Beruflich Dokumente

Kultur Dokumente

Lesson 3.1 International Finance Management

Hochgeladen von

ashu1286Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Lesson 3.1 International Finance Management

Hochgeladen von

ashu1286Copyright:

Verfügbare Formate

MBA (Finance specialisation)

&

MBA Banking and Finance

(Trimester)

Term VI

Module : International Financial Management

Unit III: Financial Management of Multinational firm

Lesson 3.1

(Cost of capital and Capital Structure Decision of the Multinational firm)

Introduction

The cost of capital for a domestic firm is the rate that must be earned in

order to satisfy the required rate of return of the firms investors.

Simply put, it is the minimum acceptable rate of return for capital

investments.

The cost of capital has a major impact on the firms value.

The determination of the cost of capital for international projects is a

complex issue in international finance because of the difficulties

associated with estimating the risks posed by each foreign project.

Cost of Capital - MNC

Importance of Cost of capital

The determination of the firm's cost of capital is important because it:

I. Provides the very basis for financial appraisal of new capital

expenditure proposals and thus serves as acceptance criterion for

capital expenditure projects,

II. Helps the managers in determining the optimal capital structure of

the firm,

III. Serves as the basis for evaluating the financial performance of top

management,

IV. Helps in formulating dividend policy and working capital policy, and

V. Can serve as capitalization rate which can be used to determine

capitalization of a new firm.

Cost of Capital - MNC

Difference in Practice MNC and Domestic companies

Scale of Operations: MNCs generally being larger in size as compared to the domestic firms may

be in a privileged position to garner funds both through stocks and bonds at lower cost because

they are accorded preferential treatment due to their size.

Access to International Capital Markets: In view of easier access to international capital markets,

MNCs are in a position to obtain funds at lower cost than that paid by the domestic firms. Further,

international availability permits MNCs to maintain the desired ratio, even if substantially large

funds are required.

International Diversification:MNCs, by virtue of their diversified operations, are in a better

position to reduce their cost of capital in comparison to domestic firms for at least two reasons:

A firm with cash inflows pouring in from different sources across the world enjoys relatively

greater stability, for the fact that total sales will not be greatly influenced by a single economy.

Less cash flow volatility causes the firm to support a higher debt ratio leading to lower cost of

capital;

International diversification (by country and by product) should lower the systematic risk of the

firms, thus lowering its beta coefficient and consequently the cost of equity.

Cost of Capital - MNC

Difference in Practice MNC and Domestic companies

Exposure to Exchange Rate Risk: Operations of MNCs and their cash flows are

exposed to higher exchange rate fluctuations than domestic firms leading to

greater possibility of bankruptcy. As a result, creditors and stockholders demand a

higher return, which enhances the MNC's cost of capital.

Exposure to Country Risk: The total country risk of foreign investment, as noted

earlier, is greater in the case of foreign investment than in similar domestic

investment because of the additional cultural, political and financial risks of foreign

investments.

Cost of Capital - MNC

Variation of Cost of Capital across countries Reasons

Cost of capital mainly contains two important components :

Risk free rate of return

Amount of premium for risk

These two components may vary from country to country as a

result of which cost of capital also vary.

There are various reasons for country differences in the risk-free rate and

in the risk premium.

Cost of Capital - MNC

Variation of Cost of Capital across countries Reasons

The risk free rate of return may vary due to following reasons

Tax laws in different countries differ in terms of tax rate, exemption and

incentives, thus influencing differently the supply of funds to the corporate sector

and hence the interest rate.

Demographic condition of a country impacts demand and supply of funds and

thereby the interest rate. A country with a majority of population being younger

will have higher interest rate, for the fact that youngsters are relatively less thrifty

and demand more money to satisfy their varied needs.

Monetary policy of Central bank of a country directly influences interest rate at

which funds can be borrowed by MNCs. The Central bank following tight monetary

policy to curb inflationary tendencies in the country will raise bank rate and hence

the interest rate.

