Beruflich Dokumente

Kultur Dokumente

Article

Hochgeladen von

Jitendra RaghuwanshiCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Article

Hochgeladen von

Jitendra RaghuwanshiCopyright:

Verfügbare Formate

PRESENTATION ON

Behavior of Stock Market Volatility after Derivatives

SYNOPSIS OF THE ARTICLE

The article briefly discuss about the financial market liberalisation since early 1990s that have brought major changes

The creation and empowerment of SEBI has helped in providing higher level accountability in the market

The new institutions like NSEIL, NSCCL, NSDL, have been the change agents and helped cleaning the system and provided safety in investing public at large

2

Microstructure changes brought reduction in transaction cost that helped investor to lock in a deal faster and cheaper One decade of reforms saw implementation of policies that have:

Improved the transparency in the system, Provided cheaper mode of information dissemination without much time delay, Better corporate governance, Prohibiting the insider trading and price rigging.

The objective has been to move the Indian market to such a level where it would fully integrate with the global developed markets.

INTRODUCTION

The article talks about the derivatives in Capital Market. The derivatives were first introduced on the basis of recommendation made by L C Gupta Committee report. The committee had recommenced in December 1997 the introduction of stock index futures in the first place to be followed by other products once the market matures.

The preparation of regulatory framework for the operations of the index futures contracts took some more time and finally futures on benchmark indices were introduced in: June June

2000 Futures on indices 2001 Options on indices

July

2001 Options on individual stock

2001 Futures on individual

November

OBJECTIVE OF THE STUDY

To study the behaviour volatility in Cash Market after introduction of derivatives. Impact of derivatives trading on the volatility of the cash market in India has been studied by:1.

2.

Thenmozhi (2002) lower level volatility in cash market.

Shenbagaraman (2003) there was no significances fall in cash market.

3.

Gupta and Kumar (2002) overall volatility of underlying market declined.

Raju and Karande (2003) decline in volatility of cash market.

4.

All these studies have been done using the market index and not individual stocks, Study has been done on the longer period of data to study the volatility of the derivative. The study use indices as well as individual stocks for analysis.

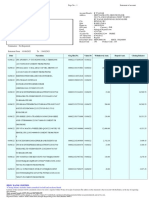

METHODOLOGY

The article used the daily stock market data from January 1999- October 2003.

Daily returns had been calculated by the following equation: Rt

= Log(Pt /Pt-1)/(n -1)

The standard deviation of returns had been calculated by the following method

2

= (Rt )2 /(n -1)

Source of Data and Data characteristics

Two benchmark indices:

S&P CNX NIFTY, S&P CNX NIFTY Junior along with some stocks.

Time Period :January 1999 to October 2003. Total stocks:- 20 stocks

3 were single stock futures and option while 7 do not have the same).

9

Whole data is divided into 6 blocks.

Full period from January 1,1999 October 31, 2003. (PD1) First sample period from January 1,1991- May 31, 2000.(PD2) Second sample period from June 1,2000- November 30, 2001.(PD3) Third sample period from December 1,2001- October 31, 2003.(PD4) Fourth sample period from June 1,2002- October 31, 2003.(PD5)

Fifth sample period from November 1,2002- October 2003.(PD6)

10

The justification for the sub-periods is that they have given 6 months time after introduction of all available four products to sell down.

Futures on individual stocks and indices,

Options on individual stocks and indices.

The period from June 2000 to November 2001 as the intervening period during which various derivatives products were introduced in the market. Two method had been used to model the conditional volatility:1. 2.

GARCH IGARCH

11

PROCESS

Run a GARCH estimation using dummy variable to ascertain the impact of derivatives on the Cash Market Volatility. Identified 4 relevant dates of event to control the dummy variable. The dummy variable is given a value:

0 Before the new derivatives product was introduced. 1 After the event date.

12

RESULTS

Volatility that is measured by standard deviation has came down for most of the stocks.

