Beruflich Dokumente

Kultur Dokumente

FINAL Standard Chartered Bank

Hochgeladen von

nareshmanglani0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

621 Ansichten9 SeitenBank card industry is relatively new business the name is derived from standard& chartered, standard bank of British south Africa merged with chartered bank of india, Australia and china in 1969. Standard Chartered gained mileage over its competitors by innovating concept in the credit card history of India ( photo card, member get member scheme) No aggressive advertisement credit card facilities are not as good as other private banks.

Originalbeschreibung:

Originaltitel

FINAL Standard Chartered Bank[1]

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PPT, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenBank card industry is relatively new business the name is derived from standard& chartered, standard bank of British south Africa merged with chartered bank of india, Australia and china in 1969. Standard Chartered gained mileage over its competitors by innovating concept in the credit card history of India ( photo card, member get member scheme) No aggressive advertisement credit card facilities are not as good as other private banks.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

621 Ansichten9 SeitenFINAL Standard Chartered Bank

Hochgeladen von

nareshmanglaniBank card industry is relatively new business the name is derived from standard& chartered, standard bank of British south Africa merged with chartered bank of india, Australia and china in 1969. Standard Chartered gained mileage over its competitors by innovating concept in the credit card history of India ( photo card, member get member scheme) No aggressive advertisement credit card facilities are not as good as other private banks.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 9

Credit Card Business of Standard

Chartered Bank

KOMAL RANI (6314)

ARTEE ADVANI (6703)

SAEEDA WAZIR ALI (5864)

GULZAR AHMED (7557)

NARESH (6712)

INTRODUCTION:

• Bank card industry is relatively a new business

• Bank card history began when individual retail

merchants extended credit to their customers

• The name is derived from standard& chartered,

standard bank of British south Africa merged with

chartered bank of India, Australia and china in 1969.

• Standard Chartered Bank is a British bank

headquartered in London with operations in more than

seventy countries

It has network of over 1,700 branches and outlets

focuses on consumer, corporate, and institutional

banking, and on the provision of treasury services

Standard Chartered Bank has been actively engaged in

acquisitions and expansion

The Standard Chartered Credit Cards come with varied

categories and each category has some attractive

features

Standard chartered was the first issues a global card in

India, i.e. photo card

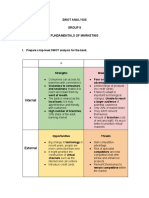

STRENGTHS:

Strong Brand name- worldwide presence.

Standard Chartered carried regular marketing research.

Strategic management of Standard Chartered bank was

great motivator of employees.

Standard Chartered gained mileage over its competitors

by innovating concept in the credit card history of India

( photo card, member get member scheme)

They launch their product at the right time (cricket

credit card in world cup 1996)

They did aggressive marketing in terms of sales

promotion and direct sales.

More focus on technology and telecommunication

(ATM Network, APS, Quality System)

Standard Chartered has been able to sustain its legacy

of being hailed as a trusted provider of credit services

to the modern-day customers

Highly trained and motivated sales force

Standard chartered is growing at the rate of 37% which

is higher than the market rate of 33%

Biggest acquirer of Asian banking assets

WEAKNESS

SCB charges higher exchange rates and other hidden

charges those are unknown to the customer.

No focus on upper class urban population.

Bank has offices only in ten major cities in populous

country like India.(Not many branch networks)

No aggressive advertisement

Credit card facilities are not as good as other private

banks.

OPPORTUNITIES:

There are a large number of potential customers for credit

cards; hence the market growth is expected to increase.

It recorded a growth of about 33% in March 2003

There is established infrastructure in the market.

Laws regarding credit card are not that strict to expand

business

THREATS:

Credit card business is essentially a volume driven

businesses with marginal returns

The returns on investments take long periods and so

the risk involved is also greater.

A critical number is required to make the business

profitable for issuers.

Acquisition of new customers and retention of existing

customer

The market was already dominated by an early entrant

– Citibank. Their competitors include Cancard, HSBC

The threat of new entrants –

sales force W2: offices only in Ten cities

S2: Brand image in market W3: Less focus on advertising

S3: Focus on technology and W4: Credit card facilities are not as good as other private

innovations banks

S4: Customer service

OPPORTUNITIES (O): SO STRATEGIES: WO STRATEGIES:

O1: Market growth Use S2, S4 & S1 to capture O1,O2 Overcome W2 to exploit O1.

O2: Govt: laws regarding credit & O3. •Standard Chartered should increase its offices in

card business are not strict •It should focus on market most cities of India to capture the market share.

O3: Established infrastructure capitalisation by providing

quality service to their Overcome W1 to exploit O1

customers through their •It should also focus on upper class urban population

motivated sales force. Market to have more market share.

expansion can also be

supported by lenient Govt:

laws and established

infrastructure.

