Beruflich Dokumente

Kultur Dokumente

Risk+Return NT

Hochgeladen von

Rana HaiderOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Risk+Return NT

Hochgeladen von

Rana HaiderCopyright:

Verfügbare Formate

The Pricing Of Risk

Understanding the Risk Return Relation

Discounting Risky Cash Flows

How should the discount rate change in the

NPV calculation if the cash flows are not

riskless?

The question is more easily answered from

the other side. How must the expected

return on an asset change so you will be

happy to own it if it is a risky rather than a

riskless asset?

Risk averse investors will say that to hold a risky

asset they require a higher expected return than

they require for holding a riskless asset. E(r

risky

) = r

f

+ u.

Note that we now have to start to talk about expected

returns since risk has been explicitly introduced.

Note also that this captures the two basic services

investors perform for the economy.

Most agree that expected returns should increase with risk.

Expected

Return

Risk

But, how should risk be measured?

at what rate does the line slope up?

is the relation linear?

Lets look at some simple but important historical evidence.

E(r) = r

f

+

Returns for Different Types of Securities

Risk, More Formally

Many people think intuitively about risk as the possibility

of an outcome that is worse than what one expected.

Must be incomplete.

For those who hold more than one asset, is it the risk of

each asset they care about, or the risk of their whole

portfolio?

A useful construct for thinking rigorously about risk:

The probability distribution.

A list of all possible outcomes and their probabilities.

Very importantly we think about the moments of the

distribution.

The Empirical Distribution of Annual Returns for U.S.

Large Stocks (S&P 500), Small Stocks, Corporate Bonds,

and Treasury Bills, 19262008.

Expected Return

Expected (Mean) Return

Calculated as a weighted average of the

possible returns, where the weights correspond

to the probabilities.

| |

Expected Return = =

R

R

E R P R

Variance and Standard Deviation

Variance

The expected squared deviation from the mean

Standard Deviation

The square root of the variance, commonly called

volatility in finance

Both are measures of the risk or uncertainty

associated with a probability distribution

( ) ( ) = SD R Var R

| | ( ) | | ( )

2 2

( )

(

= =

R

R

Var R E R E R P R E R

Average Annual Return and Variance

Where R

t

is the realized return of a security in year t, for the

years 1 through T

The estimate of the volatility/standard deviation is the

square root of the estimate of variance.

( )

1 2

1

1 1

=

= + + + =

T

T t

t

R R R R R

T T

( )

2

1

1

( )

1

T

t

t

Var R R R

T

=

=

History for US Portfolios (1926 2008)

Portfolio

Average

Annual

Return

Excess Return:

Average Return

in Excess of T-

Bills

Return Volatility

(Standard Deviation)

Small Stocks

20.9%

17.1%

41.5%

S&P 500

11.6%

7.7%

20.6%

Corporate

Bonds

6.6%

2.7%

7.0%

Treasury Bonds

3.9%

0.0%

3.1%

Using Past Returns to Predict the Future:

Lets Remind Ourselves of Estimation Error

Standard Error of the Estimate of Expected Return

A statistical measure of the degree of estimation error

95% Confidence Interval

For the S&P 500 (19262004)

Or a range from 7.7% to 16.9% not a great deal of accuracy

Historical Average Return (2 Standard Error)

20.36%

12.3% 2 12.3% 4.6%

79

| |

=

|

\ .

SD(Individual Risk)

Standard Error

Number of Observations

=

The Historical Tradeoff Between Risk and

Return in Large Portfolios, 19262005

Note: a positive linear relationship between volatility and average returns for large

portfolios.

Historical Volatility and Return for 500 Individual

Stocks, by Size, Updated Quarterly, 19262005

The Returns of Individual Stocks

Is there a positive linear relationship between

volatility and average returns for individual stocks?

As shown on the last slide, there is no precise relationship

between volatility and average return for individual stocks.

Larger stocks tend to have lower volatility than smaller stocks.

All stocks tend to have higher risk for a given average return

relative to large portfolios.

There must be something magical going on with portfolios.

Volatility doesnt seem to be an adequate measure of risk to

explain the expected return of individual stocks.

Can we deal with this and resurrect our simple idea?

Going Forward

As we discussed, the market pays investors for two

services they provide: (1) surrendering their capital

and so forgoing current consumption and (2) sharing

in the aggregate risk of the economy.

The first gets you the time value of money.

The second gets you a risk premium whose size should

depend on the share of aggregate risk you take on.

From this we wrote E(r) = r

f

+

We refine this to E(r) = r

f

+ Units Price

In other words the premium cannot be the same for all assets.

