Beruflich Dokumente

Kultur Dokumente

2006 Level 1 SS 7 and 8

Hochgeladen von

kevinpuraOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2006 Level 1 SS 7 and 8

Hochgeladen von

kevinpuraCopyright:

Verfügbare Formate

Financial Statement Analysis

Financial Statement Analysis

Study Session 7 & 8

Financial Statement Analysis

Financial Statement Analysis Basic Concepts

Study Session 7

Financial Statement Analysis

CONTENTS OF STOCKHOLDERS REPORT

Managements Discussion and Analysis (MDA) Balance Sheet Income Statement Statement of Stockholders Equity Statement of Cash Flows Statement of Comprehensive Income Auditors Report Explanatory Notes Supplementary Information

LOS 29 d discuss the additional sources of information accompanying the financial statements, including the financial footnotes, supplementary schedules, Management Discussion and Analysis (MD&A) and Proxy statements

Financial Statement Analysis

CONTENTS OF MANAGEMENT DISCUSSION AND ANALYSIS

Results of operations + discussion of trends

Capital resources and liquidity + trends in cashflows

General business overview based on known trends Effects of known trends, events and uncertainties Discontinued operations, extraordinary items, unusual items Disclosures in interim financial statements Segmental cash flow requirements and contributions

LOS 29 d discuss the additional sources of information accompanying the financial statements, including the financial footnotes, supplementary schedules, Management Discussion and Analysis (MD&A) and Proxy statements

Financial Statement Analysis

Corporate Filings/Proxy Statements

Form 10-K Annual Report Detailed financial results reported to the SEC on annual basis. Audited and filed 90 days after the close of a fiscal year. Publicly held companies report their financial results annually to shareholders in an annual report. Effectively the report is a condensed version of the 10K. A proxy statement is sent to all shareholders in connection with company meetings. The proxy explains proposals that will be voted on by the shareholders. The proxy also contains information about management remuneration, stock options, special deals and related party transactions. The proxy will also detail any changes of auditor.

Proxy

LOS 29 d discuss the additional sources of information accompanying the financial statements, including the financial footnotes, supplementary schedules, Management Discussion and Analysis (MD&A) and Proxy statements

Financial Statement Analysis

Corporate Filings/Proxy Statements

Form 10-Q Public companies must file quarterly reports 45 days after the end of the period using form 10-Q. The form contains a balance sheet, statement of operations, cashflow and MDA but is not audited. 8-K is used to inform the SEC of special events: changes in control, acquisitions, dispositions, auditor changes, director resignation and bankruptcy. (Normally due within 15 days 5 for auditor) Insiders must register every time they buy or sell stock. When a publicly held company plans to issue securities, it must file a registration statement, including a prospectus and exhibits

Form 8-K

Form 144 Registration

LOS 29 d discuss the additional sources of information accompanying the financial statements, including the financial footnotes, supplementary schedules, Management Discussion and Analysis (MD&A) and Proxy statements

Financial Statement Analysis

FINANCIAL ACCOUNTING STANDARD SETTING

American Institute of Certified Public Accountants (AICPA)

(Recognize) Pre-1973 APB

Securities and Exchange Commission (SEC)

Financial Accounting Standards Board (FASB)

Statements of Financial Accounting Concepts (SFAC)

Statements of Financial Accounting Standards (SFAS)

LOS 29 a discuss the general principles of the financial reporting system and explain the objectives of financial reporting according to the Financial Accounting Standards Board (FASB) conceptual framework;

Financial Statement Analysis

INTERNATIONAL FINANCIAL ACCOUNTING STANDARD SETTING

Different accounting standards make international comparisons difficult IOSCO International Organization of Securities Commissions 65 countries securities regulators investigate and set standards on multinational disclosure and financial statements. Implementation is left to the individual members. International Accounting Standards Board attempting to provide a unified international framework of accounting standards. Has issued over 40 proclamations. Lacks a formal mechanism to ensure compliance with standards. Many governments now voluntarily adopting IAS. International Accounting standards were adopted by the EU in 2005. US and IAS are slowly converging.

IASB

LOS 29c discuss the role of IOSCO and IASB in setting and enforcing global accounting standards

Financial Statement Analysis

General Principals of Financial Reporting System

Timing Economic events and accounting entries may take place in different periods, e.g., changes in market value of PP&E Many economic events do not receive recognition, e.g., contingencies, off balance sheet finance Certain items may be reported in different ways, e.g., FIFO vs. LIFO

Recognition

Measurement

LOS 29a : Discuss the general principals of the financial reporting system

Financial Statement Analysis

Objectives of Financial Reporting

Equity Investors

Interested in identifying firms with long term earning power, growth opportunities and ability to pay dividends Interested in liquidity of the business

Long term asset position and earning power Investors debt and equity

Short Term Creditors

Long Term Creditors

Classes of user

Government taxes/regulators Others public, special interest groups, workforce etc

LOS 29a : Discuss the general principals of the financial reporting system

Financial Statement Analysis

Foundations of Accrual Accounting

Recognition Principle

Revenue is recognized when goods are delivered or services performed, not necessarily when the cash is received Revenues and associated costs are recognized in the same accounting period Assets and liabilities are recorded at the transactions original value. The advantage is that historic cost is objective and verifiable.

Matching Principle

Historic Cost Principle

LOS 29a : Discuss the general principals of the financial reporting system

Financial Statement Analysis

Statement of Financial Accounting Concepts (SFAC) 2

Relevance Timeliness Reliability Consistency Comparability Materiality Information that could potentially affect a decision Information looses value rapidly in the financial world. Helpful for forecasting. Verifiable and representational faithfulness Same accounting principles consistently applied over time Information should allow comparison between companies. Often difficult due to estimates and methods. Which data is important enough for inclusion in the financial statements.

LOS 29 b identify the accounting qualities (e.g., relevance, reliability, predictive value, timeliness) set forth in Statement of Financial Accounting Concepts (SFAC) 2, and discuss how these qualities provide useful information to an analyst

Financial Statement Analysis

The Audit Report

Audit = independent review of the companys financial statements

Financial statements are true and fair

Audit Report

Responsibility of management to prepare accounts Independence of Auditors Properly prepared in accordance with relevant GAAP Free from material misstatement

Accounting principles and estimates chosen are reasonable

Unqualified opinion vs. qualified opinion Uncertainties

LOS 29 e Discuss the role of the Auditor and the meaning of the audit opinion

Financial Statement Analysis

MONEY IN

Loan capital (ST & LT)

Share capital Reserves Assets Liabilities Equity

MONEY OUT

Long-lived assets Current assets Investments

probable current and future economic benefit obtained as a result of past transactions probable sacrifices of economic benefit/transfers of wealth as a result of past transactions residual interest in Net Assets of an entity (Total Assets Total Liabilities) = ASSETS

LIABILITIES + STOCKHOLDER EQUITY

Assets In order of liquidity

Liabilities In order of due date

LOS 29 d describe and distinguish between the principal financial statements: Balance Sheet, Income Statement, Statement of Comprehensive Income, Statement of Cash Flows and Statement of Stockholders Equity

Financial Statement Analysis

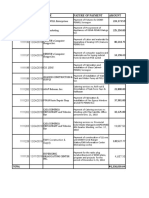

LOFTUS INC. BALANCE SHEET AS AT 31 DECEMBER 20X0

ASSETS Current assets Cash Short term investments Accounts receivable Less: Bad debt provision Inventory Prepayments Total current assets Investments Property plant & equipment Land and Buildings Plant & Machinery Less: Accumulated depreciation Intangible assets: Goodwill TOTAL ASSETS

LOS 29 d describe and distinguish between the principal financial statements: Balance Sheet LOS 30 a describe the factors that distinguish long-term assets from and identify common types of long-term assets and their carrying values on the balance sheet;

$000

$000 100 40

$000

400 (20)

380 540 10 1,070 200

500 1800 (400) 1400

1,900

2,000 5,170

Financial Statement Analysis

Long Term Assets

Long term asset = asset held for continuing use within the business, not resale Carrying Value Balance Sheet $ Profit on disposal Income Statement $ Proceeds NBV Profit/(loss) X (X) X/(X)

Cost

Accumulated Depn /Amort Net Book Value (NBV)

X

(X) X

Cost includes all expenditure to acquire the asset and ready it for usage (installation, broker, legal fees, etc.)

