Beruflich Dokumente

Kultur Dokumente

Payment and Settlement Systems in India

Hochgeladen von

Arunav Guha RoyOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Payment and Settlement Systems in India

Hochgeladen von

Arunav Guha RoyCopyright:

Verfügbare Formate

PAYMENT AND SETTLEMENT SYSTEMS IN INDIA

VII SEMESTER, UNIT 4, 2012 NLU DELHI

PAYMENT AND SETTLEMENT SYSTEMS ACT 2007 (PSSA)

Systemically Important Payment Systems (SIPS)

Real Time Gross Settlement (RTGS) Paper based-Cheque, DD,

Retail Payment Systems (RPS)

Speed clearing/High Value, Cheq truncation

Electronic clearing systems (ECS) Card-based systems.

Board for Regulation and Supervision of Payment and Settlement Systems (BPSS) (2005) Department of Payment and Settlement Services (DPSS)

Electronic based payment systems

National Electronic Clearing Service (NECS) ECS Credit

bulk and repetitive payment requirements (like salary, interest, dividend payments) of corporates and other institutions faster method of effecting periodic and repetitive collections of utility companies Batch settlements at hourly intervals Transfer of money takes place from one bank to another on a "real time" and on "gross" basis. Real time means payment is not subjected to any waiting period. Gross means the transaction is settled on one to one basis without bunching or netting with any other transaction.

ECS Debit

National Electronic Funds Transfer (NEFT)

Real Time Gross Settlement (RTGS)

Paper Based & Electronic Based

Electronic payment system:

enable the formal financial sector to more easily and efficiently reach disadvantaged Indian households and offer modern financial products. ensure that every poor household in India - approximately 80 to 100 million - will have unparalleled access to secure and convenient benefits directly from the government, and without the interference of intermediaries. allow greater penetration into rural India where traditional payment systems remain woefully inadequate in terms of reliability greater participation from poor rural citizens, and bring the Govt closer to its cherished goal of reducing poverty and hunger through its welfare, food, and housing subsidy schemes.

RBI AS REGULATOR OF PAYMENT AND SETTLEMENT SYSTEMS

National Payments corporation of India (NPCI) The core objective of the NPCI

to consolidate and integrate the multiple systems with varying service levels into nation-wide uniform and standard business process for all retail payment systems. Facilitate an affordable payment mechanism to benefit the common man across the country and help financial inclusion. It has been incorporated as a Section 25 company under Companies Act and is aimed to operate for the benefit of all the member banks and their customers. Function as a hub in all electronic retail payment systems

Clearing Corporation of India Ltd (CCIL)

The objective behind setting up CCIL :Provide a safe institutional structure for the clearing and settlement of trades in the Government Securities, Forex (FX), Money and Debt Markets, Significantly improve efficiency in the transaction settlement process, Insulate the financial system from shocks emanating from the counterparty risks and market deficiencies of various types that currently plague the Indian financial markets. For participants of the forex market, CCIL's intermediation provides a structure to mitigate, and manage risks associated with settlement of these high-

Das könnte Ihnen auch gefallen

- New Balance $10,195.04 Minimum Payment Due $102.00 Payment Due Date 10/23/22Dokument11 SeitenNew Balance $10,195.04 Minimum Payment Due $102.00 Payment Due Date 10/23/22Rahul SharmaNoch keine Bewertungen

- 001dec052019 2 PDFDokument8 Seiten001dec052019 2 PDFjdbejxbdbdjNoch keine Bewertungen

- Exploring Local Bank Compliance On Emv ChipsDokument17 SeitenExploring Local Bank Compliance On Emv ChipsRomskyNoch keine Bewertungen

- ListDokument8 SeitenListLuis RodríguezNoch keine Bewertungen

- Tool Kit for Tax Administration Management Information SystemVon EverandTool Kit for Tax Administration Management Information SystemBewertung: 1 von 5 Sternen1/5 (1)

- American Express Bank Statement Cythel M GomaDokument4 SeitenAmerican Express Bank Statement Cythel M Gomashirleysimone53Noch keine Bewertungen

- Bad Debt PolicyDokument5 SeitenBad Debt PolicyOrlandoNoch keine Bewertungen

- Eyob Finance ManualDokument46 SeitenEyob Finance ManualMiki DeregeNoch keine Bewertungen

- Consolidated KYC Risk ManagementDokument9 SeitenConsolidated KYC Risk ManagementSri Harikanth Balijepalli100% (1)