If you take more risk (more units) you get more of a premium.

Going Forward

We need a reference for measuring risk and choose the

risk the market has to distribute across investors or the

market portfolio as that reference.

The market portfolio is defined to have one unit of risk

(Var(r

m

) = 1 unit of risk). Other assets will be evaluated

relative to this definition of one unit of risk.

From E(r) = r

f

+ Units Price we can see that

Price = {E(r

m

) r

f

}. (Note: Units = 1 for the market.)

In other words we also defined the price per unit risk (the

market risk premium).

Going Forward

The hard part is to show that any assets contribution to

the aggregate risk of the economy or Var(r

m

) is

determined not by Var(r

i

) but rather by Cov(r

i

, r

m

).

Standardize Cov(r

i

, r

m

) so that we measure the risk of

each asset relative to our definition of one unit and we

get beta:

Units =

i

= Cov(r

i

, r

m

)/Var(r

m

)

The number of units of risk for asset i is

i

.

So E(r

i

)=r

f

+

i

(E(r

m

) r

f

) = r

f

+ Units Price.

Risk and Return

When we are concerned with only one asset (or only a

large portfolio) risk and return can be measured using

expected return and variance of return.

If there is more that one asset (so portfolios can be

formed) risk becomes more complex.

We will show there are two types of risk for individual

assets:

Diversifiable/nonsystematic/idiosyncratic risk

Nondiversifiable/systematic/market risk

Diversifiable risk can be eliminated without cost by

combining assets into portfolios. (Big Wow.)

Individual stocks are exposed to this type of risk.

Large portfolios (generally) are not.

Diversification

One of the most important lessons in all of finance

concerns the power of diversification.

Part of the total risk of any asset can be diversified

away (its effect on portfolio risk is zero) without any loss

in expected return (i.e. without cost).

This also means that no compensation needs to be

provided to investors for exposing their portfolios to this

type of risk.

Why should the economy pay you to hold risk that you can get rid

of for free (or which is not part of the aggregate risk that all agents

must some how share).

This in turn implies that the risk/return relation is actually

a systematic risk/return relation.

An asset/portfolio with a lot of systematic risk will have a high

expected return.

An asset/portfolio with very little systematic risk will have a low

expected return.

Diversification Example

Suppose a large green ogre has approached you

and demanded that you enter into a bet with him.

The terms are that you must wager $10,000 and it

must be decided by the flip of a coin, where heads

he wins and tails you win.

What is your expected payoff and what is your risk?

Example

The expected payoff from such a bet is of course $0

if the coin is fair.

The standard deviation of this position is $10,000,

reflecting the wide swings in value across the two

outcomes (winning and losing).

Can you suggest another approach that stays within

the rules?

Example

If instead of wagering the whole $10,000 on one

coin flip think about wagering $1 on each of

10,000 coin flips.

The expected payoff on this version is still $0 so

you havent changed the expectation.

The standard deviation of the payoff in this

version, however, is $100.

Why the change?

If we bet a penny on each of 1,000,000 coin flips,

the risk, measured by the standard deviation of

the payoff, is $10. The expected payoff is of

course still $0.

Example

The example works so well at reducing risk

because the coin flips are independent.

If the coins were somehow perfectly correlated

we would be right back in the first situation.

Suppose all flips after the first always landed the same

way as the first did, what good is bothering with 10,000

flips?

With one dollar bets on 10,000 flips, for flip

correlations between zero (independence) and

one (perfect correlation) the measure of risk lies

between $100 and $10,000.

This is one way to see that the way an asset

contributes to the risk of a large portfolio is

determined by its correlation or covariance with

the other assets in the portfolio.

Covariances and Correlations: The Keys

to Understanding Diversification

When thinking in terms of probability distributions, the

covariance between the returns of two assets (A & B)

equals Cov(R

A

,R

B

) = o

AB

=

When estimating covariances from historical data, the

estimate is given by:

Note: An assets variance is its covariance with itself.

p ]) E[R -

R

])( E[R -

R

(

s B

B

A

A

S

1 = s

s s

)

R

-

R

)(

R

-

R

(

1 T

1

B

B

A

A

T

1 = t

t t

Correlation Coefficients

Covariances are difficult to interpret. Only the sign is

really informative. Is a covariance of 20 big or small?

The correlation coefficient, , is a normalized version of

the covariance given by:

Correlation = CORR(R

A

,R

B

) =

The correlation will always lie between 1 and -1.

A correlation of 1.0 implies ...

A correlation of -1.0 implies ...

