Beruflich Dokumente

Kultur Dokumente

Income Under The Head "Salaries"

Hochgeladen von

Santosh Saroj0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

52 Ansichten22 Seitenb

Originaltitel

Salary

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PPT, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenb

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

52 Ansichten22 SeitenIncome Under The Head "Salaries"

Hochgeladen von

Santosh Sarojb

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 22

INCOME UNDER THE HEAD SALARIES

Meaning of Salary

Relationship between payer and payee No conceptual difference between salary and wages Salary from more than one source Salary from former, present or prospective employer Salary income must be real foregoing of salary is an application of income Surrender of salary benefit available to all Salary paid tax-free Voluntary payments gratuitous v/s contractual

Salary under Section 17(1)

Wages Any annuity or pension Any gratuity Any fees, commission, perquisites or profits Any advance of salary Any payment received by an employee in respect of any period of leave not availed Portion of annual accretion in any previous year to balance at credit of an employee participating in recognised provident fund to the extent taxable Contribution by CG under a pension scheme

Basis of charge of Salary income

taxable on due or receipt basis, whichever is earlier accounting method of the employee not relevant place of accrual of salary income [ Section 9(1)] accrued in India even if it is payable outside India or payable after contract of employment in India comes to an end pension paid in respect of services in India is deemed to accrue or arise in India leave salary paid abroad in respect of leave in India is also deemed to accrue or arise in India

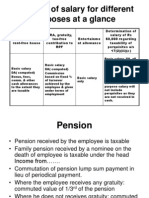

Different forms of Salary

Advance salary: taxable on receipt basis Arrear salary: taxable on receipt basis if not taxed earlier on due basis Leave salary: Fully exempt for Govt. employees, while fully or partly exempt from tax for Non-Govt. employees Period of earned leave to credit* avg. monthly pay 10 * avg. monthly pay Amount specified by the Govt. now Rs. 3,00,000 leave encashment actually received on retirement

Different forms of Salary

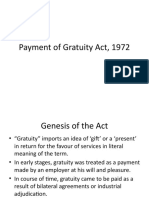

salary in lieu of notice period: taxable on receipt basis salary to a partner: it is appropriation of profit fees and commission bonus: taxable as receipt if not as due earlier Gratuity [ Section 10(10)]: 15 days salary ( 7 days in seasonal works ) Rs. 3,50,000 gratuity actually received salary includes basic+dearness allowance only

Different forms of Salary

Pension: uncommuted pension is a periodical payment taxable for Govt. and Non-Govt. employees commuted pension is a lump sum payment in lieu of periodical payment One-third of the commuted pension is exempt from tax when gratuity is received; otherwise onehalf of commuted pension is exempt from tax pension scheme in case of an employee joining Central Government on or after Jan. 1, 2004

Different forms of Salary

Annuity [ Section 17(1)(ii)]: annuity payable is taxable even if voluntarily paid annuity from an ex-employer is taxed as profit in lieu of salary annual accretion to credit balance in provident fund amount transferred from unrecognised provident fund to recognised provident fund remuneration for extra duties:

Different forms of Salary

retrenchment compensation [ Section 10(10B)]: amount calculated in accordance with Industrial Disputes Act, 1947 i.e. 15 days average pay amount as notified by the Govt. Rs. 5,00,000 amount received profits in lieu of salary [ Section 17(3)]: voluntary payments to employees salary received from UNO compensation received at time of voluntary retirement [ Section 10(10C)]:

Allowances- how taxed ?

City compensatory allowance house rent allowance [ Section 10(13A) & rule 2A ]: salary includes dearness allowance, commission based on fixed percentage of turnover salary is determined on due basis amount equal to 50% or 40% of salary house rent allowance received excess of rent paid over 10% of salary exemption not available in case of own house or no rent paid or rent not exceeding 10% of salary

Allowances- how taxed ?

entertainment allowance [ Section 16(ii) ]: Rs. 5,000 20% of basic salary amount of allowance granted during the year here, salary excludes any allowance, benefit or perquisites For Non-Govt. employee, it is not deductible allowance to Govt. employees outside India: wholly exempt from tax tiffin allowance

Allowances- how taxed ?

special allowances under section 10(14): amount of the allowance amount utilised for the specific purpose travelling/ transfer allowance, daily allowance, helper allowance, research allowance etc. hill area, border area, tribal area allowances fixed medical allowance servant allowance allowance to high court and supreme court judges allowance received from UNO

