Beruflich Dokumente

Kultur Dokumente

2.1 The FX Market

Hochgeladen von

SanaFatimaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2.1 The FX Market

Hochgeladen von

SanaFatimaCopyright:

Verfügbare Formate

The Foreign Exchange Market

Ch. 6 ESM

6-2

The Foreign Exchange Market

The Foreign Exchange Market provides:

the physical and institutional structure through

which the money of one country is exchanged for

that of another country;

the determination rate of exchange between

currencies, and

is where foreign exchange transactions are

physically completed.

6-3

The Foreign Exchange Market

Foreign exchange means the money of a foreign

country; that is, foreign currency bank balances,

banknotes, checks and drafts.

A foreign exchange transaction is an agreement

between a buyer and a seller that a fixed amount

of one currency will be delivered for some other

currency at a specified date.

6-4

Geography

The foreign exchange market spans the globe,

with prices moving and currencies trading

somewhere every hour of every business day.

As the next exhibit will illustrate, the volume of

currency transactions ebbs and flows across the

globe as the major currency trading centers open

and close throughout the day.

6-5

Exhibit 6.1 Measuring Foreign Exchange Market Activity: Average Electronic

Conversions Per Hour

Exhibit 6.2 Global Currency Trading:

The Trading Day

6-7

Functions of the Foreign Exchange

Market

The foreign exchange Market is the

mechanism by which participants:

transfer purchasing power between countries;

obtain or provide credit for international trade

transactions, and

minimize exposure to the risks of exchange rate

changes.

6-8

Market Participants

The foreign exchange market consists of two tiers:

the interbank or wholesale market (multiples of $1MM US or

equivalent in transaction size), and

the client or retail market (specific, smaller amounts).

Four broad categories of participants operate within these

two tiers; bank and nonbank foreign exchange dealers,

individuals and firms conducting commercial or investment

transactions, speculators and arbitragers, and central banks

and treasuries.

6-9

Market Participants: Bank and Nonbank Foreign Exchange

Dealers

Banks and a few nonbank foreign exchange dealers operate in both the

interbank and client markets.

The profit from buying foreign exchange at a bid price and reselling it at

a slightly higher offer or ask price.

Dealers in the foreign exchange department of large international banks

often function as market makers.

These dealers stand willing at all times to buy and sell those currencies in

which they specialize and thus maintain an inventory position in those

currencies.

6-10

Market Participants: Individuals and Firms

Individuals (such as tourists) and firms (such as importers,

exporters and MNEs) conduct commercial and investment

transactions in the foreign exchange market.

Their use of the foreign exchange market is necessary but

nevertheless incidental to their underlying commercial or

investment purpose.

Some of the participants use the market to hedge foreign

exchange risk.

6-11

Market Participants: Speculators and Arbitragers

Speculators and arbitragers seek to profit from trading in the

market itself.

They operate in their own interest, without a need or

obligation to serve clients or ensure a continuous market.

While dealers seek the bid/ask spread, speculators seek all

the profit from exchange rate changes and arbitragers try to

profit from simultaneous exchange rate differences in

different markets.

6-12

Market Participants: Central Banks and Treasuries

Central banks and treasuries use the market to acquire or spend their

countrys foreign exchange reserves as well as to influence the price at

which their own currency is traded.

They may act to support the value of their own currency because of

policies adopted at the national level or because of commitments

entered into through membership in joint agreements such as the

European Monetary System.

The motive is not to earn a profit as such, but rather to influence the

foreign exchange value of their currency in a manner that will benefit the

interests of their citizens.

As willing loss takers, central banks and treasuries differ in motive from

all other market participants.

6-13

Transactions in the Interbank Market

A spot transaction in the interbank market is

the purchase of foreign exchange, with

delivery and payment between banks to take

place, normally, on the second following

business day.

The date of settlement is referred to as the

value date.

6-14

Transactions in the Interbank Market

An outright forward transaction (usually called just forward) requires

delivery at a future value date of a specified amount of one currency for a

specified amount of another currency.

The exchange rate is established at the time of the agreement, but

payment and delivery are not required until maturity.

Forward exchange rates are usually quoted for value dates of one, two,

three, six and twelve months.

Buying forward and selling forward describe the same transaction (the

only difference is the order in which currencies are referenced.)

6-15

Transactions in the Interbank Market

A swap transaction in the interbank market is the

simultaneous purchase and sale of a given amount of foreign

exchange for two different value dates.

Both purchase and sale are conducted with the same

counterparty.

