Beruflich Dokumente

Kultur Dokumente

Apple Computer Case

Hochgeladen von

pradhu1Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Apple Computer Case

Hochgeladen von

pradhu1Copyright:

Verfügbare Formate

Apple Computer, 2006

Situation

Complication

Resolution

Jobs has revived Apple

entering new markets (iPod, iTunes)

Intel collaboration

direct sale to consumers online, followed by the push into retail

stores

PC industry growing to be less attractive

Continue to focus on Apples core competency of being a technology

lifestyle force identify nascent substitutes to engage in disruptive

self-innovation

Apples current scenario

Only Apple and IBM

in the market,

allows them to

charge high prices

and pursue

different strategies.

IBM-compatible

clones, low

investments

needed to enter

the mkt.

No substitutes

for the PC

Numerous

suppliers,

Wintel not

established

yet.

Few

competitors,

market growth,

product highly

desirable

Many players

Lack of product

differentiation

Personal Digital

Assistants (1990s)

Increasing powerful

smartphones

(2000s)

Concentrated

supplers: Wntel

Personal Digital

Assistants (1990s)

Increasing powerful

smartphones

(2000s)

1970 to 1990 1990 to 2006

L

o

w

M

e

d

i

u

m

H

i

g

h

PC Industry has grown less attractive over the last 20 years

Contract

manufacturers and

white-box

manufacturers

minimize capital

investment for new

entrants

Rvalry New entrants Substtutes Supplers Customers

Apples Sources of Competitive Advantage

Allows for

differentiation &

creation price premium

Exercise greater control

on quality & synergy

Be perceived as a

technology lifestyle and

cultural force

Design Philosophy

Focus on Performance

Closed Ecosystem

Culture of Innovation

Departure from core competencies hurt Apple during the

Non-Job years

1990: Release of Mac Classic (low-cost) computer to counter Windows 3.0 and IBM clones

1991-1992: Collaboration with IBM and Intel for development of Next-Gen OS.

1993-1995: Focus on international markets & licensing for Mac clones.

1995-1997: Inability to launch a new OS eroded technology leadership.

Dilution of Brand Value

Switch from first-mover to follower

Lack of a clear strategy to counter Wintel growth

Apples significantly smaller sales volume compared to

Microsoft Windows puts it at a competitive

disadvantage.

Microsoft recovers development cost of Windows XP in

1.3 months as compared to 52 months for Apple

To achieve competitive parity with Windows, Mac would

need to capture equal market share as Windows (~45%

of the PC market from current market share of 2.2%)

Microsoft, with its huge competitive advantage, will not

allow Mac to steal so much market share, and will

intensify R&D f necessary to match up its OS capabltes.

On the other hand, embracing the Windows OS on Mac

may significantly dilute Apple`s differentiation within an

extremely competitive industry

Lastly, immediately closing down the Mac with just the

ipod remaining will result in a too thin product portfolio,

and dilute the brand of Apple.

As a result, we recommend Apple to leverage its core

competencies in consumer understanding and design to

explore blue ocean lifestyle markets and reduce

dependency on Mac n the long run

Superior Product yet lack of economies of scale makes Apple

vulnerable in the long run

Economics of shifting to Windows

Window Licencse (In USD) 50,0

Units Sold by Apple (In Million units) 4,53

Cost of Windows OS per annum (In

USD Millions) 227

Current Mac OS expenses per annum

(In USD million) 1 000

Net Annual Savings (USD million) 773

Savings as % of current net profits 58%

Particulars Windows MAC OS

Cost of Developing an OS (In

USD Millions) 1 000 1 000

Volume Per Year (2005, In

million units) 187,74 4,53

Charge per copy (In USD) 50 50

Revenue per year (In USD

Millions) 9 387 227

Recovery time (In

Months)months 1,3 52,9

Implied cost of OS to Apple

per unit sold (In USD) 220,6

Average Sales Price per unit

of Macintosh (In USD) 1 384,0

Margin on sales price unit 16%

What helped Apple turn-around?

Refocus on core competencies of performance, product

design and ease-of-use

Intel collaboration

iMac (Wndows plug-n-play peripherals)

BOOTCAMP application to help users migrate from

windows to OSX

Moving

towards Wintel

standards

whilst charting

its own path

Using strengths to enter blue ocean markets with a focus

on building a lifestyle brand

iPod, iTunes

Move towards direct sales to consumers

Online sales

Subsequent push into retail stores

What Are Key Issues Facing Apple Today?

Small and Stagnant share in the PC industry

lack of compatibility between Apple & Wintel products

closed ecosystem limits availability of complements

IPods, ITunes

rise of new substitutes (mobile phones, streaming)

music labels are unhappy with the rigid iTunes pricing structure

1

2

How Can Apple Ensure Continued Success Going Forward?

Continue to focus on Apples core competencies

Identify nascent PC substitutes

Leverage innovative culture and R&D expertise to engage in self-disruptive

innovation

Position as a lifestyle brand

Continue to target the consumer segment

Implementation Risks / Key Considerations

Discontinuity in long-term strategy

CEO dependence succession plan should be implemented

Opportunity cost of not targeting the enterprise customer?

How to consistently sustain a culture of continuous self-disruption and avoid

complacency/drift towards incremental innovation?

Music label companies - supplier power?