For part exchange replace proceeds with trade in allowance

LOS 30 a identify the common types of long-term assets and their carrying values on the balance sheet LOS 30 b determine the cost and record the purchase, of property, plant, and equipment LOS 30 d describe how to account for the sale, exchange, or disposal of depreciable assets

Financial Statement Analysis

LOFTUS INC BALANCE SHEET AS AT 31 DECEMBER 20X0

LIABILITIES Current liabilities $000 $000 $000

Accounts payable Tax payable Current portion of long term debt

Total current liabilities Long term liabilities Bonds payable STOCKHOLDERS EQUITY Contributed capital Common stock $1 par value 500,000 shares issued and outstanding Other paid in capital Total contributed capital Retained earnings Total stockholders equity TOTAL LIABILITIES AND STOCKHOLDERS EQUITY

LOS 29 d describe and distinguish between the principal financial statements: Balance Sheet LOS 31 f describe the components/format of the balance sheet

390 250 120

760

2,340

500 200 700 1,370 2,070 5,170

Financial Statement Analysis

Stockholders Equity

Preferred Stock Disclosure dividends (fixed, floating, participating), call provisions, conversion privileges. If redeemable by holder reclassify after liabilities

Each class reported separately, recorded at par value, treasury stock contra for repurchases If common stock is issued above par value any excess is recorded in additional paid in capital

Common Stock

Additional Paid in Capital Other items

- Minimum Liability Adjustment (Pensions) - Forex gains and losses under the all current method - Market Valuation Adjustment (Available for sale securities) - Unearned shares issued to employee stock ownership plans

LOS 31 f describe the format and the components of the balance sheet and the format, classification, and use of each component of the statement of stockholders equity.

Financial Statement Analysis

STATEMENT OF STOCKHOLDERS EQUITY LOFTUS INC.

Year Ending December 31 20X0 $000

Stockholders Equity at beginning

Additions: Sale of Common Stock at Par Additional Paid-In Capital: Net Income 200X Dividends Paid: Stockholders Equity at end

1,520

200 200 500 (350) 2,070

LOS 29 d describe and distinguish between the principal financial statements: Statement of Stockholders Equity LOS 31 f describe the format and the components of the balance sheet and the format, classification, and use of each component of the statement of stockholders equity.

Financial Statement Analysis

INCOME STATEMENT FOR THE YEAR ENDING 31 DECEMBER 20X0

LOFTUS INC $000 Revenues Cost of goods sold Gross profit Operating expenses Depreciation Earnings before interest and taxes Interest expense Earnings before taxes Taxes Net income 6,350 2,400 3,950 2,500 200 1,250 500 750 250 500

LOS 29 d describe and distinguish between the principal financial statements: Balance Sheet, Income Statement, Statement of Comprehensive Income, Statement of Cash Flows and Statement of Stockholders Equity LOS 31 a describe the format on the Income Statement and the components of net income

Financial Statement Analysis

FINANCIAL STATEMENT FOOTNOTES

Information on accounting methods, assumptions and estimates Additional information on items appearing in major statements

Depreciation methods Inventory valuation methods Leasing arrangements Deferred tax calculations Items not otherwise reported in the financial statements that are relevant and/or material

(these are potential losses/payments potentially to be incurred by the firm, subject to the outcome of some future event/action e.g. litigation)

Disclosures relating to contingent losses Accrue a loss: - probable that loss has been incurred - amount can be reasonably estimated Footnote disclosure: - loss is reasonably possible - e.g., litigation, expropriation

LOS 29 d discuss the additional sources of information accompanying the financial statements, including the financial footnotes, supplementary schedules, Management Discussion and Analysis (MD&A) and Proxy statements

Financial Statement Analysis

INCOME STATEMENT FORMAT SUGGESTED IN READING

+ +/

+/ +/ +/

Revenues from the sales of goods and services: Other income and revenues Operating expenses Financing costs Unusual or infrequent items

Pre-tax earnings from continuing operations Income tax expense Net income from continuing operations Income from discontinued operations Extraordinary items Cumulative effect of accounting changes Net income

LOS 29 d describe and distinguish between the principal financial statements: Balance Sheet, Income Statement, Statement of Comprehensive Income, Statement of Cash Flows and Statement of Stockholders Equity LOS 31 a describe the format on the Income Statement and the components of net income

Financial Statement Analysis

CRITERIA FOR REVENUE RECOGNITION

In order to recognize revenues (in the Income Statement) two conditions must be met: 1. Completion of the earnings process This amounts to the firm having provided all or virtually all of the services for which it is to be paid, knowing the total expected cost of providing those services and the associated revenues

2. Assurance of payment The seller must be able to reasonably estimate the probability of payment

LOS 31 b Identify the requirements for revenue recognition to occur.

Financial Statement Analysis

METHODS OF REVENUE RECOGNITION

Sales basis Sales and corresponding costs recognized at the point of sale and/or when a service has been provided For long term contracts where a reliable estimate of revenues, costs and completion time exists. Revenues and costs recognized according to the proportion of work completed. For long term contracts where there is no contract or estimates of revenues and costs are unreliable. Revenues and costs are not recognized in the Income Statement until the entire project is completed.

Percentage-of-completion

Completed contract

LOS 31 b explain the importance of the matching principle for revenue and expense recognition, identify the requirements for revenue recognition to occur, identify and describe the appropriate revenue recognition, given the status of completion of the earning process and the assurance of payment, and discuss different revenue recognition methods and their implications for financial analysis;

Financial Statement Analysis

METHODS OF REVENUE RECOGNITION

For contracts where costs and revenues are known but the exact timing of the receipt of sales cash is unclear. Revenues and costs are recognized in the Income Statement in proportion to the cash collection. For contracts where revenues are known but the exact size of costs is not clear. Profits are not recognized in the Income Statement until all costs have been recovered, i.e., through the recognition of sales just equal to costs incurred.

Instalment sales

Cost recovery

LOS 31 b explain the importance of the matching principle for revenue and expense recognition, identify the requirements for revenue recognition to occur, identify and describe the appropriate revenue recognition, given the status of completion of the earning process and the assurance of payment, and discuss different revenue recognition methods and their implications for financial analysis;

Financial Statement Analysis

PERCENTAGE OF COMPLETION METHOD EXAMPLE

Bircham Properties Ltd. has a contract to build a hotel for $2,000,000 to be received in equal installments over 4 years. A reliable estimate of total cost of this contract is $1,600,000. During the first year, Bircham Properties incurred $400,000 in cost. During the second year, $500,000 of costs were incurred. The estimate of the projects total cost did not change in the second year. Calculate the revenue to be recognized in each of the first two years.

LOS 31 c identify the appropriate income statement and balance sheet entries using the percentage-of-completion method and the completed contract method and describe and calculate the effects on cash flows and selected financial ratios that result from using the percentage-of-completion method versus the completed contract method;

Financial Statement Analysis

POC vs. CC METHODS EXAMPLE (BALANCE SHEET)

Cook Properties has a contract to build an office building for $2 million. An estimate of the contracts total costs is $1.5 million. Billings and cost patterns are as follows: 20x1 20x2 20x3 Total Amounts billed

Cash received Costs incurred

800

600 500

700

900 700

500

500 300

2,000

2,000 1,500

You are required to prepare the balance sheets using the percentage of completion and completed contract methods.