Some different types of swaps are:

spot against forward,

forward-forward,

nondeliverable forwards (NDF).

6-16

Market Size

In April 2010, a survey conducted by the Bank

for International Settlements (BIS) estimated

the daily global net turnover in traditional

foreign exchange market activity to be $3.2

trillion, up from $1.9tn in 2004.

This most recent period showed dramatic

growth in foreign exchange trading over that

seen in April 2001.

6-17

Exhibit 6.3 Top 10 Geographic Trading Centers in the Foreign Exchange

Market, 19922007

(daily averages in April, billions of U.S. dollars)

Exhibit 6.4 Global Foreign Exchange Market Turnover, 1989-

2010 (average daily turnover in April, billions of U.S. dollars)

Exhibit 6.5 Top 10 Geographic Trading Centers in the Foreign

Exchange Market, 1991-2010 (average daily turnover in April)

Exhibit 6.6 Foreign Exchange Market Turnover by Currency Pair

(daily average in April)

6-21

Foreign Exchange Rates and

Quotations

A foreign exchange rate is the price of one

currency expressed in terms of another

currency.

A foreign exchange quotation (or quote) is a

statement of willingness to buy or sell at an

announced rate.

6-22

Foreign Exchange Rates and

Quotations

Most foreign exchange transactions involve the

US dollar.

Professional dealers and brokers may state

foreign exchange quotations in one of two ways:

the foreign currency price of one dollar, or

the dollar price of a unit of foreign currency.

Most foreign currencies in the world are stated in

terms of the number of units of foreign currency

needed to buy one dollar.

6-23

Foreign Exchange Rates and

Quotations

For example, the exchange rate between US

dollars and the Swiss franc is normally stated:

SF 1.6000/$ (European terms)

However, this rate can also be stated as:

$0.6250/SF (American terms)

Excluding two important exceptions, most

interbank quotations around the world are

stated in European terms.

6-24

Foreign Exchange Rates and

Quotations

As mentioned, several exceptions exist to the use

of European terms quotes.

The two most important are quotes for the euro

and U.K. pound sterling which are both normally

quoted in American terms.

American terms are also utilized in quoting rates

for most foreign currency options and futures, as

well as in retail markets that deal with tourists.

6-25

Foreign Exchange Rates and

Quotations

Foreign exchange quotes are at times described as either direct or

indirect.

In this pair of definitions, the home or base country of the currencies

being discussed is critical.

A direct quote is a home currency price of a unit of foreign currency.

An indirect quote is a foreign currency price of a unit of home currency.

The form of the quote depends on what the speaker regard as home.

6-26

Foreign Exchange Rates and

Quotations

Interbank quotations are given as a bid and ask (also referred to as offer).

A bid is the price (i.e. exchange rate) in one currency at which a dealer will

buy another currency.

An ask is the price (i.e. exchange rate) at which a dealer will sell the other

currency.

Dealers bid (buy) at one price and ask (sell) at a slightly higher price,

making their profit from the spread between the buying and selling prices.

A bid for one currency is also the offer for the opposite currency.

6-27

Foreign Exchange Rates and Quotes

Forward rates are typically quoted in terms of

points.

A forward quotation is expressed in points is

not a foreign exchange rate as such.

Rather, it is the difference between the

forward rate and the spot rate.

6-28

Foreign Exchange Rates and Quotes

Forward quotations may also be expressed as

the percent-per-annum deviation from the

spot rate.

This method of quotation facilitates

comparing premiums or discounts in the

forward market with interest rate differentials.

6-29

Foreign Exchange Rates and Quotes

Many currency pairs are only inactively

traded, so their exchange rate is determined

through their relationship to a widely traded

third currency (cross rate).

Cross rates can be used to check on

opportunities for intermarket arbitrage.

This situation arose because one banks

(Dresdner) quotation on / is not the same a

calculated cross rate between $/ (Barclays)

and $/ (Citibank).

6-30

Foreign Exchange Rates and Quotes

Citibank quote - $/ $1.2223/

Barclays quote - $/ $1.8410/

Dresdner quote - / 1.5100/

Cross rate calculation:

$1.8410/

$1.2223/

= 1.5062/

=

6-31

Exhibit 6.8A Triangular Arbitrage

6-32

Foreign Exchange Rates

and Quotes

Measuring a change in the spot rate for quotations expressed

in home currency terms (direct quotations):

% = Ending rate Beginning Rate

Quotations expressed in foreign currency terms (indirect

quotations):

% = Beginning Rate Ending Rate

Beginning Rate

x 100

Ending Rate

x 100

6-33

Mini-Case Questions: The Venezuelan Bolivar Black

Market

Why does a country like Venezuela impose

capital controls?

