Beruflich Dokumente

Kultur Dokumente

Cash Flow December

Hochgeladen von

Ammara MubasharCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cash Flow December

Hochgeladen von

Ammara MubasharCopyright:

Verfügbare Formate

Slide 13-1

Chapter

13

STATEMENT OF CASH FLOWS

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-2

STATEMENT OF CASH FLOWS

Some investors believe that "

cash is

king".

The statement of cash flows is one of the

main financial statements. The other financial statements are the

balance sheet, income statement, and statement of stockholders' equity.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-3

Cash flow versus Income Statement

The cash flow statement identifies the cash that

is flowing in and out of the company.

The

difference of Inflow and Outflow of the Cash is indentified

Because the income statement is prepared

under the accrual basis of accounting, the revenues reported may not have been collected. Similarly, the expenses reported on the income statement might not have been paid

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-4

Purpose of the Statement of Cash Flows

Provides information about the cash receipts and cash payments of a business entity during the accounting period.

Helps investors with questions about the companys: Ability to generate positive cash flows. Ability to meet its obligations and to pay dividends. Need for external financing. Investing and financing transactions for the period.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-5

Format and structure of the cash flow statement

Cash flows from operating activities + Cash flows from investing activities + Cash flows from financing activities

Net change in cash during period

+ Beginning cash balance = Ending cash balance

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-6

Classification of Cash Flows

The Statement of Cash Flows must include the following three sections: Cash Flows from Operating Activities Cash Flows from Investing Activities Cash Flows from Financing Activities

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-7

Operating Activities

Inflows from:

Sales to customers. Interest and dividends received.

Cash flows from operating activities are cash flows from transactions that affect net income, Current Assets and Current Liabilities.

+ Outflows to: PAYMENTS to:

Suppliers of merchandise and services. Employees. Lenders for interest. McGraw-Hill/Irwin Governments for taxes.

Cash Flows from Operating Activities

The McGraw-Hill Companies, Inc., 2002

Slide 13-8

1 Cash Flows from Investing Activities

Cash flows from investing activities are cash flows from

transactions that affect the investments in noncurrent assets of the company. Cash inflows from investing activities normally arise from selling fixed assets, investments, and intangible assets.

Cash outflows from investing activities normally include

payments to acquire fixed assets, investments, and intangible assets.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-9

Investing Activities

Inflows from:

Selling investments and plant assets. Collecting of principal on loans.

Outflows to:

Payments to acquire investments and plant assets. Purchase debt or equity investments. Make loans.

Cash Flows from Investing Activities

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-10

Cash flows from financing activities

Cash flows from financing activities are cash flows from transactions that affect the equity and debt of the company.

Cash inflows from financing activities normally

arise from issuing debt or equity securities.

Cash outflows from financing activities normally

include paying cash dividends, repaying debt, and acquiring treasury stock.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-11

Financing Activities

Inflows from:

long-term borrowing. Owners (for example, from issuing stock).

Outflows to:

Repayments of borrowed funds. Payment of dividends. Purchase treasury stock.

Cash Flows from Financing Activities

McGraw-Hill/Irwin

Related to the external The McGraw-Hill Companies, Inc., 2002 financing

Slide 13-12

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-13

Quiz Time

Classifying Cash Flows Identify whether each of the following would be reported as an operating, investing, or financing activity in the statement of cash flows. a. Purchase of patent i b. Payment of cash dividend f c. Disposal of equipment i

d. Cash sale o e. Purchase of treasury stock f f. Payment of wages expense o

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-14

Cash and Cash Equivalents

Cash Equivalents

Cash

Currency

Short-term, highly liquid investments. Readily convertible into cash. So near maturity that market value is unaffected by interest rate changes.

The McGraw-Hill Companies, Inc., 2002

McGraw-Hill/Irwin

Slide 13-15

Company Name Statement of Cash Flows Period Covered Cash flows from operating activities: [List of individual inflows and outflows] Net cash provided (used) by operating activities Cash flows from investing activities: The operating [List of individual inflows and outflows] cash section provided (used) by investing activities cash Net flows

$ #####

Lets look ##### at the In-Direct Cash from financing activities: canflows be prepared [List of individual inflows and outflows] Method for using either the Net cash provided (used) by financing activities ##### direct method or preparing the Net increase (decrease) in Cash $ ##### the indirect Statement of Cash (and equivalents) balance at beginning of period ##### method. Cash Flows. Cash (and equivalents) balance at end of period $ #####

