Beruflich Dokumente

Kultur Dokumente

Depreciation Accounting

Hochgeladen von

HRish BhimberOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Depreciation Accounting

Hochgeladen von

HRish BhimberCopyright:

Verfügbare Formate

Depreciation Accounting

forests, plantations and similar regenerative

natural resources;

wasting assets including expenditure on the

exploration for and extraction of minerals, oils, natural gas and similar no regenerative resources;

expenditure on research and development; goodwill and other intangible assets; live stock.

Depreciation is a measure of the wearing out, consumption or

other loss of value of a depreciable asset arising from use, effluxion of time or obsolescence through technology and market changes. Depreciable assets are assets which are expected to be used during more than one accounting period; and have a limited useful life; are held by an enterprise for use in the production or supply of goods and services, for rental to others, or for administrative purposes and not for the purpose of sale in the ordinary course of business. Useful life is either the period over which a depreciable asset is expected to be used by the enterprise; or the number of production or similar units expected to be obtained from the use of the asset by the enterprise. Depreciable amount of a depreciable asset is its historical cost, or other amount substituted for historical cost2 in the financial statements, less the estimated residual value.

Charged in each accounting period by reference to the extent of the

depreciable amount, irrespective of an increase in the market value of the assets. based on historical cost, expected useful life & estimated residual value of the depreciable asset Any addition or extension to an existing asset The quantum of depreciation to be provided in an accounting period Methods of depreciation The statute governing an enterprise may provide the basis for computation of the depreciation Where depreciable assets are disposed of, discarded, demolished or destroyed, the net surplus or deficiency, if material, is disclosed separately. A change from one method of providing depreciation to another by statute, compliance with an accounting standard, or is appropriate in preparation of financial statement If the historical cost of an asset has undergone a change

The depreciation methods used; the total

depreciation; the gross amount of each class of depreciable assets and the related accumulated depreciation the provision for depreciation is based on the revalued amount on the estimate of the remaining useful life of such assets. treated as a change in an accounting policy

In case the depreciable assets are revalued,

A change in the method of depreciation is

The depreciable amount of a depreciable asset should be The depreciation method selected should be applied

allocated on a systematic basis to each accounting period during the useful life of the asset. consistently from period to period. A change from one method of providing depreciation to another by statute, compliance with an accounting standard, or is appropriate in preparation of financial statement after considering expected physical wear and tear; obsolescence; legal or other limits on the use of the asset. depreciable assets may be reviewed periodically

The useful life of a depreciable asset should be estimated The useful lives of major depreciable assets or classes of

Any addition or extension which becomes an integral

part of the existing asset should be depreciated over the remaining useful life of that asset. Where the historical cost of a depreciable asset has undergone a change, the depreciation on the revised unamortised depreciable amount should be provided prospectively over the residual useful life of the asset Where the depreciable assets are revalued, the provision for depreciation should be based on the revalued amount and on the estimate of the remaining useful lives of such assets. If any depreciable asset is disposed of, discarded, demolished or destroyed, the net surplus or deficiency, if material, should be disclosed separately.

The following information should be disclosed in the

financial statements:

the historical cost or other amount substituted for

historical cost of each class of depreciable assets; assets; and

total depreciation for the period for each class of

the related accumulated depreciation. The following information should also be disclosed in the

financial statements along with the disclosure of other accounting policies:

depreciation methods used; and depreciation rates or the useful lives of the assets, if

they are different from the principal rates specified in the statute governing the enterprise.

Das könnte Ihnen auch gefallen

- DepreciationDokument17 SeitenDepreciationTahirAli100% (1)

- Depreciation & Amortization: Presented byDokument26 SeitenDepreciation & Amortization: Presented byharish0505100% (1)

- AS 6, 10 and 28 on Accounting for Depreciation, Fixed Assets and ImpairmentDokument40 SeitenAS 6, 10 and 28 on Accounting for Depreciation, Fixed Assets and ImpairmentArunkumarNoch keine Bewertungen

- AS-6 DepreciationDokument18 SeitenAS-6 DepreciationKiran MishraNoch keine Bewertungen