LOS 31 c identify the appropriate income statement and balance sheet entries using the percentage-of-completion method and the completed contract method and describe and calculate the effects on cash flows and selected financial ratios that result from using the percentage-of-completion method versus the completed contract method;

Financial Statement Analysis

BALANCE SHEET PERCENTAGE-OF-COMPLETION METHOD

Total Assets 20x1 20x2 20x3

Cash

(Cash Recd Cost Incurred)

Accounts receivable

(Amounts Billed Cash Recd)

Net CIP* Total Assets

* See working slide

LOS 31 c identify the appropriate income statement and balance sheet entries using the percentage-of-completion method and the completed contract method and describe and calculate the effects on cash flows and selected financial ratios that result from using the percentage-of-completion method versus the completed contract method;

Financial Statement Analysis

BALANCE SHEET PERCENTAGE-OF-COMPLETION METHOD

Total Liabilities and Equity 20x1 Net Advanced Billings* Retained Earnings Total Liabilities & Equity 20x2 20x3

* See working slide

LOS 31 c identify the appropriate income statement and balance sheet entries using the percentage-of-completion method and the completed contract method and describe and calculate the effects on cash flows and selected financial ratios that result from using the percentage-of-completion method versus the completed contract method;

Financial Statement Analysis

MEMO CIP

20x1 Cost Profit Allocation

Cost to Date

Total Cost Contract Price Total X Cost

20x2

20x3

Amounts Billed Net CIP/(Net Advanced Billings)

Financial Statement Analysis

BALANCE SHEET COMPLETED CONTRACT METHOD

Total Assets 20x1 Cash Accounts receivable Net CIP Total Assets 20x2 20x3

LOS 31 c identify the appropriate income statement and balance sheet entries using the percentage-of-completion method and the completed contract method and describe and calculate the effects on cash flows and selected financial ratios that result from using the percentage-of-completion method versus the completed contract method;

Financial Statement Analysis

BALANCE SHEET COMPLETED CONTRACT METHOD

Total Liabilities and Equity 20x1 Net Advanced Billings 20x2 20x3

Retained Earnings

Total Liabilities & Equity

LOS 31 c identify the appropriate income statement and balance sheet entries using the percentage-of-completion method and the completed contract method and describe and calculate the effects on cash flows and selected financial ratios that result from using the percentage-of-completion method versus the completed contract method;

Financial Statement Analysis

MEMO CIP

20x1 Cost 20x2 20x3

Amounts Billed Net CIP/(Net Advanced Billings)

Financial Statement Analysis

PERCENTAGE-OF-COMPLETION vs. COMPLETED CONTRACT

During Project Life

Net income Income Statement Volatility of income Total assets Balance Sheet Statement of Cash Flows Liabilities POC CC

R/E

Cash flow Importance of CFO

LOS 31 c identify the appropriate income statement and balance sheet entries using the percentage-of-completion method and the completed contract method and describe and calculate the effects on cash flows and selected financial ratios that result from using the percentage-of-completion method versus the completed contract method;

Financial Statement Analysis

INSTALLMENT SALES METHOD EXAMPLE

During 20X0, Sturridge Inc. sold $20,000 of inventory, with a cost of $10,000. During 20X0 and 20X1, Sturridge collected $8,000 and $12,000 respectively, of its receivables. Under the Instalment Method, what are the sales and gross profit to be reported in each of the two years?

LOS 31 b explain the importance of the matching principle for revenue and expense recognition, identify the requirements for revenue recognition to occur, identify and describe the appropriate revenue recognition, given the status of completion of the earning process and the assurance of payment, and discuss different revenue recognition methods and their implications for financial analysis;

Financial Statement Analysis

COST RECOVERY METHOD EXAMPLE

During 20X0, Sturridge Inc. sold $20,000 of services but the cost of providing this service was unclear at the outset of the contract. During 20X0 and 20X1, Sturridge Inc. collected $8,000 and $12,000, respectively of its receivables. The project was completed during 20X1 at which time the company had incurred total costs of $10,000. Under the Cost Recovery Method, what are the sales and gross profit to be reported in each of the two years?

LOS 31 b explain the importance of the matching principle for revenue and expense recognition, identify the requirements for revenue recognition to occur, identify and describe the appropriate revenue recognition, given the status of completion of the earning process and the assurance of payment, and discuss different revenue recognition methods and their implications for financial analysis;

Financial Statement Analysis

CHOOSING THE APPROPRIATE REVENUE RECOGNITION METHOD

Completion of Earning Process

Complete Complete Complete with contingencies Complete with contingencies Incomplete and costs can be estimated Incomplete and costs can be estimated

Assurance of Payment

Assured Not assured Assured Not assured Assured Not assured

Revenue Recognition Method

Sales basis Installment sales Cost recovery Cost recovery Percentage of completion Completed contract

Incomplete and costs cant be estimated

Incomplete and costs cant be estimated

Assured

Not assured

Completed contract

Completed contract

LOS 31 b explain the importance of the matching principle for revenue and expense recognition, identify the requirements for revenue recognition to occur, identify and describe the appropriate revenue recognition, given the status of completion of the earning process and the assurance of payment, and discuss different revenue recognition methods and their implications for financial analysis;

Financial Statement Analysis

INCOME STATEMENT FORMAT SUGGESTED IN READING

+ +/

+/ +/ +/

Revenues from the sales of goods and services: Other income and revenues Operating expenses Financing costs Gross of tax Unusual or infrequent items

Pre-tax earnings from continuing operations Income tax expense Net income from continuing operations Income from discontinued operations Extraordinary items Cumulative effect of accounting changes Net income

LOS 31 d describe the types and analysis of unusual or infrequent items, extraordinary items, discontinued operations, accounting changes, and prior period adjustments;

Net of tax

Financial Statement Analysis

INCOME STATEMENT: NON-RECURRING ITEMS

Gains of losses from disposal of a portion of a business segment Unusual or infrequent items Gains or losses from sale of assets or investments Impairments, write-offs and restructuring costs Gains or losses from the early retirement of debt (note can be extraordinary if infrequent) Provisions against environmental remediation

Extraordinary items

Unusual AND infrequent AND material: Losses due to a foreign governments expropriation of assets Uninsured losses from natural disasters

LOS 31 d describe the types and analysis of unusual or infrequent items, extraordinary items, discontinued operations, accounting changes, and prior period adjustments;

Financial Statement Analysis

INCOME STATEMENT: NON-RECURRING ITEMS

Discontinued operations Operating income (e.g., revenue and expenses up to the date of disposal) and any gains or losses from their sale are reported separately since these activities will not contribute to future income and cash flows.

Changes in accounting principle

The cumulative impact on prior period earnings is reported net of tax after extraordinary items and discontinued operations where, for example, the company changes the depreciation method. Not that this is not required for changes in accounting estimates.

LOS 31 d describe the types and analysis of unusual or infrequent items, extraordinary items, discontinued operations, accounting changes, and prior period adjustments;

Financial Statement Analysis

Role of Nonrecurring Items in Estimating Earnings Power

The analyst focus is often on net income from continuing operations as this serves as a basis for forecasts.

Companies therefore tend towards putting profitable one off transactions above this line in the income statement and loss producing one off items below this line Companies attempt to reduce earnings in years of good performance and inflate earnings in years of bad performance through aggressive or conservative accounting policy selection.

Classification of good/bad news

Income smoothing

LOS 31 e discuss managerial discretion in areas such as classification of good news/bad news, income smoothing, big bath behaviour, and accounting changes, and explain how this discretion can affect the financial statements;

Financial Statement Analysis

Role of Nonrecurring Items in Estimating Earnings Power

When firms are experiencing a bad year they may attempt to recognize all of their bad news at once. Going forward therefore, the subsequent improvement in performance will be magnified and this will show management in a better light.