The McGraw-Hill Companies, Inc., 2002

McGraw-Hill/Irwin

Slide 13-16

Steps in Preparation

The statement of cash flows is prepared using the

following information: 1. Comparative balance sheets The changes between the beginning and ending balance sheets are analyzed to determine the sources of changes in cash flows. 2. Current income statement The current income statement provides the information required to determine the sources and uses of cash during the accounting period.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-17

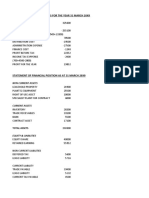

Comparative Balance Sheet

Shiner Corporation Dec 31, 2012 $54,000 Dec 31, 2011 $37,000 Change 17000 Cash Inflow

Assets Cash Accounts Receivable Inventories Prepaid Expenses Land

McGraw-Hill/Irwin

$18,000

$28,000

-10,000

Inflow

$54,000

$0

54,000

Cash outflow

$14,000 $45,000

$6,000 $70,000

8000

outflow

-25,000

inflow

The McGraw-Hill Companies, Inc., 2002

Slide 13-18

Prepare a statement of cash flows, using the indirect method.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-19

Usefulness and Format

Indirect and Direct Methods

Companies favor the indirect method for two reasons:

1. Easier and less costly to prepare. 2. Focuses on differences between net income and net cash flow from operating activities.

McGraw-Hill/Irwin

SO 3 Explain the impact of the product life cycle on a companys cash flows. The McGraw-Hill Companies, Inc., 2002

Slide 13-20

Preparing the Statement of Cash Flows

Illustration Indirect Method

Illustration 12-5

McGraw-Hill/Irwin

SO 4 Prepare a statement of cash flows using the indirect method. The McGraw-Hill Companies, Inc., 2002

Slide 13-21

Preparing the Statement of Cash Flows

Illustration 12-5

McGraw-Hill/Irwin

SO 4 Prepare a statement of cash flows using the indirect method. The McGraw-Hill Companies, Inc., 2002

Slide 13-22

Preparing the Statement of Cash Flows

Illustration 12-5

Additional information for 2012: 1. Depreciation expense was comprised of $6,000 for building and $3,000 for equipment. 2. The company sold equipment with a book value of $7,000 (cost $8,000, less accumulated depreciation $1,000) for $4,000 cash. 3. Issued $110,000 of long-term bonds in direct exchange for land. 4. A building costing $120,000 was purchased for cash. Equipment costing $25,000 was also purchased for cash. 5. Issued common stock for $20,000 cash. 6. The company declared and paid a $29,000 cash dividend.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

SO 4.

Slide 13-23

Preparation of the Statement of Cash Flows Indirect Method

Step 1: Operating Activities

Determine net cash provided/used by operating activities by converting net income from accrual basis to cash basis.

Common adjustments to Net Income (Loss):

Add back non-cash expenses (depreciation, amortization, or depletion expense). Deduct gains and add losses. Changes in noncash current assets and current liabilities.

SO 4 Prepare a statement of cash flows using the indirect method. The McGraw-Hill Companies, Inc., 2002

McGraw-Hill/Irwin

Slide 13-24

Step 1: Operating Activities

Depreciation Expense

Although depreciation expense reduces net income, it does not reduce cash. The company must add it back to net income.

Illustration 12-7

Cash flows from operating activities: Net income Adjustments : 9,000 $ 154,000 $ 145,000

Depreciation expense Net cash provided by operating activities

McGraw-Hill/Irwin

SO 4 Prepare a statement of cash flows using the indirect method. The McGraw-Hill Companies, Inc., 2002

Slide 13-25

Step 1: Operating Activities

Question

Which is an example of a cash flow from an operating activity? a. Payment of cash to lenders for interest. b. Receipt of cash from the sale of capital stock. c. Payment of cash dividends to the companys stockholders. d. Dividend Payable Dividend Payables are not e. None of the above. considered in Cash Flow SO 4 Prepare a statement of cash flows using the indirect method. The McGraw-Hill Companies, Inc., 2002 Analysis McGraw-Hill/Irwin

Slide 13-26

Operating Activities

Loss on Sale of Equipment

Companies report as a source of cash in the investing activities section the actual amount of cash received from the sale. For the sake of operating section, reverse treatments are made:

Any loss on sale is added to net income in the

operating section (non-cash expense).

Any gain on sale is deducted from net income in the operating section.