THREATS (T): ST STRATEGIES: WT STRATEGIES:

T1: Competition by CITI Bank Use S3 to minimise T1 & T3: Overcome W3 to cope with T3

and HSBC •Highly focus on technology •SCB can acquire prospective customers by

T2: Threat of new entrants in order to come up with identifying and stimulating the hidden needs of

T3: acquisition and retention of more innovative products can customers through more focus on advertisement.

customers. lead them from their

competitors. Overcome W4 to cope with T1 & T3:

•SCB should offer a wide range of Credit card to

Use S4 to minimize T3: acquire and retain customers than their competitors.

•It should give priority to

quality customer service to

acquire new customers and

retain existing ones.

Das könnte Ihnen auch gefallen

- Banking 2020: Transform yourself in the new era of financial servicesVon EverandBanking 2020: Transform yourself in the new era of financial servicesNoch keine Bewertungen

- SPAH Local GovernmentDokument17 SeitenSPAH Local GovernmentAnonymous 3VAQ9SNxl7Noch keine Bewertungen

- Final Report RURB Construction June 2016 PDFDokument188 SeitenFinal Report RURB Construction June 2016 PDFShamiel AmirulNoch keine Bewertungen

- Contoh Report ThesisDokument55 SeitenContoh Report ThesisWan Radhiah100% (1)

- Curent Status of Ibs Industry in MalaysiaDokument28 SeitenCurent Status of Ibs Industry in MalaysiaDukeNoch keine Bewertungen

- Swot Analysis of Standard Chartered BankDokument1 SeiteSwot Analysis of Standard Chartered Bankmaster of finance and control100% (1)

- Malaysian Legal SystemDokument24 SeitenMalaysian Legal Systemmohd izzat amsyatNoch keine Bewertungen

- Axis Bank - Marketing of ServicesDokument58 SeitenAxis Bank - Marketing of ServicesUtkarsh Jaiswal100% (1)

- SingYouth Heart Challenge 2017 - Abstract Briefing SlidesDokument15 SeitenSingYouth Heart Challenge 2017 - Abstract Briefing Slidesultra_sc100% (1)

- Standard Chartered Bank ShortcutDokument20 SeitenStandard Chartered Bank ShortcutRoyNoch keine Bewertungen

- SBSMBL - Malaysian Legal SystemDokument22 SeitenSBSMBL - Malaysian Legal SystemSN KhairudinNoch keine Bewertungen

- Standard Chartered Bank ProfileDokument8 SeitenStandard Chartered Bank ProfileNeeloy HoqueNoch keine Bewertungen

- Malaysia - SMART Tunnel - Specialty GroutingDokument2 SeitenMalaysia - SMART Tunnel - Specialty GroutingKai Chun NgNoch keine Bewertungen

- Issues and Challenges in Water SectorDokument31 SeitenIssues and Challenges in Water SectorAlec LiuNoch keine Bewertungen

- Smart Tunnel and TBMDokument10 SeitenSmart Tunnel and TBMPandu RiezkyNoch keine Bewertungen

- A180172 BPM Assignment1Dokument12 SeitenA180172 BPM Assignment1Nurul IzzatyNoch keine Bewertungen

- FINAL - SMART TUNNEL - Presentation (Hydraulics Winter 2013)Dokument17 SeitenFINAL - SMART TUNNEL - Presentation (Hydraulics Winter 2013)JunaidKhanNoch keine Bewertungen

- Strategic Management ReportDokument33 SeitenStrategic Management ReportLuxme PokhrelNoch keine Bewertungen

- Chapter 6 Dam and Spillways2Dokument48 SeitenChapter 6 Dam and Spillways2Hasnolhadi Samsudin100% (1)

- SIU Report Summary 21.06.2018Dokument28 SeitenSIU Report Summary 21.06.2018CityPressNoch keine Bewertungen

- Petronas TowersDokument10 SeitenPetronas TowersMizta MikeNoch keine Bewertungen

- An Overview of Malaysian Legal SystemDokument5 SeitenAn Overview of Malaysian Legal SystemKamarulAzimMuhaimiNoch keine Bewertungen

- Standard Chartered BankDokument31 SeitenStandard Chartered BankAl Imran100% (3)

- Full Assignment of Sun TzuDokument14 SeitenFull Assignment of Sun TzuDanny Yong Seng Ee100% (1)

- MPW2133 Malaysian Studies JudiciaryDokument16 SeitenMPW2133 Malaysian Studies JudiciaryfarhanialihoneybunnyNoch keine Bewertungen

- Assignment AnswersDokument4 SeitenAssignment AnswersFierdzz XieeraNoch keine Bewertungen

