Beruflich Dokumente

Kultur Dokumente

2201AFE VW Week 10 Cost of Capital

Hochgeladen von

Vut BayOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2201AFE VW Week 10 Cost of Capital

Hochgeladen von

Vut BayCopyright:

Verfügbare Formate

2201AFE Corporate Finance

Week 10:

Cost of Capital

Readings: Chapter 17

Agenda

Last Week

Cost of Capital

Key Concepts and Skills

Real World Application

Investors Need A Good WACC

Next Week

2

Last Lecture

Expected Returns and Variances

Single asset & Portfolios

Using probabilities & Historical returns

Principle of Diversification

Systematic and Unsystematic Risk

Beta

CAPM = Capital Asset Pricing Model

SML = Security Market Line

Reward-to-Risk Ratio

Deciding if assets are undervalued or overvalued?

3

Cost of Capital

Chapter 17

4

5

1. Introduction & Financial

Statements

2. Time Value of Money

3. Valuing Shares & Bonds

7. Mid-semester Exam

8. Some Lessons from Capital

Market History

11. Financial Leverage & Capital

Structure Policy

13. Options & Revision

9. Return, Risk & the Security

Market Line

5. Making Capital Investment

Decisions & Project Analysis

12. Dividends & Dividend Policy

6. Revision for Mid-sem Exam

4. Net Present Value & Other

Investment Criteria

10. Cost of Capital

Key Concepts and Skills

Cost of Capital: Introduction

Cost of Equity

Cost of Debt

Cost of Preferred Stock

Weighted Average Cost of Capital (WACC)

Divisional and Project Costs of Capital

Flotation Costs (cost of issuing shares)

6

Why Cost of Capital Is Important

The return to an investor is the same as the cost to the

company.

Our cost of capital provides us with an indication of how

the market views the risk of our assets.

Knowing our cost of capital can also help us determine our

required return for capital budgeting projects.

7

Required Return = Cost of Capital

The Required Rate of Return = Discount Rate = Hurdle Rate

= Cost of Capital

Need to know the required return for an investment so we

can compute the NPV and decide whether or not to take

the investment.

Need to earn at least the required return to compensate

investors for their financing.

Required return from the investors point of view.

Cost of capital from the firms point of view.

8

Cost of Capital

The firm is financed by a mixture of equity and debt (i.e.

capital structure).

Cost of Capital is a mix of Cost of Equity and Cost of Debt.

These costs are determined by the market.

The firm determines the mix, Debt/Equity (D/E) reflecting

its target capital structure.

To calculate cost of capital:

Calculate cost of equity

Calculate cost of debt

Combine them

9

Cost of Equity

The cost of equity is the return required by equity

investors, the shareholders on their investment in the firm.

Since this cost is not directly observable, it must be

estimated.

There are two main methods for determining the cost of

equity:

Dividend Growth Model

CAPM

10

Cost of Equity DGM Approach

Start with the dividend growth model formula where g is

constant:

where: R

E

is the required return for shareholders, P

0

is the

current price, D

0

is the current/last dividend, D

1

is the next

dividend. Rearranging to solve for R

E

:

where D

1

/ P

0

is the dividend yield, and g is the growth rate of

dividends.

11

g R

D

g R

g) 1 ( D

P

E

1

E

0

0

+

=

g

P

D

R

0

1

E

+ =

DGM Example 1

Bentex Ltd. recently paid a dividend of 40 cents per share.

This dividend is expected to grow at 6% per year

indefinitely. If the current market price of Bentex shares is

$6 per share, estimate its cost of equity.

D

0

= $0.40, g = 6%, P

0

= $6, R

E

= ?

D

1

= D

0

(1 + g) = $0.40(1.06) = $0.424

12

equity of cost = 13.07% or 1307 0 = 06 0 +

00 6

424 0

= + =

0

1

. . g

P

D

R

E

.

.

DGM Example 2

Suppose ABC company is expected to pay a dividend of

$1.50 per share next year. There has been a steady growth

in dividends of 5.1% per year. The current price is $25.

What is the cost of equity?

D

1

= $1.50, g = 5.1%, P

0

= $25, R

E

= ?