- TOA 011 - Depreciation, Revaluation and Impairment With AnsDokument5 SeitenTOA 011 - Depreciation, Revaluation and Impairment With AnsSyril SarientasNoch keine Bewertungen

- DepreciationDokument22 SeitenDepreciationGelyn CruzNoch keine Bewertungen

- Revised: Accounting FOR Depreciatio NDokument15 SeitenRevised: Accounting FOR Depreciatio Nolick71Noch keine Bewertungen

- Concept of DepreciationDokument8 SeitenConcept of Depreciationuyphiljoshua06Noch keine Bewertungen

- Module 4 (Topic 5) - Depreciation (Straight Line and Variable Method)Dokument9 SeitenModule 4 (Topic 5) - Depreciation (Straight Line and Variable Method)Ann BergonioNoch keine Bewertungen

- Depreciation: AR1 SY 2016-17 Pol D. MedinaDokument52 SeitenDepreciation: AR1 SY 2016-17 Pol D. MedinaShieldon Vic PinoonNoch keine Bewertungen

- Accounting 102 quiz on depreciation, revaluation and impairmentDokument2 SeitenAccounting 102 quiz on depreciation, revaluation and impairmentKristine LaraNoch keine Bewertungen

- Ias 16 - PpeDokument4 SeitenIas 16 - Ppecar itselfNoch keine Bewertungen

- Accounting Standard 6Dokument9 SeitenAccounting Standard 6api-3828505Noch keine Bewertungen

- Accounting Standard 6 on DepreciationDokument9 SeitenAccounting Standard 6 on DepreciationGurkiran WaliaNoch keine Bewertungen

- Understanding Depreciation MethodsDokument4 SeitenUnderstanding Depreciation MethodsAlexander DimaliposNoch keine Bewertungen

- Depletion: Valix, C. T. Et Al. Intermediate GIC Enterprises & Co. IncDokument21 SeitenDepletion: Valix, C. T. Et Al. Intermediate GIC Enterprises & Co. IncJoris YapNoch keine Bewertungen

- Intangible AssetsDokument10 SeitenIntangible Assetssamuel debebeNoch keine Bewertungen

- What Is Reported As PropertyDokument10 SeitenWhat Is Reported As Propertypramodh kumarNoch keine Bewertungen

- Banking Technology Information ItDokument13 SeitenBanking Technology Information ItMughilan MNoch keine Bewertungen

- Depreciation Accounting Depreciation AccountingDokument25 SeitenDepreciation Accounting Depreciation AccountingLakshmi Prasanna BollareddyNoch keine Bewertungen

- Depreciation AccountingDokument42 SeitenDepreciation AccountingGaurav SharmaNoch keine Bewertungen

- 52 As 6Dokument3 Seiten52 As 6Tejendra SoniNoch keine Bewertungen

- Chapter 30Dokument2 SeitenChapter 30Ney GascNoch keine Bewertungen

- Depriciation AccountingDokument42 SeitenDepriciation Accountingezek1elNoch keine Bewertungen

- Accounting Standard 6 and 10Dokument14 SeitenAccounting Standard 6 and 10Sudha SalgiaNoch keine Bewertungen

- Ipcc Accounting - As-6Dokument16 SeitenIpcc Accounting - As-6meenakshi vermaNoch keine Bewertungen

- Accounting SystemDokument14 SeitenAccounting SystemPooja MaldeNoch keine Bewertungen

- Accounting Standard 6Dokument12 SeitenAccounting Standard 6Fɘstʋs JoʜŋNoch keine Bewertungen

- AS 6: Depreciation Accounting: IPCC Paper 1: Accounting Chapter 1 Unit 2Dokument40 SeitenAS 6: Depreciation Accounting: IPCC Paper 1: Accounting Chapter 1 Unit 2Jatin PandeNoch keine Bewertungen

- Fixed Assets AccountingDokument24 SeitenFixed Assets Accountingjayti desaiNoch keine Bewertungen

- Fin Acc Project DepriciationDokument33 SeitenFin Acc Project DepriciationJude R D'SouzaNoch keine Bewertungen