Perquisite when taxable

It is an casual emolument or benefit attached to an office or position in addition to salary or wages they are included in salary income only if they are received by an employee from his employer in case of perquisites being received from a person other than an employer, they are taxable under profits and gains of business & profession or income from other sources perquisite needs to have a legal origin, any unauthorised advantage by an employee is not taken as perquisite taxable under the act

Perquisite when taxable

Perquisites can be defined by following items: value of any rent-free accommodation value of any concession in the matter of rent value of any benefit or amenity granted or provided free of cost or at concessional rate any sum paid by the employer for an obligation which would have to be paid by the employee any sum payable by employer through a fund not being recognised provident fund or approved superannuation fund or effect contract for an annuity

Perquisite when taxable

Following perquisites are taxable in all cases: rent-free accommodation accommodation at concessional rent employees obligation met by employer amount payable by employer to effect an assurance on life of employee Some perquisites are taxable in the case of specified employees Valuation of rent-free unfurnished accommodation: according to licence fee prescribed by Govt.

Perquisite when taxable

Valuation of rent-free furnished accommodation: find for unfurnished accommodation then add value of furniture, which will be either 10% per annum of original cost of furniture or actual hire charges payable Valuation of accommodation at concessional rent: find the value of perquisite on assumption of no rent charged by the employer further deduct rent charged by employer If balance amount is positive, it is taxable

Perquisite when taxable

Valuation of perquisite in respect of motorcar: depends on the cubic capacity of the engine and whether driver is provided also its use has to be seen in terms of official only or private or official and private purposes rules change according to the ownership of car and how various expenses are met Valuation or perquisite for gas, electricity or water supply: depends on whether purchased from outside or supplied out of own sources by the employer

Perquisite when taxable

Valuation of perquisite for free education: fixed education and hostel expenditure allowance for maximum 2 children Valuation of perquisite in respect of free transport Valuation in respect of free domestic servants Valuation in respect of interest-free loan or loan at concessional rate when the loan id given for medical treatment and does not exceed Rs. 20,000, it is not taxable Interest rates charged by SBI are taken for valuation

Perquisite when taxable

Valuation in respect of lunch/refreshment Valuation in respect of travelling, tourist accommodation Valuation in respect of gift, voucher or token Valuation in respect of credit card Valuation in respect of club expenditure Valuation in respect of use of movable assets Valuation in respect of movable assets sold by an employer to its employees at a nominal price Valuation in respect of leave travel concession

Perquisite when taxable

Valuation of leave travel concession to a foreign citizen Valuation of medical facilities Issue of right shares to an employee-shareholder Allotment of shares/securities under stock option or sweat equity plan Valuation of other perquisites Permissible deductions from salary income: entertainment allowance deduction professional tax

Perquisite when taxable

Tax treatment of provident fund: employees provident fund may be statutory or unrecognised or recognised provident fund Tax treatment of approved superannuation fund: it means a fund that has been and continues to be approved by Commissioner with rules in part B of the fourth schedule

Is salaried employee entitled to relief w.r.t salary in arrears, advance etc.

Computation of relief in respect of compensation on termination of employment Computation of relief in respect of payment in commutation of pension Computation of relief in respect of other payments Procedure for claiming the tax relief Computation of relief in respect of arrears or advance Computation of relief in respect of gratuity

Das könnte Ihnen auch gefallen

- Tax Planning With Example, Compensation MGMTDokument40 SeitenTax Planning With Example, Compensation MGMTrashmi_shantikumarNoch keine Bewertungen

- Fta Checklist Group NV 7-6-09Dokument7 SeitenFta Checklist Group NV 7-6-09initiative1972Noch keine Bewertungen

- RA MEWP 0003 Dec 2011Dokument3 SeitenRA MEWP 0003 Dec 2011Anup George Thomas100% (1)

- 1040 Exam Prep Module IV: Items Excluded from Gross IncomeVon Everand1040 Exam Prep Module IV: Items Excluded from Gross IncomeNoch keine Bewertungen

- Al Fara'aDokument56 SeitenAl Fara'azoinasNoch keine Bewertungen

- Ngulchu Thogme Zangpo - The Thirty-Seven Bodhisattva PracticesDokument184 SeitenNgulchu Thogme Zangpo - The Thirty-Seven Bodhisattva PracticesMario Galle MNoch keine Bewertungen