SO 4 Prepare a statement of cash flows using the indirect method. The McGraw-Hill Companies, Inc., 2002

McGraw-Hill/Irwin

Slide 13-27

Operating Activities

Loss on Sale of Equipment

Illustration 12-8

Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense Loss on sale of equipment Net cash provided by operating activities $ 9,000 3,000 157,000 $ 145,000

McGraw-Hill/Irwin

SO 4 Prepare a statement of cash flows using the indirect method. The McGraw-Hill Companies, Inc., 2002

Slide 13-28

Adjustments to Net IncomeIndirect Method

Omni Corporations accumulated depreciation increased by $12,000, while patents decreased by $3,400 between balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In addition, the income statement showed a gain of $4,100 from sale of land. Reconcile a net income of $50,000 to net cash flow from operating activities.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-29

Net income. $50,000 Adjustments to reconcile net income to net cash flow from operating activities: Depreciation. 12,000 Amortization of patents. 3,400 Gain on sale of land... (4,100) Net cash flow from operating activities.. $61,300

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-30

Operating Activities

Changes to Noncash Current Asset Accounts

When the Accounts Receivable balance decreases,

Illustration 12-9

Accounts Receivable 1/1/012 Balance 30,000 A/R Received During the year 10,000 12/31/12 Balance 20,000

Company adds to net income the amount of the decrease in accounts receivable because the difference has been received in form of cash.

McGraw-Hill/Irwin

SO 4 Prepare a statement of cash flows using the indirect method. The McGraw-Hill Companies, Inc., 2002

Slide 13-31

Operating Activities

Changes to Noncash Current Asset Accounts

Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense Loss on sale of equipment Decrease in accounts receivable Net cash provided by operating activities $ 9,000 3,000 10,000 167,000 $

Illustration 12-10

145,000

McGraw-Hill/Irwin

SO 4 Prepare a statement of cash flows using the indirect method. The McGraw-Hill Companies, Inc., 2002

Slide 13-32

Operating Activities

Changes to Noncash Current Asset Accounts

When the Inventory balance increases, cash has been paid to purchase the inventory.

Inventory 1/1/12 Balance Purchases 10,000 5,000 15,000

12/31/12 Balance

The company deducts from net income this inventory increase.

McGraw-Hill/Irwin

SO 4 Prepare a statement of cash flows using the indirect method. The McGraw-Hill Companies, Inc., 2002

Slide 13-33

Operating Activities

Changes to Noncash Current Asset Accounts

Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense Loss on sale of equipment Decrease in accounts receivable Increase in inventory Net cash provided by operating activities $ 9,000 3,000 10,000 (5,000) 162,000 $

Illustration 12-10

145,000

McGraw-Hill/Irwin

SO 4 Prepare a statement of cash flows using the indirect method. The McGraw-Hill Companies, Inc., 2002

Slide 13-34

Operating Activities

Changes to Noncash Current Asset Accounts

When the Prepaid Expense balance increases, cash paid for expenses has increased.= OUTFLOW OF CASH

If prepaid expenses decrease:

December 2011 prepaid Expenses: 20,000 December 2012 prepaid Expenses: 12,000 Change= -8000 (non-cash change)

McGraw-Hill/Irwin

SO 4 Prepare a statement of cash flows using the indirect method. The McGraw-Hill Companies, Inc., 2002

Slide 13-35

Operating Activities

Changes to Noncash Current Asset Accounts

Illustration 12-10

Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense Loss on sale of equipment Decrease in accounts receivable Increase in inventory Increase in prepaid expenses Net cash provided by operating activities $ 9,000 3,000 10,000 (5,000) (4,000) 158,000 $ 145,000

McGraw-Hill/Irwin

SO 4 Prepare a statement of cash flows using the indirect method. The McGraw-Hill Companies, Inc., 2002

Slide 13-36

Operating Activities

Changes to Noncash Current Liability Accounts

When Accounts Payable increases, the company received more in goods than it actually paid for. The increase is added to net

income to determine net cash provided by operating activities. When Income Tax Payable decreases, the income tax expense reported on the income statement was less than the amount of taxes paid during the period. The decrease is subtracted from net income to determine net cash provided by operating activities.