A correlation of 0.0 implies ...

AB

B A

AB

B A

o o

o

o o

= =

) R , Cov(R

B A

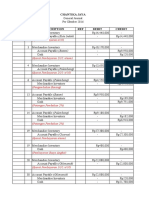

Return (%) Deviation from mean Squared Dev. from Mean

Probability A B P A B P A*B A B P

0.2 18 25 21.5 2 13 7.5 26 4 169 56.25

0.2 30 10 20 14 -2 6 -28 196 4 36

0.2 -10 10 0 -26 -2 -14 52 676 4 196

0.2 25 20 22.5 9 8 8.5 72 81 64 72.25

0.2 17 -5 6 1 -17 -8 -17 1 289 64

Mean 16 12 14 21 191.6 106 84.9

Risk and Return in Portfolios: Example

Two Assets, A and B

A portfolio, P, comprised of 50% of your total investment

invested in asset A and 50% in B.

There are five equally probable future outcomes, see below.

In this case:

VAR(R

A

) = 191.6, STD(R

A

) = 13.84, and E(R

A

) = 16%.

VAR(R

B

) = 106.0, STD(R

B

) = 10.29, and E(R

B

) = 12%.

COV(R

A

,R

B

) = 21

CORR(R

A

,R

B

) = 21/(13.84*10.29) = .1475.

VAR(R

P

)=84.9, STD(R

p

)=9.21, E(R

p

)=14%= E(R

A

) + E(R

B

)

Var(R

p

) or STD(R

P

) is less than that of either component!

Risk/return pairs with different weights

CORR(AB) 0.1475

-0.5

Risk and Return in 2-asset Portfolio

11

12

13

14

15

16

17

0 2 4 6 8 10 12 14 16

Standard Deviation

E

x

p

e

c

t

e

d

R

e

t

u

r

n

Asset A

Asset B

and portfolio

CORR(AB) 0.1 -1 1

-0.5

Risk and Return in 2-asset Portfolio

11

12

13

14

15

16

17

0 2 4 6 8 10 12 14 16

Standard Deviation

E

x

p

e

c

t

e

d

R

e

t

u

r

n

Asset A

Asset B

Risk return pairs with different correlations

How Diversification Works: The Variance of

a Two-Asset Portfolio

For a portfolio of two assets, A and B, the portfolio

variance is:

o o o

o

AB B A

2

B

2

B

2

A

2

A

2

p

w w

2 +

w

+

w

= Variance Portfolio =

For the two-asset example considered above:

Portfolio Variance = .5

2

(191.6) + .5

2

(106.0)

+ 2(.5)(.5)21

= 84.9 (check for yourself)

Or,

B AB A

B A

2

B

2

B

2

A

2

A

2

p

w w

2 +

w

+

w

= Variance Portfolio o o

o o

o =

For General Portfolios

The expected return on a portfolio is the weighted

average of the expected returns on each asset. If w

i

is the proportion of the investment invested in asset

i, then

Note that this is a linear relationship.

=

=

N

i

i i

R E w

1

p

] [ ] E[R

For General Portfolios

The variance of the portfolios return is given by:

Not simple and not linear but very powerful.

= =

=

N

i

N

j

j i j i

R R Cov w w

1 1

p

) , ( ) Var(R

In A Picture (N = 2)

Var(R

A

)=

Cov(R

A

, R

A

)

Cov(R

A

, R

B

)

Cov(R

B

, R

A

) Var(R

B

)=

Cov(R

B

, R

B

)

Portfolio variance is a weighted sum of

these terms.

In A Picture (N = 3)

Portfolio variance is a weighted sum of

these terms.

Var(R

A

) Cov(R

A

,R

B

) Cov(R

A

,R

C

)

Cov(R

B

,R

A

) Var(R

B

) Cov(R

B

,R

C

)

Cov(R

C

,R

A

) Cov(R

C

,R

B

) Var(R

C

)

In A Picture (N = 10)

Portfolio variance is a simple weighted sum of

the terms in the squares. The blue are covariances

and the white the variance terms.

In A Picture (N = 20)

Which squares are becoming more important?

Volatility of an Equally Weighted Portfolio

Versus the Number of Stocks

Implications of Diversification

Diversification reduces risk. If asset returns were uncorrelated on

average, diversification could eliminate all risk. They are positively

correlated on average.

Diversification will reduce risk but will not remove all of the risk. So,

Individual stocks are exposed to two kinds of risk

Diversifiable/nonsystematic/idiosyncratic risk.

Disappears in well diversified portfolios.