- Income From SalariesDokument48 SeitenIncome From Salarieskeerthana_hassan67% (6)

- Ciac Revised Rules of ProcedureDokument16 SeitenCiac Revised Rules of ProcedurebidanNoch keine Bewertungen

- International Marketing StrategiesDokument19 SeitenInternational Marketing StrategiesHafeez AfzalNoch keine Bewertungen

- Income From The Head "Salary"Dokument29 SeitenIncome From The Head "Salary"Sahitya Kumar SheeNoch keine Bewertungen

- Chapter 4: Income From Salaries (Section 15 To 17) : Advance Direct Tax and Service Tax (Sub Code: 441)Dokument34 SeitenChapter 4: Income From Salaries (Section 15 To 17) : Advance Direct Tax and Service Tax (Sub Code: 441)Puneeth DhondaleNoch keine Bewertungen

- Salary Income (Sec15,16 & 17)Dokument48 SeitenSalary Income (Sec15,16 & 17)Sarvesh MishraNoch keine Bewertungen

- What is Salary - Income Tax Meaning and ComponentsDokument12 SeitenWhat is Salary - Income Tax Meaning and ComponentsAlezNoch keine Bewertungen

- Taxation Law ProjectDokument16 SeitenTaxation Law ProjectAtinNoch keine Bewertungen

- Income From SalaryDokument19 SeitenIncome From SalaryAnupriya BajpaiNoch keine Bewertungen

- Salaries: Lecture NotesDokument12 SeitenSalaries: Lecture Notesapi-3832224100% (1)

- Income From Salart 27-04-2021 (Recovered)Dokument111 SeitenIncome From Salart 27-04-2021 (Recovered)Harshit YNoch keine Bewertungen

- Income From SalaryDokument66 SeitenIncome From SalaryShamika LloydNoch keine Bewertungen

- Perquisites in Indian Tax SystemDokument5 SeitenPerquisites in Indian Tax SystemShreyas DalviNoch keine Bewertungen

- Employment IncomeDokument12 SeitenEmployment Incomemusobya godfreyNoch keine Bewertungen

- Taxation Law HeadingsDokument41 SeitenTaxation Law HeadingsAR RahoojoNoch keine Bewertungen

- SalaryDokument13 SeitenSalarydharm287Noch keine Bewertungen

- Recalling Income From Salary and House PropertyDokument75 SeitenRecalling Income From Salary and House Propertypritesh.ks1409Noch keine Bewertungen

- Unit 4-CormDokument47 SeitenUnit 4-CormPrashanthNoch keine Bewertungen

- Income Under Head SalariesDokument61 SeitenIncome Under Head SalariesAbhinay SrivastavNoch keine Bewertungen

- MG 3027 TAXATION - Week 8 Income From EmploymentDokument44 SeitenMG 3027 TAXATION - Week 8 Income From EmploymentSyed SafdarNoch keine Bewertungen

- Module 2 - TaxationDokument69 SeitenModule 2 - TaxationAnik KararNoch keine Bewertungen

- EXCLUSIONSDokument8 SeitenEXCLUSIONSMeliodas SamaNoch keine Bewertungen

- Gratuiuty ActDokument10 SeitenGratuiuty ActPrachi B.Noch keine Bewertungen

- Unit 2 SalaryDokument131 SeitenUnit 2 SalaryRekha BansalNoch keine Bewertungen

- Income Under The Head "Salaries"Dokument7 SeitenIncome Under The Head "Salaries"Rahul AgarwalNoch keine Bewertungen

- Income TaxAct 1961Dokument48 SeitenIncome TaxAct 1961api-386513388% (8)

- Chapter 6Dokument38 SeitenChapter 6assadrafaqNoch keine Bewertungen

- Gross Income Regular Tax: MARCH 2019Dokument57 SeitenGross Income Regular Tax: MARCH 2019tyineNoch keine Bewertungen

- Tax Rules for Salary IncomeDokument16 SeitenTax Rules for Salary IncomeNoob GamerNoch keine Bewertungen

- Taxation Law: 2019 Bar Examinations Last Minute LectureDokument51 SeitenTaxation Law: 2019 Bar Examinations Last Minute LectureApril VillanuevaNoch keine Bewertungen