- FAR_REV_FINALSDokument90 SeitenFAR_REV_FINALSmickaNoch keine Bewertungen

- Meaning and DefinitionDokument5 SeitenMeaning and DefinitionAdi PoeteraNoch keine Bewertungen

- Ias 16Dokument9 SeitenIas 16ADEYANJU AKEEMNoch keine Bewertungen

- Fixed Asset and DepreciationDokument29 SeitenFixed Asset and DepreciationRushabh BeloskarNoch keine Bewertungen

- Fixed Assets, DepreciationDokument30 SeitenFixed Assets, Depreciationnahar570Noch keine Bewertungen

- BAB 4 Analyzing Investing Activities 220916 PDFDokument15 SeitenBAB 4 Analyzing Investing Activities 220916 PDFHaniedar NadifaNoch keine Bewertungen

- Accounting Standard 6Dokument208 SeitenAccounting Standard 6aanu1234Noch keine Bewertungen

- Ipsas 31-Intangable Assets IpsasDokument6 SeitenIpsas 31-Intangable Assets IpsasSolomon MollaNoch keine Bewertungen

- International Accounting Standard 16 Property, Plant and EquipmentDokument29 SeitenInternational Accounting Standard 16 Property, Plant and EquipmentAbdullah Shaker TahaNoch keine Bewertungen

- Reviewer Depreciation and Depletion Expires PDFDokument64 SeitenReviewer Depreciation and Depletion Expires PDFGab Ignacio0% (1)

- Indian Accounting Standard 16 Property, Plant & Equipment: By: Rahul DabralDokument9 SeitenIndian Accounting Standard 16 Property, Plant & Equipment: By: Rahul DabralMangala BorkarNoch keine Bewertungen

- Indian Accounting StandardDokument18 SeitenIndian Accounting StandardKamal Soni0% (1)

- C17 - MFRS 116 PpeDokument15 SeitenC17 - MFRS 116 Ppe2022478048Noch keine Bewertungen

- Depreciation-AS 6: Typical Problems Areas of Fixed AccountingDokument4 SeitenDepreciation-AS 6: Typical Problems Areas of Fixed AccountingRevanth NvNoch keine Bewertungen

- Accounting StandardsDokument14 SeitenAccounting StandardsarulesNoch keine Bewertungen

- Accounting Standard 6 - Depreciation Accounting Methods and DisclosuresDokument8 SeitenAccounting Standard 6 - Depreciation Accounting Methods and DisclosuresYudhister ReddyNoch keine Bewertungen

- Libby Financial Accounting Solution Manual Chapter 8 Entire VersionDokument5 SeitenLibby Financial Accounting Solution Manual Chapter 8 Entire Versionmercy ko0% (1)

- Unit - 5 DepreciationDokument19 SeitenUnit - 5 DepreciationGeethaNoch keine Bewertungen

- TA07b - Current AssetsDokument11 SeitenTA07b - Current AssetsMarsha Sabrina LillahNoch keine Bewertungen

- Unit 5 BBA SEM I DepreciationDokument24 SeitenUnit 5 BBA SEM I DepreciationRaghuNoch keine Bewertungen

- DepreciationDokument15 SeitenDepreciationHamza MughalNoch keine Bewertungen

- DepreciationDokument26 SeitenDepreciationBalu BalireddiNoch keine Bewertungen

- Intacc ReportDokument4 SeitenIntacc ReportChristen HerceNoch keine Bewertungen

- Definition of DepreciationDokument10 SeitenDefinition of DepreciationSureshKumarNoch keine Bewertungen

- CH 5 Depreciation and AmortisationDokument50 SeitenCH 5 Depreciation and AmortisationdeepakNoch keine Bewertungen

- "Accounting Standard 6": Cbc10/2007/prakra177/javak/5/2062008 A Project Report OnDokument7 Seiten"Accounting Standard 6": Cbc10/2007/prakra177/javak/5/2062008 A Project Report OnparliavinashNoch keine Bewertungen

- Fixed Assets and DepreciationDokument7 SeitenFixed Assets and DepreciationArun PeterNoch keine Bewertungen