Daily static standard deviation has fallen from 2.05%(annually 32.54%) to 1.19 (18.91%)for NIFTY. For NIFTY JUNIOR, the fall is from 2.69% (42.78%) to 1.34% (21.40%).

13

IMPACT OF DERIVATIVE ON CASH MARKET

The volatility has come down in recent months, specifically in post derivative period. The reduction due to many reasons

The

Microstructure changes,

Robust

risk management practices followed by exchange to contain volatility,

derivatives on indices as well as on individual stocks.

14

Introduction of

Events dates:1. 2. 3. 4.

June 12, 2000. June 4, 2001. July 2, 2001. November 9, 2001.

To study the impact of each event, they introduce dummy variable to ascertain their coefficients and find its statistical significance. RESULTS:-

1.

The event 1 is significant at 1% level with a negative coefficient of 0.23 that indicates the introduction of futures.

15

CONCLUSION

By studying conditional volatility we observed that for most of the stocks, the volatility has come down in the post-derivative period.

All these methods suggested that the volatility of the market as measured by benchmark indices like S&P CNX NIFTY and S&P CNX NIFTY JUNIOR have fallen after in the post- derivatives period.

16

The finding in the line with the earlier findings of Thenmozhi (2002), Shenbagaran (2003), Gupta and Kumar (2002) and Raju and Karande (2003) to the extent that there is a general fall in volatility after introduction of derivatives. The earlier studies used shorter period of data and pre- single stock futures and options period data.

17

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- ParineetaDokument8 SeitenParineetaJitendra Raghuwanshi0% (1)

- Case Study - Appraising The Secretaries at Sweetwater University - PMSDokument5 SeitenCase Study - Appraising The Secretaries at Sweetwater University - PMSJitendra Raghuwanshi100% (3)

- Fundamental Equity Analysis - QMS Gold Miners FlexIndex - The QMS Advisors' Gold Miners Flexible Index Tracks Companies Involved in The Gold Mining IndustryDokument205 SeitenFundamental Equity Analysis - QMS Gold Miners FlexIndex - The QMS Advisors' Gold Miners Flexible Index Tracks Companies Involved in The Gold Mining IndustryQ.M.S Advisors LLCNoch keine Bewertungen

- Zawya Collaborative Sukuk ReportDokument130 SeitenZawya Collaborative Sukuk ReportBRR_DAG100% (4)

- Just in Time: Anushri Dipti ShikhaDokument10 SeitenJust in Time: Anushri Dipti ShikhaJitendra RaghuwanshiNoch keine Bewertungen

- Rural Credit: A Source of Sustainable Livelihood of Rural IndiaDokument16 SeitenRural Credit: A Source of Sustainable Livelihood of Rural IndiaJitendra RaghuwanshiNoch keine Bewertungen

- Public Finance: Anushri Singhania 4110007007Dokument4 SeitenPublic Finance: Anushri Singhania 4110007007Jitendra RaghuwanshiNoch keine Bewertungen

- Raghu 2Dokument8 SeitenRaghu 2Jitendra RaghuwanshiNoch keine Bewertungen

- The Shakespeare of Indian LiteratureDokument44 SeitenThe Shakespeare of Indian LiteratureJitendra RaghuwanshiNoch keine Bewertungen

- SelfHelpGroup GuideLineDokument13 SeitenSelfHelpGroup GuideLineJitendra RaghuwanshiNoch keine Bewertungen

- KalidasDokument32 SeitenKalidasJitendra RaghuwanshiNoch keine Bewertungen

- Algeria January 2012Dokument3 SeitenAlgeria January 2012Jitendra RaghuwanshiNoch keine Bewertungen

- V1 Group Limited: Overseas Regulatory Announcement Inside InformationDokument6 SeitenV1 Group Limited: Overseas Regulatory Announcement Inside InformationxandaniNoch keine Bewertungen

- 5301 Ch. 7-14 Additional Multiple Choice QuestionsDokument9 Seiten5301 Ch. 7-14 Additional Multiple Choice QuestionsZhou Tian YangNoch keine Bewertungen