- Gratuity ActDokument34 SeitenGratuity Actapi-369848680% (5)

- Salary Presentation 1Dokument56 SeitenSalary Presentation 1NIRAVNoch keine Bewertungen

- CTT - April 15 and 16 2023Dokument81 SeitenCTT - April 15 and 16 2023bandocamilleNoch keine Bewertungen

- CTT Compilation - October 2023Dokument270 SeitenCTT Compilation - October 2023Arsenio N. RojoNoch keine Bewertungen

- Inclusion and Exclusion of Gross IncomeDokument70 SeitenInclusion and Exclusion of Gross IncomeEnola HeitsgerNoch keine Bewertungen

- Payment of Bonus Act:: Kamgar Sangh Vs Government of India, ItDokument16 SeitenPayment of Bonus Act:: Kamgar Sangh Vs Government of India, ItArun ShettarNoch keine Bewertungen

- Income From SalariesDokument30 SeitenIncome From SalariesDeepak Gupta50% (2)

- HhytyDokument51 SeitenHhytyNitin gNoch keine Bewertungen

- What Is A PerquisiteDokument8 SeitenWhat Is A PerquisitesoujnyNoch keine Bewertungen

- Paper 7 New Book 83 152 SalaryDokument70 SeitenPaper 7 New Book 83 152 SalaryHridya PrasadNoch keine Bewertungen

- Chapter No: 1 Introduction-SalaryDokument23 SeitenChapter No: 1 Introduction-SalaryMrunali kadamNoch keine Bewertungen

- Gratuity ActDokument14 SeitenGratuity ActAusNoch keine Bewertungen

- Exempted Income Under Section 10Dokument21 SeitenExempted Income Under Section 10Vaishali SharmaNoch keine Bewertungen

- Valuation of Perquisites: Calculating Taxable BenefitsDokument22 SeitenValuation of Perquisites: Calculating Taxable BenefitsKamesh TiwariNoch keine Bewertungen

- Heads of IncomeDokument30 SeitenHeads of Income9986212378Noch keine Bewertungen

- Session II - Payment of Gratuity ActDokument16 SeitenSession II - Payment of Gratuity ActHarshit Kumar SinghNoch keine Bewertungen

- The Payment of Bonus Act, 1965Dokument6 SeitenThe Payment of Bonus Act, 1965Ravi GuptaNoch keine Bewertungen

- The Payment of Bonus Act1965Dokument9 SeitenThe Payment of Bonus Act1965nishi18guptaNoch keine Bewertungen

- SlideDokument12 SeitenSlidekirandeshmukh40Noch keine Bewertungen

- Employment Vs HiringDokument29 SeitenEmployment Vs Hiringnaulele robertNoch keine Bewertungen

- Chap 003Dokument19 SeitenChap 003AfnanNoch keine Bewertungen

- HEADS OF INCOME AND TAX TREATMENT OF SALARY AND ALLOWANCESDokument50 SeitenHEADS OF INCOME AND TAX TREATMENT OF SALARY AND ALLOWANCESRajeev shuklaNoch keine Bewertungen

- As Amended by The Payment of Bonus (Amendment) Ordinance, 2007Dokument32 SeitenAs Amended by The Payment of Bonus (Amendment) Ordinance, 2007hariambikaNoch keine Bewertungen

- Business Law (PAYMENT OF BONUS ACT - 1965)Dokument28 SeitenBusiness Law (PAYMENT OF BONUS ACT - 1965)kasthuri ksatriyaaNoch keine Bewertungen

- Commerce PPT AmbedkarDokument14 SeitenCommerce PPT Ambedkarpritesh.ks1409Noch keine Bewertungen

- Employment TaxDokument45 SeitenEmployment Taxleeroybradley44Noch keine Bewertungen

- Understanding Salary, Allowances and PerquisitesDokument12 SeitenUnderstanding Salary, Allowances and PerquisitesShruti PatilNoch keine Bewertungen

- Learn Income Tax in Easy StepsDokument79 SeitenLearn Income Tax in Easy Stepsbushra_anwarNoch keine Bewertungen

- 2.1-Module 2-Part 1 PDFDokument4 Seiten2.1-Module 2-Part 1 PDFArpita ArtaniNoch keine Bewertungen