13

% 1 . 11 111 . 0 051 . 0

25

50 . 1

g

P

D

R

g R

D

P

0

1

E

E

1

0

= = + = + =

=

Example Estimating the Dividend Growth Rate g

One method for estimating the growth rate is to use the

historical average:

Another way is use analysts forecast of growth (g).

14

Year Dividend Change Return

2000 1.23 -

2001 1.30 (1.30-1.23) / 1.23 = 5.7%

2002 1.36 (1.36-1.30) / 1.30 = 4.6%

2003 1.43 (1.43-1.36) / 1.36 = 5.1%

2004 1.50 (1.50-1.43) / 1.43 = 4.9%

Average return = (5.7 + 4.6 + 5.1 + 4.9) / 4 = 5.1%

Advantages and Disadvantages of Dividend Growth Model

Advantage:

Easy to understand and use.

Disadvantages:

Only applicable to companies currently paying dividends.

Assumes dividend growth is constant.

Cost of equity is sensitive to growth estimate.

Does not explicitly consider risk.

15

Cost of Equity CAPM or SML Approach

Recall CAPM for any asset i is:

E(R

i

) = R

f

+

i

[E(R

m

) R

f

]

The CAPM cost of equity (R

E

) is:

R

E

= R

f

+

E

[E(R

m

) R

f

]

Where:

R

E

= Required return for shareholders

R

f

= Risk-free rate

E(R

M

) R

f

= Market risk premium

|

E

= Systematic risk of firms equity relative to the market

16

CAPM Example

Suppose our ABC company has an equity beta of 0.58 and

the current risk-free rate is 6.1%. If the expected market

risk premium is 8.6%, what is the cost of equity capital?

E

= 0.58, R

f

= 6.1%, E(R

M

) R

f

= 8.6%

R

E

= R

f

+

E

[E(R

m

) R

f

]

R

E

= 0.061 + 0.58(0.086) = 11.1%

What if the expected market return E(R

m

) is 8.6%?

R

E

= 0.061 + 0.58(0.086 0.061) = 7.55%

17

Advantages and Disadvantages of CAPM

Advantages:

Explicitly adjusts for risk.

Applicable to all companies.

Disadvantages:

Have to estimate the expected market risk premium, which

does vary over time.

Have to estimate beta, which also varies over time.

We are using the past to predict the future, which is not

always reliable.

18

Example Cost of Equity

Suppose our company has a beta of 1.5. The market risk

premium is expected to be 9% and the current risk-free

rate is 6%. The market believes our dividends will grow at

6% per year and our last dividend was $2. The stock is

currently selling for $15.65. What is the cost of equity?

Using CAPM:

R

E

= R

f

+

E

[E(R

m

) R

f

]

Using DGM:

19

g

P

g D

R

E

+

+ 1

=

0

0

) (

Cost of Preferred Stock

Reminders:

Preferred stock pays a constant dividend.

Dividends are expected to be paid forever.

Preferred stock return = Perpetuity = R

P

P

0

= D / R

p

R

P

= D / P

0

Example: Your company has preferred stock that has an

annual dividend of $3. If the current price is $25, what is

the cost of preferred stock?

25 = 3 / R

p

therefore, R

P

= 3 / 25 = 12%

20

Cost of Debt

The cost of debt is the required return on our companys

debt.

We usually focus on the cost of long-term debt or bonds.

The required return is best estimated by computing the

yield-to-maturity or YTM.

The cost of debt is NOT the coupon rate.

For publicly listed debt use YTM.

If the firm has no publicly traded debt, use YTM on similar

debt that is traded.

21

YTM of Bond

In general:

Where:

C = coupon interest payment

R

D

= required market return or YTM

T = the number of periods left until repayment

F

= face value

Need to solve for R

D

22

T

D D

T

D

0

) R 1 (

F

R

) R 1 (

1

1

C P

+

+

(

(

(

(

=

Example Cost of Debt

Gloss Ltd issued a 20-year, 12% bond 10 years ago. The

bond is currently priced at $86, and pays interest annually.

What is its cost of debt?

Excel solution gives R

D

= 0.1476, meaning that Glosss cost

of debt is 14.76%.