Big bath techniques

Accounting changes

Firms can use accounting changes to smooth earnings, as noted above, and these can often have a material impact on earnings without effecting cash flow.

LOS 31 e discuss managerial discretion in areas such as classification of good news/bad news, income smoothing, big bath behaviour, and accounting changes, and explain how this discretion can affect the financial statements;

Financial Statement Analysis

The Cashflow Statement

Regular operations generate enough cash to sustain the business Enough cash is generated to pay off maturing debt Highlights the need for additional finance Ability to meet unexpected obligations The flexibility to take advantage of new business opportunities How the firm obtains and spends cash FASB requirements Borrowing and debt repayment activities Issue and repurchase of equity Distributions to owners (dividends) Other factors affecting liquidity and solvency

LOS 32 a identify the types of important information for investment decision making presented in the statement of cash flows;

Benefits for the analyst

Financial Statement Analysis

STATEMENT OF CASH FLOWS SFAS 95

Cash flow from operations Cash flow from investing Cash flow from financing Change in cash balance Beginning cash Ending cash (CFO) (CFI) (CFF)

Cash received from customers Cash dividends received Cash interest received Other cash income

$ X

+ + = + =

X

X X (X)

Payments to suppliers

Cash expenses (wages etc) (X) Cash interest paid Cash taxes paid CFO (X)

(X)

X/(X)

LOS 32 a identify the types of important information for investment decision making presented in the statement of cash flows; LOS 32 b compare and contrast the categories (i.e., cash provided or used by operating activities, investing activities, and financing activities) in a statement of cashflows, and describe how noncash investing and financing transactions are reported

Financial Statement Analysis

CASH FROM INVESTING

Purchase and sale proceeds of: Property, plant & equipment

Subsidiaries, Joint Ventures and Affiliates

Investments CASH FROM FINANCING

Issue and redemption of:

Common stock Debt

Dividend payments (divs recd = CFO)

LOS 32 b compare and contrast the categories (i.e., cash provided or used by operating activities, investing activities, and financing activities) in a statement of cashflows, and describe how noncash investing and financing transactions are reported LOS 33 a classify a particular transaction or item as cash flow from 1) operations, 2) investing, or 3) financing;

Financial Statement Analysis

Non-Cash Investing and Financing Activities

Retirement of debt via conversion into equity Conversion of preferred stock into common stock Assets acquired under capital leases Obtaining assets by issuing notes payable Exchange of one non cash asset for another Purchase of non cash assets by issuing equity or other securities

All the above items will affect the Balance Sheet but not the Cashflow Statements as no cash is raised or paid

LOS 32 b compare and contrast the categories (i.e., cash provided or used by operating activities, investing activities, and financing activities) in a statement of cashflows, and describe how noncash investing and financing transactions are reported

Financial Statement Analysis

CASH FROM OPERATIONS

DIRECT METHOD

INDIRECT METHOD

Cash inflows

less

cash outflows

Net income + depreciation & amortisation gains on disposal of l/t assets + losses on disposal of l/t assets + other non-cash expenses non-cash revenues +/ changes in non-cash working capital Cash from operations

Cash from operations

LOS 33 b compute and interpret a statement of cash flows, using the direct method and the indirect method; LOS 32 c calculate and interpret, using the indirect method, the net cash provided or used by operating activities;

Financial Statement Analysis

Direct Method CFO

Steps 1. Start at the top of the Income Statement e.g., Sales 2. Move to the balance sheet and identify any asset and liability that relate to that Income Statement item e.g., Accounts Receivable 3. Look at the change in the Balance Sheet item during the period (ending balance opening balance) 4. Apply the rule: Increases in an asset deduct Increase in a liability add Decrease in an asset add Decrease in a liability deduct

5. Adjust the Income Statement amount by the change in the Balance Sheet

LOS 33 b compute and interpret a statement of cash flows, using the direct method and the indirect method; LOS 32 c calculate and interpret, using the indirect method, the net cash provided or used by operating activities;

Financial Statement Analysis

Direct Method cont.

6. Tick off the items dealt with in both the Income Statement and Balance sheet 7. Move to the next item on the Income Statement and repeat 8. Ignore depreciation/amortization and gains/losses on the disposal of assets as these are all non cash items 9. Keep moving down the Income Statement until all items included in Net Income have been addressed applying steps 1-8 10.Total up the amounts and you have CFO

LOS 33 b compute and interpret a statement of cash flows, using the direct method and the indirect method; LOS 32 c calculate and interpret, using the indirect method, the net cash provided or used by operating activities;

Financial Statement Analysis

EXAMPLE HOLLOWAY INDUSTRIES

Holloway Industries has the following Income Statement for 20X3 and Balance Sheets for 20X2 and 20X3. You are to construct the Statement of Cash Flows using the templates provided.

Income Statement for Year to 31 December 20X3

Sales revenue Expenses: Cost of goods sold Salaries Goodwill amortization Depreciation Interest Gain from sale of PPE Pre-tax income Provision for taxes Net income

200,000

80,000 10,000 2,000 12,000 1,000

105,000 95,000 20,000 115,000 40,000 75,000

LOS 33 b compute and interpret a statement of cash flows, using the direct method and the indirect method; LOS 32 c calculate and interpret, using the indirect method, the net cash provided or used by operating activities;

Financial Statement Analysis

EXAMPLE HOLLOWAY INDUSTRIES cont.

Balance Sheets Current assets Cash Accounts receivable Inventory Noncurrent assets Land Plant & equipment Less: Acc depreciation Goodwill Total Assets 20X2 $ 18,000 18,000 14,000 80,000 120,000 (18,000) 20,000 252,000 20X3 $ 66,000 20,000 10,000 80,000 150,000 (20,000) 18,000 324,000

Note the order of years (older/most recent) may be reversed in questions always check!

PPE includes an asset that cost $20,000 and had accumulated depreciation of $20,000 at the point of disposal

LOS 33 b compute and interpret a statement of cash flows, using the direct method and the indirect method; LOS 32 c calculate and interpret, using the indirect method, the net cash provided or used by operating activities;

Financial Statement Analysis

EXAMPLE HOLLOWAY INDUSTRIES cont.

Balance Sheets Current liabilities Accounts payable Salaries payable Interest payable Taxes payable Dividends payable Noncurrent liabilities Bonds Deferred taxes Stockholders equity Common stock Retained earnings Total Liabilities & Equity 20X2 $ 10,000 16,000 6,000 8,000 2,000 20,000 30,000 100,000 60,000 252,000 20X3 $ 18,000 9,000 7,000 10,000 12,000 30,000 40,000 80,000 118,000 324,000

LOS 33 b compute and interpret a statement of cash flows, using the direct method and the indirect method; LOS 32 c calculate and interpret, using the indirect method, the net cash provided or used by operating activities;

Financial Statement Analysis

HOLLOWAY INDUSTRIES CASH FLOW FROM OPERATIONS

$ $

Direct Method

Cash Inflows Sales Less: increase in A/R Cash collected from customers Direct cash outflows Cost of goods sold Add: decrease in inventory Purchases Add: increase in A/P Cash paid to suppliers

Operating expense (wages) Less: decrease in salaries payable Cash paid to employees

LOS 33 b compute and interpret a statement of cash flows, using the direct method and the indirect method; LOS 32 c calculate and interpret, using the indirect method, the net cash provided or used by operating activities;

Financial Statement Analysis

Direct Method cont.