Because of varying levels of economic development, interest rates differ across

countries. Thus, in relatively advanced countries and so also highly developed and

integrated financial markets interest rate on debt is always lower than the less

developed nations.

Cost of Capital - MNC

Variation of Cost of Capital across countries Reasons

The risk premium may vary due to following reasons:

In case of economic stability, possibility of the country experiencing recession is relatively

low and so also the borrowers defaulting in repayment. Under such a situation, risk

premium is likely to be low.

Risk premium will be relatively lower in countries where the relationships between

corporations and creditors are very cordial . When creditors are ready to help their client to

get over the illiquidity crisis. In such a situation amount of risk premium will be less.

Governments in some countries like the UK and India intervene actively to rescue failing

firms, particularly those partly owned by them and provide all kinds of financial support to

them. However, in the USA, the probability of Government intervention to rescue firms from

incipient sickness is low. Hence, risk premium in the case of the former will be lower than

the latter.

Risk premium also differs across countries because of varying degree of financial leverage

of firms in those countries. For instance, firms in Japan and Germany have a higher degree

of financial leverage than firms in the USA. Obviously, the high leverage firms would have to

pay a higher risk premium, with other factors being equal. In fact, the reason for higher

leverage of the firm is their unique relationship with creditors and governments.

Capital Structure

The capital structure of any firm (MNC or domestic) is function of following variables:

a) Weight of each of kind of capital ( Debt, equity, preference shares , retained earnings)

b) Cost of these components of capital.

Weighted Average Cost of capital (WACC) = Kd X Wd + Ke X We + Kp X Wp

Since one of the important component of capital structure is the cost of capital of

individual source of funds, therefore, factors determining capital structure of MNC are

also distinct from domestic companies just as we have observed in case of cost of

capital.

Capital Structure and Cost of Capital

A firms capital consists of equity (retained

earnings and funds obtained by issuing stock) and

debt (borrowed funds).

The cost of equity reflects an opportunity cost,

while the cost of debt is reflected in the interest

expenses.

Firms want a capital structure that will minimize

their cost of capital, and hence the required rate of

return on projects.

Capital Structure and Cost of Capital

A firms weighted average cost of capital

k

c

= (

D

)

k

d

(

1

_

t

)

+

(

E

)

k

e

D + E D + E

where Dis the amount of debt of the firm

E is the equity of the firm

k

d

is the before-tax cost of its debt

t is the corporate tax rate

k

e

is the cost of financing with equity

Capital Structure

Formulae for calculating cost of capital of different components :

Cost of Debt

K

d

= [(Interest) / (sale value )] ( 1 tax rate)

Cost of Equity

Constant Dividend Growth model : K

e

= [D

1

/ P

0

] + g

Capital Asset Pricing Model :

Cost of Preference Shares

K

e

= [D

/ P

0

( 1- f)]

-

j f j m f

R = R + (R R )

The capital asset pricing model (CAPM) can

be used to assess how the required rates of

return of MNCs differ from those of purely

domestic firms.

CAPM: k

e

= R

f

+ (R

m

R

f

)

where k

e

= the required return on a stock

R

f

= risk-free rate of return

R

m

= market return

= the beta of the stock

Cost-of-Equity Comparison

Using the CAPM

A stocks beta represents the sensitivity of

the stocks returns to market returns, just

as a projects beta represents the sensitivity

of the projects cash flows to market

conditions.

The lower a projects beta, the lower its

systematic risk, and the lower its required

rate of return, if its unsystematic risk can be

diversified away.

Implications of the CAPM

for an MNCs Risk

An MNC that increases its foreign sales may

be able to reduce its stocks beta, and

hence reduce the required return.

However, some MNCs consider

unsystematic project risk to be important in

determining a projects required return.

Hence, we cannot say whether an MNC will

have a lower cost of capital than a purely

domestic firm in the same industry.

Implications of the CAPM

for an MNCs Risk

The MNCs

Capital Structure Decision

The overall capital structure of an MNC is

essentially a combination of the capital

structures of the parent body and its

subsidiaries.