Excel formula =rate(nper,pmt,pv,fv) =rate(10,12,-86,100)

23

10

D D

10

D

) R 1 (

100 $

R

) R 1 (

1

1

12 $ 86 $

+

+

(

(

(

(

=

Example Cost of Debt

Suppose a firm has a bond issue currently outstanding that

has 25 years left to maturity and pays coupons semi-

annually. The coupon rate is 9% per year. The bonds

current price is $90.87 per $100 bond. What is the cost of

debt?

t = 25 years 2 = 50; C = $9 / 2 = 4.5;

F = $100; Bond Price or P = $90.87;

R

D

or YTM = ?

By trial and error semiannual yield = 5%

YTM = R

D

= 5% 2 = 10%

24

Weighted Average Cost of Capital

We can use the individual costs of capital that we have

computed to get our average cost of capital for the firm.

WACC is the required return on our assets, based on the

markets perception of the risk of those assets

The weights are determined by how much of each type of

financing we use:

WACC = w

E

R

E

+ w

P

R

P

+ w

D

R

D

WACC = (E/V) R

E

+ (P/V) R

P

+ (D/V) R

D

where V = E + P + D

25

Weighted Average Cost of Capital

Notations:

E = market value of equity

no. of outstanding shares price per share

P = market value of preference shares

no. of outstanding preference shares price per share

D = market value of debt

no. of outstanding bonds bond price

V = market value of the firm = E + P + D

26

Capital Structure Weights

Weights:

w

E

= E/V = percent financed with equity

w

P

= P/V = percent financed with preference stock

w

D

= D/V = percent financed with debt

w

E

+ w

P

+ w

D

= 1

27

Example Weights & WACC

Cost of debt = 5.7 %, Cost of equity = 14.0 %

Cost of preference shares = 9.0 %

WACC = (E/V) R

E

+ (P/V) R

P

+ (D/V) R

D

= (0.5)0.14 + (0.1)0.09 + (0.4)0.057

= 0.1018 or 10.18% (Unadjusted for taxation effects)

28

Source of Capital Market Value Weight

Long term debt $40m 40%

Preference shares $10m 10%

Equity $50m 50%

Total $100m 100%

WACC Adjusted

The company gets a tax deduction for interest on debt,

reducing the effective cost of debt.

If T

C

is the corporate tax rate then the after tax cost of debt

is R

D

(1 T

C

), and the WACC adjusted for taxation effects

is given by:

WACC = w

E

R

E

+ w

P

R

P

+ w

D

R

D

(1T

c

)

or

WACC = (E/V) R

E

+ (P/V) R

P

+ (D/V) R

D

(1T

c

)

Previous example: If tax rate is 30%, then

WACC = (0.5)0.14 + (0.1)0.09 + (0.4)0.057(10.3)

= 0.0950 or 9.5%.

29

WACC Extended Example (1)

Equity Information:

50 million shares

$80 per share

Beta = 1.15

Market risk premium = 9%

Risk-free rate = 5%

Step 1: Calculate cost of equity and cost of debt.

Step 2: Calculate the market value of each source of financing and

the weights.

Step 3: Calculate the WACC adjusting for tax.

30

Debt Information:

$1 billion in outstanding

debt (face value)

Current quote = 110%

Coupon rate = 9%,

semiannual coupons

15 years to maturity

Tax rate = 40%

WACC Extended Example (2)

What is the cost of equity?

E

= 1.15; R

f

= 5%; R

M

R

f

= 9%; R

E

= ?

R

E

= 5% + 1.15(0.09) = 0.1535 or 15.35%

What is the cost of debt?

t = 15 years 2=30; Price = $110; C = $9 / 2 = 4.5;

F = $100; by trial & error semi yield = 3.9268%

R

D

= 0.03927 2 = 0.07854 or 7.854%

What is the after-tax cost of debt?

R

D

(1 T

C

) = 7.854(1 0.4) = 0.04712 or 4.712%

31

WACC Extended Example (3)

What are the capital structure weights?

E = 50 million $80 = $4 billion

D = $1 billion 110% = $1.1 billion or

$1 billion / 100 = 10 million bonds issued

10 million bonds $110 = $1.1 billion

V = 4 + 1.1 = 5.1 billion

w

E

= (E / V) = (4 / 5.1) = 0.7843

w

D

= (D / V) = (1.1 / 5.1) = 0.2157

What is the WACC?