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- American Connector Company: Competitive Advantage From OperationsDokument4 SeitenAmerican Connector Company: Competitive Advantage From Operationspradhu1Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Financial Markets HMC CaseDokument7 SeitenFinancial Markets HMC Casepradhu1Noch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Corporate Finance UST CaseDokument7 SeitenCorporate Finance UST Casepradhu1100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Destin Brass Case AnalysisDokument1 SeiteDestin Brass Case Analysisfelipevwa100% (1)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Britannia Corp - Finance CaseDokument4 SeitenBritannia Corp - Finance Casepradhu1Noch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

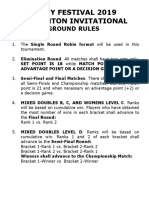

- Ground Rules 2019Dokument3 SeitenGround Rules 2019Jeremiah Miko LepasanaNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Shkodër An Albanian CityDokument16 SeitenShkodër An Albanian CityXINKIANGNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- English Lesson Plan 6 AugustDokument10 SeitenEnglish Lesson Plan 6 AugustKhairunnisa FazilNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- TugasFilsS32019.AnthoniSulthanHarahap.450326 (Pencegahan Misconduct)Dokument7 SeitenTugasFilsS32019.AnthoniSulthanHarahap.450326 (Pencegahan Misconduct)Anthoni SulthanNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Handmaid's Tale - Chapter 2.2Dokument1 SeiteThe Handmaid's Tale - Chapter 2.2amber_straussNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- 25 ConstitutionDokument150 Seiten25 ConstitutionSaddy MehmoodbuttNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Seismic Response of Elevated Liquid Storage Steel Tanks Isolated by VCFPS at Top of Tower Under Near-Fault Ground MotionsDokument6 SeitenSeismic Response of Elevated Liquid Storage Steel Tanks Isolated by VCFPS at Top of Tower Under Near-Fault Ground MotionsciscoNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Configuration Steps - Settlement Management in S - 4 HANA - SAP BlogsDokument30 SeitenConfiguration Steps - Settlement Management in S - 4 HANA - SAP Blogsenza100% (4)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Sucesos de Las Islas Filipinas PPT Content - Carlos 1Dokument2 SeitenSucesos de Las Islas Filipinas PPT Content - Carlos 1A Mi YaNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Education Law OutlineDokument53 SeitenEducation Law Outlinemischa29100% (1)

- S - BlockDokument21 SeitenS - BlockRakshit Gupta100% (2)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- History of Drugs (Autosaved)Dokument68 SeitenHistory of Drugs (Autosaved)Juan TowTowNoch keine Bewertungen

- Accomplishment Report: For Service Credits (Availment/claim) Election May 2019Dokument1 SeiteAccomplishment Report: For Service Credits (Availment/claim) Election May 2019Glazy Kim Seco - JorquiaNoch keine Bewertungen

- Echnical Ocational Ivelihood: Edia and Nformation IteracyDokument12 SeitenEchnical Ocational Ivelihood: Edia and Nformation IteracyKrystelle Marie AnteroNoch keine Bewertungen

- Gits Systems Anaphy DisordersDokument23 SeitenGits Systems Anaphy DisordersIlawNoch keine Bewertungen

- Mathematics Trial SPM 2015 P2 Bahagian BDokument2 SeitenMathematics Trial SPM 2015 P2 Bahagian BPauling ChiaNoch keine Bewertungen

- 1 Mark QuestionsDokument8 Seiten1 Mark QuestionsPhani Chintu100% (2)

- MSDS PetrolDokument13 SeitenMSDS PetrolazlanNoch keine Bewertungen

- F3 Eng Mid-Term 2023Dokument5 SeitenF3 Eng Mid-Term 2023Mwinyi BlogNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Jordana Wagner Leadership Inventory Outcome 2Dokument22 SeitenJordana Wagner Leadership Inventory Outcome 2api-664984112Noch keine Bewertungen

- Physics Syllabus PDFDokument17 SeitenPhysics Syllabus PDFCharles Ghati100% (1)

- Motivational Speech About Our Dreams and AmbitionsDokument2 SeitenMotivational Speech About Our Dreams and AmbitionsÇhärlöttë Çhrístíñë Dë ÇöldëNoch keine Bewertungen

- Indus Valley Sites in IndiaDokument52 SeitenIndus Valley Sites in IndiaDurai IlasunNoch keine Bewertungen

- Anti-Epileptic Drugs: - Classification of SeizuresDokument31 SeitenAnti-Epileptic Drugs: - Classification of SeizuresgopscharanNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- HIS Unit COMBINES Two Birthdays:: George Washington's BirthdayDokument9 SeitenHIS Unit COMBINES Two Birthdays:: George Washington's BirthdayOscar Panez LizargaNoch keine Bewertungen

- (Music of The African Diaspora) Robin D. Moore-Music and Revolution - Cultural Change in Socialist Cuba (Music of The African Diaspora) - University of California Press (2006) PDFDokument367 Seiten(Music of The African Diaspora) Robin D. Moore-Music and Revolution - Cultural Change in Socialist Cuba (Music of The African Diaspora) - University of California Press (2006) PDFGabrielNoch keine Bewertungen

- AMCAT All in ONEDokument138 SeitenAMCAT All in ONEKuldip DeshmukhNoch keine Bewertungen

- D5 PROF. ED in Mastery Learning The DefinitionDokument12 SeitenD5 PROF. ED in Mastery Learning The DefinitionMarrah TenorioNoch keine Bewertungen

- Oda A La InmortalidadDokument7 SeitenOda A La InmortalidadEmy OoTeam ClésNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)