- Cc-6 (High Powered Money) - 2Dokument10 SeitenCc-6 (High Powered Money) - 2sommelierNoch keine Bewertungen

- AdanirightsDokument291 SeitenAdanirightsVivek AgarwalNoch keine Bewertungen

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokument65 SeitenDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceMohan KumarNoch keine Bewertungen

- Day Trader - ScreenplayDokument18 SeitenDay Trader - ScreenplayCyprian FrancisNoch keine Bewertungen

- Raising Venture Capital - Comprehenseive Plan With TimelineDokument6 SeitenRaising Venture Capital - Comprehenseive Plan With Timelinejaknap1802Noch keine Bewertungen

- Regional College For Education, Reserch & Technology: SubjectDokument37 SeitenRegional College For Education, Reserch & Technology: SubjectAshu SinghNoch keine Bewertungen

- SECP Internship ReportDokument53 SeitenSECP Internship ReportKomal ShujaatNoch keine Bewertungen

- ZuluTrade WSJ ArticleDokument2 SeitenZuluTrade WSJ ArticleMinura MevanNoch keine Bewertungen

- Investing, Purchaing Power, & Frictional CostsDokument12 SeitenInvesting, Purchaing Power, & Frictional Costss2mcpaul100% (1)

- Non Negotialbe IntrumentDokument15 SeitenNon Negotialbe IntrumentSenthil MassenNoch keine Bewertungen

- MBF14e Chap05 FX Markets PbmsDokument20 SeitenMBF14e Chap05 FX Markets PbmsNhi Phạm Trần YếnNoch keine Bewertungen

- MFSI-Unit IDokument35 SeitenMFSI-Unit ISanthiya LakshmiNoch keine Bewertungen

- Comm 2Dokument2 SeitenComm 2the saintNoch keine Bewertungen

- Deakin University: Unit Code: MAF203 Unit Name: Business Finance Writing Time: 2 Hours Reading Time: 15 MinutesDokument16 SeitenDeakin University: Unit Code: MAF203 Unit Name: Business Finance Writing Time: 2 Hours Reading Time: 15 MinutesJoel Christian MascariñaNoch keine Bewertungen

- MBA711 - Answers To Book - Chapter 3Dokument17 SeitenMBA711 - Answers To Book - Chapter 3noisomeNoch keine Bewertungen

- MasterthesisDokument64 SeitenMasterthesisNet TeeramungcalanonNoch keine Bewertungen

- Darvas Technical Filter Plus PDFDokument32 SeitenDarvas Technical Filter Plus PDFAlvinNoch keine Bewertungen

- Educational File 2Dokument7 SeitenEducational File 2Phát MinhNoch keine Bewertungen

- Summer Internship ReportDokument16 SeitenSummer Internship ReportRavi MehraNoch keine Bewertungen

- Box Spread Arbitrage Efficiency of Nifty Index OptionsDokument20 SeitenBox Spread Arbitrage Efficiency of Nifty Index OptionsVignesh_23Noch keine Bewertungen

- FIM Chapter 4Dokument16 SeitenFIM Chapter 4Surafel BefekaduNoch keine Bewertungen

- Carlyle V Conway - NY SuperiorDokument115 SeitenCarlyle V Conway - NY SuperiorcecurranNoch keine Bewertungen

- 13 Flist 1997 Q 2Dokument323 Seiten13 Flist 1997 Q 2doodle bobNoch keine Bewertungen

- Estimating Firm Cost of Equity For Nova Scotia Bank - EditedDokument9 SeitenEstimating Firm Cost of Equity For Nova Scotia Bank - EditedPoetic YatchyNoch keine Bewertungen

- Assignment 1 - Yuvraj Chauhan PDFDokument4 SeitenAssignment 1 - Yuvraj Chauhan PDFYuvraj ChauhanNoch keine Bewertungen

- Mem (Monetary Policy)Dokument9 SeitenMem (Monetary Policy)Himanshu RatnaniNoch keine Bewertungen