McGraw-Hill/Irwin

SO 4 Prepare a statement of cash flows using the indirect method. The McGraw-Hill Companies, Inc., 2002

Slide 13-37

Operating Activities

Changes to Noncash Current Liability Accounts

Illustration 12-11

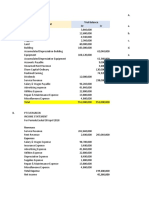

Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense Loss on sale of equipment Decrease in accounts receivable Increase in inventory Increase in prepaid expenses Increase in accounts payable Decrease in income taxes payable Net cash provided by operating activities

McGraw-Hill/Irwin

145,000

9,000 3,000 10,000 (5,000) (4,000) 16,000 (2,000) $ 172,000

SO 4

The McGraw-Hill Companies, Inc., 2002

Slide 13-38

Changes in Current Operating Assets and Liabilities Indirect Method Victor Corporations comparative balance sheet for current assets and current liabilities was as follows:

Dec. 31, 2011 Accounts receivable Inventory Accounts payable Dividends payable $ 6,500 12,300 4,800 5,000 Dec. 31, 2010 $ 4,900 15,000 5,200 4,000

Adjust net income of $70,000 for changes in operating assets and liabilities to arrive at cash flows from operating activities.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-39

Net income.. Adjustments to reconcile net income to net cash flow from operating activities: Increase in accounts receivable. Decrease in inventory... Decrease in accounts payable Net cash flow from operating activities .....

$70,000

(1,600) 2,700 (400) $70,700

16-38

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-40

2

Cash Flows from Operating ActivitiesIndirect Method Omicron, Inc. reported the following data:

Net income Depreciation expense Loss on disposal of equipment Increase in Accounts receivable Decrease in Accounts payable $120,000 12,000 15,000 5,000 (2,000)

Prepare the cash flows for operating activities section of the statement of cash flows using the indirect method.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-41

Cash flows from operating activities: Net income.. $120,000 Adjustments to reconcile net income to net cash flow from operating activities: Depreciation.. 12,000 Loss from disposal of equipment... 15,000 Changes in current operating assets and liabilities: Increase in accounts receivable.. (5,000) Decrease in accounts payable.. (2,000) Net cash flow from operating activities... $140,000

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-42

Prepare a statement of cash flows, using the direct method.

16-53

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-43

The Direct Method

The final amount reported in the Cash Flows from Operating Activities section will be the same whether the direct or indirect approach is used. The methods differ in how the data are obtained, analyzed, and reported. Direct method starts with Cash Sales.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-44

Cash Received from Customers

Rundell, Inc. reports sales of $350,000for 2010. To determine the cash received from customers, sales are adjusted by any increase or decrease in accounts receivable.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-45

Example

Cash Received from CustomersDirect Method Sales reported on the income statement were $350,000. The accounts receivable balance declined $8,000 over the year. Determine the amount of cash received from customers.

Sales $350,000 Add decrease in accounts receivable 8,000 Cash received from customers $358,000

16-57

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-46

Cash Payments for Merchandise Rundell, Inc. reports purchase of merchandise of $790,000. To determine the cash payment for merchandise, the $790,000 is adjusted for any increase or decrease in inventories and accounts payable (assuming the accounts payable are owed to merchandise suppliers).

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-47

Direct Method Cash Paid for Merchandise

Step 1

Purchases = COGS

+ Increase in inventory - Decrease in inventory

Step 2

Cash paid for merchandise = Purchases

+ Decrease in A/P - Increase in A/P

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-48

3

Cash Payment for MerchandiseDirect Method Purchase of Merchandise reported on the income statement was $145,000. The accounts payable balance increased $4,000, and the inventory balance increased by $9,000 over the year. Determine the amount of cash paid for merchandise.

Cost of merchandise sold Add increase in inventory Deduct increase in accounts payable.. Cash paid for merchandise.

16-60

McGraw-Hill/Irwin

$145,000 9,000 (4,000) $150,000

The McGraw-Hill Companies, Inc., 2002

Slide 13-49

Cash Payments for Operating Expenses Rundell, Inc. reports total operating expenses of $203,000, which includes depreciation expense of $7,000. To determine cash payments for operating expenses, the other operating expenses (excluding depreciation) of $196,000 are adjusted for any increase or decrease in accrued expenses payable.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-50

$0 $196,000 $(2,200) = $193,800

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-51

Interest Expense

Rundell, Inc. reports interest expense of 8,000. To determine the cash payments for interest, the $8,000 is adjusted for any increases or decreases in interest payable.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-52

$0

$8,000 $0

= $8,000

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-53

3 Cash Payments for Income Taxes

Rundell, Inc. reports income tax expense of $83,000. To determine the cash payments for income taxes, the $83,000 is adjusted for any increases or decreases in income taxes payable.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-54

$500 $83,000 $0 = $83,500

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-55

3

Exhibit 7

Statement of Cash FlowsDirect Method

(continued)

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-56

3

Exhibit 7

Statement of Cash FlowsDirect Method (continued)

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-57

Managing Cash Flows

Cash Budgets are used by management to plan and forecast future cash flows.