- BFM-CH - 10 - Module BDokument20 SeitenBFM-CH - 10 - Module BSantosh Saroj100% (1)

- Chapter No.2: Risk Management and Basics of DerivativesDokument21 SeitenChapter No.2: Risk Management and Basics of DerivativesSantosh SarojNoch keine Bewertungen

- Chapter No.2: Risk Management and Basics of DerivativesDokument21 SeitenChapter No.2: Risk Management and Basics of DerivativesSantosh SarojNoch keine Bewertungen

- BFM - Ch-15 - Module CDokument21 SeitenBFM - Ch-15 - Module CSantosh SarojNoch keine Bewertungen

- Sales and Distribution Management, 2eDokument12 SeitenSales and Distribution Management, 2eSantosh SarojNoch keine Bewertungen

- Securities Transaction Tax: A.b.acharya Addl - Asst.directorDokument7 SeitenSecurities Transaction Tax: A.b.acharya Addl - Asst.directorSantosh SarojNoch keine Bewertungen

- Questions and AnswerDokument3 SeitenQuestions and AnswerSantosh SarojNoch keine Bewertungen

- ProbabilityDokument9 SeitenProbabilitySantosh SarojNoch keine Bewertungen

- BFM-CH - 10 - Module BDokument20 SeitenBFM-CH - 10 - Module BSantosh Saroj100% (1)

- Service Marekting & CRM M 35 CourseDokument5 SeitenService Marekting & CRM M 35 CourseSantosh SarojNoch keine Bewertungen

- Nature of Management Control SystemsDokument14 SeitenNature of Management Control SystemsSantosh SarojNoch keine Bewertungen

- Declaration: Shopping Behavior" With Reference To Ahmedabad Is Original To The Best of MyDokument7 SeitenDeclaration: Shopping Behavior" With Reference To Ahmedabad Is Original To The Best of MySantosh SarojNoch keine Bewertungen

- Certificate: Contemporary Trend in Online Shopping Behavior" With Reference To Ahmedabad in TheDokument1 SeiteCertificate: Contemporary Trend in Online Shopping Behavior" With Reference To Ahmedabad in TheSantosh SarojNoch keine Bewertungen

- Declaration: Shopping Behavior" With Reference To Ahmedabad Is Original To The Best of MyDokument7 SeitenDeclaration: Shopping Behavior" With Reference To Ahmedabad Is Original To The Best of MySantosh SarojNoch keine Bewertungen

- Types of ContractDokument25 SeitenTypes of ContractSachin MishraNoch keine Bewertungen

- 43Dokument9 Seiten43Santosh SarojNoch keine Bewertungen

- Legal Aspects of BusinessDokument41 SeitenLegal Aspects of BusinessRakesh BajajNoch keine Bewertungen

- Nature of Management Control SystemsDokument14 SeitenNature of Management Control SystemsSantosh SarojNoch keine Bewertungen

- Ch-5 Communication MixDokument14 SeitenCh-5 Communication MixSantosh SarojNoch keine Bewertungen

- Ch-6 PricingDokument17 SeitenCh-6 PricingSantosh SarojNoch keine Bewertungen

- Ch-8 Designing and Managing Service ProcessesDokument11 SeitenCh-8 Designing and Managing Service ProcessesSantosh SarojNoch keine Bewertungen

- Service Marekting & CRM M 35 CourseDokument5 SeitenService Marekting & CRM M 35 CourseSantosh SarojNoch keine Bewertungen

- Chap 2Dokument19 SeitenChap 2Santosh SarojNoch keine Bewertungen

- Ch-6 PricingDokument17 SeitenCh-6 PricingSantosh SarojNoch keine Bewertungen

- Sales WarrantiesDokument26 SeitenSales WarrantiesSantosh SarojNoch keine Bewertungen

- Nature of Management Control SystemsDokument14 SeitenNature of Management Control SystemsSantosh SarojNoch keine Bewertungen

- Negotiable Instrument TypesDokument21 SeitenNegotiable Instrument TypesSantosh SarojNoch keine Bewertungen

- Malhotra Mr05 PPT 01Dokument33 SeitenMalhotra Mr05 PPT 01Santosh Saroj100% (1)

- CapmDokument7 SeitenCapmSantosh SarojNoch keine Bewertungen

- Dua' - Study Circle 1Dokument12 SeitenDua' - Study Circle 1Dini Ika NordinNoch keine Bewertungen