WACC = w

E

R

E

+ w

D

R

D

(1T

c

)

WACC = 0.7843(0.1535) + 0.2157(0.04712)

= 0.1336 or 13.06%

32

Finding the Weights from D/E

Suppose Belo Corp has a target D/E ratio of 0.33. Cost of Debt is

10% and cost of equity is 20%. If tax is 34%, what is WACC?

First calculate W

E

and W

D

.

If D / E = 0.33 what is E = ? D = ?

Assign any value to equity, E = 1

D / 1= 0.33 then D = 0.33 and V = 1.33

E / V = 1 / 1.33 = 0.7519 and

D / V = 0.33 / 1.33 = 0.2481

WACC = w

E

R

E

+ w

D

R

D

(1T

c

)

WACC = 0.750.20 + 0.250.10(10.34) = 0.1665 or 16.65%

33

Finding D/E

If BHP has a WACC of 21.67% and the cost of equity is 29.2%,

cost of debt is 10%, what is its target D/E ratio? Assume tax is

34%.

We know that:

E + D = V or W

E

+ W

D

= 1

We express one in terms of another:

W

E

= 1 - W

D

And insert in WACC equation:

0.2167 = W

E

0.292 + W

D

0.10 (10.34)

0.2167 = (1-W

D

) 0.292 + W

D

0.10 (10.34)

34

Finding D/E

0.2167 = (1-W

D

) 0.292 + W

D

0.10 (1-0.34)

Solve for W

D

the only unknown variable:

0.2167 = 0.292 W

D

0.292 + W

D

0.066

0.2167 0.292 = -W

D

0.292 + W

D

0.066

-0.0753 = -W

D

(0.292 - 0.066)

0.0753 = W

D

0.226

W

D

= 0.0753/0.2260 = 0.333

Therefore W

E

= 1 W

D

, W

E

= 1 0.333 = 0.667

D/E = 0.333/0.667 = 0.5

35

Divisional and Project Costs of Capital

Using the WACC as our discount rate is only appropriate for

projects that have the same risk as the firms current

operations.

If we are looking at a project that does NOT have the same

risk as the firm, then we need to determine the appropriate

discount rate for that project.

Divisions also often require separate discount rates

(Divisions Overview).

36

Using WACC for All Projects Example

Assume the WACC = 15%.

If we use the WACC for all projects regardless of risk

Accept A and B, reject C

If correct required return based on specific risk is used

Accept B and C, reject A

37

Project Required Return IRR WACC

A 20% reject 17% accept 15%

B 15% accept 18% accept 15%

C 10% accept 12% reject 15%

Divisional and Project costs of capital

WACC is the appropriate discount rate only when the

project is about the same risk as the firm.

Other approaches to estimating a discount rate:

Divisional cost of capital used if a company has more

than one division with different levels of risk;

Pure play approach a discount rate that is unique to a

particular project is used;

Subjective approach projects are allocated to specific

risk classes which, in turn, have specified discount rates.

38

Other Approaches

Pure Play Approach:

Look at companies in the same line of business as the new

project.

Calculate an average WACC for all the companies and use

this rate as the discount rate of the new project.

Subjective Approach:

Consider the projects risk relative to the firm overall risk.

If the project risk > firm risk,

use a discount rate > WACC

If the project risk < firm risk,

use a discount rate < WACC

39

Flotation Costs

The required return depends on the risk, not how the money is

raised.

However, the cost of issuing new securities should not just be

ignored either.

Basic Approach:

Compute the weighted average flotation cost

Use the target weights because the firm will issue securities in

these percentages over the long term

f

A

= (E/V) f

E

+ (D/V) f

D

where f

A

is the weighted average flotation cost, f

E

is the equity

flotation cost proportion, and f

D

is debt flotation cost proportion.

True cost of project = Cost / (1 f

A

)

40

Flotation Costs Example

A firm has a target structure that is 80% equity and 20% debt.

The costs for raising equity are 20% and the cost of raising debt

are 6%.