It disappears without cost, i.e. you need not sacrifice expected

return to reduce/eliminate this type of risk.

The law of one price implies that there will be no premium for

diversifiable risk.

Nondiversifiable/systematic/market risk.

Does not disappear in well diversified portfolios.

A large (well diversified) portfolio has only this type of risk.

Must trade expected return for systematic risk.

Level of systematic risk in a portfolio is an important choice for an

individual.

Measuring Systematic Risk

How can we estimate the amount or proportion of an

asset's risk that is diversifiable or non-diversifiable?

The Beta Coefficient is the slope coefficient in an OLS

regression of stock returns on market returns:

Beta is a measure of sensitivity: it describes how strongly

the stock excess return moves with the market excess

return.

What is the expected percent change in the excess return of

security i for a 1% change in the excess return of the market

portfolio?

It is standardized covariance, standardized by a measure

of risk we call one unit.

) Var(R

) R , Cov(R

M

M i

i

= |

The CAPM Intuition

E[R

i

] = R

F

(risk free rate) + Risk Premium

= Appropriate Discount Rate

Risk free assets earn the risk-free rate (think of this as

a rental rate on capital).

If the asset is risky, we need to add a risk premium.

The size of the risk premium depends on the amount of

systematic risk for the asset (stock, bond, or investment

project) and the price per unit risk.

Aside: could a risk premium ever be negative?

The CAPM Intuition Formalized

] R ] [E[R

) Var(R

) R , Cov(R

R ] E[R

F M

M

M i

F i

+ =

] R ] [E[R R ] E[R

F M i F i

+ = |

The expression above is referred to as the Security

Market Line (SML) or commonly just the CAPM.

Number of units of

systematic risk (|)

Market Risk Premium

or the price per unit risk

or,

Betas and Portfolios

The beta of a portfolio is the weighted average of the component

assets betas.

Example: You have 30% of your money in asset X, which has |

X

= 1.4 and 70% of your money in asset Y, which has |

Y

= 0.8.

Your portfolio beta is:

|

P

= .30(1.4) + .70(0.8) = 0.98.

Why do we care about this feature of betas?

It further demonstrates that an assets beta measures

the contribution that asset makes to the systematic

risk of a portfolio!

Note that this is a linear relation just like expected

return.

Risk and the Cost of Capital

Three inputs are required:

(i) An estimate of the risk free interest rate.

The current yield on short term treasury bills is one proxy.

Practitioners tend to favor the current yield on longer-term treasury

bonds but this may be a fix for a problem we dont fully understand.

Must adjust the market risk premium accordingly.

(ii) An estimate of the market risk premium, E(R

m

) - R

f

.

Expectations are not observable.

Use a historically estimated value. Use the average spread between

the risk free rate and the market return.

(iii) An estimate of beta. Is the asset or a close substitute for the

asset traded in financial markets? If so, gather data and run an

OLS regression or look it up from a variety of sources. If not, it

gets fuzzy.

The Market Risk Premium

The market is defined as a portfolio of all wealth including real

estate, human capital, etc.

In practice, a broad based stock index, such as the S&P 500 or

the portfolio of all NYSE stocks, is generally used.

We want the expected return on the market portfolio above the

risk free rate.

Again, we use the average of this difference over time.

Historically, the average market risk premium has been about

8% - 9% above the return on treasury bills.

The average market risk premium has been about 6% - 7%

above the return on treasury bonds.

More recent averages are considerably lower.

Das könnte Ihnen auch gefallen

- Risk and Return Chapter Explains Systematic and Unsystematic RiskDokument17 SeitenRisk and Return Chapter Explains Systematic and Unsystematic RiskAshish BhallaNoch keine Bewertungen

- The Relation Between Risk and ReturnDokument8 SeitenThe Relation Between Risk and ReturnBasharat TawheedaabadiNoch keine Bewertungen

- R P - P - + C: Chapter Seven Basics of Risk and ReturnDokument13 SeitenR P - P - + C: Chapter Seven Basics of Risk and ReturntemedebereNoch keine Bewertungen

- IFA NAZUWA (69875) Tutorial 2Dokument6 SeitenIFA NAZUWA (69875) Tutorial 2Ifa Nazuwa ZaidilNoch keine Bewertungen

- Understanding Market Indexes, Portfolios, Risk and the Capital Asset Pricing ModelDokument141 SeitenUnderstanding Market Indexes, Portfolios, Risk and the Capital Asset Pricing Modelrow rowNoch keine Bewertungen