$ Cash outflows Interest Expense Add: increase in interest payable Cash interest paid $

Taxation Expenses Add: Increase in deferred tax Tax payable Add: increase in taxes payable Cash paid to IRS CFO

LOS 33 b compute and interpret a statement of cash flows, using the direct method and the indirect method; LOS 32 c calculate and interpret, using the indirect method, the net cash provided or used by operating activities;

Financial Statement Analysis

Indirect Method CFO

Steps 1. Start at the bottom of the Income Statement e.g., Net Income. This means we have already included all the items on the Income Statement 2. Return to the top of the Income Statement and adjust each item line by line. Note that we have already included Sales in our Net Income figure 3. Look at the change in the Balance Sheet item during the period (ending balance opening balance). These are identical to the Direct Method! Increases in an asset deduct 4. Apply the rule: Increase in a liability add Decrease in an asset add Decrease in a liability deduct

LOS 33 b compute and interpret a statement of cash flows, using the direct method and the indirect method; LOS 32 c calculate and interpret, using the indirect method, the net cash provided or used by operating activities;

Financial Statement Analysis

Indirect Method cont.

5. Tick off the items dealt with in both the Income Statement and Balance sheet 6. Move to the next item on the Income Statement and repeat 7. Eliminate depreciation and amortization by adding them back (theyve been deducted in arriving at Net Income but have no cash implication) 8. Eliminate gains on disposal by deducting them and losses on disposal by adding them back. 9. Keep moving down the Income Statement until all items included in Net Income have been addressed applying steps 1-8 10. Total up the amounts and you have CFO

LOS 33 b compute and interpret a statement of cash flows, using the direct method and the indirect method; LOS 32 c calculate and interpret, using the indirect method, the net cash provided or used by operating activities;

Financial Statement Analysis

HOLLOWAY INDUSTRIES CASH FLOW FROM OPERATIONS

$

Indirect Method

Net income depreciation goodwill amortisation gain from sale of land increase in deferred taxes Current asset adjustments increase in accounts receivable decrease in inventory Current liability adjustments increase in accounts payable decrease in salaries payable increase in interest payable increase in taxes payable

Cash flow from operations

LOS 33 b compute and interpret a statement of cash flows, using the direct method and the indirect method; LOS 32 c calculate and interpret, using the indirect method, the net cash provided or used by operating activities;

Financial Statement Analysis

Computing CFI

Additions to PPE 2 Methods $ Opening Cost $ Opening NBV

X

(X) X

X

(X) (X)

Cost of Disposals

Additions Closing Cost

NBV of Disposals

Depreciation Charge Additions

X

X

Closing NBV

The method to choose depends on whether cost and accumulated depreciation have been disclosed separately or together as NBV

LOS 32 d prepare and interpret, using the indirect method, the statement of cash flows for investing activities and financing activities.

Financial Statement Analysis

Computing CFI Holloway Industries

Additions to PPE 2 Methods $ Opening Cost Opening NBV $

Cost of Disposals

Additions Closing Cost

NBV of Disposals

Depreciation Charge Additions

Closing NBV

The method to choose depends on whether cost and accumulated depreciation have been disclosed separately or together as NBV

LOS 32 d prepare and interpret, using the indirect method, the statement of cash flows for investing activities and financing activities.

Financial Statement Analysis

Computing Proceed on Disposal

Profit/(loss) on disposal of long lived assets $ Proceeds NBV Profit/(loss) X (X) X/(X) Disclosed in question From Income Statement Proceeds NBV Profit/(loss) Holloway Industries $

LOS 32 d prepare and interpret, using the indirect method, the statement of cash flows for investing activities and financing activities.

Financial Statement Analysis

Computing CFF

Change in Debt Change in Common Stock Cash Dividends Paid Simply closing balance less opening balance dont forget to check current liabilities for any debt maturing within 12 months!

Calculate Dividends

Net Income Dividends in Retained Earnings

$ X (X)

$

Dividends Proposed (X) Dividends Payable X/(X) Cash Paid (X)

Simply the change in both common stock and additional paid in capital during the period this could be made more complicated by including scrip issues

LOS 32 d prepare and interpret, using the indirect method, the statement of cash flows for investing activities and financing activities.

Financial Statement Analysis

Holloway CFF

$ Change in Debt Change in Common Stock Cash Dividends Paid

Calculate Dividends

Net Income

Dividends in Retained Earnings

Dividends Proposed

Dividends Payable Cash Paid

LOS 32 d prepare and interpret, using the indirect method, the statement of cash flows for investing activities and financing activities.

Financial Statement Analysis

HOLLOWAY INDUSTRIES STATEMENT OF CASH FLOWS

$

Cash flow from operations Cash flow from investing activities Sale of PP&E Purchase of PP&E Cash flow from investing Cash flow from financing activities Increase in bonds Decrease in common stock Payment of dividends Cash flow from financing Net increase in cash Cash at beginning Cash at end

LOS 33 b compute and interpret a statement of cash flows, using the direct method and the indirect method

Financial Statement Analysis

FREE CASH FLOW

Measures the cash available to the firm for discretionary uses after making all required cash outlays. Formally, it should be the operating cash flow minus those cash flows necessary to maintain the firms productive capacity and provide for growth. However, it is not practical for an analyst to determine which capital expenditures are necessary to maintain capacity and which are allotted for growth.

Consequently, free cash flow is measured by:

Free Cash Flow = Operating cash flow - Net capital expenditures

Expenditure on capital items after tax sales proceeds from disposals

LOS 33 e describe and compute free cash flow;

Financial Statement Analysis

STATEMENT OF CASH FLOW

U.S. GAAP vs. IAS GAAP

U.S. GAAP (SFAS 95) Interest received Interest paid Dividends received Dividends paid CFO CFO CFO CFF IAS GAAP (IAS 7) CFO or CFI CFO or CFF CFO or CFI CFO or CFF

LOS 33 f Distinguish between the U.S. GAAP and IAS GAAP classifications of dividends paid or received and interest paid or received for statement of cash flow purposes

Financial Statement Analysis

Future FASB Changes and the Analytical Challenges of GAAP

European Commission Publicly traded companies mandatory adoption of IAS by 2005 (unless producing accounts under U.S. GAAP in which they must adopt IAS by 2007) ISAB and FASB attempting to eliminate 3 major differences: Expensing of employee stock options

Business combinations under the purchase method

In-process R&D Restructuring costs

Measurement date for acquisitions using stock

Reconciling standards in revenue recognition

LOS 34 a identify the projects on the FASB agenda that were/are related to international convergence

Financial Statement Analysis

Future FASB Changes and the Analytical Challenges of GAAP

Other convergence projects Revisions to Income Statement format/content Accounting for financial instruments with both equity and liability characteristics (e.g., convertibles)

Fair-value measurement

LOS 34 a identify the projects on the FASB agenda that were/are related to international convergence

Financial Statement Analysis

FASB Revenue Recognition

2 conceptual approaches that may conflict

Approach 1 Recognition criteria 1. Completion of earnings process

Approach 2

Revenue recognition occurs when there is any increase in net assets resulting from transactions with non shareholders i.e., any increase in Net Assets (worth) that is not the result of issuing new equity

2. Assurance of receipt

LOS 34 b describe two different guidance rules for revenue recognition discussed by FASB and IASB

Financial Statement Analysis

Financial Statement Analysis Financial Ratios and Earnings Per Share

Study Session 8

Financial Statement Analysis

Why are Ratios so Important in Financial Analysis?