If the firm needs $65 million for a new facility, what is the true

cost after accounting for flotation costs?

f

A

= (E/V) f

E

+ (D/V) f

D

= 0.80.2 + 0.20.06 = 0.172 or 17.2%

If the flotation cost is 17.2%, and we need to raise $65 million

net, this would be only 82.8% or (1 17.2%) of amount raised

$65m = (1 f

A

) True amount raised

True amount raised = $65 / (1 f

A

) = 65 / 0.828 = $78.50 million

41

Flotation Costs Example

The firm needs to raise

$78.5 million to account for flotation costs and to have $65

million left to invest.

Since 78.5 / 65 = 1.2077, this suggests that:

for every dollar required by the project, the firm must raise

$1.2077 to finance its projects and to cover the cost of

raising the funds.

42

Quick Quiz

What are the two approaches for computing the cost of equity?

What is the cost of debt?

How do you compute the after-tax cost of debt?

When is appropriate to use WACC as the discount rate for

projects?

What is the proportion of E and D if we have a D/E ratio of 1.2?

43

Real World Application

Investors Need A Good WACC

44

Investors Need A Good WACC

During the dotcom era, there were predictions of the Dow Jones

Index soaring to 30,000!

Around five times greater than current value.

But this was a time when the market lost itself to the hype.

Role of psychology and behavioural finance?

When investors, along with their valuations, come back down to

earth from such heights, there can be a loud thump, reminding

everyone that it's time to get back to fundamentals and take a

look at a key aspect of share valuations.

the weighted average cost of capital (WACC)

Source: http://www.investopedia.com/articles/fundamental/03/061103.asp

45

To understand WACC, think of a company as a bag of money. The money in the bag

comes from two sources: debt and equity

Money from business operations is not a third source because, after paying for debt,

any cash left over that is not returned to shareholders in the form of dividends is kept

in the bag on behalf of shareholders

If debt holders require a 10% return on their investment and shareholders require

a 20% return, then, on average, projects funded by the bag of money will have to

return 15% to satisfy debt and equity holders - the 15% is the WACC

If the only money the bag held was $50 from debt holders and $50 from

shareholders, and the company invested $100 in a project, the return from this

project, to meet expectations, would have to return $5 a year to debt holders and

$10 a year to shareholders - this would require a total return of $15 a year, or a

15% WACC

Investors use WACC as a tool to decide whether to invest. The WACC represents the

minimum rate of return at which a company produces value for its investors

Let's say a company produces a return of 20% and has a WACC of 11%. That

means that for every dollar the company invests into capital, the company is

creating $0.09 of value

By contrast, if the company's return is less than WACC, the company is shedding

value, which indicates that investors should put their money elsewhere

46

Next Week

Next week we look at the role of leverage and the Nobel

Prize winning work on selecting a capital structure.

47

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Combo Wave ManualDokument6 SeitenCombo Wave ManualHankStoranNoch keine Bewertungen

- Brinell Hardness Standard.Dokument32 SeitenBrinell Hardness Standard.Basker VenkataramanNoch keine Bewertungen

- FANUC Series 16i 18i 21i Expansion of Custom Macro Interface SignalDokument10 SeitenFANUC Series 16i 18i 21i Expansion of Custom Macro Interface Signalmahdi elmayNoch keine Bewertungen

- Unit 1 Essay QuestionsDokument2 SeitenUnit 1 Essay QuestionsTharun kondaNoch keine Bewertungen

- Business Analytics Using R - A Practical ApproachDokument7 SeitenBusiness Analytics Using R - A Practical ApproachRiya LokhandeNoch keine Bewertungen

- Artificial Intellegence & Future Workplace: Submited by - Hitesh Gayakwad B.B.A.LLB. (2019) Roll No.-12Dokument12 SeitenArtificial Intellegence & Future Workplace: Submited by - Hitesh Gayakwad B.B.A.LLB. (2019) Roll No.-12hitesh gayakwadNoch keine Bewertungen

- Two Way Slab Design Excel SheetDokument11 SeitenTwo Way Slab Design Excel Sheetkshitj100% (1)

- Comparison Between Full Order and Minimum Order Observer Controller For DC MotorDokument6 SeitenComparison Between Full Order and Minimum Order Observer Controller For DC MotorInternational Journal of Research and DiscoveryNoch keine Bewertungen