The capital structure decision involves the

choice of debt versus equity financing, and is

influenced by both corporate and country

characteristics.

The MNCs

Capital Structure Decision

Corporate Characteristics

Stability of MNCs cash flows More stable cash flows

the MNC can handle more debt

MNCs access to

retained earnings

Profitable / less growth opportunities

more able to finance with earnings

MNCs credit risk Lower risk more access to credit

The MNCs

Capital Structure Decision

Country Characteristics

Stock restrictions Less investment opportunities

lower cost of raising equity

Strength of host country

currency

Expect to weaken borrow host country currency to

reduce exposure

Tax laws

Higher tax rate

prefer local debt financing

Interest rates Lower rate lower cost of debt

Country risk Likely to block funds prefer local debt financing

Interaction Between Subsidiary and

Parent Financing Decisions

Increased debt financing by the subsidiary

A larger amount of internal funds may be

available to the parent.

The need for debt financing by the parent may

be reduced.

The revised composition of debt financing may

affect the interest charged on debt as well as

the MNCs overall exposure to exchange rate

risk.

Interaction Between Subsidiary and

Parent Financing Decisions

Reduced debt financing by the subsidiary

A smaller amount of internal funds may be

available to the parent.

The need for debt financing by the parent may

be increased.

The revised composition of debt financing may

affect the interest charged on debt as well as

the MNCs overall exposure to exchange rate

risk.

Cost of Capital in Segmented Markets

Market Segmentation is the process of splitting customers in a market into different

groups , or in which customer share a similar level of interest.

Firms located in a segmented market usually have a higher cost of capital and less

availability of capital for long-term debt and equity needs. Such firms need to devise

strategies to escape dependence on that market so that they can raise capital from

cheaper sources.

Main reasons for Market Segmentation:

Imperfect flow of information between domestic and foreign based investors.

Lack of transparency in the markets

A high degree of anticipated foreign exchange risk

Country risk and Political risk

Lack of good corporate governance.

Practical Problems

Example 1 : The systematic risk (beta) of Grand Pet stock is 0.9 when measured against the

Morgan Stanley Capital International (MSCI) world market index and 1.2 against the

London Financial Times 100 (or FTSE 100) stock index. The annual risk free rate in the

United Kingdom is 5%.

a) If the required return on the MSCI world market index is 12%, what is the required

return on Grand Pet stock in an integrated financial market.

b) Suppose the U.K. financial markets are segmented from rest of the World. If the

required return on the FTSE 100 is 10%, what is the required return on Grand Pet

stock?

Solution

a) Using CAPM model

Re = Rf + (Rm Rf)

Re = 5% + 0.9 ( 12% - 5% ) = 11.30%

b) Again , Using CAPM model

Re = Rf + (Rm Rf)

Re = 5% + 1.2( 10% - 5% ) = 11.00%

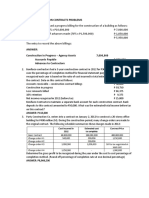

Practical Problems

Example 2 : ABC (MNC) has a market value debt to value ratio of 45 percent. ABC

pretax borrowing cost on new long-term debt in France is 8%. ABC beta relative to the

French Stock market is 1.5. The risk free rate is 7%. Interest is deductible in France at the

marginal corporate income tax of 38 percent. The required return on the world market

portfolio is 15% . What is the ABC weighted average cost of captial in the French market?

Solution

WACC = ( Weight of Debt x Cost of Debt + Weight of equity X cost of equity)

Weight of Debt = 45%

Weight of Equity = 55%

Cost of Debt = I ( 1- t) = 8% ( 1 38%) = 4.96%

Cost of Equity , using CAPM model

Re = Rf + (Rm Rf)

Re = 7% + 1.5 ( 15% - 7% ) = 19%

Substituting these values in the above formula , we have

WACC = (45% x 4.96 % + 55% x 19% ) = 12.68 %

Practical Problems

Problem 1: The systematic risk (beta) of Fairfield Corporation is 1.3 when measured

against the world stock market index and 1.5 against French Stock index. The annual risk

free rate in France is 6%.

a) If the required return on the World market index is 11%, what is the required return on

Fairfield stock in an integrated financial market.

b) Suppose the French financial markets are segmented from rest of the World. If the

required return on the French Market is 10%, what is the required return on Fairfield

stock?