- Quality Management Systems For Education and Training ProvidersDokument7 SeitenQuality Management Systems For Education and Training Providersselinasimpson311Noch keine Bewertungen

- IT Audit Report On Core Banking System in BDBLDokument58 SeitenIT Audit Report On Core Banking System in BDBLannasserNoch keine Bewertungen

- It Policy PDFDokument53 SeitenIt Policy PDFgr8jobs nigeriaNoch keine Bewertungen

- Manual - Fixed AssetsDokument48 SeitenManual - Fixed AssetsIliIllilI IliIllilIIliIllilINoch keine Bewertungen

- Future Aml EditDokument25 SeitenFuture Aml EditSharukhAnsariNoch keine Bewertungen

- Revenueassurance101 150709111645 Lva1 App6891Dokument55 SeitenRevenueassurance101 150709111645 Lva1 App6891malisevicNoch keine Bewertungen

- Account StatementDokument12 SeitenAccount StatementBhabani Prasad DasNoch keine Bewertungen

- Digital Services Governance Recommendations: Supporting Implementation of Digital Services Governance Structures in The Federal GovernmentDokument42 SeitenDigital Services Governance Recommendations: Supporting Implementation of Digital Services Governance Structures in The Federal GovernmentFedScoop100% (1)

- IT Policies OverviewDokument12 SeitenIT Policies OverviewDan RaineyNoch keine Bewertungen

- Chief Information Officer - Job DescriptionDokument3 SeitenChief Information Officer - Job Descriptionyoesgreat2891Noch keine Bewertungen

- 15789965599009292pso1 PDFDokument1 Seite15789965599009292pso1 PDFSapat DasNoch keine Bewertungen

- Negotin Bar Exam QuestionsDokument13 SeitenNegotin Bar Exam QuestionsVenz LacreNoch keine Bewertungen

- Review of Payment & Settlement Systems in IndiaDokument29 SeitenReview of Payment & Settlement Systems in IndiaJoel JCNoch keine Bewertungen

- E PassbookDokument9 SeitenE PassbookAdnan QureshiNoch keine Bewertungen

- Sample Report II - Card System Forensic Audit ReportDokument24 SeitenSample Report II - Card System Forensic Audit ReportArif AhmedNoch keine Bewertungen

- Training Workshop On IT AuditingDokument2 SeitenTraining Workshop On IT AuditingOluwaseun MatthewNoch keine Bewertungen

- B P D R: Usiness Rocess Efinition AND EquirementsDokument8 SeitenB P D R: Usiness Rocess Efinition AND EquirementsKhwaja ArshadNoch keine Bewertungen

- Guideline On Agent Banking-Cbk PG 15Dokument45 SeitenGuideline On Agent Banking-Cbk PG 15Jacobias100% (1)

- CFDG Fraud Policy PDFDokument6 SeitenCFDG Fraud Policy PDFSanath FernandoNoch keine Bewertungen

- International Arbitration in The Energy SectorDokument1 SeiteInternational Arbitration in The Energy SectorArunav Guha Roy0% (1)

- Quality Management ProcessesDokument9 SeitenQuality Management Processesselinasimpson0701Noch keine Bewertungen

- Tickmill LTD Seychelles Privacy PolicyDokument11 SeitenTickmill LTD Seychelles Privacy PolicyJalil MochlasNoch keine Bewertungen

- ERP Implementation at VITDokument6 SeitenERP Implementation at VITPrabudh Kushagra100% (1)

- Payment Systems in India: Reserve Bank of IndiaDokument16 SeitenPayment Systems in India: Reserve Bank of IndiaRahul BadaniNoch keine Bewertungen

- How IT Is Reinventing Itself As A Strategic Business PartnerDokument3 SeitenHow IT Is Reinventing Itself As A Strategic Business PartnerJoana ReisNoch keine Bewertungen

- Adyen and Fintech - Driving Change in The Financial Services IndustryDokument4 SeitenAdyen and Fintech - Driving Change in The Financial Services Industry030239230171Noch keine Bewertungen

- Sample SLA Templates PDFDokument14 SeitenSample SLA Templates PDFOzioma Ihekwoaba100% (2)

- Digital Technologies for Government-Supported Health Insurance Systems in Asia and the PacificVon EverandDigital Technologies for Government-Supported Health Insurance Systems in Asia and the PacificNoch keine Bewertungen