The analyst reviews the companys financial statements to gain an insight into a companys financial decision making and performance. Ratios allow the analyst to raise questions about the performance of the firm. This performance may be compared year on year within the firm or with competitors within the industry and the economy as a whole. Although there are many dozens of ratios that could be computed there are several key ratios that give the analyst an insight into the firms: Performance: Liquidity: Risk: determine how well management operate the business determine the firms ability to pay its short term liabilities measure the uncertainty of the firms income flows

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

INTERNAL LIQUIDITY RATIOS

Current ratio current assets current liabilities current assets inventory current liabilities

Quick ratio

Cash ratio

cash + marketable securities current liabilities

Receivables turnover

net sales avg. receivables

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

INTERNAL LIQUIDITY RATIOS

Receivables collection period

365 receivables turnover

OR

avg. receivables net sales

365

Inventory turnover

cost of goods sold avg. inventory

365 inventory turnover avg. inventory cost of goods sold 365

Inventory processing period

OR

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

INTERNAL LIQUIDITY RATIOS

Payables turnover

cost of goods sold avg. accounts payable

Payables payment period

365 payables turnover

OR

avg. inventory 365 cost of goods sold

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

Cash Conversion Cycle

Raw Materials Arrive Production Commences Inventory processing period Payables payment period Pay Supplier Days Cash Conversion Cycle

Production Complete

Receivables collection period Cash Collected

Goods Sold

Inventory Period Receivables Period Payables Period

X X

(X)

Cash Conversion Cycle X

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

Holloway Industries

20x2 Current ratio 20x3

Quick ratio

Cash ratio

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

Holloway Industries

20x3 20x3 Inventory turnover

Receivables turnover

Average receivables collection period

Average inventory processing period

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

Holloway Industries

20x3

Payables turnover

Cash Conversion Cycle

Collection period + Inventory period Payment period

Payables payment period

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

Holloway Industries

OPERATING EFFICIENCY

Total asset turnover

net sales avg. total net assets net sales avg. net fixed assets

Fixed asset turnover

Equity turnover

net sales avg. equity

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

Holloway Industries

20x3

Total asset turnover

Fixed asset turnover

Equity turnover

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

Holloway Industries

OPERATING PROFITABILITY

Gross profit margin

sales COGS (GP) net sales

100

Operating profit margin

EBIT 100 net sales EAT 100 net sales

Net profit margin

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

Holloway Industries

OPERATING PROFITABILITY

20x3

Gross profit margin

Operating profit margin

Net profit margin

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

Holloway Industries

OPERATING PROFITABILITY

Return on total capital

EAT + interest avg. total capital

100

Equity Liabilities Return on equity

= Total Assets

EAT 100 avg. equity

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

Holloway Industries

OPERATING PROFITABILITY 20x3

Return on total capital

Return on equity

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

COMMON SIZE STATEMENTS

Income statement

income statement account sales

e.g., marketing expense sales

balance sheet account Balance sheet total assets

e.g.,

inventory total assets

LOS 35 a interpret common-size balance sheets and common-size income statements, and discuss the circumstances under which the use of common-size financial statements is appropriate;

Financial Statement Analysis

DUPONT RATIO ANALYSIS

ROE = EAT

EQUITY ROE = EAT SALES SALES EQUITY

ROE

EAT SALES

SALES ASSETS Asset turnover

ASSETS EQUITY

Traditional version of DuPont equation

After tax profit margin

Financial leverage multiplier

LOS 35 c calculate and interpret the various components of the companys return on equity using the original and extended DuPont systems and a companys financial ratios relative to its industry, to the aggregate economy, and to the companys own performance over time;

Financial Statement Analysis

Holloway Industries

DUPONT RATIO ANALYSIS 20x3 ROE =

ROE

ROE

Traditional version of DuPont equation

LOS 35 c calculate and interpret the various components of the companys return on equity using the original and extended DuPont systems and a companys financial ratios relative to its industry, to the aggregate economy, and to the companys own performance over time;

Financial Statement Analysis

EXTENDED DUPONT EQUATION

ROE = EAT

SALES

SALES

ASSETS

ASSETS EQUITY

ROE

EBT

SALES

(1 t)

SALES

ASSETS

ASSETS

EQUITY

t = effective tax rate

ROE

EBIT SALES

Operating profit margin

SALES

ASSETS Asset turnover

I

ASSETS Interest expense rate

ASSETS

EQUITY Financial leverage multiplier

(1 t)

Tax retention rate

LOS 35 c calculate and interpret the various components of the companys return on equity using the original and extended DuPont systems and a companys financial ratios relative to its industry, to the aggregate economy, and to the companys own performance over time;

Financial Statement Analysis

Holloway Industries

EXTENDED DUPONT EQUATION 20x3 ROE = 75,000 200,000 200,000 324,000 198,000 = 38%

324,000

ROE

ROE

LOS 35 c calculate and interpret the various components of the companys return on equity using the original and extended DuPont systems and a companys financial ratios relative to its industry, to the aggregate economy, and to the companys own performance over time;

Financial Statement Analysis

RISK PROFILE

Business risk Measures the uncertainty of the firms operating income as a result of variability of sales and production costs CVs operating income sales

Operating leverage

Additional volatility of the firms equity returns caused by the firms Financial risk use of debt Leverage Coverage

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

BUSINESS RISK

Coefficient of Variation of Operating Income

EBIT EBIT Sales Sales

Coefficient of Variation of Sales

Operating Leverage

% in EBIT % in Sales

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

FINANCIAL RISK RATIOS LEVERAGE

Long-term liabilities Deferred tax

Debt to equity ratio

long-term debt stockholder equity

PV of operating leases Common Stock Preferred Stock Additional Paid in Capital Other Reserves

Debt to long term capital ratio

long-term debt long-term debt + stockholder equity

Retained Earnings

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

FINANCIAL RISK RATIOS LEVERAGE

Total Debt Ratio current liabilities + long-term debt stockholder equity

Total Interest-Bearing Debt to Total Funded Capital

total interest-bearing debt total capital non-interest-bearing liabilities

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

FINANCIAL RISK RATIOS COVERAGE

Interest Coverage EBIT interest expense ELIE = Estimated Lease Interest Expense

EBIT + ELIE

Fixed Financial Cost gross interest expense + ELIE

Cash Flow Interest Coverage

cash flow + interest expense + ELIE interest expense + ELIE

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

HOLLOWAY INDUSTRIES FINANCIAL RISK RATIOS

20x3

Interest Coverage

Long Term Debt to equity

Debt to long term capital

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

GROWTH ANALYSIS

Sustainable growth Earnings retention rate ROE

Example:

= =

(earnings retention rate)(ROE) [1 (dividends/net income)]

[EAT/sales] [sales/assets] [assets/equity]

A firm has a dividend payout ratio of 35%, a net profit margin of 10%, an asset turnover of 1.4 and an equity multiplier leverage measure of 1.2. Estimate the firms sustainable growth rate.

LOS 35 b calculate, interpret, and discuss the uses of measures of a companys internal liquidity, operating performance (i.e., operating efficiency (activity) and operating profitability), risk profile, and growth potential;

Financial Statement Analysis

CONSIDERATIONS WHEN USING FINANCIAL RATIOS

Financial ratios should always be relative

Are alternative firms accounting treatments comparable? Is the firm involved in several industries or just one? Are the implied results consistent or just a one-off Is the ratio within a reasonable range for the industry?

Financial Statement Analysis

EARNINGS PER SHARE (EPS)

Simple capital structure - Basic EPS

One that contains no potentially dilutive securities Contains potentially dilutive securities (that would decrease EPS if exercised or converted to common stock

Convertible Bonds

Complex capital structure - Diluted EPS

Convertible Preferred Stock

Warrants and Employee Stock Options

LOS 36 a differentiate between simple and complex capital structures for purposes of calculating earnings per share (EPS), describe the components of EPS, and calculate a companys EPS in a simple capital structure;

Financial Statement Analysis

EPS BASIC CALCULATION

Earnings = net income preference dividends

earnings attributable to common stockholders weighted average number of shares of common outstanding

Weighted Average Number of Shares A time weighted average, necessary when the number of shares in issue has changed during the year. For example: share repurchases - which are excluded from date of repurchase share issues for cash or to acquire subsidiary share issues for free (via stock splits or stock dividends)

LOS 36 a differentiate between simple and complex capital structures for purposes of calculating earnings per share (EPS), describe the components of EPS, and calculate a companys EPS in a simple capital structure;

Financial Statement Analysis

CHANGES IN EQUITY ISSUE FOR CASH AT MARKET PRICE

1 January 4 million common stock in issue ranking for dividend 30 September 1 million further shares issued ranking for dividend (assuming year ending 31 December) Million

Number of shares used in EPS calculation

LOS 36 a differentiate between simple and complex capital structures for purposes of calculating earnings per share (EPS), describe the components of EPS, and calculate a companys EPS in a simple capital structure;

Financial Statement Analysis

CHANGES IN EQUITY NO EFFECT ON EARNINGS

The following have no effect on earnings: stock dividends 10% stock dividend the holder of 100 shares would receive 10 new shares 5:4 Stock split The holder of 100 shares would be holding 125 shares post split 5:4

stock splits

New holding

Old holding

These changes in equity are back dated, to assume that they occurred on the first day of the year with all prior year figures being retrospectively adjusted.