- Risk and Return Analysis for Financial PortfoliosDokument47 SeitenRisk and Return Analysis for Financial PortfoliosAbraham Gebregiorgis BerheNoch keine Bewertungen

- PortfolioDokument46 SeitenPortfolioSarita ThakurNoch keine Bewertungen

- Chapter Five: Advanced Risk Analysis: Firm Risk and Market RiskDokument15 SeitenChapter Five: Advanced Risk Analysis: Firm Risk and Market RisktemedebereNoch keine Bewertungen

- Topic 4 Risk ReturnDokument48 SeitenTopic 4 Risk ReturnBulan Bintang MatahariNoch keine Bewertungen

- FM Unit 3 Lecture Notes - Risk and ReturnDokument6 SeitenFM Unit 3 Lecture Notes - Risk and ReturnDebbie DebzNoch keine Bewertungen

- Optimal Risky PortfolioDokument25 SeitenOptimal Risky PortfolioAlexandra HsiajsnaksNoch keine Bewertungen

- Chapter 6Dokument16 SeitenChapter 6elnathan azenawNoch keine Bewertungen

- Chapter 1 FMDokument47 SeitenChapter 1 FMabdellaNoch keine Bewertungen

- Risk and Return Study NotesDokument24 SeitenRisk and Return Study NotesOblivionOmbreNoch keine Bewertungen

- FIN 440 Risk & Return Chapter Reference - CHP 6Dokument4 SeitenFIN 440 Risk & Return Chapter Reference - CHP 6Syed Ataur RahmanNoch keine Bewertungen

- FIN 440 Risk & Return Chapter Reference - CHP 6Dokument4 SeitenFIN 440 Risk & Return Chapter Reference - CHP 6Syed Ataur RahmanNoch keine Bewertungen

- Chapter 5.pptx Risk and ReturnDokument25 SeitenChapter 5.pptx Risk and ReturnKevin Kivanc IlgarNoch keine Bewertungen

- Risk and Return S1 2018Dokument9 SeitenRisk and Return S1 2018Quentin SchwartzNoch keine Bewertungen

- Measuring and Modeling VolatilityDokument33 SeitenMeasuring and Modeling VolatilityMujeeb Ul Rahman MrkhosoNoch keine Bewertungen

- Fin 310 Lecture 5 - Risk & Return Diversification Portfolio Theory CAPM APTDokument92 SeitenFin 310 Lecture 5 - Risk & Return Diversification Portfolio Theory CAPM APTYaonik HimmatramkaNoch keine Bewertungen

- Stand Alone Risk PDFDokument26 SeitenStand Alone Risk PDFlander21100% (1)

- 8.3 NeweloDokument6 Seiten8.3 NeweloOlwen IrawanNoch keine Bewertungen

- Risk and Return For PrintDokument30 SeitenRisk and Return For PrintTahir DestaNoch keine Bewertungen

- Finman Written ReportDokument9 SeitenFinman Written ReportRanie MonteclaroNoch keine Bewertungen

- Return and Risk:: Portfolio Theory AND Capital Asset Pricing Model (Capm)Dokument52 SeitenReturn and Risk:: Portfolio Theory AND Capital Asset Pricing Model (Capm)anna_alwanNoch keine Bewertungen

- Understanding Risk and ReturnDokument59 SeitenUnderstanding Risk and ReturnErin GamerNoch keine Bewertungen

- Portfolio Management & Analysis: 1. UtilityDokument10 SeitenPortfolio Management & Analysis: 1. UtilityMarie Remise100% (1)

- CFA1 - Corporate Finance and Equity Investment TrainingDokument177 SeitenCFA1 - Corporate Finance and Equity Investment Traininglamkk0520Noch keine Bewertungen

- Risk and Return: Basic Return Concepts Basic Risk Concepts Stand-Alone RiskDokument38 SeitenRisk and Return: Basic Return Concepts Basic Risk Concepts Stand-Alone Riskarmando.chappell1005Noch keine Bewertungen

- Ch-10 (Return and Risk-The Capital Asset Pricing Model)Dokument29 SeitenCh-10 (Return and Risk-The Capital Asset Pricing Model)Ahmed ShaanNoch keine Bewertungen

- IBF RIsk & Return NotesDokument10 SeitenIBF RIsk & Return NotesMinhaj TariqNoch keine Bewertungen

- MFCF - Session 3Dokument47 SeitenMFCF - Session 3Ondřej HengeričNoch keine Bewertungen

- Aide Memoire: FTX3044F - TEST 2 (Chapters 5 - 12)Dokument18 SeitenAide Memoire: FTX3044F - TEST 2 (Chapters 5 - 12)Callum Thain BlackNoch keine Bewertungen