- Highland Towers Collapse 2Dokument7 SeitenHighland Towers Collapse 2nik arifNoch keine Bewertungen

- History of The Malaysian Legal SystemDokument36 SeitenHistory of The Malaysian Legal SystemSiti Nur AthirahNoch keine Bewertungen

- Procedures of Procurement: Centralised and DecentralisedDokument6 SeitenProcedures of Procurement: Centralised and DecentralisedLouvennea JoyenneNoch keine Bewertungen

- DID Malaysia Final - Stormwater Submission ChecklistDokument62 SeitenDID Malaysia Final - Stormwater Submission ChecklistVincentNoch keine Bewertungen

- Standered Chartered BankDokument75 SeitenStandered Chartered BankfaizanjahangirNoch keine Bewertungen

- Review of Issue On Pavement EngineeringDokument8 SeitenReview of Issue On Pavement EngineeringInahMisumiNoch keine Bewertungen

- Sustainable Construction Waste Management in Malaysia - A Contractor's PerspectiveDokument10 SeitenSustainable Construction Waste Management in Malaysia - A Contractor's PerspectiveMuhammad Amirul HakimNoch keine Bewertungen

- Thesis Storm 2013Dokument35 SeitenThesis Storm 2013ashuNoch keine Bewertungen

- Intro To Project ManagementDokument6 SeitenIntro To Project ManagementR. MillsNoch keine Bewertungen

- NOKIA - Case StudyDokument12 SeitenNOKIA - Case StudySCMLDPGPEL_2010_11Noch keine Bewertungen

- General and Design PerspectiveDokument25 SeitenGeneral and Design PerspectiveEyntan Natasha100% (1)

- Embankment Dam Ppt01Dokument146 SeitenEmbankment Dam Ppt01Riqicha JaalalaaNoch keine Bewertungen

- Science HBPDokument156 SeitenScience HBPVanness Kung0% (1)

- Role of ProjectDokument28 SeitenRole of Projectaden1919Noch keine Bewertungen

- A Case Study On International Construction Projects: Stadiums and ArenasDokument33 SeitenA Case Study On International Construction Projects: Stadiums and ArenasNor AdzierahNoch keine Bewertungen

- Development of Underground Land in MalaysiaDokument17 SeitenDevelopment of Underground Land in MalaysiaNorAisyahJamalludinNoch keine Bewertungen

- Chapter 1 Malaysian Legal SystemDokument21 SeitenChapter 1 Malaysian Legal Systemafiq91Noch keine Bewertungen

- Possible Russian Invasion of Ukraine Scenarios For Sanctions and Likely Economic Impact On Russia Ukraine and The Eu DLP 6044Dokument28 SeitenPossible Russian Invasion of Ukraine Scenarios For Sanctions and Likely Economic Impact On Russia Ukraine and The Eu DLP 6044dhaiwat100% (1)

- International Business Economics, Greek Debt Crisis' ScenariosDokument36 SeitenInternational Business Economics, Greek Debt Crisis' ScenariosNguyen Quoc BaoNoch keine Bewertungen

- Case Study MilitaryDokument1 SeiteCase Study Militaryrazvan6b49Noch keine Bewertungen

- Chapter 6Dokument2 SeitenChapter 6Kartz EswarNoch keine Bewertungen

- S3b1 Malaysia PDFDokument68 SeitenS3b1 Malaysia PDFlittle projectNoch keine Bewertungen

- Highland TowersDokument4 SeitenHighland Towersrex999Noch keine Bewertungen

- Nokia's Road To FailureDokument12 SeitenNokia's Road To Failurefatemah zahid100% (1)

- 8 EditDokument24 Seiten8 Editlim hyNoch keine Bewertungen

- Kenya M-PESA Case Study-2Dokument5 SeitenKenya M-PESA Case Study-2salimsayouriNoch keine Bewertungen

- Standard Chartered: Credit CardsDokument26 SeitenStandard Chartered: Credit CardsjaslikethatNoch keine Bewertungen

- Swot Analysis Group 8 Fundamentals of Marketing: InternalDokument3 SeitenSwot Analysis Group 8 Fundamentals of Marketing: InternalDANIELA SÁNCHEZ HERRERA-AlumnoNoch keine Bewertungen

- HSBC Bank Business Model, GVC, 4IR, Porters Five Forces, SWOT, Strategic MappingDokument29 SeitenHSBC Bank Business Model, GVC, 4IR, Porters Five Forces, SWOT, Strategic MappingShamsuzzaman SunNoch keine Bewertungen

- ProjectReport UpdatedDokument27 SeitenProjectReport UpdatedLavanya KashyapNoch keine Bewertungen

- Capital One MCFP Group1Dokument18 SeitenCapital One MCFP Group1vijay kumarNoch keine Bewertungen