Problem 2: ABC (MNC) can borrow in the Euro market at pretax cost of 8 percent.

International investors will tolerate a 50% debt to value mix. With a 50 percent debt to-

value ratio, the beta of ABC is 1.4. The required return on the world market portfolio is 15

percent. Interest is deductible at the marginal corporate income tax of 30 percent. The

required return on the world market portfolio is 18% .What is the ABC s weighted

average cost of capital under these circumstances ? (Assume risk free rate of return as 6%)

Das könnte Ihnen auch gefallen

- Lesson - 4.1 (1) International Finance ManagementDokument14 SeitenLesson - 4.1 (1) International Finance Managementashu1286Noch keine Bewertungen

- Lesson - 5.2 International Finance ManagementDokument12 SeitenLesson - 5.2 International Finance Managementashu1286Noch keine Bewertungen

- Lesson 2.1 Foreign Exchange MarketDokument19 SeitenLesson 2.1 Foreign Exchange Marketashu1286Noch keine Bewertungen

- Lesson 1.1 International Finance ManagementDokument15 SeitenLesson 1.1 International Finance Managementashu1286Noch keine Bewertungen

- International Finance ManagementDokument38 SeitenInternational Finance Managementashu1286Noch keine Bewertungen

- Lesson - 4.2 International Finance ManagementDokument19 SeitenLesson - 4.2 International Finance Managementashu1286Noch keine Bewertungen

- Lesson - 2.2 International Finance ManagementDokument10 SeitenLesson - 2.2 International Finance Managementashu1286Noch keine Bewertungen

- Lesson - 3.3 International Finance ManagementDokument11 SeitenLesson - 3.3 International Finance Managementashu1286Noch keine Bewertungen

- Lesson - 5.2 International Finance ManagementDokument37 SeitenLesson - 5.2 International Finance Managementashu1286Noch keine Bewertungen

- Lesson 2.4 International Finance ManagementDokument18 SeitenLesson 2.4 International Finance Managementashu1286Noch keine Bewertungen

- IFM SyllabusDokument4 SeitenIFM Syllabusashu1286Noch keine Bewertungen

- Lesson - 5.1 International Finance ManagementDokument31 SeitenLesson - 5.1 International Finance Managementashu1286Noch keine Bewertungen

- Test of IfmDokument3 SeitenTest of Ifmashu1286Noch keine Bewertungen

- Lesson 1.2 BOP International Finance ManagementDokument16 SeitenLesson 1.2 BOP International Finance Managementashu1286Noch keine Bewertungen

- Lesson 3.2 International Finance ManagementDokument26 SeitenLesson 3.2 International Finance Managementashu1286Noch keine Bewertungen

- Project Finance and Management Post-Completion Audit Abandonment AnalysisDokument8 SeitenProject Finance and Management Post-Completion Audit Abandonment Analysisashu1286Noch keine Bewertungen

- Lesson 2.3 Revised International Finance ManagementDokument12 SeitenLesson 2.3 Revised International Finance Managementashu1286Noch keine Bewertungen

- Assignment 1 International Financial MangtDokument5 SeitenAssignment 1 International Financial Mangtashu1286Noch keine Bewertungen

- Iifm AssignmentDokument3 SeitenIifm Assignmentashu1286Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Business Economics AssignmentDokument11 SeitenBusiness Economics AssignmentVineet PrajapatiNoch keine Bewertungen

- PMK Slides 5 MirjhamDokument40 SeitenPMK Slides 5 MirjhamTran PhamNoch keine Bewertungen