- Chapter 5 and 6 Security AnalysisDokument5 SeitenChapter 5 and 6 Security AnalysisMohiuddin Al FarukNoch keine Bewertungen

- Module #04 - Risk and Rates ReturnDokument13 SeitenModule #04 - Risk and Rates ReturnRhesus UrbanoNoch keine Bewertungen

- FinalrisknreturnDokument86 SeitenFinalrisknreturnpriya nNoch keine Bewertungen

- Finance&Accounting Uniseminar112Dokument354 SeitenFinance&Accounting Uniseminar112JohnChiticNoch keine Bewertungen

- An Introduction To Portfolio ManagementDokument32 SeitenAn Introduction To Portfolio Managementch_arfan2002Noch keine Bewertungen

- DIVERSIFICATIONDokument72 SeitenDIVERSIFICATIONshaRUKHNoch keine Bewertungen

- Chapter 5 Chapter 5: Risk and ReturnDokument20 SeitenChapter 5 Chapter 5: Risk and ReturnAhmad Ridhuwan AbdullahNoch keine Bewertungen

- Risk and Return Analysis of Stocks and PortfoliosDokument10 SeitenRisk and Return Analysis of Stocks and PortfoliosRabinNoch keine Bewertungen

- Chapter One: Risk Analysis & ManagementDokument65 SeitenChapter One: Risk Analysis & ManagementYohaannis BaayisaaNoch keine Bewertungen

- 08 Handout 124Dokument11 Seiten08 Handout 124bernadette soteroNoch keine Bewertungen

- Risk and Return FundamentalsDokument19 SeitenRisk and Return FundamentalsMariana MuñozNoch keine Bewertungen

- Fnce 220: Business Finance: Topic: Risk & Return RelationshipsDokument26 SeitenFnce 220: Business Finance: Topic: Risk & Return RelationshipsVincent KamemiaNoch keine Bewertungen

- Return Risk Analysis ToolsDokument8 SeitenReturn Risk Analysis ToolsVimbai ChituraNoch keine Bewertungen

- Topic 4Dokument26 SeitenTopic 420070304 Nguyễn Thị PhươngNoch keine Bewertungen

- Portfolio Markowitz ModelDokument43 SeitenPortfolio Markowitz Modelbcips100% (1)

- Theory of Finance AnswersDokument11 SeitenTheory of Finance Answersroberto piccinottiNoch keine Bewertungen

- Risk, Return & Portfolio Theory ExplainedDokument74 SeitenRisk, Return & Portfolio Theory ExplainedWegene Benti UmaNoch keine Bewertungen

- Risk and Return and Capm: Mba 2 Lecturer SeriesDokument32 SeitenRisk and Return and Capm: Mba 2 Lecturer SeriesOKELLONoch keine Bewertungen

- Ch11 Solutions 6thedDokument26 SeitenCh11 Solutions 6thedMrinmay kunduNoch keine Bewertungen

- UntitledDokument42 SeitenUntitledVivaan KothariNoch keine Bewertungen

- American Finance AssociationDokument16 SeitenAmerican Finance Associationsafa haddadNoch keine Bewertungen

- Portfolio ManagementDokument50 SeitenPortfolio ManagementmamunimamaNoch keine Bewertungen

- Financial Management - Risk and ReturnDokument22 SeitenFinancial Management - Risk and ReturnSoledad Perez100% (1)

- Chapter 8 Risk and Rates of Return Part 1Dokument15 SeitenChapter 8 Risk and Rates of Return Part 1Nusrat JahanNoch keine Bewertungen

- Capital Asset Pricing Model: Make smart investment decisions to build a strong portfolioVon EverandCapital Asset Pricing Model: Make smart investment decisions to build a strong portfolioBewertung: 4.5 von 5 Sternen4.5/5 (3)

- In Search of Returns 2e: Making Sense of Financial MarketsVon EverandIn Search of Returns 2e: Making Sense of Financial MarketsNoch keine Bewertungen

- Share Price GufranDokument24 SeitenShare Price GufranMuhammad Saleem SattarNoch keine Bewertungen

- Accounting Standard - 22Dokument25 SeitenAccounting Standard - 22Rana HaiderNoch keine Bewertungen

- HEC Committee Minutes on Degree RecognitionDokument91 SeitenHEC Committee Minutes on Degree RecognitionSohaib Ahmed100% (2)