- Emergence of Payment Systems in The Age of Electronic Commerce: The State of ArtDokument6 SeitenEmergence of Payment Systems in The Age of Electronic Commerce: The State of ArtThulhaj ParveenNoch keine Bewertungen

- Information Security Strategic PlanDokument1 SeiteInformation Security Strategic PlanVince VulpesNoch keine Bewertungen

- Digital Banking Strategy Roadmap: March 24, 2015Dokument30 SeitenDigital Banking Strategy Roadmap: March 24, 2015goranksNoch keine Bewertungen

- Mifos X Data Sheet July2015Dokument4 SeitenMifos X Data Sheet July2015konverg101Noch keine Bewertungen

- EPIS Merchant AcquiringDokument3 SeitenEPIS Merchant AcquiringyadbhavishyaNoch keine Bewertungen

- Ghana Case StudyDokument26 SeitenGhana Case StudyNii Lante AddisonNoch keine Bewertungen

- Policy and Procedures (Audit)Dokument24 SeitenPolicy and Procedures (Audit)Orlie CuadraNoch keine Bewertungen

- Mlro Responsibilities Checklist 20Q1 PDFDokument1 SeiteMlro Responsibilities Checklist 20Q1 PDFElena DianaNoch keine Bewertungen

- Policy StatementDokument2 SeitenPolicy StatementUnited CertificationNoch keine Bewertungen

- Smart Gym Management SystemDokument17 SeitenSmart Gym Management SystemMasha KingNoch keine Bewertungen

- Core Banking SolutionDokument42 SeitenCore Banking SolutionbusinessmbaNoch keine Bewertungen

- Pradhanmantri Jan Dhan Yojana: Finatix Club IIM RaipurDokument10 SeitenPradhanmantri Jan Dhan Yojana: Finatix Club IIM RaipurYadvendra YadavNoch keine Bewertungen

- Delivering Itil Best PracticesDokument11 SeitenDelivering Itil Best PracticesDavid Carter100% (1)

- Payment System Oversight FrameworkDokument16 SeitenPayment System Oversight FrameworkNarayanPrajapatiNoch keine Bewertungen

- Automated Payment SystemDokument12 SeitenAutomated Payment SystemJillian HartNoch keine Bewertungen

- It DaibbDokument5 SeitenIt DaibbSaugata Shovan HaiderNoch keine Bewertungen

- IS AuditDokument27 SeitenIS AuditSiddiqui JamilNoch keine Bewertungen

- University of Georgia Long-Term IT Master PlanDokument24 SeitenUniversity of Georgia Long-Term IT Master PlanaccidentalcioNoch keine Bewertungen

- Developing and Implementing Commercial Loan Pricing ModelsDokument5 SeitenDeveloping and Implementing Commercial Loan Pricing Modelsr.jeyashankar9550Noch keine Bewertungen

- Mobile Banking PolicyDokument12 SeitenMobile Banking PolicySuraj GCNoch keine Bewertungen

- National Bank of Ethiopia VPN Policy: V P N (VPN) PDokument42 SeitenNational Bank of Ethiopia VPN Policy: V P N (VPN) PBirhanNoch keine Bewertungen

- Nestlé India Corporate Social Responsibility PolicyDokument3 SeitenNestlé India Corporate Social Responsibility PolicyanuragNoch keine Bewertungen

- Approval Procedure of PSO PSP Pso - PSP - 03022019Dokument7 SeitenApproval Procedure of PSO PSP Pso - PSP - 03022019Shaq JordanNoch keine Bewertungen

- Company CSR Policy As Per Section 135 (4) - 24072018Dokument6 SeitenCompany CSR Policy As Per Section 135 (4) - 24072018rajesh uluwatuNoch keine Bewertungen

- Is Auditing Procedure P2: Digital Signatures and Key ManagementDokument6 SeitenIs Auditing Procedure P2: Digital Signatures and Key ManagementadiltsaNoch keine Bewertungen

- Crowdfunding PolicyDokument7 SeitenCrowdfunding PolicyFuaad DodooNoch keine Bewertungen

- My Background: What Is ITS?Dokument7 SeitenMy Background: What Is ITS?fahmiamroziNoch keine Bewertungen

- Sr. No. Attribute Activity Description Process ReferenceDokument21 SeitenSr. No. Attribute Activity Description Process ReferenceWajahat AliNoch keine Bewertungen

- NEW DELHI Safe City ProjectDokument8 SeitenNEW DELHI Safe City ProjectApril MartinezNoch keine Bewertungen