In the case of Venezuela, what is the

difference between the gray market and the

black market?

Create a financial analysis of Santiagos

choices and use it to recommend a solution to

his problem.

Das könnte Ihnen auch gefallen

- MD4003 LectureDokument403 SeitenMD4003 LectureSanaFatimaNoch keine Bewertungen

- MD4003 LectureDokument49 SeitenMD4003 LectureSanaFatimaNoch keine Bewertungen

- MD4003 - Management Theory and Practice Module GuideDokument9 SeitenMD4003 - Management Theory and Practice Module GuideSanaFatimaNoch keine Bewertungen

- 6.0 Poyout PolicyDokument28 Seiten6.0 Poyout PolicySanaFatimaNoch keine Bewertungen

- 7.0 Does Debt Policy MatterDokument22 Seiten7.0 Does Debt Policy MatterSanaFatimaNoch keine Bewertungen

- Term Structure of Interest Rates ExplainedDokument29 SeitenTerm Structure of Interest Rates ExplainedSanaFatimaNoch keine Bewertungen

- 3.1 NPV and Other RulesDokument25 Seiten3.1 NPV and Other RulesSanaFatimaNoch keine Bewertungen

- 6.0 BondsDokument35 Seiten6.0 BondsSanaFatimaNoch keine Bewertungen

- 7.1 Transaction ExposureDokument32 Seiten7.1 Transaction ExposureSanaFatimaNoch keine Bewertungen

- 1.0 IntroDokument23 Seiten1.0 IntroSanaFatimaNoch keine Bewertungen

- 0.1 Ac4201 Mip 2012-13Dokument7 Seiten0.1 Ac4201 Mip 2012-13SanaFatimaNoch keine Bewertungen

- Operating Exposure and Strategic ManagementDokument28 SeitenOperating Exposure and Strategic ManagementSanaFatimaNoch keine Bewertungen

- 8.0 How Much Should A Corporation BorrowDokument35 Seiten8.0 How Much Should A Corporation BorrowSanaFatimaNoch keine Bewertungen

- 2.0 PVsDokument37 Seiten2.0 PVsSanaFatimaNoch keine Bewertungen

- 4.3 Q MiniCase Turkish Kriz (A)Dokument6 Seiten4.3 Q MiniCase Turkish Kriz (A)SanaFatimaNoch keine Bewertungen

- 3.1 International Parity ConditionsDokument41 Seiten3.1 International Parity ConditionsSanaFatimaNoch keine Bewertungen

- 2.2 FX MiniCase Venezuelan BolivarDokument4 Seiten2.2 FX MiniCase Venezuelan BolivarSanaFatimaNoch keine Bewertungen

- 5.1foreign Exchange Rate Determination and ForecastingDokument34 Seiten5.1foreign Exchange Rate Determination and ForecastingSanaFatimaNoch keine Bewertungen

- Female Appetite in Early Modern EnglandDokument4 SeitenFemale Appetite in Early Modern EnglandNabiAliNoch keine Bewertungen

- 1.ac4202 - MipDokument6 Seiten1.ac4202 - MipSanaFatimaNoch keine Bewertungen

- 4.1the Balance of PaymentsDokument45 Seiten4.1the Balance of PaymentsSanaFatimaNoch keine Bewertungen

- Country RiskDokument42 SeitenCountry RiskmandarcoolNoch keine Bewertungen

- 5.2 Q JPMorgan Chase FXDokument7 Seiten5.2 Q JPMorgan Chase FXSanaFatimaNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- IBPA Yield Curve: Daily Price & Fair Values Indonesia Corporate BondsDokument11 SeitenIBPA Yield Curve: Daily Price & Fair Values Indonesia Corporate Bondsbintar_21Noch keine Bewertungen

- FinQuiz - Smart Summary - Study Session 16 - Reading 56Dokument7 SeitenFinQuiz - Smart Summary - Study Session 16 - Reading 56Rafael100% (1)

- Fundsmith Equity Fund Value Assessment 2019Dokument14 SeitenFundsmith Equity Fund Value Assessment 2019John SmithNoch keine Bewertungen

- Functions of Commercial BanksDokument4 SeitenFunctions of Commercial BanksRajashree MuktiarNoch keine Bewertungen

- General Principles of TaxationDokument2 SeitenGeneral Principles of TaxationemgraceNoch keine Bewertungen