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsVon EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNoch keine Bewertungen

- Detailed Cost StructureDokument7 SeitenDetailed Cost StructureHRish BhimberNoch keine Bewertungen

- Rcom Abridged 2012-13Dokument96 SeitenRcom Abridged 2012-13Jason RobertsonNoch keine Bewertungen

- Specific OrderDokument12 SeitenSpecific OrderHRish BhimberNoch keine Bewertungen

- Capital Budgeting MethodsDokument17 SeitenCapital Budgeting MethodsHRish BhimberNoch keine Bewertungen

- MDokument4 SeitenMHRish BhimberNoch keine Bewertungen

- India's Telecom Industry Growth and LiberalisationDokument7 SeitenIndia's Telecom Industry Growth and LiberalisationHRish BhimberNoch keine Bewertungen

- Summer InternshipDokument5 SeitenSummer InternshipHRish BhimberNoch keine Bewertungen

- Conventional Signs: and Further Information To The Swiss Topographic MapsDokument7 SeitenConventional Signs: and Further Information To The Swiss Topographic MapsHRish BhimberNoch keine Bewertungen

- Credit RatingDokument18 SeitenCredit RatingAmanjyot SinghNoch keine Bewertungen

- 13525module 1Dokument252 Seiten13525module 1DrVikram NaiduNoch keine Bewertungen

- At05 Pp01 Conventional SignsDokument18 SeitenAt05 Pp01 Conventional SignsHRish BhimberNoch keine Bewertungen

- EntrepreneurshipDokument75 SeitenEntrepreneurshipHRish BhimberNoch keine Bewertungen

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDokument54 SeitenSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNoch keine Bewertungen

- Explain The Importance of Purchasing in A Manufacturing OrganizationDokument14 SeitenExplain The Importance of Purchasing in A Manufacturing OrganizationHRish BhimberNoch keine Bewertungen

- LeasingDokument9 SeitenLeasingHRish BhimberNoch keine Bewertungen

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDokument34 SeitenSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNoch keine Bewertungen

- Case Study 4 February 2000-Narmada ProjectDokument14 SeitenCase Study 4 February 2000-Narmada ProjectHRish BhimberNoch keine Bewertungen

- Capital Budgeting MethodsDokument17 SeitenCapital Budgeting MethodsHRish BhimberNoch keine Bewertungen

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDokument28 SeitenSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNoch keine Bewertungen

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDokument36 SeitenSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNoch keine Bewertungen

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDokument30 SeitenSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNoch keine Bewertungen

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDokument44 SeitenSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNoch keine Bewertungen

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDokument34 SeitenSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNoch keine Bewertungen

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDokument54 SeitenSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNoch keine Bewertungen

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDokument51 SeitenSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNoch keine Bewertungen

- Accounting StandardDokument6 SeitenAccounting StandardHRish BhimberNoch keine Bewertungen

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDokument34 SeitenSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNoch keine Bewertungen

- Create an organization chart in PowerPointDokument3 SeitenCreate an organization chart in PowerPointHRish BhimberNoch keine Bewertungen

- Statistics Full BookDokument135 SeitenStatistics Full BookHRish BhimberNoch keine Bewertungen

- LeasingDokument9 SeitenLeasingHRish BhimberNoch keine Bewertungen

- Episode 8Dokument11 SeitenEpisode 8annieguillermaNoch keine Bewertungen

- Passive Voice Exercises EnglishDokument1 SeitePassive Voice Exercises EnglishPaulo AbrantesNoch keine Bewertungen

- Improve Your Social Skills With Soft And Hard TechniquesDokument26 SeitenImprove Your Social Skills With Soft And Hard TechniquesEarlkenneth NavarroNoch keine Bewertungen

- Product Packaging, Labelling and Shipping Plans: What's NextDokument17 SeitenProduct Packaging, Labelling and Shipping Plans: What's NextShameer ShahNoch keine Bewertungen

- Earth Drill FlightsDokument2 SeitenEarth Drill FlightsMMM-MMMNoch keine Bewertungen