- Assiegnment On Khidmah Credit CardDokument14 SeitenAssiegnment On Khidmah Credit Cardgaffar652Noch keine Bewertungen

- SM PPT RBCDokument20 SeitenSM PPT RBCAnkita KumariNoch keine Bewertungen

- Strategic Business Managegent Case Study of FIRST DIRECT BANK by SADIQ YUSUF YABODokument12 SeitenStrategic Business Managegent Case Study of FIRST DIRECT BANK by SADIQ YUSUF YABOsadiq yusuf100% (6)

- Assignment On Marketing Communication Mix of CadburyDokument6 SeitenAssignment On Marketing Communication Mix of Cadburykarangrover100% (1)

- Swot of NikeDokument2 SeitenSwot of Nikeynkamat100% (1)

- Role of Marketing in A Developing EconomyDokument23 SeitenRole of Marketing in A Developing EconomyAanchal GuptaNoch keine Bewertungen

- An Analysis Into Service Marketing Perspective For Service ImprovementDokument24 SeitenAn Analysis Into Service Marketing Perspective For Service ImprovementUtkarsh SinghNoch keine Bewertungen

- Final Report On LifebuoyDokument41 SeitenFinal Report On LifebuoyNawaz TanvirNoch keine Bewertungen

- Independent University, BangladeshDokument93 SeitenIndependent University, BangladeshShahriar HaqueNoch keine Bewertungen

- Asq - Design FmeaDokument35 SeitenAsq - Design Fmeasa_arunkumarNoch keine Bewertungen

- Maruti Manesar StrikeDokument4 SeitenMaruti Manesar StrikePrasad KhotNoch keine Bewertungen

- Complaint - Little Caesars v. Piara PizzaDokument22 SeitenComplaint - Little Caesars v. Piara PizzaDarius C. GambinoNoch keine Bewertungen

- IMCDokument28 SeitenIMCChanchal Kansal0% (1)

- Dabur Project - 11111Dokument32 SeitenDabur Project - 11111King Nitin Agnihotri0% (1)

- 39 - Kshitij Varma - World of Titan Vs FossilDokument14 Seiten39 - Kshitij Varma - World of Titan Vs FossilPuneet DhingraNoch keine Bewertungen

- Management Strategic For External AssessmentDokument40 SeitenManagement Strategic For External AssessmentRadhika Hartami PutriNoch keine Bewertungen

- Increasing Returns To Scale in ProductionDokument8 SeitenIncreasing Returns To Scale in ProductionjulieNoch keine Bewertungen

- Mcdonalds Brand ManagementDokument30 SeitenMcdonalds Brand ManagementRachit AgarwalNoch keine Bewertungen

- BT Lifter HPT Brochure 0614Dokument12 SeitenBT Lifter HPT Brochure 0614Ram ReddyNoch keine Bewertungen

- Marketing Aspect-Feasibility StudyDokument9 SeitenMarketing Aspect-Feasibility StudyJeremy Kuizon Pacuan50% (2)

- Strategic Management MCQDokument3 SeitenStrategic Management MCQsyedqutub16100% (1)

- Loans and AdvancesDokument64 SeitenLoans and AdvancesShams SNoch keine Bewertungen

- L2 - Decision Making - ENDokument57 SeitenL2 - Decision Making - ENKiến Văn QuốcNoch keine Bewertungen

- Study Report On HondaDokument62 SeitenStudy Report On HondaAkansha Mehta67% (3)

- Chapter 8 Segmenting and Targeting MarketsDokument26 SeitenChapter 8 Segmenting and Targeting Marketsrizcst9759Noch keine Bewertungen

- E-Commerce in BangladeshDokument8 SeitenE-Commerce in BangladeshFariya HossainNoch keine Bewertungen

- PVR Marketing PDFDokument32 SeitenPVR Marketing PDFRudro Mukherjee100% (1)

- Script MMDokument2 SeitenScript MMaakash pandeyNoch keine Bewertungen

- Measurement of Macroeconomic AggregatesDokument10 SeitenMeasurement of Macroeconomic Aggregatesnigam34Noch keine Bewertungen

- Labor Economics ch3 NotesDokument8 SeitenLabor Economics ch3 NotesBuddy PolidoNoch keine Bewertungen

- A Project Report by Satya R.Tanna T.Y.Bmm 221Dokument15 SeitenA Project Report by Satya R.Tanna T.Y.Bmm 221Satya Rajendra TannaNoch keine Bewertungen

- Crocs Revolution An Industry Supply Chain Model For Competitive AdvantageDokument28 SeitenCrocs Revolution An Industry Supply Chain Model For Competitive AdvantageNengah Sugita100% (1)

- Design and Size of Sales TerritoriesDokument26 SeitenDesign and Size of Sales TerritoriesImran Malik100% (1)