- Introduction To Operations and Supply Chain ManagementDokument44 SeitenIntroduction To Operations and Supply Chain ManagementRana HaiderNoch keine Bewertungen

- Excel Formulas and FunctionsDokument16 SeitenExcel Formulas and Functionsgoyal.pavan100% (1)

- Capital Budgeting Part 1 - Revision NotesDokument14 SeitenCapital Budgeting Part 1 - Revision Notessohail merchantNoch keine Bewertungen

- Method One of Reading:-: Standard Costing - IDokument9 SeitenMethod One of Reading:-: Standard Costing - IRana HaiderNoch keine Bewertungen

- Youth Empowerment Programs for Improving Self-EfficacyDokument38 SeitenYouth Empowerment Programs for Improving Self-EfficacyRana HaiderNoch keine Bewertungen

- Sample Paper State Bank of PakistanDokument7 SeitenSample Paper State Bank of PakistanShahid JappaNoch keine Bewertungen

- Microfinance For Youth in Conflict SettingsDokument52 SeitenMicrofinance For Youth in Conflict SettingsRana HaiderNoch keine Bewertungen

- Monthly Demand ABC Corporation (Jan '98 - Dec '02)Dokument2 SeitenMonthly Demand ABC Corporation (Jan '98 - Dec '02)Rana HaiderNoch keine Bewertungen

- Waste Management FraudDokument12 SeitenWaste Management FraudRana Haider67% (3)

- EqualVoice YouthEmpowerment Toolkit-WebDokument36 SeitenEqualVoice YouthEmpowerment Toolkit-WebRana HaiderNoch keine Bewertungen

- 7 ProcessCostingDokument2 Seiten7 ProcessCostingRana HaiderNoch keine Bewertungen

- Report On Operation of KapcoDokument45 SeitenReport On Operation of KapcoZunaira RasheedNoch keine Bewertungen

- New Microsoft Office Word DocumentDokument1 SeiteNew Microsoft Office Word DocumentRana HaiderNoch keine Bewertungen

- AIOU Research Methods PacketDokument8 SeitenAIOU Research Methods PacketRana HaiderNoch keine Bewertungen

- Waste Management FraudDokument12 SeitenWaste Management FraudRana Haider67% (3)

- Marketing Strategies of Dawlance and LGDokument7 SeitenMarketing Strategies of Dawlance and LGRana HaiderNoch keine Bewertungen

- Functions of Stock ExchangeDokument24 SeitenFunctions of Stock Exchangesaqibch44Noch keine Bewertungen

- Price Earning Ratio:: Market AverageDokument25 SeitenPrice Earning Ratio:: Market AverageRana HaiderNoch keine Bewertungen

- KSE 100 Executive Summary of CFA Level 1 reading on Security Market IndexesDokument6 SeitenKSE 100 Executive Summary of CFA Level 1 reading on Security Market IndexesRana HaiderNoch keine Bewertungen

- New Microsoft Word DocumentDokument5 SeitenNew Microsoft Word DocumentRana HaiderNoch keine Bewertungen

- New Microsoft Word DocumentDokument6 SeitenNew Microsoft Word DocumentRana HaiderNoch keine Bewertungen

- Womens Empowerment in The Context of Microfinance - A PhotovoiceDokument147 SeitenWomens Empowerment in The Context of Microfinance - A PhotovoiceRana HaiderNoch keine Bewertungen

- TT05B - Investment Plan Example InstructionsDokument12 SeitenTT05B - Investment Plan Example InstructionsRana HaiderNoch keine Bewertungen

- New Microsoft Office Word DocumentDokument2 SeitenNew Microsoft Office Word DocumentRana HaiderNoch keine Bewertungen

- M/s. Dawood Hercules Chemical Limited: ProposingDokument2 SeitenM/s. Dawood Hercules Chemical Limited: ProposingRana HaiderNoch keine Bewertungen

- Market Research ReportDokument32 SeitenMarket Research ReportRana HaiderNoch keine Bewertungen

- Zjyc Youth Baseline Survey Executive Report Final10marchDokument48 SeitenZjyc Youth Baseline Survey Executive Report Final10marchRana HaiderNoch keine Bewertungen

- PT Amar Sejahtera General LedgerDokument6 SeitenPT Amar Sejahtera General LedgerRiska GintingNoch keine Bewertungen

- Mr. Gopikrishna - CH: Career ObjectiveDokument3 SeitenMr. Gopikrishna - CH: Career ObjectiveGopi KrishnaNoch keine Bewertungen

- Ruskin Bond's Haunting Stories CollectionDokument5 SeitenRuskin Bond's Haunting Stories CollectionGopal DeyNoch keine Bewertungen