- 721-1002-000 Ad 0Dokument124 Seiten721-1002-000 Ad 0rashmi mNoch keine Bewertungen

- AN ORDINANCE ESTABLISHING THE BARANGAY SPECIAL BENEFIT AND SERVICE IMPROVEMENT SYSTEMDokument7 SeitenAN ORDINANCE ESTABLISHING THE BARANGAY SPECIAL BENEFIT AND SERVICE IMPROVEMENT SYSTEMRomel VillanuevaNoch keine Bewertungen

- Purpose and Types of Construction EstimatesDokument10 SeitenPurpose and Types of Construction EstimatesAisha MalikNoch keine Bewertungen

- Intermediate Algebra For College Students 7th Edition Blitzer Test BankDokument19 SeitenIntermediate Algebra For College Students 7th Edition Blitzer Test Bankdireful.trunnionmnwf5100% (30)

- Introduction To Contemporary World: Alan C. Denate Maed Social Science, LPTDokument19 SeitenIntroduction To Contemporary World: Alan C. Denate Maed Social Science, LPTLorlie GolezNoch keine Bewertungen

- Galvanize Action donation instructionsDokument1 SeiteGalvanize Action donation instructionsRasaq LakajeNoch keine Bewertungen

- National Dairy Authority BrochureDokument62 SeitenNational Dairy Authority BrochureRIKKA JELLEANNA SUMAGANG PALASANNoch keine Bewertungen

- 2024 JanuaryDokument9 Seiten2024 Januaryedgardo61taurusNoch keine Bewertungen

- Interview - Duga, Rennabelle PDokument4 SeitenInterview - Duga, Rennabelle PDuga Rennabelle84% (19)

- PMT Machines LTD Inspection and Test Plan For Bogie Frame FabricationDokument6 SeitenPMT Machines LTD Inspection and Test Plan For Bogie Frame FabricationAMIT SHAHNoch keine Bewertungen

- Strategic Road Map For A Better Internet Café IndustryDokument12 SeitenStrategic Road Map For A Better Internet Café Industrygener moradaNoch keine Bewertungen

- James M Stearns JR ResumeDokument2 SeitenJames M Stearns JR Resumeapi-281469512Noch keine Bewertungen

- Ecocritical Approach To Literary Text Interpretation: Neema Bagula JimmyDokument10 SeitenEcocritical Approach To Literary Text Interpretation: Neema Bagula JimmyhafizhNoch keine Bewertungen

- Gender, Race, and Semicolonialism: Liu Na'ou's Urban Shanghai LandscapeDokument24 SeitenGender, Race, and Semicolonialism: Liu Na'ou's Urban Shanghai Landscapebaiqian liuNoch keine Bewertungen

- Detailed Project Report Bread Making Unit Under Pmfme SchemeDokument26 SeitenDetailed Project Report Bread Making Unit Under Pmfme SchemeMohammed hassenNoch keine Bewertungen

- Courtroom Etiquette and ProcedureDokument3 SeitenCourtroom Etiquette and ProcedureVineethSundarNoch keine Bewertungen

- City of Watertown Seasonal Collection of Brush and Green WasteDokument3 SeitenCity of Watertown Seasonal Collection of Brush and Green WasteNewzjunkyNoch keine Bewertungen

- Globalization Winners and LosersDokument2 SeitenGlobalization Winners and Losersnprjkb5r2wNoch keine Bewertungen

- Medtech LawsDokument19 SeitenMedtech LawsJon Nicole DublinNoch keine Bewertungen

- Esmf 04052017 PDFDokument265 SeitenEsmf 04052017 PDFRaju ReddyNoch keine Bewertungen

- Senate Hearing, 110TH Congress - The Employee Free Choice Act: Restoring Economic Opportunity For Working FamiliesDokument83 SeitenSenate Hearing, 110TH Congress - The Employee Free Choice Act: Restoring Economic Opportunity For Working FamiliesScribd Government DocsNoch keine Bewertungen

- Who Am I Assignment InstructionsDokument2 SeitenWho Am I Assignment Instructionslucassleights 1Noch keine Bewertungen

- Entrance English Test for Graduate Management StudiesDokument6 SeitenEntrance English Test for Graduate Management StudiesPhương Linh TrươngNoch keine Bewertungen