungen

- Tech PresentationDokument19 SeitenTech PresentationRajan DubeyNoch keine Bewertungen

- Enterprise Solutions To Scale: Lessons Learned in Catalysing Sustainable Solutions To Global Development ChallengesDokument60 SeitenEnterprise Solutions To Scale: Lessons Learned in Catalysing Sustainable Solutions To Global Development ChallengesAkhandal MohantyNoch keine Bewertungen

- The First Assignment For StrategyDokument7 SeitenThe First Assignment For StrategySơn TùngNoch keine Bewertungen

- Fathema Global Strategy, Development and Implementation (3000 Words)Dokument20 SeitenFathema Global Strategy, Development and Implementation (3000 Words)Azmain KhanNoch keine Bewertungen

- Company Analysis Paper NewDokument13 SeitenCompany Analysis Paper Newsameen shafaatNoch keine Bewertungen

- VISION ArvindDokument26 SeitenVISION ArvindPalak MehrotraNoch keine Bewertungen

- KORS Equity Research ReportDokument21 SeitenKORS Equity Research ReportJeremy_Edwards11Noch keine Bewertungen

- LVMH Ra GB 2019 PDFDokument148 SeitenLVMH Ra GB 2019 PDFLee KangNoch keine Bewertungen

- AFTER DOMA: Ken Mehlman On What's Next at OUT OnlineDokument6 SeitenAFTER DOMA: Ken Mehlman On What's Next at OUT OnlineAlex HoltNoch keine Bewertungen

- Private Equity Firm KKR, Appoints Shusaku Minoda To Chairman, Hirofumi Hirano Joins As CEODokument6 SeitenPrivate Equity Firm KKR, Appoints Shusaku Minoda To Chairman, Hirofumi Hirano Joins As CEOAlex HoltNoch keine Bewertungen

- British Private Equity Is Losing Out To American Firms Such As KKR's Henry Kravis and Blackstone's Stephen SchwarzmanDokument9 SeitenBritish Private Equity Is Losing Out To American Firms Such As KKR's Henry Kravis and Blackstone's Stephen SchwarzmanAlex HoltNoch keine Bewertungen

- PEI Media Presents (With Well-Known Members Such As Dean B Nelson and Anne Rannaleet) - PERE Global Investor Forum Apirl 9-10, 2013Dokument10 SeitenPEI Media Presents (With Well-Known Members Such As Dean B Nelson and Anne Rannaleet) - PERE Global Investor Forum Apirl 9-10, 2013Alex HoltNoch keine Bewertungen

- SWOT Analysis of Hospitality IndustryDokument2 SeitenSWOT Analysis of Hospitality Industryaltinakhot0% (2)

- Firms in Competitive MarketsDokument9 SeitenFirms in Competitive MarketsYasmine JazzNoch keine Bewertungen

- AP Microeconomics Course and Exam DescriptionDokument182 SeitenAP Microeconomics Course and Exam DescriptionEllie KerNoch keine Bewertungen

- O&SCM Introduction & Operations Strategy - PPSXDokument60 SeitenO&SCM Introduction & Operations Strategy - PPSXRuchi DurejaNoch keine Bewertungen

- Appendix 2: Revenue and Expenditures of Chaman BCP From Year 01 To YearDokument1 SeiteAppendix 2: Revenue and Expenditures of Chaman BCP From Year 01 To YearKAshif UMarNoch keine Bewertungen

- Positioning and PLCDokument14 SeitenPositioning and PLCAvishek JainNoch keine Bewertungen

- Private Equity AsiaDokument12 SeitenPrivate Equity AsiaGiovanni Graziano100% (1)

- Remaking The North America Food SystemDokument385 SeitenRemaking The North America Food SystemSnuse04100% (1)

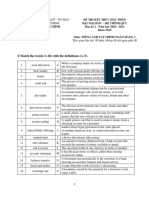

- Đề thi tiếng Anh chuyên ngành Tài chính Ngân hàng 1Dokument4 SeitenĐề thi tiếng Anh chuyên ngành Tài chính Ngân hàng 1Hoang TrieuNoch keine Bewertungen

- Winter '21 1150-004Dokument7 SeitenWinter '21 1150-004Rafael DomingosNoch keine Bewertungen

- Addressing The Sustainable Development Through Sustainable Procurement What Factors Resist The Implementation of Sustainable Procurement in PakistanDokument37 SeitenAddressing The Sustainable Development Through Sustainable Procurement What Factors Resist The Implementation of Sustainable Procurement in PakistanEngr Awais Tahir MughalNoch keine Bewertungen

- ISO Certification in NepalDokument9 SeitenISO Certification in NepalAbishek AdhikariNoch keine Bewertungen

- Becg m-4Dokument25 SeitenBecg m-4CH ANIL VARMANoch keine Bewertungen

- Jongmann - The Transformation of Economic Life Under The Roman Empire - THE ROMAN ECONOMY - FROM CITIES TO EMPIREDokument20 SeitenJongmann - The Transformation of Economic Life Under The Roman Empire - THE ROMAN ECONOMY - FROM CITIES TO EMPIREjorge ricardo camaraNoch keine Bewertungen

- Solution Jan 2018Dokument8 SeitenSolution Jan 2018anis izzatiNoch keine Bewertungen

- Coal Import ProcessDokument5 SeitenCoal Import Processsmyns.bwNoch keine Bewertungen

- SalesDokument19 SeitenSalesdrbrijmohanNoch keine Bewertungen

- 1 8 - PestelDokument2 Seiten1 8 - PestelMai HươngNoch keine Bewertungen

- Option One 2006-1 Jul07Dokument72 SeitenOption One 2006-1 Jul07janisnagobadsNoch keine Bewertungen

- RGPPSEZ - Annual Report - 2022 - ENGDokument149 SeitenRGPPSEZ - Annual Report - 2022 - ENGsteveNoch keine Bewertungen

- IPRDokument25 SeitenIPRsimranNoch keine Bewertungen

- What Are Commercial BanksDokument3 SeitenWhat Are Commercial BanksShyam BahlNoch keine Bewertungen

- An Assignment: Case Study of Dell Inc.-Push or Pull?Dokument3 SeitenAn Assignment: Case Study of Dell Inc.-Push or Pull?Shahbaz NaserNoch keine Bewertungen

- AU Small Finance Bank - Research InsightDokument6 SeitenAU Small Finance Bank - Research InsightDickson KulluNoch keine Bewertungen

- Week 14: Game Theory and Pricing Strategies Game TheoryDokument3 SeitenWeek 14: Game Theory and Pricing Strategies Game Theorysherryl caoNoch keine Bewertungen

- IC38 SushantDokument46 SeitenIC38 SushantAyush BhardwajNoch keine Bewertungen

- Spring Specialisations List Updated 10062021Dokument19 SeitenSpring Specialisations List Updated 10062021ashokNoch keine Bewertungen

- Intro To Inclusive BuisnessDokument27 SeitenIntro To Inclusive BuisnessKhalid AhmedNoch keine Bewertungen

- Smart Manufacturing Market - Innovations & Competitive Analysis - Forecast - Facts and TrendsDokument2 SeitenSmart Manufacturing Market - Innovations & Competitive Analysis - Forecast - Facts and Trendssurendra choudharyNoch keine Bewertungen

- Starbucks MissionDokument2 SeitenStarbucks MissionMine SayracNoch keine Bewertungen