- Strategic Supply Chain Management Implementation: Case Study of IKEADokument5 SeitenStrategic Supply Chain Management Implementation: Case Study of IKEAGirish bhangaleNoch keine Bewertungen

- The Top Five Principles of Successful RetailDokument3 SeitenThe Top Five Principles of Successful RetailAgung HartantoNoch keine Bewertungen

- Revised Guidelines for Green Energy Auction Program in PhilippinesDokument10 SeitenRevised Guidelines for Green Energy Auction Program in Philippinesmidas33Noch keine Bewertungen

- FCNRDokument8 SeitenFCNRvicky_tiwari1023Noch keine Bewertungen

- Understanding The Time Value of MoneyDokument20 SeitenUnderstanding The Time Value of MoneyanayNoch keine Bewertungen

- Instalment Method Calculations for The Trisha Co., Glenda Motors, and Mats CorporationDokument7 SeitenInstalment Method Calculations for The Trisha Co., Glenda Motors, and Mats CorporationJomar VillenaNoch keine Bewertungen

- A Study On Customer Satisfaction Towards PDFDokument120 SeitenA Study On Customer Satisfaction Towards PDFN InbasagaranNoch keine Bewertungen

- RPT-Project Report FinalDokument29 SeitenRPT-Project Report Finalarvind3041990100% (3)

- 2 Cost Function With Cobb DouglasDokument5 Seiten2 Cost Function With Cobb DouglaslowchangsongNoch keine Bewertungen

- Memoramdum SampleDokument4 SeitenMemoramdum SampleAlexandra H'cNoch keine Bewertungen

- Tradersworld June2017Dokument140 SeitenTradersworld June2017anudora100% (5)

- Chart Patterns ForexDokument16 SeitenChart Patterns Forexnishitsardhara75% (4)

- Pset Capital Structure SolDokument6 SeitenPset Capital Structure SolDivyesh DixitNoch keine Bewertungen

- 4th Semester (Previous YEar Question Paper)Dokument88 Seiten4th Semester (Previous YEar Question Paper)HassanNoch keine Bewertungen

- Operational ManagementDokument7 SeitenOperational ManagementSabbir_07Noch keine Bewertungen

- Ariel in Trouble-2019Dokument3 SeitenAriel in Trouble-2019Shahaan AnwarNoch keine Bewertungen

- Brief IntroductionDokument25 SeitenBrief IntroductionRahul BasnetNoch keine Bewertungen

- Level 3 Charging Stations FactsheetDokument4 SeitenLevel 3 Charging Stations FactsheetJorgeMelguizoNoch keine Bewertungen

- Checklist Calculation Ib EconomicsDokument2 SeitenChecklist Calculation Ib Economicstesde lujoNoch keine Bewertungen

- Reworld20160102 DLDokument148 SeitenReworld20160102 DLtorinomgNoch keine Bewertungen

- LNP Treasurers Handbook March 2017Dokument30 SeitenLNP Treasurers Handbook March 2017Anonymous eVAr1PhNoch keine Bewertungen

- 2Br Townhouse at West Wing Residences, QC (Reagan Sample Computations)Dokument1 Seite2Br Townhouse at West Wing Residences, QC (Reagan Sample Computations)Evelyn L. AguinaldoNoch keine Bewertungen

- Estimating Electrical Construction Book PreviewDokument18 SeitenEstimating Electrical Construction Book PreviewCordero FitzGerald100% (1)

- 2015 Mitsubishi Lancer 104439 PDFDokument434 Seiten2015 Mitsubishi Lancer 104439 PDFwilber chavezNoch keine Bewertungen

- Focus: A Uitp Position PaperDokument4 SeitenFocus: A Uitp Position PaperGrandcherokee PtNoch keine Bewertungen

- Long Term Construction ContractsDokument2 SeitenLong Term Construction ContractsFerdinand FernandoNoch keine Bewertungen

- Risk CHAPTER 1Dokument10 SeitenRisk CHAPTER 1Wonde BiruNoch keine Bewertungen