- Spo2 M1191aDokument247 SeitenSpo2 M1191ashashibiya33Noch keine Bewertungen

- Trash and Recycling Space Allocation GuideDokument24 SeitenTrash and Recycling Space Allocation GuideJohan RodriguezNoch keine Bewertungen

- Berklee Blues Progression in SongwritingDokument4 SeitenBerklee Blues Progression in SongwritingTC Ahmet Ayhan Altunoğlu100% (1)

- Inbound 6094510472110192055Dokument2 SeitenInbound 6094510472110192055MarielleNoch keine Bewertungen

- Charles L. Mader - Numerical Modeling of The Deflagration-to-Detonation TransitionDokument21 SeitenCharles L. Mader - Numerical Modeling of The Deflagration-to-Detonation TransitionSteemWheelNoch keine Bewertungen

- Antipsychotic DrugsDokument23 SeitenAntipsychotic DrugsASHLEY DAWN BUENAFENoch keine Bewertungen

- Guerrero vs. CA - DigestDokument2 SeitenGuerrero vs. CA - DigestMarionnie SabadoNoch keine Bewertungen

- Icpo Naft 4Dokument7 SeitenIcpo Naft 4Juan AgueroNoch keine Bewertungen

- Osisense XX Xx518a3pam12Dokument6 SeitenOsisense XX Xx518a3pam12Paulinho CezarNoch keine Bewertungen

- Assessment Task 2Dokument15 SeitenAssessment Task 2Hira Raza0% (2)

- 50 - Shreyashree Maity - Computer Assignment - 5 TH JulyDokument13 Seiten50 - Shreyashree Maity - Computer Assignment - 5 TH JulyShreyashree MaityNoch keine Bewertungen

- Accounting Income and Assets: The Accrual ConceptDokument40 SeitenAccounting Income and Assets: The Accrual ConceptMd TowkikNoch keine Bewertungen

- 21 B 53679 Cdae 251 D 88 AeDokument2 Seiten21 B 53679 Cdae 251 D 88 Aeapi-439429931Noch keine Bewertungen

- Digital Signature Certificate Subscription FormDokument7 SeitenDigital Signature Certificate Subscription FormAneesh VelluvalappilNoch keine Bewertungen

- VideosDokument5 SeitenVideosElvin Joseph Pualengco MendozaNoch keine Bewertungen

- C M P (P N) : Ommunication Anagement LAN Roject AMEDokument8 SeitenC M P (P N) : Ommunication Anagement LAN Roject AMEArun BungseeNoch keine Bewertungen

- Rule 11-Time To File Responsive PleadingsDokument6 SeitenRule 11-Time To File Responsive PleadingsAnne DemNoch keine Bewertungen

- 06 Traffic Flow Fundamentals PDFDokument27 Seiten06 Traffic Flow Fundamentals PDFDaryl ChanNoch keine Bewertungen

- RLE Journal CoverDokument2 SeitenRLE Journal Coverrchellee689Noch keine Bewertungen

- Terms and conditions for FLAC 3D licensingDokument2 SeitenTerms and conditions for FLAC 3D licensingseif17Noch keine Bewertungen

- Nadig Reporter Newspaper Chicago June 19 2013 EditionDokument20 SeitenNadig Reporter Newspaper Chicago June 19 2013 EditionchicagokenjiNoch keine Bewertungen

- Segment Reporting NotesDokument2 SeitenSegment Reporting NotesAshis Kumar MuduliNoch keine Bewertungen

- The Cucumber Book Behaviour-Driven Development For Testers and DevelopersDokument28 SeitenThe Cucumber Book Behaviour-Driven Development For Testers and DevelopersGursharan AulakhNoch keine Bewertungen

- Dan John Case Study - Scaling with Facebook AdsDokument5 SeitenDan John Case Study - Scaling with Facebook AdsZeynep ÖzenNoch keine Bewertungen

- 00 2 Physical Science - Zchs MainDokument4 Seiten00 2 Physical Science - Zchs MainPRC BoardNoch keine Bewertungen

- Machine Learning: MACHINE LEARNING - Copy Rights Reserved Real Time SignalsDokument56 SeitenMachine Learning: MACHINE LEARNING - Copy Rights Reserved Real Time SignalsLohith Ds BangloreNoch keine Bewertungen

- G.R. No. 173637 - Speedy TRial and Double JeopardyDokument3 SeitenG.R. No. 173637 - Speedy TRial and Double Jeopardylr dagaangNoch keine Bewertungen