A Cash Budget can be used to:

Force management to coordinate activities. Provide managers with advance notice of available resources. Provide targets useful in evaluating performance. Provide advance warnings of potential cash shortages.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-58

Managing Cash Flows

Increase collection of accounts receivables. Keep inventory low. Delay payment of liabilities. Plan timing of major expenditures. Invest idle cash.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-59

Cash Budgeting

Cash Budget May June $ 27,500 $ 15,000 3,500 $ 31,000 16,000 July $ August $ -

Beginning cash balance Add: Cash receipts Total available cash

Less: Cash disbursements Excess (deficiency) of available cash over cash disbursements $ Financing needed Financing repayments Ending cash balance $

15,000 15,000

The ending cash balance of one month becomes the beginning cash balance of the next month.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-60

Cash Budgeting

Cash Budget May June $ 27,500 $ 15,000 3,500 2,000 $ 31,000 $ 17,000 16,000 18,000 July $ 10,000 9,000 $ 19,000 6,000 August $ 10,000 14,000 $ 24,000 8,000

Beginning cash balance Add: Cash receipts Total available cash

Less: Cash disbursements Excess (deficiency) of available cash over cash disbursements $ Financing needed Financing repayments Ending cash balance $

15,000 15,000

(1,000) $ 11,000 10,000 $

13,000 3,000 10,000

16,000 6,000 10,000

Financing is needed in June because the company must maintain a minimum cash balance of $10,000.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Slide 13-61

End of Chapter 13 Chester, ol buddy, I wonder if you could help me with a little cash flow problem Im having?

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2002

Das könnte Ihnen auch gefallen

- 1 s2.0 S0378426615002526 MainDokument14 Seiten1 s2.0 S0378426615002526 MainAmmara MubasharNoch keine Bewertungen

- CH 1Dokument9 SeitenCH 1Carla TateNoch keine Bewertungen

- ch12Dokument32 Seitench12Ara E. Caballero100% (1)

- Main Lab, ISB: Ammara Mubashar CH-81505Dokument1 SeiteMain Lab, ISB: Ammara Mubashar CH-81505Ammara MubasharNoch keine Bewertungen

- Solutions To End-Of-Chapter ProblemsDokument2 SeitenSolutions To End-Of-Chapter ProblemsAmmara MubasharNoch keine Bewertungen

- CH 3 NewDokument31 SeitenCH 3 NewAmmara MubasharNoch keine Bewertungen

- Account ReceveibelDokument27 SeitenAccount ReceveibelAmmara MubasharNoch keine Bewertungen

- Flaws With Black Scholes Exotic GreeksDokument48 SeitenFlaws With Black Scholes Exotic GreeksAmmara MubasharNoch keine Bewertungen

- Falcon Values123Dokument16 SeitenFalcon Values123Ammara MubasharNoch keine Bewertungen

- Chap005s - Decision TheoryDokument14 SeitenChap005s - Decision Theoryshivram20Noch keine Bewertungen

- GaleDokument13 SeitenGaleAmmara MubasharNoch keine Bewertungen

- BSA 1998-2003 NewDokument1.793 SeitenBSA 1998-2003 NewAmmara MubasharNoch keine Bewertungen

- The Determinants of Capital Structure: Analysis of Non Financial Firms Listed in Karachi Stock Exchange in PakistanDokument29 SeitenThe Determinants of Capital Structure: Analysis of Non Financial Firms Listed in Karachi Stock Exchange in Pakistanxaxif8265Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Tugas P5.1: Nama Farah Nur Lailatun Nikmah NIM 175020300111045 NIM Akuntansi Keuangan Lanjutan 2 - CA No Absen5Dokument12 SeitenTugas P5.1: Nama Farah Nur Lailatun Nikmah NIM 175020300111045 NIM Akuntansi Keuangan Lanjutan 2 - CA No Absen5farahNoch keine Bewertungen

- CRQS Final AccountsDokument54 SeitenCRQS Final AccountsAtka FahimNoch keine Bewertungen