- Money LaunderingDokument33 SeitenMoney Launderingvishnu m vNoch keine Bewertungen

- RBICircular On Cyber SecurityDokument13 SeitenRBICircular On Cyber SecurityPravin BandaleNoch keine Bewertungen

- Fy18 It Budget GuidanceDokument79 SeitenFy18 It Budget Guidancethangave2000Noch keine Bewertungen

- E WalletDokument15 SeitenE WalletManoj Kumar Paras100% (1)

- B U S L: Oston Niversity Chool of AWDokument32 SeitenB U S L: Oston Niversity Chool of AWArunav Guha RoyNoch keine Bewertungen

- Commercial Banking in IndiaDokument56 SeitenCommercial Banking in IndiaArunav Guha Roy0% (1)

- Role of RBI in Banking Sector in IndiaDokument17 SeitenRole of RBI in Banking Sector in IndiaArunav Guha RoyNoch keine Bewertungen

- Authoritarianism in Globalization: A Theoretical ConsiderationDokument18 SeitenAuthoritarianism in Globalization: A Theoretical ConsiderationArunav Guha RoyNoch keine Bewertungen

- Taxation HandoutsDokument5 SeitenTaxation HandoutsTiyon TiyonNoch keine Bewertungen

- Salary: After Studying This Chapter, You Would Be Able ToDokument67 SeitenSalary: After Studying This Chapter, You Would Be Able Torishikesh kumarNoch keine Bewertungen

- Vodafone International Holdings Vs Union of IndiaDokument33 SeitenVodafone International Holdings Vs Union of IndiaSwaraj SiddhantNoch keine Bewertungen

- Financial Budget PlanDokument11 SeitenFinancial Budget PlanApril Dawn DaepNoch keine Bewertungen

- Sneha Foundation PlusDokument17 SeitenSneha Foundation PlusBikash KumarNoch keine Bewertungen

- Credit InflowsDokument1 SeiteCredit InflowsKayodeNoch keine Bewertungen

- Payment Receipt: Urban Administration and Development DepartmentDokument2 SeitenPayment Receipt: Urban Administration and Development Departmentaadarsh vermaNoch keine Bewertungen

- Bank Account FormDokument1 SeiteBank Account FormGampang GedeNoch keine Bewertungen

- Unified Patents Aml Ip US6876979Dokument13 SeitenUnified Patents Aml Ip US6876979Jennifer M GallagherNoch keine Bewertungen

- Ahm-Emporio-A143: Tax Invoice Infiniti Retail Limited Trading As CromaDokument3 SeitenAhm-Emporio-A143: Tax Invoice Infiniti Retail Limited Trading As CromaBoeing MaxNoch keine Bewertungen

- IT Module No. 6 Capital Gains Taxation Module Specific Learning OutcomesDokument18 SeitenIT Module No. 6 Capital Gains Taxation Module Specific Learning Outcomesdesiree bautistaNoch keine Bewertungen

- MEDITECH - MEDITECH Statement 20191128 PDFDokument49 SeitenMEDITECH - MEDITECH Statement 20191128 PDFLion Micheal OtitolaiyeNoch keine Bewertungen

- Bank StatementDokument3 SeitenBank Statementapexindustries5199100% (1)

- Campus Date of Joining: Noida Institute of Engineering & Technology (NIET) July 18, 2022Dokument2 SeitenCampus Date of Joining: Noida Institute of Engineering & Technology (NIET) July 18, 2022KESHAV JHANoch keine Bewertungen

- EXCLUSIONSDokument8 SeitenEXCLUSIONSMeliodas SamaNoch keine Bewertungen

- Fesco Online Bill May 2018Dokument2 SeitenFesco Online Bill May 2018Ataa Ul MustafaNoch keine Bewertungen

- What Is Annualized Withholding TaxDokument7 SeitenWhat Is Annualized Withholding TaxMarietta Fragata RamiterreNoch keine Bewertungen

- Tax Invoice: Coraplast IndustriesDokument1 SeiteTax Invoice: Coraplast IndustriesParesh GanganiNoch keine Bewertungen

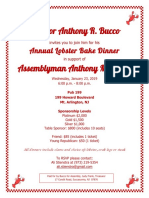

- 1.23.19 Lobsterbake InviteDokument2 Seiten1.23.19 Lobsterbake InviteAnthony M. BuccoNoch keine Bewertungen

- Factura - L MKTP 315540Dokument2 SeitenFactura - L MKTP 315540lauraNoch keine Bewertungen