LOS 36 c describe stock dividends and stock splits and determine the effect of each on a companys weighted average number of shares outstanding;

Financial Statement Analysis

EPS WORKED EXAMPLE

Profit Inc had 10 million shares outstanding at the beginning of the year and net income of $20m. The following transactions occurred during the year:

1 July 1 September 1 November

2 million new shares issued for cash 10% stock dividend 500,000 common shares repurchased

(assuming year ending 31 December)

Calculate the EPS for the year

LOS 36 c describe stock dividends and stock splits and determine the effect of each on a companys weighted average number of shares outstanding;

Financial Statement Analysis

Dilutive vs. Anti-Dilutive Securities

Securities are Dilutive if: Convertible Bonds coupon saved (1T)

<

Basic EPS

Shares Created

Convertible Preferred Stock

preferred dividend saved shares created

<

Basic EPS

Warrants and Employee Stock Options

Average Share Price > Strike Price

LOS 36 d distinguish between dilutive and antidilutive securities and calculate a companys basic and diluted EPS in a complex capital structure and describe and determine the effects of convertible securities, options, and warrants on a companys EPS;

Financial Statement Analysis

DILUTED EPS CONVERTIBLE SECURITIES EXAMPLE

$

Earnings for equity in year to 31/Dec/X1 2,500,000 Common stock of $10 each 10,000,000 Basic EPS $2.50 Tax rate 30% There have been in issue throughout the year $2,000,000 of 5% convertible loan stock. The terms of conversion are, for every $1,000 nominal value of loan stock:

On 31 March 20X2 31 March 20X3 31 March 20X4 110 common shares 120 common shares 103 common shares

Calculate fully diluted EPS for 20X1.

LOS 36 d distinguish between dilutive and antidilutive securities and calculate a companys basic and diluted EPS in a complex capital structure and describe and determine the effects of convertible securities, options, and warrants on a companys EPS;

Financial Statement Analysis

DILUTED EPS CONVERTIBLE SECURITIES SOLUTION

$

Earnings Add: Interest saved Less: Relief for tax @ 30%

No. of equity shares if loan stock was converted: In issue On conversion

LOS 36 d distinguish between dilutive and antidilutive securities and calculate a companys basic and diluted EPS in a complex capital structure and describe and determine the effects of convertible securities, options, and warrants on a companys EPS;

Financial Statement Analysis

DILUTED EPS CONVERTIBLE PREFERRED STOCK EXAMPLE

$ Earnings for equity in year to 31/Dec/X1 4,000,000 Common stock of $10 each 20,000,000 Basic EPS $2.00 Tax rate n/a There have been in issue throughout the year $5,000,000 of 7% convertible preferred stock. The terms of conversion are, for every $1,000 nominal value of preferred stock: On 30 April 20X2 30 April 20X3 30 April 20X4 120 common stock shares 110 common stock shares 105 common stock shares

Calculate fully diluted EPS for 20X1.

LOS 36 d distinguish between dilutive and antidilutive securities and calculate a companys basic and diluted EPS in a complex capital structure and describe and determine the effects of convertible securities, options, and warrants on a companys EPS;

Financial Statement Analysis

DILUTED EPS CONVERTIBLE PREFERRED STOCK SOLUTION

$

Earnings Add: Preferred dividend saved

No. of common stock shares if preferred shares were converted: In issue On conversion

LOS 36 d distinguish between dilutive and antidilutive securities and calculate a companys basic and diluted EPS in a complex capital structure and describe and determine the effects of convertible securities, options, and warrants on a companys EPS;

Financial Statement Analysis

DILUTIVE STOCK OPTIONS TREASURY STOCK METHOD

Dilutive only when the exercise price is less than the average market price Assume proceeds from sale of stock issued to buy back shares in the market at the average market price STEPS Calculate number of common shares created if options are exercised

Calculate cash received from sale of stock Calculate number of shares that can be purchased at the average market price with sale proceeds Calculate the net increase in common shares outstanding

LOS 36 d distinguish between dilutive and antidilutive securities and calculate a companys basic and diluted EPS in a complex capital structure and describe and determine the effects of convertible securities, options, and warrants on a companys EPS;

Financial Statement Analysis

EPS OPTIONS FOR COMMON STOCK EXAMPLE

Earnings for equity in year to 31/Dec/X1 Weighted average no. of common stock shares Average price of common stock during year Exercise price Number of options outstanding in the year Basic EPS Calculate diluted EPS for 20X1. $1,200,000 500,000 $20 $15 100,000

LOS 36 d distinguish between dilutive and antidilutive securities and calculate a companys basic and diluted EPS in a complex capital structure and describe and determine the effects of convertible securities, options, and warrants on a companys EPS;

Financial Statement Analysis

EPS Reporting

A company with a complex capital structure must report: Basic EPS Dilutive EPS In addition the impact of the following effects must be shown:

Discontinued Activities Extraordinary Items Cumulative Effect of Accounting Policy Changes

LOS 36 e compare and contrast the requirements for EPS reporting in simple versus complex capital structures.

Financial Statement Analysis

Seek and Ye Shall Find and Searching for Shenanigans

Study Session 8

Financial Statement Analysis

FINANCIAL SHENANIGANS

Two basic strategies underlying all accounting tricks: To inflate current period earnings by inflating current-period revenue and gains or by deflating current-period expenses To deflate current-period earnings (and, consequently, inflate future periods results) by deflating current period revenue or by inflating current-period expenses Shenanigan 1. 2. 3. 4. 5. 6. Recording revenue too soon or of questionable quality Recording bogus revenue Boosting income with one-time gains Shifting current expenses to a later or earlier period Failing to record or improperly reducing liabilities Shifting current revenue to a later period

7.

Shifting future expenses to the current period as a special charge

LOS 38 a explain the two basic strategies underlying all accounting shenanigans, and describe seven categories of techniques that may be used by management to distort a company's reported financial performance and financial condition;

Financial Statement Analysis

EVALUATING ACCOUNTING POLICIES

Accounting Policies Revenue recognition Depreciation choice Conservative After sale, when risk has passed to buyer Accelerated over shorter period LIFO (assuming prices are rising) Over a shorter period High estimate High estimate Aggressive At sale, although risk remains Straight line over longer period FIFO (assuming prices are rising) Over 40 years Low estimate Low estimate

Inventory method

Amortization of goodwill* Estimate of warranty Estimate of bad debts Treatment of advertising Loss contingencies

Expense

Accrue loss

Capitalize

Footnote only

* NB Goodwill is no longer amortized under U.S. GAAP

LOS 38 b identify conservative and aggressive accounting policies;

Financial Statement Analysis

WHY DO SHENANIGANS EXIST?

Based on the authors research, there are three general reasons for shenanigans:

It Pays to Do It

Management bonuses encourage the posting of high sales and profits Misguided incentive plans Look for: Compensation structures that heavily emphasize the bottom line

Its Easy to Do

Profit can vary widely while complying with GAAP Management has considerable flexibility in interpreting financial standards Look for: Overly liberal accounting rules Poor internal controls

Its Unlikely That Youll Get Caught

Often, companies are not caught for improper accounting Penalties are often too little, too late Look for: Over reliance on unaudited quarterly financial reports

LOS 38 c describe why shenanigans exist and explain where they are most likely to occur

Financial Statement Analysis

WHERE DO SHENANIGANS OCCUR?