- Excel Keyboard Shortcuts MasterclassDokument18 SeitenExcel Keyboard Shortcuts MasterclassluinksNoch keine Bewertungen

- 4AD15ME053Dokument25 Seiten4AD15ME053Yàshánk GøwdàNoch keine Bewertungen

- MiQ Programmatic Media Intern RoleDokument4 SeitenMiQ Programmatic Media Intern Role124 SHAIL SINGHNoch keine Bewertungen

- Compound SentenceDokument31 SeitenCompound Sentencerosemarie ricoNoch keine Bewertungen

- Overlord Volume 1 - The Undead King Black EditionDokument291 SeitenOverlord Volume 1 - The Undead King Black EditionSaadAmir100% (11)

- Markle 1999 Shield VeriaDokument37 SeitenMarkle 1999 Shield VeriaMads Sondre PrøitzNoch keine Bewertungen

- Supply Chain AssignmentDokument29 SeitenSupply Chain AssignmentHisham JackNoch keine Bewertungen

- Introduction To Computing (COMP-01102) Telecom 1 Semester: Lab Experiment No.05Dokument7 SeitenIntroduction To Computing (COMP-01102) Telecom 1 Semester: Lab Experiment No.05ASISNoch keine Bewertungen

- Module 6: 4M'S of Production and Business ModelDokument43 SeitenModule 6: 4M'S of Production and Business ModelSou MeiNoch keine Bewertungen

- Strategies To Promote ConcordanceDokument4 SeitenStrategies To Promote ConcordanceDem BertoNoch keine Bewertungen

- Virtue Ethics: Aristotle and St. Thomas Aquinas: DiscussionDokument16 SeitenVirtue Ethics: Aristotle and St. Thomas Aquinas: DiscussionCarlisle ParkerNoch keine Bewertungen

- Research Proposal by Efe Onomake Updated.Dokument18 SeitenResearch Proposal by Efe Onomake Updated.efe westNoch keine Bewertungen

- The Serpents Tail A Brief History of KHMDokument294 SeitenThe Serpents Tail A Brief History of KHMWill ConquerNoch keine Bewertungen

- Research PhilosophyDokument4 SeitenResearch Philosophygdayanand4uNoch keine Bewertungen

- GASB 34 Governmental Funds vs Government-Wide StatementsDokument22 SeitenGASB 34 Governmental Funds vs Government-Wide StatementsLisa Cooley100% (1)

- TorricelliDokument35 SeitenTorricelliAdinda Kayla Salsabila PutriNoch keine Bewertungen

- IndiGo flight booking from Ahmedabad to DurgaPurDokument2 SeitenIndiGo flight booking from Ahmedabad to DurgaPurVikram RajpurohitNoch keine Bewertungen

- Solidworks Inspection Data SheetDokument3 SeitenSolidworks Inspection Data SheetTeguh Iman RamadhanNoch keine Bewertungen

- Phasin Ngamthanaphaisarn - Unit 3 - Final Assessment Literary EssayDokument4 SeitenPhasin Ngamthanaphaisarn - Unit 3 - Final Assessment Literary Essayapi-428138727Noch keine Bewertungen

- All Forms of Gerunds and InfinitivesDokument4 SeitenAll Forms of Gerunds and InfinitivesNagimaNoch keine Bewertungen

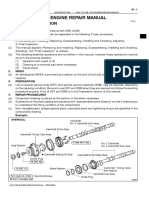

- How To Use This Engine Repair Manual: General InformationDokument3 SeitenHow To Use This Engine Repair Manual: General InformationHenry SilvaNoch keine Bewertungen

- Popular Painters & Other Visionaries. Museo Del BarrioDokument18 SeitenPopular Painters & Other Visionaries. Museo Del BarrioRenato MenezesNoch keine Bewertungen

- Sangam ReportDokument37 SeitenSangam ReportSagar ShriNoch keine Bewertungen

- Pharmaceuticals CompanyDokument14 SeitenPharmaceuticals CompanyRahul Pambhar100% (1)

- Addendum Dokpil Patimban 2Dokument19 SeitenAddendum Dokpil Patimban 2HeriYantoNoch keine Bewertungen