- Tesla Sec Filing Elon Musk Buy SharesDokument2 SeitenTesla Sec Filing Elon Musk Buy SharesFred LamertNoch keine Bewertungen

- Investment Pattern and Awareness of Salaried Class Investors in Tiruvannamalai District of TamilnaduDokument9 SeitenInvestment Pattern and Awareness of Salaried Class Investors in Tiruvannamalai District of Tamilnadumurugan_muruNoch keine Bewertungen

- WMCC Assignment 15TH AprilDokument18 SeitenWMCC Assignment 15TH AprilRamya GowdaNoch keine Bewertungen

- Islamic Banking - Principles and PracticesDokument28 SeitenIslamic Banking - Principles and Practicesbashir_abdi100% (2)

- Annual Report 12Dokument83 SeitenAnnual Report 12Master SeriesNoch keine Bewertungen

- Activity 1 - Audit of LiabilitiesDokument2 SeitenActivity 1 - Audit of LiabilitiesChristian AbieraNoch keine Bewertungen

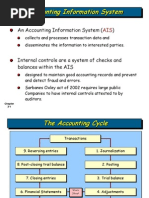

- Wiley - Chapter 3: The Accounting Information SystemDokument36 SeitenWiley - Chapter 3: The Accounting Information SystemIvan BliminseNoch keine Bewertungen

- Financial Statement Analysis Ebook PDFDokument496 SeitenFinancial Statement Analysis Ebook PDFKhoaNamNguyen82% (11)

- CB3410 - Last Year Final Exam - With SolutionsDokument11 SeitenCB3410 - Last Year Final Exam - With SolutionsKazaf TsangNoch keine Bewertungen

- GMO Capital Q3 2013 Letter To InvestorsDokument15 SeitenGMO Capital Q3 2013 Letter To InvestorsWall Street WanderlustNoch keine Bewertungen

- Angela Stark 3-21-10 Omar TRNSCRPTDokument15 SeitenAngela Stark 3-21-10 Omar TRNSCRPTB-Nicole Williams100% (7)

- IPO IngelecDokument10 SeitenIPO IngelecSakina FenNoch keine Bewertungen

- Quiz - Chapter 11 - Investments - Additional Concepts - Ia 1 - 2020 EditionDokument2 SeitenQuiz - Chapter 11 - Investments - Additional Concepts - Ia 1 - 2020 EditionJennifer RelosoNoch keine Bewertungen

- Understanding Securitisation: A Complete GuideDokument20 SeitenUnderstanding Securitisation: A Complete GuidebeingshashankNoch keine Bewertungen

- We Understand Your WorldDokument48 SeitenWe Understand Your Worldkelvinsantis80% (5)

- Requisition For Default JudgementDokument6 SeitenRequisition For Default Judgementapi-2501630820% (1)

- Presentation On Preferential Allotment' - by Mahavir LunawatDokument37 SeitenPresentation On Preferential Allotment' - by Mahavir LunawatArunachalam SubramanianNoch keine Bewertungen

- Joel Greenblatt The Little Book That Beats The Market Talks at Google Chinese TranslationDokument28 SeitenJoel Greenblatt The Little Book That Beats The Market Talks at Google Chinese TranslationSun ZhishengNoch keine Bewertungen

- Analysis of Company Cash Flow Statement and TransactionsDokument5 SeitenAnalysis of Company Cash Flow Statement and TransactionsEmy ManiyarNoch keine Bewertungen

- Asset Liability ManagementDokument18 SeitenAsset Liability Managementmahesh19689Noch keine Bewertungen

- A Study On An Analysis On Mutual Fund of India: Synopsis Submitted To TheDokument10 SeitenA Study On An Analysis On Mutual Fund of India: Synopsis Submitted To TheAsit kumar BeheraNoch keine Bewertungen

- Data AnalysisDokument73 SeitenData AnalysisrathnakotariNoch keine Bewertungen

- FAR.112 - INVESTMENT IN ASSOCIATES AND JOINT VENTURES With AnswerDokument6 SeitenFAR.112 - INVESTMENT IN ASSOCIATES AND JOINT VENTURES With AnswerMaeNoch keine Bewertungen

- Debt Securitization in IndiaDokument16 SeitenDebt Securitization in Indiasaurabhm590Noch keine Bewertungen

- Us Experience of Asset SecuritizationDokument6 SeitenUs Experience of Asset SecuritizationResearch ParkNoch keine Bewertungen