- ACI 549R-97: Reported by ACI Committee 549Dokument26 SeitenACI 549R-97: Reported by ACI Committee 549curlyjockeyNoch keine Bewertungen

- The Essentials of Machine Learning in Finance and AccountingDokument259 SeitenThe Essentials of Machine Learning in Finance and Accountingernestdark11100% (1)

- Part BDokument6 SeitenPart BVut BayNoch keine Bewertungen

- 2201AFE VW Week 12 Dividends & Dividend PolicyDokument44 Seiten2201AFE VW Week 12 Dividends & Dividend PolicyVut BayNoch keine Bewertungen

- 2201AFE VW Week 9 Return, Risk and The SMLDokument50 Seiten2201AFE VW Week 9 Return, Risk and The SMLVut BayNoch keine Bewertungen

- 2201AFE VW Week 8 Some Lessons From Capital Market HistoryDokument47 Seiten2201AFE VW Week 8 Some Lessons From Capital Market HistoryVut BayNoch keine Bewertungen

- 2201AFE VW Week 6 Mid-Semester Exam InfoDokument19 Seiten2201AFE VW Week 6 Mid-Semester Exam InfoVut BayNoch keine Bewertungen

- Hand Washing Survey 2002Dokument8 SeitenHand Washing Survey 2002Vut BayNoch keine Bewertungen

- Bayesian Analysis of Working Capital Management On Corporate Profitability: Evidence From IndiaDokument19 SeitenBayesian Analysis of Working Capital Management On Corporate Profitability: Evidence From IndiaHargobind CoachNoch keine Bewertungen

- Capital BugetingDokument6 SeitenCapital BugetingMichael ReyesNoch keine Bewertungen

- Mechanics of Tooth Movement: or SmithDokument14 SeitenMechanics of Tooth Movement: or SmithRamesh SakthyNoch keine Bewertungen

- Simple Braced Non-SwayDokument23 SeitenSimple Braced Non-SwaydineshNoch keine Bewertungen

- Data Mining With Weka: Ian H. WittenDokument33 SeitenData Mining With Weka: Ian H. WittenQuân PhạmNoch keine Bewertungen

- 6 Prosiding ICM2E 2017Dokument434 Seiten6 Prosiding ICM2E 2017Andinuralfia syahrirNoch keine Bewertungen

- St501-Ln1kv 04fs EnglishDokument12 SeitenSt501-Ln1kv 04fs Englishsanthoshs241s0% (1)

- General Mathematics: Simple and Compound InterestDokument19 SeitenGeneral Mathematics: Simple and Compound InterestLynette LicsiNoch keine Bewertungen

- Ojimc 2021 (Imo Mock)Dokument8 SeitenOjimc 2021 (Imo Mock)NonuNoch keine Bewertungen

- A Beautiful Blonde A Nash Coordination GameDokument12 SeitenA Beautiful Blonde A Nash Coordination GameAnonymous va7umdWyhNoch keine Bewertungen

- Fuzzy Quasi Regular RingDokument3 SeitenFuzzy Quasi Regular RingIIR indiaNoch keine Bewertungen

- Crystal Ball Report - FullDokument7 SeitenCrystal Ball Report - FullVan A HoangNoch keine Bewertungen

- 通訊原理Dokument303 Seiten通訊原理ZenPhiNoch keine Bewertungen

- Urdaneta City UniversityDokument2 SeitenUrdaneta City UniversityTheodore VilaNoch keine Bewertungen

- TMPG PPT Course Unit AssignmentDokument2 SeitenTMPG PPT Course Unit AssignmentJusteen BalcortaNoch keine Bewertungen

- Basis Path TestingDokument4 SeitenBasis Path TestingKaushik MukherjeeNoch keine Bewertungen

- Tu 5 Mechanics PDFDokument4 SeitenTu 5 Mechanics PDFJyotish VudikavalasaNoch keine Bewertungen

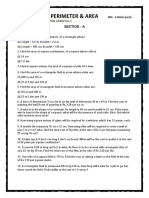

- Perimeter & Area: Section - ADokument5 SeitenPerimeter & Area: Section - AKrishna Agrawal100% (1)

- Rakesh Mandal 180120031Dokument7 SeitenRakesh Mandal 180120031Rakesh RajputNoch keine Bewertungen