Early Warning Signs Likely Companies

A weak control environment Management facing extreme competitive pressure Management known or suspected of having questionable character

Fast growth companies whose real growth is beginning to slow Basket-case companies that are struggling to survive Newly listed public companies

Private companies

LOS 38 c describe why shenanigans exist and explain where they are most likely to occur

Financial Statement Analysis

IDENTIFYING SHENANIGANS

Where to Look Auditors report What to Look For Absence of opinion or qualified report Reputation of auditor Litigation Executive compensation Related-party transactions Accounting policies/changes in those policies Related-party transactions Contingencies or commitments Forthrightness Specific concise disclosure Consistency with footnote disclosure Disagreements over accounting policies Past performance Quality of management and directors

Proxy statement

Footnotes

Presidents letter MD&A

Form 8-K Registration statement

LOS 38 d list the documents that an analyst should use to identify shenanigans and explain what information to look for in such documents.

Financial Statement Analysis

SOLUTIONS

Financial Statement Analysis

PERCENTAGE OF COMPLETION METHOD EXAMPLE (INCOME STATEMENT)

Bircham Properties Ltd. has a contract to build a hotel for $2,000,000 to be received in equal installments over 4 years. A reliable estimate of total cost of this contract is $1,600,000. During the first year, Bircham Properties incurred $400,000 in cost. During the second year, $500,000 of costs were incurred. The estimate of the projects total cost did not change in the second year.

Calculate the revenue to be recognized in each of the first two years.

Year 1: Year 2:

$2,000,000 (400,000/1,600,000) = $500,000 $2,000,000 (900,000/1,600,000) = $625,000 $500,000

Financial Statement Analysis

BALANCE SHEET PERCENTAGE-OF-COMPLETION METHOD

Total Assets

20x1 20x2

300

20x3

500

Cash

(Cash Recd Cost Incurred)

100

Accounts receivable

(Amounts Billed Cash Recd)

200

Net CIP* Total Assets

0

300

100 400

500

* See working slide

LOS 31 c identify the appropriate income statement and balance sheet entries using the percentage-of-completion method and the completed contract method and describe and calculate the effects on cash flows and selected financial ratios that result from using the percentage-of-completion method versus the completed contract method;

Financial Statement Analysis

BALANCE SHEET PERCENTAGE-OF-COMPLETION METHOD

Total Liabilities and Equity

20x1 Net Advanced Billings Retained Earnings Total Liabilities & Equity 133 167 300 20x2 0 400 400 20x3 0 500 500

LOS 31 c identify the appropriate income statement and balance sheet entries using the percentage-of-completion method and the completed contract method and describe and calculate the effects on cash flows and selected financial ratios that result from using the percentage-of-completion method versus the completed contract method;

Financial Statement Analysis

MEMO CIP

20x1 Cost Profit Allocation

Cost to Date

Total Cost Contract Price Total Cost

20x2 1,200 400

20x3 1,500 500

500

167

667

1,600

2,000

Amounts Billed Net CIP/(Net Advanced Billings)

(800)

(1,500)

(2,000)

(133)

100

Financial Statement Analysis

BALANCE SHEET COMPLETED CONTRACT METHOD

Total Assets

20x1 20x2 20x3

Cash Accounts receivable Net CIP Total Assets

100

300 0 0 300

500 0 0 500

200

0 300

LOS 31 c identify the appropriate income statement and balance sheet entries using the percentage-of-completion method and the completed contract method and describe and calculate the effects on cash flows and selected financial ratios that result from using the percentage-of-completion method versus the completed contract method;

Financial Statement Analysis

BALANCE SHEET COMPLETED CONTRACT METHOD

Total Liabilities and Equity

20x1 Net Advanced Billings 300 20x2 300 20x3 0

Retained Earnings

500

Total Liabilities & Equity

300

300

500

LOS 31 c identify the appropriate income statement and balance sheet entries using the percentage-of-completion method and the completed contract method and describe and calculate the effects on cash flows and selected financial ratios that result from using the percentage-of-completion method versus the completed contract method;

Financial Statement Analysis

MEMO CIP

20x1 Cost 500 20x2 20x3 0

1,200

Amounts Billed Net CIP/(Net Advanced Billings)

(800)

(1,500)

(0)

(300)

(300)

(0)

Financial Statement Analysis

PERCENTAGE-OF-COMPLETION vs. COMPLETED CONTRACT

During Project Life

POC Net income Income Statement Volatility of income HIGHER LOWER

CC

LOWER HIGHER

Total assets Balance Sheet Liabilities R/E

HIGHER LOWER HIGHER

LOWER HIGHER LOWER

Cash flow

Statement of Cash Flows Importance of CFO

SAME

LOWER

SAME

HIGHER

Financial Statement Analysis

INSTALLMENT SALES METHOD EXAMPLE

During 20X0, Sturridge Inc. sold $20,000 of inventory, with a cost of $10,000. During 20X0 and 20X1, Sturridge Inc. collected $8,000 and $12,000 respectively, of its receivables. Under the Instalment Method, what are the sales and gross profit to be reported in each of the two years?

Sales Cost of sales Gross profit

20X0 8,000 (4,000) 4,000

20X1 12,000 (6,000) 6,000

Financial Statement Analysis

COST RECOVERY METHOD EXAMPLE

During 20X0, Sturridge Inc. sold $20,000 of services but the cost of providing this service was unclear at the outset of the contract. During 20X0 and 20X1, Sturridge Inc. collected $8,000 and $12,000, respectively of its receivables. The project was completed during 20X1 at which time the company had incurred total costs of $10,000. Under the Cost Recovery Method, what are the sales and gross profit to be reported in each of the two years?

Sales Cost of sales Gross profit

20X0 8,000 (8,000) -

20X1 12,000 (2,000) 10,000

Financial Statement Analysis

HOLLOWAY INDUSTRIES CASH FLOW FROM OPERATIONS

$ $

Direct Method

Cash Inflows 200,000 Sales (2,000) Less: increase in A/R Cash collected from customers Direct cash outflows Cost of goods sold Add: decrease in inventory Purchases Add: increase in A/P Cash paid to suppliers Operating expense (wages) Less: decrease in salaries payable Cash paid to employees

(80,000) 4,000 (76,000) 8,000

198,000

(68,000) (10,000) (7,000) (17,000)

Financial Statement Analysis

Direct Method cont.

$ Cash outflows Interest Expense Add: increase in interest payable Cash interest paid

(1,000) 1,000

Taxation Expenses Add: Increase in deferred tax Tax payable Add: increase in taxes payable Cash paid to IRS

(40,000) 10,000 (30,000) 2,000 (28,000)

CFO

(85,000)

Financial Statement Analysis

GOULBURN INDUSTRIES CASH FLOW FROM OPERATIONS

Indirect Method

Net income Add: depreciation Add: goodwill amortisation Less: gain from sale of land Add: increase in deferred taxes Current asset adjustments Less: increase in accounts receivable Add: decrease in inventory Current liability adjustments Add: increase in accounts payable Less: decrease in accounts payable Add: increase in interest payable Add: increase in taxes payable Cash flow from operations + + + +

$

75,000 12,000 2,000 20,000 10,000

2,000 4,000

+ + +

8,000 7,000 1,000 2,000 85,000

Financial Statement Analysis

Computing CFI Holloway Industries

Additions to PPE 2 Methods $ Opening Cost $ Opening NBV

120,000

(20,000) 50,000

102,000

(10,000) (12,000)

Cost of Disposals

Additions Closing Cost

NBV of Disposals

Depreciation Charge Additions

150,000