- Ifrs 11: Joint Arrangements Joint Arrangement Joint ControlDokument4 SeitenIfrs 11: Joint Arrangements Joint Arrangement Joint ControlMariette Alex Agbanlog100% (1)

- AICPA Newly Released QuestionsDokument64 SeitenAICPA Newly Released QuestionsShubham Goel100% (1)

- 3 Statement Financial Model: How To Build From Start To FinishDokument9 Seiten3 Statement Financial Model: How To Build From Start To FinishMiks EnriquezNoch keine Bewertungen

- Module 2Dokument15 SeitenModule 2Calvin Rivero BrownNoch keine Bewertungen

- Solution of Finanical Statement AnalysisDokument14 SeitenSolution of Finanical Statement AnalysisMUHAMMAD AZAM100% (2)

- Luyong - 4TH Q - Fabm1Dokument3 SeitenLuyong - 4TH Q - Fabm1Jonavi LuyongNoch keine Bewertungen

- Intercompany DividendsDokument6 SeitenIntercompany DividendsClauie BarsNoch keine Bewertungen

- 2010-09-27 104244 AdvancedDokument11 Seiten2010-09-27 104244 Advancedhetalcar100% (1)

- PICAR, Janine A. - Problems On Financial AnalysisDokument4 SeitenPICAR, Janine A. - Problems On Financial AnalysisJanine AriNoch keine Bewertungen

- Chapter9 18Dokument243 SeitenChapter9 18Xander ClockNoch keine Bewertungen

- Chapter 4 To 6 MillanDokument27 SeitenChapter 4 To 6 MillanAlona MeladNoch keine Bewertungen

- Nelson Daganta CashDokument10 SeitenNelson Daganta CashDan RioNoch keine Bewertungen

- P 4 4 A Vang Management ServicesDokument1 SeiteP 4 4 A Vang Management ServicesJanice KusnandarNoch keine Bewertungen

- Q&a - Finrep - EbaDokument14 SeitenQ&a - Finrep - EbaCynical GuyNoch keine Bewertungen

- Chapter 3 AMA StudentDokument28 SeitenChapter 3 AMA StudentjessicaNoch keine Bewertungen

- Sum - Costo Total ($USD) ($) 255,432.00Dokument13 SeitenSum - Costo Total ($USD) ($) 255,432.00Raul Rojas CerqueraNoch keine Bewertungen

- Rice Company Was Incorporated On January 1Dokument6 SeitenRice Company Was Incorporated On January 1Marjorie PalmaNoch keine Bewertungen

- Tugas MK11Dokument2 SeitenTugas MK11Nan BaeeeNoch keine Bewertungen

- Bakery Business Plan Planul de Afaceri de PanificatieDokument34 SeitenBakery Business Plan Planul de Afaceri de PanificatieCioloca AdrianaNoch keine Bewertungen

- IFRS Disclosure Checklist: October 2012Dokument164 SeitenIFRS Disclosure Checklist: October 2012Nizam Uddin MasudNoch keine Bewertungen

- Gina Balance SheetDokument4 SeitenGina Balance SheetNawshin DastagirNoch keine Bewertungen

- CH 14Dokument146 SeitenCH 14Love FreddyNoch keine Bewertungen

- Pfrs 3 and 10 EXAM - FINALDokument12 SeitenPfrs 3 and 10 EXAM - FINALElizabeth DumawalNoch keine Bewertungen

- Bab 4 Soal 4Dokument4 SeitenBab 4 Soal 4Abel AbdallahNoch keine Bewertungen

- VERTICAL ANALYSIS OF INCOME STATEMENT of Toyota 2022-2021Dokument8 SeitenVERTICAL ANALYSIS OF INCOME STATEMENT of Toyota 2022-2021Touqeer HussainNoch keine Bewertungen

- CFI Accounting FactsheetDokument1 SeiteCFI Accounting FactsheetPirvuNoch keine Bewertungen

- Dashboard Template: Business Unit Revenue ($000) Profit Margin ($000)Dokument1 SeiteDashboard Template: Business Unit Revenue ($000) Profit Margin ($000)GolamMostafaNoch keine Bewertungen

- Exercise 1: On December 31, Bryniuk's Company, The Accounting Records Showed The Following InformationDokument10 SeitenExercise 1: On December 31, Bryniuk's Company, The Accounting Records Showed The Following InformationJohn Kenneth Bohol50% (2)